Is Short Term Insurance For Me

Short term insurance may be for you if you’re:

- Unable to apply for Affordable Care Act , also called Obamacare, coverage because you missed Open Enrollment and you don’t qualify for Special Enrollment

- Waiting for your ACA coverage to start

- Looking for coverage to bridge you to Medicare

- Turning 26 and coming off your parent’s insurance

- Between jobs or waiting for benefits to begin at your new job

- Healthy and under 65

For these situations and many others, Short term health insurance, also called temporary health insurance or term health insurance, might be right for you. It can fill that gap in coverage until you can choose a longer term solution.

Short Term Health Insurance Law

The current federal short-term health insurance restrictions include:

- Coverage term length restrictions

- Renewal restrictions

- Many states have stricter regulations than this

- Several states prohibit short-term plans entirely

- Plans are not Affordable Care Act compliant

- Plans are not subject to the same protections as ACA-compliant plans

- Many plans do not cover preexisting or chronic conditions due to being exempt from ACA rules

Many states have stricter or looser regulations than what is mandated by the federal government. As an example, lets look at Michigans rules regarding short-term health insurance. Here, short-term duration plans are governed by the following set of rules:

- Coverage period limited to 185 days

- Policies are not required to cover preexisting conditions

- Do not satisfy the requirement to have health insurance

- Plans are non-compliant with the Affordable Care Act and its protections

While you should weigh your options carefully if youre considering short-term health insurance, you can compare quotes from the following providers if youre ready to buy temporary coverage.

What Does Catastrophic Health Insurance Cost

The average cost of a catastrophic health plan is $195 per month, but your cost will depend on your location, age, and insurer. That amount is significantly less than what a bronze plan purchased through the Health Insurance Marketplace would cost. As of 2021, the lowest-tier bronze plan costs $328 per month, on average.

Short-term insurance plans are another option that can be inexpensive since theyre meant as temporary coverage and dont cover pre-existing conditions. Short-term policies typically cost around $124 per month.

Don’t Miss: Is Eye Surgery Covered By Health Insurance

How Mira Is Different

For $45 per month or $300 annually, you become a Mira member. A Mira membership includes access to affordable all-inclusive urgent care visits, same-day lab tests, COVID-19 testing, discounted prescriptions, and more.

Pros: 400+ affiliated walk-in clinics, 1600 laboratories, and 60,000 pharmacies. Mira will keep you covered for your primary care and urgent care needs until you are able to obtain long-term insurance.

Cons: Mira does not offer coverage for mental health services, hospital visits, or vision and dental services.

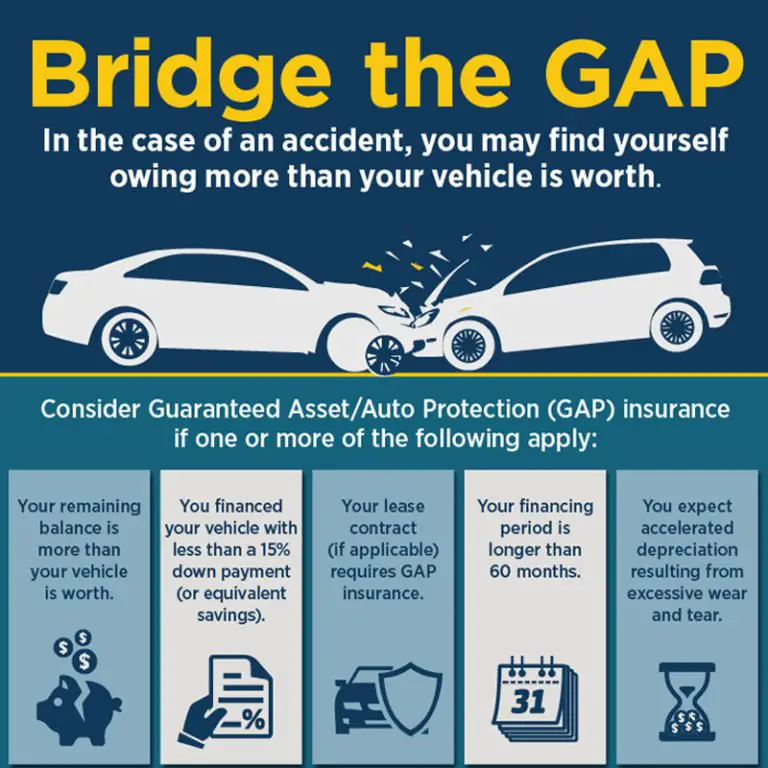

When Negative Equity Matters

You may be wondering why negative equity even matters. If a lender is willing to give you a loan and youre willing to pay for the loan, who cares if you owe more than the car is worth?

