Keep Costs Down Stay In Network With Provider Finder

One way to help keep your health insurance costs down is to use only doctors, hospitals and other health care professionals in your plan’s network. If you go out of network, you might have to pay the entire bill. Not all plans have the same network. The best way to find in-network providers is byregistering or logging into Blue Access for MembersSM, our secure member website, for a personalized search based on your health plan and network using our Provider Finder®tool.

Workers Premium Payments Grew Faster Than Median Income Over The Decade

U.S. workers contributed about 21 percent of the overall premium for single plans and 28 percent for family plans in 2018. This has not changed over the decade . But in some states the share is much higher: workers were responsible for a third of their family plan premiums in Louisiana, Mississippi, Nevada, North Carolina, and Virginia.

Worker contributions to single-plan premiums averaged $1,427 in 2018. They ranged from a low of $755 in Hawaii to a high of $1,903 in Massachusetts . Contributions to family plans averaged $5,431 in 2018 and ranged from a low in Washington of $3,862 to a high of $6,597 in Virginia .

To see what these costs mean for people with middle incomes , we compared premium contributions to median household income in 50 states and D.C.4

Between 2008 and 2018, employee premium contributions for both single and family plans grew at an average annual rate higher than 4 percent, going as high as 6.4 percent between 2010 and 2012 . This was faster than growth in median household income over the same time period, which ranged from 1.5 percent during the deep recession of 2008 to 2010 to 3.8 percent in 2012 to 2014.

On average, the employee share of premium amounted to 6.8 percent of median income in 2018. This was up from 5.1 percent in 2008, but has remained largely constant since 2012 . In nine states , premium contributions were 8 percent or more of median income, with a high of 10 percent in Louisiana .

Does Your Car Insurance Deductible Affect How Much Pay

Generally, the higher the amount you choose, the lower your insurance rate will be. For example, choosing a $2,000 deductible will have a lower premium than one with the $500 option.

You will pay $500 out of pocket in this scenario, and your insurer will pay the remaining $4,500 to cover the $5,000 of damage. You pay the deductible if you cause the accident. If you are not the cause of the accident or have accident forgiveness, your insurer may waive the fee.

Don’t Miss: What Do I Need To Know About Health Insurance

Things To Know About Deductibles In The Health Insurance Marketplace

IMPORTANT: This page is out-of-dateGet the latest information here.

Deductibles, premiums, copayments, and coinsurance, are important for you to consider when choosing a health insurance plan. You can compare health plans and see if you qualify for lower costs before you apply. Most people who apply will be eligible for help paying for health coverage.

Here are 6 important things to know about deductibles:

How Much Of A Deductible Should Your Health Insurance Have

When you purchase an individual plan on the health insurance marketplace, and sometimes even if youre choosing a plan offered by your employer, you will need to choose a deductible amount for your plan. Deductible amounts typically range from $500 to $1,500 for an individual and $1,000 to $3,000 for families, but can be even higher.

You May Like: Does Golden Rule Insurance Cover Mental Health

Average Health Insurance Rates By Plan Type

Another distinction between plans that can change the rates you pay is the type of network the plan uses.

Depending on whether the plan is a preferred provider organization , health maintenance organization , exclusive provider organization or point of service , access to health care providers will be managed in different ways.

HMOs tend to be the most restrictive about which doctors you can see and what you must do to see them. This usually means that the insurers save on your cost of care and thereby provide lower premiums.

| Type |

|---|

Policy premiums are for a 40-year-old applicant.

How Do Premiums Deductibles Cost

Generally,the more benefits your plan pays, the more you pay in premium. But your medicalexpenses for care are lower.

Toillustrate how these costs may influence your choice of plans, consider the ACAplans.

Inaddition to the metallic plan categories, some people are eligible to purchasea plan with catastrophic coverage. Catastrophic plans have very low premiums andvery high annual deductibles . However, they pay for preventivecare regardless of the deductible. These plans may be a suitable insuranceoption for young, healthy people. To qualify for a Catastrophic plan, you mustbe under age 30 or be of any age with a hardship exemption or affordabilityexemption . Learnmore about Catastrophic coverage.

Recommended Reading: Will My Dental Insurance Cover Veneers

Read Also: How Much Is Health Insurance A Month In New York

How Premium Costs Have Changed In Recent Years

In recent years, healthcare costs have kept rising for both individuals and families in the U.S. This is also true for monthly and annual insurance premiums. The average yearly premium for a family has increased by 22% since 2015 it’s increased by 55% since 2010.

Healthcare spending in the U.S. grows each year. Projections estimate yearly annual spending of nearly $6 trillion by 2027, compared to $3.8 trillion in 2019.

Qualified Small Employer Hra

A qualified small employer HRA is a health benefit for employers with fewer than 50 full-time equivalent employees who dont want to offer employees group health insurance. With a QSEHRA, employers reimburse employees tax-free for their medical expenses, including individual health insurance premiums up to a maximum contribution limit. Check out our latest QSEHRA annual report to see how a QSEHRA helped our customers last year.

