How Much Does An Employer Pay For Health Insurance

Employer health insurance is often more affordable than individual health insurance, thanks to the group discounts that accompany multiple policies.

KFF reports that employers paid an average of 83% of single premiums in 2020. The average employee spends an average insurance premium of $1,243 per year for single coverage with employers picking up an average of more than $6,200 annually.

Job-based plans are hugely affordable, compared to paying more than $5,000 annually for the average individual premium. Family plans could cost more than double or more.

Here are the average costs for employer group health insurance, according to Kaiser Family Foundation.

| Plan type |

|---|

| $21,342 |

Still, premiums continue to rise each year, with an average of 3% increases for single plans and around 5% for family coverage. Deductibles and out-of-pocket costs continue to increase, as well.

In addition to standard health insurance coverage, employers may also offer other benefits and perks that can increase the value of your healthcare.

How Health Insurance Works

Health care is expensive. Health care costs are increasing every year. Without health insurance it would be difficult for most people to afford their health care bills.

Health insurance is a way for people to:

- Protect themselves from extreme financial medical care costs if they become severely ill

- Ensure that they have access to health care when they need it

What Do Employers Gain

If workers prefer to obtain health insurance through their employers rather than on their own, why are employers willing to act as their health insurance agents? Part of the explanation undoubtedly rests with the tax incentives for employers to offer coverage to workers and their dependents. Payments for health insurance are deducted from gross revenues in calculating the employer’s taxable income, and they also are excluded from the base payroll in determining the employer’s share of the payroll tax for Medicare and Social Security. More important, however, employers may want to offer health insurance to their workers because failing to do so could harm the firm’s performance. The evolution of company-sponsored medical care plans suggests that employers have long recognized the value of providing health insurance to workers. With the rapid growth of manufacturing and unions before World War I, the provision of welfare benefits, including health insurance, was widely acknowledged to be good business: The employee plans

relieved the employer of the solicitations for aid for the destitute dependents of deceased employees also, it was not necessary for the employees to pass the hat among themselves during working hours for the same purpose the program assisted in attracting better employees and in retaining those already employed, employee morale was enhanced, job relations improved and the public relations of some firms favorably affected.

You May Like: What Is The Health Insurance For Low Income

Benefits Of A Group Health Insurance Plan

The primary advantage of a group plan is that it spreads risk across a pool of insured individuals. This benefits the group members by keeping premiums low, and insurers can better manage risk when they have a clearer idea of who they are covering. Insurers can exert even greater control over costs through health maintenance organizations , in which providers contract with insurers to provide care to members.

The HMO model tends to keep costs low, at the cost of restrictions on the flexibility of care afforded to individuals. Preferred provider organizations offer the patient a greater choice of doctors and easier access to specialists but tend to charge higher premiums than HMOs.

Once I Am Receiving Benefits Can My Employer Terminate Them

Yes. An employer may at any time amend the terms of an existing plan, including termination of the plan. Additionally, an employer may reduce or terminate health benefits of retired former employees who become eligible for Medicare Benefits without violating the Age Discrimination in Employment Act.

Exception: An employer may not terminate, suspend, discipline, discriminate, or take any adverse action against the employee for exercising his or her rights under a plan or ERISA, or for giving information or testimony in an investigation or proceeding relating to ERISA.

Read Also: Does Colonial Life Offer Health Insurance

Advantages Of Getting Insurance On Your Own

The two biggest advantages of getting insurance on your own are directly related to the two biggest disadvantages of getting it through work.

First, you can get as much coverage as you need. Theres no employer limiting you. So even if your employer offers some amount of insurance, it may be necessary to find some individual coverage on top of that to make sure that your family is fully protected.

Second, the insurance is yours as long as you continue to pay the premiums. You can change jobs, change states, or really whatever you want. No one can take it away from you as long as you pay on time.

You also have more freedom to find the best policy for your specific situation. This is especially important with disability insurance, where both the definition of disability and exclusions for certain conditions can really affect the quality of the insurance.

Finally, any disability benefits paid out on an individual policy would be tax-free, while any benefits paid out from an employer policy would likely be taxed. So with an individual policy, its likely that your benefit would actually be worth more money.

The Coverage Offered By My Employer Doesnt Cover My Spouse What Can I Do

If you spouse still needs health insurance coverage, they can shop on the Marketplace for an Obamacare plan. And if they dont have insurance through their job or your job, they might be able to qualify for a subsidy. If your spouse has a subsidized Marketplace plan and you have insurance through your employer, that might be the most cost effective.

