International Health Insurance For Us Citizens Living Abroad Whats Covered

How much youll pay for health insurance isnt a number you can guess. Its affected by many factors, few of which you control.

With William Russell, international health insurance can cover US citizens for:

- Doctor visits, consultations, hospital care and mental health treatment in multiple overseas territories .

- Up to $100,000 for unexpected elective medical care and $250,000 in emergency treatment costs during short visits back to US soil, for reassurance when you visit family or head home for the holidays .

How Buying Private Health Insurance Works

Some Americans get insurance by enrolling in a group health insurance plan through their employers.

Medicare provides health care coverage to seniors and the disabled, and Medicaid has coverage for low-income Americans.

Medicare is a federal health insurance program for people who are 65 or older. Certain young people with disabilities and people with end-stage renal disease may also qualify for Medicare. Medicaid is a public assistance healthcare program for low-income Americans regardless of their age.

If your company does not offer an employer-sponsored plan, and if you are not eligible for Medicare or Medicaid, individuals and families have the option of purchasing insurance policies directly from private insurance companies or through the Health Insurance Marketplace.

How Much Does Self

The cost of self-employed health insurance in California can vary depending on the provider and healthcare plan you select. Your income will largely determine the cost of your monthly premiums. For example, there are some plans that only qualify people with a low income. Some health insurance plans are flexible and allow you to change your plan according to your income levels, which may enable you to qualify for government subsidies that can help with the cost of coverage. There are also several cost assistance options.

Also Check: How To Find Personal Health Insurance

Total Costs & Metal Categories

When you compare plans in the Marketplace, the plans appear in 4 metal categories: Bronze, Silver, Gold, and Platinum. The categories are based on how you and the health plan share the total costs of your care.

Generally speaking, categories with higher premiums pay more of your total costs of health care. Categories with lower premiums pay less of your total costs.

So how do you find a category that works for you?

- If you dont expect to use regular medical services and dont take regular prescriptions: You may want a Bronze plan. These plans can have very low monthly premiums, but have high deductibles and pay less of your costs when you need care.

- If you qualify for “cost-sharing reductions” : Silver plans may offer good value. If you qualify, your deductible will be lower and youll pay less each time you get care. But you get these extra savings only if you enroll in Silver. If you dont qualify for CSRs, compare premiums and out-of-pocket costs of Silver and Gold prices to find your right plan. See if your income estimate falls in the range for cost-sharing reductions.

- If you expect a lot of doctor visits or need regular prescriptions: You may want a Gold plan or Platinum plan. These plans generally have higher monthly premiums but pay more of your costs when you need care.

The American Treatment Cost Gap

The raw cost of treatment is higher in the USA than in many countries, so this influences the cost of insurance. There are several reasons for this cost gap:

- Pharmaceutical drugs, for instance, cost nearly four times more in the USA than other similar countries.

- American doctors and nurses enjoy some of the worlds best pay the average registered nurse in California earns $113,240 so this also drives up cost.

- The American system also tends to favour more frequent interventions and complicated procedures, which comes with a price tag.

Due to the sizeable treatment cost differences, many international insurers including William Russell do not cover treatments that take place on American soil as part of our standard policies.

However, if youre an American citizen working overseas, then its good to know some of our international health insurance policies provide short-term cover for visits of up to 45 or 90 days. Find out more about our USA-45 and USA-90 international health policies.

You May Like: How To Add Dependent To Health Insurance

Digging Deeper For Pricing Information

For more details, we consulted the 2020 Health Insurance Exchange Premium Landscape Issue Brief linked to the bottom of the press release. It reveals that 27-year-olds buying silver plans will see their premiums increase by 10% or more in Indiana, Louisiana, and New Jersey.

More importantly, it reveals that the percentage changes don’t tell us much about what people are actually paying: “Some of the states with the largest decreases still have relatively high premiums and vice versa,” the brief states. “For example, while Nebraskas benchmark plan premium decreased 15% from PY19 to PY20, the average 27-year-old PY20 benchmark plan premium is $583. On the other hand, while Indianas average PY20 benchmark plan premium increased 13% from PY19, the average 27-year-old PY20 benchmark plan premium is $314.”

In fact, the benchmark plan premium for a 27-year-old in 2020 is a whopping $723 in Wyoming. How many 27-year-olds can afford that kind of monthly premium? By contrast, New Mexicos 2020 benchmark plan premium for a 27-year-old is the lowest in the nation at $282.

All of these numbers only apply to the 38 states whose residents buy plans through the federal exchange at Healthcare.gov. Residents of California, Colorado, Connecticut, Idaho, Maryland, Massachusetts, Minnesota, Nevada, New York, Rhode Island, Vermont, Washington, and Washington, D.C. buy insurance through their state’s exchange.

Change In Average Health Insurance Cost For 2021

From 2020 to 2021 health insurance rates decreased across the nation by over 2%. Additionally, year over year, Indiana saw the largest jump in health insurance costs across all metal tiers increasing nearly 10%. Including Indiana, 21 states had their rates increase on average from 2020 to 2021.

Both Pennsylvania and New Jersey switched their health insurance exchanges from being government-based to state-based. Interestingly, New Jersey had an increase in rates of close to 9% due to the change, while Pennsylvania’s rates went down decreasing by 8%.

On the other hand, rates in Iowa and Maryland decreased the most year over year, falling 20% and 17%, respectively. Overall, 27 states experienced a decrease in health insurance premiums.

| State |

|---|

Policy premiums are for a 40-year-old applicant.

Recommended Reading: How To Enroll In Cigna Health Insurance

Five Factors That Shape Health Insurance Premiums For Americans

Some Americans may pay significantly more or less for health cover due to factors such as:

- State laws these can dictate what health insurance must cover and affect competition. For instance, a 2017 Maine law instructs insurers to compensate customers who find a better deal on certain services. On the flipside, some states have certificate-of-need laws that may decrease competition.

- Your employers size larger employers tend to have access to cheaper cover. Those who dont have access through their employer will often pay more.

- Geography health insurance can be cheaper in cities than in remote locations.

- Plan type preferred provider organizations tend to cost the most, while high-deductible health plans cost the least.

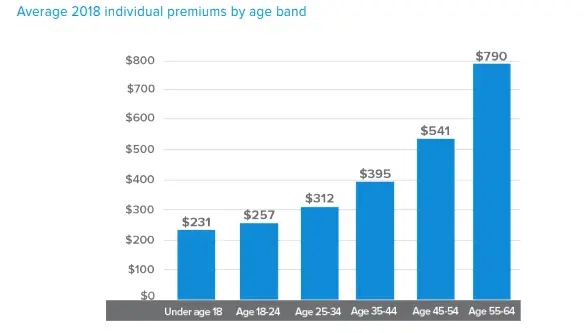

- Personal factors such as age.

What are the best places for American expats to live abroad?

Find out more here

Compare Health Insurance Plans In California

Wednesday, February 3 2021By Lee Prindle

In addition to sandy beaches and sunny weather, California also has good health insurance options for residents. In a US News study, the Golden State was ranked as the eleventh best state regarding health care access, health care quality, and good public health.

You May Like: How To Enroll In Health Insurance

Will Health Insurance Save You Money In The Long Run

When you are purchasing health insurance for the first time, you may find that comparing offers from different insurers, and buying an affordable from the start will help you save in the long term. Take the time to shop around and find the best policy for your requirements.

Consider how much money youll have to save to pay for future medical expenses that are not covered by Medicare. Add that annual amount to the Lifetime Health Cover loading and Medicare Levy Surcharge you must pay. If these costs are lower than what youll pay in premiums a year, then the cost of health insurance might not be worth it for you.

Health insurance policies vary from insurer to insurer. Luckily, its a very competitive market. You can shop around and compare policies from major health funds to find a plan best suited to your requirements and budget.

Buying California Individual Health Insurance

Before purchasing individual health insurance, you need to think about your health care needs and budget. Then, compare various plans to find the most suitable fit. Here are some questions you need to consider.

- How is the plan structured?

- Which providers are in the network?

- What is covered by the plan?

- How much out-of-pocket costs do you pay?

- How much does the plan pay for your coverage?

Think about your budget as well as your health care needs, and find out how much it will cost you in insurance premiums and out-of-pocket costs for every plan you consider. Covered California makes it easier to compare different plans and choose the one that fits your individual health needs and budget.

Making a smart choice in health insurance isnt easy, but the research you do now will pay off later when you need health care for yourself and your family. Take advantage of our online services at Health for CA Insurance Center to get free, instant quotes on California health insurance plans for individuals. Just fill out our confidential form to get started.

Read Also: Where Can I Go For Health Care Without Insurance

The Effect Of Several Hospitals On The Cost Of Private Health Insurance

The amounts charged by a UK hospital for treatment may vary by the hospital equipment, facilities, and accommodation may be charged at varying rates. It is common for hospitals in major UK cities to be more expensive than rural hospitals.

Insurers are trying to make this situation fair for everyone involved.

First, they negotiate with hospitals to make sure prices dont get out of hand they can also negotiate preferential tariffs, leading to lower premiums.

Second, they divide hospitals into different groups each insurer calls their groups in different ways. They are still practically grouped by cheaper hospitals, a middle set, and the more expensive hospitals.

Choose which group you want to receive treatment in and pay more if you want coverage in more expensive hospitals. This guarantees that people living near cheaper hospitals pay less to cover their health.

The downside is if you live near a large city, the nearest hospital may be in the more expensive category. It can affect the amount you pay.

For example, the lowest vitality category includes all hospitals in the largest UK hospital groups, Spire Healthcare, Nuffield Health, BMI Healthcare, Aspen and Ramsay Health Care.

The next level includes most other private hospitals outside London, private NHS patient units outside London and some private NHS units in London.

Its top-level includes all private hospitals in the UK and all private NHS patient units.

How Cobra Affects Your Taxes

If you decide to continue your current health insurance with COBRA, there is another expense you may not be aware of: higher taxes.

While you’re employed, your insurance premium is deducted from your paycheck before taxes along with other pretax deductions such as your 401 retirement plan and group term life insurance. These deductions make your net income look smaller and, by doing so, lower your income tax.

When you lose job-based health coverage and switch to COBRA, you have to pay your COBRA premiums with after-tax money. This means that you lose the tax-free benefit you enjoyed while being employed.

In some cases, you may be able to deduct part or all of your COBRA premiums from your taxes. But not everybody is eligible for this deduction. Speak with an accountant or tax advisor.

Read Also: When Does New Health Insurance Start

Average Cost Of Health Insurance

One of the primary factors in your individual health insurance costs is your location, as prices will vary depending on the state and county where you live. In this first table, we look at health insurance premiums for 2021 and how they differ based upon the state you reside in.

| State |

|---|

Policy premiums are for a 40-year-old applicant.

Average Cost Of Health Insurance For A Single Male

The average cost of health insurance for men in 2020 was $438 per month without a subsidy, per eHealth data. Note that this research focuses on those who buy insurance through the marketplace.

The premium you pay for health insurance will also depend on the type of plan you select. Consider options like HMO vs. PPO when you make your choice.

Read Also: How Does Health Insurance Work Through Employer

Your Gender And Marital Status

Under the Affordable Care Act, insurance companies are no longer able to charge consumers more based on their gender.8 But other factors do make a difference. For instance, if youre married and have kids, you can expect to pay more to cover your familys needs. Note that if your familys income falls below a certain level, a tax credit could save you money.9

But marital status arent the only things that determine how much you could be shelling out. Here are some other things insurance companies look for.

What Is The Average Cost Of Health Insurance

Maybe youre wondering, How much does individual health insurance cost? Heres what you can expect. The average individual in America pays $452 per month for marketplace health insurance in 2021.2 The average family pays $1,779 per month.3

But the cost of health insurance varies widely based on a bunch of factors. Some things are in your control, some arent. Things like your age, how many people are on your plan, how much coverage you need, where you live and who your employer is all play a role in the price of your coverage.

Heres a breakdown showing the average costs depending on your state:

Kaiser Family Foundation, 2021.

You May Like: How Much Do You Pay For Health Insurance

California Health Insurance Laws

When the Affordable Care Act was passed in 2014, changes were made among what factors insurance companies can use when pricing your policy. Here are some things companies can’t use for pricing your policy:

- Pre-existing conditions: Before the ACA, insurance companies often charged people with pre-existing conditions more for coverage. Now, insurance companies can’t charge higher rates to people with pre-existing conditions.

- Gender: According to a Health Services Study, women historically pay more for health care. However, the Affordable Care Act doesn’t allow insurance companies to charge men and women a different premium for the same plan.

- Insurance and medical history: Insurance companies also used to analyze your medical history and your past insurance coverage. Those with medical problems historically had to face steeper premiums, if coverage was even provided. This changed with the implementation of the ACA, which made it so that insurance companies could not price your policy based on insurance and medical history.

For a 2020 marketplace plan, there are out-of-pocket maximum limits. This year, out-of-pocket maximums are $8,150 for an individual plan and $16,300 for a family plan.

According to the California Department of Insurance, California law requires health insurance policies to include these benefits:

- Hospital care

- Visits to primary care doctors

- Pregnancy and newborn care

- Oral and vision care for children

- Prescription drugs

Factors For Your Health Insurance Rate

Health insurers look at many factors when figuring out how much your premium will cost. These include:

The Kaiser Family Foundation offers a Health Insurance Marketplace Calculator that can help you figure out roughly how much your plan will cost.

You May Like: What Is Employer Group Health Insurance

Blue Shield Of California

Blue Shield of CA boasts several member benefits. These include a 24/7 nurse help line, care programs, gym discounts, wellness programs, and more. Most members purchase individual and family plans through Covered CA. Medical plans come in bronze, silver, gold, platinum, and minimum coverage. Depending on your plan, youâll receive different benefits, deductibles, and out-of-pocket costs.

Blue Shield was founded in CA in 1938. Today, the company has 6,800 employees serving over four million members. Blue Shield prides itself on giving back to the community. In 2014, employees raised over $400,000 for local nonprofit organizations.

The Qualified Small Employer Hra

With a QSEHRA, employees purchase their own health insurance and get reimbursed for medical expenses, health insurance premiums, and other qualified costs with tax-free dollars by their company. To qualify, a company must have fewer than 50 full-time employees and cant offer a group health insurance policy to any employee.

You May Like: How Much Is Health Insurance Usually

Your Options If You’re Not Eligible Through Your Employer

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

If your employer doesn’t offer you health insurance as part of an employee benefits program, you may be looking at purchasing your own health insurance through a private health insurance company.

A premium is the amount of money an individual or business pays to an insurance company for coverage. Health insurance premiums are typically paid monthly. Employers who offer an employer-sponsored health insurance plan typically cover part of the insurance premiums. If you need to insure yourself, you’ll be paying the full cost of the premiums.

It is common to be concerned about how much it will cost to purchase health insurance for yourself. However, there are various options and prices available to you based on the level of coverage you need.

When purchasing your own insurance, the process is more complicated than simply selecting a company plan and having the premium payments come straight out of your paycheck every month. Here are some tips to help guide you through the process of purchasing your own health insurance.