Blind Decisions Are Bad Decisions

This is why Remodel Health has developed our proprietary Health Benefits Analysis for your team. This secure and compliant evaluation of your organization will provide you with the exact outlook for what getting started with managed individual health benefits can look like. Before you dont click on the link, dont worryits only $35 per employee. Yeah, thats it! While it would normally cost about $9,500 to accomplish this, you can get it done cheaper and more easily than ever.

Head on over to remodelhealth.com/analysis to get started today in the future of health benefits!

Important Notice: Remodel Health does not intend to provide specific insurance, legal, or tax advice. Remodel Health always recommends consulting with your own professional representation to properly evaluate the information presented and its appropriate application to your particular situation.

Moving Out Of Province And Health Insurance

If you move out of your home province or territory, whether for school or a new job, you must apply for insurance through the government. This can take several months. OHIP, Ontario’s insurance program, takes three months to kick in, for example.

For some people, this is an uncomfortable period of time to not have health insurance.

If a new job does not offer coverage that begins immediately, individuals may choose to take out a private plan. They may then choose to continue the private plan after Medicare kicks in or to go off of it completely.

How Do Health Insurance Subsidies Work In The Usa

A health insurance subsidy provides government assistance to contribute to the cost of cover in the USA, the Affordable Care Act provides a sliding scale of support to US citizens and legal residents earning four times the federal poverty level or less.

In 2021, the federal poverty level is $12,880 for an individual, so individuals earning less than $51,520 may be entitled to subsidised health insurance.

Applications are made through the government-run health insurance marketplaces in each state. Changes to incomes may affect eligibility, so applicants sometimes need to pay subsidies back if circumstances change.

Also Check: Can I Be On My Parents Health Insurance

Do Us Citizens Living Abroad Have To Buy Health Insurance

Americans who live abroad, or who spend a large proportion of their time overseas, often find theyll need a separate health insurance policy for this.

One option is to buy local insurance, but this wont cover you for trips home and you may find there are language barriers if you need to make a claim.

International health insurance is a popular alternative for American expats living overseas. With William Russell, English-speaking customer service representatives handle every stage of your claim from our UK offices, so youre in safe hands.

Read more about the difference between travel, local and international health insurance with our FAQ guide.

Paying For Health Care Even With Insurance

If youre new to health insurance, you may be surprised that you still have to pay for health care. Isnt your health plan supposed to pay your medical bills now?

Well, yes and no. Your health insurance is supposed to pay part of the cost of your health care, depending on the services that you need during the year. But youll still end up paying deductibles, copayments, and coinsurance.

JGI / Jamie Gril / GettyImages

Also Check: What Is A Good Cheap Health Insurance

Preventative Care And Early Intervention

When you don’t have insurance, you may avoid getting treated for minor issues which can escalate into bigger problems quickly. Preventive medicine and quick treatment are the best ways to avoid expensive hospital stays.

If you have insurance, then you won’t need to worry about this as much. Additionally, if you put off going in for treatment and wind up developing a serious medical condition, you may have a difficult time finding health insurance after you have not had any for so long.

How To Choose Your Premium And Deductible

Premiums and deductibles work together. Plans with higher deductibles usually have lower premiums, while plans with lower deductibles often have higher premiums. One thing to consider when choosing a plan is how much you think you will use your insurance.

- I will use my insurance often: Do you have small children? Or do you or a family member get sick often or have an ongoing illness or disability? If you think you’ll need to see doctors regularly, you may want to consider a plan with a higher premium and lower deductible. You’ll pay more each month, but you’ll also meet your deductible faster which means lower total out-of-pocket costs.

- I will not use my insurance often: If you’re healthy and don’t go to the doctor often, you may want to consider a plan with a lower monthly premium and higher deductible. If you don’t think you will meet your deductible with the amount of health care services you may use, a lower premium may be the best way to keep your overall annual costs down.

You May Like: How Much Does Family Health Insurance Cost Per Month

Medical Emergencies Can Bankrupt You

Medical emergencies are very expensive. If you have the misfortune of undergoing a medical emergency without insurance, it is easy to find yourself with a crippling amount of medical debt, and seemingly no way out of the mess.

If you take good, preventative care of your health, it’s hard to see why you’d really need insurance. However, missing that last stair at home and dislocating an ankle, or having an accident on the ski slope and breaking an arm could cause an injury that costs you thousands of dollars in medical bills, and it can quickly climb higher if you need surgery or any kind of ongoing rehabilitation. Emergency surgeries such as an appendectomy can be very expensive as well.

You may not be able to work while you’re laid up, and that means that you could lose out on pay as well. Even with insurance, you may find it difficult to pay for health care costs in these instances. It is very hard to pay for medical costs without health insurance, especially if you are checked into a hospital even just overnight.

Where To Shop For Small Business Health Insurance Plans

Business owners can quickly search on eHealth to find local plans that may help them qualify for tax credits. The quick health plan quote box on eHealth also provides direct access to information about all kinds of health plans for businesses, families, and individuals. These resources can help businesses and consumers find plans to fit a variety of budgets and get the right information to make an informed decision.

