Have You Received A Cpp/ei Ruling

If you received a CPP/EI ruling, and if a workers employment has changed from:

- not pensionable to pensionable, or

- not insurable to insurableor if, on the contrary, the employment has changed from:

- pensionable to not pensionable, or

- insurable to not insurable

We have information that could be of interest to you.

To find out more about the possible implications of a CPP/EI Ruling, go to Have you received a CPP/EI ruling?

What Happens If I Still Can’t Afford To Buy Health Insurance

If you cannot purchase insurance, it will be extremely difficult to find Healthcare options in your area. Many doctors don’t accept patients without insurance and hospitals have the tendency to charge higher rates to customers without insurance. In emergency situations, you will be treated, but you will have little protection from the bills that the hospital charges you.

Ehealthinsurance Best Pick For 2021

eHealthInsurance is one of the most affordable health insurance options for self-employed people. You can compare different health plans available for yourself or your family in the area you currently live.

After putting in my information in , it gave me over 100 options and the cheapest price of about $198 a month.

If youre in the pre-existing condition pool, no worries. Some states offer health plans through a high-risk pool.

Depending on the severity of the pre-existing condition, a regular insurance company may not automatically decline .

For more information, head over to the eHealthInsurance website.

Don’t Miss: How Much Does A Family Health Insurance Plan Cost

How Do You Get Health Insurance When You Own Your Own Business

How to get health insurance for small business owners

Self Employed Health Insurance

If you are self-employed and work independently, you can purchase individual health insurance. This is the equivalent of buying a health insurance plan similar to how you would buy a cell phone plan.

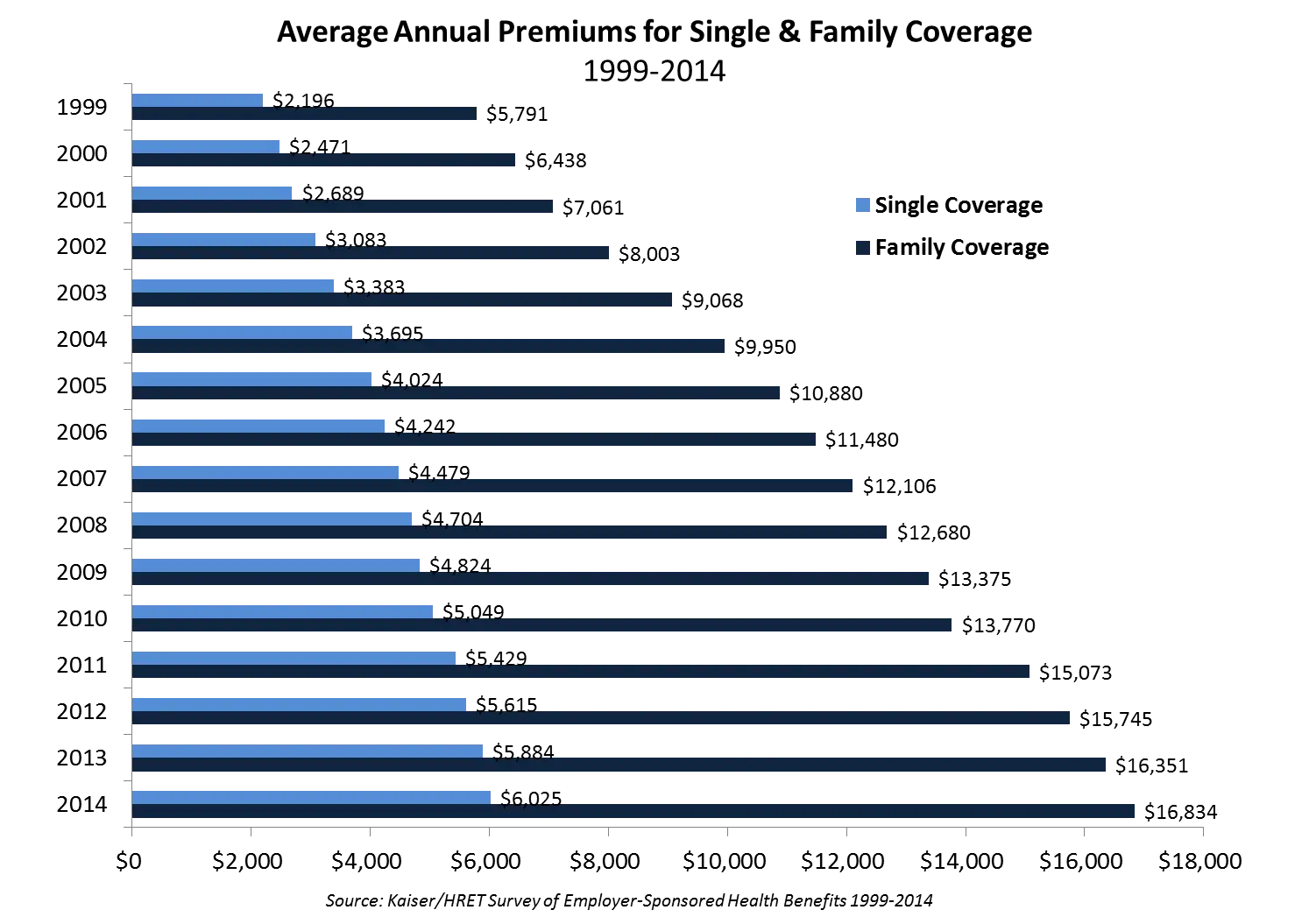

The average health insurance cost for an individual plan is about $388 per month. If you require insurance for dependents, like children, the cost on average is about $1,520 a month.

The cost for individual health insurance has increased over the past few years but remains an overall lower cost than group insurance.

You can access the marketplace via Healthcare.gov. Open enrollment is between the beginning of November and the middle of December, but you may still qualify to purchase insurance outside of that time period based on certain life events.

Also Check: How Does Health Insurance Through Employer Work

How Can You Save Money On Health Insurance Costs

If the cost of health insurance seems too steep for you, there are ways you can minimize the costs.

Under Obamacare, you may qualify for a subsidy, or premium tax credit that lowers the amount of money you must pay each month if your income falls below a certain level.22 If you are eligible for a subsidy, the amount you qualify for is based on how your income compares to the federal poverty level.

You can also purchase supplemental health insurance, which can cover some of your out-of-pocket costs such as deductibles and coinsurance.23

If you are self-employed and have a high deductible health plan , you can open a health savings account or a medical savings account 24 that lets you save pre-tax dollars to pay for qualified medical expenses.25

Factor in ALL Costs Before Deciding

When choosing a plan, factor in ALL costsnot just your monthly premiums, but also your out-of-pocket costs both before and after you meet your deductible.

Do Small Business Owners Need To Insure Freelancers And Independent Contractors

Some people work for employers as freelancers. If youre a small business owner who employs freelancers, you may be wondering if you need to provide health coverage.

Under the Affordable Care Act, businesses with fewer than 50 full-time workers arent required to offer health coverage. However, some small businesses may still choose to voluntarily offer health coverage to full-time employees. For more information, take a look at this page on eHealths small business health plans.

When it comes to freelancers, rules may vary by location, state, and insurance company. Generally, small businesses arent required to offer health coverage for freelancers. However, in some cases, employers may extend group health coverage to their freelance workers.

If youre a small business owner and decide to offer group health coverage to your freelancers:

- You arent required to pay part of the premium.

- If you do choose to contribute to premium costs, the freelancer may need to report these contributions as taxable income.

- Freelancers who pay for their own premiums may be able to deduct the cost from their income taxes.

If you work as an independent contractor, meaning you are self-employed, see more information on self-employed coverage options.

Also Check: How Do You Pay For Health Insurance

Best For Convenience: Cigna

-

Not available in all states

-

Mixed ConsumerAffairs reviews

Cigna is the oldest health insurance company on our list, with a history dating back to 1792. The company has earned an A rating from AM Best and rankings of 2.5 to 4.0 from NCQA. Cigna also earned high marks, including four regional first places, in the J.D. Power 2021 U.S. Commercial Member Health Plan Study.

Cigna offers global coverage to 180 million customers in 30 countries, which includes 1.5 million providers and facilities. In the United States, the company works with over 67,000 pharmacies, more than 500 hospitals, and over 175,000 mental and behavioral health providers, growing 70% since 2016.

Cigna offers individual plans in 10 states: Arizona, Colorado, Florida, Illinois, Kansas, Missouri, North Carolina, Tennessee, Utah, and Virginia. Depending on where you live, you may have access to Cignas other products like Medicare, Medicare supplemental plans, dental insurance, vision insurance, or international health insurance.

You may shop for quotes or buy coverage online or by phone. You may also purchase coverage through your state exchange or Healthcare.gov. The pricing may vary based on factors like where you live, the type of plan, your age, smoking status, and the size of your family.

What Are The Specific Costs Involved

There are a number of costs associated with individual health insurance that you may have to pay, depending on the type of policy you have.

- A premium is the amount you pay your insurance carrier each month.18

- A deductible is the amount of money you must pay out of your pocket before your insurance begins to pay a benefit.19

- A copayment is a flat dollar amount you may have to pay for certain services

- Coinsurance is a percentage of covered health services that you are responsible for paying for once youve met your deductible.20

- An out-of-pocket maximum is the total amount of money you may have to pay for healthcare services in a particular plan year. 21

In some cases, a person may have to pay each of these costs. For example, a consumer may have a healthcare plan with a $1,000 deductible that costs $300 in monthly premiums. After hes met his deductible, he may have to pay $50 for a doctors office visit and 30% of the cost for any laboratory services. The good news is this consumer knows his total out-of-pocket costs will be capped by his out-of-pocket maximum in case he becomes seriously ill or injured.

How Much Youll Pay

Many variables affect how much youll pay for health care coverage, some of which are under your control.

You May Like: How Much Is Health Insurance Usually

Best Health Insurance Options For The Self

Side hustles and self-employment are on the rise. If you are one of the millions of Americans who are self-employed, you may be concerned about whether you can find affordable, quality health insurance.

Generally, you can sign up for a health plan during open enrollment. This open enrollment period begins Nov. 1 every year and typically ends in December. A qualifying life event may also allow you to enroll in a health insurance plan. Qualifying life events include:

- Losing previous health insurance

- Plan category

- Individual versus family plans

Some states have set rules that determine how much each of these factors can affect your monthly premiums. Premiums for tobacco users and older workers can be significantly higher. If you live in an urban area, you may pay more for health insurance than someone who lives in a rural area. But insurance companies cannot charge you more for health insurance based on your medical history, current health status or gender.

A health plan that has a lower premium may be called a high-deductible or catastrophic plan. With this type of plan, you will pay a lower monthly premium. But if you do need health care services, you will pay out-of-pocket for some costs before your insurance begins covering costs. If you are young and in good health, this may be a good option for you.

Affordable Care Act Individual And Family Health Insurance Plan

As an independent contractor or consultant, you may be able to buy ACA health insurance, and if this is right for you, eHealth can help you find the right individual health insurance plan. Open enrollment for ACA plans begins in November and usually ends in mid-December. Plans sold during that time typically begin coverage on January 1 of the following year. So if you enrolled in a plan in November 2020, your coverage would begin on Jan. 1, 2021. If you miss open enrollment, you may qualify for special enrollment because of life circumstances. Learn more about ACA plans and enrollment here.

Pros: When you buy an ACA plan, you are guaranteed the coverage and consumer protections of the ACA. Its also relatively easy to compare the metal levels of coverage bronze, silver, gold and platinum insurance to determine which meets your personal needs for affordable coverage. Your out-of-pocket expenses may be lower as well, especially if you qualify for a tax subsidy.

Cons: If you dont qualify for a tax subsidy, ACA plan coverage may cost more than you can comfortably afford. You can learn more about ACA plan subsidy and income levels here.

You May Like: How Do I Know If My Health Insurance Is Good

Get The Right Plan If Youre Self

Health insurance premiums for self-employed individuals became 100% tax deductible in 2003 in many cases. This deduction reduces your taxable income by the amount of money you pay for health insurance premiums in the tax year. Tax rules and qualifications can change, so be sure to check current guidelines each year before taking the deduction on your 1040.

If youre newly self-employed and still building your income, a subsidized marketplace plan may be the best solution in the short term. However, if you have significant savings or are able to regularly fund a health savings account, a high-deductible health insurance plan may be a more cost-effective solution that also provides more freedom.

A High Deductible Health Plan Makes Financial Sense

If your health insurance plan has a high deductible, that means lower monthly premiums. And we like those! Its also great for self-employed folks like Ollie and Rebecca because it reduces their monthly expenses. They just need to make sure they can foot the higher deductible when they need to. And thats where the Health Savings Account comes in.

To summarize: An HSA is a tax-advantaged savings account linked to a high deductible health plan . Its a savings account for you and your dependents to pay for qualifying medical expenses. The interest you earn in your HSA is tax-deferred, and the withdrawals you make to pay for medical expenses are tax-free too.

If your health insurance plan has a high deductible, that means lower monthly premiums. And we like those!

You May Like: Is Student Health Insurance Cheaper

Example Of Self Employed Health Insurance Deduction

Here is a real-world example of how to apply for a personal health insurance discount on your tax return.