Youre right it certainly doesnt matter most of the time.

However, this gap between what you owe and what your car is worth can create a financial chasm if your car is totaled in an accident. When a total loss occurs and you need to be reimbursed by your auto insurer, negative equity raises its ugly head.

Case in point:

Lets say you own a 2019 Honda CR-V. Last month, a massive tree fell on it, and it is irreparably damaged. The insurance adjuster determined it is a total loss.

You still owe $40,321 on your auto loan, but the claims adjuster estimates the value to be $34,389.

You receive a check for $34,389. You use that money to pay down your auto loan, but even after giving the lender your entire insurance check, you still owe $5,932.

Now, you have a problem. You have to scrounge up $5,932 just to pay off the loan on a car you no longer have plus, you dont have any money left for a down payment on a new ride.

This scenario illustrates why you might need gap insurance.

So, what is gap insurance? Its the protection for the difference between your vehicles worth and your auto loan amount. In this scenario, if your vehicle was totaled, gap insurance would potentially cover the $5,932 not covered by your auto insurance policy.

Don’t Miss: Does Health Insurance Cover Birth Control Pills

Affordable Care Act Vs Short

Before signing up for short-term health insurance, there are a few things to consider. First and foremost, short-term plans arent considered comprehensive health insurance under federal law, as a result they arent required to be compliant with Affordable Care Act consumer protections.

This year, the current administration set forth new regulations to expand the availability of short-term health insurance by allowing these plans to be offered for up to 364 days and renewed at the discretion of the insurer for up to three years .

Short-Term Health Insurance Key Takeaways:

- Federal rule now allows 364-day plans, with option to renew for up to 36 months

- There are 11 states where no short-term plans are available

- Enrollment in short-term coverage is likely to increase over the next decade

- Short-term plans are aggressively marketed to consumers

- Multiple health organizations have filed suit to invalidate the new regulations governing short-term plans that allow them to provide coverage for up to 364 days and to be renewed for up to 36 months.

While the final rules expansion from three to 12-month policy terms can be seen as a plus for consumers who may have missed the open-enrollment deadline and do not qualify for other healthcare alternatives, light regulation in some states has incentivized some of the less than ethical operators in the business to ramp up their practices, according to a Georgetown University study.

Helpful Information About Short Term Health Insurance

The number of uninsured Americans is on the rise again for the first time in a decade. According to new census data, 27.5 million people had no form of health insurance in 2018. Thats nearly 2 million more than the number of uninsured in 2017. Census officials said this marks the first year-to-year increase of uninsured people since 2008-09, when the Affordable Care Act was passed.

The reasons for this increase are mostly speculative for now. However, analyses from the Kaiser Family Foundation, the Congressional Budget Office , the Joint Committee on Taxation , the Commonwealth Fund, the Urban Institute, and the Center for Children and Families suggested that the increase in the number of uninsured Americans could be due to rising health insurance premiums. Other factors may include:

- The repeal of the Affordable Care Acts individual mandate

- Expanded availability of short-term limited duration policies

- The addition of work requirements for Medicaid enrollment

- Certain statesrefusal of Medicaid expansion regardless of federal funding to match coverage of their poorest citizens

The U.S. Census Bureau reported the rate of uninsured American was on the rise again

After the Affordable Care Act came into effect, the percentage of uninsured historically. This was due to ACAs efforts to extend Medicaid coverage to many low-income individuals. New census data shows the first significant rise in uninsured population in a decade.Statistics provided by the U.S. Census Bureau.

