Wisconsin Dental And Vision Plans

Dental and vision insurance plans, underwritten by Golden Rule Insurance Company, have no age limit restrictions.3 They offer coverage for the dental and vision services many medical insurance plans dont include.

From Milwaukee to Madison, Green Bay to Kenosha, explore these Wisconsin health insurance options and more that may be available now.

The American Rescue Plan Act Of : Health Equity

The American Rescue Plan Act of 2021 will work to address systemic inequities through a $25.2 billion investment in underserved communities and communities of color, including:

- $7.6 billion for community health centers, Federally Qualified Health Center Look-Alikes, and Native Hawaiian Health Centers

- $3.3 billion for the Indian Health Service

- $1 billion for emergency assistance for children, families, and workers through the Temporary Assistance for Needy Families program

- $500 million for nursing home strike teams to manage COVID-19 outbreaks and another $200 million for infection control in nursing homes

- $276 million to protect the elderly and fight elder abuse

- $150 million for the Maternal, Infant, and Early Childhood Home Visiting Program

- $50 million for the Title X Family Planning Program

- Allowing states to provide Medicaid coverage for one year postpartum to address the maternal health crisis disproportionately affecting communities of color

- Increased federal support through Medicaid for home- and community-based services

When Do You Need Short

Many situations can leave you in a coverage gap. For example:

- You may have left a job and need health insurance until your new job starts

- Missed the open enrollment period for Obamacare.

Short-term health insurance offers temporary coverage to fill these gaps.

Wisconsin allows you to have short-term health insurance for up to 364 days. But unlike many states that allow renewals for up to 36 months, Wisconsin limits them to 18 months.13

Short-term health plans offer basic benefits that can help you pay for care, such as doctors visits. However, these plans are not the same as ACA health insurance that offers comprehensive coverage. This means short-term plans arent required to cover pre-existing conditions or include essential health benefits.

Short-term health insurance may not work for everyone. Getting comprehensive coverage may have a higher monthly premium but could save you more money out of pocket in the long run. This summary about Wisconsin health insurance can help you decide whats best.

Recommended Reading: Starbucks Insurance Benefits

How Are Individual Health Insurance Premiums Calculated

The state allows for private health insurers to set their premiums at whatever rate they see fit, hoping that market competition will help keep them at a reasonable cost. Your insurer will take many factors into consideration when determining your rate, including age, health, and plan type.There are no laws or restrictions regarding what an individual can be charged for a policy or exclusions on the reasons for quoting a high premium. When it is time to renew your policy, your insurer also has the right to raise your premium for any reason. The good news for health insurance customers is that their provider cannot cancel their policy because they get sick, even at renewal. They can, however, raise your premium to compensate for this increased risk.

Wisconsin Available Standardized Plans

To help you more easily compare costs and benefits, ACA designates that all qualifying plans be one of four metals: Bronze, Silver, Gold and Platinum. Each is based on the average amount of healthcare costs the plan will cover shown as a percentage of what is covered by your insurance company and what is paid for by you. All insurers participating in the federal or a state healthcare exchange must offer , at minimum, Silver and Gold plans. All metal plans have a shared maximum out-of-pocket amount that you can be charged in any calendar year.

| Metal Plan | |

| 90% | 10% |

In addition, if you are under 30 or meet the criteria for a hardship exemption, you can purchase a catastrophic plan that is compliant with ACA requirements.

Also Check: Starbucks Open Enrollment 2018

Howdoyougetcoveredthrough Medicaid Or Chip In Wisconsin

In Wisconsin, Medicaid, for people with low income or a disability, and the Childrens Health Insurance Program , for children under 19, are combined in the BadgerCare Plus program. You can find out whether you qualify by applying anytime online. BadgerCare Plus covers a variety of services, including lab visits and X-rays, wellness visits, emergency room care, hospitalization, mental health, substance abuse and prescription drugs.

Donât Miss: How Much Does It Cost For Health Insurance

What Happens If You Object To Receiving A Vaccine When Your Employer Requires It

Just because you have a valid medical disability or theological objection to receiving a coronavirus vaccine doesn’t mean your employer has to let you continue working under the same conditions you’ve been used to. Companies are required to make “reasonable accommodations” if an employee objects to receiving a vaccine for valid reasons. Such accommodations could include allowing the employee to work remotely or take a leave of absence. The employee could also show a negative COVID-19 test once a week, per the president’s mandate.

If you don’t have a medical condition per the ADA or religious reason for refusing the COVID-19 vaccine, your employer has the right to terminate your employment. Note that you likely won’t be able to claim unemployment benefits if that happens because your employer’s reasoning for firing you would be “for cause” that’s tied to complying with company policy.

Some companies are also considering imposing fines on unvaccinated workers refusing to get the shot. This could include raising health care costs, withholding raises and restricting access to workplace amenities. For instance, the NBA says it won’t pay unvaccinated players who miss games.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

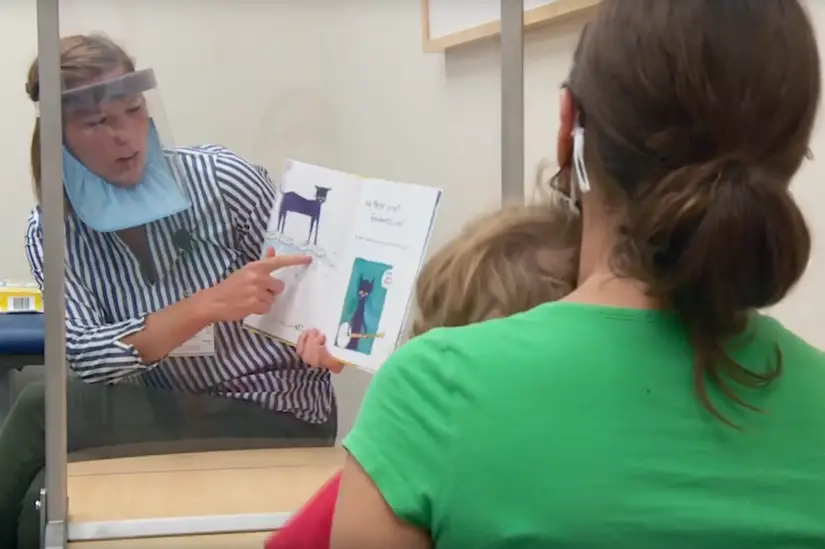

Students Are Strongly Encouraged To Carry Health Insurance Since Student Health Services Is Not Health Insurance Please See Below For Information On The Affordable Care Act

If students are currently covered by health insurance, they should check with the carrier to see what arrangements need to be made so coverage continues while at college. All students should carry health insurance cards with them. Participation in the University of Wisconsin System Student Health Insurance Plan is required for international students.

From UW-River Falls Risk Management web page:”UWRF does not provide any type of compensation for injuries that occur on campus. Each student and visitor is expected to have their own health insurance to cover personal medical costs.”

How To Become An Insurance Agent In Wisconsin

: Ethan Peyton

Getting your Wisconsin insurance license is the first step to becoming an insurance agent in Wisconsin. Whether youre interested in selling property and casualty insurance, life insurance, health insurance, or any combination of those lines of authority, this article has the information you need to get started.

The Wisconsin Department of Insurance has a 6-step process to getting your insurance license. Well walk you through step-by-step from the license application to insurance test prep, to the Wisconsin insurance exam, and beyond.

This guide has everything you need to know to get your Wisconsin insurance license quickly and easily.

Also Check: How To Get Health Insurance For My Family

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

Wisconsin Health Insurance Costs And Subsidies

Wisconsin health insurance premiums dropped for 2021 plans over the previous year. The average monthly premium among Marketplace plans are as follows:

Here are the monthly premiums for Wisconsin Marketplace plans:

- Average Lowest Cost Bronze Premium: $338 in 2021 $345 in 2020

- Average Lowest Cost Silver Premium: $443 in 2021 $470 in 2020

- Average Lowest Cost Gold Premium: $491 in 2021 $484 in 2020

Among Wisconsin enrollees, 87% received federal subsidies in 2020.6Subsidies help reduce your monthly premium and can be applied to any metal plan.The average subsidy was $623 in 2019 .7

How Likely Is Your Employer To Require A Covid

If your company employs 100 or more workers, they would be legally required to mandate the COVID-19 vaccine or subject you to regular testing by Jan. 4, assuming the OSHA suspension is lifted. Smaller companies can also require workers to get vaccinated, although it’s not considered a federal mandate. Here’s more about who’s required to get vaccinated against the coronavirus.

For more information, here’s the latest on who’s eligible for the Moderna COVID-19 booster shot and the Pfizer booster vaccine right now.

The information contained in this article is for educational and informational purposes only and is not intended as health or medical advice. Always consult a physician or other qualified health provider regarding any questions you may have about a medical condition or health objectives.

Read Also: Does Starbucks Offer Health Insurance

Cheapest Health Insurance Plan By County

Because the county you live in determines the availability of health insurers, policies available and their rates, finding the best health plan for you may be difficult. To make this process simpler, in the table below we compared rates for every policy in Wisconsin to find the cheapest Silver health plan in each county.

| County |

|---|

Eligibility: How Am I Evaluated By Health Insurance Companies

Each private health insurance company has the flexibility to create their own rules regarding which applicants will be accepted for an individual health insurance policy in Wisconsin. Additionally, an applicant can be turned down by in insurance provider for any reason. The only exception to this is for newborns who are required to be covered under their parents policy for the first 30 days and disabled, dependent children whose parents have a policy that covers dependents.Although private insurance in the state is not guarantee issue, to comply with HIPAA Group-to-Individual Portability Coverage regulations, the state does guarantee acceptance into the Wisconsin Health Insurance Risk Pool , for those who are HIPAA eligible but have been unable to obtain coverage through a private insurer.

Don’t Miss: Starbucks Health Plan

How To Shop For Health Insurance

Whatâs in this article?

Note: Some parts of the Affordable Care Act are being changed or eliminated via government policies and laws. It is likely that some of the rules and regulations affecting the health insurance marketplace will continue to change over time. To stay up to date on Obamacare and other health insurance issues, visit healthcare.gov and the website of the health commissionerâs office in your state.

In America today, we all need health insurance. You do. Your kids do. Itâs not a ânice to haveâ anymore itâs a âmust-have.â And thatâs the law. In most cases, parents who arenât covered by health insurance might have to pay a fine each year. Going without also means that if someone gets sick or is injured, a family might have to pay all the bills for care received. That can cost a whole lot more than paying for coverage.

To help people get health insurance, the federal and state governments set up a health insurance marketplace . This makes it easier than ever to get coverage, but the process can seem a bit confusing.

Hereâs what to do to get health insurance.

Read Also: Does Health Insurance Cover Tooth Extraction

What Is The Individual Mandate

The health insurance marketplacesestablished by the AffordableCare Act provide coverage to 11.41 million consumers, according to anApril 2020 report from the Centers for Medicare & Medicaid Services .

Prior to 2020, if you went without Affordable Care Act compliant health insurance for more than two consecutive months, you would pay a penalty. This requirement was commonly known as the Obamacare individual mandate. The purpose of the penalty was to encourage everyone to purchase health insurance if they werent covered through their employment or a government-sponsored program. According to Kaiser Health News, the federal ACA penalty for going without health insurance in 2018 was $695 per uninsured adult or 2.5% of your income, whichever amount was higher.

In response to concerns about the affordability of marketplace ACA plans, congress passed the Tax Cuts and Jobs Act at the end of 2017. The law reduced the individual penalty of the Obamacare individual mandate to zero dollars, starting in 2019. Now that the individual mandate tax penalty has been removed, there is not a tax penalty at the federal level.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

$0 Monthly Premiums And More

Original Medicare, which includes Part A and B, pays for some hospital charges and some doctor visits and outpatient care. Most Medicare beneficiaries can protect themselves from high costs by enrolling in a Medicare health plan.

- We have plans in all 72 counties of Wisconsin

- All our Medicare plans limit your out-of-pocket costs

- Pay $0 for office visits to your primary care physician

- Pay the same costs for Medicare-covered services in and out of network

- Plans with Part D drug coverage include low copays on generics

- Medicare Advantage premiums remain the same regardless of age

- $0 premium plans available

Coverage Through Your Job

More than half of all Americans receive their health coverage through their employer-provided plan, and you may have a chance to be one of them.

So when considering a job, find out about the health insurance benefits. And if you have a job now, stop by your employers human resources or personnel office to see what health insurance benefits are available, if any, and find out how to sign up.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

After Getting Your Wisconsin Insurance License

Once youve passed your exams and completed the licensing application, you are now a licensed insurance agent in Wisconsin. A common question we hear is, I have my insurance license, now what? Here are a few things you can do or need to know:

- Get a job in the insurance field. Check out StateRequirements Insurance Jobs board.

- If youre going to sell advanced life insurance products, youll need to have the proper securities licenses. Series 6, Series 7, and Series 63 are the most common among insurance agents, but youll need to begin with the SIE exam. Find out which licenses you need with our Securities Licensing Guide.

- Every two years, youll need to renew your insurance license. Check out our guides on Wisconsin Insurance License Renewal and Wisconsin Insurance Continuing Education for more details.

Talk To A Medicare Expert

Get answers one-on-one from a Medicare sales expert. Simply call 1-866-335-0482 to learn about Securitys Medicare plan options. Were available weekdays, 8 a.m. to 5 p.m. Or, if you prefer, click below to schedule an in-person appointment at our office in Marshfield.

You May Like: Starbucks Health Insurance Eligibility

How Long Does It Take To Get An Insurance License In Wisconsin

2-8 weeks. The bulk of the time is spent studying for your Wisconsin insurance exam. Some people study for as little as one week and feel comfortable taking the exam. We recommend you take whatever amount of time you need to feel comfortable with the material. Check out our guide: How to Pass the Insurance Exam

Network Health Outscores National Averages In Quality Ratings

We have a strong reputation for one-on-one, quality service and take extra steps to do the right thing for our members. Members rate us higher than Wisconsin and national averages in several categories. For 2022, we earned a 5 out of 5 overall Star rating for our Medicare Advantage PPO plans from the Centers for Medicare and Medicaid Services , outperforming the national average of 4.5 Stars. Every year, Medicare evaluates plans based on a 5-star rating system. In addition, the National Committee for Quality Assurance awarded Network Health a 4.5 out of 5 rating for both Medicare and commercial lines of business for 2021.

Don’t Miss: Starbucks Insurance Part Time

Caution Online Recruiting Scam

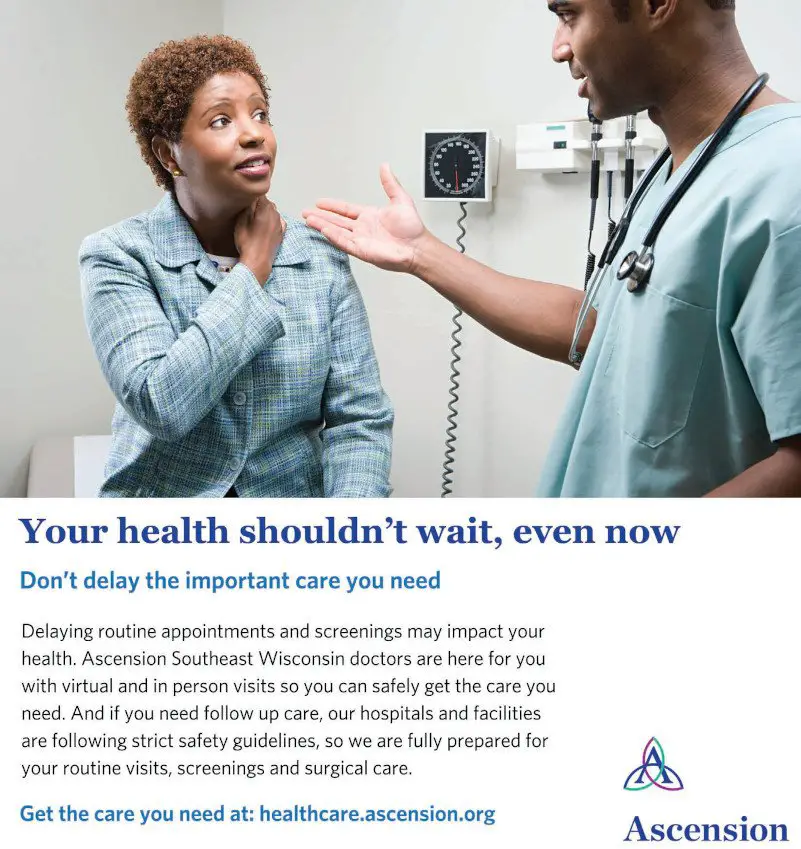

Please be aware of internet scams designed to access your personal health or financial information. Fraudulent ads on career sites, social media platforms and other websites, including remote work opportunities, could be directing you to a scam site. Job opportunities across Ascension will require you to submit an application only at jobs.ascension.org.

Finding Affordable Health Insurance In Wisconsin With Healthmarkets

We’ve put together information on policies offered by insurance companies nationwide. We’ll match your needs with what they have to find you affordable health insurance in Wisconsin in just a few minutes. Our services are offered at no cost to you, and can save you time, money, and make sure you have the coverage that you need.

To learn about affordable health insurance in Wisconsin, give us a call at or request a free quote online today.

46931-HM-0121

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

Free Expert Health Insurance Help

Finding affordable health insurance that works for you can be hard. We get it.

But no one should have to struggle to find the insurance that gets them the care they need when and where they need it.

The Wisconsin Office of the Commissioner of Insurance built WisCovered.com to help connect you to free expert help in your community and around the state. Below you will find options to call and talk to a real person who can walk you through the complicated maze of health insurance. If youre more the DIY type, you can find options to apply online right now.

Weve also got common questions and answers that may help you find coverage or get help paying for your health insurance.

Your health is important.

Yes. Every year plan prices and options change. Also, the amount of financial help may change so it is important to update your financial and household information. If your income goes down or you have a baby, you may qualify for additional financial help. If your income goes up, youll want to make sure youre not taking more financial help than you should.

Be sure to check to see if your favorite doctors, hospitals, medications, and pharmacies are still available if you renew your plan sometimes networks change from year to year.