Why Should I Get Germany Travel Medical Insurance

There are three reasons why you should get travel insurance when travelling to Germany:

- It is for your own good. Germany has one of the best healthcare systems in the world, and some of the best doctors. Moreover, medical care in Germany is quite cheap compared to the GDP. Still, healthcare is cheap and affordable only for German and other EEA citizens. Third-country nationals who find themselves in a health emergency may have to pay unbearable amounts of money. When you have health insurance, your provider takes care of that, and you do not need to worry about anything else. Moreover, if you lose your passport, luggage, or something similar, what can always happen on a trip, you will be covered.

- Because you need it to apply for a visa to enter Germany for short stays. If you need a visa to Germany, you need health insurance too. Your health insurance must cover not just Germany but the whole territory of Schengen. Without it, your application will be rejected immediately.

- You will enter the Schengen Area through a country that asks you to present your travel insurance at the port of entry.

Health Insurance policies for foreigners travelling to Germany that fulfil Germany Visa requirements can be purchased online from AXA Assistance, Europ Assistance or DR-WALTER.

Spousal Benefits Can Enable Insurance For An Early Retirement

An option that you may have if you are married is to use your spouses health insurance plan, Purkat explains.

I see in many cases, one spouse may be retiring early, but the other is still working full-time, Says Purkat. This is a great situation because if you can cover the years before you turn 62 with your spouses insurance, it can save you a lot of money.

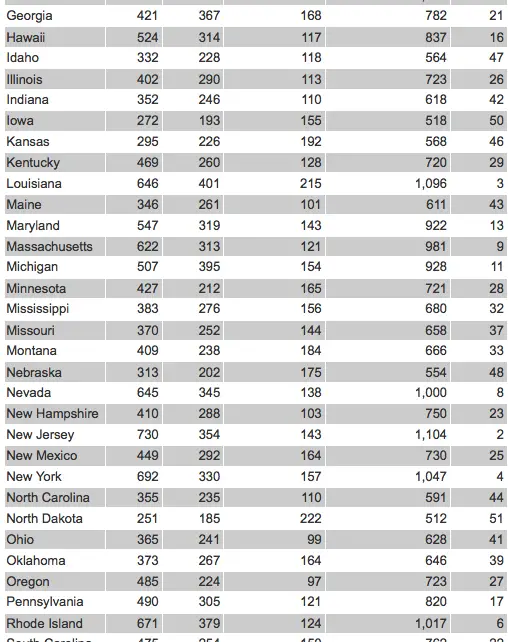

Average Premium Tax Credits For Marketplace Insurance

The average premium tax credit for the United States is $371 per month. Alaska had the highest premium tax credit at $976. New York had the lowest average tax credit at $230. The government makes these payments on your behalf. It’s to help make your insurance premiums more affordable. The credits are based on your total household income. The credits operate on a sliding scale.

You May Like: What Health Insurance Does Starbucks Offer

Save On Your Premiums By Reviewing Your Health Insurance Annually

One of the biggest mistakes to make is becoming complacent with your existing policy. Even if you initially purchase a Health Insurance policy at a competitive price, there is no guarantee that your premiums will be as competitive the following year as markets and personal circumstances change.

How We Helped Hayden Half His Health Insurance Costs

We were able to help 69 year old, retiree Hayden, halve the cost of his Health Insurance by simply reviewing his existing policy. You can read more about Haydens story here.

Finding Individual Health Insurance Plans For Your Kids

You may be interested in enrolling in separate health insurance for your kids if you have not insured yourself or your employer does not offer a bundled plan that includes your child at a cost you can afford. Just like family plans, medical insurance for kids can be purchased either through Obamacare or from a private insurance company.

Make sure to watch from the Open Enrollment Period if looking for an affordable plan on the Marketplace, or learn if you qualify for a Special Enrollment Period, which may apply to you if your child was just born, adopted, or fostered into your household. If you qualify for a federal subsidy and need compressive coverage, HealthCare.gov may be the more affordable choice. Additionally, some private health insurance providers may allow you to sign up for health insurance for kids at any time of year.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

Getting Singles Cover When Youre Young

Say you play a sport. You pivot on the court or field and suddenly your cruciate ligament tears. Ouch! Your GP refers you for surgery. While its serious enough to require treatment, it isnt a high enough priority operation to jump to the top of hospital waiting lists.

If youre covered by private hospital cover, you can avoid long queues at a public hospital and jump straight into treatment as a private patient.

Health insurance is also useful in cases where you might need treatment from a specialist. With private hospital cover, you can choose your own specialists or stay in a private room for your recovery .

Depending on your level of cover, health insurance can also help pay your bills for certain extras services that Medicare doesnt cover, like:

- Chiro

And more. With a good extras policy, you might be able to grab a new pair of trendy prescription glasses each year, and your insurer helps cover part of the cost . But more generally speaking, health insurance can give you peace of mind, even if you think youll never need it. Because you never know!

