Health Insurance Options: How To Shop For Coverage

Shopping for small business group health insurance plans is a time-consuming process, but there are a variety of ways to reach the end goal. The more you outsource the process, the more money you will eat away from your budget, but the more time you will conserve to spend on other tasks.

Heres where to go for your business health insurance needs:

Understand The Cost To Offer Health Insurance

Working with an insurance broker, PEO or private health exchange will give you an easy way to determine your costs. These organizations will need to provide that information. Keep in mind that any amount you pay towards your employees health insurance plan is tax deductible. So, it literally pays to offer your employees health insurance.

In general, most employers pay at least 50% of their employees health insurance premiums. And, since its tax deductible and allows some small businesses to apply for a tax credit, paying this amount is well worth it.

What Hsas Are Acceptable

Incorporated businesses, including shareholder employees and all other corporate employees, are eligible to participate in an HSA. Corporations with as few as one employee can be eligible as well.

In the case of unincorporated businesses or sole proprietors, the owner and their employees are also eligible if the owner has at least one arm’s-length employee.

Recommended Reading: How To Qualify For Government Health Insurance

Receive Other Tax Benefits

Beyond the SHOP tax credit, youâll also be able to write off the health insurance premiums you pay as tax deductions, saving even more money. Small business owners can save a lot by deducting expenses, and health insurance premiums are one of the most common small business tax deductions out there.

Plus, with just a bit of extra paperwork, you can set up your health insurance so that your employees can pay their portions of the premium with pre-tax money. They save cash, which makes them happier and more satisfied with their jobs: win-win.

Is A Private Health Services Plan Right For Your Business

Lets set the scene you are an entrepreneur who recently incorporated a rapidly growing business. You have a spouse who isnt working and you are about to have your first child. Currently you have no staff, but your business is expanding rapidly and you need to hire some employees.

As you start to write the job posting, you suddenly realize that any suitable candidate is going to want medical and dental coverage. You have been so busy dealing with the increase in customer demand that you havent had time to think about this for either yourself or your future employees.

Recommended Reading: How To Get Health Insurance Without Social Security Number

Whats The Health Care Provider Network

Your network is the list of physicians and hospitals who your health insurance provider has contracted with. Because health insurance companies secure cheaper health care service only from a certain selection of doctors, your out-of-pocket payments will be lower when you stay within that network.

You can see doctors out of the network, but employees will have to pay a larger share of the cost.

Its important to consider your network with regards to who your employees currently see. Some employees, especially older ones, might not be comfortable switching away from their current physicians. This may be distinctly true if theyâve been seeing the same family doctor for decades. Others, though, might be completely fine with switching doctors. Itâs up to you to figure out where your employeesâ priorities areâand try to meet them!

Employee Health Benefits Guide For Small Business Owners

Lets suppose you are a small business owner with 50 full-time employees that are paid at market value and bring in an average salary of $50,000 a year. You also understand how integral happy and healthy employees are to your business success. Thats why, this year, youre going to offer your hardworking and loyal employees health benefits.

The question youre asking now is, where do I begin?

On the other hand, maybe your small business has 20 full-time employees, and youre beginning to hear some rumblings that your employees are thinking of leaving if they dont get some affordable healthcare options.

Similar to the first scenario, you just arent sure where to begin.

These are dilemmas many small business owners face, so dont worry if youre confused. Between dense language and ever-changing rules, its easy to lose sight of what is required of small business employers in relation to employee health benefits. In this article, well give you an overview of what you can expect when it comes to group health insurance plans, how you can find the right plan for you and your employees, and how to implement an employee benefits package.

You May Like: How To Get Life And Health Insurance License In Texas

How Can I Purchase A Health Insurance Plan

There is more than one way to purchase a health insurance plan. Here are the most popular for small businesses:

- Group health insurance plans: You can buy these plans through the federally run SHOP Marketplace. This was the most popular choice for small businesses in the past, but due to the high costs and lack of flexibility, this is no longer an option for many companies.

- Qualified small employer health reimbursement arrangement : Set up by Congress in December 2016, QSEHRA is becoming an increasingly popular choice for small businesses. Under this arrangement, businesses offer employees a tax-free monthly allowance, and employees then choose and pay for their own health care using that money. The advantages of QESHRA are that it gives employees the flexibility to choose their own plan and its considerably easier to manage from an administrative point of view.

- Association health plans: Small businesses can join with other small companies to buy large-group health insurance . This works in the same way as a normal group health insurance policy.

How To Start A Qsehra

Small employers can set up a QSEHRA at any time. To provide a QSEHRA youll need to give written notice to your employees as soon as theyre eligible to participate and 90 days before the beginning of each plan year. This notice is required to include certain informationto learn more about what this notice must include, see IRS Notice 2017-67 . Note: Employees must have qualifying health coverage to use their QSEHRA amount.

