Office Of Personnel Management Contact Information

Once you retire, your retirement annuity is paid to you by the Office of Personnel Management . OPM becomes your “servicing personnel office” and you will need to contact them to make any changes to your benefits coverage or ask questions about your annuity.

OPM Phone Numbers for Retirees

Hours of Operation – Automated System is available 24 hours/ 7 days a week, Customer Service Representative 7:30 a.m. to 7:45 p.m. Eastern Time, Monday though Friday.

- IN the Washington DC area – 1-202-606-0500

- OUTSIDE the Washington DC area – 1-888-767-6738

- Hearing Impaired – 1-800-878-5707

To use the automated phone system’s features, you will need your CSA and Personal Identification Number . At the time OPM completes processing of your retirement papers, they will mail you your PIN. Contact the Customer Service Representative if you need to obtain a new PIN.

Automated System:

The OPM Services Online website provides access to the same automated information as the phone line provides. Some of the things you can do by using the automated system include:

- Change your Federal Income Tax withholding

- Change your State Income Tax withholding

- Buy Savings Bonds

Fehb And Medicare Parts C & D

Federal employees should definitely enroll in Medicare Parts A & B according to Brian. However, when it comes to Medicare Advantage, Brian recommends declining that coverage and sticking with your FEHB instead. Typically the FEHB has more benefits and greater coverage than Medicare part C. Finally, most FEHB plans also cover prescription drugs, so you should not need to enroll in Medicare Part D. However, you may want to double check that your FEHB plan does cover the prescription drugs you need before declining Medicare Part D. If you decide you want Medicare Part D, you can add Medicare Part D during a future open enrollment period but may face a penalty in the form of an increased premium. Furthermore, you can only add Part D during the open season.

So, in summary, most federal employees should:

- Keep FEHB coverage

- Enroll in Medicare Parts A & B when they are eligible

If you want to go deep into the weeds on this topic, OPM published a 20 page book that walks you through the decision making process. Be warned that it is extremely dry reading.

What Is The Cost In Retirement

One of the advantages of having FEHBas compared to private health insuranceis that the cost of health insurance remains the same for federal employees after they retire. The government keeps paying a portion of your health insurance for you. This can amount to big savings on health care costs, since FEHB pays 72-75% of the cost.

This is a big advantage over private employer coverage. For example, a private employer will often pay for part of your health benefit costs while you’re employed, just like the FEHB. However, once you retire in the private sector, you most often can not keep your employee health benefits. Instead, you must transition to an individual health insurance plan or to Medicare if you are old enough. This change could mean that your cost of health insurance will increase after you retire.

One primary difference for those with FEHB is that because your retirement annuity is paid monthly, you might see a shift in the payment frequency or amounts. However, you should not pay more in total.

Your spouse, domestic partner, or other family members could also save money on their health insurance if they are also eligible for coverage under your FEHB. If you have been divorced and are on good terms with your ex-spouse, you could check to see whether they might be able to get access to your FEHB.

You May Like: Does Health Insurance Pay For Chiropractic

Does A Federal Employee Get Free Health Insurance After Retirement

Unfortunately, federal employees do not receive free health insurance upon retirement. However, federal employees can keep their current federal employee health benefits plan upon retirement. Employees continue to pay the employee portion of the premium. The government pays the remainder of the retirees premium at the same rate as they do for current employees. .

Long Term Care Insurance

Federal Long Term Care Insurance Program coverage is portable. If you have coverage at the time of retirement, it will continue with you into retirement. Coverage will continue as long as you pay the premiums.

Any allotments you had set to come out of your salary payment will discontinue upon retirement. You will need to make arrangements with Long Term Care to ensure that your premium payments are not interrupted. You will be able to arrange to have your premiums deducted from your annuity once your retirement has been finalized by OPM.

Contact an LTC Consultant at 1-800-582-3337 or submit a completed Billing change form to LTC to ensure that there is no break in payment of premiums after your retirement date.

