Factors That Affect Premiums

Many factors that affect how much you pay for health insurance are not within your control. Nonetheless, it’s good to have an understanding of what they are. Here are 10 key factors that affect how much health insurance premiums cost.

The coverage offered by employers contributes to several of the biggest factors that determine how much your coverage costs and how comprehensive it is. Lets take a closer look.

Advanced Premium Tax Credit

Many more people qualify for an Advanced Premium Tax Credit, which lowers your monthly health insurance bill for coverage bought through the Marketplace. Like the cost-sharing reductions, you must be ineligible for public coverage and unable to get qualified health insurance through an employer in order to qualify.

Though you can choose any metallic level plan in the marketplace, your income must fall between 100% and 400% of the federal poverty level to qualify for the tax credit. For 2021, in order to be eligible for a subsidy, you must make below $68,960 for an individual and $104,800 for a family of four. In each case, that number represents four times the federal poverty rate for 2020.

For 2021 and 2022, the American Rescue Plan Act of 2021 changes how the Advanced Premium Tax Credit is applied. The law increases premium tax credits for all income brackets for these years. Previously, households with incomes that are more than 400% of the federal poverty level were not eligible for such tax credits. The law allows families making more than 400% of the poverty level to claim premium tax credits and instead places a cap on the level of household income families must pay toward premiums at 8.5%. Other tax brackets and income levels are also expected to see lower premiums due to the American Rescue Plan as the percentage of tax credits relative to income increases.

Plus Potential Ways To Reduce Your Premium

Open enrollment for health insurance planswhether it’s an employer-sponsored plan or an Obamacare plan you buy through a federal or state healthcare exchangegenerally takes place in the last two or three months of the year. Unless you have a qualifying life event such as getting married or losing your job at a different time of the year, open enrollment is the time to shop around to ensure that youre paying the best price for the right coverage.

It helps to first understand what average premiums are, how the rates have changed over the past few years, and ways you can reduce your monthly premium.

Recommended Reading: What’s The Penalty For Not Having Health Insurance In California

How To Find An Affordable Plan That Meets Your Needs

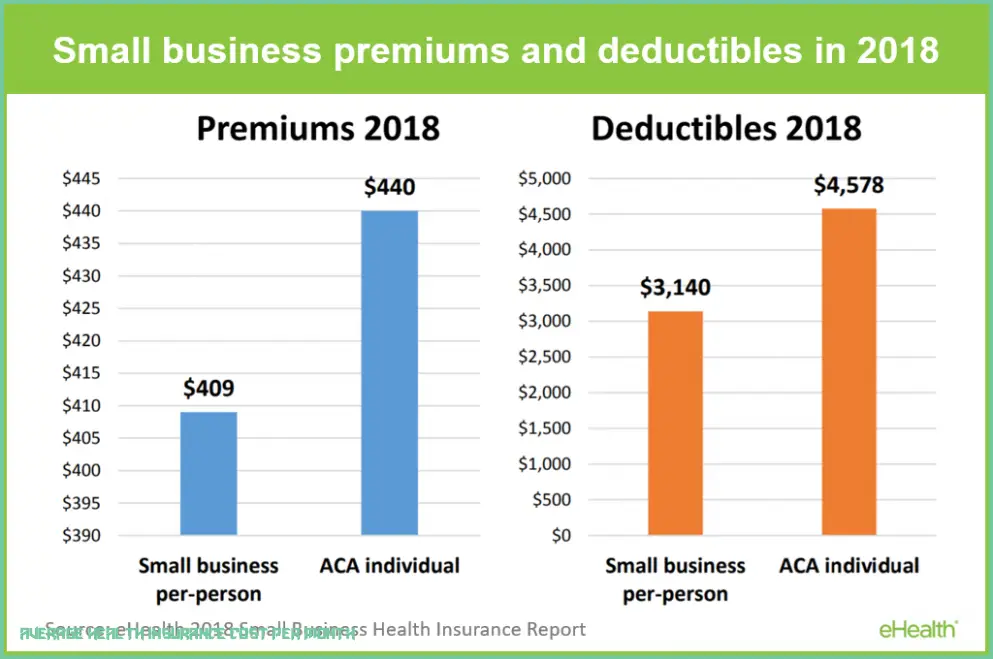

Among eHealth customers who bought ACA individual health insurance, more than 75% chose Bronze or Silver plans. Your state may host an exchange for comparing and purchasing ACA plans or it may use the federal exchange at Healthcare.gov. Keep in mind, you arent limited to the exchange.

The licensed insurance brokers at eHealth can help you find the best health plan to meet your health coverage needs and your budget. They will listen to your priorities in health coverage and use their expertise to match your needs with health insurance options both on and off the exchange.

Factors That Impact Health Insurance Rates

For a particular health insurance plan, the cost of coverage is determined by certain factors that have been set by law. States can limit the degree to which these factors impact your rates for instance, some states like California and New York don’t allow the cost of health insurance to differ based on tobacco use.

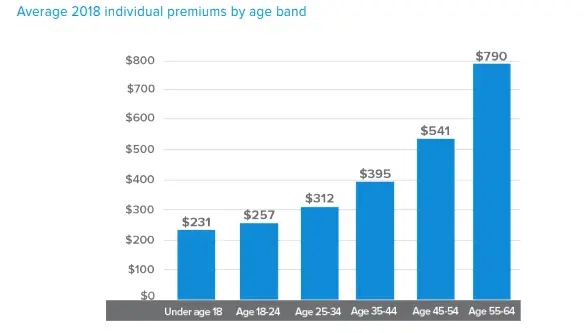

- Age: The health care cost per person covered by a policy will be set according to their age, with rates increasing as the individual gets older. Children up to the age of 14 will cost a flat rate to add to a health plan, but premiums typically increase annually beginning at age 15.

- Where you live: Health insurance companies determine the set of policies offered and the cost of coverage based on the state and county you live in. So a resident of Miami-Dade County in Florida, for instance, may pay lower rates for the same policy than a resident of Jackson County.

- Smoking/tobacco use: If you smoke, you could pay up to 50% higher rates for health insurance, though the maximum increase is determined by the state.

- Number of people insured: The total cost of a health plan is set according to the number of people covered by it, as well as each person’s age and possibly their tobacco use. For example, a family of three, with two adults and a child, would pay a much higher monthly health insurance premium than an individual.

Recommended Reading: Is Dental Insurance Included In Health Insurance

The Cost Of Obamacare

The Affordable Care Act of 2010, commonly known as ObamaCare, made health insurance plans more affordable in the public health insurance market exchange. There are, therefore, no specific ObamaCare plans, but just more affordable options through different companies. ObamaCare plans vary in price depending on the company, type of plan you choose, and where you live. The average monthly cost of a plan from the public health insurance market ranges from $328 to $482.

Purchasing Health Care Coverage Through The Marketplace And Reporting Changes

Each year the Health Insurance Marketplace has an open enrollment period and special enrollment periods for eligible taxpayers. For information about enrollment periods, visit HealthCare.gov or contact your state-based Marketplace.

If you enrolled in insurance coverage through the Marketplace, you should report any changes in your circumstances like changes to your household income or family size to the Marketplace when they happen. Changes in circumstances may affect your advance payments of the premium tax credit. When you report a change in circumstances, you may become eligible for a special enrollment period, which allows you to purchase health care insurance through the Marketplace outside of the open enrollment period. Visit the Marketplace at HealthCare.gov for more information about reporting changes in circumstances and special enrollment.

To estimate the effect that changes in circumstances may have upon the amount of premium tax credit that you can claim – see the Premium Tax Credit Change Estimator on our Affordable Care Act Estimator Tools page.

Find out more about the Premium Tax Credit and other tax provisions of the Affordable Care Act at IRS.gov

Read Also: What Is The Federal Health Insurance Marketplace

Set Targets For Improved Enrollment In Health Coverage

Setting enrollment targets can help keep the goal of expanding coverage front and center, preventing states from focusing too narrowly on cutting costs or minimizing disruption. Setting targets across programs can also help ensure that the state includes lower-income residents eligible for Medicaid or CHIP in the push for improved health coverage.

Issues to Consider: Enrollment Targets

- What is an achievable goal for health coverage gains that the state could set for its first year and for subsequent years of operating an SBM?

- What more ambitious goals for coverage or affordability could the state set for future years?

States should develop targets by analyzing data on their remaining uninsured populations. Across states, the majority of the remaining uninsured have incomes low enough to qualify for subsidized marketplace coverage or Medicaid. Data analysis should show that expanding coverage will require increasing both Medicaid and marketplace enrollment, which could boost support for program coordination.

How Do Obamacare Subsidies Work

If you make between 100 and 400 percent of the Federal Poverty Level, youll be eligible for subsidies for your Marketplace insurance. This means you will get additional savings that reduce your monthly premium amounts for your Obamacare plan. There are two types of health insurance subsidies: premium tax credits and cost-sharing reductions.

Premium tax credits help make Marketplace insurance more affordable. You can have this credit applied monthly to reduce your monthly premium costs. Or, you can opt to have this amount credited back to you at the end of the year in full when you complete your annual tax return. The amount a person receives in premium tax credits depends on their annual income and household size. You can use a premium tax credit for any metal-tier Marketplace plan.

Cost-sharing reductions are extra savings that apply only to those who enroll in a Silver-tier plan. These extra savings lower the amount a person has to pay for deductibles, copayments, and coinsurance. If you qualify for cost-sharing reductions, youll also have a lower out-of-pocket maximum.

Also Check: Does Golden Rule Insurance Cover Mental Health

Average Health Insurance Rates By Plan Type

Another distinction between plans that can change the rates you pay is the type of network the plan uses.

Depending on whether the plan is a preferred provider organization , health maintenance organization , exclusive provider organization or point of service , access to health care providers will be managed in different ways.

HMOs tend to be the most restrictive about which doctors you can see and what you must do to see them. This usually means that the insurers save on your cost of care and thereby provide lower premiums.

| Type |

|---|

Policy premiums are for a 40-year-old applicant.

What Are South Dakota’s Medicare Options For Seniors And People With Disabilities

The federal government regulates Medicare, which is generally for seniors 65 and over. However, Medicare can also be available for those under 65 years with disabilities or specific chronic health conditions like kidney failure.

In South Dakota, people receiving Medicare have two options:

- Original Medicare is the basic form of Medicare managed by the federal government. It consists of Part A , and Part B . It pays for hospital care, preventive services, durable medical equipment, and other medical services, but does not cover prescriptions. Supplemental plans are available to help with prescription costs these plans are known as Medicare Part D.

- Medicare Advantage provides all-inclusive packages. Hospital, medical, and prescription drug coverage are combined, effectively combining Parts A, B, and D. In addition, along with these bundled plans, insurers provide optional inclusions such as dental or vision benefits. Individual insurers can also offer Part D plans as stand-alone health packages.

If you choose Original Medicare, you can also purchase supplemental plans to extend your coverage. Medicare Part D covers prescription medications, while Medicare Supplement Insurance covers deductibles, copays, and other out-of-pocket Medicare costs. In South Dakota, almost 50 insurers offer Medigap plans. Federal policy obligates insurers to deliver standardized policies to cover the same basic benefits.

Eligibility

Enrollment

Recommended Reading: How Much Does Health Insurance Cost For Married Couple

Buying Your Own Health Insurance Just Got A Lot Less Expensive

If youve already bought a plan on Healthcare.gov, or you didnt because it was too pricey, act now to save money.

Last month, hundreds of millions of Americans got a cash infusion from the government as part of the American Rescue Plan.

But starting this month, another part of that law could have an even bigger effect on the wallets of tens of millions of Americans.

Thats because starting April 1, the law makes health insurance much less expensive for people who dont get it from their job, Medicare, Medicaid, or military and veterans programs.

The program, which will last through 2022, increases the financial help thats available to people who buy their own insurance through the national Marketplace at Healthcare.gov.

That includes both people who already bought a plan for this year, and people who dont have insurance right now.

That means the monthly premium for a particular plan will be lower than before for many people, much, much lower. Or, you might be able to get an even better insurance plan for what a lower-level one used to cost.

And thats on top of the fact that having health insurance can save you hundreds or thousands of dollars if you get sick or injured.

The Open Enrollment period for anyone who wants to take change or choose their plan through Healthcare.gov for this year runs through August 15. Changes to cost and coverage take effect soon after approval. You will still have to pay any co-pays, co-insurance and deductibles that a plan has.

What Is The Difference Between Obamacare And Trumpcare

Trumpcare refers to the American Health Care Act passed in 2017 by President Trump. Overall, there are not that many differences between the two bills. With Trumpcare, there is no tax penalty for not having a health insurance plan, and states are not required to offer preventative care in their marketplace plans. Trumpcare also ensured that state authority was responsible for managing Medicaid and implemented the Federal Invisible Risk Sharing Program.

