Private Health Insurance Companies

You can visit the websites of major health insurance companies in your geographic region and browse available options based on the type of coverage you prefer and the deductible you can afford to pay.

The types of plans available and the premiums will vary based on the region you live in and your age. It’s important to note that the plan price quoted on the website is the lowest available price for that plan and assumes that you are in excellent health. You won’t know what you’ll really pay per month until you apply and provide the insurance company with your medical history.

Pricing and the type of coverage can vary significantly based on the health insurance company. Because of this, it can be difficult to truly compare the plans to determine which company has the best combination of rates and coverage. It can be a good idea to identify which plans offer the most of the features that you require and are within your price range, and then to read consumer reviews of those plans.

If you’re choosing a family plan or you are an employer who is choosing a plan that you’ll provide to your employees, you’ll also want to consider the needs of others who will be covered under the plan.

What Types Of Coverage Are Not Private Health Insurance

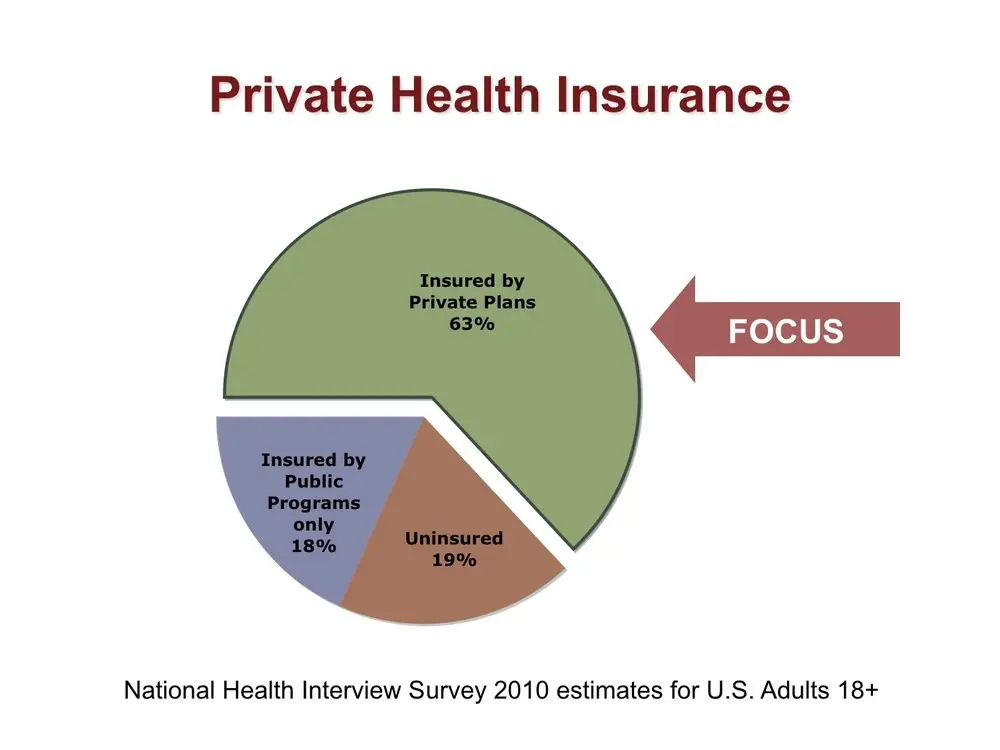

More than a third of the American population is covered by government-run health insurance, as opposed to private coverage. This includes Medicare, Medicaid, CHIP, Indian Health Service, and VA coverage.

To be clear, many people who have Medicare, Medicaid, or CHIP are covered under managed care plans that are run by private health insurance

The same is true for Medicare Advantage plans: the insurers have contracts with the federal government to offer Medicare benefits through a plan administered by a private health insurance company. As of 2018, more than two-thirds of the countrys Medicaid enrollees were covered under private Medicaid managed care plans, and 40 percent of Medicare beneficiaries were enrolled in private Medicare Advantage plans in 2020.

However, these managed care plans are in contracts with the federal government to offer the public health benefits that theyre providing, and the funding for these plans still comes from the government . But it can be a bit confusing, since many of the insurers that contract with the government to offer Medicaid managed care coverage or Medicare Advantage plans are the same insurers that offer private health insurance to individuals and employers.