Don’t Miss: Which State Has The Cheapest Health Insurance

Why Do I Have More Than One Deductible

Health insurance plans may have multiple deductibles. For example, your policy may have both individual and family deductible limits. Most plans also have a separate deductible if you use medical providers who are outside the plans provider network. Your deductible will generally be higher if you use an out-of-network provider. Your plan may also have separate deductibles for medical and prescription drug benefits.

If you switch plans part way through the year, youll generally have to start over with a new deductible on your new plan. This is common, for example, if you leave a job where you had employer-sponsored health coverage, and switch to an individual market plan or a new employers health plan mid-year.

What Is A Typical Deductible

Deductibles can vary significantly from plan to plan. According to the Kaiser Family Foundation , the 2020 average deductible for individual, employer-provided coverage was $1,644 . KFF reported the average 2021 deductible for marketplace plans sold via HealthCare.gov, by metal rating: $6,921 for Bronze plans, $4,816 for Silver plans, $1,641 for Gold plans, and $0 for Platinum plans.

High-deductible health plans have become common. Typically, a healthcare plan with a higher deductible will have a lower premium, while a plan with a lower deductible will have a higher premium. For 2021, the IRS defines an HDHP as one with a minimum deductible of $1,400 for individual coverage or $2,800 for family coverage. HDHPs can have higher deductibles, although theyre more limited than other plans in terms of total out-of-pocket caps: In 2021, an HDHPs maximum out-of-pocket cant exceed $7,000 for an individual or $14,000 for a family .

Also Check: Do Employers Pay For Health Insurance

Factors That Impact Health Insurance Rates

For a particular health insurance plan, the cost of coverage is determined by certain factors that have been set by law. States can limit the degree to which these factors impact your rates for instance, some states like California and New York don’t allow the cost of health insurance to differ based on tobacco use.

- Age: The health care cost per person covered by a policy will be set according to their age, with rates increasing as the individual gets older. Children up to the age of 14 will cost a flat rate to add to a health plan, but premiums typically increase annually beginning at age 15.

- Where you live: Health insurance companies determine the set of policies offered and the cost of coverage based on the state and county you live in. So a resident of Miami-Dade County in Florida, for instance, may pay lower rates for the same policy than a resident of Jackson County.

- Smoking/tobacco use: If you smoke, you could pay up to 50% higher rates for health insurance, though the maximum increase is determined by the state.

- Number of people insured: The total cost of a health plan is set according to the number of people covered by it, as well as each person’s age and possibly their tobacco use. For example, a family of three, with two adults and a child, would pay a much higher monthly health insurance premium than an individual.

How To Estimate Your Yearly Total Costs Of Care

In order to pick a plan based on your total costs of care, youll need to estimate the medical services youll use for the year ahead. Of course its impossible to predict the exact amount. So think about how much care you usually use, or are likely to use.

- Before you compare plans when youre logged in to HealthCare.gov or preview plans and prices before you log in, you can choose each family members expected medical use as low, medium, or high.

- When you view plans, youll see an estimate of your total costs including monthly premiums and all out-of-pocket costs based on your households expected use of care.

- Your actual expenses will vary, but the estimate is useful for comparing plans total impact on your household budget.

Also Check: Does Travel Insurance Cover If Company Goes Bust

Read Also: Do Real Estate Brokers Offer Health Insurance

How Much Are Hdhp Deductibles

The average deductible for a employer-based plan’s single coverage is $1,644 in 2020 — nearly identical to 2019. The average deductible for HDHPs is $2,303 for a single plan, a slight decrease from 2019, according to Kaiser Family Foundation.

Insure.com found that respondents single plan deductibles are usually between $1,701 and $4,000. Thats well above the $1,400 threshold for a plan to be considered high deductible.

Here are what the survey respondents said single coverage deductibles are:

- Between $1,701 and $2,499 — 33%

- $2,500-$4,000 — 26%

- More than $4,000 — 16%

- Less than $1,700 — 11%

Kaiser Family Foundation said the average HDHP annual deductible for family coverage is $4,552 for high-deductible employer-based plans in 2020. Our respondents said their family plan deductibles are:

- $3,001-$4,449 — 29%

- Less than $3,000 — 25%

- More than $6,000 — 18%

These deductibles are significantly higher than PPO and health maintenance organization plans. However, those higher costs are offset by lower premiums.

Kaiser Family Foundation said the average premiums for plans in 2020 are:

| Type of plan |

|---|

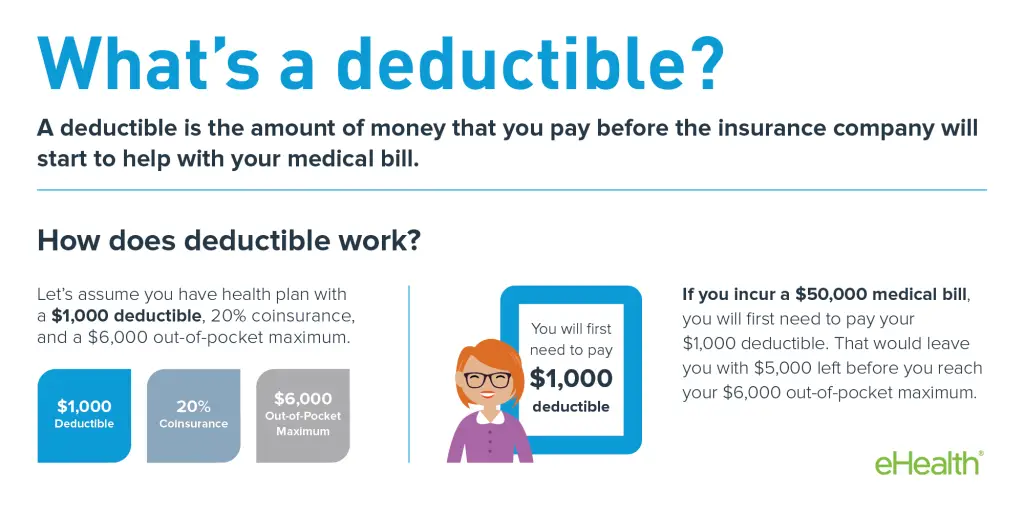

What Is A Deductible

A deductible is how much you have to pay toward your health insurance costs before your health plan will begin to pay for covered services in a given year. For example, if your deductible is $2,000 for the year, you have to pay for the first $2,000 in medical services. Some plans will pay for certain costs, like preventive services, before you’ve met your deductible.

Recommended Reading: What Do Expats Do For Health Insurance

Lower Your Healthcare Costs With Subsidies

No matter how high or low your health policys deductible is, having the option to lower how much you pay out of pocket can help out any familys budget. For low-income families, you may be eligible for a health insurance subsidy to help lower the cost of your monthly premiums or out-of-pocket expenses, including your deductible. These subsidies are only available for Affordable Care Act plans.

And with the 2021 American Rescue Plan Act now in effect, you could be eligible for a zero-premium silver or bronze plan thanks to expanded eligibility requirements.5

The premium tax credit is a subsidy that helps families making a modest income afford the cost of their monthly health insurance premiums. You can receive this subsidy in one of two ways:

In order to be eligible for this tax credit, you must meet these requirements:6

In order to be eligible for this reduction, you must meet these requirements:

Drawbacks Of High Deductible Plans

One drawback of a high deductible health plan? In a worst-case scenario or emergency situation, meeting the deductible or out-of- pocket maximum could pose a financial burden. Another drawback? Some people might skip making doctors appointments or filling prescriptions to avoid spending money risking their health in the process.

Don’t Miss: How Much Health Insurance Do You Need

What’s The Difference Between A Deductible And An Out

Your insurance deductible is relevant at the beginning of your health insurance policy, and your out-of-pocket maximum is relevant after you’ve had significant health care during a policy year.

- Deductible: You pay 100% of your health care costs until your spending totals your deductible amount.

- Coinsurance/copay: You’ll pay a portion of your health care costs until your total spending reaches your out-of-pocket limit.

- Out-of-pocket limit: You’ll pay 0% for covered health services after your out-of-pocket limit.

Health Insurance Deductibles: What Can You Expect

On top of premiums, everyone who carries health insurance also pays a deductible. This means you pay 100% of your health expenses out of pocket until you have paid a predetermined amount. At that point, insurance coverage kicks in and you pay a percentage of your bills, with the insurer picking up the rest. Most workers are covered by a general annual deductible, which means it applies to most or all healthcare services. Here’s how general deductibles varied in 2019:

- $1,655: Average general annual deductible for a single worker, employer plan

- $2,271: Average annual deductible if that single worker was employed by a small firm

- $1,412: Average annual deductible if that single worker was employed by a large firm

| Median Individual Deductible, Qualifying Health Plan Without Subsidies from Healthcare.gov., Plan Year 2020 |

|---|

| Bronze |

| $1,430 |

Individuals who are eligible for cost-sharing reductions are responsible for deductibles as low as $115 for those with household incomes closest to the federal poverty level.

Don’t Miss: What Is A Health Insurance Plan

What Does A Disappearing Deductible Mean

A disappearing, or vanishing, deductible is an endorsement that can be added to your insurance to lower your costs. For each year you do not file, your payment will be reduced by 20%. Ideally, after five years of driving, there would be no fee to pay unless you make a claim.

Advantages

- It is an extra way to save.

- You pay less money out of pocket if you file an at-fault accident.

- Once you sign up, your insurer will automatically lower your cost each year.

Disadvantages

Read Also: How Does Social Security Disability Insurance Influence Staffing

What Is A Health Insurance Deductible

A health insurance deductible is a set amount of money that an insured person must pay out of pocket every year for eligible healthcare services before the health insurance plan begins to pay any benefits.

The amount of the deductible varies depending on the health insurance plan you choose. As a general rule, the higher the monthly premium you pay, the lower your deductible will be. Your monthly premium is the amount you pay to a health insurance company to provide you with coverage.

Even after you pay off your deductible for the year, you may still have to pick up some of your healthcare costs. Most insurance plans have co-payments, which require the insured to pay a set dollar amount as their share of the cost of some services. Most also have coinsurance payments, which make the insured responsible for a set percentage of the total cost of some services.

Also Check: Does Health Insurance Cover Funeral Costs