Ways To Get A Health Plan

There are many different ways that you can buy a health plan in Massachusetts. Many people get their health plan through their place of employment. For people that can’t do this, there are several other ways to get a health plan.

Through Your Employer or Union

In Massachusetts over 70% of all employers offer health insurance as a benefit to their employees. Most of these employers pay part of the premium and also offer a choice of several health plans. You can choose the health plan that is best for you from the choices offered.

Qualified Student Health Insurance Plan

If you are enrolled as a student in a Massachusetts college or university, you can buy a health plan through your school. This SHIP id designed for students and is only available while you are enrolled.

Directly from an Insurance Company

Massachusetts residents can buy health plans directly from an insurance company. And the company can’t turn you down if you have a health condition. Sometimes the company will direct you to purchase their health plan through an intermediary. An intermediary is a company that takes care of the enrollment and premiums.

MassHealth

If you meet certain income requirements, you may be eligible for MassHealth. This is a Medicaid program paid for by the state and federal taxes for eligible persons. You can learn more at or call 1-800-841-2900

Through the Connector

Medicare

Other Government Health Plans

The Importance Of Subsidies

The good news is that many who purchase marketplace plans will pay lower premiums through what the government calls advanced premium tax credits, otherwise known as subsidies. In 2019, 88% of people who enrolled at HealthCare.gov were eligible for advanced premium tax credits.

What are these subsidies? They are credits the government applies to your health insurance premiums each month to make them affordable. Essentially, the government pays part of your premium directly to your health insurance company, and you’re responsible for the rest.

As part of the American Rescue Plan Act passed in March 2021, subsidies have increased for lower-income Americans and extended to those with higher incomes. The ARPA expanded marketplace subsidies above 400% of the poverty level and increased subsidies for those making between 100% and 400% of the poverty level.

You can take your advance premium tax credit in one of three ways: equal amounts each month more in some months and less in others, which is helpful if your income is irregular or as a credit against your income tax liability when you file your annual tax return, which could mean you owe less tax or get a bigger refund. The tax credit is designed to make premiums affordable based on your household size and income.

Is There An Alternative To Paying Group Health Insurance Costs

Yes. Employers can control their health insurance costs with a simple solution: reimburse premiums instead of paying for them.

In other words, employers may reimburse employees tax-free for their individual health insurance premiums by establishing a formal, compliant health reimbursement arrangement like a qualified small employer HRA or an individual coverage HRA . By doing so, employers are able fix their costs on a monthly basis, and employees can choose an individual health insurance policy that best meets their health and financial situation.

Aside from offering more choices, individual health insurance reimbursement is a cost-effective solution for employers who want to provide health care benefits to their employees.

You May Like: Sidecar Health Dental

Average Health Insurance Premiums By Metal Tier

Health insurance plans are separated into metal tiers based on the proportion of health care costs the insurance plan is expected to cover.

The silver plan falls around the middle, with moderate deductibles, copays and coinsurance. The catastrophic and bronze plans offer the smallest amount of coverage, while platinum plans offer the greatest.

The average rates paid for health insurance plans are inversely related to the amount of coverage they provide, with platinum plans being the most expensive and catastrophic and bronze plans being the cheapest. The following table shows the average rates a 40-year-old would pay for individual health insurance based on the tier. Older consumers would see their rates increase according to the age scale set by the federal guidelines.

| Metal tier |

|---|

Policy premiums are for a 40-year-old applicant.

Who Can Consider Taking Out Family Health Insurance

Anyone who is a resident of the UAE and has a spouse and three children or more, for annual premiums below AED 10,000 can take up this type of policy. These are considered to be standard family covering criteria in many countries worldwide. Newer policies may vary slightly in terms of deductibles and coverage levels however, the basic structure remains the same.

For example, some insurers allow you to include parents if their age is less than 90 years old . Under this plan, they will pay lower premiums compared to insuring them separately. There are also additional options available such as expanding the plan to include childrens children. This way, your grandkids can also be covered by the same insurance policy.

You May Like: Do Substitute Teachers Get Health Insurance

Average Health Insurance Cost For Family Of 4

The typical cost for a family of 4 is around $1,200, as indicated by client information assembled by one medical coverage organization. This does exclude families who received government endowments. Like individual protection, your familys health insurance cost will rely upon factors such as age, area, plan classification, tobacco use, and number of plan individuals. Conversing with an authorized protection specialist is the most ideal approach to get a gauge and locate the best cost for your familys needs. HealthMarkets can help you in such cases.

How Much Does Health Insurance Cost

10 Minute Read | October 14, 2021

The average individual in America pays $452 per month for marketplace health insurance.1 But costs for health insurance coverage vary widely based on many factors.

Maybe you just turned 26 and are off your parents plan . Or maybe youre facing a job loss and need to replace your former employers coverage. Or youre just looking for other options besides your employers plan. No matter your situation, youre wondering: How much does health insurance cost?

Everyone knows health insurance is expensive. It can pretty quickly suck the life out of your monthly budget. But just how expensive is it? And why is it so costly? Are there ways you can pay less?

Well, youre in the right place! Ill walk you through everything you need to know about health insurance costs, what all those terms mean and what factors make up that hefty price tag.

Recommended Reading: How Long After Quitting Job Health Insurance

Does Affordable Care Act Apply To Expats

Unfortunately, not anymore. Today, the US Government does not require anyone to subscribe to an ACA-compliant health insurance policy. However, a handful of states still impose a penalty on people who do not comply with the ACA. These are:

- California

- Massachusetts

- New Jersey

Other states are also currently processing legislation that will make health insurance compulsory, so before you move to the USA, check your new states laws.

Also Check: How Much Is Temporary Health Insurance

International Health Insurance For Us Citizens Living Abroad Whats Covered

How much youll pay for health insurance isnt a number you can guess. Its affected by many factors, few of which you control.

With William Russell, international health insurance can cover US citizens for:

- Doctor visits, consultations, hospital care and mental health treatment in multiple overseas territories .

- Up to $100,000 for unexpected elective medical care and $250,000 in emergency treatment costs during short visits back to US soil, for reassurance when you visit family or head home for the holidays .

Recommended Reading: What Benefits Does Starbucks Offer

How Much Is Health Insurance Per Month For One Person

Monthly premiums for ACA Marketplace plans vary by state and can be reduced by subsidies. The average national monthly health insurance cost for one person on an Affordable Care Act plan in 2019 was $612 before tax subsidies and $143 after tax subsidies are applied.

Wondering how insurance premiums are decided? The Affordable Care Act ensures that insurance companies cannot discriminate based on gender, current health status, or medical history. Here are factors that determine health insurance premiums.

Beware Of Unlicensed Health Plans

When choosing a health plan, it is important to consider the differences between your options. Some plans provide more generous coverage, while others could leave you responsible for high medical bills. Shopping for health insurance can be overwhelming, but remember, if the plan sounds too good to be true, it probably is.

Discount Plans

Do not buy a discount plan as an alternative to health plan coverage. Discount plans charge a monthly fee in exchange for access to health care services at a reduced fee. These plans are not insurance and do not make any payments when you need health care services. Instead, they allow you to get a discount off of some of your medical charges. Discount plans may look like a cheap health plan, but they are not health insurance and they do not meet your Massachusetts “individual mandate” requirement for health coverage. You should check with your doctor or local pharmacist to ask whether you will receive any real savings before you give your money or your personal information to anyone offering health care discounts.

Health care sharing ministry plans.

| Limited Time Offer | Pay First, Read Later |

| Beware of high pressure sales tactics that tell you a low monthly price is a limited time offer and will expire in a day or two.There is no such thing as a limited time offer or “special” in health insurance. | Beware of companies that will not provide any written information about the health plan unless you pay first. |

Remember: Stop. Call. Confirm.

You May Like: Evolve Medical Insurance

Think About Heath Insurance Costs Before You Quit

If you plan to leave the safety net of an employer, your goal should be to make AT LEAST 5X your annual health insurance premiums first. 5X comes from taking the inverse of 20 percent, which is the top percentage in my healthcare affordability ratio recommendation.

I always recommend people start a side-hustle while working to minimize financial disaster and maximize the probability of eventually breaking free.

Now Ive provided you with a concrete annual side income figure you can shoot for before retiring early or becoming a full-time entrepreneur.

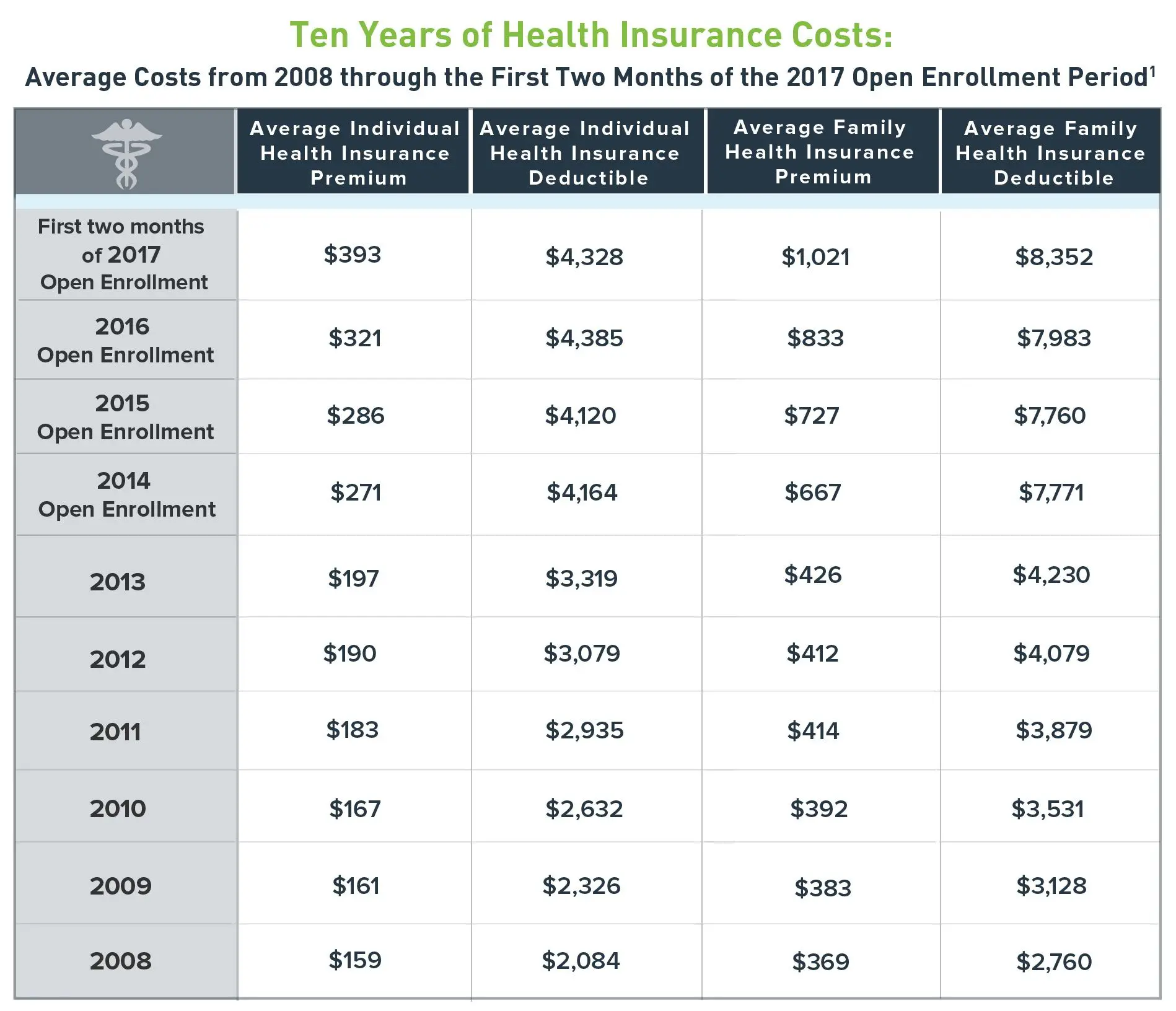

Health Insurance Costs Rising

All the noise pointed people away from the real meat of the Fraser studies. That was how much health costs had increased and how fast they were increasing.

For that average family, the cost of health insurance rose 1.4 times faster than their incomes did between 2006 and 2016. Incomes were up 26% in that time, but health insurance was up 37%.

To put it in perspective, the cost of shelter rose 36% during that time and the cost of food rose 30% during that time. Insurance costs rose 1.3 times as fast as these basic costs.

Read Also: Does Costco Offer Health Insurance For Members

How Much Does Private Health Insurance Cost In Ontario

Our experts were quoted $168.26 per month with Blue Cross for a 41-year old with no pre-existing conditions for full comprehensive hospital, dental and prescription drug coverage. Cost varies depending on the level of coverage you choose.

Other factors that may affect premiums would include:

- Age

Dont Undervalue How Much Coverage Your Family Needs

In most cases, we find people underestimate their debt obligations, says Browning. They factor in mortgage, but they dont factor in costs such as daycare or the loss of a pension plan. With a larger policy, you can save your family from potential financial turmoil, which is more valuable than saving a few dollars every month. The ballpark policy is usually worth 10 to 12 times your annual income, he adds.

Recommended Reading: Evolve Health Insurance Company

What Is The Aca Health Insurance Marketplace

Established by the Affordable Care Act , the Health Insurance Marketplace is a platform that offers medical insurance plans to individuals, families, and small businesses. Fourteen states and the District of Columbia offer their own marketplaces, also known as exchanges, while the federal government manages a marketplace open to residents of other states. Marketplace plans are divided into four categories that range in cost and coverage. Though offered by private companies, all must meet certain criteria established by the state or federal government.

Will My Family’s Health Insurance Increase In Cost Each Year

In most cases, barring any provider promotions, you can expect your policy to increase in cost as you age and to factor in increases in the cost of accessing private healthcare. With this in mind, it’s always sensible to have your health insurance broker review your policy each year to make sure you’re still getting the best deal. With many of the best providers having highly rated products, you can often switch without losing significant benefits.

Read Also: What Is Evolve Health Insurance

Individual Health Insurance And Health Reimbursement Arrangements

Group and individual health insurance plans are popular choices but theres another option that can benefit employees and employers called a health reimbursement arrangement that is growing in popularity and works in conjunction with individual health insurance.

HRAs allow employers to reimburse employees, tax-free, for healthcare, including individual health insurance premiums and qualifying out-of-pocket medical expenses.

With an HRA, employers set their own budgets by offering an allowance amount for each employee. Employees win big on flexibility by being able to choose their own individual health insurance plan thats tailored to their specific needs.

Lets take a look at two of the most popular HRAs which are the qualified small employer HRA and the individual coverage HRA .

Canadian Costs Versus The World

So where does this leave our average family of four? In their 2015 report, the Canadian Institute of Health Information noted that Canadians were among the highest health care spenders in the world. They estimated the average spend at $5,782 per person.

That put the personal spending above the average but nowhere near the biggest spenders. As it has for years, the average American spent twice as much as $11,916. An average family in Sweden spent slightly more at $6,601 and the same family in the UK spent $5,170.

Recommended Reading: Does Kroger Give Employee Discounts

What Is Family Life Insurance

Family insurance doesnt have an industry-wide definition like, say, term or whole life insurance does. Instead, its a provider-created package therefore, it varies from one company or broker to another, and comparing packages isnt straightforward. But in broad terms, family insurance is a package of different types of life insurance to cover a family for life. For instance, you may choose a package that includes term insurance until retirement with added-on child riders, as well as riders for critical illness and disability. . Or it could be a package that includes term insurance to age 65 in addition to a whole life policy to cover funeral expenses. Another option? Create a package with whole life, critical illness, disability, a child rider, plus another whole policy to cover estate-transfer costs. Below, we list the different types of life insurance coverage and how they might fit into a plan for your family.

Keep Costs Down Stay In Network With Provider Finder

One way to help keep your health insurance costs down is to use only doctors, hospitals and other health care professionals in your plan’s network. If you go out of network, you might have to pay the entire bill. Not all plans have the same network. The best way to find in-network providers is byregistering or logging into Blue Access for MembersSM, our secure member website, for a personalized search based on your health plan and network using our Provider Finder®tool.

Recommended Reading: Minnesotacare Premium Estimator

The Effectiveness Of The Canadian Health Care System

The Canadian health care system receives higher marks from the OECD regarding overall international health care systems. After all, the colorectal and breast cancer survival rates are some of the highest in the world.

Canada also scores well in primary care, which can help to prevent costly admissions to the hospital due to chronic conditions such as uncontrolled diabetes and asthma.

Some of the areas where Canada doesn’t score as well as on the wait times. It’s reported that the wait times are longer than in other countries, especially for those who are seeing specialists or undergoing elective surgery.

In fact, it was shown in 2010 that over 59 percent of respondents to a particular study waited for over four weeks to receive an appointment with a specialist. This is more than double the number in the U.S.

How Much Is Health Insurance By Family Size

Not surprisingly, the more people in your family are covered by your health insurance plan, the more youre likely to pay in premiums.

The average cost for a 40-year-old couple is $954 per month or double the cost for an individual in that age range. But adding kids isnt quite as linear. A 40-year-old couple with one child under age 14 would pay an average of $1,230 per month, and a family of five would pay around $1,782.

To estimate the average family’s health insurance cost, MoneyGeek used national averages by age and added the premiums together. Actual family premiums may vary.

Average Health Insurance Premiums by Family Size

Scroll for more

- Couple w/ Three Kids $1,782

It seems logical that families would stick together on health insurance its convenient and easy to do so. And together, youre more likely to meet the out-of-pocket maximum, after which you shouldnt have to pay out-of-pocket costs for covered services.

But some families might be better off on separate plans.

For example, if one spouse can get low-cost coverage through their job, but that plan may not be open to family members , it may make sense for that spouse to use their employer-provided insurance while the rest of the family uses a Marketplace plan.

Or, if one partner has more medical needs and higher costs, they may benefit from paying more for more coverage. But if the other partner has few health needs, they may be better off in a high-deductible plan just for themselves.

Don’t Miss: Starbucks Health Insurance Eligibility