Medicare beneficiaries can also purchase Medigap and/or Medicare Part D plans. These are considered private health insurance, but they are heavily regulated by the federal government.

Will I Have To Have A Medical To Get Covered

No, if you dont have any pre-existing conditions, you wont usually have to undergo a medical to get cover. Youll just need to fill out a medical history form and choose your level of cover. With some health plans you might be able to get a general health assessment if you want one, to make sure youre in tip-top condition. If you have a pre-existing condition, you might need to give the healthcare provider permission to access your medical records or to contact your GP.

You May Like: Does Short Term Health Insurance Cover Pre Existing Conditions

About Bupa Egypt Insurance

Bupa Egypt Insurance is a health insurance provider offering a premium range of health plans designed for individuals and families who appreciate a global level of medical protection. With our international health plans, you are not limited to treatment in just Egypt, but have quick access to medical care from all over the world when it matters most within your area of cover.

Whether you are pursuing active lifestyles, thinking of protecting your family or even planning for retirement, our global health plans offer a wealth of benefits that suit every life stage. Our flexible health plan with various add-ons helps you enjoy the reassurance of day-to-day protection and preventive health checks.

Direct access to global expertise

Our plans offer direct access to some of the best doctors and hospitals locally and internationally.

Overseas direct billing network

Focus on your treatment and recovery while we take care of your payments and claims, even for serious illnesses like cancer.

Personalised service

As our customer, you will be taken through the details of your plan, to make sure you are comfortable with your choice and know how to get the most out of it.

Wellness benefits

To help you staying healthy, choose our Worldwide Wellbeing option that offers regular dental, optical and medical health checks .

Why Choose Compare The Market

| Get a quote in 2 minutes*** | 92.4%of our users would recommend Compare the Market to friends or family**** |

***On average, it can take less than 2 minutes to complete a health insurance quote through Compare the Market based on data in November 2020. **** For the period 1st March to 31st May 2021, 9,781 people responded to the recommend question. 9,033 responded with a score of 6 or above, therefore 92.4% are likely to recommend

Kamran Altaf

Life insurance expert

The cost of private health insurance and the various plans available can vary a great deal between insurance providers.

The best way to ensure you get the cover you need is to shop around and compare quotes. Dont automatically assume that the most expensive plan is the best for you.

Read Also: How To Get Health Insurance Fast

Regulation Of Health Insurance

The Health Insurance Authority is the independent statutory regulator for the private health insurancemarket in Ireland.

It monitors the operation of health insurance business in Ireland andadvises the Minister for Health in this regard, including assessing the effectof any regulations or new legislation on consumers.

The HIA aims to ensure that consumers are aware of their rights and thatpolicies and publicity material describe cover in a fair and comparable way.The Authority also reviews the appropriateness of the procedures used byinsurers in their dealings with consumers.

The Health Insurance Authority has useful publications called My Rights,My Choices and Selecting a PrivateHealth Insurance Product. You can read them online or request a hard copy.

You can also compare the benefits and prices of different health insuranceproducts using the HIA product comparisontool.

Do I Need Private Health Insurance If Im Covered Through My Work

If the organisation you work for already offers private health insurance as part of your employment benefits package, theres probably no need to get extra medical cover. But it might not be enough for everyone. For starters, there could be a limit on the amount of cover you get and it might not cover your whole family. Secondly, any insurance you get through your work will only cover you for as long as your employer continues to offer it and you continue to work there.

Don’t Miss: Is Cigna Health Insurance Any Good

The Best Private Health Insurers For Customer Satisfaction

No private health insurer is truly delivering if they’re letting you down on service.

Between May and June 2021, we surveyed 538 Which? members that own private health insurance and have made a claim within the last five years. Members can see how five insurers – Aviva, AXAPPP, BUPA, Saga and Vitality Health – fared in our analysis of their service.

