How Much Is Family Health Insurance

As with almost all types of health coverage, there are several different costs associated with family plans, including:

- Premiums Premiums are monthly payments that you make to remain enrolled in your family health insurance plan. The average premium for major medical health insurance plans for families was $1,152 a month in 2020.

- Deductibles A deductible is the amount of money you must pay out of pocket for healthcare before your insurance kicks in. For example, if your family health insurance plan has a $10,000 deductible, youll need to pay all your medical bills until youve spent $10,000 your insurance will then cover much of the remaining care you get that year. On average, health insurance plans for families had deductibles of $8,439 in 2020. Average deductibles have also been rising, though not as rapidly as premiums.

- Various costs- There are other costs associated with health insurance plans like copayments, coinsurance, and out-of-pocket maximums. You will want to assess your familys health care needs to determine how these costs will affect you. If you foresee needing a lot of care, then you may want to opt for a plan with a higher premium, but lower costs elsewhere, like your coinsurance, copayment, and deductible.

While these are average costs, specific pricing will vary based on the plan you choose, the amount of coverage you receive, and the number of people in your family to be insured.

Individual Health Insurance And Health Reimbursement Arrangements

Group and individual health insurance plans are popular choices but theres another option that can benefit employees and employers called a health reimbursement arrangement that is growing in popularity and works in conjunction with individual health insurance.

HRAs allow employers to reimburse employees, tax-free, for healthcare, including individual health insurance premiums and qualifying out-of-pocket medical expenses.

With an HRA, employers set their own budgets by offering an allowance amount for each employee. Employees win big on flexibility by being able to choose their own individual health insurance plan thats tailored to their specific needs.

Lets take a look at two of the most popular HRAs which are the qualified small employer HRA and the individual coverage HRA .

Additional Family Health Insurance Costs

In addition to your premium and deductible, you can expect other costs with family health insurance, including the following:

- Copayment: A copayment is a fixed amount thatyou pay for a covered service. A copayment may come into effect before or afteryou have reached your deductible.

- Coinsurance: Coinsurance is a percentage you payfor covered service after reaching your deductible. You can expect to paycoinsurance until you have reached your out-of-pocket maximum.

- Out-of-Pocket Maximums: Out-of-pocket maximumsare limits on how much money you are required to pay for coverage. Once youhave reached your out-of-pocket limit, your insurance will pay for 100% of thecost of your covered benefits for the rest of the coverage year.

