When Should You Apply For Medicare If You Have Employer Health Coverage

The vast majority should pursue Medicare Part A when theyre first qualified on the grounds that it will hardly cost you a penny. Be that as it may, a few groups delay signing up for Part B since they would prefer not to pay the month to month premium. The choice generally relies upon the kind of health coverage you already have.

Furthermore, you can put off enrolling for Part B at the age of 65 in the event that you have group health coverage through your or your life partners work place and the organization has at least 20 employees. In addition to this, youll have the option to enroll with no punishment during the Special Enrollment Period that follows the end of your boss insurance. You can likewise decide to sign up for Part B while still having coverage and pay the premium. On the off chance that your workplace has less than 20 employees, you ought to apply for Part A and Part B when youre qualified.

Other Health Care Coverage Options

If you are 65 or over, you can apply for Medicare. Learn about and research Medicare coverage options in your area.

You may also qualify for Medicaid, Childrens Health Insurance Program or other assistance based on your income. These health care coverage options are provided by the government. You can apply at any time. You may also qualify for financial help.

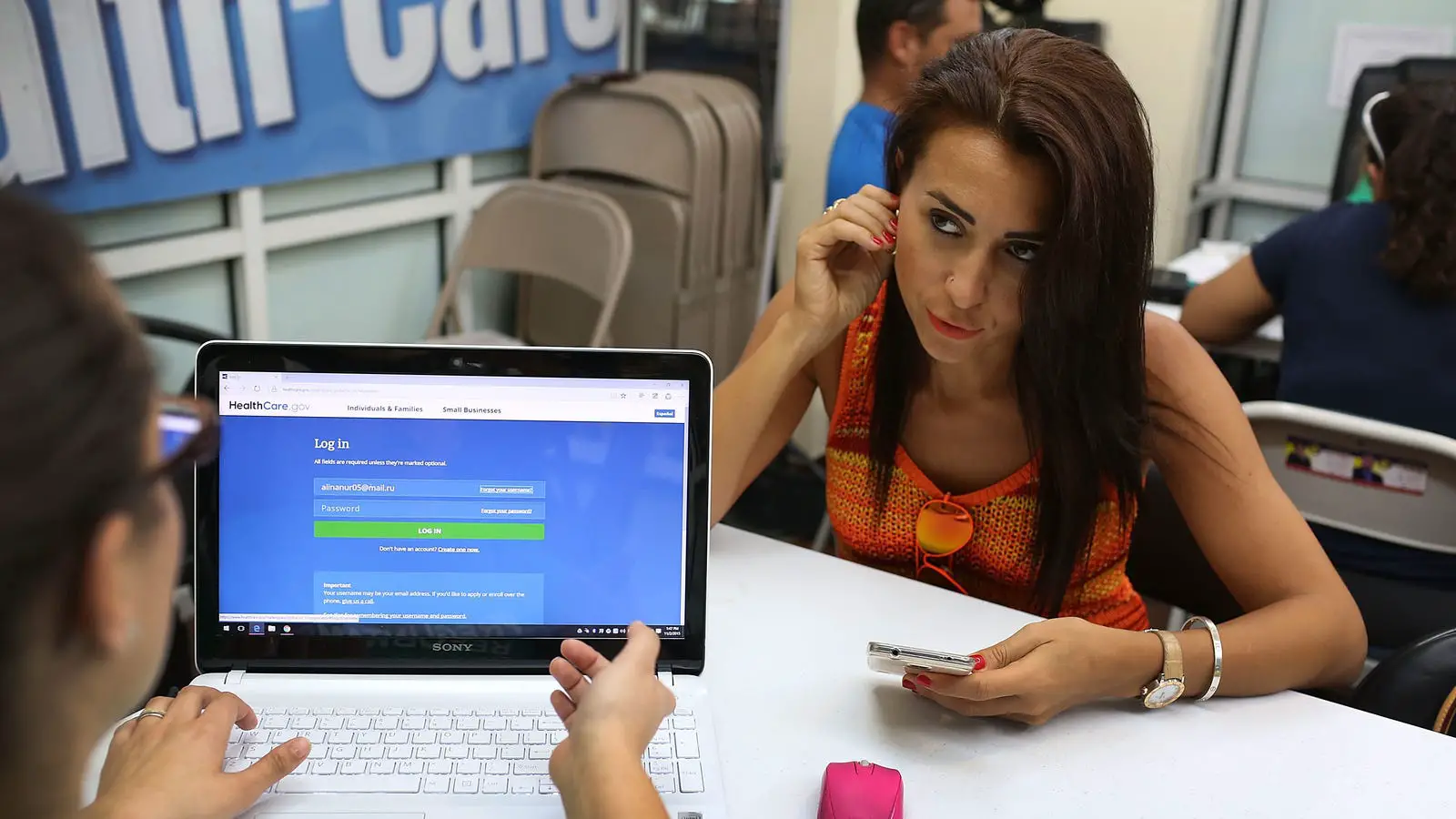

Who Can Use Healthcaregov

HealthCare.gov is available to anyone who doesnt have health insurance through work or one of these programs:

- Medicare

- Childrens Health Insurance Program

- Any other source that offers qualifying health coverage

Additionally, you may qualify to use HealthCare.gov if you have the option of insurance through work but find it unaffordable. However, we should note that your companys plan must fail to meet a strictly defined affordability standard if this is your situation.

Don’t Miss: How Much Does Usps Health Insurance Cost

What Are Cobra Deadlines

Once the plan has been notified of a qualifying event, the plan must provide qualified beneficiaries with an election notice within 14 days. The notice will include your deadline for signing up. Keep in mind that you must sign up for COBRA during a specific time frame and COBRA bills must be paid on time or you risk losing coverage. Heres how it works.

You have 60 days to sign up for COBRA once its offered to you. Coverage is retroactive from the day after you became unemployed. Then, after you elect COBRA, you have 45 days to make your first premium payment. If you do not make the first payment in that time frame, the health plan can terminate your benefits.

Highlights

You have 60 days to sign up for COBRA once its offered to you.

Youll learn from the plan what day monthly payments after the initial payment are due. You have a 30-day grace period. If you miss that grace period, your plan can cancel your coverage.

You can use tax advantaged funds from a Health Savings Account to pay COBRA premiums.7

How To Apply For Individual Health Insurance

Written by: Gabrielle SmithJuly 8, 2021 at 8:35 AM

More and more employers today are adopting reimbursement models for their employees healthcare, empowering employees to choose their own individual health insurance plan and get reimbursed, tax-free, for their premium.

While this freedom is great for your healthcare, it can be daunting to shop for your own insurance plan if youve never done it before. While there are several ways to go about shopping for health insurance, the most common way is through the Health Insurance Marketplaces.

In this article, well walk you through the five-step process so you can choose the right plan for you and your family.

Read Also: Are Abortions Covered By Health Insurance

How Much Will You Pay For Cobra

COBRA is expensive. Youll be paying the full premium cost, including the portion of the premium your employer previously paid for you. Considering the average employer pays about 80% of the $7,188 average annual premium for individuals, youll likely see a dramatic increase in premium costs, according to data from the Kaiser Family Foundation.5

You cant be charged more than 102 percent of the cost of the plan. Youll make payments directly to the health insurance company or COBRA plan administrator.

In some cases, the employer may choose to pay some or all of COBRA premiums. This may happen if your employer is undergoing a merger or acquisition, has furloughed you, or is offering severance o. In these cases, the employer may pay the health plan directly or reimburse employees for their payments.6

When Can You Sign Up If You Missed The Initial Enrollment Period

In the event that you did not join when you were first qualified and you do not have current healthcare coverage anywhere else , you will need to wait for the following General Enrollment Period which runs every year from January 1 through to March 31. Your coverage will then start in July of that year, and you might need to pay a late enrollment penalty on your Medicare Part B premium for as long as you have Part B coverage. Your premium will go up by 10% for each 12-month period you were not enrolled.

Read Also: What Is The Largest Health Insurance Company

How Long Are Cobra Benefits

In the majority of cases, COBRA continuing coverage lasts 18 months after you become unemployed. There are some longer periods of coverage for special beneficiaries. Coverage may continue for a total of 29 months in the case of a disability. And non-employee qualified beneficiaries, such as spouses and dependents, may be eligible to continue coverage for a total of up to 36 months if there is a second qualifying event.8

COBRA is an important alternative for people who have lost employer-sponsored insurance, especially those beneficiaries with an ongoing health issue or those who want to keep their current healthcare providers. Knowing how COBRA works can help you evaluate your options.

Ny Mn Ma And Ct Residents With Fairly Low Income Can Enroll Year

New York and Minnesota have Basic Health Programs , both of which offer year-round enrollment and are available to residents with income up to 200 percent of the poverty level.

Massachusetts has a program called ConnectorCare, which is available to residents with income up to 300 percent of the poverty level. ConnectorCare enrollment is available year-round, but only for people who are newly eligible or who havent enrolled previously.

And Connecticut created the Covered Connecticut program in 2021. People eligible for this coverage can enroll anytime until the end of 2021.

If youre in one of these states and have an eligible income, you may still be able to sign up for coverage regardless of what time of year it is.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health marketplace updates are regularly cited by media who cover health reform and by other health insurance experts.

Also Check: Does Aarp Offer Health Insurance

What Is Open Enrollment

An open enrollment period is a window of time that happens once a year typically in the fall when you can sign up for health insurance, adjust your current plan or cancel your plan. Its usually limited to a few weeks. If you miss it, you may have to wait until the next open enrollment period to make any changes.

What Do I Need To Know About Health Care Subsidies

Certain people will qualify for a premium tax credit based on their income and family size. To qualify for the tax credit, your estimated income must be between 100% and 400% of the federal poverty level based on household size.

Once you qualify for this health care subsidy, you have the option to use all, some or none of tax credit to lower your monthly premium.

If you use more advance payments of the tax credit than you qualify for based on your final yearly income, you must repay the difference when you file your federal income tax return, HealthCare.gov notes.

The reverse also holds true. If you opt to pay your monthly premium without using the tax credit you qualify for, youll get a refund of the amount you didnt use when you file your taxes.

You May Like: How Much Do Health Insurance Agents Make

When To Change The Status Of Obvezno Health Insurance

Any change to your obvezno must be registered in a regional office of HZZO. Changes must be registered within 8 days from the day of the occurrence, change, or termination of the consequences on the basis of which the obvezno health insurance is acquired.

If you leave Croatia for a certain period and lose your residence, you cannot freeze or pause your insurance. Instead, you must sign off from obvezno. This means that if youd like to come back in the future, you must sign up again. However, if you come back and sign up for obvezno in a period of 30 days from arrival, you dont have to pay 1 year of premiums for the previous year again.

If you dont have a Croatian address, then you cannot have obvezno.

Insured people who lost the right to obvezno can use their rights for 30 days from the date of termination of their status of the insured person. However, it is important to have obvezno due to the many rights it entitles you to.

People with obvezno have the right to:

- Health care

Who Must Have Obvezno Health Insurance

Obvezno health insurance is regulated by the Compulsory Health Insurance Act , which is available here.

Obvezno health insurance is mandatory for:

- Croatian residents with permanent residence or temporary residence in Croatia

- Foreigners with temporary or permanent residence in Croatia

- Citizens of EU Member States with a granted temporary stay in Croatia who work for an employer with headquarters in Croatia or perform economic or professional activity, if the conditions are met according to special regulations governing the issue of residence and work of foreigners in Croatia and unless otherwise is determined by an international agreement or a special law

- Third-country citizens with a granted temporary stay in Croatia who work for an employer with headquarters in Croatia or perform an economic or professional activity, if the conditions are met according to special regulations governing the issue of residence and work of foreigners in Croatia and unless otherwise is determined by an international agreement or a special law

The following groups are EXEMPT from signing up for Croatias state health insurance:

- EU citizens who have state health insurance in another EU/EEA Member State

- Third-country nationals who have state health insurance in another EU/EEA Member State just like other citizens of EU Member States

- Third-country nationals granted temporary residence based on being a digital nomad

In Croatia, you can sign up for the obvezno health insurance for:

- Spouses

Don’t Miss: Does Health Insurance Cover Birth Control Pills

How To Get Health Coverage

You can get health care coverage through:

- A group coverage plan at your job or your spouse or partner’s job

- Your parents’ insurance plan, if you are under age 26

- A plan you purchase on your own directly from a health insurance company or through the Health Insurance Marketplace

- Government programs such as

What Can You Do During Open Enrollment

During the open enrollment period, you can:

- change from a Medicare Advantage plan back to original Medicare

- change from Original Medicare to a Medicare Advantage plan

- join, switch, or drop a Part D prescription drug plan

- switch from a Medicare Advantage plan that does not include prescription drug coverage to one that does

- switch from a Medicare Advantage plan that includes prescription drug coverage to one that does not

- switch from one Medicare Advantage plan to another

Advertisement

You May Like: Is Cigna Health Insurance Any Good

How Do I Sign Up For Health Insurance

Shopping on HealthCare.gov during open enrollment 2020 is easy. Just go to the website and enter the following information:

HealthCare.gov will tell you if you or any of your dependents may be eligible for coverage through Medicaid, CHIP or a similar program.

Youll also learn what health care subsidies you qualify for, if any.

Finally, if youve got insurance through HealthCare.gov last year, the website also gives you the option to enter your current 14-character Plan ID.

Signing Up For Coverage Today Doesn’t Mean Your Coverage Will Be Effective Immediately Here’s What You Need To Know To Get Coverage In Place Asap

What are your options for buying a health plan in the individual health insurance market today, tomorrow, or at any other point during the year?

- Health insurance & health reform authority

- Open enrollment for 2022 health coverage begins November 1, 2021, and will continue until January 15 in most states.

- Consumers in most states can buy short-term coverage at any time during the year and coverage can be effective within days often by the next business day.

- If you have a qualifying event or are Native American, you can buy ACA-compliant coverage today, but probably will have to wait until at least the start of next month before the coverage is in force. A new year-round special enrollment period has also been added for households that are subsidy-eligible and have income up to 150% of the poverty level.

- People with modest incomes in New York, Minnesota, Massachusetts, and Connecticut can enroll in health programs year-round.

The mere fact that youre reading this article suggests that you need to buy health insurance coverage soon. So what are your options for buying a health plan in the individual health insurance market today, tomorrow, or at any other point during the year?

Recommended Reading: Where To Go To Apply For Health Insurance

What Other Times Can You Sign Up

You may likewise become qualified for Medicare for different reasons. In case you are qualified because of a disability, you qualify after you have gotten Social Security disability or certain Railroad Retirement Board disability benefits for two years. On the off chance that you have end-stage renal disease , you are qualified in the fourth month of dialysis treatment, potentially earlier. And if you have ALS, you qualify that very month your handicap benefits start.

What Do You Need To Know Before Choosing A Plan

Whether youre purchasing an insurance plan through Healthcare.gov or picking one from your employers benefits package, you need to know some key terms to make an informed choice.

Deductibles and premiums

Deductibles and premiums are two of the most significant factors that affect the cost of your insurance plan.

You pay a premium each month to have an insurance policy. You pay the same amount, even if you dont visit a doctor or fill a prescription.3

By contrast, the deductible is how much you pay for healthcare before your insurance starts to pay for your care. For example, if you have a $2,000 deductible, you have to pay for the first $2,000 of covered services before your insurer will start to cover procedures.4

If you want a low deductible meaning you want your health insurance plan to start paying for coverage sooner expect to pay a higher premium. If you are reasonably healthy and want to keep costs down, a plan with a higher deductible and lower monthly premium may be better for you.

Copayments

Your copayment is a fixed amount you pay for covered health services after youve met your deductible. For example, lets say you have a $500 deductible and a $20 copay for visits to the doctor.

If you havent met your deductible, youre responsible for paying for the full cost of the office visit on your own. Once you reach your deductible $500 then you just pay $20 per office visit.

Coinsurance

Network types

Recommended Reading: What Is The Best Health Insurance Coverage

How To Get Cobra

Group health plans must give covered employees and their families a notice explaining their COBRA rights. Plans must have rules for how COBRA coverage is offered, how beneficiaries may choose to get it and when they can stop coverage. For more COBRA information, see COBRA Premium Subsidy. The page links to information about COBRA including:

How To Sign Up For Medicare Advantage

Medicare Advantage, or Medicare Part C, is a private bundled health insurance plan. It offers similar coverage as parts A and B. It often gives prescription coverage as well. Some Medicare Advantage plans additionally cover vision, dental, and other healthcare benefits. This plan might put a yearly cap on your out-of-pocket costs. That can be useful in the event that you expect to have any huge healthcare costs.

However, a Medicare Advantage plan will be an extra expense on top of any premiums you pay for other Medicare parts. Numerous Medicare Advantage plans will cover a few or all of your Medicare Part B premium costs. Gauge your healthcare needs with the costs of coverage when choosing what parts of Medicare are best for you.

Assuming you need to sign up for Medicare Advantage, you can do that during your initial enrollment period. You can likewise change your selections during Medicares open enrollment period from October 15 till December 7. On the off chance that you join outside these times, you would have to pay a late-enrollment fee, and your coverage will not start until July 1.

You have two ways to sign up for Medicare Part C:

- Shop for Part C plans with Medicare.govs plan finder tool.

- With a private company. Insurance companies provide Part C plans, and you can directly sign up with them through their website or by phone.

Don’t Miss: What Is A Gap Plan Health Insurance