Paycheck Deductions: How Much Do Employees Pay For Health Insurance On Average

56 percent of Americans got health insurance from their employers in 2017. If you have an employer-sponsored health insurance plan, you will have a certain amount deducted from your paycheck to cover your premiums.

Understanding how much is taken out of your paycheck to cover health insurance is essential to figuring out how to best pay for your coverage. If your employer-provided plan is too expensive, it may make sense for you to change to a private plan.

Its important to ask how much do employees pay for health insurance also because you want to make sure that youre not overpaying your employer.

Which Type Of Health Insurance To Buy

Generally, there are twotypes of health insurance: public health insurance andprivate health insurance. Most people have some form of private health insurance, whether they purchase it through a marketplace or get it from an employer. State exchanges and the federal exchange can offer consumers both public health insurance and private health insurance.

Supplemental Insurance For Low Income Individuals

Even though a good part of your medical needs will be covered by the health plan in your territory, as you know not everything is paid for. There are few things more upsetting than knowing that if you were to become severely ill, you could not afford to be cared for. This feeling is even worse if you have children, as the prospect of being unable to afford medical care for them is a hopeless, powerless thing. However, if you are unfortunate enough to be one who cannot afford to purchase an additional policy to help with medical expenses for your or your family, there are different programs available that might provide a light of hope for you. After all, a government that believes every citizen should have access to health care is not going to make the least fortunate among you suffer needlessly.

Read Also: What’s The Penalty For Not Having Health Insurance In California

How Many Americans Have No Health Insurance

The number of uninsured nonelderly Americans fell from 48 million in 2010 to 28 million in 2016, before rising to 30 million in the first half of 2020. 30 million U.S. residents lacked health insurance in the first half of 2020, according to newly released estimates from the National Health Interview Survey .

How Do Us Health Insurance Costs Stack Up Globally

Voluntary healthcare payments including for private health insurance totalled more than $1,685 per capita in the USA in 2019.

This is lower than the figure in Switzerland, where voluntary payments were worth $2,745 per capita.

However, the USAs private spending continues to soar far above that in many other nations. American private health spending is five times higher than Canadas, for instance.

You May Like: Who Pays First Auto Insurance Or Health Insurance

Get Help Paying For Your Health Insurance Costs

Did you know that under the Affordable Care Act, you might be able to get assistance paying for your health insurance costs? You may qualify for one or both of these options:

- Cost-sharing assistance. This is a discount that reduces the amount you have to pay toward your deductible, copays and coinsurance. To use this discount, you must buy a Silver plan.

- Premium tax credit.This credit goes toward your premium and reduces the amount you pay every month.

To get help paying for your health insurance costs, you must:

- Not qualify for a government-sponsored program or an employer-sponsored health insurance plan.

- Not be claimed as a dependent on someone else’s tax return.

- Purchase a plan on the Health Insurance Marketplace.

- Have an income within a certain range for your household size.

See if you qualify for thepremium tax credit. You can alsoapply online to get your official results.

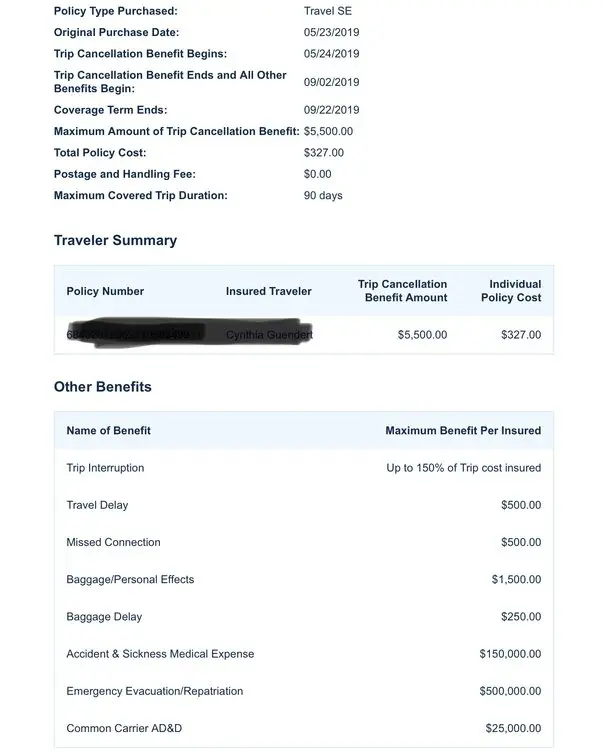

Does My Us Health Insurance Cover Me Abroad

Most of the time, your domestic health insurance plan doesnt provide cover abroad, but there are some cases it will for instance, for emergencies, medical evacuations or during short trips. Contacting your provider is usually the best way to find out. Sometimes, even if your insurer will cover care in such cases, you may need to pay out-of-pocket and apply for reimbursement.

