How Much Does Health Insurance Cost For A Family Of 2

In response to rising costs of health care, premiums for health insurance have increased dramatically in the last decade. Obamacare, also known as the ACA, has made health insurance more accessible for Americans. It created exchanges or health insurance marketplaces and provided subsidies to those with lower incomes.

However, most middle-class Americans dont qualify for subsidies. It is important to know if you are eligible for subsidies. If you do not qualify for subsidies, what is the average cost of non-subsidized insurance that you could expect to pay? eHealth can help walk you through health insurance costs without a subsidy, and when youre ready, get you started with an individual or family health insurance plan that fits your needs and budget

Its Helpful To Think About How Much Youll Pay For Healthcare In Terms Of Phases

The deductible phase starts at the beginning of the insurance plan year. When you get a prescription or medical service, you will either pay a copay or be billed for the full amount at that time, depending on your plan details. plans, you will pay your full bill until your deductible is met. Then copays will go into effect.)

The coinsurance phase begins after you have paid enough for healthcare services and prescriptions to meet your deductible. Your health insurance company will split the costs with you. You pay a percentage of covered healthcare service or medications, and the insurance company pays the rest . Any copays continue to be paid at the time of service.

The out-of-pocket maximum phase begins after the total of all copays, prescriptions or bills for covered healthcare services adds up to the out-of-pocket maximum amount for your plan. Your health insurance company pays 100% of the costs of covered services until the end of December.

Did you know?

Your gender and pre-existing conditions do NOT impact your premium amount, thanks to the Affordable Care Act. Your premium amount is based on your age, location, plan category and tobacco use.

Keep in mind

Tip: Plans with a lower monthly premium have higher costs for prescriptions and healthcare at the time of care.

The Average Cost Of Health Insurance In 2022

Everyone knows that health care is expensive, but just how much is health insurance for one person? The average health insurance cost per month for a 40-year-old individual is $477, or nearly $6,000 per year. However, keep in mind that premiums vary widely based on where you live, along with your age, family size and type of insurance plan.

Compare Health Insurance Rates

Ensure you’re getting the best rate for your health insurance. Compare quotes from the top insurance companies.

This national average is for private health insurance you buy on the governments Health Insurance Marketplace created by the Affordable Care Act, often called Obamacare.

MoneyGeek researched national data and analyzed how health insurance rates change based on the type of insurance plan, the number of people covered and the location of that coverage, among other factors.

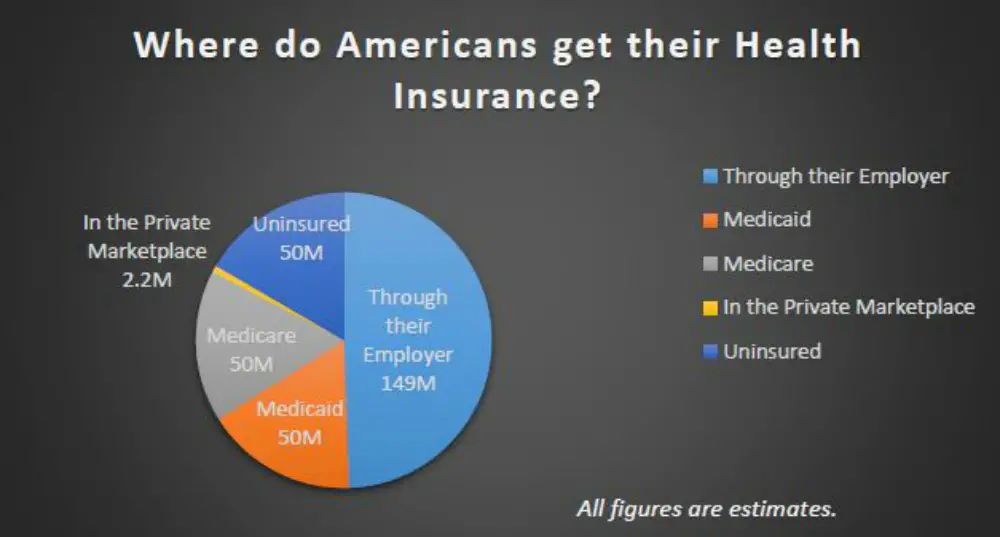

Many Americans qualify for subsidies that make buying health insurance on the Marketplace more affordable. You may also have lower-cost options if your employer offers health benefits or you’re eligible for government insurance programs such as Medicaid or Medicare, which offer comprehensive plans like Medicare Advantage for affordable prices.

Key Takeaways

The average health insurance premium for a 40-year-old is $477 per month.

Age, location, family size and plan type are all influential factors in the cost of health insurance.

Recommended Reading: A Good Health Insurance Plan

What Options Do I Have To Reduce The Cost Of Health Insurance Plans For Families

There are a number of government incentives and other programs that provide or help pay for health insurance plans for families who have trouble affording them. These include:

- ACA Subsidies The Patient Protection and Affordable Care Act, popularly known as Obamacare, provides tax credits to individuals and families who have trouble purchasing health insurance for themselves. Generally speaking, the lower your income and the more family members you have, the larger a subsidy youll qualify for. These benefits immediately go toward the cost of purchasing health insurance plans for families.

- CHIP Plans The Childrens Health Insurance Program, or CHIP, is a joint Federal-state effort to provide free or inexpensive insurance to families with children. The specific requirements for this program vary from state to state, but, in general, your family will qualify if you make too much money to qualify for Medicaid but your income is below 200% of the poverty line.

- Other Options Many states have specific programs designed to help cover the cost of health insurance for large families. Between these state programs and the federal ones listed above, you should qualify for at least some assistance if you have health insurance for a family of four and you make less than $98,400 a year.

How Does The Size Of My Family Impact My Insurance Cost

Who is this for?

If you purchase your own health coverage, this explains how the number of people covered by your insurance affects your monthly payment and other costs.

The size of your family doesn’t necessarily determine what you spend on doctors and prescriptions. A healthy family of six could spend less than a married couple with chronic conditions. But when it comes to your health insurance costs, the number of people on a plan does affect what you pay. We’ll show you how.

You May Like: How To Qualify For Low Income Health Insurance

Average Health Insurance Cost By Age And State

Healthcare has been one of the biggest talking points in politics over the past several decades. Health costs and the ability of the average person to afford them have been at the forefront of many presidential and Congressional debates — from arguments for and against the Affordable Care Act to the rise in insurance premiums to growing support for Medicare for All plan.

Many factors determine health insurance rates and premiums and what’s offered. Individuals seeking healthcare may have options provided by an employer or may get health insurance through the ACA. Depending on a person’s income and health, he may have several options to choose from or may only be able to qualify for certain plans.

With this in mind, what does the average health insurance cost?

Factors That Impact Health Insurance Rates

For a particular health insurance plan, the cost of coverage is determined by certain factors that have been set by law. States can limit the degree to which these factors impact your rates: For instance, some states like California and New York don’t allow the cost of health insurance to differ based on tobacco use.

- Age: The health care cost per person covered by a policy will be set according to their age, with rates increasing as the individual gets older. Children up to the age of 14 will cost a flat rate to add to a health plan, but premiums typically increase annually beginning at age 15.

- Where you live: Health insurance companies determine the set of policies offered and the cost of coverage based on the state and county you live in. So a resident of Miami-Dade County in southern Florida, for instance, may pay lower rates for the same policy than a resident of Jackson County, in the Florida Panhandle.

- Smoking/tobacco use: If you smoke, you could pay up to 50% higher rates for health insurance, though the maximum increase is determined by the state.

- Number of people insured: The total cost of a health plan is set according to the number of people covered by it, as well as each person’s age and possibly their tobacco use. For example, a family of three, with two adults and a child, would pay a much higher monthly health insurance premium than an individual.

Read Also: How Long Can My Dependent Stay On My Health Insurance

Digging Deeper For Pricing Information

However, it’s not universally good news. For more details, we consulted the CMS’ 2020 Health Insurance Exchange Premium Landscape Issue Brief. It indicates that 27-year-olds buying silver plans saw their premiums increase by 10% or more in Indiana, Louisiana, and New Jersey.

More importantly, it reveals that the percentage changes don’t tell us much about what people are actually paying: “Some of the states with the largest decreases still have relatively high premiums and vice versa,” the brief states. “For example, while Nebraskas benchmark plan premium decreased 15% from PY19 to PY20, the average 27-year-old PY20 benchmark plan premium is $583. On the other hand, while Indianas average PY20 benchmark plan premium increased 13% from PY19, the average 27-year-old PY20 benchmark plan premium is $314.”

In 2021, that trend continues. The 2021 edition of the CMS Brief notes that, for example, while Wyomings average benchmark plan premium decreased 10% from PY20 to PY21, the average 27-year-old PY21 benchmark plan premium is $648the highest in the U.S. How many 27-year-olds can afford that kind of monthly premium? By contrast, New Hampshire’s benchmark plan premium for a 27-year-old is the lowest in the nation at $273.

Use Obamacare For Early Retirement

Whether you love the program or hate it, for a few years, Obamacare did make early retirement health insurance costs much more affordable.

One of the ideas behind Obamacare was that everyone could get insurance preexisting conditions were not a factor. This was especially useful for people in their 50s and 60s most of whom have had or are facing some kind of health issue.

While you can still get coverage if you have a preexisting condition, Obamacare insurance has gotten a lot more expensive and the future of the program is in flux.

Many insurers have significantly raised premiums, in part because the Trump administration decided to stop payments to insurers that cover the discounts they are required to give to some low-income customers to cover out-of-pocket costs.

Nonetheless, if you are retiring early, it is still worth it to explore your Obamacare health coverage options on healthcare.gov.

Recommended Reading: What Is Standard Health Insurance

How Do Us Health Insurance Costs Stack Up Globally

Voluntary healthcare payments including for private health insurance totalled more than US$1,685 per capita in the USA in 2019.

This is lower than the figure in Switzerland, where voluntary payments were worth US$2,745 per capita. Check out how much medical treatment can cost abroad.

However, the USAs private spending continues to soar far above that in many other nations. American private health spending is five times higher than Canadas, for instance.

How Premium Costs Have Changed In Recent Years

In recent years, healthcare costs have kept rising for both individuals and families in the U.S. This is also true for monthly and annual insurance premiums. The average yearly premium for a family has increased by more than 25% since 2015, and it’s increased by over 60% since 2010.

Healthcare spending in the U.S. grows each year. Projections estimate yearly annual spending of nearly $6 trillion by 2027, 50% increase compared to the $4.1 trillion spent in 2020.

Also Check: Can You Get Health Insurance

Different Levels Of Coverage

Okay, stay with me here. I’m almost done with this marathon investigation into all things health insurance. I looked at the different types of plans, but theres a little more to it before we put a bow on all this.

When it comes to marketplace health care plans, there are four different levelsbronze, silver, gold and platinum. Think of them like medals at the Olympics. These tiers give you different options on how much your plan will actually pay out versus how much youll pay. Also keep in mind they dont reflect quality of care.14

Generally speaking, plans with a lower monthly premium will mean a higher deductible, and vice versa.

Bronze is one step up from a catastrophic plan. They give you lower monthly costs, but more out-of-pocket expenses.

Silver offers lower deductibles and out-of-pocket costs than Bronze, but youll pay more in monthly premiums. And depending on your income, silver plans also come with discounts called cost-sharing reductions where the provider could cover costs up to the 90% mark.

Gold plans have high monthly premiums but low deductibles, coinsurance and out-of-pocket costs.

Platinum is the highest monthly premium out there, with the lowest out-of-pocket costs. This type of coverage means youre really putting all your eggs in that big monthly premium basket! But having a lower deductible means your insurance company will start covering those crazy health care expenses a lot sooner.

Factors That Affect Premiums

Many factors that affect how much you pay for health insurance are not within your control. Nonetheless, it’s good to have an understanding of what they are. Here are 10 key factors that affect how much health insurance premiums cost.

Investopedia / Ellen Lindner

The coverage offered by employers contributes to several of the biggest factors that determine how much your coverage costs and how comprehensive it is. Lets take a closer look.

Recommended Reading: How To Find My Health Insurance

Health Insurance Costs By Tier Of Plan

| Plan Tier | Percentage of costs covered by the plan | Who it’s best for |

|---|---|---|

| 100% after out of pocket maximum is reached | Those who only want coverage in case of an emergency | |

| Bronze | Healthy people who do not go to the doctor often | |

| Silver | People who qualify for tax credits | |

| Gold | People who often seek medical care | |

| Platinum | Those who use a lot of care and can afford a high monthly fee |

How To Find An Affordable Plan That Meets Your Needs

Among eHealth customers who bought ACA individual health insurance, more than 75% chose Bronze or Silver plans. Your state may host an exchange for comparing and purchasing ACA plans or it may use the federal exchange at Healthcare.gov. Keep in mind, you arent limited to the exchange.

The licensed insurance brokers at eHealth can help you find the best health plan to meet your health coverage needs and your budget. They will listen to your priorities in health coverage and use their expertise to match your needs with health insurance options both on and off the exchange.

Read Also: How Much Does A Federal Employee Pay For Health Insurance

How Much Does Health Insurance For Families Cost

When it comes to providing for your loved ones, family health insurance is something you have likely thought through very carefully. The burden of protecting your families health and protecting your finances from unexpected medical bills can be lightened by having a family health insurance policy.

Whether its just for you and your partner, or you need health insurance for a family of dependents, eHealth has the tools and variety of options that you need in order to find a family health insurance plan. Our brokers are licensed in every state to help you find the right coverage for your needs and budget, all at no extra cost. You can enroll in one of our plans by phone, on our website, or through our live chat, making it easy and convenient to get the best plan for your family. Contact us for more information today.

Although health insurance for families will have different price points based on factors like plan type, level of coverage, number of dependents, and where you live, you can look at the average cost of family plans as a useful reference.

What Are The Total Health Care Costs Under Obamacare

Health insurance premiums are just one part of total health care costs. This applies if you get an Obamacare plan or have employer-sponsored coverage. When choosing a plan, make sure to consider other factors such as health insurance deductibles, copayments, coinsurance, out-of-pocket maximums, and network coverage. Sometimes a plan with higher premium will actually cost less when you incorporate health care costs. Especially if you can apply a subsidy.

Try to estimate what sort of medical services youll need, considering healthcare services you currently use, or anything youll need in the future. When you compare plans, youll be able to see premiums and health care prices associated with each and can use that information to calculate which plan is best for you.

If you need help enrolling in health insurance, give us a call at .

Recommended Reading: How Long Can You Go Without Health Insurance In Massachusetts

Is Employer Coverage Cheaper

Many people assume that employer coverage is the best or cheapest option. In 2020 an estimated 157 million people opted for their employer-based health care plan.4

But is it? Should you always choose your employers health coverage or should you opt for individual health insurance?

Employer plans can sometimes be less expensive since the company chips in part of the costs. Your employer can also sometimes get a better rate because theyre buying a large block of insurance packages. But not always. It can sometimes be cheaper to get health insurance on your own. While it might take a little more work on your end, if youre looking to save money on your health insurance costs, you might want to pass on the employer coverage and shop for an individual plan.