Digging Deeper For Pricing Information

However, it’s not universally good news. For more details, we consulted the CMS’ 2020 Health Insurance Exchange Premium Landscape Issue Brief. It indicates that 27-year-olds buying silver plans saw their premiums increase by 10% or more in Indiana, Louisiana, and New Jersey.

More importantly, it reveals that the percentage changes don’t tell us much about what people are actually paying: “Some of the states with the largest decreases still have relatively high premiums and vice versa,” the brief states. “For example, while Nebraskas benchmark plan premium decreased 15% from PY19 to PY20, the average 27-year-old PY20 benchmark plan premium is $583. On the other hand, while Indianas average PY20 benchmark plan premium increased 13% from PY19, the average 27-year-old PY20 benchmark plan premium is $314.”

In 2021, that trend continues. The 2021 edition of the CMS Brief notes that, for example, while Wyomings average benchmark plan premium decreased 10% from PY20 to PY21, the average 27-year-old PY21 benchmark plan premium is $648the highest in the U.S. How many 27-year-olds can afford that kind of monthly premium? By contrast, New Hampshire’s benchmark plan premium for a 27-year-old is the lowest in the nation at $273.

Medicare And Medicare Advantage

The charts showing the cost the the number of enrollees includes people covered by all types of Medicare and Medicare Advantage. The cost of this type of health coverage includes participation from employers, individuals, federal, state and local government. Excluded from the costs are any form of co-pay or a deductible the individual must pay to receive care.

How enrollees use their health care services is based on enrollees in Medicare Advantage plans only. Medicare Advantage plans are Medicare health plans offered by private companies that contract with Medicare. Medicare Advantage plans include Health Maintenance Organizations , Preferred Provider Organizations , Private Fee for Service Plans, Special Needs Plans and Medicare Medical Savings Account Plans .

The States That Drink The Most Beer

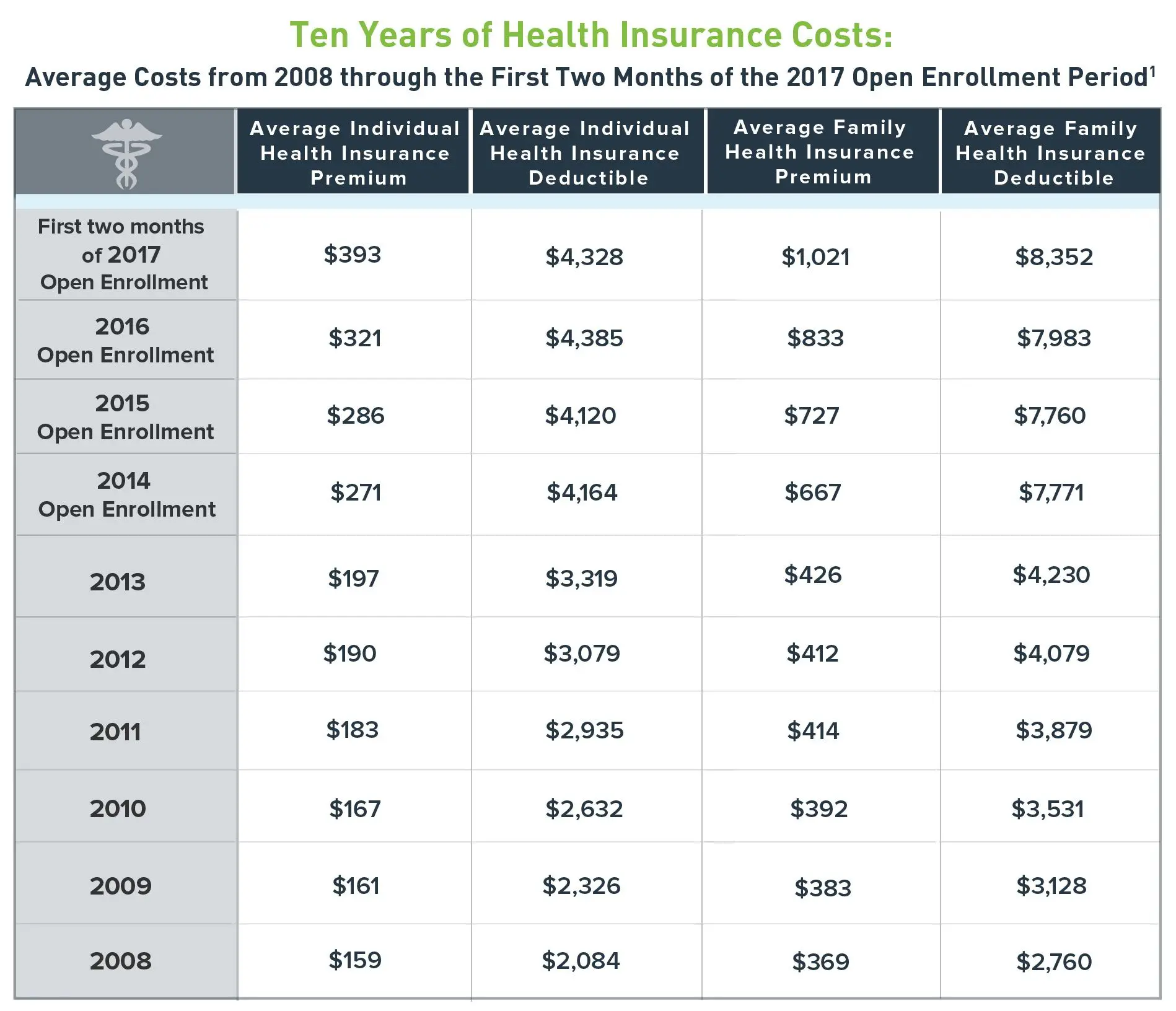

After age 50, premiums rise tremendously. At age 53 the average premium is more than double the base rate, and by 55 the average premium is $446. At age 60, the average premium is $543. If a person is 64 years old, the average health insurance premium is $600 – 3 full times what it is at 21.

It is also important to note that while this is a general guideline, prices vary dramatically from state to state. Some states, like New York, don’t factor age into premiums at all.

Also Check: Why Do Doctors Hate Chiropractors

Buying New York Health Insurance For Individuals Families And Self

The Empire State offers affordable private health insurance for individuals and families. If youre self-employed with no employees, you qualify as an individual. You can buy coverage through the Marketplace called New York State of Health. Plans are available in all four metal levels: bronze, silver, gold, and platinum.3 These are known as Qualified Health Plans.

Each metal plan pays a percentage of your covered healthcare costs ranging from 60% to 90%. For instance, bronze pays 60% and is usually the lowest-cost plan. Platinum pays 90% and is the most expensive plan.

All plans provide comprehensive coverage that includes essential health benefits, such as hospitalization, maternity care, prescription drug coverage, and free preventive services.

The Cheapest Health Insurance In New York By Age And Metal Tier

The cost of health insurance in New York is not dependent on age. This is because insurance regulations in New York prohibit insurers from using age when calculating health insurance premiums.

This means that a 26-year-old in New York will pay the same health insurance premiums as a 60-year-old. The average cost of a Silver plan in New York for both a 26-year-old and a 60-year-old is $710 monthly.

These average rates are based on OON and INN plans.

Health Insurance Costs in New York by Age and Metal Tier

Although age will not affect your health insurance costs in New York, other factors such as income will. To get a personalized quote, you can apply for a plan on the New York Insurance exchange. You can also read MoneyGeeks guide on health insurance in New York to determine the most appropriate metal tier for your needs.

Cheapest Health Insurance in New York by Age And Metal Tier

Sort by Metal Tier:

Recommended Reading: Does Insurance Cover Chiropractic

How Much Is Family Health Insurance Per Month

The average premium for a family of 4 in 2020 is was $1,437, according to customer data gathered by one health insurance agency. This does not include families who received government subsides. Like individual insurance, your family cost will depend on ages, location, plan category, tobacco use, and number of plan members.

What Does Health Insurance Not Cover

Most health insurance plans dont cover the following treatments and therapies:

- Travel vaccinations: Your insurance provider must offer coverage for vaccines that are medically necessary. Boosters, flu shots and immunizations are crucial parts of most health care providers lists of medically necessary treatments. However, vaccines that are only required for international travel may not be covered under your plan.

- Weight loss surgery: There is no federal mandate that requires private health insurance plan providers to offer coverage for bariatric surgery. Do you think someone on your plan might need bariatric surgery in the future? Consult with insurance representatives before you enroll in a plan.

- Cosmetic surgery: No insurance plan provides coverage for procedures that arent medically necessary. This includes injectables, fat reduction surgeries and other types of cosmetic enhancements.

- Dental, vision and hearing coverage: ACA-compliant plans must only provide dental and vision coverage for children. Need dental, vision or hearing protections for adults on your plan? You may be able to purchase an add-on package with your health insurance provider.

Recommended Reading: Is Umr Good Insurance

How Do I Enroll In New York’s Health Insurance Marketplace

While most states require you to use HealthCare.gov to enroll in health insurance coverage, New York lets you enroll on its own website. New York State of Health is the official state marketplace website where you purchase plans managed by individual insurance companies called Qualified Health Plans. The website allows individuals, families, and small businesses with 100 or fewer employees to compare and buy health plans online, or you can do it over the phone or in person.

To get started, you must create an online account by providing your name and email address, then accept an email invitation to activate your account. Once activated, you must provide Social Security numbers, birthdates, income information, and details on any available job-related insurance for yourself and other members of your family who will be on your plan. These details help determine what type of insurance you need and whether you qualify for financial help for your health coverage.

The following insurance companies offer individual health insurance plans to residents of New York, but some are only available in certain counties:

- BlueCross BlueShield of Western New York

- BlueShield of Northeastern New York

- Capital District Physicians Health Plan

- Emblem Health

- Univera Healthcare

Cobra Extension For Young Adults In New York

Children who turn 26 typically are no longer eligible to stay on their parents plan. However, New York allows parents to extend that coverage until the age of 29.

The state law is meant to help young adults who dont have access to their own employer-sponsored health insurance. Children until the age of 29 can get coverage on a parents employers plan either through two options:

- Young adult option — Employees or their eligible children can select this option and pay an additional premium, which must be within 100% of the plans single premium rate. This option allows an adult child to stay on a parents health insurance until 29 without paying for COBRA coverage, which is more expensive.

- Make available option — This coverage happens when an employer allows parents to extend coverage for children under standard family coverage until the age of 29.

Check with your employer to find out more about these options.

Read Also: Starbucks Pet Insurance

Enrollment In New Yorks Exchange Plus A Look At Historical Enrollment Since 2014

By the end of May 2021, New York State of Health reported that it had more than 6 million enrollees. Most are enrolled in Medicaid, the Essential Plan, or Child Health Plus, with only 220,000 enrolled in qualified health plans .

Enrollment in QHPs was lower than it had been in 2020, when 272,948 people had enrolled in QHPs during open enrollment. But enrollment in Medicaid, Child Health Plan, and the Essential Plan were all higher than they had been in prior years, due in large part to the pandemic and the resulting job losses and income reductions. Its also important to note that nationwide, states are not disenrolling people from Medicaid until after the pandemic emergency period ends, resulting in higher Medicaid enrollment than wed otherwise see.

For perspective, heres a look at QHP enrollment in New York State of Health since 2014:

- 2014: 370,451 people enrolled in QHPs

- 2015: 408,841 people enrolled in QHPs

- 2016: 271,964 people enrolled in QHPs

- 2017: 242,880 people enrolled

- 2018: 253,102 people enrolled in QHPs

- 2019: 271,873 people enrolled in QHPs

- 2020: 272,948 people enrolled in QHPs

- 2021: 215,889 people enrolled in QHPs Note that 215,889 was the official CMS enrollment total as of the initially scheduled end of open enrollment. But open enrollment has been extended due to COVID, and NY State of Health reported that the enrollment total had grown to 220,000 by the end of May 2021.

Ny State Of Health History

New York launched its consumer-facing website for its health insurance marketplace, NY State of Mind, on Aug. 20, 2013. The website included FAQs, an interactive map showing which health plans were available by county, and a calculator to help consumers learn if they are eligible for tax credits and how much they would pay for health insurance.

NY State of Health was working well early in October 2013, at a time when HealthCare.gov and many of the state-run exchanges were still struggling. And just before the second open enrollment began, the New York State Health Association released the results of a survey that found 92 percent of the 2014 NY State of Health enrollees were satisfied with their coverage, and three-quarters of the exchanges enrollees would recommend NY State of Health to other people.

Gov. Cuomo established New Yorks marketplace, or health insurance exchange, through an executive order. Cuomo issued the order in April 2012 after New Yorks legislature failed to approve an exchange law in both the 2011 and 2012 sessions.

New York enacted some ACA-style reforms in the individual market in the early 1990s policies there have been guaranteed issue and community rated ever since. But there was no individual mandate, premium subsidy, or restriction on when people could enroll, and few insurers participated in the pre-ACA individual market in New York. So premiums in New York were far higher than in other states where medical underwriting was utilized.

Read Also: Starbucks Healthcare Benefits

Pregnancy Now A Qualifying Event

In June 2015, the New York state Assembly and Senate unanimously passed S. 5972. And on December 22, 2015, Governor Cuomo signed the legislation into law. The legislation makes pregnancy a qualifying event through the state-run exchange, New York State of Health, and took effect in January 2016. New York was the first state in the nation where the commencement of pregnancy allows a woman to enroll in a plan through the exchange, although Connecticut implemented a similar provision starting in 2019. The New York law allows a pregnant woman to enroll with an effective date of the first of the month in which her pregnancy is confirmed by a licensed healthcare provider.

Under federal ACA rules, a babys birth triggers a qualifying event, but pregnancy does not. Advocates have pushed for the inclusion of pregnancy in the list of qualifying events at a federal level, but although HHS considered that possibility, they noted in February 2015 that they had opted not to include pregnancy as a qualifying event.

The Cheapest Health Insurance In Massachusetts By County

Another factor that impacts the cost of health insurance in Massachusetts is the area in which you live. In Massachusetts, similar to other states, insurance providers use rating areas to calculate policy premiums. Rates are computed the same way for counties within each rating area.

Massachusetts has fourteen counties divided into seven rating areas. In Middlesex, its most populous county of the 14 counties in the state, the cheapest Silver plan is Standard Silver: BMC HealthNet Plan Silver A II by BMC HealthNet Plan. It costs $354 per month.

If you want to find the most affordable health insurance plan in Massachusetts for all metal tiers in your county, use the table below.

Cheapest Health Insurance Plans in Massachusetts by County

Sort by county:

Also Check: How Long Insurance After Quitting

Recommended Reading: Starbucks Dental Coverage

Financial Value And Ratings

Aflac is a leading supplemental insurance company with excellent financial ratings. The organization has an A+ rating with Better Business Bureau and an A+ rating from A.M Best. In 2017, Aflac earned the 126th spot on the Fortune 500. In addition, they were also ranked number 91 on the Fortune list of Best Companies.

The Duck Makes Its First Appearance

Before Aflac started plastering the airwaves with cute duck commercials, the company was a little-known player in the world of supplemental insurance.

But all of that changed when, on January 1, 2000, the world was introduced to the Aflac duck.

This adorable commercial was called Park Bench, and was broadcast during a college football game.

Since then, the corporate mascot has appeared in more than 75 commercials, helping to make the company a household name instead of an unknown quantity.

These commercials are among the most successful in advertising history.

And since Aflac does most of its business in Japan, it was inevitable that the duck would become as big there as he is in the States.

He was introduced in that country in 2003, making the Aflac brand even more popular there than it was before.

And thats saying a lot because Aflac has been insanely in demand in Japan since around 1974.

The squawking Aflac duck moved on from his burgeoning fame in the US and Japan to become one of the biggest corporate mascots in the world.

And in 2004, he was even was inducted into the Advertising Walk of Fame.

In 2011, the mascot attained the only kind of lasting fame that truly mattersbecoming a balloon in the Macys Thanksgiving Parade.

The runaway popularity of this advertising character caused Aflacs brand recognition to soar from 11 to an incredible 94 percent in a mere 14 years!

You May Like: Asares Advanced Fingerprint Solutions

Can I Get Short

No. New York prohibits the sale of health plans that dont provide comprehensive coverage or essential health benefits. This ban includes short-term health plans, which dont count as qualified coverage under the Affordable Care Act .

States that follow federal rules for short-term health insurance offer coverage for up to 364 days with renewals up to 36 months. Short-term plans are used to fill temporary gaps in coverage, such as when youre in between jobs or waiting for new benefits to start.

Short-term health plans are usually cheaper than ACA-qualified insurance. But if youre concerned about cost, you can use the New York State of Health Marketplace to see if you qualify for Medicaid or the Essential Plan. These programs provide coverage beyond what a short-term plan would offer.

New Yorks Medicaid Cancer Treatment Program

New Yorks MCTP services are available to low-income residents with breast, cervical, colorectal, or prostate cancer. Generally, residents must be under 65, meet citizenship requirements, and not be enrolled in qualified coverage at the time of application. The states Department of Health Cancer Services Program oversees the application process.

Income limits vary. For example, the threshold for colorectal and prostate cancer is 250% of the FPL or up to $32,200 for a single adult in 2020.12

Those who qualify get full Medicaid coverage for a specific amount of time tied to the type of cancer. Enrollees must recertify each year if treatment is still needed.

Also Check: Kroger Part Time Health Insurance

Change In Average Health Insurance Cost For 2022

From 2021 to 2022, health insurance rates across the nation increased by less than 1%. South Dakota saw the largest year-over-year jump in health insurance costs for a 40-year old on a silver plan increasing just over 23%. Including South Dakota, 27 states had their rates increase on average from 2021 to 2022.

Year-over-year rates decreased the most in Georgia, South Carolina and Nebraska, which all fell by more than 10% . Overall, 21 states experienced a decrease in health insurance premiums. Two states Idaho and Virginia saw no year-over-year change.

| State |

|---|

Policy premiums are for a 40-year-old applicant on a silver plan.

How The American Recovery Plan Act Makes Health Insurance Cheaper

Signed into law on March 11, 2021, the new $1.9 trillion COVD-19 stimulus package will have a major impact on the healthcare premiums of millions of Americans.

Officially known as the American Rescue Plan Act, this stimulus is expected to reduce healthcare premiums on some plans by as much as 20%. This will ultimately save millions of Americans hundreds of dollars on healthcare.

The stimulus plan reduces healthcare costs by expanding tax credits on many healthcare plans. Healthcare costs vary based upon an individualâs age, income and chosen plan but consider the following examples.

Stimulus impact for

You May Like: Evolve Health Insurance