What Should I Look For

- Options. When comparing plans keep in mind the total costs, including premiums as well as out-of-pocket costs.

- Quality care. You need access to personalized treatment from doctors and hospitals, no matter where you are.

- Discounted rates. You’ll want a range of in-network doctors and hospitals to choose from, so you can take advantage of discounted rates.

- Annual check-ups and preventive care at no additional cost.2 Preventive care, like your annual exam and screenings, help you stay healthy.

- Easy-to-use tools. Online tools can help you pick plans and find doctors, and predict your costs.

- 24/7 service. When you have questions, you’ll want access to your claims, as well as health care experts who can answer your questions.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Monthly Cost Estimate By Age

The cost of health insurance may also vary based on your age. Per the eHealth data, the average cost by age is:

$278 for the 18-24 age group

$329 for 25-34 age group

$411 for 35-44 age group

$551 for 45-54 age group

$784 for 55-64 age group

These numbers are for both men and women. But, they give a sense of how your costs may vary.

Single Male Health Insurance Options

Before you choose a plan, check these sources of health insurance coverage:

- Your employer

- The marketplace

- Your domestic partner’s health plan. Some people consider themselves single but don’t realize they may qualify for coverage as domestic partners.

- Your parents’ health plan if you are under 26, or health plans through your school

- If you are unemployed or have low income, review sources for affordable coverage

Always check if you qualify for tax breaks that can really help you save on the monthly costs.

Don’t Miss: Starbucks Insurance Benefits

Finding Insurance For Children

The Health Insurance Marketplace is an online shopping site for health insurance offered by the federal government. Some states also have their own exchanges. While many private insurance companies offer their own medical plans, you can compare insurance from many companies through a single source: eHealth.com, opens new window. All of the plans available in your area can be seen and purchased through the eHealth.com, opens new window website.

How Much Does It Cost To Get German Travel Health Insurance For Foreigners

The costs of travel insurance in Germany are not fixed. Different providers have different prices. Yet the cost will vary in four main factors:

- Your age. Most providers charge older travellers more.

- The length of your trip. The longer the trip the more you will have to pay.

- The coverage limits. Despite there is a minimum coverage limit, there is not a maximum coverage limit. The higher this limit, the more you will have to pay.

- Extra coverage. Most providers offer you the chance to select extra coverage for adventure activities, winter sports and similar, for an extra charge.

On the other hand, most companies provide cheaper health insurance for groups, families, students etc.

> > Health Insurance for International Students in Germany

Don’t Miss: Starbucks Health Insurance Eligibility

Health Insurance In Spain

Moving to Spain? Make sure you and your family are covered for every eventuality by reading our guide to health insurance in Spain.

All residents in Spain have access to the free public Spanish healthcare system, although private insurance may be necessary in certain situations.

This guide on health insurance in Spain covers the following topics:

Globality Health

Globality Health is an expat-friendly international health insurance provider. They tailor their range of expert premiums to the needs of you and your family, including eye care, dentistry, family doctors, and more. So, see your health care options more clearly with Globality Health.

Childrens Health Insurance Program

The CHIP is a great option for parents that dont qualify for Medicare that are seeking cheap health insurance for kids. While there is still a monthly premium with this program that varies from state to state, the cost will never amount to more than 5% of your familys annual income. Like Medicaid, CHIP offers comprehensive benefits and can take form as a Medicaid Expansion, a separate CHIP program, or a combination program. It is up to each individual state how they wish to design this program and what the income qualifications are.

CHIP can be enrolled in at any time, and you do not need to wait for your childs coverage to begin. In some states, pregnant women may be able to qualify for this program for covering prenatal care, labor and delivery, and newborn care. You can apply for CHIP through the Health Insurance Marketplace or by calling 1-800-318-2596.

Recommended Reading: Starbucks Insurance Part Time

Our Recommendation: Find Your Best Fit With Healthcare

Finding the right company for your situation means considering all of your options and getting the right advice. AARP makes it easy to get personalize quotes from top insurers and apply for your best policy in one place. Its combination of online tools and the support of unbiase and licensed experts make AARP the best site to help you get the right insurance.

UnitedHealthcare Insurance Company pays royalty fees to AARP for the use of its intellectual property. These rates are use for the general purposes of AARP. AARP and its affiliates are not insurers. Now AARP does not employ or endorse agents, brokers, or producers.

We encourages you to consider your needs when selecting products and does not make product recommendations for individuals.

Please note that each insurer has sole financial responsibility for their products.

Are There Waiting Periods Before I Can Use My Singles Health Policy

Waiting periods apply for both hospital cover and extras cover, regardless of whether your health insurance is a young singles policy or not. Extras cover waiting periods differ between providers, but hospital insurance waiting periods are set by the government.