Don’t Miss: How To Get Cheap Health Insurance In Texas

What Should I Do Once I Have Arrange Gap Year Insurance

Once youve chosen and secured gap year insurance its really important to ensure you have a copy of the policy. Here are a few top tips:

Its sensible to have the contact details for your insurer and your policy number accessible at all times. Some people choose to keep these in their wallet or stored in their phone. Share the policy details with your parent or guardian too. If the details are sent on email ensure they are kept safe and that you wont delete them by accident. You could create a folder for important documents within your inbox. If you are sent printed documents you could scan or photograph the policy and email it to yourself so you also have a digital copy. Before you depart, read the policy details carefully. You are likely to need certain documentation if you have to make a claim, for example, you may need a receipt from a hospital if you require medical care. Or if something is stolen you could be asked for a police report or reference number.

We know that sorting your gap year travel insurance can feel a bit tedious. But its an essential part of organising a gap year, and once youve arranged your policy you can sit back and get ready to enjoy your trip. Before you know it, youll be on your gap year!

The Big Questions About Build Back Better

Lurking behind this is a question that applies to everything under consideration in Build Back Better: whether it even makes sense to try and fund so many options, rather than focusing on a small handful and doing them well.

Theres an argument that spreading the money too thinly will create a bunch of unsatisfactory initiatives that simply fuel cynicism about government, without actually making a big impact on any problems. Theres also a counterargument that change in the U.S. is always incremental and that scaling up existing initiatives is easier than launching new ones.

Politics is a big consideration, too, and thats by necessity. Democratic leaders want to create programs that will survive future, almost inevitable attempts at defunding or repeal by Republicans and, ideally, restore the faith in the public sector that has waned over the past few decades. Democrats would also like something they can show voters in 2022 and 2024, as proof they can govern.

