Types Of Health Insurance Plans

When purchasing health insurance, your choices typically fall into one of three categories:

- Traditional fee-for-service health insurance plans are usually the most expensive choice. They offer the most flexibility in choosing health care providers.

- Health maintenance organizations offer lower co-payments and cover the costs of more preventive care. Your choice of health care providers is limited to those who are part of the plan.

- Preferred provider organizations offer lower co-payments like HMOs but give you more options when selecting a provider.

Consumer Guide To Understanding Health Insurance

Many of the requirements discussed in this guide do not apply if your employer “self-funds” its health benefits plan. This Self-fund means that the employer pays your health claims from its own funds and does not pay premiums to an insurance company. The employer decides the plan coverage, including employee eligibility, covered benefits and exclusions, employee cost-sharing and policy limits. Federal law exempts these self-funded plans from state insurance laws, so these plans do not need to include state mandated benefits. You can ask your employer if your health plan is self-funded.

How To Get Cobra

Group health plans must give covered employees and their families a notice explaining their COBRA rights. Plans must have rules for how COBRA coverage is offered, how beneficiaries may choose to get it and when they can stop coverage. For more COBRA information, see COBRA Premium Subsidy. The page links to information about COBRA including:

Recommended Reading: How To Get Temporary Health Insurance

Reviewing Florida Blue Insurance Vs Cigna Vs Ambetter Vs Bright Health : Reviews Of Best Affordable Health/medical Insurance Companies & Plans In Florida

New York, NY — 17 Sep 2020

Comparing Florida health insurance plans online is time consuming, overwhelming, and in many cases inaccurate, as people still lose money on their premiums which they could have saved.

Enter AI PLUS experts advise! Call GoHealth at 711-0412 to get free-advice in helping you chose best health/medical insurance for you, at best rate.

Regardless of how many insurance review portals and websites you come across, chosing the best health insurance plan for you in terms of price, network and coverage is always challenging.

For customers, enrolling in a health insurance plan in Florida is confusing and difficult, and seemingly small differences between plans can lead to significant out-of-pocket costs or lack of access to critical medicines and even providers.

Companies like GoHealth combine cutting edge technology with good old fashioned friendly expertise to compare hundreds of plans and find the right one for you.

How much is health/medical insurance in Florida?

If youre trying to find your best health insurance plan in the state of Florida, you will find many cost-effective options on the Florida health insurance marketplace. In 2020, the average cost of health insurance in Florida is $554 per month for a 40-year-old. Averaging over-all age groups, average cost of health insurance comes to about $203 per person for a major medical individual health insurance plan. Prices will vary and premiums can be reduced if you are in good health.

How Do I Get My Card

You will receive a PDF of your guard.me card in your myCentennial email 4 weeks after the beginning of your first semester. Sometimes, the email from guard.me goes to your Spam or Junk folder, so be sure to check there. You will not receive a physical card.

Even though you receive your card 4 weeks after the start of your first semester, you are covered from the first day of your first month. If you have to seek medical help before you receive your card, make sure you are familiar with what is covered. Keep all your receipts so that you may submit your claim online once you receive your card.

If you still do not find your policy information, please email from your myCentennial email or visit your International Education department with your student card.

You May Like: How To Get Health Insurance Without Social Security Number

What Is Covered In My Health Plan

Your insurance company or your employer will give you an “evidence of coverage” certificate that tells you about your benefits. You may receive this certificate directly from the insurer, through your job, or through the internet. Not all health plans are the same, so you should read your certificate carefully. In order to get all of the coverage available to you, you should know your benefits and the procedures you must follow.

Benefits

It is important that you read your policy carefully so that you know the benefits and services that are covered under your plan. You should also know what benefits and services are excluded from coverage. Massachusetts law requires that certain benefits be covered by all plans. However, all other services are only covered if they are specifically listed as a benefit in your plan certificate.

Health plans may have limits that apply when you first join the plan. Some plans have a pre-existing condition limit or a waiting period during which the enrollee is only covered for emergency treatment. According to Massachusetts law, insured plans may not have a pre-existing condition limitation of more than six-months. They also may not have a waiting period of more than four-months. Also, if you were covered by another health plan before you joined and you did not have more than 63 days between plans, the time that you were in the other plan may reduce or eliminate the pre-existing condition limit or waiting period.

Dependents

COBRA

Plant Closing

Things To Know About Deductibles In The Health Insurance Marketplace

IMPORTANT: This page is out-of-dateGet the latest information here.

Deductibles, premiums, copayments, and coinsurance, are important for you to consider when choosing a health insurance plan. You can compare health plans and see if you qualify for lower costs before you apply. Most people who apply will be eligible for help paying for health coverage.

Here are 6 important things to know about deductibles:

Also Check: What Is On Exchange Health Insurance

How To Shop For Health Insurance

Note: Some parts of the Affordable Care Act are being changed or eliminated via government policies and laws. It is likely that some of the rules and regulations affecting the health insurance marketplace will continue to change over time. To stay up to date on Obamacare and other health insurance issues, visit healthcare.gov and the website of the health commissioner’s office in your state.

In America today, we all need health insurance. You do. Your kids do. It’s not a “nice to have” anymore it’s a “must-have.” And that’s the law. In most cases, parents who aren’t covered by health insurance might have to pay a fine each year. Going without also means that if someone gets sick or is injured, a family might have to pay all the bills for care received. That can cost a whole lot more than paying for coverage.

To help people get health insurance, the federal and state governments set up a health insurance marketplace . This makes it easier than ever to get coverage, but the process can seem a bit confusing.

Here’s what to do to get health insurance.

Im From The Government

Neither state nor federal government representatives will ever call you to verify your social security number or bank information. Agencies like the IRS or Medicare may send a written letter via snail mail asking you to contact the agency, but they will not request or demand you wire money or provide credit card or bank information over the phone to make a payment.

-

Your move: Do not provide any personal or financial information to anyone cold-calling you or contacting you via fax, letter, or email without verifying the identity of the company or agency. Ask for a name, department, and phone number to call the person back. Though scammers may sound convincing when they tell you theyre from the government, remember that those agencies will never contact you via phone.

You May Like: Does Colonial Life Offer Health Insurance

What Is The Affordable Care Act

The Affordable Care Act provides individuals and families greater access to affordable health insurance options including medical, dental, vision, and other types of health insurance that may not otherwise be available. Under the ACA:

-

You may be able to purchase health care coverage through a state or federal marketplace that offers a choice of plans.

-

Insurers can’t refuse coverage based on gender or a pre-existing condition.

-

There are no lifetime or annual limits on coverage.

-

Young adults can stay on their familys insurance plan until age 26.

-

Seniors who hit the Medicare Prescription Drug Plan coverage gap or “donut hole” can get a discount on medications.

Read the full text of the ACA and learn more about its provisions and relationship to patients, insurers, businesses, and families.

Life Vs Health Insurance: Choosing What To Buy

Theres a definite comfort in knowing that even if your health takes an unexpected turn, you and your family have a financial safety net. When moneys tight, though, paying for both a life insurance policy and healthcare coverage each month can get tricky. As expenses start to mount, it can be tempting to drop one or the other to make ends meet.

Each type of insurance, however, serves a completely different purpose and offers different coverage.

Also Check: Does Health Insurance Cover Esthetician

Will My Current Conditions Be Covered

If you walk into your new job with pre-existing conditions, youll definitely want to be sure that necessary care is covered whether its routine appointments or prescriptions.

ONeill says you can ask for a drug summary, as well as a detailed drug list. Certain drugs fall into specific tiers, based on pricing. She says this is especially useful if you take recurring drugs .

What Happens When I Turn 26

Under Obamacare, you may be covered through your parents health insurance until you are 26, at which time you will have to get insurance on your own. You may qualify for special enrollment if your birthday falls outside of the open enrollment period.

Start shopping before you turn 26 so your new plan starts when your old one ends to avoid any gap in coverage. If you enroll in a Marketplace plan before the 15th of the month, your coverage will start the first of the following month. For example, if you need coverage starting Aug. 1, make sure you are enrolled no later than July 15.

Recommended Reading: How Do I Know Which Health Insurance I Have

When Can I Sign Up For Health Insurance

Under the ACA, you can generally buy health insurance only during open enrollment. Open enrollment for ACA coverage in 2016 starts Nov. 1, 2015 and runs through Jan 31, 2016.

However, you may be eligible to enroll at other times if you qualify for a special exception. Exceptions are granted for a number of reasons, including if you get married or divorced, have a child, change jobs or move to a new state.

Read more: How to cancel COBRA insurance

Check Their Qualifications And Registrations

The private consultant you choose must have the necessary qualifications and be a member of relevant organisations and institutions in the UK.

The number of procedures performed by private consultants should be made public by the Private Healthcare Information Network on their web page. Surgeons should also be members of the Royal College of Surgeons, and all doctors/consultants must be registered with the General Medical Council.

If required, you should also check out specialist organisations, for example, The Institute of Urology & Nephrology.

You May Like: How To Get A Health Insurance Exemption

What To Look For When Choosing A Policy

The important words to remember when shopping for a policy are “premium” and “deductible.” The premium is the amount you pay each month for coverage. The deductible is the amount you need to pay each year for medical services before your health insurance kicks in. As a general rule, insurance plans with low premiums have high deductibles, and plans with high premiums have low deductibles.

These are the basic levels of coverage:

- Catastrophic insurance is designed to protect an otherwise healthy person in the event of a major injury or illness. It’s available only to people under age 30 and those who are exempt from other plans due to hardship. This type of insurance can have low premiums but very high deductibles. Plans generally cover less than 60% of the costs of health care.

- Bronze plans also have low premiums and high deductibles, but they offer better coverage than catastrophic insurance, typically paying for 60% of costs.

- Silver plans and gold plans have average-sized premiums and average-sized deductibles. Silver plans cover 70% of costs. Gold plans pay 80% of costs.

- Platinum plans, the highest level of coverage, have high premiums and low deductibles. These plans cover 90% or more of health care costs.

