Washington State Workers Compensation Insurance

1. How to Get a Workers Compensation Account L& I If you are bringing employees from out-of-state, indicate the date they will start working in Washington. Submit application and payment. We will receive your Workers compensation provides no-fault industrial insurance coverage for most employers and workers in Washington. Featured Content.

Do Real Estate Agents Get Benefits

Disclosure: This post may contain affiliate links, meaning our company, JCHQ Publishing will get a commission if you decide to make a purchase through the links, but at no additional cost to you.

Most people want to know about the earning potential before they start their career in the real estate industry. In addition to that, you might also want to find out will your broker provide you with any benefits. Just to clarify, Im not talking about the benefits of being your own boss, the flexibility in scheduling your work time, etc. Im talking about benefits that is more tangible such as medical insurance and retirement plan.

Do real estate agents get benefits? The quick answer is the majority of the real estate salespeople do not receive health benefits from their brokerage. They either get the medical benefits from a spousal plan or they would pay out of their own pocket.

In this article, Ill go over some benefits you should into, the things to consider when choosing between a group plan versus individual plan, and the statistics of brokers who are providing these benefits.

What If I Own A Real Estate Agency That Is Considered A Small Business

If you own a small business, you might be able to purchase your insurance plan through the Small Business Health Options Program. This program helps you provide health insurance to your employees if you have 50 or fewer full-time equivalent employees. There is no open enrollment period for this program.

You can give your employees the opportunity to choose from multiple plans and choose how much money to contribute to their coverage. You can use a private broker to navigate this program or do it online.

If you employ less than 25 people, you might qualify for the SHOP tax credit which can be worth up to 50 percent of the monthly premium costs.

Read Also: How To Cancel Anthem Health Insurance

National Association Of Realtors

Another option is finding insurance through the National Association of Realtors. Members of NAR have access to Realtors Core Health Insurance. This offers plans for those ages 18-65. Core Health Insurance provides Limited Medical plans that are designed specifically for real estate agents who are members of NAR. It is designed to provide for the everyday health needs of members.

With this plan there are no medical exams or questions. Plans start at $70 per month. There are three plans to choose from and members can choose any provider with the choice for in network providers at a lower cost. There are no contracts to be signed and coverage can begin the day after applying and receiving approval. All plans are underwritten by United States Fire Insurance Company.

Coverage varies among the three different plans through NAR, but what is covered is standard. Key features of all three Core Health Insurance Plans include little or no deductibles, little or no co-pays, and coverage for everyday issues. The plans are not based on age and they are meant to be inexpensive because they are based on income. It is important to understand that this is not a major medical plan. Major medical plans provide coverage for emergencies as well as everyday medical situations.

Shop Around For Fl Health Insurance

Another options for real estate agnets, is to shop around. Shopping around can allow you to see what different insurance companies have to offer. Sometimes the amount of plans available is overwhelming. The best way to decide what plan is right for you is to compare the choices. Right now you can use the FL health insurance comparison tool on this page to compare rates and quotes from top companies.

If you still have questions after using the comparison tool, you can contact one of our experienced independent agents who can answers any remaining questions you may have. Donât go without insurance just because you are self-employed. And donât forget that all of these options included coverage for you and your family as well. There are many options available to you. Enter the zip code of your primary residence above. You can do it right now!

Don’t Miss: Does Your Employer Pay For Health Insurance

New Kids On The Block

While the legacy brands have increasingly worked to connect their agents to health plans, some of the newer entrants to the industry have gone further by offering options closer to traditional coverage. Probably the most prominent of these is eXp Realty, which in late 2019 began offering agents plans as an alternative to finding their own coverage on an open marketplace.

The program works through a partnership with insurance startup Clearwater Benefits, and CEO Jason Gesing told Inman it ultimately saves agents about $8,000 a year.

Jason Gesing

Agents enter the program by first going through a consultation about their options. Not every eXp agent uses the program, but Gesing said it was still important for eXp to offer something.

For us its a fundamental necessity, he said, adding that theres a business case for offering benefits as well. I think to the extent that our agents cant stay healthy, they cant continue to do their work.

Among other things, eXp says that the benefits of its program include a national network, which gives participants more choice when choosing doctors, low co-pays and a concierge service. The company believes the program is, overall, an economic boon for agents, and in the final days of 2021 pointed to examples of participants saving as much as $12,000 a year.

There are literally hundreds of plans in every state, and they vary by state, she said. Theres a lot of information to know.

Ee Lyn Khoo

Consider All Of Your Health Insurance Options

There are several ways to purchase health insurance. When you shop at Healthcare.gov, youre only seeing on-exchange plans. However, insurance companies only make a fraction of their plans available on exchange.” If you go directly to an insurance companys website, youll see their off-exchange plans. There are also private exchanges, co-ops, and even faith-based medical sharing plans that function similar to insurance. At Take Command Health, we can help you quickly see ALL of your options.

Special Note: You may get approached by aggressive brokers that want to sell you short-term medical insurance or indemnity plans. They will sound too good to be true, and they are. Short-term medical plans are affordable and do a decent job of protecting you from injury and illness. They are terrible for pre-existing conditions or routine care. So why not string together a series of short-term plans like some brokers recommend? Well, short-term plans dont count as insurance. Yes, you get a lower premium, but then youll get hit with some hefty tax penalties when you file your taxes. Only use short-term plans for three months or less if you have a unique situation. Never never never buy an indemnity plan and run from whoever is selling it to you. Indemnity = pure snake oil.

Also Check: Can Foreigners Buy Health Insurance In Usa

Can You Get Added To Your Spouses Health Insurance

The best option for your situation may be to get on your spouses health insurance. Obviously, this is not an option if you are not married. However, if you are married and your spouse has health coverage through their job, you can always go on their policy.

The cost of their premiums will go up once you are added, but it will be cheaper than having two separate insurance policies. Many real estate agents that are offered insurance through their agencies still choose to go on their spouses policy if they can get a good deal. Do not rule out this option for health coverage.

All Realtor Health Insurance Options In 2021

Published by Brian E Adams on November 17, 2020November 17, 2020

Update November 17, 2020 Originally published September 8, 2020

2021 open enrollment from the ACA Healthcare Marketplace runs from November 1, 2020 to December 15, 2020.

Do Realtors get health insurance?

Well, most do. But they mostly get it from outside their real estate job.

This is one of the most frequent gripes Ive seen leveled at the National Association of Realtors from NAR members: the lack of a good group healthcare program.

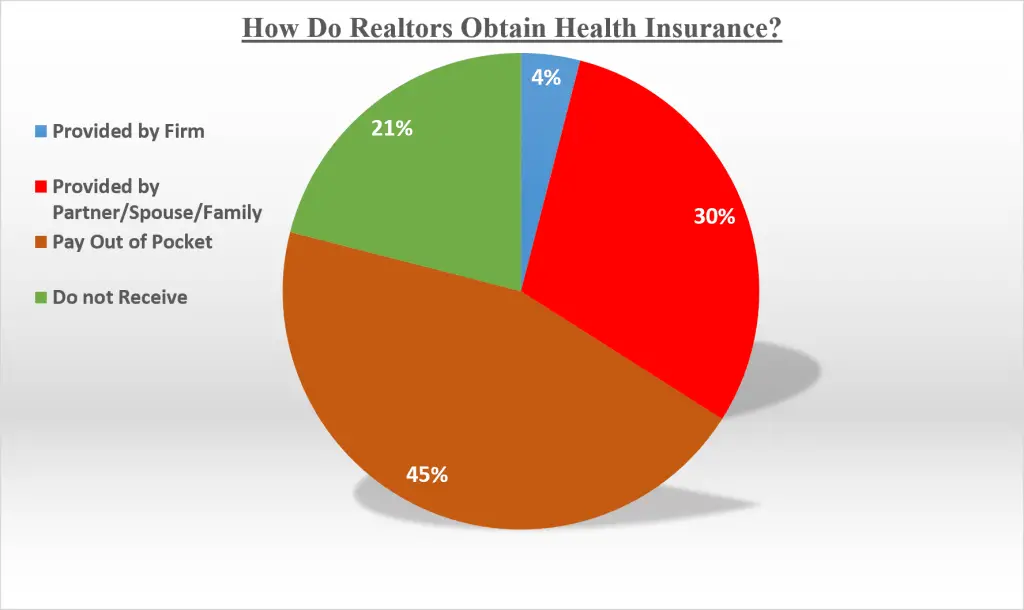

In a world dominated by independent contractors, its not a surprise that insurance coverage might be spotty. A startling 21% of Realtors report having no insurance .

NAR has a 2020 survey that shows where most agents get their coverage.

- Spouse

- NAR Insurance Marketplace

- Other

Most agents are paying out of pocket, usually through the government Healthcare marketplace or directly to health insurance carriers.

If you are an agent looking to get health coverage for you and your family members, below is hopefully a good list to get you looking in the right direction!

Don’t Miss: How To Get My Health Insurance Card

Read About 4 Exp Agents Who Are Saving Thousands Each Year

As many real estate agents know, healthcare insurance is something they either forego because of the expense or buy on the open market. When eXp Realty started partnering with Clearwater Benefits to offer eXp Agent Healthcare for its agents, many agents opted to try it out and many have experienced great success! Here are four stories of eXp agents who have benefited from eXps Agent Healthcare program.

Fl Self Employment Health Insurance For Realtors

The first option available for real estate agents is self-employment insurance. Self-employment insurance is available in a variety of forms and plans. One option is to become a member of the National Association of the Self Employed. This association assists the self-employed with many things including health insurance. Once you become a member, you can get a quality health insurance plan through pre-negotiated prices. As long as you keep up your monthly membership fee and your monthly premium, your coverage will continue.

Also Check: How Much Does Health Insurance Cost For Small Business Owners

How Much Does Health Insurance Cost For Real Estate Agents

The cost of health insurance for realtors can vary widely, just as it can for people in other occupations. Generally, people who are able to go on their spouses policy end up having the lowest premiums.

People who get insurance through their agencies usually have affordable health insurance as well. Those that have to buy a private health insurance policy have higher costs on average, but good deals can be found if you do your research when comparing insurance quotes online.

Compare Insurance Providers Rates to Save Up to 75%

Secured with SHA-256 Encryption

The Real Estate Agent Health Insurance Guide

Jack

Hip-pocket: You’re a pro at selling homes and closing deals, but there’s this one lingering thing each year you feel a little uneasy about–choosing a health plan. Your firm helps with many things, but not this. You look to into getting onto your spouses plan but it’s too expensive. Your corporate friends complain about health insurance, but they don’t really know what it’s like to be totally on their own.

The reality is shopping on the individual market can be overwhelming:

Am I getting the coverage my family needs? Will my doctor I’ve seen for 20 years take my new insurance? What about my prescriptions? Am I getting sold something I dont really need or am I missing something I desperately do?

At Take Command Health, our job is to empower you to make smart health insurance decisions and make your busy life a little easier. A smart decision not only gives you peace of mind, itll also save you money. Research shows more than 85% of people shopping on their own choose the wrong health plan each year, costing more than $500 in unnecessary health expenses.

Let’s do it. Let’s find an awesome plan this Open Enrollment with no head-aches that has exactly what you need. We created this guide and 7 simple health insurance shopping rules to arm you with the inside information you need to make a smart decision for you and your family.

Don’t Miss: Does Oregon Have Free Health Insurance

National Association Of Realtors Options

One place to visit if you are a member of the NATIONAL ASSOCIATION of REALTORS® is the REALTORS® Insurance Marketplace. This shopping site/exchange provides NAR members with a variety of health insurance options, including:

- Qualified Health Plans that meet the mandates of the Affordable Care Act through major insurance carriers

- Supplemental Medicare insurance options for Medicare-eligible NAR members

- Short Term Insurance ranging from 30 days to 6 months that can serve as coverage to avoid gaps between long-term policies.

- Members TeleHealth programs where members can gain telephone, smartphone app, web chat, or email access to licensed physicians for non-emergency diagnosis and treatment.

- Members Supplemental Health Plans that can be combined with other major medical health insurance plans to provide financial aid for out-of-pocket expenses and other services that traditional insurance might not cover.

- REALTORS® Dental Insurance that provides coverage for dental expenses exclusively for NAR members and their families.

- REALTORS® Vision Insurance that provides a PPO and non-PPO option for NAR members and their families.

Through A Family Member

If your spouse is employed and has access to health benefits, you can purchase a plan together for a combined policy. This is a common option to choose if you happened to be married and are seeking the most affordable option for you and your family. Joining your spouses policy can alleviate the stress of searching for an affordable healthcare plan as an independent contractor, giving you more time to focus on the job rather than worry about insurance plans.

Also Check: How Much Does It Cost For Health Insurance

Find A Plan With Free Primary Care

Due to skyrocketing health insurance costs, many physicians have decided to opt out of fee-for-service insurance model and charge patients a flat fee instead. Known as direct primary care , this allows physicians freedom from exhaustive paperwork and oversight from non-medical administrators to focus more on spending quality time with patients. The flat feeâwhich patients pay monthly, quarterly, or annuallyâcovers all routine primary care services like lab work, blood tests, strep throat cultures, and annual check-ups.

While the DPC model is a great alternative for patients, it doesnât cover all services, so many patients also purchase a high-deductible policy to help cover emergencies. Some progressive insurers have realized the benefits of this model and now offer plans with free primary care wrapped into their affordable health plans. This hybrid model is a great option for real estate agents, who can benefit from free primary care while also carrying a health plan that will cover other health needs that come up throughout the year.

How Much Does Health Insurance Cost For A Real Estate Agent

If you dont have health coverage through an agency and you need to purchase your own coverage, the best thing to do is log on to healthcare.gov and see what medical plans are available to you and price policies with insurance carriers that are known for their coverage for the self-employed, like UnitedHealthcare and Blue Cross Blue Shield.

How much you pay will depend primarily on your income, but the average insurance premium for a self-employed person in the United States is $484/month, and the average premium for a family is $1,230 per month.

Read Also: Why Short Term Health Insurance

How To Make Your Insurance Payment

Use your MasterCard or Visa to make your insurance payment online through MyWeb, RECOs exclusive web portal for registrants. If you dont already have a MyWeb account, creating one is easy and free. Once youve logged into MyWeb, click on the Insurance banner located at the top of the screen to make your payment.

Please note: Please do not email or fax your credit card details to RECO. Registrants are required to pay using MyWeb. Payments cannot be made by phone.

For additional information:

Whats The Bottom Line

In conclusion, there are several different ways for real estate agents to get health benefits. The right option differs depending on your own personal situation, but if you are intelligent and do your research youll be able to find a good health insurance policy. This is the case no matter whether youre self-employed or work for a real estate agency that offers you health insurance benefits as part of your compensation package.

You May Like: How Long Do You Have Health Insurance After Being Fired

Know Which Doctors You Really Need

This year, we are seeing a lot of new EPO networks. With an EPO, you dont need a primary care doctor and you can see any specialist youd like thats in-network. The only difference between an EPO and a PPO is that an EPO doesnt cover out of network benefits. But as long as youre smart about choosing a plan that has your doctors in network, this can be a great money saving opportunity!

If your doctors happen to be in an HMO or if you dont have preferred doctors yet, the HMO can be a great money saving choice. These arent the HMOs of the past with long wait times and long lines. You can get referrals online and going to see some specialists no longer requires a referral.

At TakeCommandHealth.com, we have a first-of-its-kind universal doctor search tool. Search for your doctors and well help you find the least expensive networks and plans he or she accepts!