Recommended Reading: What Health Insurance Is Available In Nc

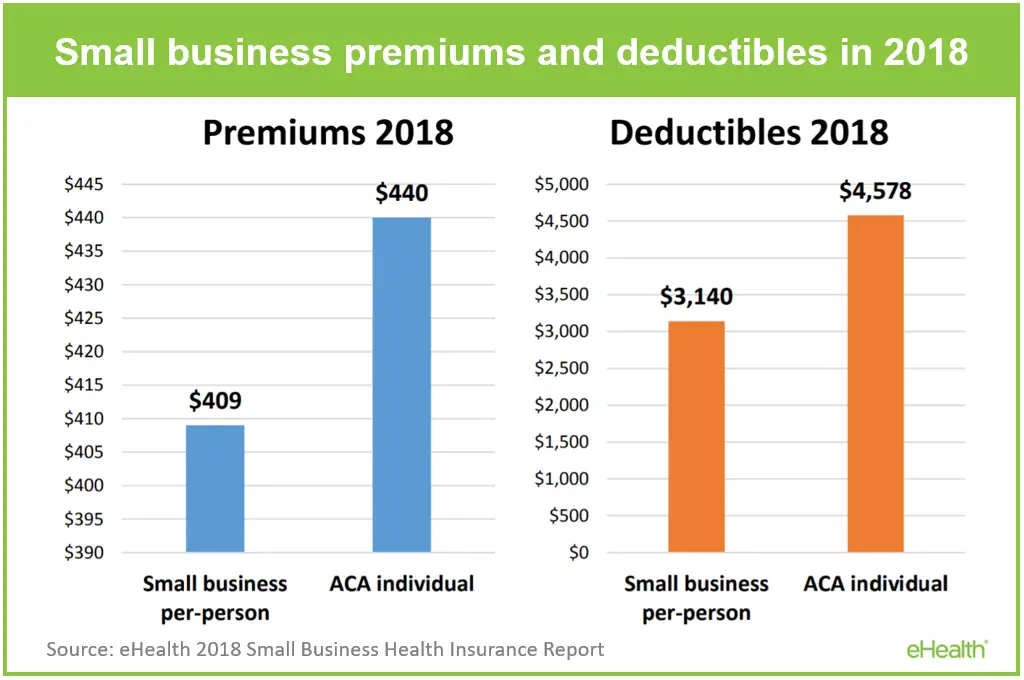

Small Employers Contribute Significantly Less To Family Coverage

While large employers contribute a significant amount to employees healthcare, small employers tell a different side of the story. 27% of covered workers in small firms are in a plan where the employer pays the entire premium for single coverage, compared to only 4% of covered workers in large firms. Similarly, 28% of covered workers are in a plan where they must contribute more than half of the premium for family coverage, compared to 4% of covered workers in large firms.

A likely reason for this is that small businesses simply cant afford to make the kind of contributions larger employers can. After all, even a 50% contribution may be more than whats available in a small employers benefits budget.

Considering that only 48% of firms with three to nine workers offer coverage compared to virtually all firms with 1,000 or more workers that offer coverage, small employers may also feel that they dont have enough employees to make investing in health benefits worth it at all. in order to offer a health benefit at all.

How Changing Your Excess Affects The Price Of Private Health Cover

As with every type of insurance, UK private health insurance policies use an excess to help control claims.

The insurer’s thinking is that if you have to pay the first part of a claim, then you’ll be more careful about incurring a claim at all and only really do it when you have to. Their fear without an excess would be that people would claim regularly as there would be no cost to them.

Excesses are typically charged either per year or per claim . Make sure you know which you have as the per claim excess will often work out more expensive.

All insurers give some degree of flexibility on the excess you have on your policy – for example, Vitality let you choose whether you have a per year or a per claim excess and what amount you’d like.

The excess can also have a material impact on cost – a high excess makes things cheaper.

For example, BUPA health insurance costs roughly £34 per month with a £500 excess for our 33-year-old example, but it leaps up to £52 per month for a zero excess. Read a review of Bupa health insurance here.

While hiking up the excess can make for attractive premium levels, buyers should remember that adding a high excess not only means more to pay when you have a big claim, it also means that you will be wholly responsible for claim amounts under the excess you choose.

You can compare UK prices for private health policies, and compare their excess levels, using Activequote.com, which allows a detailed comparison of health policies online.

Recommended Reading: How To Cancel Health Net Insurance

Change In Average Health Insurance Cost For 2021

From 2020 to 2021 health insurance rates decreased across the nation by over 2%. Additionally, year over year, Indiana saw the largest jump in health insurance costs across all metal tiers increasing nearly 10%. Including Indiana, 21 states had their rates increase on average from 2020 to 2021.

Both Pennsylvania and New Jersey switched their health insurance exchanges from being government-based to state-based. Interestingly, New Jersey had an increase in rates of close to 9% due to the change, while Pennsylvania’s rates went down decreasing by 8%.

On the other hand, rates in Iowa and Maryland decreased the most year over year, falling 20% and 17%, respectively. Overall, 27 states experienced a decrease in health insurance premiums.

| State |

|---|

Policy premiums are for a 40-year-old applicant.

Percentage Of Firms Offering Health Benefits

Not only do small employers have tighter budgets to begin with, the rising cost of health insurance makes it even harder to offer a benefit.

The average premium for family coverage has increased 22% over the last five years and 55% over the last ten years, significantly more than either workers wages or inflation. This steady increase in costs can make it difficult for small employers with tight budgets to continue to offer employees with a health benefit that will provide enough value.

Don’t Miss: How Much To Employers Pay For Health Insurance

How Much Do Individual Private Health Care Treatments Cost

Weve listed some of the average costs for private care treatments in the UK if you do not have health insurance, according to Privatehealth.co.uk.

| Private health care treatment | |

| Coronary angiogram | £2,066 |

You can access private health care treatment without insurance by paying for individual procedures or operations.

However, the cost of private care can be high. Privatehealth.co.uk found the highest price of a private knee replacement in the UK is £15,410 and the highest price of a CT scan is £960.

