Factors Of Health Insurance Costs :

Lately, the costs for health insurance have risen at a greater speed than the rate of inflation, becoming almost 18% of GDP in 2017. Due to many changes in legislation, it becomes quite difficult to find the specific reason behind the increasing costs. It is quite a possibility that the higher costs of health care drive by many factors.

The predominant factors which affect health insurance costs on an individual level are:

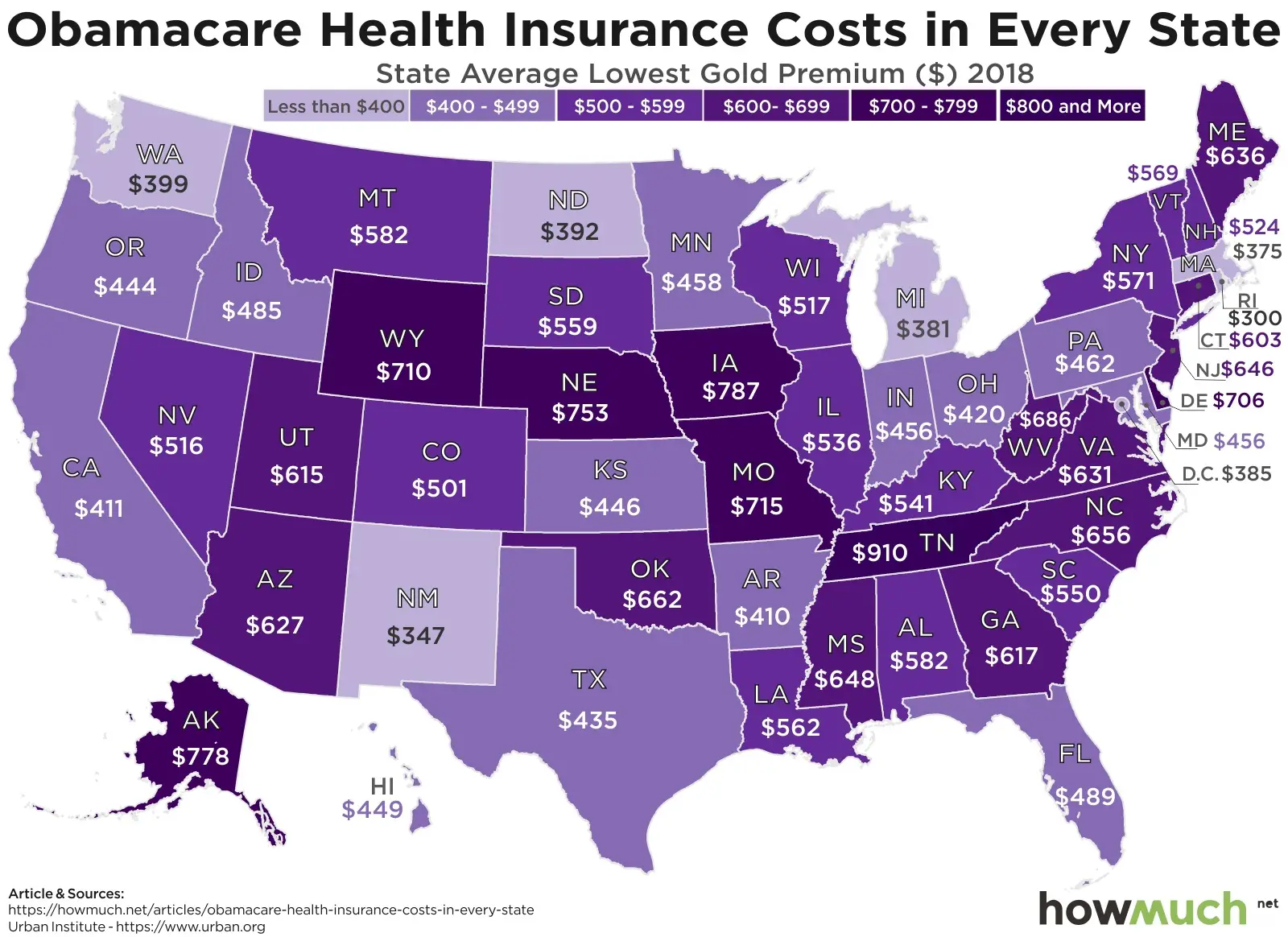

- Location: The state in which you live or even your zip code can change health insurance costs for you.

- Age: As you get older, health insurance gets costlier.

- Smoking: The ACA allows insurers to impose smokers a higher fee for health insurance. Between a smoker and non-smoker, the difference in cost could be as high as 50%. This amount generally is different for different states and some states even forbid this practice.