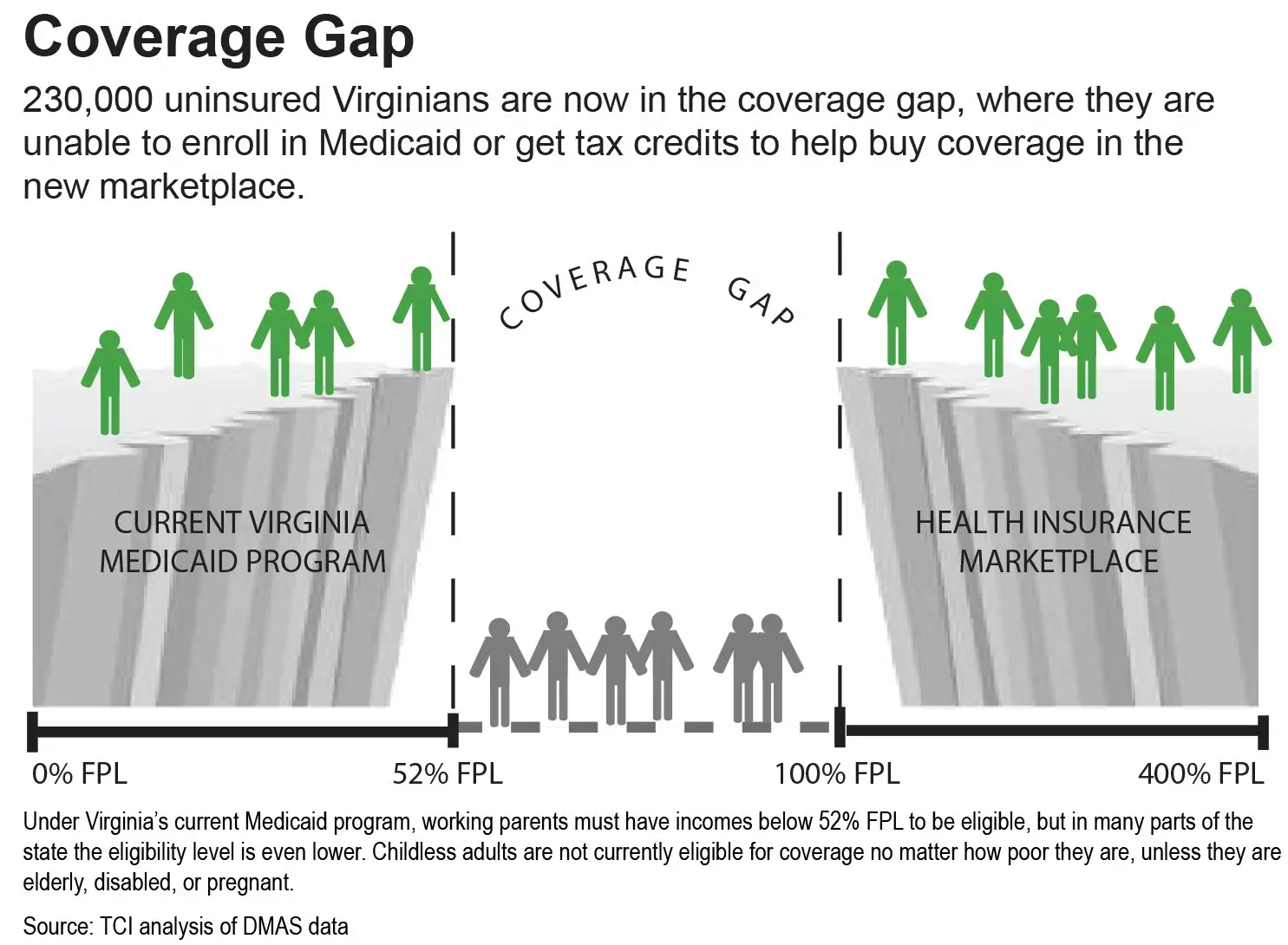

But figuring out which policies would best accomplish those goals is complex, as The Washington Posts Paul Waldman and Greg Sargent noted recently. A dental benefit for Medicare would reach many more people, targeting benefits at older Americans who vote in high numbers and many of whom might not otherwise vote Democratic. Filling the Medicaid gap would matter in states where Democrats have struggled, and let the partys newly elected Georgia senators deliver on a signature promise.

You May Like: Can I Go To The Er Without Health Insurance

Keep These Short Term Insurance Reminders In Your Long

With short term health insurance you are not buying an ACA health plan. That means you need to keep a few things in mind as you plan your coverage needs:

- ACA health plans are guaranteed issue, meaning you cannot be denied coverage based on preexisting conditions

- Short term insurance plans are not guaranteed issue, do not cover preexisting conditions, and you must answer a series of medical questions to apply for coverage

- ACA health plans are required to cover 10 essential health benefits, including maternity and newborn care, mental health and substance abuse disorder services

- Short term insurance plans do not have coverage requirements, so plans vary in what they cover. Check your plan details carefully

So, its true that you may save money by choosing short term health insurance. Just be sure you know what you are buying, and that its a good choice for you. For the right situation, short term insurance plans can definitely provide fast, flexible, temporary health insurance coverage that fits your needs.

What Are Some Potential Drawbacks Of A Level

Some argue that because level-funded plans do not stick to the ACAs 80/20 rule, it is considered a downfall of the plan. This rule deems that carriers must spend at least 80 percent of collected premiums on medical care and/or attempt to improve the quality of care. In addition, if they do not follow the 80 percent rule, they must rebate any excess amount that was charged, capping out carrier profits at 20 percent.

Due to self-funded and level funded plans being exempt from this rule, carriers often take liberties in defining claim expenses. To protect against this practice, employers should work with employee benefits specialists who know to look out for these hidden costs, that can often be overlooked.

We hope this blog will act as a guide to all the details to know about level-funded insurance plans and will help aide in the process of helping your client pick a plan that is right for them. Even if you are looking for a plan yourself, we hope the benefits and potential draw backs we mentioned here empower you to make a more informed decision for your health care. Contact our team at Agent Link to assist with any other questions you may have about level-funded insurance plans or other products that may interest you or your clients.

Don’t Miss: What Is A Good Cheap Health Insurance

Best For Added Benefits: Oscar

Oscar

-

Only available in select markets

-

Smaller provider network

-

Higher-than-average number of complaints

Oscar is a relatively new company that launched in 2012. It offers unique features like virtual urgent care, and you can book visits with healthcare providers from your home and pay $0.

