Background: Types Of Marketplaces

Under the ACA, each state must either operate its own marketplace or rely on the federal marketplace to handle exchange functions such as certifying health plans that meet ACA standards and determining eligibility for exchange plans and subsidies.

In most states, the federal government runs the marketplace. The federal platform called HealthCare.gov handles eligibility and enrollment functions and the call center for consumers, and the marketplace collects a user fee from the insurers offering plans through it. The fee is 3.0 percent of exchange plan premiums in 2020.

Thirteen states run their own SBMs, meaning they take charge of all required functions and have their own systems for conducting eligibility and enrollment, operating a call center, and conducting consumer outreach and plan certification. These states pay no user fees to the federal government.

Another six states have a hybrid between the two: SBMs on the federal platform, or SBM-FPs, which take charge of many marketplace functions but rely on the federal HealthCare.gov platform to conduct eligibility and enrollment and operate a call center. These states pay the federal government a user fee that is set at a lower rate compared to full FFMs.

The rest of this paper presents seven recommendations for states that have decided to move forward with SBM transitions.

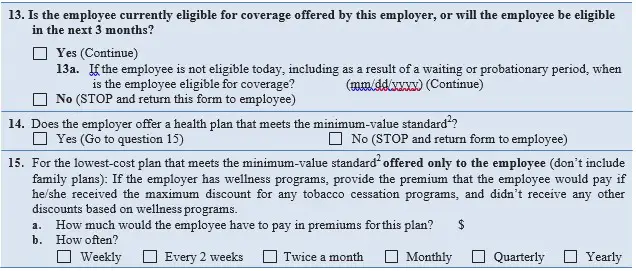

Q: Can An Employer Be Fined For Failing To Provide Employees With Notice About The Affordable Care Act’s New Health Insurance Marketplace

A: No. If your company is covered by the Fair Labor Standards Act, it should provide a written notice to its employees about the Health Insurance Marketplace by October 1, 2013, but there is no fine or penalty under the law for failing to provide the notice.

The notice should inform employees:

- About the Health Insurance Marketplace

- That, depending on their income and what coverage may be offered by the employer, they may be able to get lower cost private insurance in the Marketplace and

- That if they buy insurance through the Marketplace, they may lose the employer contribution to their health benefits

The U.S. Department of Labor has two model notices to help employers comply. There is one model for employers who do not offer a health plan and another model for employers who offer a health plan to some or all employees:

Enroll Or Change Plans If You Qualify For A Special Enrollment Period

You can enroll in or change to a different plan for the rest of 2021 if you qualify for a Special Enrollment Period due to a life event like changing jobs, moving, getting married, or having a baby. You usually have 60 days from the life event to enroll in a new plan.

- Before you apply, you can preview 2021 plans and prices based on your income.

- If you don’t qualify for a Special Enrollment Period, you can enroll in 2022 coverage during Open Enrollment from Monday, November 1, 2021Saturday, January 15, 2022. Enroll by December 15, 2021 for coverage that starts January 1, 2022.

Recommended Reading: How Much Is Private Health Insurance In Spain

Understanding The Aca Health Insurance Marketplace

The Health Insurance Marketplace is a key element of the Affordable Care Act, a healthcare reform signed into law by President Barack Obama in 2010, also known as Obamacare. The law instructed states to set up their own exchanges where individuals or families without employer-sponsored coverage could compare plans. Many states, however, have chosen not to establish a marketplace and have joined the federal exchange.

The Marketplace facilitates competition among private insurers in a central location where people who do not have access to employer-sponsored insurance can find a suitable plan. Individuals can compare and apply for plans via the Marketplace during the open enrollment period. Typically, this period takes place in November and December of the year prior to the year in which the coverage will take effect. Consumers can apply for a special enrollment period in the case of a qualifying event such as the birth of a child, marriage or the loss of another insurance plan.

The Marketplace categorizes plans into four tiers: bronze, silver, gold, and platinum, in the order of least to greatest coverage. The highest tier, platinum, includes plans that cover approximately 90% of health expenses, but is also the most costly. Lower-income individuals and families can qualify for extra savings on all the health insurance plans offered on the exchange through premium tax credits and cost-sharing reductions.

Aca Health Insurance Marketplace Requirements

The Health Insurance Marketplace has requirements for individuals and families who use it, as well as for the insurance companies that offer coverage. To be eligible to buy coverage offered on the Marketplace, you must live in the United States and be a U.S. citizen or national. If you are covered by Medicare, youre not eligible.

While the plans that insurers offer on the Marketplace can vary widely, the ACA requires that they must each satisfy 10 basic requirements or essential health benefits . Many of the EHBs might seem like they would go without saying, but plans can skimp on basic coverage and some political opponents of the ACA have proposed eliminating EHBs since the passage of the ACA.

Required benefits include:

- Mental health and substance use disorder services

- Pregnancy, maternity, and newborn care

- Prescription medications

- Preventive and wellness services and chronic disease management

- Pediatric services

- Rehabilitative and habilitative services

The ACA does not require large, employer-sponsored insurance plans to cover any of the EHBs. Instead, the writers of the law felt that the Marketplace would apply competitive pressure that would force employer plans to comply with these basic mandates.

Read Also: What Do You Need To Get Health Insurance

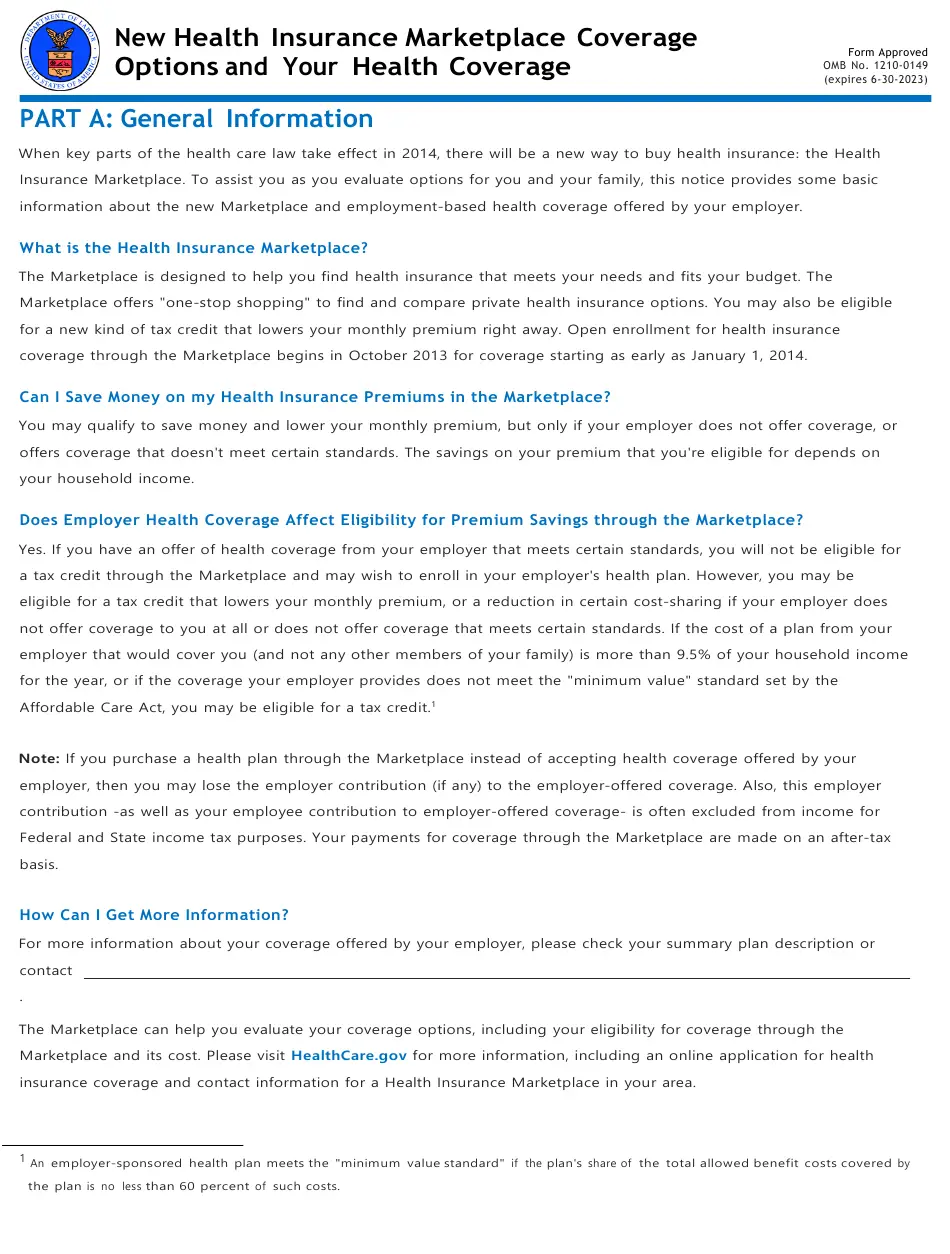

Part A: General Information

When key parts of the health care law take effect in 2014, there will be a new way to buy health insurance: the Health Insurance Marketplace. To assist you as you evaluate options for you and your family, this notice provides some basic information about the new Marketplace and employment-based health coverage offered by your employer.

What is the Health Insurance Marketplace?

The Marketplace is designed to help you find health insurance that meets your needs and fits your budget. The Marketplace offers one-stop shopping to find and compare private health insurance options. You may also be eligible for a new kind of tax credit that lowers your monthly premium right away. Open enrollment for health insurance coverage through the Marketplace begins in October 2013 for coverage starting as early as January 1, 2014.

Can I Save Money on my Health Insurance Premiums in the Marketplace?

You may qualify to save money and lower your monthly premium, but only if your employer does not offer coverage, or offers coverage that doesnt meet certain standards. The savings on your premium that youre eligible for depends on your household income.

Does Employer Health Coverage Affect Eligibility for Premium Savings through the Marketplace?

How Can I Get More Information?

Quick Summary Of The Health Insurance Marketplace

- The Marketplace is an easy place to shop online, apply, and enroll for minimum essential coverage health insurance that helps you avoid the tax penalty.

- You can view and compare benefits between plans and insurance carriers all in one place.

- It is the only way you can receive the Premium Tax Credit if you qualify.

- You can see if you or any family members qualify for Medicaid all on one application.

Not sure how Obamacare affects your health care plans in California? Learn how the ACA works in California, including benefits, costs and enrollment.

Don’t Miss: Does Aarp Offer Health Insurance

When Is Open Enrollment For Health Insurance For 2021

The open enrollment period for health insurance depends on whether you’re buying a Medicare plan, a policy from an employer, or an option from the HealthCare Marketplace.

The enrollment period for the HealthCare Marketplace runs from November 1 to December 15. The enrollment period for those newly eligible for Medicare is a seven-month window after turning 65. After that, the annual enrollment period is from October 15 to December 7.

Those who buy insurance from an employer should ask their HR department about the enrollment period because private companies can set their own deadlines.

If You Were Eligible For Cobra Premium Assistance

If you qualified for COBRA continuation coverage because you or a household member had a reduction in work hours or involuntarily lost a job, you may have qualified for help paying for your COBRA premiums, even if you dont have COBRA right now. If you qualified, you would have gotten a written notice from your former employer or insurance company and had access to COBRA without having to pay premiums. Learn more about COBRA premium assistance.

This help ended on September 30, and so you can enroll in a Marketplace plan with a Special Enrollment Period. To enroll, you can report a September 30 “loss of coverage” on your application. You cant qualify for a premium tax credit while youre enrolled in COBRA, so if you want to change to Marketplace coverage, make sure that your COBRA coverage ends on the last day before your Marketplace coverage starts. If you decide to keep COBRA without premium assistance, you can qualify for a Special Enrollment Period based on the end date of your COBRA coverage, which is usually 18 to 36 months after it started.

Learn more about COBRA premium assistance.

You May Like: How Much Does Family Health Insurance Cost Per Month

Patient Protection And Affordable Care Act Regulations

Subsidies

The subsidies for insurance premiums are given to individuals who buy a plan from an exchange and have a household income between 133% and 400% of the poverty line. Section 1401 of PPACA explains that each subsidy will be provided as an advanceable, refundable tax credit and gives a formula for its calculation:

Annual Health Insurance Premiums and Cost Sharing under PPACA for Average Family of 4Except as provided in clause , the applicable percentage with respect to any taxpayer for any taxable year is equal to 2.8 percent, increased by the number of percentage points which bears the same ratio to 7 percentage points as the taxpayer’s household income for the taxable year in excess of 100 percent of the poverty line for a family of the size involved, bears to an amount equal to 200 percent of the poverty line for a family of the size involved. * SPECIAL RULE FOR TAXPAYERS UNDER 133 PERCENT OF POVERTY LINE- If a taxpayer’s household income for the taxable year is in excess of 100 percent, but not more than 133 percent, of the poverty line for a family of the size involved, the taxpayer’s applicable percentage shall be 2 percent.

Patient Protection and Affordable Care Act: Title I: Subtitle E: Part I: Subpart A: Premium Calculation

| Income |

|---|

| Washington Healthplanfinder |

Postponement Of Tax Penalty

On October 23, 2013, The Washington Post reported that Americans with no health insurance would have an additional six weeks before they would be penalized. That deadline was extended to March 31, and those who do not enroll by then may still avoid incurring penalties and getting locked out of the healthcare enrollment system this year. Exemptions and extensions apply to:

- Those living in states that use federal exchange, who may avail themselves of a “special entrollment period” that allows individuals to avoid penalties and enroll in a health plan by checking a blue box by mid-April 2014, stating they tried to enroll before the deadline . The New York Post reports: “This method will rely on an honor system the government will not try to determine whether the person is telling the truth”. State-run exchanges have their own rules several will be granting similar extensions.

- Members of the Pre-Existing Condition Insurance Program, who were given a one-month extension until the end of April 2014.

- Those who have successfully applied for exemption status based on criteria published by HealthCare.gov, who are not required to pay a tax penalty if they don’t enroll in a health insurance plan.

Recommended Reading: Can I Buy Health Insurance After An Accident

If You Cant Pay Your Premiums Because Of A Hardship Due To Covid

- Check with your insurance company about extending your premium payment deadline or ask if they will delay terminating your coverage if you cant pay your premiums.

- If your household income has changed, update your application immediately. You could qualify for more savings than you’re getting now.

- If youre getting financial assistance for Marketplace premiums, you have a three-month grace period to catch up on premium payments to avoid having your coverage terminated for non-payment. Most of the time, if you arent getting financial help with your premiums, you have a grace period determined by state law .

If You Paid To Get A Covid

When you get a COVID-19 vaccine, your provider cant charge you for an office visit or other fee if the vaccine is the only medical service you get. If you get other medical services at the same time you get the COVID-19 vaccine, you may owe a copayment or deductible for those services.

If you paid a fee or got a bill for a COVID-19 vaccine, check this list to see if your provider should have charged you:

- Check the receipts and statements you get from your provider for any mistakes.

- Review your Explanation of Benefits. Report anything suspicious to your insurer.

If you think your provider incorrectly charged you for the COVID-19 vaccine, ask them for a refund. If you think your provider charged you for an office visit or other fee, but the only service you got was a COVID-19 vaccine, report them to the Office of the Inspector General, U.S. Department of Health and Human Services by calling 1-800-HHS-TIPS or visiting TIPS.HHS.GOV.

You May Like: What Is The Largest Health Insurance Company

Blogging About Health Insurance Coverage Insurance Markets And How People Are Affected By Insurance Reform

Welcome to CHIRblog, a blog focused on health insurance coverage, insurance markets, and how people are affected by insurance reform. Our experts share a common mission: to improve access to affordable and adequate health insurance for individuals, families, employees, and employers across the country.

Set Targets For Improved Enrollment In Health Coverage

Setting enrollment targets can help keep the goal of expanding coverage front and center, preventing states from focusing too narrowly on cutting costs or minimizing disruption. Setting targets across programs can also help ensure that the state includes lower-income residents eligible for Medicaid or CHIP in the push for improved health coverage.

Issues to Consider: Enrollment Targets

- What is an achievable goal for health coverage gains that the state could set for its first year and for subsequent years of operating an SBM?

- What more ambitious goals for coverage or affordability could the state set for future years?

States should develop targets by analyzing data on their remaining uninsured populations. Across states, the majority of the remaining uninsured have incomes low enough to qualify for subsidized marketplace coverage or Medicaid. Data analysis should show that expanding coverage will require increasing both Medicaid and marketplace enrollment, which could boost support for program coordination.

You May Like: What Type Of Health Insurance Do I Need

If You Need Medical Care

If you must visit in-person, you may be asked to do the following to lower exposure risk and protect others:

- Wait in your car until the start of the visit

- Use a limited entrance

- Be screened for COVID-19 by having your temperature checked

- Avoid waiting rooms and areas

- Maintain social distancing

- Wear a face covering, which will be provided to you if you dont have your own

- Wash your hands or use hand sanitizer

If youre sick with COVID-19 or think you may have it, visit CDC.gov for steps to help prevent the spread. If you need emergency care, you should go to the closest hospital that can help you.

Does Health Insurance Cover Therapy

Health insurance may cover therapy and counseling visits, but it depends on the specific policy. Check your insurance summary to see if mental health counseling is covered.

If it is covered, make sure the provider accepts your specific plan. Many therapists do not accept health insurance. If thats the case, you can submit receipts to your health insurance provider for reimbursement. They may provide some benefits for out-of-network therapists, but this also varies by policy.

Also Check: Can I Be On My Parents Health Insurance

The Marketplace Aka The Exchange

When the Affordable Care Act was passed in 2010, the term health insurance exchange became a lot more commonly known. However, exchanges are not new. Health insurance exchanges have existed since the early 1980s and have operated mostly in an employer/employee setting. They offered a convenient way for members to view their medical insurance options online, to select or change plans, and/or to access information about their health insurance benefits.

To buy marketplace insurance plans, get California health insurance quotes and then apply. If you live outside of California, visit Healthcare.gov.

Coverage Start Dates With A Special Enrollment Period Due To Loss In Coverage

- If youve already lost coverage, your Marketplace coverage can start the first of the month after you apply and enroll.

- If you know youll lose coverage within the next 60 days, you can submit an application on HealthCare.gov before you actually lose your coverage to help make sure theres no gap in coverage. For example, if you know youll lose coverage on August 30, and apply and enroll in a Marketplace plan August 10, your new coverage will start September 1.

Read Also: How Much Is Health Insurance For A Family Of 5