Which? members can log in to see the results of our analysis. If you’re not already a member, join Which? and get full access to these results and all our reviews.

| Provider |

|---|

|

3 out of 5 |

In May 2021, we surveyed 538 members of the Which? Connect Panel who claimed within the prior 5 years. Customer Score reflects respondents’ overall level of satisfaction with, and likelihood of recommending, the insurer. Customer Score sample sizes – Aviva , AXA PPP Healthcare , Bupa , Saga , Vitality Health

What Is Covered By Medicare

Medicare is the basis of Australias health care system and covers many health care costs. Most Australian residents are eligible for Medicare. Under Medicare you can be treated as a public patient in a public hospital, at no charge. Medicare will also cover some or all the costs of seeing a GP or specialist outside of hospital, and some pharmaceuticals.

Medicare does not cover private patient hospital costs, ambulance services, and other out of hospital services such as dental, physiotherapy, glasses and contact lenses, hearings aids. Many of these items can be covered on private health insurance.

Medicare is the basis of Australias health care system and covers many health care costs. Most Australian residents are eligible for Medicare.

You can get a Medicare card if you live in Australia or Norfolk Island and meet meet certain criteria. You may also get a reciprocal Medicare card if you visit from certain countries.

You can choose whether to have Medicare cover only, or a combination of Medicare and private health insurance.

The Medicare system has three parts: hospital, medical and pharmaceutical.

Read Also: How Do I Find My Health Insurance

Other Private Health Insurance Options

If you are on a tight budget, you may be able to pick from two different types of plans designed to save money: short-term health insurance and catastrophic coverage.

Short-term health insurance is worth considering if you are between health plans and need temporary health coverage to fill in the gaps in the event of an emergency — and dont want to pay for COBRA coverage. These plans commonly include varying levels of coverage for doctor visits, preventive care, prescription medications and urgent/emergency care, but little else. For instance, short-term plans dont usually cover mental health or prescription drug benefits.

Most states allow short-term plans for up to a year with the chance to renew the policies twice. However, some states restrict the months, while others forbid short-term health insurance.

Another option for some Americans is catastrophic health insurance. Theyre only available for people under 30 years old or people who can demonstrate financial or circumstantial hardship due to bankruptcy, eviction or other reasons.

Catastrophic plans cover essential services like emergency room visits, pregnancy care and prescription medications, as well as some preventive services and a handful of primary care visits annually. The premiums for these plans are relatively inexpensive, but the deductibles required can be high . Once you pay your deductible, your insurer covers all covered costs with no coinsurance or copayment required.

What Is International Health Insurance

International health insurance is a policy designed for people living or working abroad, either temporarily or permanently. For example, you might want international private cover if you have a holiday home abroad and spend part of the year there. Or you might be temporarily relocating overseas for work, studying or volunteering. While travel insurance can cover you for medical emergencies and accidents abroad, international health insurance offers more comprehensive cover, much in the same way as a UK private health insurance policy. An international health insurance policy is better suited for people actually living abroad, rather than just visiting for a shorter period of time. Some providers offer private health insurance plans for home and abroad. Just be aware that overseas care is usually included in their premium plans, which are typically more expensive.

Read Also: How To Sign Up For Obama Care Health Insurance

Join Our Facebook Group

Join our private for money news and updates as soon as we get them.

Its also a place to ask money questions, share worries and help others out.

Your healthcare insurance wont usually cover private treatment for:

- organ transplants

- normal pregnancy and childbirth costs

- cosmetic surgery to improve your appearance

- injuries relating to dangerous sports or arising from war or war-like hostilities

- chronic illnesses such as HIV/AIDs-related illnesses, diabetes, epilepsy, hypertension and related illnesses.

You might be able to choose a policy that covers mental health, depression and sports injuries, but these arent always covered.

What Is A Pre

A pre-existing condition is anything youve had medical treatment for in the past, like diabetes, heart disease or asthma. Most insurance providers count this as any condition youve had symptoms or treatment for in the past five years, even if you were diagnosed more than five years ago. Some providers might set the limit higher or lower than five years though, so always read your policy documents carefully and compare your options before buying.

Read Also: Can You Buy One Month Of Health Insurance

How Do I Choose A Private Health Insurance Plan

Private medical insurance can be offered to employees as part of company benefit plans.

Some employers set up the policy for you and pay all the premiums as part of their package. Others offer access to lower cost private medical insurance than you would be able to buy individually.

