Factors That Affect Premiums

Many factors that affect how much you pay for health insurance are not within your control. Nonetheless, it’s good to have an understanding of what they are. Here are 10 key factors that affect how much health insurance premiums cost.

The coverage offered by employers contributes to several of the biggest factors that determine how much your coverage costs and how comprehensive it is. Lets take a closer look.

Costs Of Health Insurance In Germany

Healthcare insurance is mandatory by law in Germany, which means its essential that you calculate how much it is going to cost you when youre budgeting for a move to the country. The majority of people, even international students, will need to register for public healthcare insurance, however, some individuals are eligible to choose a private insurance plan.

The cost of healthcare coverage can range from 80 to 1,500 euros per month, depending on your circumstances and insurance premium. Let’s take a look at the costs in more detail.

The Qualified Small Employer Hra

With a QSEHRA, employees buy their health insurance and get reimbursed for medical expenses, health insurance premiums, and other qualified costs with tax-free dollars. To be eligible, a company must have fewer than 50 full-time employees and cant provide a group health insurance policy to any employee.

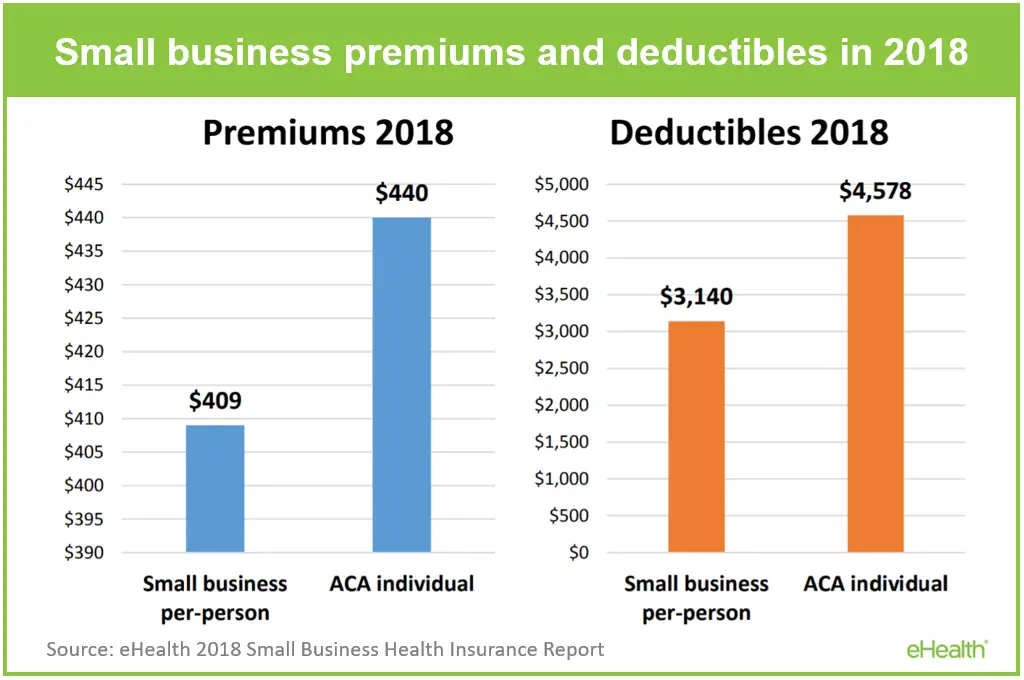

Prices for Individual and group health insurance premiums and deductibles normally differ from year to year, whereas the QSEHRA has annual reimbursement caps that the IRS sets every year.

You May Like: Is There Health Insurance In The Philippines

Factors That Impact Health Insurance Rates

For a particular health insurance plan, the cost of coverage is determined by certain factors that have been set by law. States can limit the degree to which these factors impact your rates for instance, some states like California and New York don’t allow the cost of health insurance to differ based on tobacco use.

- Age: The health care cost per person covered by a policy will be set according to their age, with rates increasing as the individual gets older. Children up to the age of 14 will cost a flat rate to add to a health plan, but premiums typically increase annually beginning at age 15.