Depending on the specific treatment, you might face waiting periods of a couple of months or a whole year or more. This information should be provided in the PDS of any policy so you know how long youll have to wait before you can make a claim.

There are some health funds that will waive waiting periods on extras cover as a part of special offers, although these are usually for shorter periods .

Also Check: Starbucks Perks For Employees

Use Obamacare For Early Retirement

Whether you love the program or hate it, for a few years, Obamacare did make early retirement health insurance costs much more affordable.

One of the ideas behind Obamacare was that everyone could get insurance preexisting conditions were not a factor. This was especially useful for people in their 50s and 60s most of whom have had or are facing some kind of health issue.

While you can still get coverage if you have a preexisting condition, Obamacare insurance has gotten a lot more expensive and the future of the program is in flux.

Many insurers have significantly raised premiums, in part because the Trump administration decided to stop payments to insurers that cover the discounts they are required to give to some low-income customers to cover out-of-pocket costs.

Nonetheless, if you are retiring early, it is still worth it to explore your Obamacare health coverage options on healthcare.gov.

How To Apply For Public Health Insurance

If you are a resident in Spain, you need to register your address on the padron at your local town hall.

Once you have done this, you will get an empadronamiento . Youll need this to apply for a healthcare card.

You will also need to make sure you have your social security number, which will be issued by your employer. If you havent received one, you can sort this out through your local social security office, called the Tesoreria General de la Seguridad Social .

You can find your local Social Security Office on the governments website.

Once you have your TSI card, you can register with an individual doctor or at your local health center. You can select doctors and pediatricians from within your local healthcare district. To see any other specialist practitioners, however, you must be referred by your GP.

Your TSI health card proves that you have health insurance in Spain. Present it whenever you use a public health service or purchase a prescription from a pharmacy.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

Are You A Travelling Senior Seeking Fun In The Sun

Don’t get burned! Make sure that the senior travel insurance you buy offers reliable coverage!

We’ve got Canada’s #1 selection of travel insurance companies offering plans specifically for snowbirds, retirees, tour groups or senior travellers, AND we provide personalized guidance and advice to ensure you obtain reliable coverage at the right price.

Whether you have a more complicated medical history and need help to navigate through the various medical questionnaires or whether it’s better to avoid the questionnaires altogether. Whether you need to find a policy with a short stability period or get a discount for perfect health we’ve got Canada’s best policies and the best prices.

Travel insurance prices have been increasing due to the lower Canadian dollar, and recently due to COVID19 related claims especially for senior travellers trying to cover pre-existing conditions.

Recent rate increases make our quick online comparisons and advice even more relevant than before. Keep in mind that the policy that worked well last year may not be the wisest choice this year depending on the size of the recent rate adjustment, the age bracket the company uses, or changes to your health. Over the last year, we’ve also added new policies that use different age brackets so you may remain in the lower-priced age bracket with one company while the others have bumped you into the next higher-priced group even if you are in perfect health.

We have policies that:

Health Insurance Options If You Are Under 26 Years Old

If you are under 26 years old, then you have two options for acquiring health insurance if you do not get coverage through an employer: Stay on your parents’ health policy, or purchase health insurance through the state exchange. All states allow parents to add and keep their children on their health insurance policies until the child reaches age 26. New York state allows policyholders to extend coverage up to age 29 by adding an Age 29 Rider to a marketplace health insurance plan.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Here Are Anthonys Top Tips For Young Singles Looking For Health Insurance

1: Look for perks in your policy

Some insurers offer complimentary well-being and discount programs as part of your health insurance. These programs often entitle you to many additional benefits such as discounts on shopping, movies and even flights. These great benefits can help offset some of the costs of your premiums.

2: Can you stay on your parents policy?

If you are in the position of coming off your parents policy as you are no longer studying, there is the possibility you could stay on longer with an alternative insurer. There are some funds that could cover you until 25 even if youre not studying full time. It might be worth your parents comparing their options to find a better deal.

3: Consider helping out older Australians

Young people are a critical piece to the private health insurance ecosystem. Their involvement offsets the drawdown by older adults who are more likely to claim on costly procedures . This means young people are indirectly helping reduce premiums paid by older Australians and reducing the pressure on the public health system at the same time. If this is you, thanks for helping!

Average Health Insurance Cost By Plan

Less surprising, though, is how the cost will differ based on the plan you use. After all, different plans offer different services, and those with more services and flexibility come at the price of a higher premium.

The four types of plans you may be able to get for your health insurance are a health maintenance organization , point-of-service , preferred provider organization and exclusive provider organization . Per ValuePenguin, the average monthly rate for a 21-year-old on each plan is:

- HMO: $230

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees