What Does International Health Insurance Cover

You have several types of travel health insurance plans, and they offer different medical coverage features. For example, heres what you get from a basic plan:

- Reimbursement for costs This covers medical expenses. Some may even pay for dental if needed.

- Travel assistance As we said, your insurance can help you find a hospital while youre in another country.

- Advance payments for medical facilities In other words, your policy may forward medical payments on your behalf.

- Access to medical transport This often means getting an ambulance when you need it. Depending on your plan, you may gain access to other modes of medical transport.

- Emergency evac services that will help you safely reach a proper medical facility

- Accident benefits If you get injured, you may find it hard to take care of your family. This feature could deal with this problem while you recover.

You may also get comprehensive travel insurance, and it offers the same features save for one: trip insurance. This is also called cancellation coverage.

Read More: Why Proof Of Vaccination Is Trending Worldwide

You may have to cut your trip short because of an emergency. This goes beyond just medical ones, though, and it may cover natural disasters, job loss, and other kinds of unexpected situations.

The plan covers flight delays too. After all, you cant control how your chosen airline will react to certain situations. Whats more, coverage includes baggage delays.

I Have Insurance So Why Am I Getting A Bill

Your insurance plan is a cost-sharing agreement between you and your insurance company. Generally, many insurance companies cover the costs for preventive care throughout the year, such as check-ups, vaccinations, etc.

For other services, many insurance companies require you to cover all costs until you reach a specified amountknown as a deductible. Once you reach that specific amount, then the insurance company starts paying for covered services.

For example, if you have a $500 deductible, then every year you will have to pay your medical costs for non-preventive care until you have paid a total of $500. Once you reach that $500 limit, the insurance company will begin to cover some of your medical costs for the rest of the year.

How much they pay for each procedure and service after youve reached your deductible depends on your particular plan.

Treatment In Blacklisted Hospitals Is Not Covered Under Health Insurance

Some hospitals or doctors are blacklisted by health insurance companies because of their bad public image. In case you get hospitalized in a blacklisted hospital or are getting treatment from a doctor that your health insurance company has blacklisted, you may be denied a claim.

However, in case of an emergency such as an accident or a life-threatening situation, your insurance policy may cover your medical bills until your condition is stable. Once the condition is stable, you should be immediately admitted to a hospital that is in the network of the company.

Read Also: Starbucks Employee Health Insurance

Key Question #: Where Can I Receive Care

One way that health insurance plans control their costs is to influence access to providers. Providers include physicians, hospitals, laboratories, pharmacies, and other entities. Many insurance companies contract with a specified network of providers that has agreed to supply services to plan enrollees at more favorable pricing.

If a provider is not in a plans network, the insurance company may not pay for the service provided or may pay a smaller portion than it would for in-network care. This means the enrollee who goes outside of the network for care may be required to pay a much higher share of the cost. This is an important concept to understand, especially if you are not originally from the local Stanford area.

If you have a plan through a parent, for example, and that plans network is in your hometown, you may not be able to get the care you need in the Stanford area, or you may incur much higher costs to get that care.

The 8 Things Your Health Insurance Doesn’t Cover

Whether youre looking to choose a new health insurance policy, going on Medicare, or are unsure of the details of your current health plan, there are several services that you may think are covered but in actuality theyre not. Knowing in advance what services youre going to have to pay for can help you make smart health choices.

Read Also: Starbucks Health Insurance Cost

What Does Car Insurance Cover The Different Types Of Car Insurance

- Liability insurance covers damage you cause to another vehicle and its passengers.

- Comprehensive coverage replaces or repairs your car if its stolen or damaged. Its in addition to liability.

- Collision coverage repairs your car if youre in a collision or accident. Its an add-on to liability coverage.

- See Insiders guide to the best car insurance companies.

Car insurance is required by state law. There are four main types of car insurance: comprehensive, collision, and liability. Full coverage is a combination of the three.

The minimum coverage requirements for liability insurance vary by state, but if you finance or lease your car, your lender probably requires comprehensive and collision coverage.

Americas Surprise Medical Bill Problem

The difference between in-network and out-of-network providers is a leading cause of surprise medical bills.

Many health care procedures are ones you plan for and make appointments for ahead of time. Therefore, you can ensure the provider is part of your insurance planâs network.