- Where you live: Health insurance companies determine the set of policies offered and the cost of coverage based on the state and county you live in. So a resident of Miami-Dade County in Florida, for instance, may pay lower rates for the same policy than a resident of Jackson County.

- Smoking/tobacco use: If you smoke, you could pay up to 50% higher rates for health insurance, though the maximum increase is determined by the state.

- Number of people insured: The total cost of a health plan is set according to the number of people covered by it, as well as each person’s age and possibly their tobacco use. For example, a family of three, with two adults and a child, would pay a much higher monthly health insurance premium than an individual.

Average Cost Of Pet Insurance: 2021 Facts And Figures

Find the Cheapest Pet Insurance Quotes in Your Area

The average monthly cost of pet insurance is $48.78 for dogs and $29.16 for cats for plans that cover both accidents and illnesses.

After obtaining quotes from 11 of the largest pet insurance companies, we found that the average monthly cost of a pet insurance plan ranges from about $25 to $70 for dogs and $10 to $40 for cats.

Don’t Miss: When Does Health Insurance Enrollment Start

Homeowners Insurance Cost: The Bottom Line

Several factors determine home insurance costs. Unfortunately, some of those factors cant be changed.

However, you can still find a homeowners insurance company with a reliable policy and affordable coverage.

Now that you know more about how much homeowners insurance costs, youre ready to use our free comparison tool below to compare multiple insurance companies in your area.

How Much Does Company

The National Business Group on Health report provides crucial insights into group health insurance trends and costs. According to their news release:In 2020, the average group health insurance cost per worker per year is $15,375 . This stipulates that the cost of the average employer-sponsored premium increased 5 percent from 2019.

Also Check: What Is The Health Insurance For Low Income

How Does Health Insurance Work

Put simply, health insurance is a way to pay for your health care. And it works the same way your car or home insurance works: you or your employer choose a plan and agree to pay a certain rate, or premium, each month. In return, your health insurer agrees to pay a portion of your covered medical costs.

American Health Insurance Vs International Cover: Whats The Cost Difference

International health insurance is a product designed to offer cross-border coverage. Many Americans are surprised by how affordable health coverage can be when they spend time overseas so how does this product compare to domestic cover?

At William Russell, our most comprehensive international health plans provide standard coverage in every country except the USA. Weve published a full guide on how we calculate premiums for health insurance. By comparing our typical premiums to U.S. averages, its possible to get an idea of the cost difference between health insurance in the USA and other nations.

| Typical US health insurance costs in 2020 | The average William Russell international health insurance premium in 2020* |

|---|---|

| Individual cover | |

| $8,419.90 |

*Based on William Russell premiums in Thailand and Vietnam

We have a full guide on how much expat health insurance can cost in different countries, together with a list of most expensive and cheapest countries for health insurance.

Recommended Reading: Does Health Insurance Cover Vision

What Does Medicare Cost And What Does It Cover

Medicare is a government health insurance program available to Americans aged 65 and older. But even with Medicare, retirees face significant out-of-pocket costs because the program doesnt cover all health care needs.

Medicare offers three parts A, B and D and private supplementary plans, including Medigap plans and Medicare Advantage plans available for purchase under Part C.

Services such as long-term care, dentures and acupuncture are not covered by the program. In addition, several Medicare services have copays, premiums and other costs.

The Costs Of Individual Vs Family Plans

The Affordable Care Act offers some subsidies to make health insurance more affordable, but not everyone qualifies.

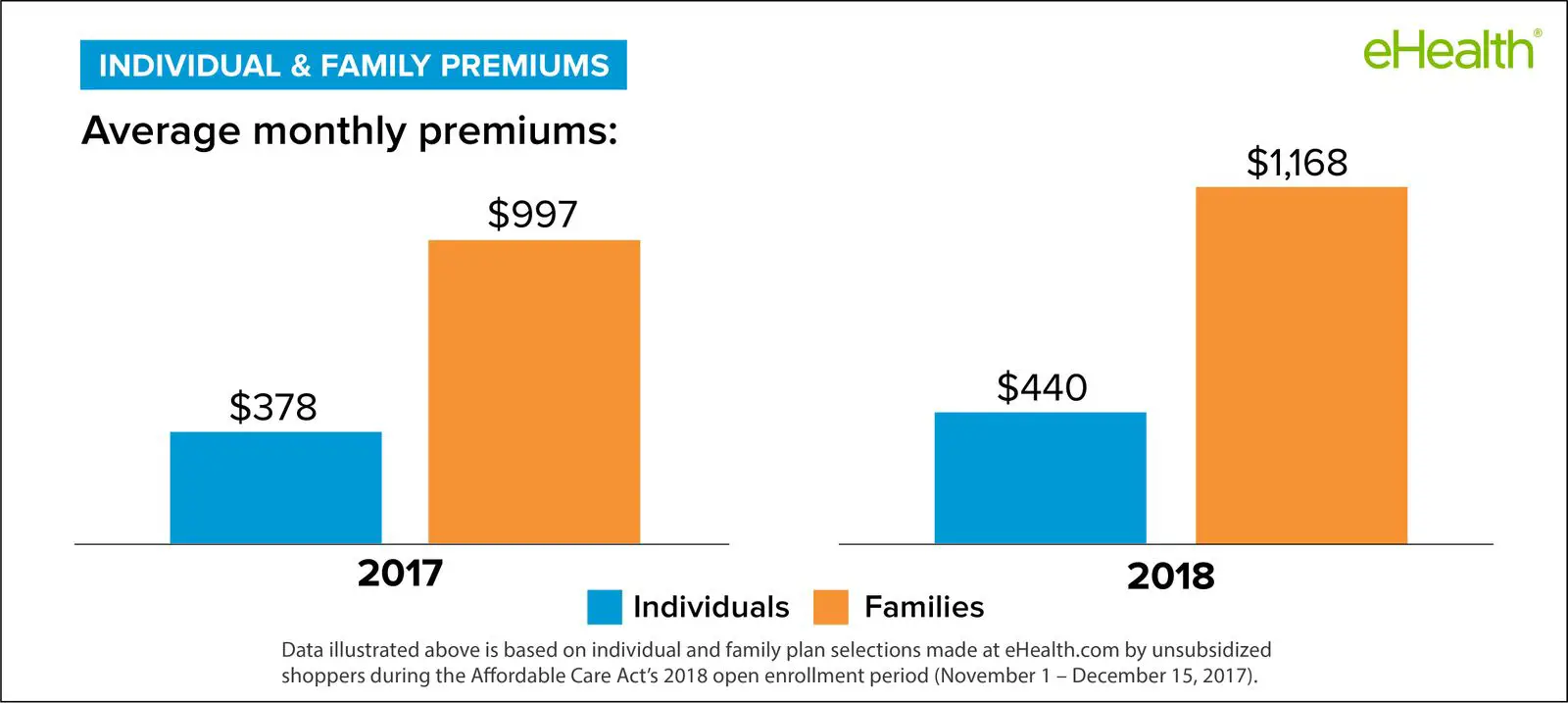

In 2020, health insurance premiums for unsubsidized individual customers were $456 per month on average, while family premiums averaged $1,152 per month. The average individual deductible was $4,364 the family deductible averaged $8,439.

Over the course of a year, the average health spending for a family of four in the U.S. was $25,011 in 2020. This figure includes spending on monthly premiums. It also includes meeting the deductible.

Read Also: Do Children Need Health Insurance

Individual Health Insurance And Health Reimbursement Arrangements

Group and individual health insurance plans are popular choices but theres another option that can benefit employees and employers called a health reimbursement arrangement that is growing in popularity and works in conjunction with individual health insurance.

HRAs allow employers to reimburse employees, tax-free, for healthcare, including individual health insurance premiums and qualifying out-of-pocket medical expenses.

With an HRA, employers set their own budgets by offering an allowance amount for each employee. Employees win big on flexibility by being able to choose their own individual health insurance plan thats tailored to their specific needs.

Lets take a look at two of the most popular HRAs which are the qualified small employer HRA and the individual coverage HRA .

What Influences Aca Plan Costs

Individual health plans and plans on the Affordable Care Acts Health Insurance Marketplace request key information from people when determining health insurance costs.

“Health insurance costs will vary significantly depending on your age, geography, family status and tobacco use,” notes Brian Martucci, a Minneapolis-based personal finance expert with Money Crashers.

Plans cant reject you or charge higher rates because of pre-existing conditions. The ACA ended that practice.

“Generally speaking, young, healthy non-smokers enjoy the lowest health insurance premiums, while older adults pay more — especially on the individual market,” says Martucci.

Chris Orestis, the president of Life Care Xchange and a nationally recognized health care expert, echoes those thoughts.

“Our current system rewards people for being younger and healthier in both group or individual coverage. But the differences are much starker for individual coverage,” says Orestis.

The ones who tend to pay the most overall are older folks who don’t yet qualify for Medicare – such as 64-year-olds, Darr says.

Franke says individual plan insurers can only charge an older person three times what it charges a younger person.

“For instance, in Seattle, a 64-year-old will pay 300% more than a 21-year-old for a Silver plan. That could mean the difference between paying about $900 per month versus $300 per month, respectively,” Franke adds.

Also Check: How To Apply For Health Insurance In Arizona

What Is The Average Cost Of Non

What do you pay if your income exceeds the 400% FPL ? The average national monthly non-subsidized health insurance premium for one person on a benchmark plan is $462 per month, or $199 with a subsidy. Monthly premiums for ACA Marketplace plans vary by state and can be reduced by subsidies. Actual cost varies based on your age, location, and health plan selection,

Take a closer look. In a recent eHealth ACA Index report, we tracked costs and shopping trends among ACA plan enrollees who bought non-subsidized health insurance at ehealth.com during the nationwide open enrollment period for 2020 coverage.

Does Affordable Care Act Apply To Expats

Unfortunately, not anymore. Today, the US Government does not require anyone to subscribe to an ACA-compliant health insurance policy. However, a handful of states still impose a penalty on people who do not comply with the ACA. These are:

- California

- Massachusetts

- New Jersey

Other states are also currently processing legislation that will make health insurance compulsory, so before you move to the USA, check your new states laws.

Recommended Reading: When Does Health Insurance Renew

What The Average American Spends A Year

According to the most recent data available from the Centers for Medicare and Medicaid Services , “the average American spent $9,596 on healthcare” in 2012, which was “up significantly from $7,700 in 2007.”

It was also more than twice the per capita average of other developed nations, but still, in 2015, experts predicted continued sharp increases: “Health care spending per person is expected to surpass $10,000 in 2016 and then march steadily higher to $14,944 in 2023.”

Indeed, average annual costs per person hit $10,345 in 2016. In 1960, the average cost per person was only $146 and, adjusting for inflation, that means costs are nine times higher now than they were then.

Is Employer Coverage Cheaper

Many people assume that employer coverage is the best or cheapest option. In 2020 an estimated 157 million people opted for their employer-based health care plan.4

But is it? Should you always choose your employers health coverage or should you opt for individual health insurance?

Employer plans can sometimes be less expensive since the company chips in part of the costs. Your employer can also sometimes get a better rate because theyre buying a large block of insurance packages. But not always. It can sometimes be cheaper to get health insurance on your own. While it might take a little more work on your end, if youre looking to save money on your health insurance costs, you might want to pass on the employer coverage and shop for an individual plan.

Also Check: What Health Insurance Is Available In Nc

How Much Does Group Health Insurance Cost

About 157 million people are covered by employer-based health insurance. But how much do companies pay for employee health insurance?

For a look into trends and costs over the years, the Kaiser Family Foundation conducts an annual survey.