Visit www.ltcfeds.com for additional information on the LTC program. If you are not currently enrolled, you have the option of enrolling after retirement using the full underwriting application. Applications may be submitted at any time.

Read Also: Does Health Insurance Pay For Abortions

How Can You Get A Waiver To The Five

If you were declared ineligible for FEHB because of the five-year rule, you may be able to obtain an exception. But you should know that such a waiver is not common and you will have to meet certain conditions.

The first condition is that you have to show that you intended to maintain FEHB when you retired. The second condition is that you can show circumstances beyond your control prevented you from adhering to the five-year rule. The final condition is that you have to have done everything within your controlincluding reading all information provided, asking questions, and asking for related informationto ensure you could maintain your health benefits in your situation.

In short, you have to have reasonably acted to protect your rights to your FEHB coverage. If you have, you may be able to obtain a waiver.

Be proactive throughout your time as a federal employee so you don’t lose your FEHB when you retire.

Federal Employee Health Benefits

The Federal Employees Health Benefits program is the largest employer-sponsored health insurance program in the world, covering more than 8 million Federal employees, retirees, former employees, family members, and former spouses.

FEHB includes different types of plans: fee-for-service with a preferred provider organization health maintenance organizations point-of-service high deductible health plans and consumer-driven health plans. How you obtain coverage or services and pay for them differs depending on the plan. However, benefits available under all plans include hospital care, surgical care, inpatient and outpatient care, obstetrical care, mental health and substance abuse care, and prescription drug coverage. There are no waiting periods or pre-existing condition limitations under FEHB, even if you change plans.

FEHB New Employees:

The following resources will help you elect a health insurance plan:

Once you enroll in a health insurance plan, your enrollment automatically continues each year, as long as you remain eligible for the program. You do not have to reenroll each year. However, if you would like to make a change in your health insurance, you may do so during the Benefits Open Season or in conjunction with a qualifying life event.

To include a foster child as a family member, you must certify that:

For additional information or assistance click on:

Recommended Reading: How To Apply For Health Insurance In Wisconsin

Can I Keep My Federal Employee Health Benefits As A Retiree

You must meet certain criteria to keep your Federal Health Benefits as a retiree. Eligibility requirements include:

- You must be currently enrolled in FEHB and have active coverage when you retire

- Youve been covered by FEHB for at least five years before your retirement

- You were covered by FEHB as an employee or a family member from the time you were qualified to join the program and stayed enrolled until you retired

- If you were continuously enrolled in a family members FEHB for five years

If you experienced a break in coverage during the five-year period that you need to be eligible to keep your coverage, dont worry it doesnt automatically mean that you cant keep your benefits. Ask your plan about your break to ensure that it doesnt affect your qualification for health coverage.

Will I Pay Less For Fehb Premiums If I Enroll In Medicare

FEHB premiums are not reduced if you enroll in Medicare, but having Medicare Part A and B can allow you to switch to a less expensive version of your current FEHB plan, because some FEHB insurers waive cost sharing when you have Medicare Parts A and B. Contact your FEHB insurer if youre wondering whether your plan waives cost sharing for people enrolled in Medicare.

The decision whether to enroll in Part B often hinges on whether you have to pay more for it because of your income. You pay more for Part B in 2020 if you earn over $87,000 , according to your tax return from two years ago. These higher premiums can range from $202.40/month to $491.60/month. Youll have to gauge how much you are willing to pay in Part B premiums in exchange for lower cost sharing when you visit the doctor.

Don’t Miss: How Much Does Health Insurance Cost For Married Couple

Cost Of Health Insurance For Federal Retirees

Of course, one of your biggest questions is likely what will federal employee health insurance cost? The good news is that your premiums wont increase. One thing that will change, though, is how often youll pay them. As with your paycheck, your premiums will be deducted from your annuity. Since youll be receiving a monthly annuity payment, rather than a paycheck, youll find youre paying premiums monthly.

