Health Insurance Deductibles: What Can You Expect

On top of premiums, everyone who carries health insurance also pays a deductible. This means you pay 100% of your health expenses out of pocket until you have paid a predetermined amount. At that point, insurance coverage kicks in and you pay a percentage of your bills, with the insurer picking up the rest. Most workers are covered by a general annual deductible, which means it applies to most or all healthcare services. Here’s how general deductibles varied in 2020:

- $1,644: average general annual deductible for a single worker, employer plan

- $2,295: average annual deductible if that single worker was employed by a small firm

- $1,418: average annual deductible if that single worker was employed by a large firm

| Median Individual Deductible, Qualifying Health Plan Without Subsidies from HealthCare.gov., Plan Year 2020 |

|---|

| Bronze |

| $95 |

Individuals who are eligible for cost-sharing reductions are responsible for deductibles as low as $115 for those with household incomes closest to the federal poverty level.

What Does Health Insurance Cover

Under the Affordable Care Act, health insurance companies have to cover certain services and treatments. There are 10 benefits that all health insurance plans must offer, known as the 10 essential benefits.

- Preventive and wellness services, including chronic disease management

- Laboratory services

- Pediatric care, or care for children including dental and vision coverage

- Ambulatory patient services, or care you get without being admitted to a hospital

- Emergency services

- Mental health and substance use disorder care

- Prescription drugs

- Pregnancy and newborn care both during pregnancy and after birth

- Rehabilitative and habilitative services and devices, or services to help people with injuries or disabilities regain or develop mental and physical skills

Insurance For Families In Arizona

There are more factors to consider when purchasing insurance for your entire family. Do any members of your family need access to more comprehensive service? If your family members need ongoing care, this may sway your decision toward a specific type of coverage or plan.

If you need regular access to health care, paying more for a lower deductible plan can help manage your familys care costs. Paying less in monthly premiums could cost you more in the long run if you need to meet a large deductible before benefits kick in. Also, consider whether you want more choice over your doctors and specialists when deciding between an HMO, PPO, or POS plan.

Don’t Miss: Does Kroger Give Employee Discounts

Unitedhealthcare Individual And Family Marketplace Plans In Arizona

Looking for health care plans on the Marketplace? UnitedHealthcare Individual and Family Marketplace plans offer affordable, reliable coverage options from UnitedHealthcare of Arizona, Inc. As part of the American Rescue Plan Act , many individuals and families are now eligible for lower or in some cases $01,2 monthly premiums for Marketplace health coverage.

Call / TTY 711 to talk to a representative.

No Medical Underwriting Guaranteed Issue Effective January 1st 2014

Arizonas BC/BS of Arizona and Celtic Insurance companies will continue to offer health insurance without medical underwriting to adults age 35 or younger next year. Also, starting in January you will be able to purchase guaranteed issue health insurance during an open enrollment period even if youre already sick. Not all carriers and plans will offer guaranteed issue policies though, so it pays to shop around for the best deal.

Recommended Reading: Starbucks Part Time Health Insurance

Lower Benchmark Rates Result In Lower Subsidies For Many Enrollees

Although Arizonas average premiums decreased slightly by 0.2 percent for 2020, average benchmark premiums in Arizona . And that came on the heels of a 10 percent decrease in 2019, when overall average premiums . So for two years in a row, average benchmark premiums in Arizonas exchange have dropped more significantly than overall average premiums.

Decreases in the benchmark premiums can be caused by rate decreases from current insurers, but also by new entrants to the market offering plans that are priced lower than the existing plans, taking over the benchmark spot . Since premium subsidies are based on the cost of the benchmark plan, some Arizona residents began receiving smaller premium subsidies in 2019 and 2020, resulting in higher after-subsidy premiums even if the pre-subsidy cost of their own plan stayed fairly flat or decreased slightly. And 83 percent of Arizona exchange enrollees receive premium subsidies, so this is significant for most enrollees.

For example, an applicant in Phoenix only had Ambetter plans available for 2018. But for 2019, there were plans available in that area from Ambetter, Cigna, Bright, and Oscar. A 40-year-old in Phoenix earning $30,000 in 2018 would have received a premium subsidy of about $310/month, because the benchmark plan cost $513/month.

And the benchmark premium dropped again in 2020 its now a plan offered by Bright Health, and its only $400/month for a 40-year-old applicant

Is Employer Coverage Cheaper

Many people assume that employer coverage is the best or cheapest option. In 2020 an estimated 157 million people opted for their employer-based health care plan.4

But is it? Should you always choose your employers health coverage or should you opt for individual health insurance?

Employer plans can sometimes be less expensive since the company chips in part of the costs. Your employer can also sometimes get a better rate because theyre buying a large block of insurance packages. But not always. It can sometimes be cheaper to get health insurance on your own. While it might take a little more work on your end, if youre looking to save money on your health insurance costs, you might want to pass on the employer coverage and shop for an individual plan.

Don’t Miss: Does Starbucks Offer Health Insurance

How Much Does Group Health Insurance Cost

About 157 million people are covered by employer-based health insurance. But how much do companies pay for employee health insurance?

For a look into trends and costs over the years, the Kaiser Family Foundation conducts an annual survey.

In their recent findings, in 2020, the average monthly premiums for group health insurance increased from previous years to:

- $622 for individual coverage

- $1,778 for family coverage

Since 2019, average employer-sponsored individual premiums increased 4% and family premiums increased 4%. Moreover, the average premium for family coverage has increased 22% over the last five years and 55% over the last ten years.

Group Coverage Also Known As Employer

Companies that provide health insurance to employees as a benefit provide an insurance type known as group insurance. The cost of this type of health plan is based on total premiums paid to the insurance company. Premiums include payments from both employers and employees. Premiums do not include payments for services such as deductibles, co-pays or other out-of-pocket costs. Group coverage includes: Health Maintenance Organizations , Preferred Provider Organizations , Point-of-Service Plans and High-Deductible Health Plans.

Recommended Reading: Substitute Teacher Health Insurance

How Do I Enroll In Arizonas Health Insurance Marketplace

Arizona doesnt have a state website for health insurance enrollment, so youll need to use the federally run website, Healthcare.gov, to enroll. Youll need to create an account to get started. Make sure to follow the instructions and provide accurate contact information.

Once you apply online or over the phone, Healthcare.gov will determine your eligibility for Medicaid and other assistance programs. The marketplace will also inform you if you qualify for a subsidized premium with the Advanced Premium Tax Credit. Have essential information on hand when you fill out your application, such as the Social Security number, full name, birth date, and income for all family members on your plan.

Additional information youll need to provide includes:

- Your marital status

- Special medical needs

What Is The Average Cost Of Health Insurance

Maybe youre wondering, How much does individual health insurance cost? Heres what you can expect. The average individual in America pays $452 per month for marketplace health insurance in 2021.2 The average family pays $1,779 per month.3

But the cost of health insurance varies widely based on a bunch of factors. Some things are in your control, some arent. Things like your age, how many people are on your plan, how much coverage you need, where you live and who your employer is all play a role in the price of your coverage.

Heres a breakdown showing the average costs depending on your state:

Kaiser Family Foundation, 2021.

Don’t Miss: Why Do Doctors Hate Chiropractors

Average Health Insurance Cost By State

Residents of different states can see some pretty stark differences in the average cost of health insurance. Which states have the highest premiums, and which ones have the lowest?

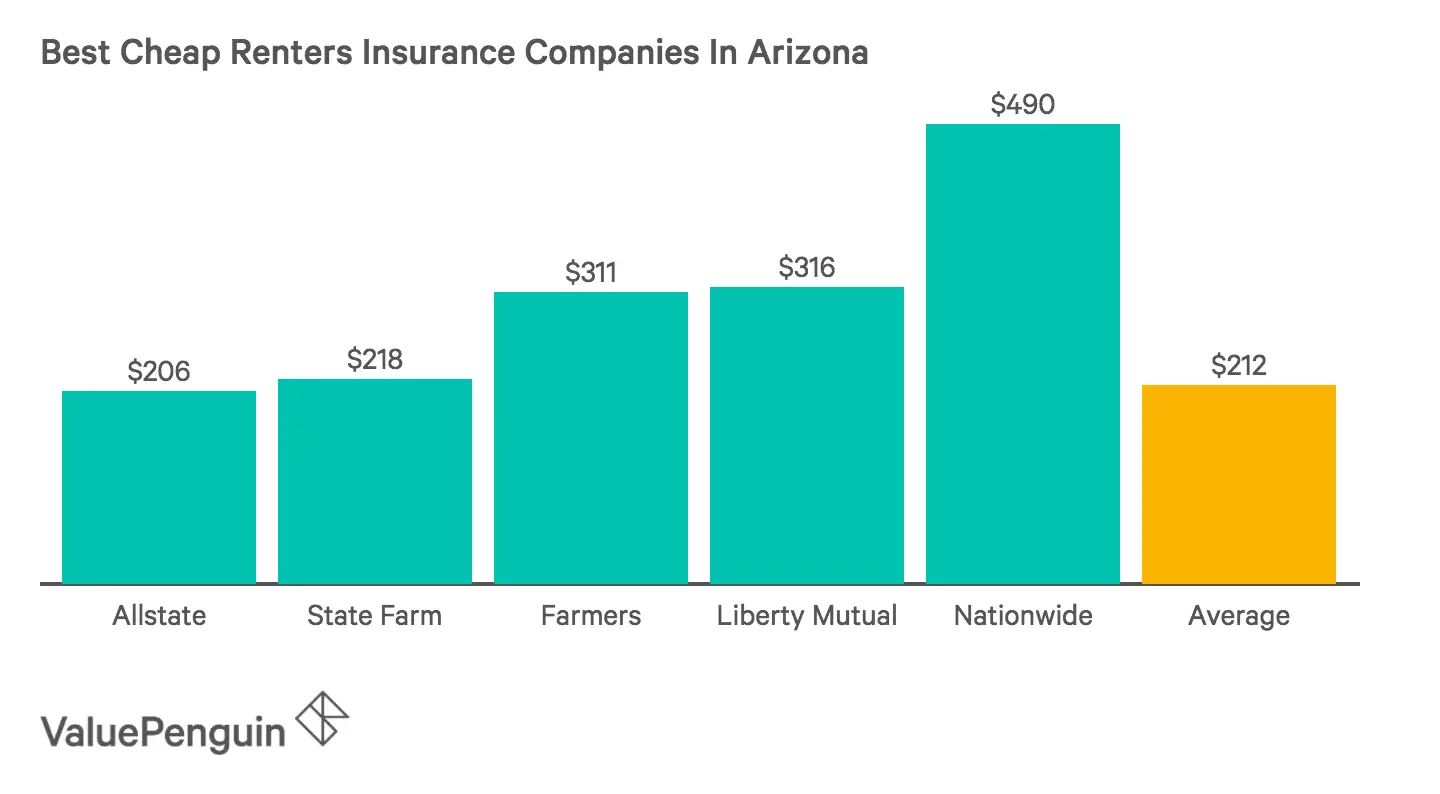

Using ValuePenguin data on certain states, the state with the highest monthly rates is Alaska at $426 for a 21-year-old. Multiplying for someone who is 30, that becomes $483.51. It becomes $544.43. for a 40-year-old, and a whopping $1,156.16 for a 60-year-old. The second-highest rate is in Wyoming at $366. Doing that math again, for those who are 30, 40 and 60 that figure turns into $415.41, $467.75 and $993.32, respectively.

These are particularly extreme examples, but even states that aren’t quite as high compared to the average rates can have monthly premiums not everyone can afford. The average health insurance premium for a 21-year-old in Florida is $285 not as large as Alaska or Wyoming, but still a lot, especially as a person gets older .

Still, there are states where premiums aren’t as expensive as these. Utah, for example, has an average cost of $180. While $180 can still be quite a lot of money per month for someone working in Utah at 21 , it is still a lesser figure than other states. In Montana, the average health care premium for someone at 21 is $210 per month. Check your state for more details, because the range of premiums can vary even more wildly than you may expect. ValuePenguin’s list did not include every state, such as Massachusetts.

Insurance For Individuals In Arizona

If you have a chronic health condition, however, you need to weigh the low premium against other out-of-pocket costs. A plan that costs $350 per month and has a $500 deductible may be a better fit for your financial needs than a plan that costs $250 per month and has a $5,000 deductible if you require regular medical care. A more expensive plan may also give you access to more specialists or better coverage for your prescriptions.

Before you select a plan, you should understand the differences between each type of plan:

- Health Maintenance Organization plans: HMO plans offer lower premiums while putting more restrictions on your care. Youll need to get a referral to see a specialist and only see local doctors in the network to receive coverage.

- Preferred Provider Organizations : PPO plans dont require approval to see the specialist of your choice. PPOs also offer nationwide coverage and out-of-network benefits. Youll likely pay more in premiums for a PPO than an HMO, though.

- Point-of-Service plans: POS plans compromise the advantages and disadvantages of HMOs and PPOs. You still need a referral to see a specialist, but if youre willing to pay a little more, you can still see out-of-network providers.

You May Like: What Insurance Does Starbucks Offer

Cheapest Plan In Arizona With An Hsa

If you dont go to the doctor frequently, you may want to consider a Health Savings Account or an HSA. These are plans with low monthly premiums, which typically equates to having fewer services covered, but HSAs allow you to make pre-tax contributions. You can save this money to serve as a nest egg if youre in good health and dont need to spend it for healthcare expenses.

HSA plans are available for both Expanded Bronze and Silver tiers. The cheapest health insurance in Arizona for each are:

- Cheapest HSA Expanded Bronze: Blue Portfolio HSA Bronze – PimaFocus Network provided by Blue Cross Blue Shield of Arizona costs an average of $302

- Cheapest HSA Silver: Ambetter Balanced Care 25 HSA by Ambetter from Arizona Complete Health costs an average of $483

Despite the possible savings you can earn with HSA plans, theres a risk that you may have to use a portion of it if you encounter major medical expenses.

Arizona Health Insurance And You

What could be more amazing than Arizonas Grand Canyon is having access to affordable health insurance. Many Arizona residents qualify for financial assistance to get private medical insurance under Obamacare. You could even get free or low-cost health insurance in Arizona through public programs like Medicaid.

To help you better understand the Arizona health insurance market and your coverage options, you can navigate to the sections below to learn more.

Recommended Reading: When Does Health Insurance Stop After Quitting Job

How Much Does Health Insurance Cost

In 2022, the average cost of health insurance is $541 a month for a silver plan. However, costs will vary by location. Insurance is expensive in West Virginia and South Dakota, averaging more than $800 a month. States with cheaper health insurance include Georgia, New Hampshire and Maryland, averaging less than $375 a month.

Enrollment In The Arizona Health Insurance Marketplace

Arizona uses the federally-run Marketplace at Healthcare.gov for open enrollment, which takes place each year from This enrollment period is for private individual and family health insurance plans regulated by the Affordable Care Act . You also have access to these plans if youre a self-employed entrepreneur with no employees.

Arizonas Marketplace enrollment has declined every year since 2015 when sign-ups peaked at nearly 206,000. For the 2021 coverage year, a little over 154,000 residents enrolled in Arizona Health Insurance Marketplace plansslightly less than the previous year when a little over160,000 people enrolled.4

Besides enrollment through the public exchange at Healthcare.gov, you can get ACA-qualified coverage in the private Marketplace. This includes buying health insurance directly from a private insurer or connecting with a licensed insurance agent.

You May Like: Starbucks Health Insurance Part-time

What Is The Aca Health Insurance Marketplace

Established by the Affordable Care Act , the Health Insurance Marketplace is a platform that offers medical insurance plans to individuals, families, and small businesses. Fourteen states and the District of Columbia offer their own marketplaces, also known as exchanges, while the federal government manages a marketplace open to residents of other states. Marketplace plans are divided into four categories that range in cost and coverage. Though offered by private companies, all must meet certain criteria established by the state or federal government.

Average Health Insurance Premiums By Metal Tier

Health insurance plans are separated into metal tiers based on the proportion of health care costs the insurance plan is expected to cover.

The silver plan falls around the middle, with moderate deductibles, copays and coinsurance. The catastrophic and bronze plans offer the smallest amount of coverage, while platinum plans offer the greatest.

The average rates paid for health insurance plans are inversely related to the amount of coverage they provide, with platinum plans being the most expensive and catastrophic and bronze plans being the cheapest. The following table shows the average rates a 40-year-old would pay for individual health insurance based on the tier. Older consumers would see their rates increase according to the age scale set by the federal guidelines.

| Metal tier |

|---|

Policy premiums are for a 40-year-old applicant.

Read Also: Health Insurance For Substitute Teachers

Average Cost Of Employer

What is the avearge cost of health insurance through an employer?

The average annual cost of health insurance premiums through an employer is $7,470 for single coverage and $21,342 for family coverage. The average employer contributes an average of $6,227 for a single coverage plan and $15,754 to family coverage.

This leaves employees paying an average of $1,243 for a year of single coverage or $5,588 for a year of family coverage through their employer-sponsored health insurance.

Is employer-sponsored health insurance cheaper?

Yes, employer-sponsored health insurance is cheaper. While the cost of the plans themselves might not change much, the fact that employers cover around 83% of the premiums means that employer-sponsored health insurance almost always works out to be less expensive than buying an individual plan.

The downside to employer-sponsored health insurance is that youre limited to certain plan options.

Do employees pay for employer-sponsored health insurance?

Yes, employees pay for employer-sponsored health insurance. While these plans are employer-sponsored, your employer does not typically cover the entirety of your premiums. On average, an employee will pay about 1/5 the price of premiums, which is usually deducted directly from their paychecks.

Additionally, employees are still responsible for making copayments and reaching their deductible before insurance covers services.

How Much Is Health Insurance A Month For A Single Person

It depends on a variety of factors, ranging from your resident state to your age to the type of plan . Employer-sponsored plans average $622.50 a month, with individual employees paying $105 of that, for example. Individual plans on the healthcare exchanges range from an average of $648 to $273 monthly.

Also Check: Starbucks Pet Insurance

Average Health Insurance Costs

With so many different variables impacting how much health insurance will cost a person on a monthly or yearly basis, we’re better off breaking things down instead of giving one general number.

So what are some of the biggest factors in determining how health insurance costs can vary? Certainly, the type of plan someone has and the tier of the plan she has to go a long way. Medical history — not to mention whether the person is a smoker — can play a role in whether insurers give a higher rate. Someone in need of insurance for a family is going to have a higher premium than someone seeking an individual plan.

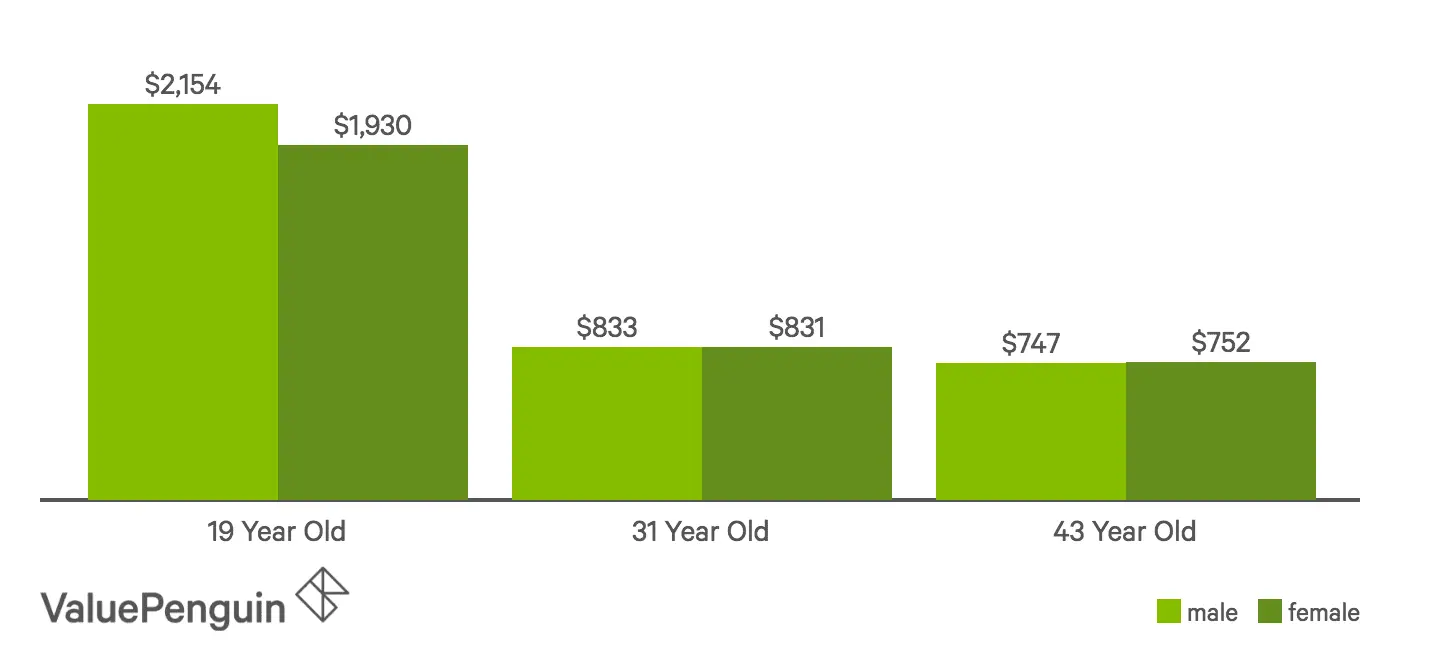

Two factors that can also play a large role in healthcare rates and premiums is how old someone is and where he lives.