In their recent findings, in 2020, the average monthly premiums for group health insurance increased from previous years to:

- $622 for individual coverage

- $1,778 for family coverage

Since 2019, average employer-sponsored individual premiums increased 4% and family premiums increased 4%. Moreover, the average premium for family coverage has increased 22% over the last five years and 55% over the last ten years.

How Much Does Homeowners Insurance Cost

Home insurance quotes are based on several factors. Each factor determines whether affordable home insurance is available to you.

One of those factors happens to be where you live. According to the National Association of Insurance Commissioners , the average cost of home insurance is $101 a month .

However, youll notice that some areas have home insurance rates that are more expensive. Sometimes, you may live in a city or state where homeowners insurance is cheaper.

Lets review the average cost of home insurance for each state in the nation:

Average Monthly Home Insurance Rates by State

| State |

|---|

Oregon has the cheapest home insurance rates in the United States, but Louisiana is the most expensive state for home insurance.

The average home insurance cost per month is a general price. Your home insurance rates may vary. Youll likely have a different home insurance rate when you decide which company you want to use.

Don’t Miss: How To Get Health Insurance In California

Healthcare Costs Based On Age And State

Healthcare costs vary based on your age and the state you live in. As you might expect, younger, healthier adults pay the least for healthcare coverage, but even for younger adults, the cost of coverage varies greatly based on location.

In 2021, the average cost of a monthly health insurance premium in the U.S. is $495 per month. The average annual deductible is $5,940. In some places, the cost varies greatly from the national average. In West Virginia, the average premium is $712 with a deductible of $8,540 in next-door Maryland, the average is only $344 with a $4,122 deductible.

Age is another big factor when it comes to the costs of health insurance. Take a look at this breakdown by age for the average monthly healthcare premium without subsidies:

- 18 and under: $236

- 55-64 years: $784

Health Savings Accounts : Saving For Retirement Health Care

Health Savings Accounts can be a good way to save for health costs in retirement. But this option is not available to everyone, and it has limits.

HSAs are an option only for people with high-deductible health insurance plans and no other health insurance. To be considered a high-deductible plan, the insurance policy must have a deductible of at least $1,350 for self-only coverage and $2,700 for family coverage, as of 2019. These deductibles dont apply to preventative care services.

HSA accounts are not available to people who qualify for Medicare or are claimed as dependents on someone elses taxes.

The accounts take pre-tax deposits to cover health care costs that are not covered by insurance. The unspent money in an HSA rolls over from year to year. The accounts are also portable and stay with you when you change jobs or stop working.

According to the Society for Human Resource Managements 2019 Employee Benefits Survey, HSAs are currently offered by 56 percent of employers. If your employer doesnt offer an HSA, some banks and other financial institutions offer them for people with high-deductible health insurance.

As of 2019, if you have a high-deductible health plan, you can contribute up to $3,500 to an HSA for self-only coverage and up to $7,000 for family coverage, according to Healthcare.gov. For 2020, you may contribute up to $3,550 for self-only coverage and up to $7,100 for family coverage.

You May Like: How Much Does State Farm Health Insurance Cost

How To Estimate Your Yearly Total Costs Of Care

In order to pick a plan based on your total costs of care, youll need to estimate the medical services youll use for the year ahead. Of course its impossible to predict the exact amount. So think about how much care you usually use, or are likely to use.

- Before you compare plans when youre logged in to HealthCare.gov or preview plans and prices before you log in, you can choose each family members expected medical use as low, medium, or high.

- When you view plans, youll see an estimate of your total costs including monthly premiums and all out-of-pocket costs based on your households expected use of care.

- Your actual expenses will vary, but the estimate is useful for comparing plans total impact on your household budget.

How Much Does Health Insurance Cost Per Month In Each State

The national average health insurance premium for a benchmark plan in 2021 is $452, according to the Kaiser Family Foundation. A benchmark plan is the average premium for each states second lowest cost silver plan.

The following data reflects the national average, and each states average, but does not include any reduction in cost from subsidies. Rates will vary by area.

Also Check: How To Apply For Hip Health Insurance Indiana