How To Choose The Best Travel Health Insurance Company

The travel health insurance industry is a competitive one. Heres how you can choose from some of the best travel health insurance companies.

- Sum Insured Offerings

Since healthcare expenses can be higher in your travel destination, it helps to choose a plan with a substantially high sum insured. The best travel health insurance companies offer various plans with high sum insured options.

- Trip-wise Offerings

The insurance provider should offer different types of travel medical insurance policies such as single-trip, multi-trip, insurance for students, family plans, etc.

- Comprehensive Coverage

The best travel health insurance companies offer wide coverage for both medical and non-medical expenses. Look for companies that provide coverage for emergency hospitalisation, medical evacuation, hospital cash allowance, emergency dental treatment, etc. The insurer must also cover a wide range of travel expenses, including trip cancellations, baggage loss, etc.

- Countries Covered

Select insurance companies that cover the maximum number of countries. If you need to travel to multiple destinations, your insurance provider should be able to cover your various costs incurred in any of the foreign countries.

- Worldwide Hospital Network

Many travel health insurance companies now offer cashless claim settlements by empanelling hospitals in foreign countries. This facility allows you to receive emergency medical care with minimal out-of-pocket expenses.

- Efficient Customer Support

Why Health Insurance Claim May Be Denied

Your insurance provider may reject your claims even when the pieces of evidence are clear you deserve to be paid. Sometimes, they may pay part of the claims and in worst-case scenarios, you are not getting successful claims process.

These things are almost normal in the health insurance sector and you should be acquainted with the factors that can lead to the denial of claims. They include:

Wrong ICD-10 Coding

If your doctor inputs the wrong ICD-10 code for a particular diagnosis, your claims application will be rejected. Your healthcare provider must of necessity link the right ICD-10 code with the appropriate diagnosis.

Coverage Limitations

This is why you must be acquainted with the provisions of your health insurance policy. Certain treatments are not covered in your insurance policy and when you receive those treatments, your insurer is not liable to pay any claims to you.

Missing Paperwork and Information

I am saying this again, for a tiny bit of information not provided, your claim application may be rejected. As an issue of top-most relevance, ensure you are not leaving out any piece of information whatsoever nor paperwork to be on the safe side.

Unnecessary and Experimental Treatments

Certain treatments are considered to be unnecessary and experimental. To insurance companies, they believe such treatments do not make a patient well and with a good claims adjuster, your claim would not see the light of the day.

Unauthorized Treatments

ALSO READ:

Ask Your Doctor For Help

Contact your physicians office and ask why they believe your insurer denied your claim. It might simply be an issue like the provider office entered the wrong payment code.

Ask them to verify that the treatment or service provided was medically necessary and that the appropriate medical code was submitted to the insurer. Document anything you learn.

Gather documentation from your provider, including health records, dates, a copy of the claim form they submitted and possibly a fresh letter from your doctor requesting that the claim be accepted based on their assessment of the situation.

Also Check: What Is Household Income For Health Insurance

How To File Travel Insurance Claims

You can file travel health insurance claims either of the two ways cashless claims or reimbursement claims.

- Cashless Claims

Some of the best travel health insurance companies have tie-ups with a vast network of hospitals in India and overseas. This feature allows you to receive cashless treatments at network hospitals even when youre overseas, by following these simple steps.

Upon successful authentication, the insurer will settle your medical bills directly with the hospital.

If you are unable to reach the nearest network hospital, you can receive treatment at a non-network hospital. Your need to pay the medical bills yourself, and your insurer will reimburse you later. Here are the claim-filing steps.

Request An External Review If The Outcome Isnt Satisfactory

The next step is to file for an external review. According to HealthCare.gov, you have four months from the final notice that your claim has been denied to file an external appeal. During an external appeal, your health insurance company no longer has input and a third party will review your appeal. Whatever the external review decides is final, and your insurance company has to accept its decision.

More From GOBankingRates

Also Check: Can You Put A Domestic Partner On Your Health Insurance

Cashless Procedure For Planned Hospitalisation

Here are the steps for the cashless claim process in case of a planned hospitalisation.

-

Choose from the list of network hospitals as specified in the policy document.

-

Approach the hospitals insurance help desk at least 72 – 48 hours before admission and provide your policy card to initiate the claim process.

-

Fill the pre-authorisation form and other forms as required.

-

If the case is found admissible, ACKO will settle the hospital bills up to the approved amount as per the terms and conditions of the policy.

If a cashless claim is not sanctioned, you can pay the bills and file for reimbursement of the medical expenses.

Filing Your Insurance Claim

Okay, youve called all the right people. Youve gathered all the information you could. Now its time to actually file your claim.

Most insurance companies will allow you to file a claim online or through a mobile app, by phone with one of their agents, or by filling out a claims form and sending it to them via email or fax. Its your choice!

Read Also: How Much Does My Company Pay For My Health Insurance

How To Submit Claims

Cigna makes it easy for health care providers to submit claims using Electronic Data Interchange .

Electronic Data Interchange Vendors

Automate your claims process and save.

Clean Claim Requirements

Make sure claims have all required information before submitting.

When to File Claims

Filing a claim as soon as possible is the best way to facilitate prompt payment.

Where Do I Send The Claim

The address for where to send your claim can be found in 2 places:

- On the second page of the instructions for the type of claim youre filing .

- On your “Medicare Summary Notice” . You can also log into your Medicare account to sign up to get your MSNs electronically and view or download them anytime.

You need to fill out an “” if you want someone to be able to call 1-800-MEDICARE on your behalf or you want Medicare to give your personal information to someone other than you.

Get this form in Spanish.

Read Also: Does Mcdonald’s Offer Health Insurance

Travel Health Insurance Exclusions

While travel medical insurance covers most medical and travel expenses, the general exclusions are as follows:

- Travel Against Doctors Advice

If you are undergoing treatment and decide to travel despite your doctors explicit instructions not to do so, your insurer will reject your claims.

In case of attempted suicide or self-inflicted injuries sustained abroad, the insurer is not liable to reimburse you for the medical expenses.

- Sexually Transmitted Diseases

Travel health insurance companies do not cover medical expenses associated with STDs such as HIV/AIDS or other venereal diseases.

- Pre-existing Diseases

Travel insurance does not cover medical complications arising due to pre-existing conditions during your international travels.

- Substance Abuse

Your insurance provider does not cover medical costs resulting from intoxication or drug use, not prescribed by a medical practitioner.

- Injuries From Adventure Sports

If you have sustained injuries due to adventure sport activities like sky diving, scuba diving, paragliding, etc., your insurer is not obligated to cover the costs to treat such injuries.

- Mental Disorders

Your insurer will not accept claims filed for treating mental illnesses such as bipolar disorders, depression, dementia, etc.

- Alternative Treatments

Your insurer will also not cover non-allopathic treatments like Ayurveda, Yoga and Naturopathy, Unani, Siddhi or Homeopathy, typically covered under general health insurance plans.

- War Or War-Like Conditions

What Is A Tpa

TPA refers to the Third-Party Administrator, an IRDA approved authority that specially acts like a third-party between you and your insurer to take care of healthcare-related claims.& nbsp

TPA refers to the Third-Party Administrator, an IRDA approved authority that specially acts like a third-party between you and your insurer to take care of healthcare-related claims.

You May Like: How Do You Find Health Insurance

How To Avoid Health Insurance Claim Rejections

Here are some tips to avoid claim rejection against your health insurance policy.

Disclose any pre-existing conditions at the time of purchasing the health insurance policy.

Do not delay in informing the insurer as per the stipulated timeline for planned and unplanned hospitalisation.

Ensure that you obtain original medical reports, the discharge summary, bills, payment receipts, etc., since they are required for reimbursement claims

Understand the features, inclusions and exclusions, health insurance claim procedure, and waiting period.

Cashless claim facility is available only in the network hospitals mentioned in your policy.

Brandon J Broderick Personal Injury Attorney At Law

Any type of car accident is already very stressful. When you find out that the other motorist is uninsured, your stress level and level of uncertainty rise as you try to determine who will be responsible for paying your medical expenses, property damage, and lost wages. Many individuals in this circumstance look for legal representation regarding suing an uninsured driver for damages.

In Vermont, if you’ve been hit by an uninsured driver, you may still be able to get compensated for your losses by suing the uninsured driver for damages. You can explore your options and the claim process with the help of an experienced Vermont auto accident attorney. In Vermont, your compensation for injuries sustained in an accident with an uninsured driver will depend on your own insurance, the financial situation of the at-fault driver, the owner of the vehicle, and whether any third parties were at fault.

In such a critical situation, the presence of reliable legal counsel can be reassuring. Brandon J. Broderick, Attorney at Law, is dedicated to providing each client with superior legal representation. This means that you will not be required to deal with any legal nonsense that may arise in a car accident case. This is only one of the numerous reasons why our Vermont auto accident lawyers are the best in the state. Please contact us for a free evaluation of your case if you have been injured in a Vermont car accident.

Also Check: Does Idaho Have Free Health Insurance

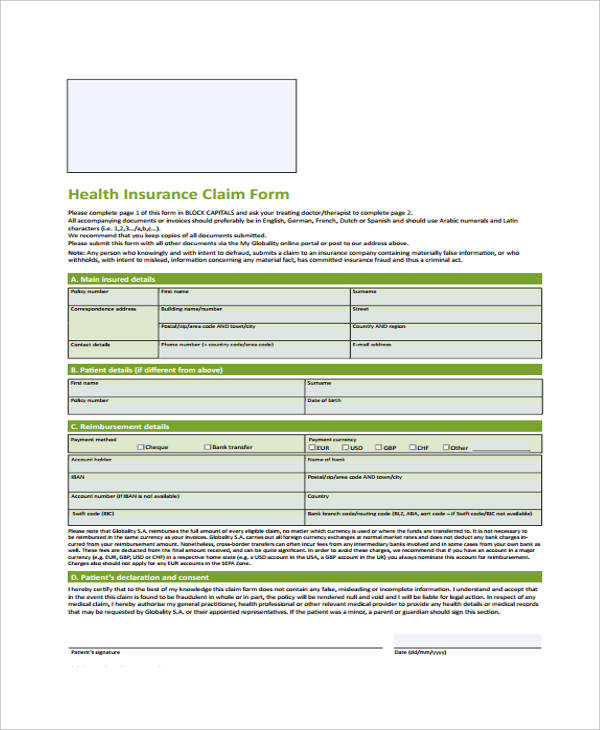

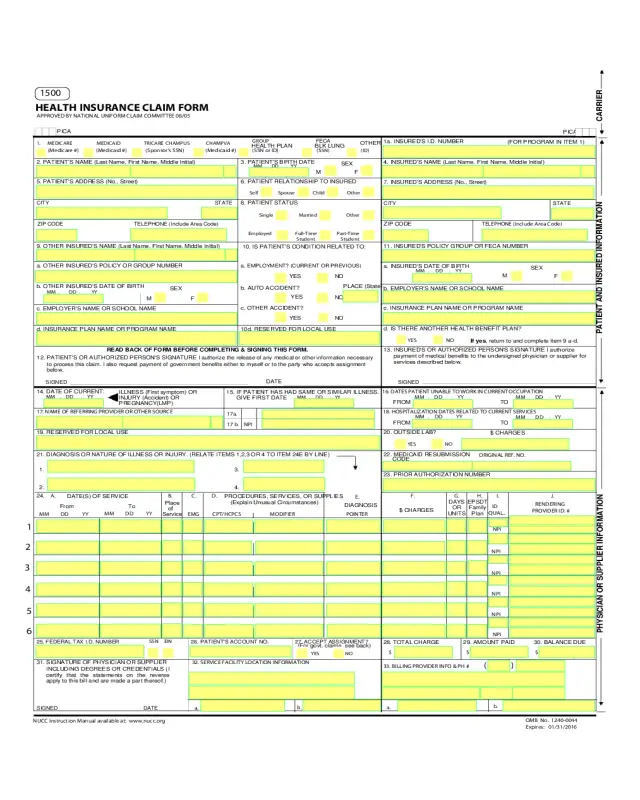

Complete A Claim Form

Tip:

A claim form is the document that tells your insurance company more details about the accident or illness in question. This will help them determine if the expenses you are claiming for are covered under your insurance plan or not, so the more information on this form the better. Keep in mind that each form should have instructions for completing the form and directions on how and where to send it, but if you have questions simply contact your insurance company.

Typical sections of a claim form:

- Personal information like your name, address and date of birth

- Insurance information such as a policy and group number

- Reason for your visit including background information about your condition

- Provider information including the doctors name and address

- Out-of-pocket expenses that you have already paid

What Is The Process To Check Iffco

The process to check IFFCO-Tokio Mediclaim Insurance Claims are same as checking any other plan claims online.

- You need to visit the official website of the Iffco Tokio General Insurance Company, then Click on Menu and select the Claim Option.