You may want to consider how your employees can get qualifying health coverage when picking a start date. For example, providing a QSEHRA starting on January 1 allows employees to choose coverage during the individual markets annual Open Enrollment Period, and in most cases, plan deductibles reset on January 1 each year. If youre ending group health plan coverage to provide a QSEHRA, your employees may qualify for a Special Enrollment Period. Newly hired employees who gain access to the QSEHRA may also qualify for a Special Enrollment Period to enroll in or change individual health insurance coverage outside of Open Enrollment. To enroll in coverage through this Special Enrollment Period, employees can submit an application on HealthCare.gov and include information about when their HRA can start.

Get help: Talk to a licensed tax professional, benefits specialist, or health insurance agent/broker to find out if group coverage or QSEHRAs are right for your small business.

Recommended Reading: What Does Long Term Health Care Insurance Cover

Why Should You Offer Small Business Health Insurance

It’s no secret that starting and running a small business is expensive, and it can be easy to dismiss health insurance as an unnecessary cost to help stay within your budget. However, health insurance is a vital part of running a successful business that people want to work for.

Here are a few reasons why you should offer health insurance to your employees:

What Is A Section 105 Plan

Similar to a business expense account, a Section 105 plan provides employees an allowance to use on health insurance. This medical reimbursement plan is aptly named after Section 105 of the IRS code, which allows an employer to reimburse employees, and their dependents, for their out-of-pocket medical costs and health insurance premiums under an employer-sponsored health plan.

A Section 105 plan is not health insurance. Rather, it is a means to reimburse employees for medical and individual health insurance expenses.

Also Check: How Do You Pay For Health Insurance

Option : Individual Coverage Hra

Another health benefits option for small employers is the ICHRA. With an ICHRA, you can choose to offer the benefit to a select number of employees while offering a group health insurance plan to the rest, or you can offer the ICHRA to all of your employees.

The ICHRA works well for employers of all sizes, specifically because they are not restricted based on employee count like the QSEHRA . With an ICHRA, employers offer employees a monthly allowance of tax-free money. Employees then enroll in an individual health insurance policy, and the businesses reimburses them up to their allowance amount.

In addition, employees can use their ICHRA to get reimbursements for eligible out-of-pocket expenses. This allows businesses to keep control over their budget while offering a meaningful benefit to their employees

The ICHRA doesn’t have any contribution limits, and businesses can offer different allowance amounts based on unique employee classes. Additionally, the ICHRA is only available to employees enrolled in individual health insurance employees enrolled in a spouse’s group health insurance policy can’t participate.

How Long Does It Take To Set Up A Small Business Health Insurance Plan

Once you have done some research and consulted with a licensed health insurance broker, how long does it take to set up a small business health insurance plan in NY? We get this question a lot from new clients and our consistent response is always the same. We can set up a group in as little as one day, but best practice would be to give yourself a good 3-4 weeks.

While the plan setup and implementation are the final steps in the process, it is important to note the initial steps that should be taken so you are fully informed of all the options and carriers available to your small business. In a prior blog post on How to Research Small Business Health Insurance Plans in NY, we discuss the initial steps you should take in the research process. Following these crucial steps first will allow you to narrow down your choices to a workable number. You will know why you are focusing in on a few carriers or networks and not the entirety of available options. Trust us, these first steps are your most important ones in the process.

Your next step, if you have not done so already, is to reach out to a NY health insurance broker to assist you in further narrowing down your choices and help you come up with a plan or plans that work for your company. In our prior article The Benefits of Using a Broker for Purchasing Health Insurance, we explain the no brainer reason you must team up with a reputable health insurance brokernot the least of which is they are FREE to use!

Also Check: How Do I Find My Health Insurance

Where To Buy Small Group Insurance

Small business owners know that offering health insurance to their employees is a competitive advantage in the labor market: good benefits can help recruit and retain employees.

If you are a small business owner , you can buy health insurance on the small employer market by going directly to an insurance company or seeking guidance and assistance from an .

Small Business Health Insurance For Simply Business Customers

Youll be eligible for healthcare cover with Equipsme if you are aged between 16 and 69 . You can also add your partner and up to six children to your plan. There are no medical questions, but pre-existing conditions from the three years before your start date won’t be covered.

If you have employees, your health cover will start 21 days after you take out your policy. This is to give your employees time to add their families and upgrade their cover. If you’re the business owner and you’re only taking cover out for yourself and your family, your cover will start on the day after you purchase it.

Read Also: How Much Is Health Insurance When You Retire

Can Business Owners Buy A Plan On The Marketplace

As a small business owner, you have two health insurance options through Healthcare.gov, a.k.a. The Marketplace. If you are a sole proprietor, you may purchase an individual health insurance plan. Your options may include bronze, silver, or gold plans with a range of monthly premiums, deductibles, and coverage.

You may also qualify for the Small Business Health Options Program if you have one to 50 full-time equivalent employees. If your company has fewer than 25 full-time employees who meet the maximum income threshold , you may be eligible for the Small Business Health Care Tax Credit. In this situation, you must offer SHOP to all of your full-time employees and pay at least 50% of their premium cost.

