Spouses Have Separate Health Plans Dependent Child Covered Under University Insurance

You and your wife each have coverage through your own employers. You have an HDHP that just covers yourself, while your wife has a non-HDHP for her own coverage. You have a 20-year-old son who is a full-time college student.

He’s enrolled in the non-HDHP health insurance plan that his college offers. You and your wife file a joint tax return, and claim your son as a dependent .

You can contribute $3,850 to your HSA in 2023, since you have self-only HDHP coverage. But you can use the money in your HSA to pay for qualifying medical expenses for yourself, your wife, and your son.

Hsa & Medicare: Use Your Hsa To Cover Medicare Costs In Retirement

Finally signing up for Medicare can be an exciting event. While it can be a lifeline for many people in retirement, Medicare isnt free and unexpected health expenses can take a pretty big bite out of your budget.

But Medicare isnt your only option for managing healthcare expenses. Contributing to a health savings account before you retire is one way you can help prepare for future medical expenses and .

Should I Get An Hsa Or Hra

One of the most important differences between the two is that the employer owns the HRA and the employee owns the HSA. This means that the employee takes the HSA along when he or she changes jobs. If an employee with an HRA changes or loses his or her job, any remaining amount in an HRA defaults to the employer.

You May Like: Do I Have Health Insurance

Is There A Tax Penalty When Using An Hsa With Medicare

All the money you contribute to an HSA is pretax. As long as youre eligible, youll be able to contribute to your HSA and not pay taxes on that money. However, you wont be eligible anymore once youre enrolled in Medicare.

Youll pay tax penalties if your HSA contributions and your Medicare enrollment overlap. The amount of penalty youll pay depends on the situation. Scenarios you might encounter include:

- Youll be subject to back taxes on any contributions made after your Medicare enrollment date. Your contributions will be added back into your taxable income for the year.

- Your contributions after youre enrolled in Medicare might be considered excess by the IRS. Excess contributions will be taxed an additional 6 percent when you withdraw them.

- Youll pay back taxes plus an additional 10 percent tax if you enroll in Medicare during your HSA testing period. An HSA testing period is the full year after you enroll in an HSA midyear if you make the maximum contributions when you first sign up. So, if you signed up for an HSA in July 2017 and contributed a full years amount, your testing period would have ended in January 2019.

Lets look at some examples of how this might play out:

Your Husband Is On Medicare

You’re allowed to contribute the full family amount to your HSA, because your HDHP is covering both yourself and your daughter. But you can only use your HSA funds to pay for your own medical care and your husband’s. You can’t use it to pay for your daughter’s care, because you can’t claim her as a tax dependent.

This is a good example of how the tax rules are separate from the insurance rules .

It’s also worth noting that your daughter can open her own HSA, since she’s covered by your HDHP, but files her own taxes. She can contribute the full $7,500 to her HSA, since she’s covered under a family HDHP.

And if you want, you can make contributions to her HSA on her behalf. She would then be able to withdraw funds from her own HSA to cover her own medical expenses.

Read Also: How Much Is Health Insurance In Ny

Let Us Help You Find The Right Medicare Coverage

- Choose between Medicare Advantage or Medicare Supplement options

- As simple as entering your basic information to compare plans right away

- Easy to distinguish between plan options with straight-forward information

- Plan options from Aetna, Anthem, BCBS, Cigna, Humana, and more

- Licensed, experienced and dedicated Medicare professionals are here to help you navigate your options

What Is A Catch

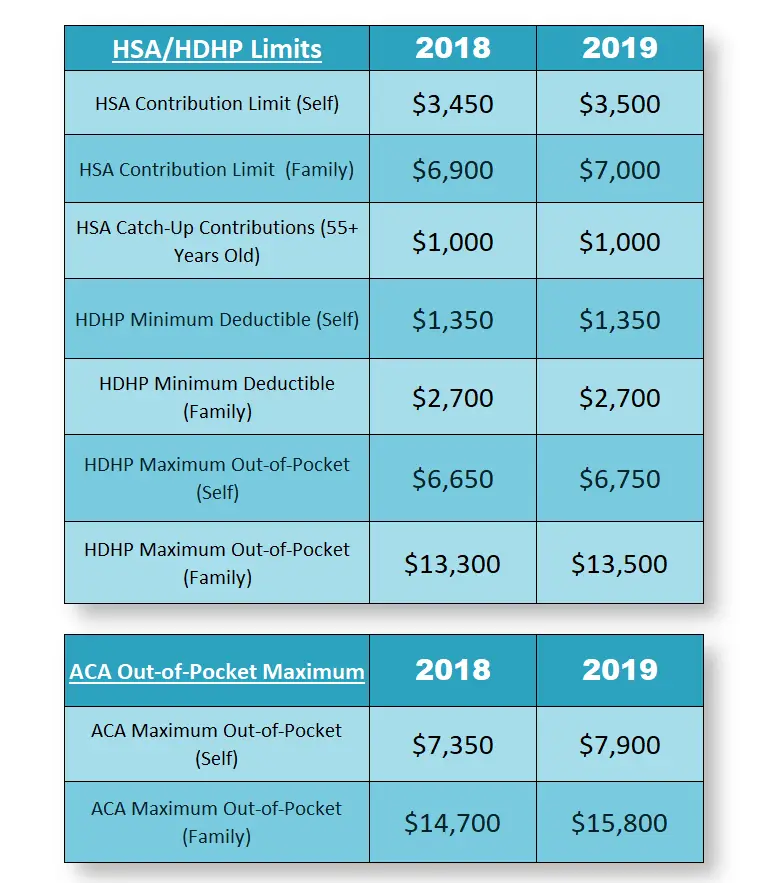

Eligible individuals over the age of 55 are allowed to make additional “catch-up” contributions to their HSAs. The catch-up amount is $1,000, and if you turn 55 during the year, you can contribute the full $1,000.

If you drop your HSA-compatible health plan during the year, you must prorate your HSA contributions to avoid tax penalties. The below examples show a calendar year taxpayer whose coverage terminated on the last day in September.

| Annual Contribution Limit* |

| $5,475.00 |

Mid-year Coverage“Full contribution” or “last month” rule – If your HSA-compatible coverage begins between January 1 and December 1 , you can contribute the maximum amount for that year provided you maintain HSA- compatible coverage until December 31st of the following year1. This rule can also be applied to catch-up contributions.

Health Plan Status ChangeIf you begin the year with family coverage and switch to single coverage in July of that year , you are eligible to contribute half of the family coverage maximum and half of the individual coverage contribution maximum. If you begin the year with single coverage and switch to family coverage by December 1st of that year, you are eligible to contribute the maximum family amount for that year provided you maintain HSA-compatible coverage until December 31st of the following year. This is covered under the âFull contributionâ rule, and can also be applied to catch-up contributions.

You May Like: Can I Cancel My Health Insurance At Any Time

When Do You Sign Up For Medicare

Most people become eligible for Medicare when they turn 65, although certain disabilities and medical conditions may hasten eligibility. At that point, a person has a seven-month period in which they can enroll in Medicare coverage without risking a penalty, says Chris Orestis, certified senior advisor and president of Retirement Genius, a website dedicated to helping older adults navigate retirement. Your individual Medicare enrollment period begins three months before your birthday and continues through your birth month and for three months after your birthday.

This timeframe is one you want to pay close attention to, says Orestis, since missing it can result in a penalty for late enrollment. Whats more, youd have to wait until the annual open enrollment period for Medicare, which runs from October 15 to December 7, potentially causing a lapse in health coverage, he adds.

Note that if you have already started receiving Social Security benefits prior to or on your 65th birthday, you will automatically be enrolled in Medicare when you turn 65.

You Can Tap Hsa Money For Cobra Medicare And A Portion Of Long

Im leaving my job and keeping my employers health insurance through COBRA until I start my new job in a few months. Can I pay the COBRA premiums from my wifes flexible-spending account or from a health savings account she has from an old job? Does it matter that its her account rather than mine?

You cant use money from a flexible-spending account to pay COBRA health insurance premiums, but you can tap money in a health savings account tax-free for COBRA costs . It doesnt matter whether its your own or your wifes account. Money in an HSA can be used tax-free for eligible medical expenses for the account holder, his or her spouse, and any current tax dependents.

In addition to COBRA premiums, you can use HSA money tax-free for Medicare Part B, Part D and Medicare Advantage premiums as long as the account holder is age 65 or older. You can also use HSA money for a portion of long-term-care insurance premiums, based on your age , and for any health premiums paid while receiving unemployment benefits. Otherwise, regular health insurance premiums whether for an employer plan or a policy you buy yourself are not an HSA-eligible expense.

Also Check: Does Health Insurance Cover Plan B

What Are The Benefits To The Employer

The HSA Bank stacked card allows for participants to pay for health care-related expenses from several accounts using one special purpose or Visa®. Availability of the card has been proven to increase participation in benefit programs such as HSAs, FSAs and HRAs. In fact, 62% of cardholders reported that the availability of a card tied to these accounts influenced their decision to sign up. Because money deposited in these accounts by employees is submitted pre-tax, there is savings to employers in FICA contributions. It is also an employee benefit that is viewed favorably by associates.

Who Can I Cover With My Hsa Understanding Hsa Eligible Dependents

You already know that a health savings account is a great way to save for future healthcare costs. You can make tax-free HSA contributions as long as you have coverage under a qualified high deductible health plan .

With HSAs triple-tax benefit, there are countless ways that you can use, or not use, your pre-tax funds: to supplement out-of-pocket expenses, use it as an emergency fund, reduce taxable income, or invest and grow as an extra retirement account. Ultimately, its your call as to whether you choose to withdraw funds to spend on eligible health essentials, or have funds roll over, from one year to the next.

If you choose to use your funds to cover qualified healthcare costs, you might be a little fuzzy on whose medical care you can pay for with tax-free HSA money. They don’t have to be covered under the same health insurance policy you have, and in some cases you can’t use your HSA funds to pay for medical care for a person who is covered under your policy. Let’s take a look at how this works:

Don’t Miss: How Do I Know What My Health Insurance Covers

Who Is Eligible To Open An Hsa

The main requirement for opening an HSA is having a high-deductible health plan that meets IRS guidelines for the annual deductible and out-of-pocket maximum. To be an eligible individual and qualify for an HSA, you must also meet the following requirements.

-

You are not covered by any other non-HDHP health plan, such as a spouse’s plan, that provides any benefits covered by your HDHP plan.

-

You are not enrolled in Medicare.

-

You do not receive health benefits under TRICARE.

-

You cannot have received medical benefits from Veterans Administration for any non-service-connected disabilities at any time during the previous three months.*

-

You cannot be claimed as a dependent on another person’s tax return.

-

You are not covered by a general purpose health care flexible spending account or health reimbursement account . Alternative plan designs, such as a limited-purpose FSA or HRA, might be permitted.

*Title 38 of the United States Code, Section 101 defines “non-service-connected” as, with respect to disability, that such disability was not incurred or aggravated in line of duty in the active military, naval, or air service.

Qualifications For Hsa Contributions

Your allowed annual HSA contribution is based on the following factors:

For example, if you have individual coverage for the first five months of 2022 and change to family coverage for the last seven months of the year, you would be able to contribute $5,779.

$5,779 = +

During your first year with an HSA plan, you may be able to take advantage of the last-month rule and contribute up to the entire maximum for the year, regardless of when you join the plan.

Last-month rule: If you are an eligible individual on the first day of the last month of your tax year , you are considered an eligible individual for the entire year. You are treated as having the same HSA-qualified coverage for the entire year as you had on the first day of that last month.

Testing period: If contributions were made to your HSA based on qualifications under the last-month rule, you must remain an eligible individual during the testing period. The testing period begins with the last month of your tax year and ends on the last day of the 12th month following that month. For example, December 1, 2019 through December 31, 2020.

For more information, see IRS publication 969 under Contributions to an HSA or consult a qualified tax advisor.

Also Check: What Health Insurance Does Walmart Offer

Who Can Contribute To An Hsa

You can contribute if you meet all three of these conditions:

For 2023, the IRS defines an HDHP as any plan with a deductible of at least $1,400 for an individual or $2,800 for a family.

The health plan can be through an employer or one you buy on your own. HSAs are portable, meaning they stay with you if you change employers or leave the workforce. Some employers make contributions to their workers HSAs as part of their benefits package.

Once you , you can still contribute to your HSA. If you contribute to your HSA after your Medicare eligibility starts or coverage begins, you may have to pay a tax penalty.

Individual Vs Family Deductible

If youre shopping for health insurance, youll likely come across the terms individual deductible and family deductible. Its just to understand the difference between the two, as it can significantly impact your out-of-pocket costs.

An individual deductible is an amount you, as an individual, are responsible for paying before your health insurance plan begins to pay for covered services. For example, suppose your individual deductible is $1,000. Before your insurance plan kicks in, you must pay the first $1,000 of covered medical expenses. Once you reach your deductible, you will typically only be responsible for a copay or coinsurance for most services.

A family deductible is like an individual deductible. Still, it applies to the family as a whole rather than just one person. So if your family deductible is $2,500, your family will need to pay the first $2,500 of covered medical expenses before your insurance plan begins to chip in. As with an individual deductible, once you reach the family deductible, you will usually only be responsible for a copay or coinsurance for most services.

The main difference between an individual and family deductible is that a family deductible generally costs more money out-of-pocket when someone in the family needs medical care. However, it may be worth it to have

Recommended Reading: What Is The Average Cost Of Self Employed Health Insurance

Can An Fsa Or Hsa Be Used For Insurance Premiums

In most cases, the pre-tax dollars in a flexible spending account or health savings account cannot be used to pay for health insurance premiums. This applies to any type of insurance policy associated with the account.

An eligible expense usually needs to be medical care that helps or prevents a physical or mental defect or illness. This includes vision and dental care.

Vision expenses covered by an FSA or HSA include prescription eyeglasses, sunglasses, contact lenses and reading glasses, along with eligible services like eye exams.

SEE RELATED:What is the difference between an HSA and an FSA?

With an FSA, health insurance premiums are considereda non-medical expense and are not allowed.

Paying for health insurance premiums with an HSA would be considered a non-medical withdrawal. Non-medical withdrawals are subject to any applicable taxes plus a 20% penalty fee from the IRS.

Can I Get An Hsa If I Have A Low

No. Only people who have high-deductible health insurance plans are eligible to open a Health Savings Account. Some employers offer a similar plan called a flexible spending account . That is, employees can choose to divert up to a certain annual limit, tax-free, into an account that can be used to pay medical expenses that the company health plan doesn’t cover. The FSA is also a “tax-favored plan” but it is relatively limited in its usefulness. For one thing, the money in your account doesn’t roll over from year to year. You use it or lose it.

Recommended Reading: What Is Public Health Insurance

What Are The Employee Benefits Of Having An Hra

-

Recognize significant tax savings with pre-tax, deductible funding and tax-free distributions used for IRS-qualified plan expenses.

-

Quickly and easily access funds with the HSA Bank Health Benefits Debit Card used at point of sale, or have funds directly deposited to a bank account.

-

Enjoy secure access to accounts using a convenient Member Website available 24/7/365.

-

Easily file claims online or via the mobile app with the system determining approval based on eligibility and availability of funds.

-

Stay up-to-date on balances and any actions required with automated email alerts, convenient member home page messages, and access to account balance information via your mobile devices.

-

Get one-click answers to your benefits questions.

-

Protect the environment by using paperless summaries available online.

What Is A Consumer

A CDHP is a high-deductible health plan with a health savings account . CDHPs offer lower premiums, a higher medical deductible, and a higher medical out-of-pocket limit than other types of health plans.

Kaiser Permanente NW, Kaiser Permanente WA, and Uniform Medical Plan all offer CDHPs. Visit benefits and coverage by plan for coverage details.

Read Also: Why Does Health Insurance Cost So Much

What Are The Benefits Of An Hsa

Health Savings Accounts are a type of tax-advantaged medical savings account available to taxpayers in the United States who are enrolled in a High Deductible Health Plan . Contributions made to an HSA are not subject to federal income tax, and can be used to pay for qualified medical expenses at any time without paying taxes on the withdrawals.There are numerous benefits of having an HSA, including: Tax advantages contributions to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free. Flexibility HSAs can be used to pay for a wide range of qualified medical expenses, including insurance premiums. Savings funds in an HSA accumulate and can be used in future years if they arent needed immediately. Investment options some HSAs offer investment options, which can provide even more tax advantages and potential growth on your account balance.