This article is for general information and may not be updated after publication. Consult your own tax, accounting, or legal advisor instead of relying on this article as tax, accounting, or legal advice.

You May Like: Does Colonial Life Offer Health Insurance

After Meeting The Deductible

The next time you have a medical expense, you will only be responsible for coinsurance, having already met the deductible in full. The deductible resets every year, so each year youâll need to repeat the process and pay out of pocket again before your health insurance covers your medical expenses.

More Health Insurance Deductible Examples

Letâs say you have a health insurance plan with a $500 deductible. A major medical event results in a $5,500 bill for an expense that is covered in your plan. Your health insurance will help in paying for these costs, but only after youâve met that deductible. This is what happens next:

You pay $500 out of pocket to the provider.

Because you met the deductible, your health insurance plan begins to cover the costs.

The remaining $5,000 is covered by insurance, but you may still be required to pay a percentage of the costs, depending on if your plan has copays or coinsurance.

Read Also: Will Health Insurance Go Down

Canadian Costs Versus The World

So where does this leave our average family of four? In their 2015 report, the Canadian Institute of Health Information noted that Canadians were among the highest health care spenders in the world. They estimated the average spend at $5,782 per person.

That put the personal spending above the average but nowhere near the biggest spenders. As it has for years, the average American spent twice as much as $11,916. An average family in Sweden spent slightly more at $6,601 and the same family in the UK spent $5,170.

How Much Should I Pay For Healthcare Introducing The Health Affordability Ratio

Updated: by Financial Samurai

Healthcare affordability continues to be a concern for millions of Americans. When the Affordable Care Act was enacted in 2010 I was happy. A universal healthcare system would insure the ~47 million Americans who were previously not insured.

After all, disease doesnt discriminate between rich and poor. Also, being rejected for healthcare coverage due to a pre-existing condition is discriminatory. Healthcare affordability shouldnt be a national crisis. However, things have changed.

Recommended Reading: How Do I Get A Health Insurance Card

What Is The Average Cost Of Health Insurance

Maybe youre wondering, How much does individual health insurance cost? Heres what you can expect. The average individual in America pays $452 per month for marketplace health insurance in 2021.2 The average family pays $1,779 per month.3

But the cost of health insurance varies widely based on a bunch of factors. Some things are in your control, some arent. Things like your age, how many people are on your plan, how much coverage you need, where you live and who your employer is all play a role in the price of your coverage.

Heres a breakdown showing the average costs depending on your state:

Kaiser Family Foundation, 2021.

Here’s How That Breaks Down

According to eHealthInsurance, for unsubsidized customers in 2016, “premiums for individual coverage averaged $321 per month while premiums for family plans averaged $833 per month. The average annual deductible for individual plans was $4,358 and the average deductible for family plans was $7,983.”

That means that, last year, the average family paid $9,996 for coverage alone, and, if they met their deductible, a total of just under $18,000.Meanwhile, an average individual spent $3,852 on coverage and, if she spent another $4,358 to meet her deductible, a total of $8,210.

These figures do not take into account any additional co-insurance responsibility she might have. In addition to co-pays and deductibles, an increasing number of plans now require co-insurance payments, which require that, even once you meet your deductible, you continue paying some percentage of all costs until you hit your out-of-pocket maximum.

You May Like: Who Qualifies For Health Insurance Subsidies

Why Is Health Insurance Important

Almost 2/3rds of bankruptcies in the United States were caused by medical bills. Health insurance is not just insuring your health it insures your wealth. Even after the passage of the Affordable Care Act, most people in the US receive their health care through their employer. Insurance can be difficult to obtain if you retire before youre eligible before Medicare. The ability to have access to any sort of coverage between retirement and Medicare is a huge benefit. Not just for federal employees, but also their spouses, and family members.

Factors That Impact Health Insurance Rates

For a particular health insurance plan, the cost of coverage is determined by certain factors that have been set by law. States can limit the degree to which these factors impact your rates for instance, some states like California and New York don’t allow the cost of health insurance to differ based on tobacco use.

- Age: The health care cost per person covered by a policy will be set according to their age, with rates increasing as the individual gets older. Children up to the age of 14 will cost a flat rate to add to a health plan, but premiums typically increase annually beginning at age 15.

- Where you live: Health insurance companies determine the set of policies offered and the cost of coverage based on the state and county you live in. So a resident of Miami-Dade County in Florida, for instance, may pay lower rates for the same policy than a resident of Jackson County.

- Smoking/tobacco use: If you smoke, you could pay up to 50% higher rates for health insurance, though the maximum increase is determined by the state.

- Number of people insured: The total cost of a health plan is set according to the number of people covered by it, as well as each person’s age and possibly their tobacco use. For example, a family of three, with two adults and a child, would pay a much higher monthly health insurance premium than an individual.

Don’t Miss: Is It Legal To Marry For Health Insurance

How Much Does It Cost For Health Insurance In Canada

Despite the rumors, health insurance in Canada isn’t really free. The actual cost of health care in Canada is thousands of dollars and can reach tens of thousands of dollars.

Universal health coverage covers everyone who is a citizen or deemed a permanent resident. It doesn’t cover everything they need.

In fact, it isn’t even really universal. There is no one plan. There are actually 15 different provincial and territory plans that makeup “health insurance, Canada.”

In America How Much Do Employees Pay For Health Insurance

From the insurance plan your company chooses to your employees health conditions, many factors affect how much employees pay for health insurance. Before detailing these items, lets take a look at some facts that reflect, on average, what these payments look like in America. This data is from the 2020 National Compensation Survey by the U.S. Bureau of Labor Statistics :

- The average cost for health care per employee-hour worked was $2.64 for private industry workers.

- 86% of workers participated in medical care plans with an employee contribution requirement, where employees paid $138.76, and employers paid $459.70 per month.

- 72% of workers participating in single coverage medical plans with contribution requirements had a flat-dollar premium, and the median amount was $120.06.

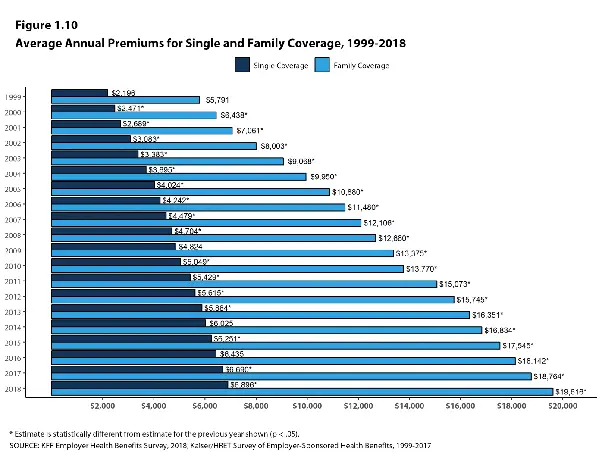

Kaiser Family Foundation reported in their 2020 Employer Health Benefits Survey: In 2020, the average annual premiums for employer-sponsored health insurance are $7,470 for single coverage and $21,342 for family coverage.

In terms of premiums, the report found that most covered workers contribute to the cost of the premium for their coverage .

Specifically, for covered employees at small firms, the average premium for single coverage is $7,483 and $20,438 for family coverage. The average annual dollar amounts contributed by covered workers for 2020 are $1,243 for single coverage and $5,588 for family coverage, the report continues.

Also Check: How Much Is Private Health Insurance In Spain

Cost Of Health Insurance In Germany: Is Public Or Private Insurance Cheaper

You contribute approximately 14.6% to 15.6% of your salary to public health insurance in Germany . The minimum amount you have to contribute, based on salary, is 180/month, whereas the maximum is around 400/month, regardless of whether your paycheck increases further.

When it comes to private insurance, there is no definite price because it depends on things like your age, whether you have pre-existing conditions, how much coverage you want to have, the deductible, as well as whether you have dependents. The price tags can be significantly different based on these factors.

As to which type of health insurance in Germany is cheaper, it depends on:

- Family members: If you have dependent family members , the public health insurance system allows you to add them to your own plan, so they also receive health insurance without any additional costs to you. In the private scheme, you have to pay additional fees for each family member.

- Your age: Since monthly contributions in the public system are based on salary, your age will play no role in the cost. On the private system, on the other hand, companies usually increase prices for older individuals.

- Your health: If you have pre-existing conditions, then public insurance will cover you at no additional cost, while private insurers will usually charge extra. On the other hand, if you are healthy, you can be covered by a private insurance company and pay less than your current contributions.

Employer Subsidized Healthcare Is Valuable

Fortunately, most peoples employers subsidize most of their healthcare premiums, but dont think for one second that companies havent baked in the cost of healthcare benefits into part of your pay package.

Take a look at the average annual healthcare premium for single and family coverage in 2019. A family pays an average of $20,600 for health insurance a year and an individual pays $7,200 for health insurance a year. Luckily, most of this is subsidized by the employer. Unfortunately, the cost trajectory looks like its going to keep going up.

For example, in 2021, my family pays $2,380 a month for health insurance for a family of four. It is unsubsidized because we make more than 400% of the Federal Poverty Level . If you want to get subsidized health insurance, you need to make less than 400% of FPL.

You May Like: How Much Does It Cost For Health Insurance

Who Has To Pay Premiums Under The Qubec Prescription Drug Insurance Plan

If you do not have prescription drug insurance through a group insurance plan, you must pay the premiums for the Quebec prescription drug insurance plan. Additionally, if you qualified for a group plan but did not sign up, you also must pay this premium. If you pay the premium for this plan because you refused to sign up for a group plan, you do not receive benefits under Québecs prescription drug plan.

There are exceptions to these rules. If you received social assistance or last-resort financial assistance through the year, you dont have to pay this premium. If your spouse has paid your premium, you dont have to pay. You do not have to pay this premium if you are registered with Indigenous and Northern Affairs Canada or if you are recognized as Inuk. There are a few additional exceptions for rare cases and for families with relatively low incomes.