How Does Third Party Health Insurance Work

The most commonly used term in insurance is third party adminstrator. Mostly TPA works as a unit of health insurance companies, but in some instances, they also work independently. TPA in health insurance helps in claim assistance, processing claims, and providing cashless facilities to the policyholder.

Do All Mutuals Practice Third

Most mutuals practice third-party payment.

To benefit from it, all you have to do is inform your compulsory scheme fund which will set up the remote transmission between them and the complementary body.

This allows you to benefit from full third-party payment for the care provided by your guarantees.

Depending on your needs, it may be interesting to take out additional health insurance so as not to have to pay excessively high costs for often very expensive dental or optical needs.

I find the right health insurance by comparing free and simply

Best Health Insurance Plans For 2023

Compare and choose the best health insurance plan for you from a range of top- rated plans that cover all your needs.

Introduction

The years of fast food binging, limited workouts, and irregular sleep cycle is slowly catching up to us. The result – multiple health complications that require expensive and immediate medical attention. This means – a significant financial dent in the savings of individuals.

Fortunately enough, people are getting smarter. They are taking hints from past cases and opting for healthy lifestyle choices and habits. However, a healthy lifestyle isnt sufficient. Falling sick or a visit to the hospital over a surprise medical complication cant really be anticipated hence, the increased purchase intent towards health insurance plans.

But, as the demand for insurance coverages increases, so does the number of players in the market. While at an initial go, almost all plans seem appealing, the truth is far from the surface. Since this is a serious financial decision that is going to affect your medical treatment access and quality, uncovering some unfavorable truth regarding your insurer or the plan wouldnt be ideal.

Hence, for 2023, heres our New Year Resolution – a list of the most trustworthy, result-yielding, and best health insurance plans for 2023, as has been researched by our industry experts.

Recommended Reading: Can You Put Your Girlfriend On Your Health Insurance

Where You Can Find Short

- UnitedHealthcare is a leading health insurance company that offers short-term health insurance plans in several states. The companys short-term plans provide temporary coverage for unexpected medical expenses and are designed to bridge the gap between other forms of coverage .

- Blue Cross Blue Shield is a national network of independent health insurance companies that offer short-term health insurance plans nationwide. BCBSs short-term plans offer a range of deductible and copayment options and can be tailored to your specific needs.

- Cigna is a global health insurance company that offers short-term health insurance plans in many states. Cignas short-term plans provide coverage for unexpected medical expenses and can be a good option for individuals who are between jobs or waiting for other coverage to start.

What Is A Tpa

TPA is the abbreviation for Third-party Administrator. As the name suggests, it is someone or some organization that is a third party and an administrator. This brings up the question: what is a third-party administrator? The simple answer is someone who is not the first or the second party in a health insurance contract and assists in the administrative aspect of the services mentioned in the contract.

For example, Health TPA is someone engaged in administering services related to health insurance.

Don’t Miss: Can I Decline My Employer’s Health Insurance

Employer Vs Individual Health Insurance Plans

In the past, most people had employer health insurance. Their company did all of the research, chose the insurance company and picked plan options for employees. This is also called group coverage or group insurance. But, a lot has changed in recent years.

- Challenging economic times have forced many employers to cut costs.

- Rising healthcare costs have made it difficult for companies to pay for health insurance.

- New and more expensive technologies, treatments and drugs have emerged, adding costs.

Due to these factors and others, a growing trend is for individuals to either partially or fully pay for their own health insurance. Even if employer-based group health insurance is still an option for you, you may wonder if you should purchase health insurance on your own, buying what is called Individual Health Insurance, or Personal Health Insurance.

To help you understand your options, well look at both individual and employer-sponsored plans, explaining and comparing them.

High Standards Across The Board

The Third Party Management Program applies to those suppliers or entities performing specific services on Cignas behalf. The goal of the Third Party Management Program is to ensure that our customers, members, and/or providers receive a comparable level of service, as though received from Cigna directly.

If an entity or supplier’s services fall under one of the following categories this higher level of supplier management will apply.

This policy applies to:

- Delegated healthcare provider arrangements

- National or regional specialty provider arrangements

- Third-party administrator arrangements, shared administration arrangements

- Outsourced business processes or functions.

This policy does not apply to:

- Traditional direct contracts with physicians, non-physician providers, ancillary providers, retail pharmacies or facilities

- Legal-related services

- Persons or entities retained by the Cigna Board of Directors or any of its committees

- Outsourced functions that do not affect key stakeholders

Third party management standards

At a minimum, third parties within the management of this program should expect:

- Execution of confidentiality agreement

- On-site visit and due diligence activities prior to contracting

- Risk assessment activities

- Contract negotiation with involvement of Cigna Sourcing and Legal professionals

- Creation, implementation and monitoring of performance metrics

- Minimum annual review of relationship

You May Like: How Much Does Single Person Health Insurance Cost

Finding The Right Tpa

Third-party administrators manage the majority of United States workers under self-funded health insurance programs. If, as an employer, you opt to work with a third-party administrator, you will be giving them access to your assets. Therefore, finding the right TPA is imperative to your operations.

Do your research before you commit to a TPA. Some employers contact consultants to help them find a good TPA, while others approach the TPAs themselves.

Find a creative, innovative TPA capable of customizing health plans to meet the exact needs of your employees. Before you start a third-party administrator firm, find out the licensing requirements in your state.

To find health insurance quotes solo, enter your zip code below and get instant quotes for free!

The Pressing Need For Tpas

According to analysts of the industry, TPAs have the potential to bring about the following changes:

- Improved quality and delivery of services

- A higher level of standardisation

- Enhance the informational foundation of healthcare services

- New management system

- Increased numbers of people with health insurance

- Minimise costs/expenditure

- Streamline the research by developing procedures that can help you avoid avoidable delays.

- Create conditions that will lead to reduced insurance prices.

Despite this, there is a significant gap between the goals of TPAs and the reality of their day-to-day operations in the field. Consequently, it is not yet clear whether or not TPAs are effective in the rapidly expanding and intricately regulated health insurance market.

Also Check: Can You Change Your Health Insurance Plan After Open Enrollment

Quick Answer: What Is Third Party Health Insurance

Third-party health insurance is defined as insurance coverage in which a third party, namely the insurance company, pays the actual provider of healthcare services for services rendered to the employee. Third-party insurance is the most versatile and comprehensive option for health insurance.

How We Conducted This Study

In May and June 2016, we conducted more than 20 interviews. Key informants included nonprofit program administrators, funders of TPP programs, carriers, and consumer groups involved with programs operating in Dane County, Wisconsin the Research Triangle area of North Carolina Portland, Oregon and Washington State, including locally sponsored programs based in Seattle and Pierce County.

We also interviewed Washington marketplace officials involved in TPP program administration. Informants were promised confidentiality. Telephone interviews used semistructured protocols to explore program history and structure effects on consumers and other stakeholders and possibilities for future expansion. Each interviewee had an opportunity to review and comment on the portions of a draft report that concerned the programs discussed by the interviewee.

1. Namrata Uberoi, Kenneth Finegold, and Emily Gee, Health Insurance Coverage and the Affordable Care Act, 20102016 , .

2. Robin A. Cohen, Emily P. Zammitti, and Michael E. Martinez, Health Insurance Coverage: Early Release of Estimates from the National Health Interview Survey, 2016 , .

Recommended Reading: Can You Get Health Insurance With No Income

Where You Can Find Individual Health Insurance Plans:

- The Affordable Care Act Marketplace: You can compare and buy ACA plans on the government-run ACA Marketplace, generally referred to as the health insurance exchange or healthcare.gov. Use the ACA Marketplace to select plans that suit your needs and price range.

- Medicaid: People and families who are considered low-income can receive coverage through Medicaid, a government-run health insurance program.

- Medicare: Medicare is a federal health insurance program for those who are at least 65 years old, or who have certain disabilities. If you meet the eligibility criteria, you can enroll.

- UnitedHealthcare: A variety of coverage options are available from UnitedHealthcare, including life, medical, dental, and vision insurance. Through a network of partner physicians, medical facilities, and other healthcare professionals, the firm offers coverage to individuals, families, and employer groups. The business also provides consumers with extra perks and resources, such as online tools and support to help them manage their health and healthcare expenses

How To Obtain Third

Small business owners who want to obtain third-party health insurance for themselves and their employees may do so directly from insurance companies, or they may join purchasing groups. Purchasing groups often allow each employee or partner of a participating employer to choose between a number of insurance policies with different benefits.

A small business, on the other hand, is usually able to enter into an agreement with only one insurance provider. Employers may pay the entire premium for their employees, or they may make partial contributions to the cost of their employees’ third-party health insurance policies.

References

Recommended Reading: What Is State Exchange Health Insurance

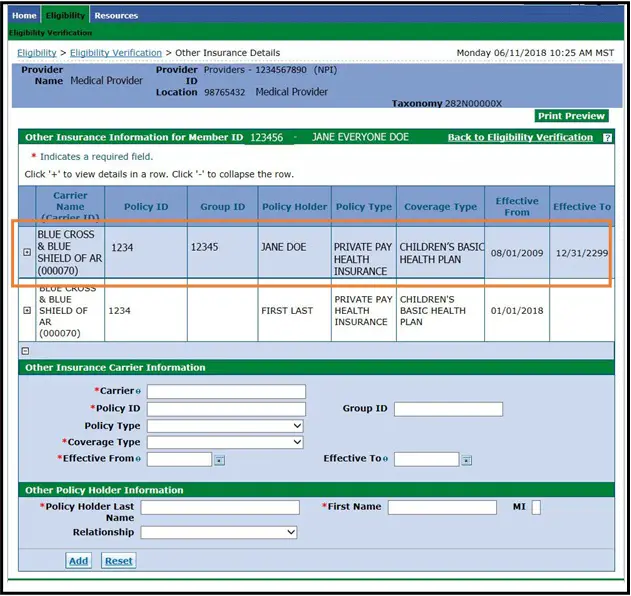

Third Party Liability Carriers

The TPL Carriers are the health insurance companies with which OHCA maintains a third party resource/billing relationship. Third parties include but are not limited to, private health insurance, casualty insurance, worker’s compensation, estates, trusts, tort proceeds and Medicare.

The list below includes the OHCA carrier number and carrier billing address.

Health Insurance Premium Payments

The Health Insurance Premium Payment program is a program that may pay for the cost of your health insurance premiums, when the cost to the Medicaid Program for the health insurance premium are less than Medicaids total cost of care.

Under HIPP Program guidelines, medical services must be covered by the recipients private insurance first, while Medicaid covers remaining expense.

Read Also: What Insurance Does Aurora Health Care Accept

Role Of Third Party Administrator

The role of third party administrator in health insurance is as follows:

What Are The Alternatives

The main alternative to third-party health insurance is direct health care coverage or self-insurance, in which an employer undertakes to pay healthcare providers directly for any expenses incurred by its covered employees. This is not feasible for most small businesses, as large employers who provide direct coverage usually negotiate price reductions based on the large number of patients for whose care the employer will take responsibility. Employers who self-fund health insurance coverage usually find it practical to set aside a certain amount of money in a trust fund to cover expenses. This is also not feasible for most small businesses.

Recommended Reading: Can I Get Private Health Insurance Anytime

Report Third Party Insurance

The Division of Medicaid by law is intended to be the payer of last resort that is, all other available third party sources must meet their legal obligation to pay claims before the Medicaid program pays for the care of an individual eligible for Medicaid or CHIP. Medicaid/CHIP recipients and providers are required to report any third party health-related insurance coverage to the Division of Medicaid. Any changes must be reported within ten days of the change.

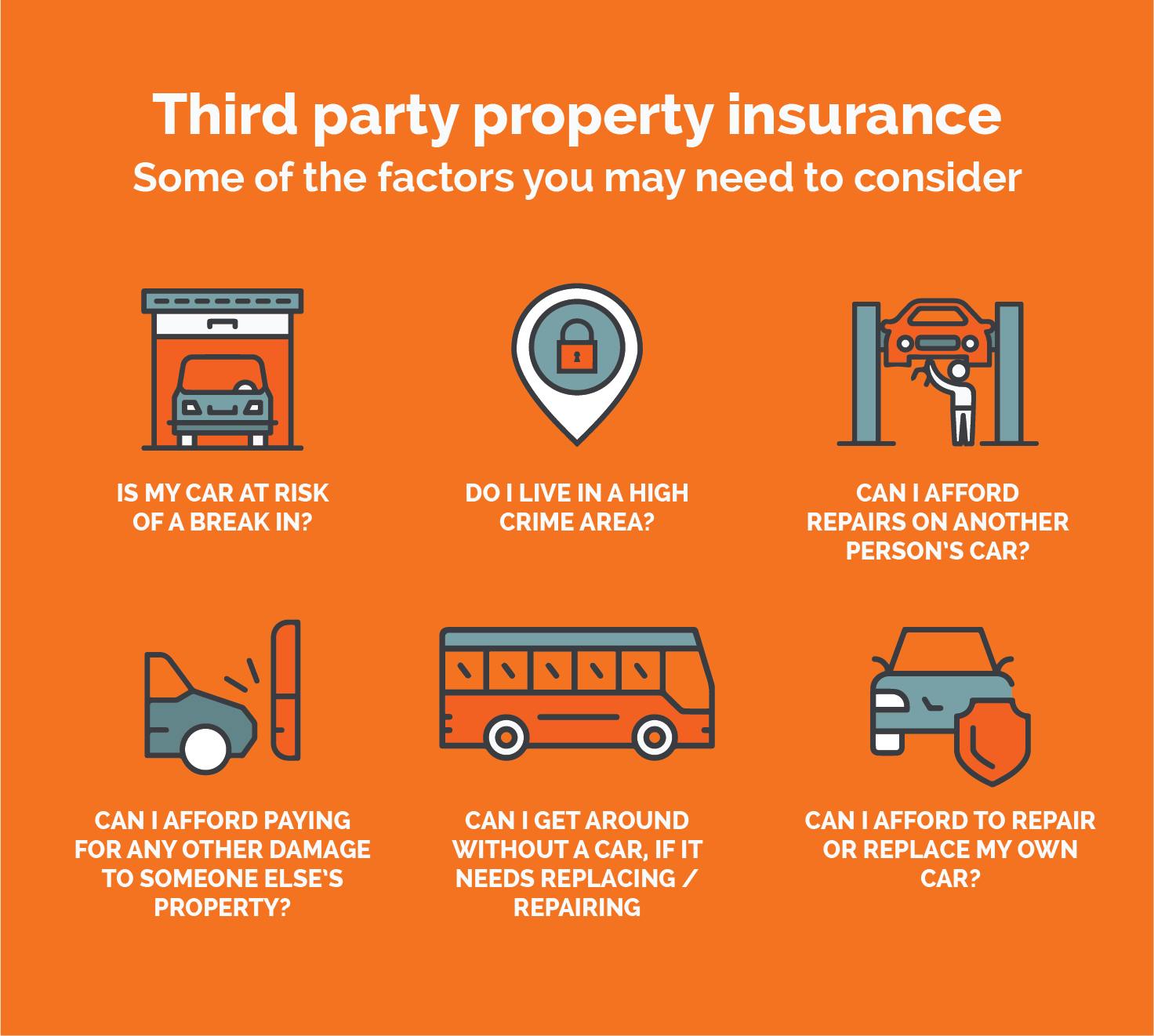

What Is An Example Of Third

We will begin our example of third-party insurance with a few definitions to help us better understand this type of coverage.

Third-party insurance is a type of coverage used when you make a claim on another partys insurance policy. As we mentioned before, there are three components to this policy.

- First-Party: The person who purchased and is named on the insurance policy. In the case of first-party coverage, this is you.

- Second-Party: The insurer the policy was purchased from.

- Third-Party: The person making a claim against anothers insurance policy. This could be you if you are making a claim on somebody elses policy.

Now that we understand what first, second, and third-parties are, let us continue with our example.

Imagine you get into a car accident and are not the one at fault. The investigation finds that the other driver in the accident caused it and they are responsible for the damages.

Since you were not at fault, you do not have to make a claim on your insurance policy. Instead, you make a claim on the third-partys policy to cover the costs.

Read Also: How Much To Employers Pay For Health Insurance

Combined Single Limit Policy

A combined single limit policy offers one coverage limit. Lets say you took out $200,000 of combined single limit coverage. In the event of an accident, you can split this coverage between different types of damages. For example, youd be covered in these instances:

One persons medical bills total $150,000, and theres $30,000 in property damage.

The medical bills of four people total $200,000.

You caused property damage that costs $180,000. You also need to pay for someones medical bill of $15,000. All of those costs are $200,000 or less, so your insurance will cover them.

Medicare Secondary Payer Recovery

MSP is the term used by Medicare when Medicare is not responsible for paying first. The MSP statute and regulations require Medicare to recover primary payments it mistakenly made for which a GHP is the proper primary payer.

If Medicare paid primary when the GHP had primary payment responsibility, the Commercial Repayment Center will seek repayment by issuing a recovery demand letter to the employer with a copy to the insurer or TPA, if known. The demand letter includes information on the claims repayment demanded and the claims detail. The demand letter explains how to resolve the debt, either by repayment or presentation, and documentation of a valid defense. An employer may authorize an insurer or TPA to respond on its behalf, but may not transfer responsibility for a debt to the insurer or TPA. Additionally, if the insurer or TPA submits a check or a response but has not submitted documentation establishing its authority to act on behalf of the employer to resolve the debt, responses will only be addressed to the employer. Please note that in some instances an insurer or TPA has a defense that does not necessarily absolve the employer of responsibility for the debt .

For more information on the processes used by the CRC to recover mistaken primary payments, click the Group Health Plan Recovery link.

For more information on the processes used by the CRC to recover conditional payments, see the Insurer NGHP Recovery page.

Don’t Miss: Will Health Insurance Cover A Breast Reduction

What Is Limited Third

Third-party insurance is also called liability insurance and is the part of your car insurance coverage that pays for the injuries or damage you cause in an accident. When youre buying third-party auto insurance, youll need to choose the amount of coverage you want. Your policy will either be a split limit or a combined single limit.

What Is A Tpa In Health Insurance

The scope of health insurance is a lot wider than other general insurance categories like vehicle or travel insurance. Due to this wide scope, health insurance involves a plethora of terminologies. This is the reason why probably potential and current policyholders perceive health insurance to be filled with complexities. From the outset, this does seem intricate, entangled, and maze-like. But it is simple to understand if you focus on one component at a time instead of getting overawed by the entirety of it. For example, not everyone might know about the concept of Third-party Administrators in health insurance.

A TPA in health insurance is an entity that is a third party in a health insurance agreement and administers the claim settlement aspect of the contract between a policyholder and the insurer. Here are some points that will help you understand TPA in a better manner.

-

TPA is a link between the insurer and the insured in the case of a hospitalization claim.

-

TPA is chosen by the health insurance company.

-

TPAs facilitate the claim settlement process by administrating tasks such as dealing with documents and settling hospital bills.

-

Insurers associate with TPAs for a smooth claim settlement process.

-

One TPA can be associated with several insurers.

Recommended Reading: Can I Have Two Health Insurance