You Should Know: Changes To The Aca

- Though the Affordable Care Act is still law as of this writing, some changes have taken place since its implementation. One of the biggest aspects of the Affordable Care Act was the requirement that everyone obtains health insurance or pays a fee, called the Individual Shared Responsibility Payment . But starting with the 2019 calendar year, individuals who choose not to obtain health insurance coverage no longer have to pay this fee.

- Another key change is that in earlier years, applicants had until January or February of the new year to sign up for coverage. But for the 2019 calendar year, open enrollment ends on December 15.

To learn about additional changes which may occur, refer to healthcare.gov for the most current information.

Difference Between Student Travel Insurance Vs Student Health Insurance

International students in Germany need two types of health insurance:

- Student travel health insurance. This is a short-time insurance plan which will cover you before your semester starts. It encompasses the period of time starting from when you depart your home country until the beginning of the semester. When you apply for a German student visa, the Embassy will ask you to have travel health insurance, which fulfils Schengen requirements.

- Student health insurance. This is a long-term health insurance plan and covers you for the duration of your studies and until you return home. You need health insurance to enrol in the university.

Why Do Students Need Health Insurance

At college, there are possibilities that a health emergence might occur at any time. Many of such health challenges are such that may never be hoped for.

So for such reason, students are ensured to get their health insurance for any health coincidence or emergence and that is just one of the ways you could stay in advance of health emergence.

–AD–

Student health insurance covers a college students health security. Student health insurance is quite expensive and that is why we have made this listing alternative for students to select from.

Check Also:

Recommended Reading: How Does Short Term Health Insurance Work

How Much Does International Student Health Insurance Cost

Public health insurance for students in Germany is around 110 per month, depending on the company. The TK health insurance cost is 106.93 per month, starting from the beginning of the semester.

Private health insurance for students in Germany starts at 33 per month and can increase to 59 per month if you are younger than 40. If you are older than 40, have pre-existing conditions, or want more coverage, you may have to pay more, but usually no more than 130/month.

What Is Health Insurance For Students

With health insurance, you pay a company a monthly sumyour premium. In return, the company agrees to cover a percentage of your health care costs, such as doctor visits, prescription medications, or hospital stays.

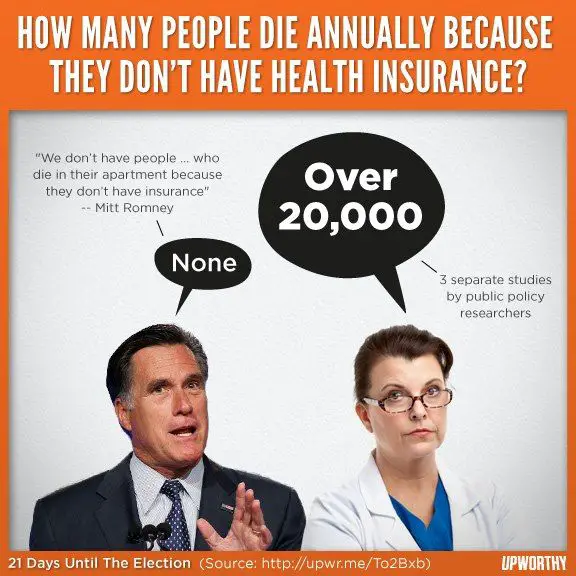

A common myth is that college students dont need health insurance because theyre young and generally healthy. But one in six young adults has a chronic health condition, and nearly half of young adults report problems affording their medical bills. Getting health coverage is an essential safeguard for your finances.

As a college student, you have the following insurance options:

- Insurance through your parents: If you are under the age of 26, you can join your parents health insurance plan.

- School-offered coverage: Many colleges offer insurance plans for incoming students.

- Insurance through the Health Insurance Marketplace: You can enroll in an insurance plan on Healthcare.gov. Depending on your income, you may qualify for subsidies that make coverage more affordable, or you can purchase an inexpensive catastrophic plan.