Even if your spouse is eligible for coverage through your employer, they still can elect to shop on the Marketplace. And even if they dont qualify for subsidies, they still might be able to find more affordable coverage for just themselves when compared to coverage through your employer-provided plan.

Recommended Reading: How Much Does Health Insurance Cost In Ct

Is My Employer Required To Provide Medical Benefits To My Spouse Domestic Partner Or Dependent Children

Much like employers are not required by law to provide health and welfare benefits to employees, they are equally not required to provide those benefits to spouses, domestic partners or dependent children. If, however, an employer voluntarily provides spousal benefits through an insurance provider or health maintenance organizations , the employer must also provide those same benefits to registered domestic partners of the covered employees. Thats because AB 2208 requires equal treatment of spouses and registered domestic partners in all aspects of insurance coverage.

Note: AB 2208 applies to insurance providers and HMOs who supply insurance to an employers employees, but does not apply to employers who self-insure, who are not required to provide equal domestic partner coverage to their employees.

When Should You Get Health Insurance

Health insurance only works when you have it. Consider your lifestyle. Do you live risk-free or do you like to live life on the edge? Adventurous? Or a home body? Do you have a chronic health condition that requires treatment? Do you have a family to care for? These are things to keep in mind when considering whether you should get health insurance:

In general, how health insurance works is similar across plans, but depending on your needs, the details of your medical coverage can vary. Make sure to learn about your particular health plan or any plan youre considering enrolling in.

Don’t Miss: How Much Does It Cost For Health Insurance

Other Sources Of Disability Benefits

You may also be eligible for benefits from the Canada Pension Plan and the Quebec Pension Plan to add to your income when you’re unable to work.

The CPP disability benefit and QPP disability benefit are available to people who have contributed to those plans and aren’t able to work regularly at any job because of a disability.

If My Employer Voluntarily Provides Health Insurance Benefits Is It Obligated To Provide Benefits To All Employees

Maybe, depending on the employer. Employers covered by Obamacare must provide health insurance to at least 95% of their full-time employees and dependents up to age 26. Otherwise, an employer is free to cover some, as opposed to all, of its employees. For example, salespersons can be excluded from an insurance plan while administrators are covered.

Exception: If an employee is entitled to participate in an employer-provided health benefits plan under ERISA, an employer may not wrongfully deny participation. To qualify, an individual must be classified as an employee, not a temporary worker or independent contractor and must be eligible to receive benefits according to the terms of the plan.

Recommended Reading: How Can A College Student Get Health Insurance

Guide To Employer Health Insurance

Insights:

Employer-sponsored health insurance is a way to get comprehensive coverage thats usually more affordable than individual health insurance plans.

When you start a new job, part of the dreaded first day is the mountain of paperwork to complete. Amongst the HR minutiae, there are often the inevitable health insurance forms that can be both confusing and overwhelming at the same time.

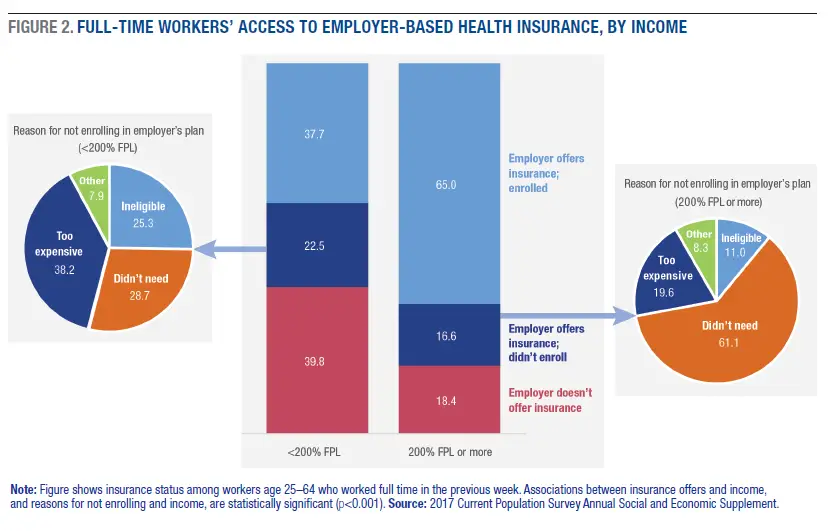

Most companies offer health coverage. FIfty-five percent of small firms and 99% of large firms offer health benefits to workers. It is typically easy to sign up, and rates are generally affordable.

But is it worth it? We investigate.

Explore Your Medicare Options

In most cases, as long as you’ve worked at least 10 years and paid Medicare taxes during those years, you’re eligible for Medicare starting at age 65. If you’re permanently disabled or have end-stage renal disease, you can qualify for Medicare before age 65.

Medicare has the following parts:

- Part A covers inpatient hospital care, limited care in a skilled nursing facility, hospice care, and some home health care.

- Part B covers other aspects of health care, including outpatient care, doctor care, and durable medical equipment. You pay a monthly premium for Part B.

- Part D covers prescriptions, and its benefits are accessed by purchasing Part D plans through private insurance companies.

On its own, Medicare has significant gaps, so many retirees opt for additional coverage. The two primary options if you don’t have access to employer health coverage are:

If you want to purchase a Medicare supplement, it’s best to do so when you start Medicare Part B, as you have a special open enrollment period. Some retirees delay enrolling in Part B if they have access to coverage through a working spouse. After your open enrollment, you may have to answer health questions and go through medical underwriting.

If you want to purchase a Medicare Advantage plan, you can enroll or change plans in the fall of each year. You can also switch Medicare Advantage plans from January 1 to March 31 each year. You can shop for both types of plans through your state’s Health Insurance Marketplace.

Recommended Reading: Is Eye Surgery Covered By Health Insurance

Your Parents Or Spouses Health Insurance Plan

Many employers allow a person to add spouses and children to their health insurance plans.

This is a great option for stay at home parents, children that havent found jobs yet or even a spouse between jobs.

An employer does not have to subsidize coverage for family members even if they subsidize coverage for their employees.

That means:

The additional cost to add a spouse or child to a policy could be much different than the premium for the employee only.

A spouse or child can be added during the plans annual open enrollment period.

If you lose coverage due to a qualifying event, you may be able to get health insurance from your spouse or your parents during the year, too.

Your spouse or parent can inquire with their companys HR department to see what options they have. If youre trying to qualify for insurance through a qualifying event, act fast.

Qualifying events may only allow you to make changes for 30 days. This can be different from marketplace health insurance.

Cost Of Cobra Health Insurance

The term “group rate” may be incorrectly perceived as a discount offer, but in reality, it may turn out to be comparatively expensive. During the employment term, the employer often pays a significant portion of the actual health insurance premium , while the employee pays the remainder. After employment, the individual is required to pay the entire premium, and at times it may be topped up with an extra 2% toward administrative charges. Costs may not exceed 102% of the cost for the plan for employees who haven’t experienced a qualifying event.

Therefore, despite the group rates being available for the COBRA continued plan in the post-employment period, the cost to the ex-employee may increase significantly when compared to prior insurance costs. In essence, the cost remains the same but has to be borne completely by the individual with no contribution from the employer.

COBRA may still be less expensive than other individual health coverage plans. It is important to compare it to coverage the former employee might be eligible for under the Affordable Care Act, especially if they qualify for a subsidy. The employer’s human resources department can provide precise details of the cost.

If you have lost your health insurance due to job loss during the 2020 economic crisis, you qualify for a “special enrollment” period on the federal exchanges, which gives you 60 days to sign up. This may be a way to find a cheaper insurance option than COBRA.

Don’t Miss: How To Apply For Low Cost Health Insurance

Who Needs Health Insurance In Belgium

Residents in Belgium generally sign up to state-sponsored schemes for health insurance. This allows them to claim partial reimbursements of medical costs in Belgium and other European countries.

To cover their personal share of medical care , some residents also sign up for supplementary private insurance in Belgium.

Failure To Provide Coverage

Employers that have enough workers to trigger the coverage requirement are referred to as “applicable large employers” or ALEs. The law calls for penalties on applicable large employers that fail to sponsor coverage as required, just as it fines individuals who fail to have basic health coverage.

Like many other elements of the Affordable Care Act, these penalties take effect over time. From 2016 and beyond, penalties will apply to those with 50 to 99 employees.

Also Check: What Health Insurance Is Available In Nc

Add Extra Protection With Supplemental Health Insurance

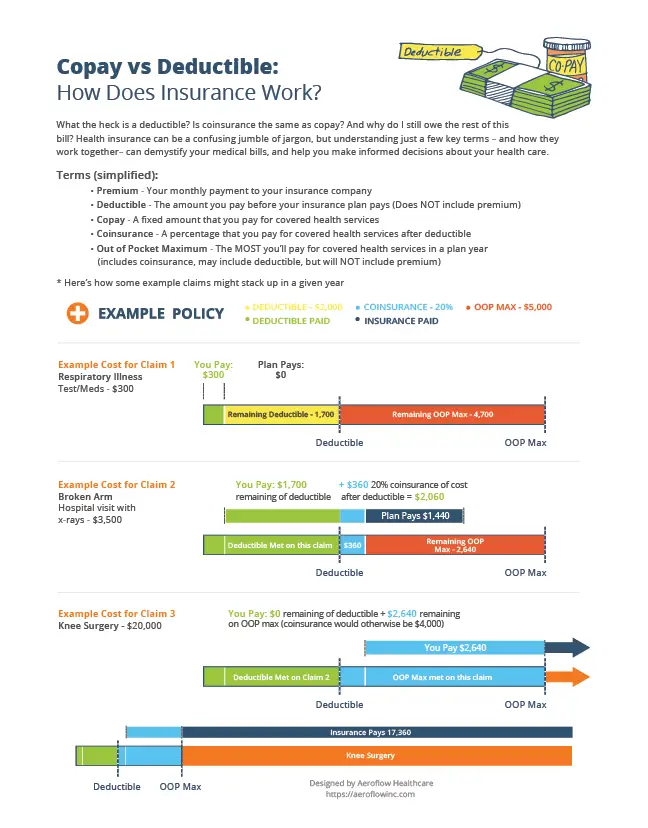

No matter if you choose employer-sponsored coverage or individual health insurance, you will likely still face many out-of-pocket medical costs. The costs of deductibles, copays, coinsurance and non-covered treatments can add up quickly with a critical illness, accident, disability or hospitalization.

You can help protect your family from high out-of-pocket medical costs with supplemental health insurance. Supplemental health insurance is intended to be used in addition to your group or individual major medical insurance. It is intended to help pay for those costs which may not be covered by major medical insurance. With supplemental health insurance, benefits are paid directly to you or your beneficiaries, not doctors or hospitals, which means you can use the money however you choose. Benefits are paid regardless of any other insurance you have, whether you have employer-sponsored or individual health insurance.

If youd like to learn more about supplemental health insurancepolicies, contactus here.

Options If You Dont Have Health Insurance From An Employer

Having health insurance is important.

Without health insurance, one visit to the emergency room could easily cost you over $1,000 or, in some cases, $10,000 or more.

Unfortunately, many people rely on their jobs to provide health insurance.

But what happens if you work for an employer that doesnt offer health insurance?

What if you quit, get fired or get laid off from a job that you had your health insurance through?

While each persons circumstances are unique, there are a few options you should consider if you dont have health insurance from your employer.

Recommended Reading: How Much Do You Pay For Health Insurance

Types Of Health Insurance Plans

There are several different types of health insurance plans available today. Some are more common than others, with Kaiser Family Foundation reporting the prevalence of each in todays group life insurance plans.

| Plan Name | |

|---|---|

| You want the option of both a PPO or HMO | 8% |

Your employer may choose from any of these, although its most likely that PPOs will be at least one choice. A 2020 Insure survey of 1,000 people found that 48% of respondents said their company only offers one health insurance plan. Forty-six percent said their job provides two or three options and only 7% provide different types.

Employers Particularly Those With Younger Leaders Dont See The Logic In Providing Healthcare

Unless you grew up in this system, it doesnt make a lot of sense. Health insurance is important and impacts peoples ability to access the care that they need for their specific family and health situations. Why should something so personal and important be tied to where you happen to work?

When employers make decisions about health insurance plan designs, they are balancing the needs and wants of a diverse employee population with a few, limited, one-size-fits-all options.

Each year, employees must go through the often-confusing process of open enrollment. As the overall costs of healthcare have risen, so too has the employees share of costs. As employees enroll in benefits, they are often left feeling that they are spending more of their income on insurance that doesnt provide as much value as it used to. That can have a negative impact on employee job satisfaction ratings.

Providing health insurance to employees places a financial burden on employers, as well. Cost-sharing falls primarily on employers, with a Kaiser Family Foundation report finding that in 2019, the average employer paid $7,188 per employee for single coverage and $20,576 per employee for family coverage.

Also Check: Can I Go To The Er Without Health Insurance