Can The Eligibility Requirements For Continuing Health Benefits Coverage Be Waived

Yes. OPM has the authority to waive the 5-year participation requirement when it’s against equity and good conscience not to allow an individual to participate in the health care insurance program as a retiree. However, the law says that a person’s failure to meet the 5-year requirement must be due to exceptional circumstances. When someone is retiring voluntarily, a waiver may not be appropriate because he or she can continue working until the requirement is met. When circumstances under these conditions otherwise warrant a waiver, we will notify the individual’s employer.

Recommended Reading: How To Get Health Insurance For My Parents

Keeping Your Employers Health Insurance Plan Through Cobra

If youre currently enrolled in an employer-sponsored health insurance plan you like, you may be able to keep it temporarily. This is made possible through the Consolidated Omnibus Budget Reconciliation Act . The program typically applies to companies with at least 20 employees, as well as some state and city government entities.

It allows you and your family to keep your employer-sponsored health insurance plan for up to 18 months after you retire or lose your job. However, youd be responsible for the entire premium. The insurance company can also slap up to 2% on the price tag for administrative costs.

But if the plan is still worth the price, you can trigger COBRA by contacting the health plan within 30 days after leaving your company. The insurance carrier will then contact you and provide you with instructions on how to elect COBRA. Because these plans change frequently, pay close attention to the details. Youd want to make sure your preferred specialists stay in the insurers network, for example.

But dont fret if you come down with sticker shock after you leave your job. You have more options.

Medicare Part B And Fehbs

Medicare Part B is medical insurance. It covers services such as doctors visits, preventive care, and certain medical equipment. Unlike Part A, most people do pay a premium for Part B.

In 2021, the standard Part B premium is $148.50. Your premium will be higher if your income is over $88,000. Youll pay this premium in addition to the premium of your FEHB plan if you use both together.

Even though youll be paying two premiums, using FEHBs and Part B together is often a good choice. Just like with Part A coverage, Medicare is the primary payer once youve retired. Medicare Part B pays 80 percent for covered services.

When you use Part B along with an FEHB plan, your FEHB plan may cover the 20 percent youd be responsible for with Part B alone. Using an FEHB plan along with Medicare Part B works like having a Medicare supplement or Medigap plan. However, your FEHB plan will also pay for coverage that Medicare doesnt.

You May Like: Does Short Term Health Insurance Cover Pregnancy

Fehb Coverage After Retirement

Its never mandatory to take Medicare yet, there can be consequences to delaying enrollment. When you have FEHB, youre safe from the Part B late enrollment penalty for as long as you or your spouse is actively working.

When you or your spouse retires, however, things get more complicated. FEHB is not , so you should take advantage of the Special Enrollment Period youll have when you or your spouse retires. Otherwise, youll be subject to the late enrollment penalty whenever you enroll in Part B.

As long as you keep FEHB, whether or not youre working, your prescription drug coverage is sufficient and youll avoid the late enrollment penalty for Part D.

How Can You Add Family Members

As long as you are eligible and have met your requirements, you can add a new spouse or a child after you have retired at any time because of a life change event. You may also switch your type of plan from a Self Only to a Self and Family plan during a Federal Benefits Open Season. An FBOS typically runs from early November to mid-December of a given year.

Recommended Reading: What Is A Gap Plan Health Insurance

Having The Government Continue To Pay 72% Of Premiums Is An Outstanding Benefit

Not only do you get to stay on one of the best employer-sponsored plans around, the government will continue to pay 72% of your premium in retirement. That is a tremendous benefit!

FEHB plans and premiums vary across the country. Here in Alaska, a good FEHB family plan will cost you about $400/month. So that means that the total premium cost for coverage is roughly $1,430. That means each month you pay $400, the government is paying roughly $1,030 to cover the rest of your cost every month.