- Medicaid: Depending on your income and location, you may be eligible for Medicaid, the federal insurance program for low-income individuals. You can apply for coverage through your state Medicaid agency.

- Private plans: You may also opt for an insurance plan offered by a private insurance company. These plans may or may not meet the requirements of the ACA, but can provide coverage against major accidents or illnesses.

Recommended Reading: Can You Get Medicaid If You Have Health Insurance

What Mistakes Do College Students Make When Obtaining Insurance And How Can They Be Avoided

One mistake is thinking they do not have coverage. Many students will be automatically enrolled in a SHIP plan through their college or university and have access to the schools health care providers.

Another mistake is not using the health plan that they do have. Students, like everyone else, should get yearly checkups and not think of insurance as something they use only when they are sick. Many preventive services are free.

Affordable Care Act/healthcare Marketplace

How to Qualify: Almost anyone will qualify for coverage through the Marketplace.

How to Sign Up: Sign up usually takes place during an open enrollment period. If a student misses this opportunity, they can sign up during a special enrollment period. This requires a qualifying event, such as losing prior health insurance coverage.

How it Works: Applicants obtain coverage by shopping at their Health Insurance Marketplace , whether run by the state or federal government. If they qualify, students may be able to receive federal subsidies to help pay their monthly premiums. Eligibility for these subsidies, as well as the subsidy amount, will depend on income level and family size.

Why Its Good: Many plans available through the Marketplace will be the same as one purchased directly from the health insurance company purchasing through the Marketplace allows the opportunity for subsidies. Every plan offered through the Marketplace will provide minimum essential coverage.

How to Make it Affordable: Most Marketplaces will have several tiers of insurance coverage, such as Bronze, Silver, Gold and Platinum. The Bronze plans are cheaper in that they have lowest monthly premiums, but usually higher deductible and out of pocket maximums.

What to Know: Getting a subsidy by purchasing a plan through a Health Insurance Marketplace may require additional paperwork to prove the students financial situation. And if that financial situation changes, their subsidy could change along with it.

You May Like: How Much Do Health Insurance Agents Make

Who Do These International Students Health Insurances For Work For

For these international students studying abroad :

- Americans

- Australia

- Switzerland

And for students studying in almost any other country in the world

In other words, no matter your citizenship or which country you are moving to study, most of these international health plans will work for you since they are truly global insurances.

Who Needs Private Student Insurance In Germany

If you fall under the following categories, then you are not eligible for student public insurance and must get a private health insurance plan suited for international students in Germany:

- You are over 30 years of age.

- You are in a preparatory or a language course.

- Guest scientists, post-graduate students, scholarship holders .

EDUCARE24 is the flexible insurance cover designed especially to meet the needs of

- Language students in Germany

| 1st to 18th month | from the 19th month on |

We recommend EDUCARE24 M, which consists of international health insurance, accident insurance, personal liability insurance and deportation costs insurance.

For a detailed list of benefits, please visit the EDUCARE24 website.

Also Check: Which Health Insurance Company Has The Highest Customer Satisfaction

How Do I Prove To My School Abroad That Im Covered By A Health Insurance

BEFORE you do anything else, talk to your school and make sure you know their requirements for health insurance.

Then, once youve purchased a plan , the insurance company will send you a certificate. All you have to do is send this certificate to the appropriate person at your university, college, or school.

International Student Health Insurance

International student health insurance is tailor-made to meet the needs of studentsstudying outside of their home country, and this article will describe the key features,coverage and approximate costs of these plans.

Serving to provide travel medical insurance while away from home, while incorporating benefits designedspecifically for students, international student health plans have a unique combination of benefits like sports,mental health, and emergency medical evacuation. These options also provide coverage for the entire duration ofastudy, allowing a student to retain one plan throughout their education.

You May Like: How To Get Health Insurance At 19

Completing The Online Health Insurance Process

Every year all full-time students, whether new or returning, must document their health insurance coverage by completing the Online Health Insurance Process during the appropriate open enrollment period. Students who enroll in the UR Student Health Insurance Plan are enrolled on the plan from August 1 through July 31 . Students enrolling in UR Student Health Insurance Plan may enroll eligible dependents. The same deadlines apply.

If you have questions about health insurance, please write to the UHS Insurance Advisor at .

Open Enrollment Periods:

If your request to waive is denied, you can appeal the denial or you can enroll in the UR Student Health Insurance Plan . Appeals must be submitted by September 15, 2020 for fall or by January 31, 2022 for Spring enrollees. Contact the UHS Insurance Advisors at for assistance.

Please Note: Students who will be studying abroad in the fall semester do not complete the online process during the Fall Open Enrollment period. For more information, check the Health Insurance for Special Programs page.

Staying On Your Parents Plan

Youve got an option to remain on your parents health plan until you turn 26, regardless of whether your parents claim you as a dependent for tax purposes. That might work out well for you and your family, but its important to note that the plans network might not include hospitals and doctors in the area where youre going to school, and also that health plans are not required to cover maternity care for dependents .

If theres any chance that you might need maternity care, or if youre concerned about the adequacy of your parents plans network in the area youre going to school, you may want to consider getting your own plan instead. Regardless of whether you purchase a plan in the individual market on-exchange or off-exchange or enroll in the student health plan offered by your college, youll have maternity coverage and your plan will have a local provider network in the area where you purchase it .

Depending on how your parents plan is structured, taking you off the plan may or may not affect the amount that they pay in premiums. This will depend on whether they buy their own plan or have coverage via an employer and on whether they have other children who will remain on the plan.

Recommended Reading: Are 1099 Employees Eligible For Health Insurance

How To Get Covered Through The Affordable Care Act In Washington

The Washington Health Benefit Exchange provides ACA Marketplace plans to residents.

In 2020, monthly premiums for Marketplace plans ranged from $305 to $435 depending on the plan level. The advantage of ACA plans is that you may qualify for a subsidy, depending on your household income. Subsidies are based on your household size and income. Use this calculator to check whether you qualify for a subsidy.

Generally, you can only sign up for a Marketplace plan during Open Enrollment, which occurs annually between November 1 and December 15. Moving to Washington to go to college may also qualify you to enroll during a Special Enrollment Period, although you must have been covered by a plan providing minimum essential services for at least one day during the 60 days before your move.

Depending on your age and dependency status you will apply with your parents or on your own.

- Apply with parents:

If you are under age 26 you can be included on your parents application if theyre also in the market for healthcare coverage.

- Apply by yourself:

If you are over age 26 or attending an out-of-state school you will apply yourself.

How To Get Cheap Health Insurance In 2021

The cheapest health insurance option is to enroll in the federal Medicaid program, but eligibility depends on the state you live in, as well as your income level.

Health insurance is available for purchase through many different services and providers. From private care to public options, there are many different types of health insurance to choose from. For many individuals, the best deal is individual health insurance, which can be found through your state marketplace. On this exchange, you can search for and compare affordable health insurance plans from multiple companies.

Also Check: Is Dental Insurance Included In Health Insurance

If No One Claims You As A Dependent

- And you live separately from your parents : You should fill out your own separate application. Your savings will be based on only your income, not your parent’s.

- And you live with your parents: You should apply on your own separate application. But if you’re under 21, you may need to provide information about your parents and their income to complete the application.

When asked if you have health coverage, answer “No.” Choose “No” even if you have student health coverage and plan to drop it when you enroll in a Marketplace plan.

Cheapest Health Insurance For International Students In Usa

In the United States, there is very limited government-funded healthcare, most of which is not accessible to international students or better put, none of which is accessible to international students and this is why you should take a look at the cheapest health insurance for international students in usa.

With a health insurance you would be sure to get a medical attention whenever needed in the US and to be honest with you, life would be very hard for you as an international student without a health insurance.

