Hear What Our Patients Say

Dr. Blake Matthews and his staff are out of this world. I have never had a doctor or dentist call me personally after a procedure like Blake did after my last implant. Not only did he call to see how I was doing, but he went out of his way to call me

Wendell W.

Verified Google Review

Dr. Matthews is wonderful! His staff is very helpful, friendly, and professional. Even my 6 year old said, Mom, that dentist man is very nice! Matthews Smiles makes going to the dentist a pleasant experience, which I didnt know was possible!

Lauren H.

Verified Google Review

A wonderful dentist! Dr. Matthews is very professional and he and his staff treat us like family for more than twenty years. They are the most kind people and always make visits comfortable and pleasant.

Hyea-Won C.

Verified Google Review

How Does Location Affect An Agents Income

The cost of living, crime rate, health statistics, and accident rates in a city can all affect insurance rates, causing fluctuations in the size of premiums and therefore the size of commissions. Location can also affect how many potential customers are available compared to how many agents are working in the market.

When deciding where to work, an agent should consider the cost of living, the likely value of premiums, and the likely amount of competition, and pick the market that best suits his desired lifestyle.

Get a start on finding affordable insurance quotes in your area by typing your ZIP code into our free and helpful tool below.

Payment From Initial Enrollment

One of the primary ways how Medicare insurance agents earn money is when a consumer enrolls in a new plan. For instance, this can be when you enroll in your very first plan or if you enroll in a new plan thatâs unlike what you were previously enrolled in. The maximum amounts of commission for Medicare Advantage and Medicare Part D sales that are payable to Medicare agents is regulated by the Centers for Medicare & Medicaid Services and updated each year. These maximum commission amounts also vary depending on the state and region the plan is in, as well as the insurance provider itself. In 2022, the maximum commission amounts are $573 for a new Medicare Advantage plan with drug coverage and $87 for a new Part D plan.

In 2022, the commissions are $573 for an initial MAPD enrollment and $87 for an initial PDP enrollment.

These commissions are paid by the insurance company offering the plan, though companies are not required to pay the CMS-regulated maximum. This allows the Medicare agent to help you find a Medicare plan without charging you a fee for their services. At the same time, there isnât any added cost you must pay for using an agent. A plan you enroll in yourself will cost the same as an agent-assisted enrollment.

Also Check: Does Health Insurance Pay For Abortions

How Much Do Health Insurance Brokers Make Per Policy

One of the questions on the mind of most health insurance policyholders is how much health insurance brokers make per policy. Before taking your cove, you may not be sure if you will be paying the brokerage fee alongside your premium or if the broker will bill you separately for his brokerage service charges.

We are here to unravel this for you. Your health insurance broker will not charge you an extra fee to cover his service fees. His charges are already included in the policy amount your health insurance cover provider will quote for you. Here is how it works.

Broker of Record

A broker or health insurance agent will probably approach you to discuss the options available for you. When you decide on the kind of cover to take, you may work with a particular broker or agent to help you understand and sign up for it. The person you choose becomes your broker of records, acting as the link between you and the health cover provider.

You will then sign a letter of broker of records indicating that you have accepted to work with this broker. It will be the first contractual step between the broker and the health insurance providers and the broker and form the basis of his payment.

Commissions

The 80/20 rule is a requirement under the Affordable Care Act. It ensures that the highest chunk of your insurance premium goes towards your health insurance, limiting the amount your insurance provider can use for other costs such as marketing, overhead, and broker commissions.

Bottom Line

General And Family Dentistry

At Elite Dental, our general and family dentistry is an invaluable service. There are so many benefits to having your entire familys dental needs treated in one place. If you are looking for a new dentist, we invite you to come visit us. If you are trying to consolidate your entire family and youre tired of driving to multiple dental offices, we are the place you have been looking for. Our general and family dentistry services include: CEREC, Dental Fillings, Dental Implant Restorations, Digital X-Rays, Inlays and Onlays, Pediatric Dentistry, Periodontal Care, Root Canal Treatment, and Sedations Dentistry.

You May Like: Where To Go To Apply For Health Insurance

How Much Can Insurance Agents Make Selling Medicare

Roxanne Anderson

If youâre considering selling Medicare, you likely want to know how much you can earn from it. Weâre covering the basics, including how working with an FMO can affect your commissions, to give you a good idea!

Listen to this article:

The 2022 plan year will be a fantastic year for Medicare Advantage sales, which is good news for agents looking to earn more commission! Letâs get right to the facts and figures.

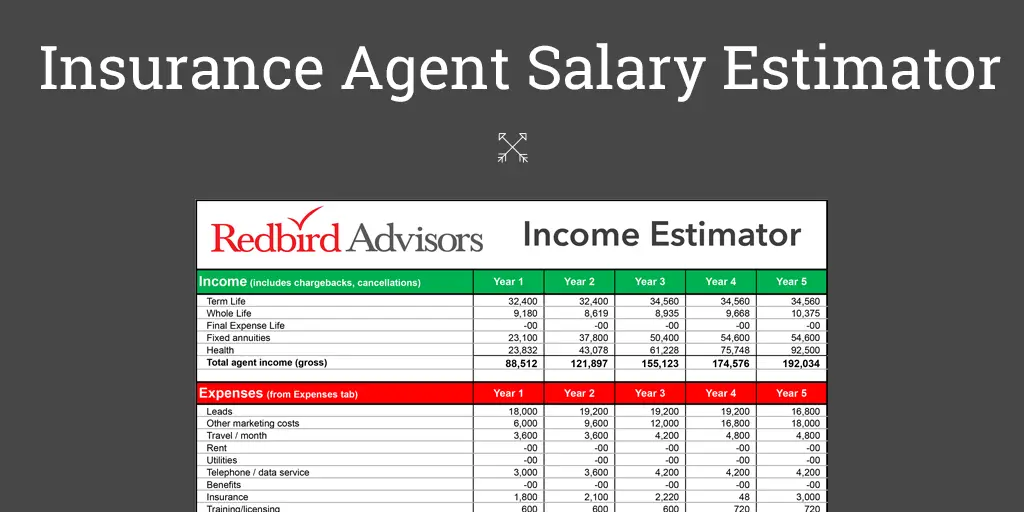

How Much Money Do Insurance Agents Make

One of the most common questions asked by students who enroll in Americas Professors online insurance agent exam preparation courses is a fairly obvious one: How much do insurance agents make? The good news is, most insurance agents can expect to make well above the average median income. While the exact amount of money an individual insurance agent makes can vary wildly between agents, statistics regarding the earnings of insurance agents in the U.S. shows that most of them are capable of making a comfortable income from their work.

How much do Life Insurance Agents Make?

The most recent government data regarding the average income of American insurance agents was compiled in 2012. According to that data from the Bureau of Labor Statistics:

- The median annual wage for insurance agents was $48,150.

- The highest paid 10% of insurance agents earned more than $116,940 annually.

- The lowest paid 10% of insurance agents earned less than $26,120 annually.

As the numbers show, there is a wide range of possible incomes for insurance agents. Because the amount of money insurance agents earn is comprised largely of commissions and bonuses, the number of sales an insurance agent makes is the biggest factor that contributes to the disparity between the highest and lowest paid of insurance agents. Factors such as the price of the plans they sell and the type of insurance they specialize in also contribute to the wide range of incomes for insurance agents.

Recommended Reading: What Is The Best Supplemental Health Insurance For Medicare

How To Become A Health Insurance Agent

Working in the insurance agency can be a great fit for people who enjoy customer service, sales and helping other people. Health insurance agents work with clients to help them choose health insurance plans and settle claims. If you’re interested in becoming a health insurance agent, it can be helpful to know details of the profession as well as how to get a job as a health insurance agent. In this article, we explain what health insurance agents are, how to become a health insurance agent and other information related to the job.

How Are Casualty And Property Insurance Agents Paid

Typically, an insurance agent is paid a commission, or percentage, of the total insurance premium the insurer charges for a given policy.