The ability to have excellent health insurance into retirement, and to pay less than a third of your premium costs gives you a huge head start on retirement planning.

Do Feds Need Medicare When They Already Have Fehb

As we kick off Open Season 2019, one topic shaking up conversations with feds is how FEHB interacts with Medicare. While Federal Employee Health Benefits offer complete health coverage to Federal Employees who are 65 and older, are there benefits to obtaining both FEHB and Medicare?

When you combine the FEHB benefits with Medicare, the result is an otherwise bizarre arrangement with massively wasteful extra spending as Walton Francis states giving his input on the subject.

That means some beneficiaries wont find value in having both FEHB and Medicare coverage.

For most of the working class, Medicare Part A enrollment is automatic. Yet too many federal employees remain unclear and still have lingering questions about benefits.

So why should federal retirees enroll in Medicare if they have benefits through the FEHB program?

For some, coordinating these benefits together saves them money. However, this isnt the case for everyone. Retirees want a clear understanding of the relationship between the FEHB Program and Medicare.

Recommended Reading: Does Amazon Have Health Insurance

Minimum Annuity Requirements For Fehb Spouse Coverage

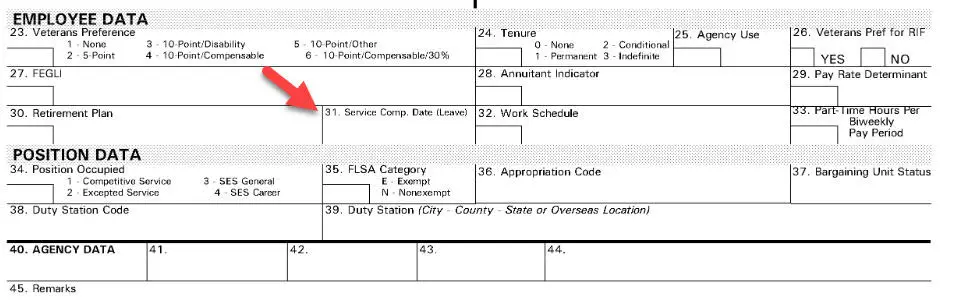

When the retiree’s spouse is not a federal employee they will most likely need FEHB coverage in retirement. The rules are different for CSRS and FERS employees and this is a major consideration for federal employees who intend to retire and leave their spouse other than a full survivors annuity.

Under CSRS your spouse will be eligible for FEHB coverage as long as you provide them with a survivors annuity. It can be any amount. In my opinion it is best to provide a survivors annuity large enough to cover FEHB expenses however it isn’t necessary. If you elect a survivors annuity of $3600, enough to cover many plan costs, your annuity will be reduced by 2.5%.

FERS retirees must elect either 50% or 25% survivors annuity for your spouse to be eligible for FEHB coverage in retirement after the annuitant’s death. The 50% election will cost you 10% of your full annuity and the 25% survivor annuity election will cost you 5% of your full annuity in retirement.

Do I Need Medicare If I Have An Fehb

In most cases, you can elect to not use your Medicare coverage and just keep using your FEHB plan. Medicare is an optional plan, meaning you dont have to have either Part A or Part B coverage.

However, there is an exception. If youre enrolled in TRICARE, an FEHB plan for military members, youll need to sign up for original Medicare to keep your coverage.

If you have any other FEHB plan, the choice is up to you. You can decide what works best for your budget and needs. Keep in mind, however, that Medicare Part A is normally premium free. Having Part A as extra coverage in the event of hospitalization is a good idea for most people since they have additional protection without paying higher costs.

While you dont have to enroll in Part B during your initial enrollment period, if you decide you want it later, youll pay a fee for signing up late.

This rule only applies if youre already retired when you become eligible for Part B. If youre still working, you can enroll in Part B once you retire. Youll have up to 8 months to enroll before you need to pay a late enrollment penalty. There is no late enrollment penalty for Part A.

Also Check: How To Sign Up For Free Health Insurance