Oscar has an app that syncs with your Google Fit or Apple Health device. You can earn $1 for every day you reach your step goals, up to $100 per year by walking. In California, members can also earn rewards by reaching their sleep goals.

You will also have access to a care teama team of guides and nurses that will help you find the best and most affordable care near you.

Oscar isnt available everywhere. General healthcare plans are available in 19 states. Only five locations have catastrophic plans: New York, Los Angeles, Orange County , San Francisco, and San Antonio.

Because Oscar is so new and is only available in some areas, it has a smaller provider network than some other insurance companies. And its had some growing pains as it expands. In 2020, its National Association of Insurance Commissioners complaint ratio was 4.82, meaning it received nearly five times more complaints than is typical in the industry.

However, Oscar offers unique benefits that make it stand out from other insurers. With its telehealth and rewards program, you can get quality care at a relatively low cost.

What Is Medicare Supplement Insurance

Medicare Supplement Insurance, also known as Medigap insurance, was created to fill in the gaps in costs left behind by Medicare Part A and Part B. Medicare Part A and Part B sometimes require you to pay deductibles, copays, and coinsurances. A Medicare Supplement policy can help you cover these costs.

A Medigap policy only supplements, not replaces, your Medicare Part A and Part B. That means you must enroll in Original Medicare before you can purchase a Medigap policy.

Medigap plans are named after letters, just like Medicare parts. This gives way to some confusion.

Remember, Medicare has Part A, Part B, Part C, and Part D.

Medicare Supplement Insurance has Plan A, Plan B, Plan C, etc., up to Plan N.

Medicare Supplement plans are standardized across almost all states. This means insurance companies cant change the plans to offer more or less benefits. Insurers can, however, decide which plans they will offer, though the government requires them to offer certain plans.

Every insurance company that offers Medicare Supplement insurance has to offer Plan A. If they offer any plan in addition to Plan A, they must also offer either Plan C or Plan F to current Medicare beneficiaries and either Plan D or Plan G to new Medicare beneficiaries.

Like we mentioned earlier, Medigap plans are the same in almost every state, except Massachusetts, Minnesota, and Wisconsin. Well discuss the differences later.

Read Also: How Much Does It Cost For Health Insurance

Pros And Cons Of Gap Health Insurance

- You choose how to use benefits payments There is no restriction on how to use the money you receive, whether for medical costs or to pay for groceries.

- Apply year-round There is no official open enrollment period and, in most cases, coverage begins the next day after you enroll online.

- A plan for every budget There are different levels of coverage to meet different needs.

- Keep your doctor No provider network limitations for fixed indemnity plans means you can visit your preferred healthcare provider.

- Unlike ACA plans, premiums are based on age and health The younger and healthier you are the lower your monthly premium, conversely, older and sicker individuals will pay more.

- Pre-existing conditions are not covered

- Not ACA-qualifying major medical coverage Gap insurance is a form of supplemental health insurance, not ACA-qualifying major medical coverage.

When And How To Enroll In Medicare

As we mentioned above, people who want to enroll in Medicare must be at least 65 years old if they are under 65, they must either have a covered disability or suffer from end-stage renal disease. Here well discuss these requirements in full.

If Youre Age 65 or Older

As you near your 65th birthday, you must start thinking about Medicare.

If you receive benefits from the Social Security Administration or the Railroad Retirement Board , you will be automatically enrolled in Parts A and B.

If you dont receive these benefits yet, youll have to enroll yourself. Youll have three months before your birthday month, the month of your birthday, and three months after your birthday month to submit the paperwork. This total of seven months is called the Initial Enrollment Period.

If youre 65 but youre covered by your or your spouses employers group health plan, you dont have to enroll in Medicare immediately. You can choose to enroll at any point during your coverage or you can enroll within eight months of the employment termination date.

For example, if youre still working, youre enrolled in your workplace group plan, and you turn 65, you can choose to enroll while you still have coverage but youre not obligated to. Once your job ends, because you retire or youre terminated, you have eight months to enroll in Part A and Part B from the date the employment or the coverage ends. This is called a Special Enrollment Period or SEP.

If Youre Under 65 With a Disability

You May Like: What Health Insurance Is Available In Nc