Many international students have several student insurance plans to help them cope with issues and this is a very good idea if I am to say. You can think that too.

If you are an international student studying in the United States, you may be required to have health insurance coverage for the entire time you are abroad for your own benefit. Some schools make it madatory for international students to present their medical insurance prove before they are being enrolled.

You May Like: How To Understand Health Insurance Plans

Who Is Eligible For Public Student Health Insurance In Germany

If you are under the age of 30 and have been accepted on a degree course in Germany, such as a BA or MA, you can enrol under the public/statutory health insurance scheme.

You can also use this online consulting tool to determine whether you are eligible for public health insurance in Germany. The quick questionnaire is a collaboration between TK and DR-Walter. You have to provide information regarding your age, level of studies, and employment and whether you are a parent, and it will show you which type of insurance you need.

Studentsecure Insurance By Hccmis

HCCMIS from the Tokio Marine group offers insurance for full-time students and scholars studying away from home .

These are the 4 levels of international student health insurance coverage they offer:

- Can only cover a pre-existing condition on its acute onset

Here is a comparison of the 4 HCC StudentSecure Benefits and Limits per plans :

What I like about HCCMIS StudentSecure plans:

- Emergency dental care is covered up to $250 maximum per tooth and $500 maximum in the certificate period

- They all meet the J-1 visa requirements

- They offer a savings plan if you pay your full premium in advance

What I dont like about the HCCMIS StudentSecure plans:

- There is no coverage for pre-existing conditions in their Smart plan

- There is a 6-month waiting period for pre-existing conditions to be covered even in their Elite plan

- There is no coverage for vaccinations unless you get the Elite plan

- There is no coverage for maternity and nursery care for newborns in the Smart plan

Global Underwriters offers international health insurance plans for a wide range of travelers, including students and exchangers.

Among GUs plans, I recommend Diplomat Long Term and Diplomat International for international students. If you want to study in the US, take a look at the Diplomat America plan that is tailored to suit foreigners in the country.

What I like about Global Underwriters plans:

What I dont like about the Global Underwriters plans:

Also Check: Does Cigna Health Insurance Cover Eye Exams

Compare And Buy International Medical Insurance For Students Online

- Our system searches all available options from leading insurers to display a list of eligible plans.

- You can now easily compare different plans based on their price and coverage details.

- You can select the plan that you like best and buy it online with ease.

- Those who are not taking any courses in the University but are on Optional Practical Training in the US can buy OPT insurance plans.

Will You Stay On Your Parents Health Insurance Plan Or Enroll In Your Own Plan

It may cost you little or nothing to remain on your parents plan but there are a few factors to consider when making this decision. If you have an out-of-state plan that doesnt allow you to go to local doctors and hospitals near your school, you may want to get your own plan. Of course, you can continue to see specialists or other providers when youre home on break, but if you need medical care while at school, it may not be covered.

Sticking with Mom and Dad

You can stay on your parents health plan until you turn 26 but if youre going to school out-of-state you may not have the coverage you need.

Also Check: What Is Expat Health Insurance

How Much Is A Student Health Plan Through A Private Or Public University

According to the American College Health Association, the average student health insurance plan costs between $1,500 and $2,500 per year however, these plans can be much higher. Below we outline the annual costs and deductibles for several student health insurance plans.

Popular University Student Health Insurance Plans

| School |

|---|

| Vaden Stanford |

Some of the more expensive plans, such as Stanford, may include more services. For example, Stanfordâs health insurance plan includes dental care with a one-time-only $25 copay. Less expensive NYU offers dental services with a $40 copay and charges 20% visit coinsurance.

Nonetheless, these plans are expensive. A $4,000 annual student health plan may seem inconsequential. But after a decade with a 5% interest rate, it could turn into a $26,000 debt for every four-year college graduate. Therefore, if you already have the coverage, you may want to opt out of your schoolâs health insurance plan.