What Is Covered In Short Term Health Insurance Plans

The coverages of a short term health insurance policy depend upon the insurance company. Usually, the following things are covered:

Hospitalization: Expenses related to hospitalization such as bed charges, doctor visits, medicines, room rent, cost of surgeries, operation theater charges, etc.

Ambulance charges: The cost of hiring an ambulance for transporting the patient from one place to another would be covered under short term health insurance.

Expenses related to organ donation: Some insurance companies may cover the cost of undergoing surgery for organ donation.

Health check-ups: Regular health check-ups are conducted on the insured persons to keep a tab on their current health status. This is crucial for detecting an ailment in its early stages.

Pre and post hospitalization: A planned surgery may require treatment before or after getting hospitalized. These charges are covered under a short term policy.

Options To Pay For Long

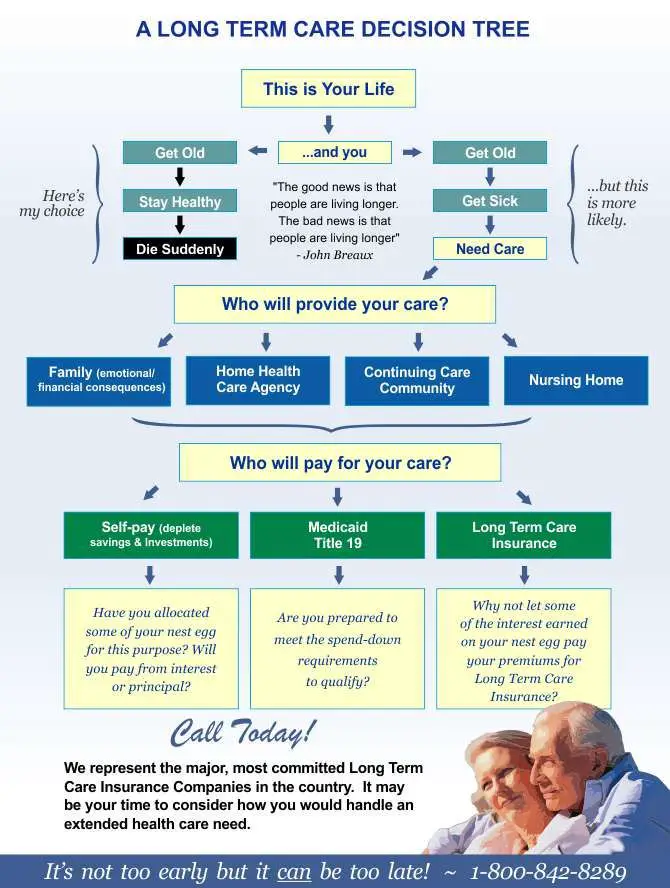

Essentially, there are 4 different ways to pay for long-term care: government assistance traditional long-term care insurance “hybrid” insurance, which offers life insurance or annuity benefits with long-term care coverage and personal savings. Your options depend largely on your personal and financial circumstances and what you expect for your standard of careboth now and in retirement.

Government programs: Veterans and people with low income who can’t afford to cover long-term care expenses might be eligible for long-term care assistance from the federal government, through Medicaid and the Veterans Health Administration, or state-run assistance programs.

You can’t rely on Medicare to cover these costs, even if you’re age 65 or older. Medicare doesn’t provide benefits for long-term care and has only limited benefits for short-term care.4

Medicaid covers long-term care costs but, in order to be eligible, you need to qualify based on an income and asset test Medicaid is generally designed for low income individuals or families. Benefits and eligibility vary from state to state, and the choices for where and how you receive care could be limited.

Traditional long-term care insurance policies: You can choose the amount of coverage, how long it lasts, and how long you have to wait before receiving benefits. Typically, you pay an annual premium for life, although your premium payment period could be shorter.

Short Term Vs Long Term Health Insurance:

A short term health insurance plan needs to be renewed more frequently since it is valid for a short duration. On the other hand, a long term health insurance policy can keep you covered with medical insurance for two to three years. Here are the major differences between these two plans:

| Parameter |

| Available |

Recommended Reading: Why Do You Need Health Insurance

The Best Way To Get Long

So, whats the best way to find long-term care insurance? Go to an independent insurance agent. Theyll shop around several different long-term care companies and get you quotes that can save you thousands of dollars and loads of unnecessary worries. Long-term care is an important decision, so make sure you get a professional on your side!

Dont know where to look? Our Endorsed Local Providers are trusted insurance experts fit to answer all your questions. Your ELP is RamseyTrusted and will listen to your needs and help you make the right decision for you and your familyand your budget.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.Learn More.

Checklist And Counseling Information:

Long term care insurance agents are required to leave a number of documents with you when they sell a long-term care insurance policy.

Among the items you should get is a copy of a “Personal Worksheet” that helps you understand some of the issues related to purchasing long-term care insurance and the name, address, and local phone number of the HICAP office nearest you where you can receive, free of charge, information and counseling about long-term care insurance.

You May Like: How Much Do Businesses Pay For Health Insurance

Can I Afford Long

Remember that after retirement, income often does not keep pace with inflation. As you age you may have unexpected medical expenses such as prescription drugs or other medical costs that may not be covered by your medical insurance. The loss of a spouse can also result in reduced income. Select a premium you can comfortably afford. Take into consideration that your premium may increase during the years you own the policy. When talking to a long term care insurance agent about long-term care insurance, it is important for you and your agent to understand your financial circumstances so that he or she can tailor a plan best suited to your needs.

When Do People Buy Long

There is a sweet spot for buying LTC insurance. If you buy it too young, you’ll have lower premiums, but you’ll be paying them for a very long time. Before their fifties, most people also can’t sufficiently predict what their finances and health will look like in the future to make an educated decision. If you buy LTC insurance past a certain age, however, your premiums will be so high that they will make LTC insurance unfeasible. Your chances of being declined for coverage also go up as you age. Most people who buy long-term care insurance do so in their fifties and sixties.

Recommended Reading: Can I Use My Health Insurance In A Different State

Past Performance Of Long

It’s helpful to be aware of the history of long-term care insurance. Historically, the performance of LTC insurance policies has been quite poor:

- About half of all LTC policies lapsed before any benefits were paid policy holders were unable or unwilling to continue paying their premiums.

- Of those people who bought insurance and later entered a nursing facility, about half never collected a dollar from their LTC policies.

- No benefits were ever paid to the many people who bought nursing facility coverage but instead received home care or entered a residential facility not covered by the insurance.

- For many of the longest-term residents, benefits were used up before the nursing facility stay ended.

In these situations, LTC insurance failed to live up to its promise to help people avoid using up their savings or relying on Medicaid to pay for long-term care. In other words, it was a lousy investment.

Does Medicare Pay Ltc Benefits

No. Medicare is a government health insurance program for individuals over 65 and others with specific disabilities. It isnt designed to pay benefits for care that is required long term. That said, it can cover some of your care during your policys elimination period.

Under Medicare Part A, skilled nursing facility care may be fully covered for the first 20 days. From day 21 through day 100, you must pay coinsurance in the amount of $185.50 per day. After the 100th day, youre responsible for all costs.

Don’t Miss: How Much Does Health Insurance Cost On The Marketplace

What Is Inflation Protection

Inflation Protection is intended to help maintain the value of the benefits you purchase today so they will keep up with future increases in the cost of care. In the past, long-term care costs in California have increased at an annual rate of more than 5%.

Protecting against the rising cost of care is one of the most important choices you will make. Inflation protection increases the Daily Maximum, the Maximum Lifetime Benefit and other benefit amounts. If you purchase individual long-term care insurance, your insurer must offer you at the time you purchase the policy the option to purchase an inflation protection feature. Your insurer must offer inflation protection which is no less favorable than the following options: Increases benefit levels annually so that the increases are compounded annually at least 5% or a Benefit Increase Option.

What Are The Benefits Of A Long Term Health Insurance Policy

Here are some of the benefits of opting for a long term health insurance policy. Exact benefits can vary from insurer to insurer and plan to plan.

A usual health insurance plan relieves you of the financial stress of medical care for a duration of a year. Possessing long term insurance, on the other hand, can keep you stress-free in this regard for up to two or three years.

Health insurers usually offer discounts on the policy premium for long term health insurance plans. Hence, buying long term insurance with a policy duration of two to three years is more cost-effective than renewing insurance every year for the same duration.

Your accumulated No Claim Bonus can be lost if you do not renew your policy on time. However, if you opt for long term insurance, you do not need to worry about losing such benefits for at least two or three years.

The premium charged for health policies can be revised periodically. Buying a health insurance long term policy can help you avoid these hikes and safeguard your hard-earned money.

Under Section 80C of the Income Tax Act, you can claim tax exemptions on the premium paid towards long term health insurance.

Don’t Miss: When Do I Have To Sign Up For Health Insurance

Do Other Types Of Insurance Plans Offer Ltc Coverage

Standard health insurance plans do not offer long-term care coverage. This includes both employer-sponsored health insurance policies, as well as federal health care programs such as Medicare. While Original Medicare does not cover long-term care insurance, it may pay for 100 days of skilled nursing services or rehabilitative stay in a nursing home. Beyond that, Medicare beneficiaries must pay 100% of the cost of LTC services.

Medicaid, on the other hand, does cover some long-term care coverage for people who fit the low-income criteria necessary to qualify for the program. Medicaid is the largest public payer of LTC services nationwide. Federal programs through the Department of Veterans Affairs may pay for long-term care services under some circumstances.

Generally, if you need long-term care services, youll need a private long-term care insurance policy. Alternatively, you could use a reverse mortgage, life insurance, or annuities to pay for long-term care costs. Otherwise, youll have to pay out-of-pocket costs, many of which add up to $50,000 to $100,000 per year. More on that below.

When You Should Consider Long

During the financial planning process, its important to consider long-term care costs. This is important if you are close to retirement age. Unfortunately, if you wait too long to purchase coverage, it may be too late. Many applicants may not qualify if they already have a chronic illness or disability.

According to the U.S. Department of Health and Human Services, an adult turning 65 has a 70% chance of needing some form of long-term care. While only one-third of retirees may never need long-term care coverage, 20% may need it for five years or longer. With a semi-private nursing home room averaging about $7,908 per month according to 2021 data from Genworth, long-term care could end up being a huge financial burden for you and your family.

Most health insurance policies wont cover long-term care costs. Additionally, if youre counting on Medicare to assist you with these extra expenses, you may be out of luck. Medicare doesnt cover long-term care or custodial care. Most nursing homes classify under the custodial care category. This classification of care includes the supervision of your daily tasks.

So, if you dont have long-term care insurance, youre on the hook for these expenses. However, its possible to get help through Medicaid for low income families. But keep in mind, you may only receive coverage after you deplete your life savings. Just know that Medicare may cover short-term nursing care or hospice care, but little of the long-term care in between.

Also Check: How Do I Find A Health Insurance Broker

How To Find The Best Long

If youre interested in considering a long-term care insurance policy, Pate recommends speaking with a licensed insurance broker about your options. They can help you search for a plan that best meets your specific coverage needs and aligns with your budget. They can also search for specialized plans that consider chronic health conditions.

Long-term care is a commonand sometimes insurmountableexpense, but the right long-term care insurance policy purchased at the right time can help relieve that financial burden significantly. Not to mention, it expands a persons care options as they need them, providing a sense of relief for them and their loved ones as they navigate the later years of their lives.

What Qualifies As Long

Long-term care insurance, according to Washington state law , is an insurance policy, contract or rider that provides coverage for at least 12 consecutive months to an insured person if they experience a debilitating prolonged illness or disability. LTC insurance typically covers the following types of services if theyre provided in a setting other than a hospitals acute care unit:

- Diagnostic

- Maintenance

- Personal care

LTC insurance typically pays benefits when an insured person can no longer independently do two or more of the following activities of daily living :

- Control their bladder or bowels

LTC insurance may be included as a rider on some life insurance and annuity policies. However, some life insurance policy riders dont qualify as long-term care insurance in our state according to the definition of LTC insurance as defined in RCW 48.83.020 . See a list of companies approved to sell long-term care insurance in Washington state.

If you have questions about benefits or exemptions regarding the new WA Cares Fund , visit the WA Cares Fund website .

Recommended Reading: Does Canada Have Private Health Insurance

When Do Benefits Begin

Typically, you become eligible for your long-term care benefits when you can no longer perform 2 “ADLs,” or Activities of Daily Living without help. Then, most policies have a waiting period , during which you pay for your care separately from your policy until your waiting period is completed and you can start long-term care benefits.

There Are Several Type Of Long

A typical, traditional LTCI policy will pay a predetermined amount for each service â for instance, $100 a day for nursing home care. There generally will be a limit to the benefits you receive, either based on a number of years or a dollar amount. A plan that offers pooled benefits will set a total dollar amount for the various services you receive.

New types of LTCI policies are growing in popularity, extending beyond the traditional âuse it or lose itâ type, many of which have experienced premium increases.

One alternative is hybrid life and long-term care insurance. This type of policy combines long-term care insurance with permanent life insurance and provides more options:

- If you need long-term care, you can tap the policy benefit.

- If you die before needing long-term care, the policy has a life insurance benefit.

- If you decide you need the money for something else, you can typically receive a cash value that can be roughly equal to or less than the total premiums paid.

- Contract terms and premiums are guaranteed not to change.

Another alternative is a universal life insurance policy with a LTCI rider. This option might be right for you if youâre interested in a meaningful death benefit for your beneficiaries in the event LTCI isnât needed.

Also Check: How Long Can Your Child Stay On Your Health Insurance

What Is Long Term Health Insurance

Long-term health insurance plans are meant to protect the policyholder’s health as well as his or her financial future. These insurance policies, which are often offered for a period of two to three years, are a wonderful alternative to conventional one-year health insurance coverage.

A policyholder is expected to pay the total premium for the duration of the coverage all at once when obtaining the insurance under this programme. A long-term insurance often provides continuous coverage for the duration of the policy, without the need to pay an annual renewal payment.

Private Insurance Plans: Life Insurance Vs Long

Long-Term Care Insurance Plans

Long-term care insurance is a type of private health insurance that provides benefits to cover some of the costs of services you might need if you develop a chronic illness or cognitive impairment.

Government Programs

In Massachusetts, the state’s Medicaid program, known as MassHealth, currently provides assistance for 65% of all nursing home residents.8 In addition, the Executive Office of Elder Affairs spends 70% of its budget on long-term care services provided in Massachusetts, but pays almost entirely for home and community-based services. To qualify for Medicaid or Elder Affairs assistance, a person may not have income or assets above a certain level.

Medicare

Many individuals incorrectly assume that Medicare will cover most of their long-term care costs. In fact, Medicare pays very little of all long-term care costs. IT IS NOT RECOMMENDED THAT YOU RELY ON MEDICARE TO PAY FOR YOUR LONG-TERM CARE NEEDS.

Medicare covers only the following long-term care services:

Veterans Benefits

If you are a veteran, you may be eligible for some long-term care services in a Veterans Administration facility. To find out whether you would be eligible for assistance, contact your city/town governments Veterans Agent or the Massachusetts Department of Veterans Services.

The Home Care Program

Medicaid

Life Insurance Plans

Don’t Miss: Where To Get Short Term Health Insurance

What Long Term Care Insurance Covers

So what does long term care insurance cover, Well, since the majority of long-term care policies are comprehensive policies, they may cover at-home care, adult day care, assisted living facilities , and nursing home care. At home, long-term care may cover the cost of professional nursing care, occupational therapy, or rehabilitation. This may also include assistance with daily tasks, including bathing or brushing teeth.

Additionally, long-term care coverage can cover short-term hospice care for individuals who are terminally ill. The objective of hospice care is to help with pain management and provide emotional and physical support for all parties involved. Most policies allow beneficiaries to obtain care at a hospice facility, nursing home, or in the comfort of their own home. However, most hospice care is not considered long-term care and may receive coverage through Medicare.

Also, long-term care insurance can help cover the costs of respite care or temporary care. These policy extensions provide time off to those who care for an individual on a regular basis. Usually, respite care provides compensation to caregivers for 14 to 21 days a year. This care can take place at a nursing home, adult daytime care facility, or at home