What Is The Cheapest Health Insurance You Can Get

Health insurance premiums ran about $623 per person per month in the U.S. in 2020, leaving many people to wonder whether a health plan exists that they can afford. Medicaid is the cheapest health plan you can get. It provides free or low-cost coverage to those who qualify.

Don’t panic if you dont meet the rules for Medicaid. You may have other options, but be cautious about signing up for a plan without first doing your research, warns healthcare expert Shelby George, CEO of PERKY.

Theres so much jargon, complexity, and misunderstanding in the health insurance world, she says. Its become just like shopping for a car. Spend the hours you need to know what youre getting for what youre paying.

Keep some key points in mind when you search for a health plan that you can afford.

-

Medicaid: It’s free or very low cost if you qualify

-

An IRS tax credit that can offset or even cover the cost of a plan

-

A cheap, short-term plan, because IRS rules changed to allow you to keep one of these for up to one year

-

Plans that claim to be low-cost but aren’t

-

Income limits that could disqualify you from Medicaid

-

The limited coverage of short-term policies

-

The fine print: plans often have complex rules and many exclude certain care

Cheapest Health Insurance Providers:

UnitedHealth Group:

UnitedHealthcare is the largest health insurance company in the country which captures almost 13% of the health care market. It has almost 900,00 health care professionals in its network. this increases the chance that your preferred provider is already a member and can be used with HMO or EPO plans.

With time, UnitedHealthcare has earned many health care surveys awards like J.D. Power awards, including awards for health care experience in Arizona and for provider choice in Texas.

Kaiser Permanente:

Kaiser Permanente has a much smaller network than UnitedHealth Group but it has a network of hospitals and medical centers in many states.

All of its plans come with an HSA option, it means that its deductibles are generally higher and as a result, premiums are often lower. If you live in an area covered by Kaiser Permanentes 22,000 participating physicians and are in good health.

You should think of getting a Kaiser Permanente plan which combines with an HSA. It could be an effective measure to keep your health insurance costs inexpensive.

Blue Cross Blue Shield:

Blue Cross Blue Shield provides health insurance in all states and is made up of many independent companies. BCBS provides better service quality, coverage across bigger geography and its plans differ depending on locations as the insurer operates through small regional companies.

Cigna:

Don’t Miss: How Much Is Health Insurance When You Retire

Availability Of Health Insurers In All States:

As every state comes with its own rules and regulations for insurers, many insurers do not provide health care plans in all states. Coverage is available in all states but the kind of coverage that is available varies. Wherever you travel within the country, your health insurance generally covers you.

If you are planning to shift to a new state then you will have to look for a new plan. It is said, the travel coverage with the United States remains ineffective when you have a plan.

Many health insurers offer their plans through the Marketplace at healthcare.gov. Basis where you reside, you might find many other private health insurance options available in your state or you might find none.

Can You Get A Health Plan For Free

Many people pay nothing if they qualify for the Affordable Care Acts premium tax credit subsidy. This tax credit is taken in advance to lower the amount of each monthly health premium you must pay, although it goes straight to the insurer.

You must apply for the subsidy and purchase a plan through your states health insurance exchange, also known as the Health Insurance Marketplace.

The amount you receive will depend on the household income that you disclose when you apply. You must make between 100% and 400% of the federal poverty level to qualify.

The American Rescue Plan allows more households, including those with incomes over 400% of the poverty level, to qualify for subsidized health plans through the Marketplace in 2021 and 2022. You may be eligible for tax credits in these years that lower the cost of your health plan, even if your income was too high in prior years.

You must file a tax return at the end of the year to reconcile your income with the tax credit you received. You may have to pay back some of the tax credit that lowered your costs if you ended up with more income than you thought you would have at the time you first applied.

You won’t have to pay back any excess tax credit you received in 2020 because the IRS has waived this rule for just this one tax year.

The Marketplace will send the credit directly to your insurer to be applied to your monthly plan premium. You may not have to pay out of pocket at all for health care costs in some cases.

You May Like: How Much Is Health Insurance In Costa Rica

Is Basic Hospital Insurance Worthwhile

There are two types of Basic policies, and while they may be cheap, they’re very limited in what they cover.

Accident policies

These cover accidents and ambulance. As a government requirement, they also must cover rehab, palliative care and psychiatric care in a public hospital which means nothing more than you can choose your own doctor. And regardless of your cover, it’s very hard to get a place in a public hospital for these services. All other services and illnesses are excluded.