Also Check: How Much Is Temporary Health Insurance

What Is A Deductible

A deductible is how much you have to pay toward your health insurance costs before your health plan will begin to pay for covered services in a given year. For example, if your deductible is $2,000 for the year, you have to pay for the first $2,000 in medical services. Some plans will pay for certain costs, like preventive services, before you’ve met your deductible.

Key Question #: Where Can I Receive Care

One way that health insurance plans control their costs is to influence access to providers. Providers include physicians, hospitals, laboratories, pharmacies, and other entities. Many insurance companies contract with a specified network of providers that has agreed to supply services to plan enrollees at more favorable pricing.

If a provider is not in a plans network, the insurance company may not pay for the service provided or may pay a smaller portion than it would for in-network care. This means the enrollee who goes outside of the network for care may be required to pay a much higher share of the cost. This is an important concept to understand, especially if you are not originally from the local Stanford area.

If you have a plan through a parent, for example, and that plans network is in your hometown, you may not be able to get the care you need in the Stanford area, or you may incur much higher costs to get that care.

Don’t Miss: What Is The Health Insurance For Low Income

How Cobra Affects Your Taxes

If you decide to continue your current health insurance with COBRA, there is another expense you may not be aware of: higher taxes.

While you’re employed, your insurance premium is deducted from your paycheck before taxes along with other pretax deductions such as your 401 retirement plan and group term life insurance. These deductions make your net income look smaller and, by doing so, lower your income tax.

When you lose job-based health coverage and switch to COBRA, you have to pay your COBRA premiums with after-tax money. This means that you lose the tax-free benefit you enjoyed while being employed.

In some cases, you may be able to deduct part or all of your COBRA premiums from your taxes. But not everybody is eligible for this deduction. Speak with an accountant or tax advisor.

How Do You Choose A Plan That Meets Your Budget And Needs

To settle on the right plan, think about how you typically use healthcare services. For example, ask yourself:

- How often do you usually visit the doctor? Once a year for a checkup, or monthly to monitor a health condition? Was last year typical, or unusual?

- Are you expecting larger-than-average health expenses next year or do you only expect to use preventive care services? For example, are you having a baby? Were you recently diagnosed with a condition that will require regular treatment?

- What prescriptions do you take regularly?

- How many healthcare providers do you typically see? Just a primary care doctor, several specialists over the year, or just the provider at your local retail or urgent care clinic?

- Do you and your family have one or more chronic health conditions?

- Have you or any of your family members been diagnosed with COVID-19 in the past year?

- Have you postponed healthcare services because of COVID-19?

It may be helpful to add up what you spent last year, just as a general guideline.

Make sure you look at all costs, not just the premiums. For example, a high-deductible plan can work out to your advantage if you are relatively healthy and only expect only to use preventive care services, since those services are at 100%. These types of plans typically have lower premiums. However, if you have a chronic condition that requires a lot of care, you might consider a plan that has a higher premium but lower out-of-pocket costs.

Dont Forget to Shop Around

Also Check: Does Health Insurance Pay For Abortions

How A Premium Works

In health insurance, the premium is the amount you pay to your provider every month. The premium is usually the first cost involved in a health plan.

You may also have to pay a deductible. The deductible is the amount you need to spend in out-of-pocket expenses before insurance actually starts to share the cost of eligible expenses. A lower deductible is ideal because it means youâll pay less for medical expenses on your own before your plan starts to cover them. However, a lower deductible usually comes with a higher premium, and a higher premium usually comes with a lower deductible.

For example, you might pay a $150 monthly premium for a health plan with a $3,000 deductible. Or you could pay $350 a month for a health plan with a $750 deductible.

Recession-proof your money. Get the free ebook.

Get the all-new ebook from Easy Money by Policygenius: 50 money moves to make in a recession.

Get your copy

You may pay a higher premium for one type of health insurance plan, such as a PPO, than you would for another type of plan, such as an HMO. You’ll also pay a premium for any supplemental health insurance policies you buy, such as for dental and vision insurance.

Learn more about the different types of health insurance and see which states have the highest premiums.

Beyond Your Monthly Premium: Deductible And Out

- Deductible: How much you have to spend for covered health services before your insurance company pays anything

- Copayments and coinsurance: Payments you make each time you get a medical service after reaching your deductible

- Out-of-pocket maximum: The most you have to spend for covered services in a year. After you reach this amount, the insurance company pays 100% for covered services.

Read Also: Does Short Term Health Insurance Cover Pre Existing Conditions

Premiums And People On Your Plan

When you add a spouse or child onto a plan, your monthly payment goes up. That’s because you’re charged for each person covered by your plan. When you have more than three children under the age of 21, you only pay for the three oldest. Here’s how that works.