Get The Help You Need Faster

Were here to help you deal with health issues big and small, sooner rather than later. Thats why you can call us directly for advice and treatment for muscle, bone or joint problems, mental health or cancer from the moment you need it – usually without the need to see a GP first. And rest assured we have specialists who can provide advice and support whenever you need it.

Recommended Reading: What Is Average Cost Of Health Insurance For A Family

Why Is Health Insurance Expensive

Healthcare can cost a lot to carry out. Even straightforward procedures can be surprisingly expensive, and well beyond most peoples budgets, if billed directly for the NHS or private healthcare they receive. For example, a total knee replacement costs an average of £11,814 3. Insurers need to take account of this, among a number of things, when they work out premiums.

In the UK, you don’t have to take out private health insurance, so make sure you could afford to pay the monthly premiums. But bear in mind that with flexible cover, you can reduce your options to whats affordable for you.

What Does It Cover

Like all insurance, the cover you get from private medical insurance depends on the policy you buy and who you buy it from.

The more basic policies usually pick up the costs of most in-patient treatments such as tests and surgery and day-care surgery.

Some policies extend to out-patient treatments such as specialists and consultants and might pay you a small fixed amount for each night you spend in an NHS hospital.

Recommended Reading: What Is The Best Health Insurance Coverage

What Are The Benefits Of Having Family Health Insurance

Having private family health insurance can have many benefits, including:

- You wont have to wait long to be seen by a medical professional – the NHS offers exceptional quality of care for patients, however, there are often long waiting lists for being seen and receiving treatments. With private family health insurance, you can receive the medical treatment you need much faster so you can get on the mend in no time.

- You can usually choose the hospital to suit your preference providing theres availability.

- You can enjoy private hospital rooms – when youre treated privately, youll usually have your own en-suite room with amenities such as a TV and menu options . This can offer you, your partner and children more comfort whilst being treated or recovering.

- You may have access to specialist drugs and treatments which arent available on the NHS.

- You can get specialist referrals from your GP to get a second opinion or to receive specialist treatment.

- Youll have peace of mind knowing that should you wish to access private healthcare for yourself or a family member, youll be financially covered, saving you money on private medical bills.

Why not take a look at our blog Is private health insurance worth it? to help you understand why private health insurance could be a good option for you and your family.

Average Cost Of Private Health Insurance For A Family Of 3

The below quotes show the average cost of health insurance for a family of three in the UK as of 22nd June 2021. Please note that these prices are based on several assumptions and are only meant to give you an idea of what private medical insurance can cost.

- 30 year old adults, child under 15 – £62.17 per month

- 40 year old adults, child under 15 – £74.22 per month

- 50 year old adults, child under 15 – £94.89 per monthââ

*While every care has been taken to make these averages representative, the prices provided are purely examples the cost of your policy will be different. To find out what a policy would cost for your family, please request a comparison quote, and we will review the market on your behalf.

Also Check: Does Health Insurance Cover Tooth Extraction

How To Get The Best Health Insurance

If youre looking to purchase health insurance on your own, you can just go to the websites of major health insurance companies in your area and see what plans they provide. You can compare plans on your own, although quotes will vary pretty widely.

But lets face it. This is a ton of work. Choosing the right health insurance plan for you or your family is a daunting task. And you probably have better things to do with your time than sifting through endless health insurance quotes.

Thats why I recommend using our trusted and independent insurance agents for your health insurance needs. Theyll look at your situation and compare the best rates so you can get the coverage you need. Theyll help you understand the marketplace or even what your employer is offering. And the best thing? Theyre free!

Connect with one of our insurance agents today.

About the author

George Kamel

George Kamel is a personal finance expert and host of The Fine Print Podcast. Since 2013, George has served at Ramsey Solutions where he teaches on how to spend less money, save more, and avoid consumer traps. He is also the host of The EntreLeadership Podcast.

How Much Does Individual Health Insurance Cost In Ohio

Ohio residents can expect to pay an average of $497 per person* for a major medical individual health insurance plan.How much does health insurance cost in ohio?Metal LevelAverage Monthly Premium*Bronze$497Silver$574Gold$610

Also, how much is health insurance for an individual per month? For example, the average cost of private healthinsurance for a Basic Hospital plan for a single adult living in NSW is between $109 to $303 per month, while Extras only costs between $25 to $187 per month .