Accident policies can also have restrictions. For example, HCF’s Accident Only policy covers you for the initial treatment if you go to emergency within 72 hours after the accident, but you’re not covered for any follow-up treatment.

Public hospital policies

These provide cover in a public hospital only. The only difference between this cover and what you get under Medicare is that you can choose your own doctor. You’ll still have to join public hospital waiting lists, and generally, you get the same treatment as public patients.

Read more: Is health insurance for tax a rip-off?

Which Health Insurance Has The Best Coverage

Best Health Insurance Companies

- Best for Medicare Advantage: Aetna.

- Best for Nationwide Coverage: Blue Cross Blue Shield.

- Best for Global Coverage: Cigna.

- Best for Umbrella Coverage: Humana.

- Best for HMOs: Kaiser Foundation Health Plan.

- Best for the Tech Savvy: United Healthcare.

- Best for the Midwest: HealthPartners.

You May Like: Can A Child Have 2 Health Insurance Plans

What Is The Best Affordable Health Insurance

Choosing the best affordable health insurance starts with determining your eligibility. Eligibility for health insurance depends upon several factors, including household income and family size. In addition, you must live in the United States and be a U.S. citizen, national, or lawfully residing in the country. You cant be denied insurance for pre-existing conditions.

The 10 Least Expensive Health Insurance Markets In The Us

This story was produced in collaboration with

People in much of Minnesota, northwestern Pennsylvania and Tucson, Ariz., are getting the best bargains from the health care laws new insurance marketplaces: premiums half the price or less than what insurers in the countrys most expensive places are charging.

The 10 regions with the lowest premiums in the nation also include Salt Lake City, all of Hawaii and eastern Tennessee. This ranking is based on the lowest cost of a silver plan, the mid-range plan most consumers are choosing.

The cheapest cost regions tend to have robust competition between hospitals and doctors, allowing insurers to wangle lower rates. Many doctors work on salary in these regions rather than being paid by procedure, weakening the financial incentive to perform more procedures.

Health systems focus on organizing patient care rather than let specialists work detached from each other.

The lowest monthly silver premium in the country is offered in the Minneapolis-St. Paul region, where a 40-year-old will pay $154 a month for a PreferredOne plan. Just across the Wisconsin border, that same level plan but with a different insurer and other doctors and hospitals costs nearly three times as much.

Minnesota has had years if not decades of experience with managed care, he said.

There are competing systems within those two regions to price against, Smith said. These lowest premium plans are the narrowest network we have by far.

Recommended Reading: What Are Some Good Health Insurance Plans

Can I Buy Affordable Health Insurance At Any Time

You may be able to buy short-term health insurance coverage at any time, but plans offered in conjunction with the ACA can only be purchased during open enrollment unless you qualify for a special enrollment period. Special enrollment periods can include any time you add a member to your family, move to a new coverage area, or experience another eligible life event.

MediGap coverage also has its own open enrollment period that starts during the month you first turn 65 and lasts for six months provided you are already enrolled in Medicare Part B. You may not be able to buy MediGap coverage after this time, or you may have to pay more for coverage.

