What Is Open Enrollment And How Does It Work

Open enrollment is when individuals can sign up for, renew, or make changes to their health insurance plans in the individual market, as mandated by the Affordable Care Act . During this time, employees can sign up for the companys health, life, disability, vision, and dental plans, among other possible benefits.

The open enrollment period typically begins in the first week of November and concludes in the second week of December for coverage to start on January 1 of the following year. While the deadline for enrollment in most states is December 15, citizens of several states have until January or February to secure health insurance.

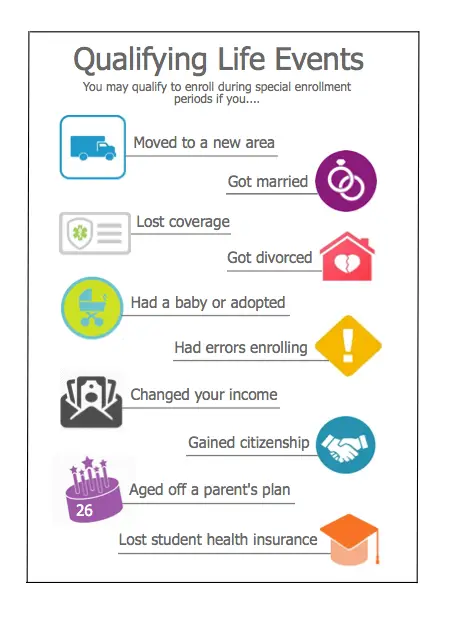

Case-specific circumstances may also necessitate the implementation of a special enrollment window. A person can enroll in or switch health plans outside the annual open enrollment period if they have a qualifying life event, such as tying the knot or having a baby.

Your clients should be encouraged to take stock of their employer-sponsored benefits during open enrollment and ensure they provide a competitive benefits package that will attract and retain top employees. One of the most important things a business can do for its success is to review its perks annually and make any necessary adjustments.

What Are Your Health Insurance Options

Depending on your situation, you have the following options during open enrollment:

Renew your current policy:

You can keep your current health insurance as long as it’s still offered. You may not have to do anything if you want to keep what you have. But your current plan may be changing. Watch the mail for a letter about any changes your plan intends to make in 2023.

Changes might not be acceptable to you. For instance, your doctor leaving the provider network or your medications not being covered any longer. You want to look for a plan that better suits your needs. If you need to switch, open enrollment is the time.

Buy an individual policy through a marketplace or directly from an insurance provider:

You can buy an individual health plan through the ACA marketplace or directly from an insurance provider.

ACA plans are eligible for tax subsidies plans bought directly from an insurance provider outside of the ACA marketplace aren’t eligible for those subsidies. Find out more about ACA subsidies.

Another option for people with low incomes is Medicaid. More than three dozen states expanded Medicaid eligibility, allowing people with incomes 138% of the federal poverty level to get Medicaid.

Make changes to your employer-based group health insurance:

If you get your health insurance through your employer, the open enrollment period for the government-run marketplaces and Affordable Care Act plans won’t affect you.

Change your Medicare plan:

Buy a short-term health plan:

What Are The Eligibility Requirements For Open Enrollment

If you are seeking insurance coverage during the open enrollment period, you will need to meet certain eligibility requirements in order to qualify. These requirements vary by state, but generally speaking, you will need to be a U.S. citizen or legal resident, have a Social Security number, and not be currently incarcerated. You will also need to provide proof of income and residency.

You May Like: How To Cancel Florida Blue Health Insurance

Option : Look Into A Primary Care Membership

Concierge medicine is primary care offered directly to consumers and employers without third-party insurance administration. In practices operating on a concierge membership model, patients pay a monthly or annual retainertypically between $60 and $100 per monthto their doctor or medical office for a contracted bundle of services.

While it wont cover surgery and other specialized care, concierge medicine offers a solution for people without coverage to receive routine, preventative care. Cheaper than traditional plans, membership medicine also tends to have more predictable out-of-pocket costs. That said, patients using concierge medicine will still need to pay out-of-pocket to treat critical illnesses, or catastrophic occurrences such as a heart attack, stroke, and physical trauma. On the plus side, however, these practices offer personalized care, streamlined billing, and priority scheduling to patients.

Why You Can’t Buy Health Insurance Anytime You Want

Why signing up for benefits is limited to the open enrollment period

Have you tried to sign up for health insurance only to be told youre not allowed to buy health insurance until open enrollment? If you go to a car dealership to buy a car, the dealership doesnt refuse to sell you a car until next November.

But with most types of health insurance, you can’t buy a policy whenever you want. This is true whether you’re trying to buy a health plan on the Affordable Care Act health insurance exchange in your state , enroll in the plan your employer offers, or even sign up for Medicare.

Health plans limit enrollment to the open enrollment period in order to discourage adverse selection.

Adverse selection happens when sick people sign up for health insurance, but healthy people dont. It skews the amount of risk a health plan takes on when insuring someone, so the entire health insurance industry tries to prevent it.

Read Also: Does Health Insurance Cover Marriage Counseling

I Am Losing My Current Health Insurance Do I Have To Wait Until Open Enrollment To Enroll In A New Health Insurance

Typically, losing health insurance is considered a qualifying life event. This includes losing health insurance through a job, becoming ineligible for MassHealth or ConnectorCare, or aging out of your parents plan when turning 26.You have 60 days from the date when you lose your health insurance to enroll in new health insurance.

It Depends On The Type Of Insurance And When You Enroll

The first thing you need to know before buying health insurance is that signing up for health insurance coverage isnt the same thing as having coverage in effect. You may be able to enroll in a health plan today, but that coverage may not take effect for several weeks.

If you lost your employer-sponsored health insurance in 2021, youve got options that include subsidized individual-market coverage.

In the ACA-compliant market, private health plans can only have first-of-the-month effective dates , and depending on where you live and the date that you apply, your effective date could be the first of the second following month .

But plans that arent regulated by the ACA can offer effective dates as soon as the day after you apply. And Medicaid can backdate your effective date to the start of the month in which you apply, or even earlier in many states. Your effective date really depends not just on when you apply, but also on the type of coverage youre getting.

So what are your options for getting coverage thats effective ASAP?

Also Check: What Do Expats Do For Health Insurance

Special Enrollment: How To Get Health Insurance After Open Enrollment

A special enrollment period is usually only available to people with qualifying life events, such as losing their coverage, having a child, getting married or moving. You can go to healthcare.gov to get started during this special enrollment period. If your state has its own marketplace, the federal site will connect you to the state website.

While on the federal or state site, you enter information, such as where you live, your household income and the number of people in the household. The site provides you with plan choices and cost estimates for the plans. Those cost estimates will include any potential cost-reducing subsidies that can reduce the cost of your coverage.

People with income up to 150% of the federal poverty level can sign up for marketplace coverage every month. The Centers for Medicare and Medicaid Services estimates that about one-third of marketplace plan members will qualify for this monthly special enrollment period.

Your employer will also grant you a special enrollment period with a qualifying life event. Check with your HR department for details.

Who Can Request An Open Enrollment Waiver

-

Massachusetts residents who missed the last open enrollment period and have not experienced a qualifying life event may request an open enrollment waiver. The Office of Patient Protection reviews waiver requests and typically grants open enrollment waivers to individuals and families who:

-

Are uninsured and did not intentionally forgo enrollment in health insurance, or

-

Lost health insurance but did not find out until after 60 days had passed.

You May Like: When Is The Deadline For Health Insurance

Recommended Reading: How Much Does Health Insurance Cost In Wisconsin

I Could Not Afford To Purchase Health Insurance Until Now Can I Get An Open Enrollment Waiver To Enroll Now And Avoid Any Additional Penalty

You may request an open enrollment waiver, but you will need to explain why you did not buy health insurance during the last open enrollment period.

If you could have applied for health insurance coverage during open enrollment and did not do so, then you may have to wait for the next open enrollment period to buy insurance.

Ask Your Association School Or Church

Some membership associations and churches offer group plans to their members. Colleges often offer plans to their students. Because group plans spread costs out over more people, theyre usually less expensive than plans you buy directly from an insurance company or agent.

Note: Health care sharing ministries arent regulated by the state, and there is no guarantee they will pay claims.

Don’t Miss: Is There A Grace Period For Health Insurance After Termination

Can I Get A Subsidy To Help Cover The Cost Of My Health Plan

Congress has yet to decide how the subsidy program will work in 2023. If something isnt done, its expected that 13 million Americans who get insurance through the Affordable Care Act marketplace will see their insurance rates rise significantly and 1 million Americans could see their health insurance costs double. But this is a worst-case scenario.

Marketplace Special Enrollment Period

A qualifying life event for a Special Enrollment Period is defined as:

- A change in household

- A change in residence

- A loss in coverage

- Becoming a U.S. citizen

- Gaining membership in a federally recognized tribe or status as an Alaska Native Claims Settlement Act Corporation shareholder

- Starting or ending service as an AmeriCorps State and National, VISTA, or NCCC member

In order to find out if you qualify for a Special Enrollment Period for Marketplace plans, visit healthcare.gov to answer a few questions. If you do qualify, begin by filling out an application on the governments website, along with visiting this section of the site to review the current plans and pricing.

Also Check: Can You Have Two Types Of Health Insurance

What Happens If I Want To Buy Health Insurance Outside The Open Enrollment Period

Once that Open Enrollment window closes, things change for consumers in need of individual or family health insurance. To purchase ACA-compliant insurance plans on the exchange, you must meet the criteria for special enrollment. Healthcare.gov defines Special Enrollment Period as the time outside of the private health insurance open enrollment period that people with special circumstances can buy individual and family policies.

You may be eligible for special enrollment if you have a qualifying life event. Some qualifying events include:

- A recent marriage

Is Open Enrollment The Same For All Companies

No. If youre getting your health insurance from an employer, there is likely going to be a short window of time for your open enrollment, but it can be at any time of the year and for any length of time. Thats up to your employer. Typically, an employers open enrollment period lasts two to four weeks.

You May Like: What Should I Be Paying For Health Insurance

Can I Get Insurance After Open Enrollment

Open Enrollment for health insurance usually occurs between November and December, but what if you miss that window? Are you stuck without health insurance for the rest of the year? The answer is no. You can still get coverage after open enrollment if you qualify for special enrollment periods. In this blog post, well discuss what qualifies you for a special enrollment period and how to get insurance after the regular open enrollment period has passed. Youll also learn about other options for avoiding the penalty of not having health insurance. Read on to learn more.

Enroll In Medicaid Or Chip

Medicaid and Children’s Health Insurance Program enrollment are available year-round. So if you or your kids are eligible, you can sign up anytime. Eligibility is based on income, and it varies considerably from one state to another.

You might find that the income limits for eligibility, especially for CHIP, are higher than you had expected . So if you’re uninsured and have missed open enrollment, be sure to check to see if you or your kids might qualify for Medicaid or CHIP before you resign yourself to being uninsured for the rest of the year.

And if you’re in New York or Minnesota and your income doesn’t exceed 200% of the poverty level, Basic Health Program coverage is available year-round.

Recommended Reading: Where To Apply For Cobra Health Insurance

What Insurance Plans And Benefits Are Available

Under the ACA, insurers in all states are required to provide essential health benefits for a range of medical treatments from routine check-ups to surgery. Also, you can not be denied coverage because of a preexisting condition.

Whats covered:

- Substance abuse services

The 2023 plans on the health insurance marketplace will cap out-of-pocket maximums at $9,100 for individuals or $18,200 for families. Even if you have significant health care needs, you wont pay more for medical care than your plans listed out-of-pocket maximum.

This is an important protection that isnt offered with policies that have more limited benefits, such as short-term health insurance or indemnity plans like Sidecar Health.

On the marketplace, plan levels can help you choose the right coverage for your situation:

Bronze plans

- Cheapest monthly costs but generally have high deductibles, and youll pay a higher portion of your medical expenses.

- Best for those who are young and healthy or who dont expect to need significant medical care.

Silver plans

- Most expensive plans that give you the most savings on medical expenses.

- Best for those who expect to need significant medical care.

Is there a health insurance mandate in 2023?

Huge Savings On Health Coverage Available

You may be eligible to save on health coverage through HealthSource RI due to the American Rescue Plan Act of 2021. Under the federal law, most HSRI customers may qualify for financial help to lower their monthly coverage cost even those who werent eligible in the past. Additionally, customers who previously did not qualify to receive financial help may now qualify to receive financial help.

In 2022, over 30% of HealthSource RI customers paid less than $10 a month for their health coverage. HealthSource RI can also connect you to low- or no-cost coverage.

Due to the federal Inflation Reduction Act, eligible HSRI customers may continue to see lower monthly costs through at least 2025.

Dont Miss: What Is The Cheapest Health Insurance Plan

Don’t Miss: Do I Have To Offer Health Insurance To All Employees

What If I Miss Open Enrollment

If you miss the open enrollment period, you may be able to secure health insurance either during a special enrollment period or through Medicaid and the Childrens Health Insurance Program .

- Special enrollment period. Once open enrollment ends, you can only enroll in or change marketplace health plans if you qualify for special enrollment. Certain life events may make you eligible for special enrollment . Visit the Health Insurance Marketplace and use the online screener to see if you qualify.

- Medicaid and CHIP.Medicaid and CHIP are free or low-cost health coverage options that do not have open enrollment periods, meaning you can enroll during any time of the year. Eligibility for both programs is primarily income based, but other factors may help you qualify .Medicaid benefits vary from state to state, but there are certain benefits each program must have, such as coverage for inpatient and outpatient medical services, lab and X-ray services and physician services. Learn more about Medicare and CHIP, including how to qualify and apply for benefits, here.

Its important to understand the details of open enrollment and the health insurance options available to you. Be sure to review the terms of any existing coverage carefully so that you can be ready when its time to renew or change your plan.

Special Enrollment Periods For Health Insurance

You need to sign up for health insurance during open enrollment, but there are a limited number of ways that you can get health care during other parts of the year. If you don’t enroll during open enrollment, you’re eligible for a special enrollment period if:

- You get married

- You get divorced and were getting your health insurance through your spouse’s employer

- You have a baby, adopt a baby or place a child for adoption or foster care

- Your spouse or partner dies and that leaves you without health insurance

- Your spouse or partner loses a job and you had coverage through their employer

- You lose your job and had coverage through your work

- You are no longer a full-time employee eligible for workplace coverage

- You are in an HMO and move outside its coverage area

- You leave jail or gain citizenship

If you voluntarily drop your coverage, you won’t qualify for a special enrollment period. The only time you can re-enroll is during open enrollment.

If you apply for a special exception and are rejected, you can appeal the decision to the Health Insurance Marketplace.

You May Like: What Is The Tax Fine For No Health Insurance