Don’t Miss: How To Apply For Health Insurance As A College Student

What Is The Difference Between Bronze Silver And Gold Marketplace Plans

All three plan types cover all of your essential healthcare needs. The difference is the ratio of premium cost vs. out-of-pocket costs . Bronze plans generally have lower premiums, but higher OOP if you need a lot of care. Gold plans have high premiums that help limit OOP. Silver plans provide the best value for most people, in terms of premium costs vs. OOP – especially if you qualify for financial assistance which will further lower your premiums.

Average Monthly Obamacare Premiums Per State

While $612 was the national average monthly premium for ACA plans, its important to understand that the majority of people enrolled get subsidies in the form of advance premium tax credits .

The table below shows the state-by-state average premium for Obamacare plans in 2019, the most recent year for which data is available. It also gives the average monthly premium after the average advance premium tax credit is applied, as well as the average monthly premium after APTC for consumers who received an APTC.

| Obamacare Average Premiums for 2019 |

|---|

| Location |

| $62 |

Also Check: Is Medishare Considered Health Insurance

Premium Tax Credits Help Lower The Cost Of Your Monthly Premium

You might have heard of premium tax credits, but how does the government decide how much you have to pay and how much help you get? It all comes down to income. The Affordable Care Act has set guidelines for the maximum percentage of your income youll have to put towards your monthly premium. Those percentages are called premium caps. That cap is used to calculate the dollar amount you will have to pay and then you get a premium tax credit to cover the rest of the cost of your plan. The more you make, the higher your cap, and the less you make the lower your cap. So the lower your income the more you can get in premium tax credits. The table below shows the premium caps based on level of income.

When Can I Buy Coverage In The Marketplace

Anyone can shop for coverage and purchase or change Marketplace plans during the annual open enrollment period which occurs every fall. After the open enrollment period ends, you must wait until the next open enrollment period to buy insurance in the Marketplace unless you qualify for a special enrollment period.

Read Also: Does Health Insurance Cover Esthetician

Insurance For Individuals In South Dakota

If you are not covered by an employer job plan, you can purchase individual health plans through the Health Insurance Marketplace. Self-employed individuals without employees are also eligible for these health plans.

There are different types of plans you can choose from:

- A Health Maintenance Organization plan offers the best choice if you dont make many visits to a doctor or a specialist or require prescriptions. It has lower monthly premiums and higher deductibles. HMO plans are the least expensive plans. However, there are restrictions with an HMO plan. Youll need to get a referral if you want to see a specialist, youll need to name a primary care physician, and youre limited to using the HMO plans in-network medical providers.

- A Preferred Provider Organization plan is a better idea if you regularly visit doctors or specialists. Youll have more flexibility with a PPO plan, although youll pay more for it. You arent limited to in-network providers, you dont need to name a primary care physician, and youll never need to obtain a referral to see a specialist.

- A Point of Service Plan is a hybrid of an HMO and a PPO. You can use out-of-network providers, but any time you want to see a specialist, youll need to get a referral.

The Health Insurance Marketplace in South Dakota is small, with only two health insurance carriers providing affordable individual health insurance plans: Avera and Sanford.

Protect Consumers From Subpar Health Plans And Problematic Web

In recent years, the federal government has put consumers at risk by expanding the availability of subpar health coverage and expanding alternative direct enrollment pathways for insurers and brokers without adequate protections.

Subpar plans include so-called short-term health plans, which a Trump Administration rule allows to last up to one year or longer. These plans are exempt from ACA standards and consumer protections, meaning that they can medically underwrite applicants, exclude pre-existing conditions from coverage, and do not include all the ACAs essential health benefits. Subpar plans also include association health plans. A Trump Administration rule allows these plans to offer coverage to individuals and small businesses that is exempt from many ACA standards.

All states have the authority to block or limit subpar plans, and its especially important that states transitioning to an SBM use the opportunity to assert their authority over their markets and protect consumers. Tightening the rules for health coverage markets outside the marketplace would enable any policy advances the state makes to reach more people, while also ensuring that SBM outreach and marketing efforts dont have to compete with misleading and distracting marketing by the sellers of subpar plans. As a state seeks to boost enrollment in health coverage, it must avoid losing people to subpar plans that will leave them with high costs if they get sick.

Issues to Consider: Consumer Protection

You May Like: Where To Go If No Health Insurance