People ask , how much is health insurance a month for a single person 2021? The average cost for individual health insurance in 2021 is $452 a month.How much does health insurance cost?YearMonthly health insurance rate2020$4622021$452Source: Kaiser Family Foundation.2 autres lignes11 mar. 2021

, what is the cheapest individual health insurance? Medicaid

, how much is Obamacare monthly? Average monthly premiums for 2020StateAverage premiumChange from 2019California$569-$13Colorado$478-$232Connecticut$684+$59Delaware$668-$17445 autres lignes1 juil. 2020

Contents

Recommended Reading: How Do I Find My Health Insurance

What Does Uk Health Insurance With Outpatient Cover Cost

We found our quote increased between £12 and £31 per month for our 33-year-old.

Most health insurance policies have a ‘basic’ or ‘core’ level of cover that insures you for treatments when you are admitted to hospital – clearly these would tend to include more serious and life-threatening conditions. However, these basic levels of cover often do not include any cover for outpatient treatment – i.e. being treated by a hospital, doctor or specialist without admission to or an overnight stay in a hospital.

This outpatient cover can be added on, and as for other covers, the details of it vary from insurer to insurer.

Our 33-year-old example buyer was quoted an extra £13 per month by AXA for their Standard Outpatient option. Their core cover includes cover for out-patient surgery, CT, MRI and PET scans already so this extra out-patient option is for consultations, diagnostic tests or if you need to see a practitioner . Their Standard option covers 3 specialist consultations with no limit on diagnostics or practitioner charges.

Vitality‘s core cover also covers MRI, CT and PET scans. Their outpatient option covers other out-patient costs, such as specialist consultations, physiotherapy, and diagnostic tests like blood tests and x-rays. £1,000 of cover per year was quoted for us at an extra £7 per month in July 2017.

How Many Small Businesses Offer Employer

When considering the costs of health coverage for employees, small business owners may wonder how common it is to provide an employer-sponsored plan.

According to the KFF survey, 57 percent of all firms offered health benefits, while 71 percent of firms with 10 to 199 workers offered health coverage in 2019. The percentage was lower for very small groups, with the survey noting that only 47 percent of firms with 3 to 9 workers offered health coverage to their employees.

Source: Kaiser Family Foundation 2019 Employer Health Benefits Survey

Given that only about half of small businesses offeremployer-provided health insurance, companies that do offer this popular employee benefit have a competitive advantage. Offeringhealth insurance may be one way to stand out from other employers whilecontributing to a companys recruiting strategy and employee benefits package.

Overall, the KFF survey notes that trends in the employer-providedhealth insurance market have been moderate over the past several years.Premiums have increased annually, but in the low to mid-single digits,and cost sharing, especially for deductibles, has meaningfullyincreased over time.

Recommended Reading: Can You Get Health Insurance Immediately

Why Should I Get Family Health Care Insurance

Being one of the top health insurance comparison websites in the UK, we realise how important your family’s health is to you. The purpose of private healthcare is to enhance NHS services. Due to the long wait periods on the NHS, numerous people opt for private health insurance to protect their families. In an emergency, you’d still need to travel to an NHS A& E, but private insurance can provide you with additional advantages. This includes:

- Less time spent waiting

- Opportunity to diagnose and treat patients more quickly.

- Amenities that involve privacy, such as a private room

- Possible access to medication not currently available on the NHS

- Potential access to medications that may not be accessible on the NHS

We have collaborated with a number of reputable partners to provide your family with the greatest coverage at the lowest price.

How Much Is Health Insurance In Florida

If you are looking for your best health insurance plan in the state of Florida, you can find many affordable choices on the Florida health insurance marketplace.

The average cost of health insurance for a 40-year-old person is $554 per month.

In 2020, the average cost of health insurance is $554 per month for a 40-year-old person. This is a decrease of 4% from 2018 when the monthly rate was $575.

Blue Cross Blue Shield provides the best rates in the majority of Florida and has offerings in every county. A plan that consumers can start looking at is the BlueOptions Silver 1410, a Silver policy that has the lowest premiums in a quarter of Florida counties.

Recommended Reading: What Is A Health Insurance Plan