Idaho Health Insurance Costs By Occupation

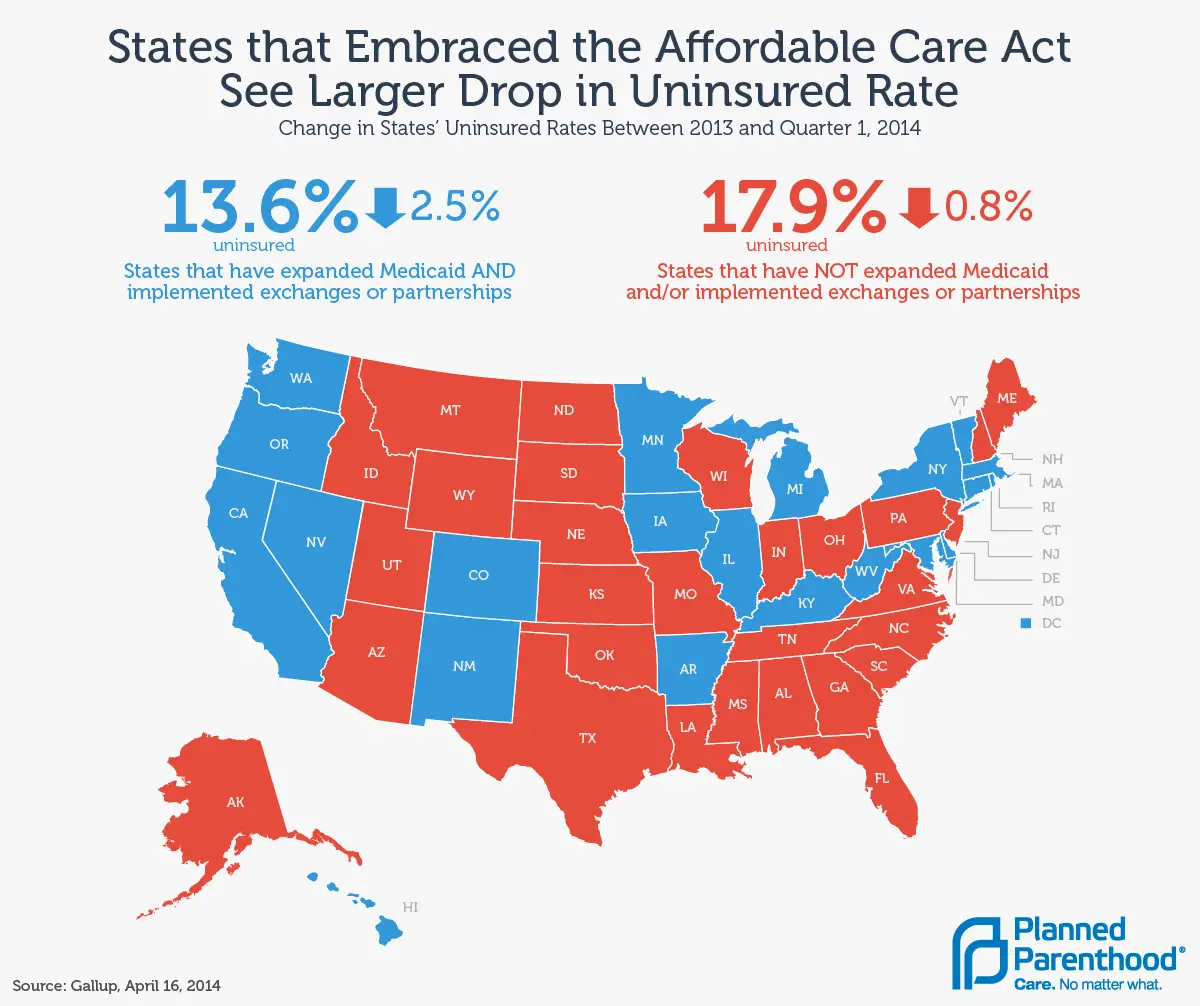

The self-employed, early retirees and other individuals that do not have insurance through their workplaces can get coverage on the state exchange. Idaho was the only state to reject Medicaid expansion and create a state-run marketplace.

Since January 1, 2020, Medicaid expansion took effect and now protects over 100,000 individuals. Those with an income of 138% or below the poverty level can take advantage of Medicaid programs.

Don’t Miss: How To Enroll In Cigna Health Insurance

How To Get Cobra

Group health plans must give covered employees and their families a notice explaining their COBRA rights. Plans must have rules for how COBRA coverage is offered, how beneficiaries may choose to get it and when they can stop coverage. For more COBRA information, see COBRA Premium Subsidy. The page links to information about COBRA including:

Average Monthly Aca Premiums By Metal Tier

In most states, Silver plans are the most popular. These arenât the cheapest plans but someone can only receive premium subsidies by purchasing a Silver plan, and most ACA enrollees do receive a subsidy. The second most popular plan in most states is a Bronze plan. For anyone who doesnât qualify for a subsidy, a Bronze plan will usually offer the lowest premium. Gold plans are usually the most expensive of these three tiers, and they are also the last popular of the three in most states.

The table below includes data for the 38 states that used the federal ACA exchange in 2020. The 13 states that used state-based exchanges have different reporting requirements and have not yet reported complete data. Platinum plans and catastrophic plans were omitted because they arenât available in all counties or states.

Recommended Reading: What Do You Need To Get Health Insurance

What You Should Know About Affordable Health Insurance Plans

- Affordable is defined as no more than 9.5% of your household income: If youre on a group employer plan, your individual premium cant cost more than 9.5% of your household income. That doesnt include your spouse or dependents.

- Anyone can apply on the Health Insurance Marketplace: The Health Insurance Marketplace is your route to affordable insurance, whether youre shopping for individual coverage, want to apply for Medicaid, or need to compare your options against what your employer offers.