If you dont have access to private medical insurance through an employer, you can buy it from:

- an insurer

How To Find A Doctor Or Dentist

All the information you need to know on how to find a doctor or dentist, even specialists in Australia can be found in this section. To help get you started, you can search on the Australian Doctors Directory. This guide lists specialists, doctors, and even services across all states.

How to Find a Family Doctor

In Australia, family doctors are referred to as general practitioners . You will have no problem finding a doctor in major Australian cities and capitals. If you happen to be an expat in a rural area, you might have to travel some distance to get to one. Unlike in some countries, it is not necessary to be registered with a specific doctor in Australiayou can see any doctor either as a public or private patient.

To see a GP, you must have an appointment. This is usually made a couple of days in advance. If it is urgent, you may be seen immediately, but whenever possible, it is best to make an appointment at least a day before.

How to Find Specialists

Public patients must be referred to specialist doctors by a GP. Private patients can make appointments directly with specialists, although most insurance companies still prefer you to be referred. If not from their doctor, private patients may also get recommendations for specialists from friends, family, work colleagues, or through their research.

How to Find a Dentist

Average Wait Time to See a Doctor in Australia

- Western Australia16%

Recommended Reading: Cmfg Life Insurance Reviews

Also Check: How To Apply For Low Cost Health Insurance

Best For Availability: Cigna

Some insurance companies can be a challenge to contact. They might only be available during business hours, which is when most of us work.

Cigna is available 24/7, which makes it easy to talk to someone when you need to. It also offers a user-friendly mobile app so that you can access your insurance info on the go. Cigna offers affordable copays and low-cost preventive care.

Types Of Individual Private Health Insurance

Both federal marketplace and private marketplace plans come in different types and tiers. These can differ by benefit type, such as:

- Preferred provider organization — These plans are often the most expensive. They offer more flexibility than other plan types and allow you to get care out of your network and see specialists without getting referrals.

- Health maintenance organization — HMOs are more restrictive than PPOs and require you to choose a primary care provider. Youll need referrals from your primary care provider to see specialists and the plan wont pay for out-of-network care.

- Exclusive provider organization — EPOs are a PPO/HMO hybrid. The plans dont pay for care outside of your network, but you dont need referrals to see specialists.

- Point of service — POS plans require you to choose a primary care provider, but you can receive care outside of your network. You also dont need referrals to see specialists.

Those are just the different benefit designs. Individual plans are also classified by metal tier, based on costs:

Bronze plans are usually the cheapest plans in terms of the lowest upfront costs. However, theyre also high-deductible health plans , which means you pay more when you need care.

With an HDHP, you pay more healthcare costs yourself before your insurance carrier begins to pay its share. An HDHP can be paired with a health savings account . HSAs allow you to save tax-advantaged money for healthcare expenses.

Also Check: What Is Employer Group Health Insurance

So Is Private Health Insurance Worth It

Ultimately whether or not private health insurance is worth it comes down to:

- How worried you are about being reliant on the NHS

- The length of time you may have to wait for a diagnosis or treatment.

For some people, who end up making multiple claims, it could end up offering excellent value for money, others might end up shelling out just for peace of mind.

Unfortunately without a crystal ball its impossible to know which camp you would fall into.

As private health insurance is expensive its also important to consider whether you can afford it. It wont provide peace of mind if it is putting you under financial strain.

Moving Out Of Province And Health Insurance

If you move out of your home province or territory, whether for school or a new job, you must apply for insurance through the government. This can take several months. OHIP, Ontario’s insurance program, takes three months to kick in, for example.

For some people, this is an uncomfortable period of time to not have health insurance.

If a new job does not offer coverage that begins immediately, individuals may choose to take out a private plan. They may then choose to continue the private plan after Medicare kicks in or to go off of it completely.

Don’t Miss: How To Add Dependent To Health Insurance

The Benefits Of Private Health Insurance

When life throws you an unexpected challenge, fast diagnosis and treatment are what matter most, along with genuine help, support and understanding from people who care. So heres a summary of everything that comes with Personal Health, your private medical insurance plan, for new medical conditions after you join.