What Is Health Insurance And Why Do I Need It

Health insurance also referred to as medical insurance or healthcare insurance refers to insurance that covers a portion of the cost of a policyholders medical costs. How much the insurance covers depends on the details of the policy itself, with specific rules and regulations that apply to some plans.

If you dont have health insurance and you end up needing medical care, you can be left with insurmountable medical bills or even face situations in which medical providers refuse to treat you.

Only screening and stabilization in a hospital emergency department are guaranteed if youre uninsured . Other than that, its up to the provider to decide whether to treat you if your ability to pay for the care is in question. Even if your out-of-pocket costs seem high under the health plans available to you, having a health insurance card might make the difference between being able to obtain care or not.

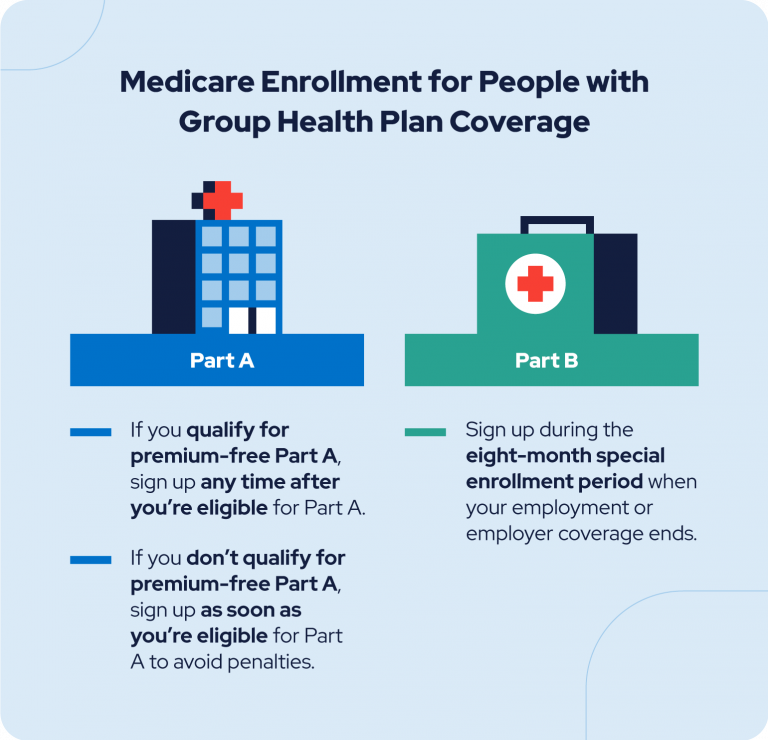

Its also important to understand that you cannot just purchase health insurance when a medical need arises. Regardless of whether youre buying your own coverage or enrolling in a plan offered by an employer, theres an annual open enrollment period that applies, and enrollment outside of that window is limited to special enrollment periods triggered by qualifying events.

What Is Covered Under The Group Health Insurance Policy

The extensive coverage that the group health insurance policies provide makes it a popular choice among employers. Some of the conditions that are covered under the group health insurance policy include:

- Pre-existing conditions without any waiting period

- Treatment expenses that are spent on chronic illness are covered

- The health insurance policy can also be extended to the family and dependents of the policyholder

- Hospital bills for some of the critical illnesses are also brought under consideration

- Cashless hospitalization at the network hospitals of the insurance company are also included

- Expenses related to pre-hospitalization and post-hospitalization are also included

- Ancillary charges are also covered under the policy. These are the charges that are spent on things like medicines, bandages, etc.

Qualifying Events For Cobra Coverage

In addition to employee status and enrollment in an eligible group health plan, employees must also experience a qualifying event in order to be eligible for continuation coverage under COBRA. Generally, this will include an event that causes the employee to lose group health coverage. Examples of these events include:

- Termination for reasons other than gross misconduct

- Reduction in employee hours

- Temporary or permanent layoffs resulting in loss of benefits

Qualifying events can also extend to an employee’s spouse or dependents if it results in a change in status for the entire family and affects the family’s ability to maintain health coverage. COBRA may apply and provide continuation coverage whenever the spouse or dependent of a covered employee:

- Death of Covered Employee

Recommended Reading: Are Glasses Covered By Health Insurance

Other Types Of Coverage

These types of health insurance provide only limited coverage. Companies selling them can deny you coverage or charge you more if you have a preexisting condition. They also usually limit the amount they will pay for your care.

- Specified disease policies pay only if you have the illness named in the policy. For instance, a cancer policy will pay only if you have cancer. It wont pay if you have another disease.

- Short-term policies provide coverage for only a limited time, usually six to 12 months. People sometimes buy these policies while they’re between jobs or waiting for other coverage to start.

Learn more: Alternative health plans

Whats Group Accident Insurance

Group accident insurance is a type of insurance that complements existing medical coverage.

Its purpose is to serve as additional protection for employees and help pay for actual expenses such as emergency room treatment .

The employer can offer this insurance to the employees to protect them from medical expenses that a workplace injury incurs.

This can be especially significant if employees work in a manufacturing unit where they are exposed to risks. The employer can cover the employees under a group insurance design plan. This way, the employees are protected, and the employer usually gets a discount based on the company size.

If the insured is injured in a covered accident, they can get a payout to use any way they wish to help cover deductibles, out-of-pocket medical costs or everyday living expenses. Policy Bazaar

Here are some key features of this insurance:

Employees pay the premium cost through payroll deduction in the usual group accident plan. The employee can choose who to cover.

Most group insurances pay an upfront lump-sum cash benefit based on injuries received. The cash is given directly to the employee. It can be used any way the employee chooses, for example, physical therapy, health questions, trauma counseling, speech therapy, child care, and other expenses.

Related Articles:

- In case of a permanent disability, disability insurance pays for the childs education

- Dental injuries

Read Also: What Is Long Term Health Insurance

What Is The Difference Between An Hmo And A Ppo

A Health Maintenance Organization covers visits to physicians in-network, a limited number of physicians, and other providers who have agreed to work with and accept payment from the group health insurance plan. A Preferred Provider Organization allows the insured to choose doctors, hospitals, and other providers either inside or outside of their network.

Exclusions Under Group Health Insurance:

Generally, Certain conditions are not covered by the group health insurance policy. Thus, these usual exclusions are not accepted by any insurance company. Some of the exclusions under the group health insurance include:

- Use of life support system in case of any treatment

- Sex change operation

- Treatments related to obesity and weight loss

- Treatment of AIDS and HIV

- Non-allopathic treatments

- An injury that is caused intentionally

- De-addiction treatment for drugs and alcohol

These exclusions are not the only exclusions that can be there in the policy, so you must check with the individual insurance companies to check what their exclusions are.

Read Also: Do You Need Health Insurance To Go To Planned Parenthood

Claim Process For Group Health Insurance:

In case of hospitalization or a medical emergency, the claims should be fined as early as possible so that you face no issues. This is the process that you can use for filing claims:

- Inform the insurance company about the medical emergency either online or by calling them on their number

- In case of hospitalization, you must share the details of the group insurance policy with the hospital

- The insurance company will ask the policyholder for the relevant documents along with the claim form

- If the claims are verified, the insurance company settles the bill on behalf of the policyholder.

History Of Group Health Insurance

Group health insurance in the United States originated during the 20th century. The idea of collective coverage first entered into public discussion during World War I and the Great Depression. Soldiers fighting in World War I received coverage through the War Risk Insurance Act, which Congress later extended to cover servicemens dependents. In the 1920s, healthcare costs increased to the point that they exceeded most consumers ability to pay.

The Great Depression exacerbated this problem dramatically, but resistance from the American Medical Association and the life insurance industry defeated several efforts to establish any form of a national health insurance system. This opposition would remain strong into the 21st century.

Employer-sponsored group health insurance plans first emerged in the 1940s as a way for employers to attract employees when wartime legislation mandated flattened wages. This was a popular tax-free benefit which employers continued to offer after the wars end, but it failed to address the needs of retirees and other non-working adults. Federal efforts to provide coverage to those groups led to the Social Security Amendments of 1965, which laid the foundation for Medicare and Medicaid.

Don’t Miss: Can You Use Hsa To Pay For Health Insurance

Can I Opt Out Of My Employers Group Health Insurance Plan

Yes. Just because you work somewhere, doesnt mean you have to use their health insurance plan. You always have options. And sometimes its best to get a second opinion from an independent health insurance agent.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Learn More.

Commonly Asked Questions About Group Health Insurance Plans

As an insurance agency, we get many questions from business owners about offering health insurance benefits to their employees. Very often, the employees of the business have a lot of questions, and some are very confusing to answer.

In this article, we will cover some of the most commonly asked questions about group health insurance to help answer them for your employees.

Read Also: How Much Does Health Insurance Cost For Two Adults

Understanding The Basics Of Association Health Insurance

Simply stated, association health insurance is just a group health plan where multiple employers join together to offer medical benefits. By joining together and increasing the number of participants to the point where the association qualifies as a âlarge groupâ health plan, the association can:

- Take advantage of less-expensive health plans that have a lower percentage of premiums spent on insurer profit and administrative costs

- Design plan benefits according to best practices among large businesses & explore the value of digital health program innovations

- Negotiate better rates from healthcare providers and insurers

- Consider self-insuring to lower plan administration costs further and avoid health insurance tax

For a more detailed overview of association health insurance, read our article âWhat Is an Association Health Plan?â or you can explore our book-length treatment Association Health Plans & the Future of American Health Insurance.

What To Do If You Lose Your Group Health Benefits

If you lose your job, you may also lose your employer-sponsored group health insurance. You and your dependents may be able to keep this coverage through whats called continuation coverage.

In 1985, Congress passed the Consolidated Omnibus Budget Reconciliation Act , which allows employees who lose their jobs to buy group health coverage for themselves or for their families for a limited amount of time. Under COBRA, the same group insurance plan with the same benefits must be made available to the terminated worker however, the former employee must pay the full costincluding whatever the employer has previously coveredof the plan.

Continuation coverage is often much more expensive than an individual health insurance plan, so consider the price, benefits and network of providers carefully before making the choice to keep your coverage through continuation coverage temporarily instead of moving to an individual plan.

You May Like: Is Oscar Health Insurance Good

Trends In Public Coverage

Public insurance cover increased from 2000â2010 in part because of an aging population and an economic downturn in the latter part of the decade. Funding for Medicaid and CHIP expanded significantly under the 2010 health reform bill. The proportion of individuals covered by Medicaid increased from 10.5% in 2000 to 14.5% in 2010 and 20% in 2015. The proportion covered by Medicare increased from 13.5% in 2000 to 15.9% in 2010, then decreased to 14% in 2015.

Who Can Sign Up For Group Health Insurance

To be eligible for group health insurance, an employee must be on payroll and the employer must pay payroll taxes. Individuals usually not eligible for group coverage include independent contractors, retirees and seasonal or temporary employees. Employees who are on unpaid leave are often ineligible for group coverage until they return to work.

Generally, group health insurance coverage must also be offered to an employees spouse and dependent children until age 26, though employers may choose to expand the age definition for child dependents. Employers may also opt to extend health benefits to unmarried partners of the same or opposite sex, and that coverage must mirror the coverage extended to spouses on the same plan.

Also Check: Who Pays For Child Health Insurance After Divorce

Insurance Options For Uninsured Individuals

Not everyone is covered by a group health insurance plan. For many decades, these uninsured people were forced to bear the cost of healthcare on their own. But that has changed.

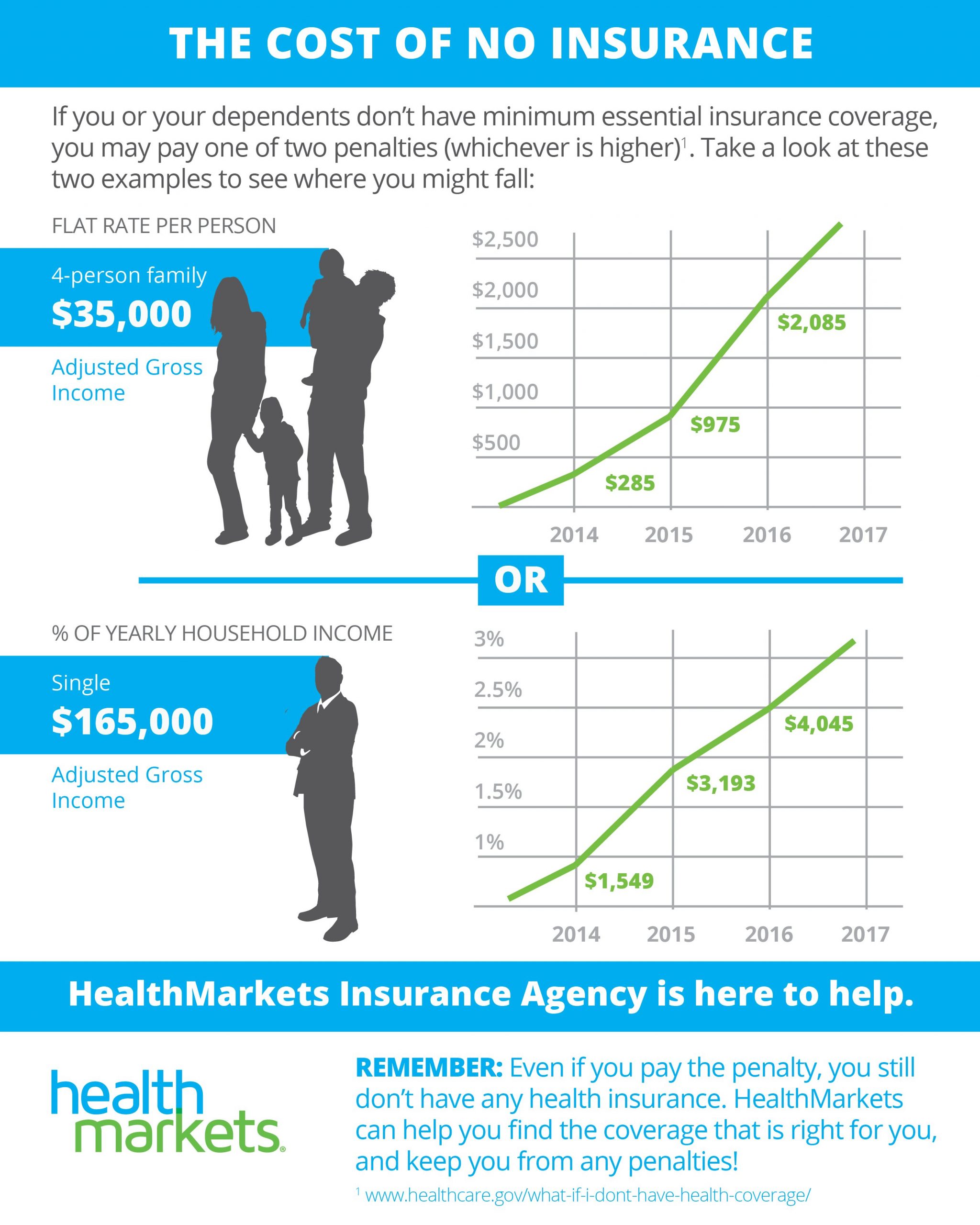

Government-sponsored health plans continue to provide care to those left out of employer-sponsored group health insurance plans. As national health expenditures have climbed past 17.7% of gross domestic product , the Affordable Care Act of 2010 substituted a nationwide mandate that each taxpayer join a group plan for the sort of single-payer solution that has faced stiff opposition since the 1930s. According to government data, roughly 23 million Americans are taking advantage of health insurance under the ACA, according to the most recent set of numbers from 2019.

Under the Obama administration, people who remained uninsured under the ACA were required to pay a health insurance mandate. This was repealed by the Trump administration, which stated it penalized people unnecessarily.

Does A Group Health Plan Include Dental Or Vision Coverage

The short answer is that it depends on the specific health insurance group plan. Some companies will offer these additional types of health care coverage as an employee benefit.

Vision and dental insurance can come from varying sources:

1) There are health insurance plans that include vision and dental benefits. These can be offered by an employer or purchased on your own through the insurer.

2) There are separate, standalone plans for vision or dental benefits that can be used on top of a health insurance plan as a form of supplemental insurance. There are even dental and vision insurance packages that offer benefits for both.

Also Check: How To Get Health Insurance When Unemployed

If You Leave Your Job

You can usually continue your coverage temporarily under COBRA .

Learn more: Need health insurance? How to find a new health plan now.

What is COBRA?

COBRA is a federal law that lets employees continue their health coverage for a period of time after they leave their job. It applies to coverage from employers with 20 or more employees. It doesnt apply to plans offered by the federal government or some church-related groups.

You can get COBRA coverage if:

- You leave your job for any reason other than gross misconduct. Gross misconduct usually means doing something harmful to others, reckless, or illegal.

- You lose your coverage at work because you switch from working full-time to part-time.

If your family was on your health plan, you can continue their coverage under COBRA. Your spouse and children also can continue their coverage if you go on Medicare, you and your spouse divorce, or you die. They must have been on your plan for one year or be younger than 1 year old. Their coverage will end if they get other coverage, dont pay the premiums, or your employer stops offering health insurance.

You have 60 days after you leave your job to decide whether you want COBRA. You must tell your employer in writing that you want it. If you continue your coverage under COBRA, you must pay the premiums yourself. Your employer doesnt have to pay any of your premiums.

For more information about COBRA, call the Employee Benefits Security Administration at 866-444-EBSA .

Private Health Care Coverage

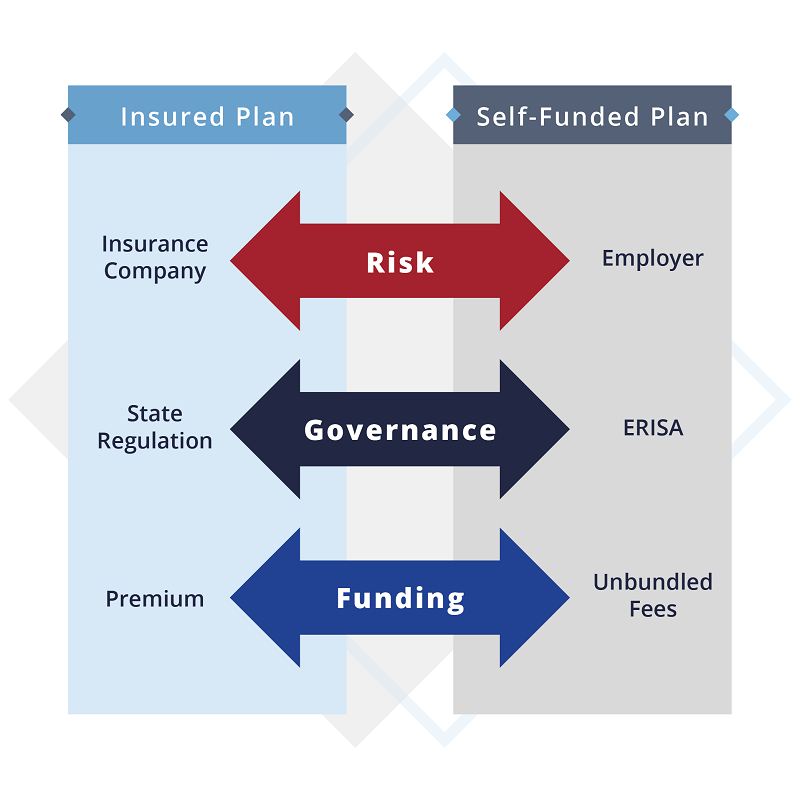

Private health insurance may be purchased on a group basis or purchased by individual consumers. Most Americans with private health insurance receive it through an employer-sponsored program. According to the United States Census Bureau, some 60% of Americans are covered through an employer, while about 9% purchase health insurance directly. Private insurance was billed for 12.2 million inpatient hospital stays in 2011, incurring approximately 29% of the total aggregate inpatient hospital costs in the United States.

The US has a joint federal and state system for regulating insurance, with the federal government ceding primary responsibility to the states under the McCarran-Ferguson Act. States regulate the content of health insurance policies and often require coverage of specific types of medical services or health care providers. State mandates generally do not apply to the health plans offered by large employers, because of the preemption clause of the Employee Retirement Income Security Act.

As of 2018, there were 953 health insurance companies in the United States, although the top 10 account for about 53% of revenue and the top 100 account for 95% of revenue.:70

You May Like: What To Do If You Lose Your Health Insurance Card

How Do I Get Insurance For My Family

You can add your family to a work health plan. If you buy from an insurance company or the marketplace, you can buy a plan that also covers your family.

You can keep your dependent children on your plan until they turn 26. They don’t have to live at home, be enrolled in school, or be claimed as a dependent on your tax return. You can keep married children on your plan, but you cant add their spouses or children to it.

If you have dependent grandchildren, you can keep them on your plan until they turn 25.

Public Health Care Coverage

Public programs provide the primary source of coverage for most seniors and also low-income children and families who meet certain eligibility requirements. The primary public programs are Medicare, a federal social insurance program for seniors and certain disabled individuals Medicaid, funded jointly by the federal government and states but administered at the state level, which covers certain very low income children and their families and CHIP, also a federal-state partnership that serves certain children and families who do not qualify for Medicaid but who cannot afford private coverage. Other public programs include military health benefits provided through TRICARE and the Veterans Health Administration and benefits provided through the Indian Health Service. Some states have additional programs for low-income individuals. U.S. Census Bureau, “CPS Health Insurance Definitions”Archived May 5, 2010, at the Wayback Machine< /ref> In 2011, approximately 60 percent of stays were billed to Medicare and Medicaidâup from 52 percent in 1997.

There is some evidence that Medicare Advantage plans select patients with low risk of incurring major medical expenses to maximize profits at the expense of traditional Medicare.

Medicare Part D

You May Like: How To Get A Health Insurance Exemption