How Long Does It Take To Get An Insurance License

In most cases, you can get your license in a matter of a few weeks. If you choose to take an online course that requires a specific number of pre-set study hours, obtaining your license will generally depend on how long youll take to complete it.

You can expect to put aside around two to eight weeks to complete all the necessary steps to acquire your insurance license.

There might also be a further week or two of waiting period for the license to be issued. This is due to the background checks that your state might have mandated.

Register For Your Exam Pay The Fee And Prepare Yourself

You cant take the exam without a reservation. PSI is the exam provider. After you have completed the prelicensing education requirements, register for the insurance examination for the type you have chosen at or by calling 800.733.9267.

The fees for the exam vary depending on the topic of the exam, but most are $43. In preparation for the exam, you should study and practice. The PSI Learning Academy has information and practice exams online.

Mail Fingerprint Card And Form L

After submitting your license application to the state, you will now mail in your fingerprint card. You will send this card to the Arizona Department of Insurance .

Arizona Department of Insurance100 North 15th Avenue Suite 261Phoenix, Arizona 85007-2630

Arizona also requires Form L-152 to be sent in with all applications. This form is the verification of Identification. You must fill it out and attach a copy of whichever approved form of identity you choose from the list.

Once you have filled this document out, email it to the . Do not send this document until you have passed the exam and sent in your application.

Also Check: Starbucks Health Insurance Cost

California Insurance License Application

Once you have completed your exams and fingerprinting, you are now ready to apply for your license. If you have more than one line of authority that you have passed the exam for, be sure to apply for all of those lines.

The fee for an online application is $188 per combined line. If you wish to get your Property & Casualty AND your Life, Accident, & Health licenses, you will need to apply for each license separately, and pay the $170 fee each time.

Fill out your online application on the NIPR California web page.

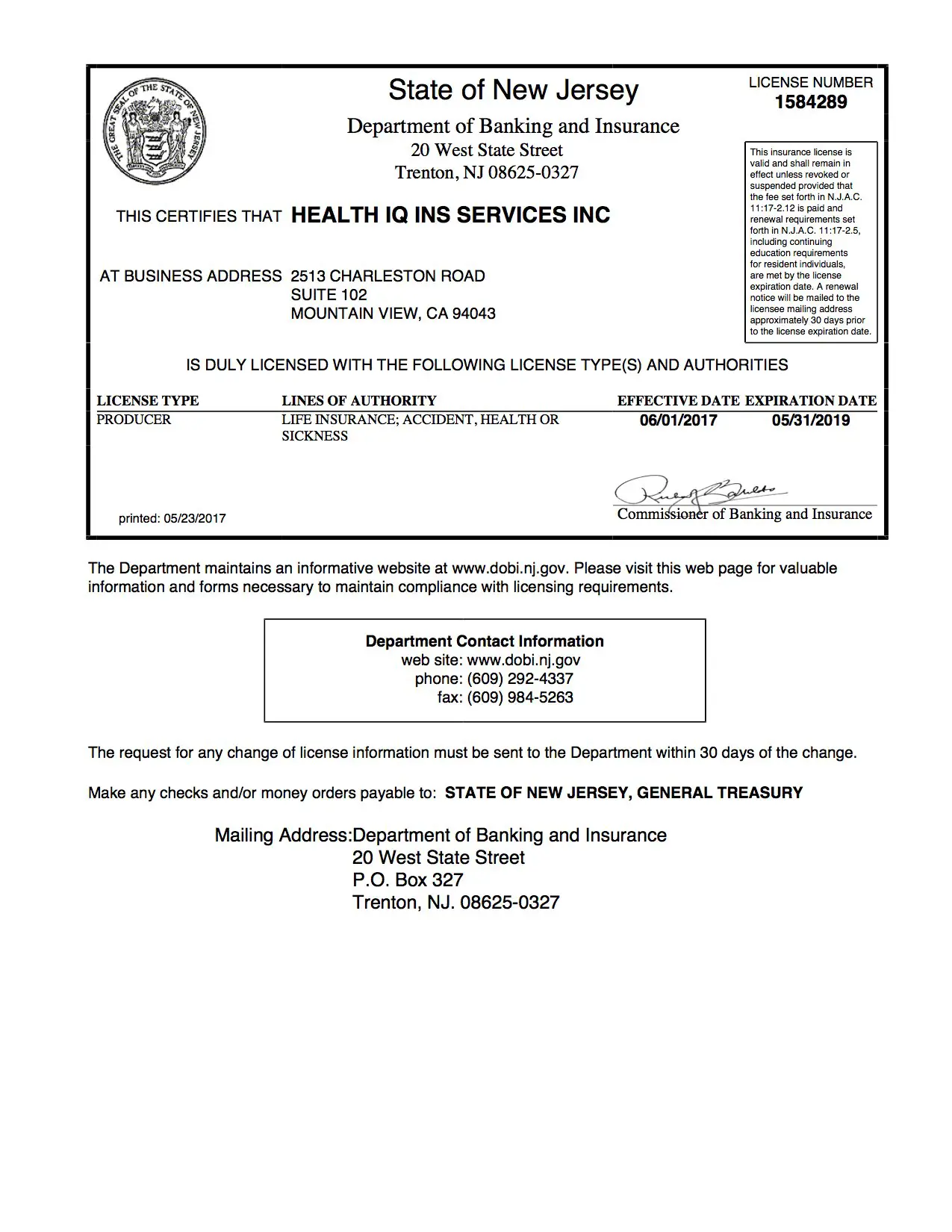

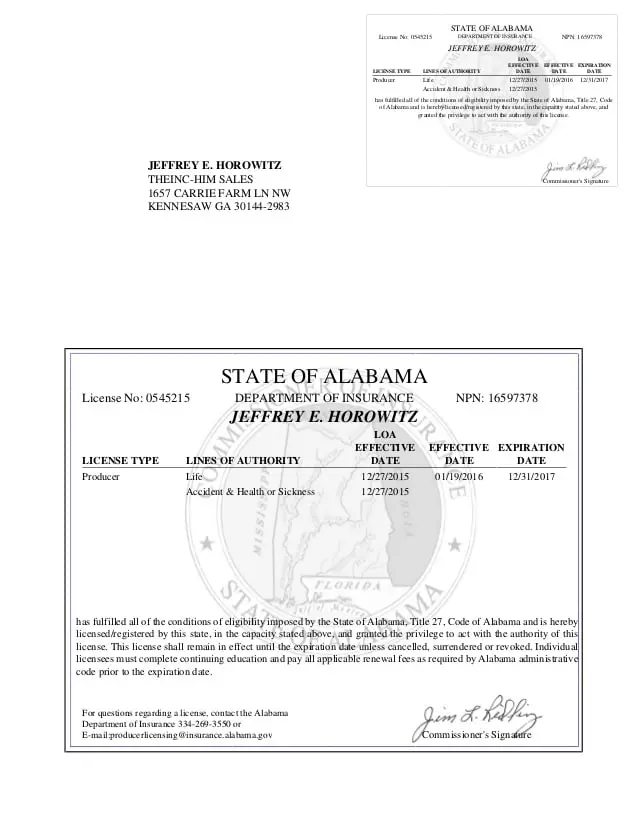

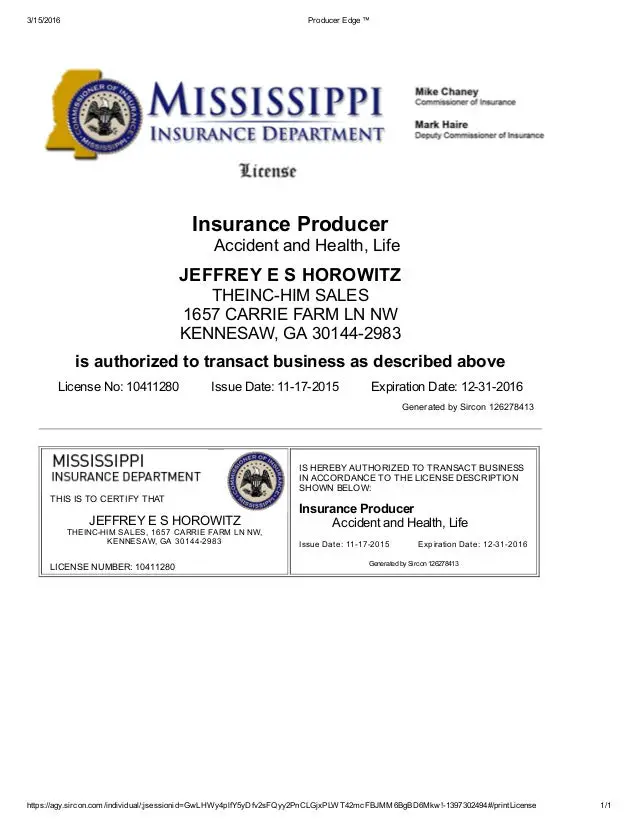

Agency And Individual Non

If you want to operate your insurance business in multiple-states, you will also need to acquire an agency and individual non-resident license.

For example, you have an insurance business in your home state of Tennessee and also want to sell insurance in Kentucky and Alabama. In that case, you will require an agency and individual non-resident license.

You will also need to pay additional fees and other requirements for each additional state you wish to operate in.

Read Also: When Does Health Insurance Stop After Quitting Job

Application Review And License

After you have submitted all of your required documents, taken your pre-license education course, passed your state insurance license exam, and your background check has been completed, your states insurance authority will review your application.

This can take anywhere from a few days to a few weeks. If your processing authority has questions, they will follow up with you.

Once your application has been approved, you will receive notification and a copy of your official insurance license. Print this for your records, as well as to have available for potential clients.

You should always be able to show your state insurance license if asked. When applying for a new job within the insurance industry, your employer will ask for your license number and National Producer Number .

Tip:

Step : Take Your Test

You must be at least 18 years of age and you must pass your states resident or non-resident licensing exam to earn a license. The exam is multiple choice, closed book.

In California, PSI Services, LLC, a California-based company providing state-based regulatory licensure services, handles the scheduling of examinations for individuals. Individuals may schedule their examinations with PSI either online or by telephone. PSI offers more than 20 sites statewide where individuals may take their qualifying license examination and provide the required fingerprints.

In Nevada, Pearson VUE is the Insurance Divisions only authorized testing vendor. Appointments may be made up to one calendar day prior to the day you wish to test, subject to availability. You can review the Pearson VUE scheduling options for Nevada here. Testing times vary from about two hours to about three and one-half hours, depending on the license for which youre applying.

On the day of the exam, youll want to arrive 20 to 30 minutes early and bring two forms of identification that include a signature. Your name on the ID must exactly match the name on your registration. The primary identification must be government-issued and photo-bearing ID with a signature, and the secondary identification must also contain a valid signature.

Acceptable, non-expired secondary IDs include: U.S. Social Security card Debit or credit card Any form of ID on the primary ID list above

Read Also: Health Insurance For Substitute Teachers

Decide What Kind Of Insurance You Want To Sell

The first thing you want to do is decide what type or types of insurance youd like to specialize in. In the industry, these are referred to as lines of authority. Heres a rundown of the most common:

- Life insurance: Selling policies and annuities related to providing for a beneficiary upon the death of the insured.

- Health insurance: Selling medical, disability, Medicare supplement, and long-term care policies.

- Property insurance: Selling homeowner, commercial property, and inland marine policies.

- Casualty insurance: Selling auto, workers compensation, crime coverage, and professional liability policies.

- Variable products insurance: Selling insurance products with an investment element. To sell this kind of insurance, you need certain securities licenses.

- Personal lines insurance: Selling products like auto insurance, homeowners insurance, renters insurance, and policies for boats, motorcycles, and snowmobiles to individual consumers only.

Another option is becoming an adjuster, which is the business of investigating and adjusting claims on an insurance policy. Insurance adjusters also solicit for the adjustment business.

In a number of cases, you dont have to pick just one line of authority. Individuals often combine certain lines, such as property and casualty insurance.

Thinking about a career in insurance? Download this free Launching Your Insurance Career eBook.

Free Ebook: Launching Your Insurance Career With Confidence

As an aspiring insurance professional, wouldnt it be great if you could sit down with a room full of successful insurance veterans and ask them for their advice? The Kaplan Financial Education team interviewed over 100 insurance professionals to develop this exclusive eBook for those who are considering the insurance industry.

Don’t Miss: How Long After Quitting Job Health Insurance

Heads And Shoulders Above The Rest

Live Florida Based Instructors and Customer Service Support

Lifetime Course Access

Courses are Narrated by Master Instructor

P& C Courses include Unit-by-Unit Video Review

Exam Simulator

Exam Cram Study Manual

Generous Refund Policy

Description: This Florida-approved 2-20 General Lines pre-licensing course is offered entirely online including the course final exam. Upon successful completion of this course, you will be eligible to sit for the state examination . Work at your own pace with your instructor available by email or telephone.

Required Text: The Florida Department of Financial Services regulations require that all 2-20 insurance agent license candidates obtain the latest edition of the FAIA Study Manual from the Florida Association of Insurance Agents. Order Online: or Order by Phone: .

Course Provider: Florida Insurance CollegeFLDFS Provider #: 371609

What Is A Life And Health License

Earning your life and health insurance license is your first step to selling life and/or health insurance in your respective state as an insurance agent.

The license is granted upon the successful passing of your specific states exam and allows the recipient to solicit and build a book of business of health and life insurance within that state.

This means you can work on behalf of an insurance agency, selling just their brand of products, or as an independent broker with access to several brands of products.

It can be encouraged for an agencys support staff, like customer service representatives or appraisers, to earn their licenses as well, as they will handle much of the administrative management of these policies.

Also Check: Starbucks Part Time Insurance

Born In Birthing Hospital Or With Registered Midwife

If your baby was born in an Ontario hospital with birthing facilities or with a registered midwife, follow these steps to apply:

Your babys new health card will be mailed to you within 8 weeks of the date the Ontario Health Coverage Infant Registration form was submitted.

If hospital staff or the registered midwife gave you the Ontario Health Coverage Infant Registration form and you have questions or concerns about your babys health card, you must contact ServiceOntario.

If hospital staff or the registered midwife do not give you the Ontario Health Coverage Infant Registration form, you may apply for health coverage for your child at either:

49 Place dArmes, 5th floorKingston, ON K7L 5J3

Arizona Insurance License Exam

The next step after completing all of your pre-license coursework or self-study is to take the insurance exam. You will take one exam for each line of insurance you wish to carry. Life, Accident, & Health and Property & Casualty lines are combined lines in Arizona, so you will take two exams if you wish to attain all of these lines of authority: Property, Casualty, Life, Accident, Health.

This is a proctored test, which means that you will be in a controlled environment with a person watching over you. For people who havent tested in a situation like this should be aware of this fact, and work on taming their nerves prior to sitting for the exam.

The fee for each attempt of the exams is $56 per combined line. Single line exams are $44 per attempt. When you show up you must have a photo ID any other documents that the testing facility has asked you to bring.

Both the Life, Accident, & Health exam and the Property & Casualty exam consist of one hundred fifty questions, and you have two and a half hours to complete each exam. Here is a copy of the exam content outline for the Life, Accident, & Health exam. Here is a copy of the exam content outline for the Property & Casualty exam. A total score of 70% is required to pass each exam. You have a limit of four attempts at each exam per year.

Check out our Insurance Exam Guide. Its extremely in-depth, and will hopefully help you pass the first time.

Tip:

StateRequirement recommends that you study for one exam at a time

Also Check: Starbucks Partner Health Insurance

Take Your Exam And Receive Your Results

How To Get Your Insurance License

If youre interested in becoming a health insurance agent, one of the first things you need to do is take the licensing exam required by your state regulator. In California, thats the California Department of Insurance . In Nevada, its the Nevada Division of Insurance .

Below are six steps that put you well on way to your new career.

Don’t Miss: Uber Driver Health Insurance

Completing The Criminal Background Check

What Do I Need To Know To Pass The Life And Health Insurance Exam

To become licensed as a Life and Health insurance producer, you will need to demonstrate entry-level knowledge of the industry by passing a state licensing exam. The testable topics include types of life insurance policies, annuities, qualified and nonqualified retirement plans, medical expense and managed care plans, disability income and long-term care insurance, Medicare, Medicaid, and Social Security benefits, group life and health insurance, policy provisions and applicable riders, the application and underwriting process, federal tax considerations and federal initiatives under the Affordable Care Act. You will also be tested on general insurance concepts, insurance contract terminology, and state-specific regulations based on the state where you are applying for a license.

You May Like: 8448679890

Decide Which Insurance Products You Will Sell

There are many kinds of commercial insurance and personal insurance policies. Personal lines of insurance focus on coverage for individuals and families. This includes insurance for motor vehicles, home insurance, and life insurance.

Commercial insurance agents focus on providing coverage to businesses with policies ranging from general liability insurance to commercial property insurance and errors and omissions coverage.

Is The Life And Health Insurance License Exam Difficult

The average pass rate for the life and health insurance exam sits around 50% for first-time test-takers. Improving chances for success will mean budgeting the time you know you need to study and retain the material.

Knowing how you best learn and take tests, having the best tools and courses available, and budgeting your study time wisely can increase your chances of passing the exam.

The most successful participants are ones that feel they were reviewing the information, rather than seeing it for the first time and winging it.

You May Like: Starbucks Health Insurance Options

Submit Your Licensing Application And Background Check

When you pass your state insurance license exam, youll submit all required licensing applications to your state licensing department. Some states will require a background check, which may involve fingerprints. Once youre officially licensed, youll be able to legally discuss and sell insurance policies.

Get Fingerprinted And Complete A Background Check

As the applicant, you are responsible for having your fingerprints taken and submitted. You will receive directions to completing this step in your state, which may direct you to a third-party agency or local law enforcement. The cost of fingerprinting is usually between $35 and $75 dollars.

Your state will initiate a background check as part of the application process. Your states agency will complete this step, but you should be aware that it is part of getting your insurance license.

You May Like: Starbucks Open Enrollment

What Are The Types Of Insurance Licenses

Insurance licenses come in many forms depending on where you want to operate and the type of coverage you wish to sell. Licenses are issued by your state after youve passed your license certification exam and completed all the necessary protocols.

Some of the most common types of insurance licenses are:

The Two Most Common License Types Are:

- Property and casualty license, for agents who plan to serve clients who need auto, home, and business insurance.

- Life, health, and accident license, for agents who plan to serve individuals who need insurance related to life events, such as life insurance, accidents, or health insurance.

Your career plan may require you to obtain multiple licenses. You will need to get the specifics from your state licensing department or the company you plan to represent.

You May Like: Do Substitute Teachers Get Health Insurance