This tax benefit credits 50% of all premiums paid on company tax returns. Since these are IRS guidelines with amounts changing annually, based on inflation and other factors, it is best to check with your tax advisor on eligibility.

Option : Reimburse For Health Insurance With An Hra

What is an HRA?

A health reimbursement arrangement is an affordable, tax-advantaged alternative to traditional insurance where employers reimburse their employees for individual insurance premiums and medical expenses on a pre-tax basis.

Unlike Health Savings Accounts and Flexible Spending Accounts that are accounts, HRA stands for Health Reimbursement Arrangement, meaning that the model operates on reimbursements. Employees will pay the insurance company or doctors office directly and then submit a claim to get reimbursed for their expenses tax-free.

The use of new reimbursement models of HRAs put the employer’s reimbursements on nearly the same tax playing field as traditional small group plans, but without all the hassles and requirements. Before, a big advantage for group plans was that they were deductible expenses for employers and were taken out of employee paychecks on a pre-tax basis. With an HRA, employers can make reimbursements without having to pay payroll taxes and employees dont have to recognize income tax. In addition, reimbursements made by the company count as a tax deduction.

How an HRA works

HRAs that work best for health insurance for small business

There are a few different kinds of HRAs that are worth noting.

QSEHRA: To cut quickly through the insurance jargon , a QSEHRA allows small employers to set aside a fixed amount of money each month that employees can use to purchase individual health insurance or use on medical expenses, tax-free.

You May Like: Can I Buy Health Insurance After An Accident

How Many Employees Do You Need To Get Health Insurance

As this is small business health insurance, the Equipsme healthcare plan is available for sole traders and businesses with employees.Equipsmes plans cover:

- the business owner

- any employees that the owner chooses to cover

- any partners and children of the owner

If you have employees, your cover will start 21 days after your take out your policy. This is to give employees time to increase cover levels or add family members get more details here. If you’re the business owner and you’re only taking cover out for yourself and your family, your cover will start on the day after you purchase it.

Can Ehealth Answer My Questions After Enrolling In A Group Plan

Once your small business is approved, you will receive official documentation from the health insurance company, which confirms when your group medical coverage will begin. After that start date and the completion of your enrollment, you and your employees can begin to use your plans health care benefits. eHealth will continue to support your business after enrolling in a group plan. For instance, our agents can help you to quickly add and remove employees to your new health insurance policy.

We also serve as your advocate, even after you are done shopping and have bought your small business health insurance plan. By serving as the middle man between you and the health insurance company, we can assist you with resolving issues related to medical claims, all at no additional cost to you.

Due to your health insurance agents relationship with the insurance company, he or she can clarify your benefits and provide guidance related to helping clear up billing disputes. This free support from eHealths agents may reduce headaches when you need to deal with the insurance company, freeing up the resources you need to focus on what matters most for your small business.

You May Like: Does Health Insurance Cover Baby Formula

How Much Does Health Insurance For Small Business Cost

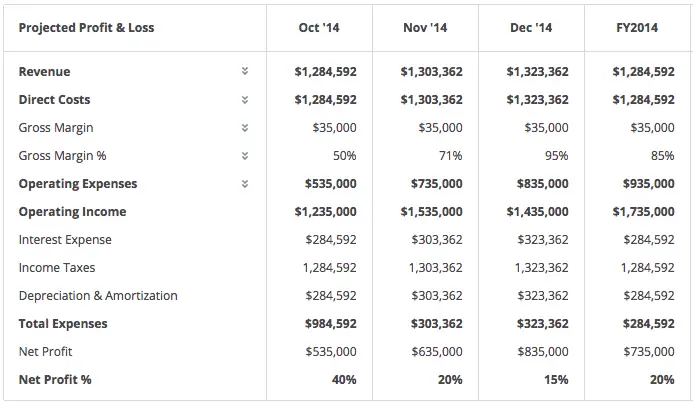

The cost of health insurance for small business should be measured in both dollars and in time.

If you’re going with a group plan, you’ll want to consider the percentage of premiums you are willing to cover, whether or not you are covering employees or their families as well, whether you use third-party services to find insurance for you, since they have a fee as well. But it also takes time to search and compare plans that meet the needs of your business, to educate your team on their plan options, and the administrative burden of setting up and maintaining the plan. And did we mention paperwork? So much paperwork.

More specifically, according to the 2019 Employee Benefits Survey by Kaiser Family Foundation, annual premiums for employer sponsored family health coverage reached $20,576 in 2019, up 5% from the previous year, with workers on average paying $6,015 toward the cost of their coverage. The Wall Street Journal reports that employers shouldered 71% of that cost, while employees paid for the rest. The average deductible among covered workers in a plan with a general annual deductible is $1,655 for single coverage.

Pro tip: The best way to budget for health benefits is either a percentage of your payroll or a monthly per-employee amount.