If Im Interested In Alternative Therapies How Does This Plans Coverage Work

See a chiropractor? Planning to have your baby at home? Curious about acupuncture?

Different health plans treat alternative therapies different ways. In some cases, youll be covered the same as any other care. In other cases, youll only be covered a little or not at all. If this kind of care matters to you, take a close look at your plans benefits.

Related questions to ask:

- How much do alternative therapies or services cost?

- Is there any kind of cost-sharing for alternative medicine?

- Do I plan on using alternative therapies often? Am I comfortable using other treatments instead?

You May Like: Does Health Insurance Have To Cover Birth Control

Is It Easy To Get Support And Advice With This Plan

Health care can be complicated, so its not unusual to have questions about using your insurance or getting care.

Whether its when youre signing up, searching for clinics near your vacation rental or wondering if you need to get care at 3 a.m., its vital to find a plan that makes member support easy and straightforward.

Related questions to ask:

- Can I call a 24/7 nurse line whenever I have a health question?

- Who will I call if I have a question about my insurance? When are they available?

- Are there people available to help me and my family pick the right plan?

- Will I know how to get in touch with the right people when I need to?

What If Im Insured Through Work And My Parents Plan

When you have two insurance plans, one is primary and the other is secondary. The plans will coordinate coverage. When youre insured by both a workplace plan and your parents plan, your work plan will be primary and your parents coverage will be secondary.

You cant have two health insurance plans covering the same benefits, Coleman says.

The primary plan pays your claims minus deductible, copay and coinsurance. Your secondary plan may pay some of the unpaid balance after youve met its deductible.

There may be no real benefit to having two plans if you have to pay premiums for both, Coleman says.

Read Also: What Jobs Give Health Insurance

Health Insurance Open Enrollment

Open enrollment is a special period of time when you get to start, stop or change your health insurance plan. This period most often happens once a year . There are different enrollment periods depending on if you have insurance through your employer, Medicare or an ACA plan.

How Does Health Insurance Work

Health insurance is a contract between you and your insurance company/insurer. When you purchase a plan, you become a member of that plan, whether thats a Medicare plan, Medicaid plan, a plan through your employer or an individual policy, like an Affordable Care Act plan.

There are many reasons to have health insurance. One reason is that it may give you peace of mind that youre covered in case unexpected medical expenses happen. Knowing the details of how health insurance works can be an advantage when youre deciding which plan is right for you.

Also Check: Where To Buy Health Insurance Online

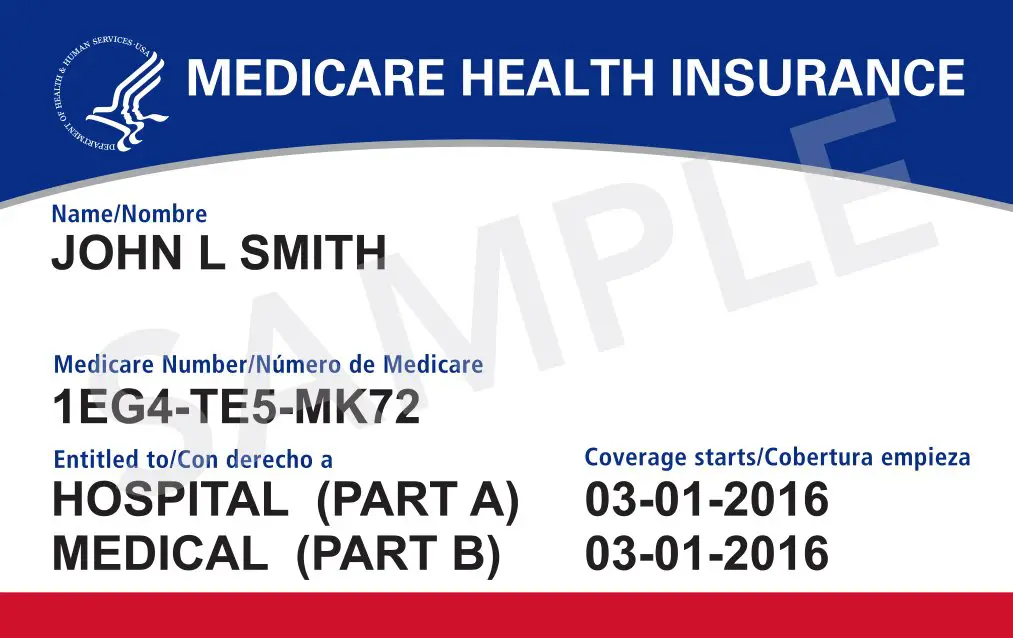

Check Your Health Insurance Enrollment Materials

- Your plan will send you a membership package with enrollment materials and a health insurance card as proof of your insurance.

- Carefully review these, and look through your plans provider directory to see where you can get care.

- Youll use the card when you get health care services, so keep it in a safe place.

- If you didnt receive a card, call your insurer to see if you should have received one already and to make sure your coverage is effective. You can find your insurers phone number on their website.

Want to change your health insurance plan? If youd like to change your plan, you can do so now only if you experience a qualifying life event like losing other coverage, having a baby, or getting married and apply with a Special Enrollment Period.