- Darrell and Tamara have five children, ages 5, 8, 12, 14 and 16. Although their health plan covers all seven of them, they’re only charged on their monthly premium for five people. They’re not charged for their two youngest children.

- Samar has two children, ages 7 and 10. So her health plan covers three people, and she’s charged for three people on her monthly premium.

- Terry and Joaquin have four children, ages 17, 20, 22 and 24. Their health plan covers six people. Because two of their children are over age 21, they’re charged on their monthly premium for all six people.

Why Supplemental Insurance Is Important

Although we have detailed the different types of plans available to all sectors of the Canadian society, you might be wondering why having a supplemental health insurance policy is so important. This is especially true if you are relatively young and are still under the impression that nothing bad will ever happen to you. After all, you might think, you can go to a doctor if you get sick, he will figure out what is wrong with you, and you will recover. However, this is not always the case. For one thing, there are no guarantees in life just because you are healthy today does not mean you will always be so. For another, the cost of medical services and prescription drugs continues to rise at a rapid rate, and if you are diagnosed with a serious illness, it is likely that you will become bankrupt in a short amount of time. If you make your health a priority, not only will you be sure you have access to whatever services you might need, but you can rest well knowing they will be covered by your insurance plan.

You May Like: Where Do You Go If You Have No Health Insurance

Average Cost Of Health Insurance

One of the primary factors in your individual health insurance costs is your location, as prices will vary depending on the state and county where you live. In this first table, we look at health insurance premiums for 2021 and how they differ based upon the state you reside in.

| State |

|---|

Policy premiums are for a 40-year-old applicant.

Offering Health Benefits: A Competitive Advantage

According to the BLSs most recent Employment Situation Summary, the total of nonfarm payroll employment rose by 379,000, with the leisure and hospitality industries receiving the most positive impact.

It may seem a modest step forward towards recovery, especially after the COVID-19 pandemic. Still, it is a clear sign that, as the economy starts to recuperate, recruiters will start competing to gain the attention of talent who are looking to enter or reenter the workforce.

An attractive health benefits package is a magnet for top staff at any company and will also help you retain committed employees. Although health care is considered one of the most expensive benefits, it is undoubtedly an investment into your companys future.

Also Check: Do You Have Health Insurance

International Health Insurance For Us Citizens Living Abroad Whats Covered

How much youll pay for health insurance isnt a number you can guess. Its affected by many factors, few of which you control.

With William Russell, international health insurance can cover US citizens for:

- Doctor visits, consultations, hospital care and mental health treatment in multiple overseas territories .

- Up to $100,000 for unexpected elective medical care and $250,000 in emergency treatment costs during short visits back to US soil, for reassurance when you visit family or head home for the holidays .

Different Types Of Plans

Shopping for a health insurance plan can sometimes feel like being in a grocery store and staring at rows of the same product for what seems like hoursonly its less exciting and way more expensive! But comparing plans could save you money. This is because the type of plan you choose also affects your health insurance costs.

Here are the plans and networks you can shop for in the health insurance marketplace:

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Costs That Count As Deductibles

Even health insurance policies that impose deductibles exempt some medical services from the deductibility requirement. The Affordable Care Act, or Obamacare, contains a list of preventative healthcare procedures that are part of polices at no additional cost beyond your premium. But you have to pay out of pocket for other services. Here are some examples of what does and doesnt apply to a deductible.

Apply to Deductibles:

- Doctor costs that exceed copays

Often dont Apply to Deductibles

- Copays

- Costs not covered by your plan

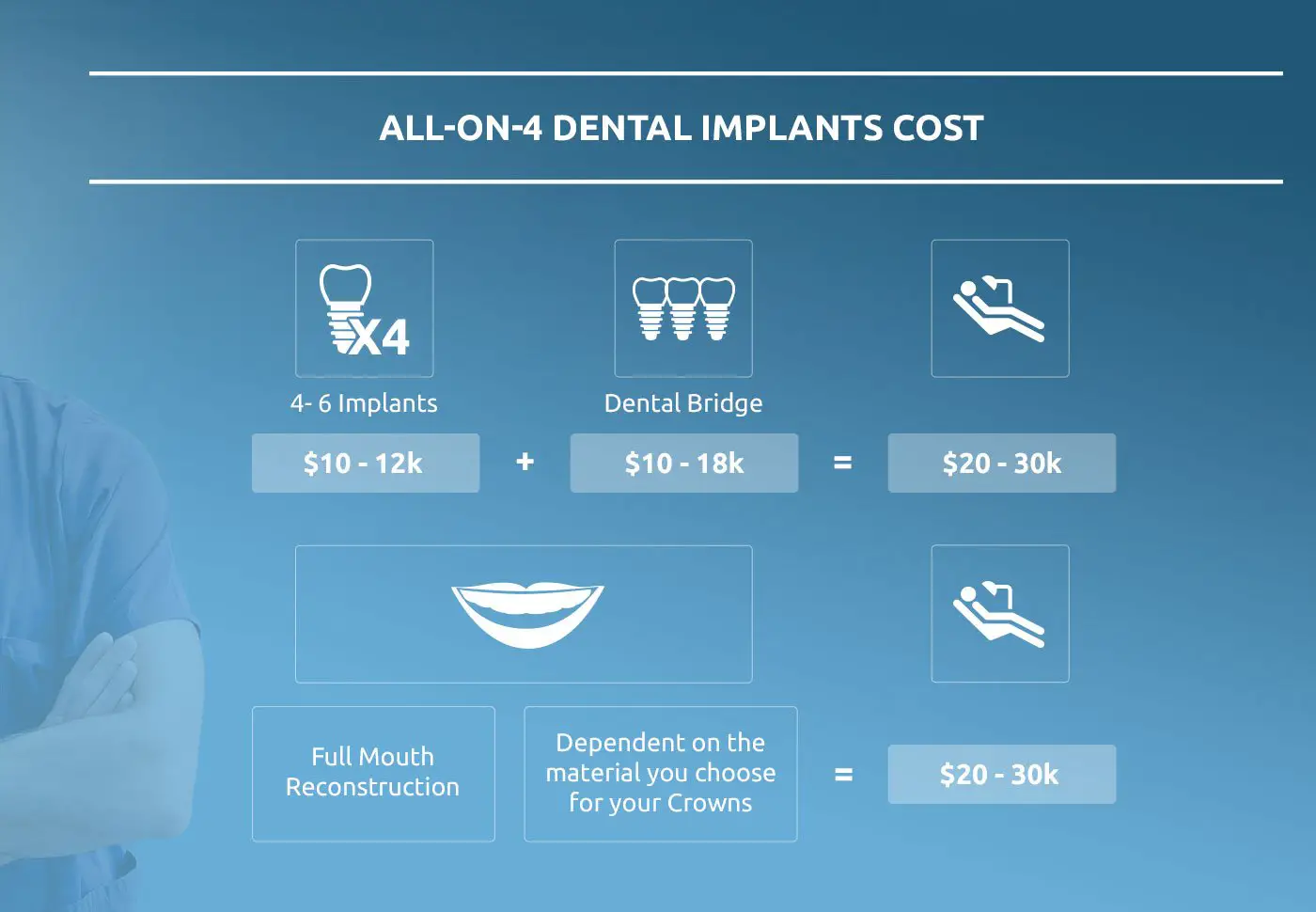

How Much Does Average Health Insurance Cost In The Usa

Health insurance means different things to people across the world the USAs system is known for several distinguishing features, including a high relative cost to the individual and a lack of universal coverage.

You may be wondering why the cost of healthcare insurance seems to be rising and how the picture compares to other nations. In a country that spends nearly $4 trillion on healthcare yet finds coverage varies widely, theres a lot to weigh up.

Across the United States, Americans pay wildly different premiums monthly for health insurance. The average annual cost of health insurance in the USA is $7,470 for an individual and $21,342 for a family as of July 2020, according to the Kaiser Family Foundation a bill employers typically fund roughly three quarters of.The cost to each person can vary a lot, however, based on factors such as age, geography, employer size and the type of plan theyre enrolled in. While these premiums are not determined by gender or pre-existing health conditions, thanks to the Affordable Care Act, a number of other factors impact what you pay.

Of course, not all companies offer health benefits to employees 44% of firms did not offer insurance to staff in 2020.

Insurance costs are rising in 2021.

Find out what’s driving up prices

Read Also: How To Apply For Health Insurance As A College Student

How Much Should A Health Insurance Plan Cost

Thanks to the Affordable Care Act, there are only five factors that go into setting your premium:

-

Your age

-

Whether or not you use tobacco

-

Individual v.s. a family plan

-

Your plan category

Health insurance companies are not allowed to take your gender or your current or past health history into account when setting your premium.

Health insurance premiums on the Affordable Care Act’s marketplaces haveincreased steadily due to many different circumstances, including political uncertainty as well as the cost of doing business. Additionally, while average premiums for the benchmarksecond-lowest-cost Silver plan have fallen slightly since 2018, costs vary widely by state and insurance market.

Over 9 million people â or 84% â who got health care through marketplaces received tax credit subsidies in 2020, further reducing the actual cost of health insurance.

When it comes to figuring the cost of health insurance, however, you need to look at more than just the monthly premium. As we mentioned in the sections above, health insurance is only one part of your total spending on health care services. In fact, if you frequently visit a doctor and you buy a plan with a high deductible and low monthly premium, it’s likely that you’ll spend more money overall than if you bought a plan with higher premiums, a lower deductible, and lower copayments and coinsurance payments.