Property and Casualty insurance agents typically earn anywhere between 7% and 20% commission on each policy sold. If you forced us to come up with a solid number, wed say 12% is what you can expect on average.

Example: $1,000 auto insurance policy at 12% commission would net you $120.00.

Each year, assuming your client is still happy and continues to insure with you, you will earn a renewal commission. Renewals are where the moneys at, as you do not have to advertise or spend time quoting the policy for it to renew .

If the client makes the renewal payment, you get paid againit may even happen while youre sleeping.

Renewal policy commissions are often slightly less than the initial commission you get paid for the new business. For example, n ew business may be 15% and renewals only 10%.

As you can see, a few years into the process of building your book of business, the renewals from previous years virtually make your income exponential. There are few products you can sell where you get paid each year, whether you worked with the customer or not.

Example: Last years auto policy from the example above renews and you sell a new auto policy on the same day the following year, earning another $120.00 your income for that day is now $240.00. Not a bad days work.

Compare Quotes From Top Companies and Save

Also Check: How Much Is Temporary Health Insurance

Serving Draper Sandy And Surrounding Areas

We believe in making dental care enjoyable and comfortable. The comprehensive dental services we offer can help you reach and maintain optimal oral health. If you want to enjoy your dental care, our dental office in Draper, Utah, is the place to go. Let our team help you create a beautiful smile that you will feel excited to show off. From routine preventive care to more complex restorative treatments, we are here to help you.

Our friendly and experienced dentist and team are dedicated to ensuring that you receive the high-quality, personal care you need to achieve a healthy smile, and we take the time to ensure your comfort as well as your oral health. We invite you to to schedule an appointment with Dr. Chase Judd and learn more!

What Is A Captive Agent

The number-one concern for all agents is attracting clients. Insurance companies have marketing budgets they spend generating interest in their brand and generating leads for their captive agents.

This benefits new agents who otherwise may have a small sphere of influence from which to attract clients. Often, simply by staying close to the phone, a new captive agent can acquire business from leads generated by the companys marketing efforts.

Many large companies employing captive agents provide benefits and provide access to the reinsurance market. Captive agents also benefit from having a desk in an office, a receptionist, and a full suite of office equipment.

Being in an office with other agents can also be a benefit since there is a wealth of experience on which to draw. These factors add a sense of credibility to an agent.

A downside is that, since a captive agent works exclusively for one insurance company, that agent can only sell the products that the company offers and doesnt have the ability to refer customers elsewhere when they cant sell them a policy.

The parent company may also push certain types of policies for the agent to sell or discontinue certain types of coverage.

Recommended Reading: What’s The Penalty For Not Having Health Insurance In California

Make The Most Of Networking Opportunities

Take full advantage of the amazing opportunity to attend conferences, trade shows, and meetings, and start networking with other insurance agents and professionals in your field. Note that these are ideal places to make connections, stay updated on industry trends, and learn from respected industry leaders.

Jeffrey Child is an insurance and tax professional at Podium, the leading messaging platform that connects financial service businesses with their members and prospects.

How Do Insurance Agents & Brokers Make Money

How much do insurance agents and brokers earn monthly or yearly? How do insurance agents & brokers make money? Here are 5 clever ways insurance agents make money. If you have purchased an insurance policy in the past, chances are that you made that purchase through an insurance agent or broker. Agents and brokers act as intermediaries between you, the insurance buyer, and the insurance company.

Read Also: Does Health Insurance Cover Birth Control Pills

With Market Size Valued At $9841 Million By 2026 It`s A Healthy Outlook For The Global Online Electronics Retailing Market

When selling home and auto insurance, an insurance agent can expect to make a percentage of the policys premium, as well as a percentage of their policy renewal. This means that having an ever-expanding network of customers could potentially grow your earnings exponentially.

Life and health insurance policies work under a slightly different pay structure. When a customer first signs up for a policy, the agent makes a large percentage off the sale. The agent also gets income from policy renewal, though at a much cheaper rate. After the third year, many agents stop earning a commission on the policy renewal altogether.

Elite Dental Loyalty Program

Elite Dental is a general dental practice that provides a full range of dental services, allowing us to make minimal referrals to specialists. Contact us today to learn how you can join our loyalty program and schedule your appointment with our dentists!

- Routine Cleanings

- X-rays

- Examinations

- 30% Off All Other Dental Services Provided in Our Office

Don’t Miss: How Does Health Insurance Work Through Employer

How Much Do Car Insurance Agents Make

According to the US Bureau of Labor Statistics, the average yearly salary for an insurance agent is just over $50,000. Its website lists commission as the post common form of compensation.

The same Bureau of Labor Statistics estimate list s bottom 10% of insurance agents earning $25,000 a year, with the upper 10% earning $125,500 per year.

These numbers depend on the type of agent, though.

- Captive agents work directly for insurance companies.

- Independent agents can sell insurance from a variety of insurance companies and arent tied down to one.

How Do Independent Insurance Agents Get Paid

Independent agents get commissions for the insurance policies they sell to the clients. These individuals do not work directly with any specific insurance company instead, independent agents may choose which plans will be offered to the people. Salary of insurance agents depends on their experience and skills. Also, an independent agent can work with as many companies as they want and offer customers a variety of options in coverage, rather than being tied down by just one partnership like captive agents.

Also Check: What Are Some Good Health Insurance Plans

Joseph W Kayne Dds & Eric Tidwell Dds

Drs. Joseph Kayne. Eric Tidwell, and Dr. John Wilson are your friendly and experienced dentists in Provo, Utah! We are pleased to offer comprehensive dentistry to meet your needs and desires, and we strive to maintain a stress-free environment, using the latest technologies to ensure your dental treatments are comfortable and precise. We also have team members who speak both English and Spanish to accommodate your needs. Drs. Kayne, Tidwell and Wilson are pleased to provide quality dentistry in Provo, Utah, and we are happy to also welcome our friends from the nearby areas as well, including American Fork, Lehi, Lindon, Orem, Payson, Pleasant Grove, Santaquin, Saratoga Springs, Spanish Fork, and Springville, Utah. Please contact us today to schedule your next visit!

Do Insurance Agents Make A Base Salary

The Base Salary of an Insurance Agent

The 2017 median annual wage for an insurance agent is $49,710 and the hourly wage is $23.90 per hour, according to the U.S. Department of Labors Bureau of Labor Statistics, New agents make less than $27,180, while those with years in the business can make upwards of $125,190.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Insurance Agent Commission Rates

What an agent makes depends on the types of insurance policy, such as life insurance, and other factors, including size and location. It can also vary by type of life insurance, including whole life insurance or term life insurance.

On average:

- Home and car captive agents typically receive a 5 to 10% commission on the first years premium, while independent agents average 15%.

- Life and health insurance agents make most of their money in the first-year premium. Such front-loaded commissions can run anywhere from 40% to more than 100% of the policy’s first-year insurance rates.

Your insurance agent could also make money every year that you renew the insurance policy.

Understanding How Insurance Brokers Make Money

The primary way an insurance broker earns money is commissions and fees based on insurance policies sold. These commissions are typically a percentage based on the amount of annual premium the policy is sold for. An insurance premium is the amount of money an individual or business pays for an insurance policy. Insurance premiums are paid for policies that cover healthcare, auto, home, life, and others.

Once earned, the premium is income for the insurance company. It also represents a liability, as the insurer must provide coverage for claims being made against the policy. Insurers use premiums to cover liabilities associated with the policies they underwrite. They may also invest the premium to generate higher returns and offset some of the costs of providing the insurance coverage, which can help an insurer keep prices competitive.

Insurers invest the premiums in assets with varying liquidity and return levels, but they are required to maintain a certain level of liquidity. State insurance regulators set the number of liquid assets necessary to ensure insurers can pay claims.

An insurance broker or agent will often earn a lump sum percentage against the first-year premium of a policy that they sell and then a smaller but ongoing annual residual income payment over the policy’s life.

Don’t Miss: Who Pays First Auto Insurance Or Health Insurance