Exemption From Public Health Insurance In Germany For Students

If you are under 30 years of age, but you want to be registered exclusively with a private health insurance company, you have to request a certificate of exemption from the statutory health insurance. You have to apply for exemption within the first three months of starting your studies at the local public health insurance companies.

Once you forfeit your statutory health insurance, you cannot get back on it, at least not for the duration of your studies. You can only re-enroll in public health insurance if you find a job and must be registered as an employee.

A 1905 Supreme Court Case Allows Employers To Require Vaccines

There are precedents for large-scale vaccination requirements in US law. In 1901, a deadly smallpox outbreak in New England prompted local governments to order mandatory vaccinations for everyone in the area. Some residents, however, objected, and one took it all the way to the Supreme Court. The Supreme Court decided in Jacobson v. Massachusetts that the government may impose “reasonable regulations,” such as a vaccine requirement during pandemics, for the purpose of protecting the “safety of the general public.”

The court case forms the basis of guidance issued by the Equal Employment Opportunity Commission, which makes it clear that employers may make similar demands of their workers.

C Scope Of Religious Exemptions And Requirements For Exempt Entities

In through and , the Religious IFC expands the exemption to plans of additional entities and individuals not encompassed by the exemption set forth in the regulations prior to the Religious IFC. Specific entities to which the expanded exemptions apply are discussed below.

Some commenters supported the expanded exemption’s approach which maintained the policy of the previous exemption in not requiring exempt entities to comply with a self-certification process. They suggested that self-certification forms for an exemption are not necessary, could add burdens to exempt entities beyond those imposed by the previous exemption, and could give rise to religious objections to the self-certification process itself. Commenters also stated that requiring an exemption form for exempt entities could cause additional operational burdens for plans that have existing processes in place to handle exemptions. Other commenters, however, favored including a self-certification process for exempt entities. They suggested that entities might abuse the availability of an exemption or use exempt status insincerely if no self-certification process exists, and that the Mandate might be difficult to enforce without a self-certification process. Some commenters asked that the government publish a list of entities that claim the exemption.

Recommended Reading: How To Get Health Insurance As A Real Estate Agent

Proof Of Coverage Provided By Your Health Plan

Health insurance plans will provide documentation to clients to prove they have the minimum coverage required by law. When you file your tax return you will have to enter information about your coverage status, or if you were eligible for an exemption, on your tax return. Insurers will provide a notice to you by January 31 that describes your coverage status during the previous year.

Connect for Health Colorado customers can review the Taxes Frequently Asked Questions to learn more about the form they will receive as proof of insurance.

The federal government oversees the enforcement of the mandate. Please contact the Internal Revenue Service for more information.

© 2021 colorado.gov/health All rights reserved

E Houses Of Worship And Integrated Auxiliaries

As noted above, the exemption in the previous regulations, found at §147.131, included only an organization that is organized and operates as a nonprofit entity and is referred to in section 6033 or of the Internal Revenue Code of 1986, as amended. Section 6033 or of the Code encompasses churches, their integrated auxiliaries, and conventions or associations of churches, and the exclusively religious activities of any religious order.

The Departments do not believe there is a sufficient factual basis to exclude from this part of the exemption entities that are so closely associated with a house of worship or integrated auxiliary that they are permitted to participate in its health plan but are not themselves integrated auxiliaries. Additionally, this interpretation is not inconsistent with the operation of the accommodation under the prior regulation where with respect to self-insured church plans, hundreds of nonprofit religious entities participating in those plans were provided a mechanism by which their plan participants would not receive contraceptive coverage through the plan or third party administrator.

Therefore, the Departments believe it is most appropriate to use a plan basis, not an employer by employer basis, to determine the scope of an exemption for a group health plan established or maintained by a house of worship or integrated auxiliary.

Don’t Miss: How Much Is Health Insurance Usually

Is Health Coverage Still Required

Starting with the 2019 coverage year , there is no longer a tax penalty or individual mandate for not having health insurance.

Learn more about the individual mandate for 2014-2018 on HealthCare.gov and the IRS websites. See below for information about exemptions for the individual mandate for 2018 and earlier.

What Should Student Health Insurance In Germany Include

When you are getting student health insurance in Germany, it must cover at least the following:

- In-patient hospital care.

- Repatriation of remains

- Funeral costs

Private health insurance companies such as DR. Walter offer affordable health insurance plans for students in Germany. EDUCARE24 is the most sought after, cheapest and comprehensive plan for international students in Germany.

Read also:Travel Insurance for Students

Don’t Miss: Does Health Insurance Cover Baby Formula

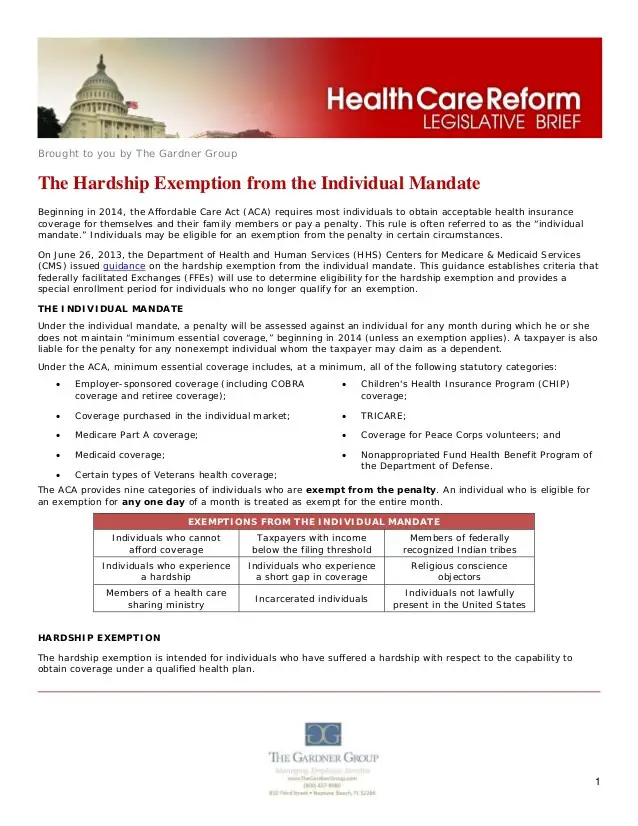

What Qualifies As A Hardship For Not Having Health Insurance

Hardship exemptions are circumstances that prevent an individual from securing health insurance. Beginning in 2019, the penalty, also known as the Shared Responsibility Payment, for not having health insurance no longer applies. Some notable hardship exemptions are homelessness and being a victim of domestic violence.

Tips For Finding Affordable Health Coverage In 2021

You can see how important health insurance is, but figuring out how to get it affordably can be challenging.

There are a few steps you can take to find the most affordable health coverage option for you:

- Use the market place to find health insurance: If you make below a certain amount of money during the year, you may qualify for premium tax credits. Youll need to fill out an application with the health care market place to find out if you qualify.

- Find an insurance agent or broker to help you: You always have the option of using a qualified insurance agent or broker to help you find the right health insurance market place plan for you and your family. They can help you fill out the application, too.

- Compare plans and medical costs carefully: Use the health care market place comparison tool to look at several plan options available to you. There is also a calculator that can help you determine your estimated medical costs for the year.

The health insurance market place has four categories of insurance plans bronze, silver, gold, and platinum and each of these provides better coverage than the next.

While it can be tempting to stick with the lowest premium cost, think about how much youll be paying for copays, deductibles, and prescriptions with that plan.

Read Also: How Much To Employers Pay For Health Insurance

M Description Of The Religious Objection

The previous regulations did not specify what, if any, religious objection applied to its exemption however, the Religious IFC set forth the scope of the religious objection of objecting entities in §147.132, as follows: The exemption of this paragraph will apply to the extent that an entity described in paragraph of this section objects to its establishing, maintaining, providing, offering, or arranging coverage, payments, or a plan that provides coverage or payments for some or all contraceptive services, based on its sincerely held religious beliefs. These rules finalize this description with technical changes to clarify the scope of the objection as intended in the Religious IFC, and based on public comments.

Throughout the exemptions for objecting entities, the rules specify that they apply where the entities object as specified in §147.132 of the Religious IFC. That paragraph describes the religious objection by specifying that exemptions for objecting entities will apply to the extent that an entity described in paragraph objects to its establishing, maintaining, providing, offering, or arranging coverage, payments, or a plan that provides coverage or payments for some or all contraceptive services, based on its sincerely held religious beliefs.Start Printed Page 57567

Guide To Exemptions For The California Health Insurance Mandate

According to the California health insurance mandate put into place at the beginning of the year, every adult and child in the state must carry medical coverage compliant with the Affordable Care Act . Despite the goal to insure 100% of the CA populace, exemptions exist for a variety of reasons.

Ideally, everyone has coverage to help pay for their healthcare related expenses. If you or anyone in your family does not currently have qualifying health insurance coverage through an employer, private plan provider, or government program like Medicare and Medicaid, avoid penalties by signing up or exploring the exemptions.

Read Also: How To Get Health Insurance For My Family

How To Obtain A Coverage Exemption

Some health coverage exemptions can be obtained only by applying for the exemption through the Marketplace while some exemptions are claimed only on a tax return. Other exemptions can be obtained either from the Marketplace or claimed on a return.

If your income is below your minimum threshold for filing a federal income tax return, you are exempt from the individual shared responsibility provision and are not required to file a federal income tax return solely to claim the exemption. However, if you file a return anyway for example, to claim a refund you need to claim a coverage exemption with your return.

You must report or claim health coverage exemptions on Form 8965, Health Coverage Exemptions, and attach it to your Form 1040, Form 1040A or Form 1040EZ. These forms can be filed electronically.

Federal Court Blocks Jan 4 Covid Vaccine Mandate: What To Know About The Rules And Exceptions

A federal appeals court temporarily blocks a vaccine mandate for large businesses that is slated to start in January for larger companies. Here’s where things stand.

Your employer can soon legally terminate your employment if you refuse the vaccine or regular COVID-19 testing.

A federal appeals court on Saturday temporarily blocked the Biden administration’s new vaccine coronavirus vaccine mandate for large businesses. The mandate would require those working for businesses employing 100 or more people to get fully vaccinated or tested weekly by Jan. 4, 2022, the The White House announced Nov. 4. This is part of President Joe Biden’s new employer vaccination mandate issued in September, and will cover 84 million workers. The requirement is designed to curb the surge in coronavirus cases, hospitalizations and deaths caused by the virus, including the delta variant.

The Biden administration hopes to sway tens of millions of people into getting vaccinated. Unvaccinated people are 10 times more likely than vaccinated people to be hospitalized and 11 times more likely to die from the coronavirus, according to the Centers for Disease Control and Prevention.

Here’s what you need to know about the temporary court order and the COVID-19 mandate for companies. Also, here’s the latest on booster shots for Moderna, Pfizer and Johnson & Johnson.

Read Also: What Is The Cost Of Supplemental Health Insurance

How The Penalty Worked

Your individual mandate tax is the greater of either 1) a flat-dollar amount based on the number of uninsured people in your household or 2) a percentage of your income .

This means wealthier households will wind up using the second formula, and may be impacted by the upper cap on the penalty. For example: for 2017, an individual earning less than $37,000 would pay just $695 while an individual earning $200,000 would pay a penalty equal to the national average cost of a bronze plan . This is because 2.5% of his income above the tax filing threshold would work out to about $4,740, which is higher than the national average cost of a bronze plan. The IRS publishes the national average cost of a bronze plan in August each year that amount is used to calculate penalty amounts when returns are filed the following year.

How Would You Use A Hardship Exemption

The primary use for hardship exemptions in 2019 or later is to enter a catastrophic plan after turning 30 years old. Since catastrophic plans are limited in the help they provide, they are normally reserved for people under the age of 30 who have fewer health needs.

Catastrophic plans have very low monthly premiums, and include all ACA benefits, but generally have extremely high deductibles . They limit your financial exposure in case of a major accident or illness but assure that you will pay out-of-pocket for most other issues.

Historic Hardship Exemptions: In previous years, hardship and affordability exemptions were used to excuse someone from paying the individual mandate, or the Obamacare tax penalty. States which have created their own individual mandate still make use of their own hardship exemptions.

Also Check: Is Health Insurance Really Worth It

Tax Filing Exemption Due To Low Income

As in most states around the country, California has a minimum income threshold for filing taxes. Any adult under the age of 65 is required to file federally if they make more than $10,400. Joint married filers have a minimal income of $20,800. Other criteria and thresholds exist, which need to be investigated for the specific instance. If your income falls below these levels, and you do not have to file taxes for the year, you are not mandated to have CA health insurance either.

The Federal Government Requires Companies To Mandate The Vaccine

Even before Biden’s COVID-19 vaccine mandate, US employers could require their employees to be vaccinated during pandemics, under federal law.

The Biden administration issued new requirements for all companies with 100 or more employees to ensure they are either fully vaccinated or produce negative test results at least once a week. The rule could give employers the option of making unvaccinated employees pay for the weekly testing, Bloomberg Law reported.

Because it’s federally mandated, the Department of Labor will require employers to give workers paid time off to get vaccinated. This includes time to get the shot and sick time to recover from any side effects.

You May Like: How Much Health Insurance Do You Need

Talk To An Insurance Agent Or Broker Today

Now that there isnt a penalty for not having insurance, that should take some pressure off of you if you only had insurance for part of this year. Youll still have to answer questions about your coverage when you file your taxes, but you wont have to pay a penalty.

Thats just one way to avoid extra costs, though. Health insurance is almost necessary to avoid financial repercussions. Figuring out which health insurance plan is right for you can be daunting, but theres help for that.

Talk with an insurance agent or broker about your financial and medical situation they can help you fill out your health care market place application, choose the right plan, and get your insurance started.

Need help figuring out your health care market place insurance options? Contact Fiorella Insurance Agency to see how we can help you choose the right plan.

Most Americans Werent Affected By The Penalty

As noted above, only 4 million tax returns for 2016 included the ACAs individual mandate penalty . The vast majority of tax filers had health insurance, and even among those who didnt, penalty exemptions were more common than penalty assessments.

Most Americans already get health insurance either from an employer or from the government they didnt need to worry about the penalty because employer-sponsored and government-sponsored health insurance count as minimum essential coverage.

Individual market major medical plans available on or off-exchange are considered minimum essential coverage, and so are grandfathered plans and grandmothered plans. And although health care sharing ministries are not considered minimum essential coverage, people with sharing ministry coverage were eligible for one of the exemptions under the ACA.

Plans that arent considered major medical coverage are not subject to the ACAs regulations, and do not count as minimum essential coverage, meaning people were subject to the penalty if they relied on something like a short-term plan and were not otherwise exempt from the Obamacare penalty. Things like accident supplements and prescription discount plans may be beneficial, but they do not fulfill the requirement to maintain health insurance.

Read Also: Does Short Term Health Insurance Cover Pregnancy

How To Get Proof Of Student Health Insurance In Germany

In order to get proof of student health insurance in Germany, you have to personally contact your private health insurance company and request a certificate. This certificate should contain details of your insurance plan, such as how much it covers and for what duration.

In most cases, health insurance providers will have information on the type of document you need to submit and will be able to issue it to you.

If you have a private health insurance plan, you still have to go to a public health insurance provider in your area and obtain proof that you have been exempt from public/statutory health insurance, and that your current private insurance meets the requirements. This also applies if you already have an acceptable health insurance plan from your home country

To calculate the amount that you have to pay for German private health insurance, you can use this free tool.

How To Report Coverage Exemptions Obtained From The Marketplace

An application for a health coverage exemption that is granted only by the Marketplace should be submitted to the Marketplace as soon as possible so you can properly report the exemption on your federal income tax return.

If you are granted an exemption from the Marketplace you will receive an exemption certificate number . The exemption is reported by entering your ECN in Part I of Form 8965, Health Coverage Exemptions, in column C. If the Marketplace hasnt processed your exemption application before you file your tax return, complete Part I of Form 8965 and enter pending in Column C.

You do not need an ECN from the Marketplace for an exemption that you claim on your tax return.

Recommended Reading: What Is A Health Insurance Plan