But even if you think youâve chosen the right providers, you may still inadvertently be under the care of a non-network provider.

For example, most patients donât get to choose the anesthesiologist for their C-section or back surgery. In another example, you may see an in-network provider who sends you to the in-house lab for blood work or a radiologist for X-rays, who are not in the insurance carrierâs network.

Any provider who bills your insurance carrier and who isnât in-network will leave you paying a larger percentage of the overall bill. In some cases, insurance companies will not pay any out-of-network costs.

Surprise medical bills often arise during emergencies, when a patient isnât able to choose a provider. For example, the ambulance that picks you up after youâve had a heart attack may take you to a non-network hospital that was closer to your home.

According to the Kaiser Family Foundation, an estimated 1 in 5 emergency claims and 1 in 6 in-network hospitalizations include at least one out-of-network bill.

You May Like: Insusiance

What Does Covered Mean Anyway

If a service is covered, it means your health plan will pay for some or all of the cost. In most cases, your doctor also needs to be on the list of doctors that take your insurance, called a network. How much your health plan pays for depends on what type of care you use and where you get it.

For example:

- Some covered services are completely free to you, like going to the doctor for your annual exam. Your plan pays everything.

- For others like seeing the doctor for a lingering sinus infection or filling a prescription for covered antibiotics youll pay a fee. The amount you pay will be different depending on the type of plan you have and whether or not youve taken care of the amount you have to pay before your plan starts helping you .

To get the biggest bang for your buck, use services your health plan covers whenever possible.

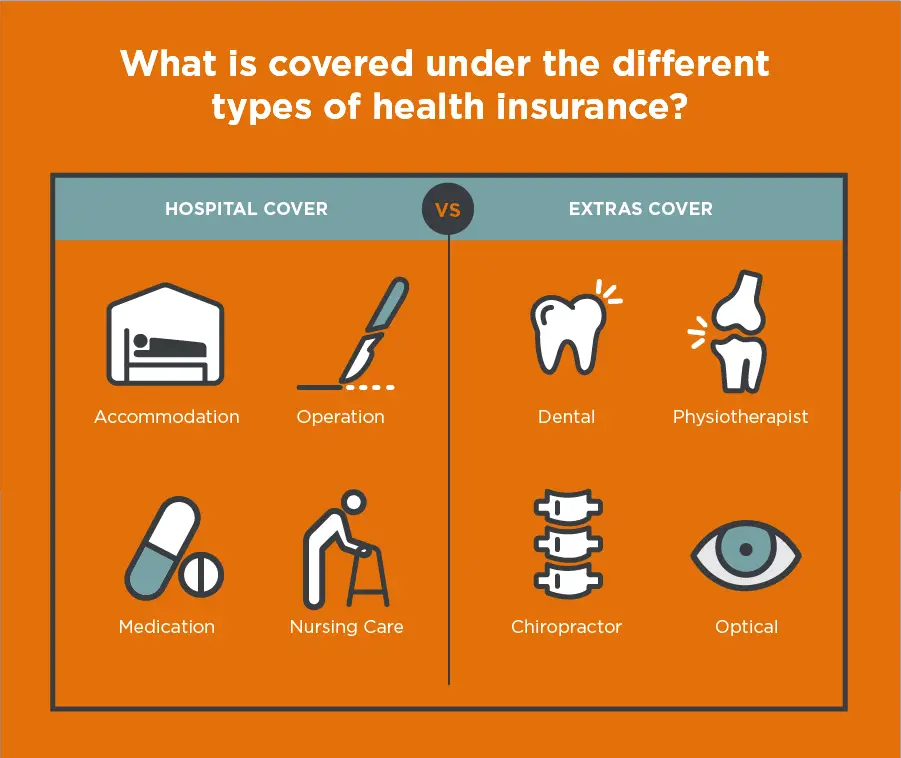

What Is Generally Covered Vs Not Covered

In general, health insurance will cover any treatment deemed medically necessary to prevent or treat sickness or injury. It typically does not cover elective, cosmetic, or experimental treatments.