- You may qualify for government assistance: Through the Health Insurance Marketplace, you may qualify for a subsidy, which offsets the cost of your monthly premiums. Depending on your income and demographics, you may qualify for Medicaid or the Childrens Health Insurance Program. If youre 65 or older or have a qualifying disability, you may be eligible for Medicaid.

| Health insurance company |

|---|

| 4 |

How To Buy Health Insurance In Utah

You can buy a plan on the federal exchange if you do not have health insurance from the state or your work. Bronze, Silver, and Gold are the three primary health insurance classifications in Utah. The costs vary depending on the plan you select, but all coverages include essential services. As you progress through the tiers, the monthly premiums get more expensive but include more services. Low-income residents can get health insurance through Medicaid.

Recommended Reading: Do You Have To Have Health Insurance In Florida

The Cost Of Obamacare Plans After Subsidies

People who have a difficult time affording health insurance may qualify for a health insurance subsidy. The most common type of subsidy is the advance premium tax credit , which functions as a tax credit you can take throughout the year to lower your monthly premiums.

In all states â but not in the District of Columbia â the majority of people who enroll in an ACA plan also receive the APTC. However, the value of the APTC varies widely by state, based on two things: the premium of the second-lowest cost silver plan on the market and the income of the enrollee. The exact premium of a stateâs SLCSP depends on the plans available in that state, and Obamacare rules explain that individuals only have to pay a final premium thatâs worth a specific percentage of their annual income. For example, a state may decide someone with an income of $35,000 shouldnât be spending any more than 8% of their income on insurance premiums.

The APTC is generally available for people who have an income within 100% and 400% of the federal poverty level. Individuals with incomes below that level can usually get Medicaid instead.

Know About Cheapest Health Insurance:

Health insurance has become a must-to-have and it is important that we pick the one which suits our requirements the best. Along with this comes the cost of the insurance which plays a very big role in deciding the plan you go for. In the United States in 2017, the average of an individual health insurance premium comes to almost $393 per month.

With such a figure, many people wonder if there are any inexpensive health insurance plans. Right now, Medicaid is the cheapest health insurance plan you can opt for, it provides low-cost or free coverage to those who are eligible.

If you are looking for medical coverage and do not qualify for Medicaid, you can go for other options of cheap health insurance. It is highly recommended to read and understand carefully what you are signing up for. These plans use many complex rules, exclusions and jargons which can create misunderstanding.

Don’t Miss: What Is The Best Supplemental Health Insurance For Medicare

How To Get Cheap Health Insurance In 2021

The cheapest health insurance option is to enroll in the federal Medicaid program, but eligibility depends on the state you live in, as well as your income level.

Health insurance is available for purchase through many different services and providers. From private care to public options, there are many different types of health insurance to choose from. For many individuals, the best deal is individual health insurance, which can be found through your state marketplace. On this exchange, you can search for and compare affordable health insurance plans from multiple companies.

The American Treatment Cost Gap

The raw cost of treatment is higher in the USA than in many countries, so this influences the cost of insurance. There are several reasons for this cost gap:

- Pharmaceutical drugs, for instance, cost nearly four times more in the USA than other similar countries.

- American doctors and nurses enjoy some of the worlds best pay the average registered nurse in California earns $113,240 so this also drives up cost.

- The American system also tends to favour more frequent interventions and complicated procedures, which comes with a price tag.

Due to the sizeable treatment cost differences, many international insurers including William Russell do not cover treatments that take place on American soil as part of our standard policies.

However, if youre an American citizen working overseas, then its good to know some of our international health insurance policies provide short-term cover for visits of up to 45 or 90 days. Find out more about our USA-45 and USA-90 international health policies.

Also Check: How To Sign Up For Aarp Health Insurance

The Impact Of States Regulatory Actions On Health Insurance Marketplaces

Although GOP lawmakers and the Trump Administration were unsuccessful in their efforts to repeal the ACA, there are ongoing threats to the stability of the individual health insurance markets. This includes the Texas v. U.S./Azar lawsuit , but it also includes the elimination of the individual mandate penalty in 2019, the expansion of short-term plans, and the reduced federal funding for enrollment assistance and exchange marketing under the Trump administration.

Although premium increases were modest for 2019 and essentially flat for 2020, average rates would have decreased nationwide in 2019 if not for the aforementioned factors that drove premiums higher. And enrollment in the exchanges nationwide ended up about 2.6 percent lower in 2019 than it had been in 2018, with another slight reduction from 2019 to 2020. If we look at effectuated enrollment, however, it was higher in early 2020 than it had been in early 2019.

Several states are implementing or considering various actions designed to stabilize their insurance markets, while others are taking actions that could lead to further instability in the ACA-compliant markets . You can click on a state in the map above to see more details, but heres an overview of the changes states have made or are considering: