How Does The Health Insurance Tax Credit Work

You can get the health care tax credits in two ways:

- Advance premium tax credit uses estimates to reduce how much you spend on health insurance each month.

- Federal tax refund allows you to receive your health insurance subsidy all at once at the end of the year or to reconcile any differences with your monthly tax credits.

The two methods would qualify you for the same number of credits, but they differ in when you would receive the subsidy and eligibility requirements. Here’s how advance premium tax credits can reduce your monthly bills.

You can apply for advance premium tax credits when you apply for health insurance through the marketplace. With this program, the government sends advance payments directly to the health insurance company every month. The insurer would then credit that money toward the cost of your health insurance premiums, decreasing your out-of-pocket costs each month.

Therefore, if you expect to have low disposable income, taking the advance premium tax credit could be more beneficial if you qualify.

How Can I Lower My Monthly Health Insurance Cost

Who is this for?

If you’re wondering how you can save money on your premium for individual and family health insurance, this explains some strategies.

You can’t control when you get sick or injured. But you do have options when it comes to what you pay for your health insurance premium. That’s the monthly payment you make to your health insurance company to maintain your health care coverage. Here’s how you may be able to lower your bill.

Retiring Early And Paying For Health Insurance

As a financial advisor, I meet with individuals and couples who hope to retire early all the time – I mean, who doesnt. Once I sit down with them for some basic number-crunching, we work together to create a long-term financial plan that will guide many of their decisions.

This can include how much to invest, when and where to invest, and ways to increase cash flow and returns while keeping long-term costs and taxes to a minimum.

While most of my clients have similar fears about , theres one single worry that pretty much everyone I encounter shares how to pay for health insurance in the midst of wanting to retire early.

Every one of my clients will eventually qualify for Medicare at 65, but what happens until then? While the passage of the Patient Protection and Affordable Care Act, also known as Obamacare, made it so that anyone can get approved for health insurance regardless of pre-existing conditions, those major changes came with a dramatic cost.

According to a study by ehealthinsurance.com, average 2018 health insurance premiums worked out to $790 per month for individuals 55 to 64. Even individuals who fell into the 45-54 age group still paid an average of $541 per month for premiums only.

In other words, health insurance isn’t cheap.

Don’t Miss: What Causes Health Insurance Premiums To Increase

How Much Does Individual Health Insurance Cost

BY Anna Porretta Updated on November 24, 2020

In 2020, the average national cost for health insurance is $456 for an individual and $1,152 for a family per month. However, costs vary among the wide selection of health plans. Understanding the relationship between health coverage and cost can help you choose the right health insurance for you.

To see personalized quotes for coverage options available in your area, browse health insurance by state. If you already know which health insurance carrier youd like to purchase from, check out our list of health insurance companies.

How Are Health Insurance Brokers Paid

If youre a small employer thinking about using a broker to help guide you through the process of selecting health insurance options for your employees, youre probably wondering whats in it for the broker. Have you thought about these questions?

These are all valid questions, and the answer to each one is NO.

Health insurance brokers are paid commissions from health insurance companies. Brokers provide quotes, information about various plans and enrollment assistance to you at no direct cost. The commissions brokers are paid come out of the monthly premium you pay for health insurance. The Affordable Care Act requires that insurance companies spend at least 80 percent of the money received from health insurance premiums on health care costs. The remaining 20 percent can be spent on administrative costs, marketing and other expenses, like broker commissions.

Most insurers pay brokers a set percentage of the premium paid, however some pay a flat fee per policyholder. For example, an insurer might pay a broker $12 per new enrollee, and $8 for each renewal.

Also Check: How Can A College Student Get Health Insurance

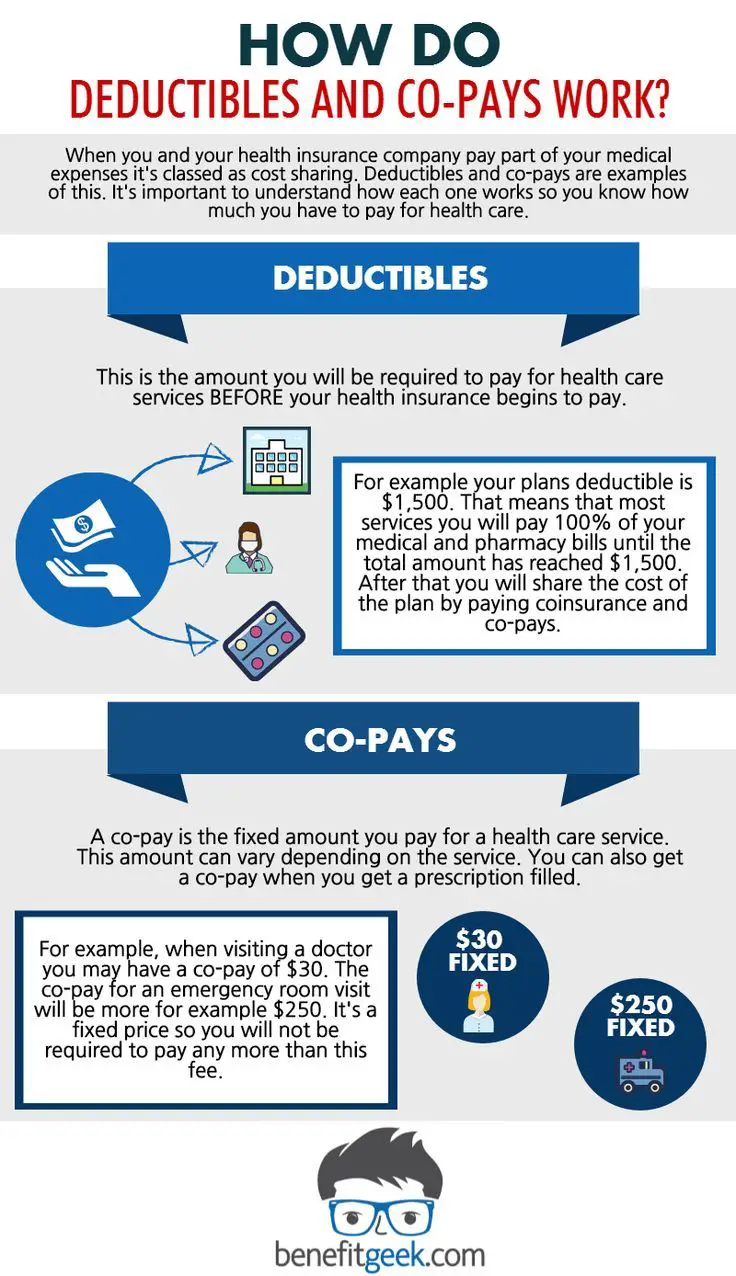

Choose A Plan With A High Deductible

A deductible is the amount you pay for health care services before your health insurance begins to pay. A plan with a high deductible, like our bronze plans, will have a lower monthly premium.

If you dont go to the doctor often or take regular prescriptions, you won’t pay much toward your deductible. But that could change at any time. That’s the risk you take. If youre injured or get seriously ill, can you afford your plan’s deductible? Will you end up paying more than you save?

What If I Have To See A Doctor While In Another Province

Manitoba has agreements with all Canadian provinces to allow physicians to bill your provincial health plan, although some physicians may choose to bill you directly. If you are admitted to an approved hospital anywhere in Canada, Manitoba Health and Seniors Care will pay the standard rate. Because some services are excluded, you are encouraged to obtain additional health insurance before travelling. Contact Manitoba Health and Seniors Care for more information.

Note: You must show your Manitoba Health card to the doctor or hospital.

Don’t Miss: Which Health Insurance Company Has The Highest Customer Satisfaction

Recommendation To Build Wealth

Sign up for Personal Capital, the webs #1 free wealth management tool to get a better handle on your finances. In addition to better money oversight, run your investments through their award-winning Investment Checkup tool to see exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their Retirement Planning calculator that pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms. Definitely run your numbers to see how youre doing.

Ive been using Personal Capital since 2012. I have seen my net worth skyrocket during this time thanks to better money management. With proper wealth management, early retirees can rest easy knowing everything will be OK.

How To Apply For Public Health Insurance

Upon completion of your residency registration at your local town hall, youll receive a Belgian eID-card .

Your eID is an official identification card. All Belgian residents aged over 15 must carry at all times. It serves a variety of purposes, including letting doctors in Belgium and Belgian hospitals digitally verify your insurance status.

Before choosing a health insurance company, you must be paying Belgian social security. Your employer might register you for social security otherwise, you can register yourself at the nearest social security office. Read how to sign up for Belgian social security. The Belgian government also provides a detailed guide.

Both employers and employees are responsible for making social security payments, with employers funding the majority of the fee.

After registering with the social security office, you can join any mutuelle in Belgium . Each mutuelle aligns itself with a political or religious group within Belgium, such as Christian, socialist and liberal groups.

All the mutuelle providers offer more or less the same services, hence why employers often enroll you in one automatically. You can choose your own mutuelle, particularly if you wish to register with one based on your religious or political affiliation. You may also find a mutuelle that offers useful services, such as English-language services.

Read Also: How To Understand Health Insurance Plans

How The Deductible And Out

ExampleGabriels plan has a $1,500 deductible, and a $2,500 out-of-pocket max

For most plans, until you reach your deductible, you pay for all of your medical care.When you go to the doctor, you may be asked for a co-pay. After your visit, you mayreceive a bill in the mail for the rest of the charges. Many plans do not count the co-payand co-insurance you pay toward the deductible.

Once you have paid enough bills to equal the amount of your deductible then, youwill only pay for the co-pay or co-insurance for all your covered medical services.

Once you have paid enough co-pays, co-insurance, or bills equal to the amount ofthe out-of-pocket max, you will not need to pay anything more for the rest of the year.

How To Pay Your Monthly Premium At Healthcaregov

Don’t Miss: Can I Buy Dental Insurance Without Health Insurance

I’m New To Manitoba How Do I Apply For Coverage

If you are eligible , coverage will begin on the first day of the third month after your arrival in Manitoba. For example, if you arrive on April 29, April will count as the first month, with May and June as the following two. Therefore, in this case your coverage would begin July 1.

When you register, you will need to:

- Complete a Manitoba Health Registration Form

- Provide your previous province’s/territory’s health card number

- Provide valid proof of legal status in Canada

Provide proof of residence in Manitoba: 6 months in a calendar year.

How to Prove Your Residence in Manitoba

Please provide any one of these documents, subject to the documents being acceptable to MHSC:

- Signed mortgage agreement

- Signed long term rental or lease agreement

- Current Employment Confirmation

- Notarized letter from the homeowner or leaseholder stating: names of the applicants for Manitoba health coverage living with them in the residence and length of stay

- Letter from a Resettlement Assistance Program providers/ Resettlement Assistance Program providers, regarding the applicant’s residence in Manitoba

Any two of these documents, subject to the documents being acceptable to MHSC:

- Utility Bill telephone, cable/satellite TV, gas, water/sewer

- Insurance policy

- Property Tax Bill

- Valid Manitoba Driver’s License

- Canadian Pension Plan statement of contributions or statement of benefits

- Old Age Security Statement

Where can I register for Manitoba Health coverage?

51 Rogers St

Key Question #: How Much Will It Cost

Understanding what insurance coverage costs is actually quite complicated. In our overview, we talked about paying a premium to enroll in a plan. This is an up front cost that is transparent to you .

Unfortunately, for most plans, this is not the only cost associated with the care you receive. There is also typically cost when you access care. Such cost is captured as deductibles, coinsurance, and/or copays and represents the share you pay out of your own pocket when you receive care. As a general rule of thumb, the more you pay in premium up front, the less you will pay when you access care. The less you pay in premium, the more you will pay when you access care.

The question for our students is, pay now or pay later?

Either way, you will pay the cost for care you receive. We have taken the approach that it is better to pay a larger share in the upfront premium to minimize, as much as possible, costs that are incurred at the time of service. The reason for our thinking is that we dont want any barrier to care, such as a high copay at the time of service, to discourage students from getting care. We want students to access medical care whenever its needed.

Also Check: Is Eye Surgery Covered By Health Insurance

Does My Plan Comply With Regulations

Next, youll need to figure out if your plan complies with all the necessary regulations. As of January 1, 2014, the Affordable Care Act created rules that impact all group health plans, including reimbursement plans.

To comply with the market reforms , reimbursement plans must:

- Not place an annual or lifetime limit on essential health benefits

- Fully cover basic preventive care

- Follow applicable federal health plan rules in ERISA, HIPAA, and COBRA

Types of reimbursement plans that generally comply include:

Types of reimbursement plans that generally do not comply include:

- Employer payment plans

Why You Need Health Insurance

No one plans to get sick or hurt. Its just a part of life. But if youre without a health insurance plan, illness and injury can quickly become devastating to your health and leave you overwhelmed with medical bills and expenses. Health insurance can limit your risk of paying for expensive illnesses and injuries by covering a portion of your medical care and other services, like a hospital stay or surgery.

Ultimately, health insurance can help you stay healthy even when youre not sick or hurt. Preventive care, which can be as simple as an annual visit with your doctor for a check-up and getting your recommended screenings, means that youre more likely to avoid or significantly reduce the chance of developing a more serious condition later on.

You may even be eligible to participate in covered well-being programs, or receive discounts on health products and services.

Tell us what other health insurance topics you would like to learn about. We are looking for feedback on what to include in updates to the site.

You May Like: How Much To Employers Pay For Health Insurance

What Is Health Insurance

Put simply, health insurance is a way to pay for your health care. Your health insurance protects you from paying the full costs of medical services when youre injured or sick. And it works the same way your car or home insurance works: you or your employer choose a plan and agree to pay a certain rate, or premium, each month. In return, your health insurer agrees to pay a portion of your covered medical costs.

How To Estimate Your Yearly Total Costs Of Care

In order to pick a plan based on your total costs of care, youll need to estimate the medical services youll use for the year ahead. Of course its impossible to predict the exact amount. So think about how much care you usually use, or are likely to use.

- Before you compare plans when youre logged in to HealthCare.gov or preview plans and prices before you log in, you can choose each family members expected medical use as low, medium, or high.

- When you view plans, youll see an estimate of your total costs including monthly premiums and all out-of-pocket costs based on your households expected use of care.

- Your actual expenses will vary, but the estimate is useful for comparing plans total impact on your household budget.

Don’t Miss: Do Real Estate Brokers Offer Health Insurance

Dropped By Your Existing Insurer

Although the Affordable Care Act prevents insurers from canceling your coverageor denying you coverage due to a preexisting condition or because you made a mistake on your applicationthere are other circumstances when your coverage may be canceled. It’s also possible that your insurance may become so expensive you cant afford it.

What Is Covered By Belgian Public Health Insurance

- Doctor and hospital visits: anyone seeking treatment in Belgium is free to visit any doctor or hospital, regardless of location or referral. This is particularly beneficial to expats who have received recommendations from colleagues for a high-quality English-speaking doctor. Read more about doctors in Belgium.

- Dental care:dental care in Belgium is subject to partial reimbursements, provided the dentist is on a state-approved list. More advanced treatments, such as crowns and bridges, usually result in the dentist offering you a variety of quotes on the work required. These require approval from your insurer.

- Maternity care: Belgian health insurance covers the cost of having a baby in Belgium, as long as youve been insured for a sufficient amount of time. Read more about giving birth in Belgium.

Read Also: How Much Is Health Insurance Usually

Waiting Period To Get Public Health Insurance

In some provinces you must wait, sometimes up to 3 months, before you can get government health insurance. Contact the ministry of health in your province or territory to know how long youll need to wait. Make sure you have private health insurance to cover your health-care needs during this waiting period.