They run a free graphic design business. After your expenses, you are claiming a profit of $ 6,000 a year. That year, they paid $ 8,000 for the Health Insurance Premium.

You can only claim a $ 6,000 premium on Form 1040 because your health insurance deduction cannot exceed your income. However, you can claim an additional $ 2,000 premium on schedule A.

How Much Do You Pay For Health Insurance

How much are your health benefits?

Monster Contributing WriterPrivate Health Insurance

Don’t Miss: What Is Private Health Insurance

Your Spouse Or Domestic Partner’s Plan

If your spouse works and has coverage through their job, you may be able to join their plan. Because it’s an employer-based plan, it may also save you money. It may charge a lower premium since the employer will usually pay into the plan.

Even if you are not married, you may qualify as a domestic partner if you share the same home and live a domestic life together. But you cannot be legally married to anyone else.

What Is Excluded From Coverage

A policy purchased on the Marketplace cannot exclude pre-existing conditions. However, the same cannot be said for short-term policies that can make their own rules on exclusions. It is essential to review the policy wording before making a purchase, in case the exclusions include something that you require coverage for.

Typical exclusions include:

- Conditions caused by smoking, drinking, or drug abuse

- Elective procedures

You May Like: Is There Health Insurance In The Philippines

Organizations For The Self

As a self-employed business owner, you may want to seek out other organizations or unions that can offer you budget-friendly plans and other perks.

Heres a list of self-employed-specific organizations that can help you get affordable health insurance.

The National Associate for the Self-Employed

The National Associate for the Self-Employed is an organization that provides day-to-day support for the self-employed. Some member benefits give you access to Health Savings Accounts and life insurance policies.

Annual memberships cost $25 for students and a max of $120 for general members. The cost includes health insurance premiums, which varies based on state and your personal plan.

As a freelance business owner you also get access to big savings as stores like Office Depot, LegalZoom, QuickBooks, TurboTax and more.

The Freelancers Union

Depending on your state, the Freelancers Union also has excellent health insurance options, as well as loads of other benefits for members.

They group members together in order to keep costs much lower than on the individual market.

One of the main things that I like about The Freelancers Union is that its completely free to join and start browsing their resources, health insurance costs and other insurance needs.

Simply enter your zip code on their website for group rates on health insurance.

National Association of Health Underwriters

- Business and marketing tools

Where Are There The Most Gig Workers

According to the U.S. Census Bureau, there are over 9 million gig workers in the United States, which represents nearly 5.9% of the total labor force.

When broken down at the state level Puerto Rico, Vermont and Montana have the largest percentages of their labor force that currently are part of the gig economy â 9.6%, 9.5% and 8.4%, respectively. On the other hand, West Virginia, Indiana and Rhode Island have the lowest rates, all with less than 5% of their labor force.

However, gig employees in Vermont face an uphill battle with health insurance. Individuals in the state have the third-highest private health insurance rates, at $530. Similarly, Maine, with a gig worker rate of 8%, also has a higher-than-average health insurance cost of $421.

| State |

|---|

| 81.6% |

Don’t Miss: Does Aarp Offer Health Insurance

Coverage From A Parent

If youre age 25 or younger, you can get health coverage from a parents insurance plan. The ACA requires all companies that provide health insurance for employees children to make this coverage available for children until they turn 26 years old.

You can still get coverage under a parents plan if you dont live together or even in the same state. However, if you live in a different state, you might have to pay extra to see providers who arent in your parents local network. Check the details of your parents plan to find out about health insurance costs and coverage before signing up.

Also, be aware that if youre on a parents health plan, your parent will probably receive notifications about your health care. If you dont want Mom or Dad knowing every time you see the doctor or have a medical test, youll need to find a plan of your own.

Alternatives To Individual Health Insurance

If you anticipate that you will not be self-employed for a long period of time or you cannot afford individual health insurance, you can buy short term health insurance.

Short-term health insurance usually provides coverage for up for 12 months. You may be able to renew short-term health insurance for up to 3 years depending on the situation.

If you still believe you cannot afford health insurance, check out this article on what you should do.

Don’t Miss: Is Health Insurance Mandatory In Ct

Looking For Health Insurance Marketplace Coverage From Unitedhealthcare

UnitedHealthcare Exchange plans offer a variety of affordable, reliable coverage options. You can find plans available in your area at UnitedHealthcare Exchange plans or you can call TTY 711.

If youre looking for ACA plans in New York or Massachusetts, visit Healthcare.gov or call to learn about plans available near you.