Most health insurance plans do not cover 100 percent of the total cost of any treatment, with the exception of preventative care. There are three main areas of out-of-pocket costs that you may have to pay, including:

- Deductible. This is the amount you have to spend for covered health services before your insurance company pays anything.

- Copayments. This is a flat dollar amount required for you to pay a provider at the time of service. For example, your plan may dictate you pay $40 for every regular office visit.

- Coinsurance. This is a percentage of the total cost of a providerâs bill that you will be required to pay. For example, your plan may state that it will cover 80 percent of a certain treatment, meaning you must pay the remaining 20 percent.

In addition, policies typically have an annual out-of-pocket maximum, which is the most you would have to spend for covered services in a year. After you reach this amount, the insurance company pays 100 percent for covered services.

Read Also: Starbucks Health Coverage

How Will My Health Plan Cover A Covid

The CARES Act requires all non-grandfathered health plans, including private insurance, Medicare, and Medicaid, to cover COVID-19 vaccines without any cost-sharing for the member .

The full coverage of COVID-19 vaccines includes both the vaccine itself and any charges from the provider or facility for the administration of the vaccine. The COVID-19 vaccine has been added to the list of recommended vaccines, and the CARES Act required private health plans to begin fully covering it within 15 business days much faster than the normal timeframe between when a preventive care recommendation is made and when insurers have to cover it with no cost-sharing. This applies to all COVID vaccines that have received FDA approval, including emergency use authorizations. As of April 2021, that includes vaccines from Pfizer, Moderna, and Johnson & Johnson.

Other Key Insurance Terms

Here are other key insurance terms to help you understand your coverage and responsibilities for costs associated with your care:

A copay is a fixed dollar amount that you pay every time you receive medical care.

For example, if you have a $20 copay, you will need to pay $20 to the providers office when you go in for your doctors appointment. Many plans have different copay amounts for different services. So your copay may be $20 for a checkup but $50 for a visit to an urgent care center.

A deductible is a fixed dollar amount that you need to pay within a defined period of time before your insurer will start to cover some of the costs for covered medical services.

Coinsurance is another way you may be required to share costs with your insurance provider. With coinsurance, instead of paying a fixed amount each time you receive medical care, you may be required to pay a percentage of the total costs. For example, your insurance company may pay 80% of the cost, and you may be responsible for to pay for the remaining 20% of the bill.

A maximum out-of-pocket expense is the most youll have to pay for your medical costs in a given time period, usually one calendar year or one plan year.

Recommended Reading: Evolve Medical Insurance

Why Ontario Drivers Pay The Highest Car Insurance Rates In The Country

If you shop around for car insurance in Ontario, you may experience something akin to sticker shock. Its well known that Ontario drivers pay the highest car insurance rates in the country. Peter Cheney of The Globe and Mail reports that in 2012, the average annual car insurance premium in Ontario was $1,544.86 a whopping 45 per cent higher than Alberta, which had the second-highest premiums in the country.

But why? Is there something inherently expensive about Ontario? Well, actually, yes. Unlike other provinces, Ontario doesnt have public car insurance, which means insurance rates arent a level playing field for all drivers. In other words, certain demographics bear the brunt of the cost. By contrast, provinces with public car insurance programs distribute costs evenly among all drivers rather than unfairly penalize those they deem a statistical risk.

Ontario is also home to a troubling amount of insurance fraud. Nick Boisvert of CBC News reports that car insurance fraud costs as much as $1.6 billion each year. Unfortunately, fraudulent claims have a ripple effect that inflates the cost of car insurance. To combat false and misleading claims, the government has already created the Ontario anti-fraud task force. The government has also pledged to take steps to reduce car insurance rates by 15 per cent from their 2013 levels.

How Insurance Coverage Requirements Vary By State

Every state but New Hampshire requires you to have both bodily injury liability and property damage liability coverage.

In the remaining states, there are also minimum dollar amounts for the coverage you must carry. Bodily injury liability can have two dollar limits: one per person and another per accident, while theres only one limit for property damage.

Coverage limits are typically expressed in your insurance policy by a sequence of numbers. So, for example, if your policy has a $25,000 bodily injury liability limit per person, a $50,000 bodily injury liability limit per accident, and a $25,000 property damage liability limit, your policy would express it as 25/50/25.

Its important to note that the minimum coverage limits are just thatminimums. You can opt to purchase coverage above those limits, and thats often a smart idea.

Whether youre legally required to carry medical payments/PIP insurance, collision coverage, comprehensive coverage, or underinsured/uninsured motorist coverage depends on your state. And again, the minimum coverage amounts youre required to have for each one can vary.

Recommended Reading: Starbucks Health Insurance Options

Alternative Options If You Want To Go Private

- Use savings for all or part of your medical costs around one in five private patients do this. Hip and knee replacements cost an average of £10,000 each, while MRI scans cost from £500. You can shop around for scan prices your GP can help you do this.

- Pay for a private consultation if you want an expert or second opinion. Then, if necessary, your consultant will refer you back into the NHS for treatment.

Is Testing For Covid

Under the terms of the Families First Coronavirus Response Act , Medicare, Medicaid, and private health insurance plans including grandfathered plans are required to fully cover the cost of COVID-19 testing, without any cost-sharing or prior-authorization requirements, for the duration of the emergency period . That includes the cost of the lab services as well as the provider fee at a doctors office, urgent care clinic, or emergency room where the test is administered.

How do I choose the best coverage for me? Heres your checklist.

Since its a federal law, the requirements apply to both self-insured and fully-insured health plans, whereas the testing coverage requirements that numerous states have imposed are only applicable to fully insured plans.

Don’t Miss: Uber Driver Health Insurance

How Does Insurance And Paying For My Medical Services Work

There are volumes and volumes of books on how insurance and medical billing works. While there are nuances, heres the basic outline of how it works.

Your health insurance plan offers coverage of certain healthcare services and treatments, and it outlines how much itll pay for each service and how much youll be responsible for. Provided that you have a managed care plan, which most Americans with health insurance do, your plan will also provide information as to which healthcare providers and facilities are in-network. Always ask to understand what insurance will and will not pay for, and how much theyll pay for, before visiting a healthcare provider.

After you visit a healthcare provider that accepts your insurance, theyll typically file a claim on your behalf. Your insurance company already has set rates that theyll pay out for each type of service, and theyll pay your provider that amount regardless of how much the provider has listed in their claim.

If your healthcare provider is in-network with your insurance plan, then theyll simply zero out the balance. If theyre out-of-network, however, whatever the insurance company does not pay for will be billed to you. This is why you may still receive medical bills after insurance pays its portion of your costs.

How Do I Choose A Private Health Insurance Plan

Private medical insurance can be offered to employees as part of company benefit plans.

Some employers set up the policy for you and pay all the premiums as part of their package. Others offer access to lower cost private medical insurance than you would be able to buy individually.

If you dont have access to private medical insurance through an employer, you can buy it from:

- an insurer

Read Also: Does Starbucks Provide Health Insurance

What Kinds Of Services Are Typically Not Covered By Health Insurance

Though coverage can vary case by case, some procedures are seldom covered. Cosmetic procedures such as plastic surgery or vein removal are nearly always considered elective and so are not covered. Fertility treatments are only covered in certain states, and even then, there are loopholes that allow insurers to deny coverage.

New medical devices are often not covered until there have been years of evidence of their value versus costs. Some prescription medications that are prescribed for off-label use may also be denied.

Your State Insurance Department May Be Able To Help You

Each state has an Insurance Commissioner who is responsible for overseeing insurance products within the state. You can find your state’s Insurance Commissioner and Insurance Department by visiting the National Association of Insurance Commissioners website. Helping consumers with insurance issues is a big part of the insurance department’s job, so don’t be shy about reaching out for help.

Once you explain your situation to the consumer assistance representative, they’ll let you know what your next steps should be. Be aware, however, that state insurance departments don’t regulate self-insured group health insurance plans, and self-insured plans cover nearly two-thirds of workers with employer-sponsored coverage in the U.S.

Self-insured plans are instead regulated under the Employee Retirement Income Security Act of 1974, which is a federal law. So if you have coverage under a self-insured employer-sponsored plan, the insurance department in your state will be able to point you in the right direction, but will generally not be able to get directly involved on your behalf. However, the ACA’s provision for internal and external appeals does apply to self-insured plans, as long as they’re not grandfathered.

You May Like: Insurance Lapse Between Jobs