- There will be multiple options displayed on the screen, from which you can select the Claim Status option.

- The page will have two dropdowns one is for Policy Number and the Claim Number, enter the details as required.

Read Also: How Long Is Open Enrollment For Health Insurance

Features Of Travel Health Insurance

The following are the key features offered by some of the best travel health insurance companies in India.

- Cashless Claims

Besides domestic network hospitals, insurers also have ties with international healthcare facilities. You can utilise the cashless claim facility, under which your insurer settles your international medical bills directly with the hospital where youre admitted for treatment.

You can select a number of tenure options. Depending on your travel duration and frequencies, you can choose single or multi-trip travel health insurance plans.

- Policy Extension

You can extend your single-trip insurance policy duration at an additional premium cost in case you are stuck in a foreign country due to medical emergencies or flight delays.

- 24×7 Customer Support

Given the different zones, insurance providers ensure that you can get round-the-clock assistance for all medical and travel expenses.

- Insurance For All Traveller Types

Whether you are an occasional traveller, frequent flier or a student, you can get travel health insurance with all types of travel plans such as single-trip, multi-trip, family plan, etc.

Fill Out Your Claim Form

Fill out every field unless noted otherwise. If the field does not apply to your claim, it should be filled out with N/A or None so that your insurer knows you did not accidentally leave it blank. Some companies will also allow you to select what currency you want them to use to reimburse you.

Providing complete and accurate claims forms will expedite the process and improve your chances of a positive outcome.

Also Check: Is There Still A Penalty For Not Having Health Insurance

File A Health Insurance Claim Without Any Trouble

Americans spend a lot of money on healthcare, reaching a total of $3.8 trillion in 2019. It is predicted that the USA will spend $6.2 trillion on healthcare by 2028.

What happens when you visit a doctor? You need to fill out a form providing your insurance information. Once the doctor performs the check-up and runs any necessary tests, you will get a bill.

In case you have coverage, you should file a health insurance claim and request payment or reimbursement for the received medical services.

DoNotPay can help you file health insurance claims efficiently, but why stop there? Use our app to claim unemployment, life, accident, flood, hail, or hurricane insurance in a few steps!

S To Check The Iffco Tokio Health Insurance Claim Status Offline

In case you cannot check the claim status online, it is also possible that you do that by visiting the Insurers branch office. Lets see how it can be done:

Visiting the Insurers Office

Most of the policyholders nowadays prefer to check their policy claim status online, but a certain percentage of people still prefer to visit the branch office in person to know about the policy claim status and take real-time updates.

The address details of the Insurers branch office are given on the Insurance Companys website. You can find the one nearest to your place. Also, do carry your policy documents along.

Through Email or Phone

To check it offline you can use your phone to call the insurer or email them to get in touch with the Iffco Tokio Insurance Companys customer care department. It is required to mention your medical insurance policy number in the mail for reference.

Read Also: What Is Deductible In Health Insurance With Example

Do I Need To Send Original Documents To Process My Health Insurance Claim

No, unlike traditional health insurance companies, Digit is digital-friendly hence all you need to do to process your health insurance claim is upload all required documents on the link shared with you by our representative during a claim.

No, unlike traditional health insurance companies, Digit is digital-friendly hence all you need to do to process your health insurance claim is upload all required documents on the link shared with you by our representative during a claim.

Cashless Procedure For Emergency Admission:

- In case of emergency admission, inform third party administrator & provide a membership number.

- Fill the cashless format the hospital, certified by a doctor.

- Send the form along with medical records to TPA.

- If a cashless facility is sanctioned, hospital bills will be settled directly.

- Seek reimbursement in case of disapproval

Recommended Reading: How Do I Get Health Insurance In Maryland

Planned Hospitalisation And Emergency Hospitalisation:

Another critical factor when making a reimbursement claim is the mode of hospitalization, which may be planned or in an emergency. For example, if someone has to undergo hip replacement surgery, it would be a planned surgery. On the other hand, due to a heart attack, angiography may be required urgently. This surgery would be an emergency.

In both kinds of hospitalization, the insurance company must be informed in time. In planned hospitalization, the notification should be done at least 3 to 4 days before the hospitalization. If it is an emergency hospitalization, the medical reimbursement request should be registered within 24 hours of hospitalization.

How Does The Claim Process Start

When you visit the doctor, your healthcare provider may file a claim with your health insurance company on your behalf for the treatment they have provided or would like to provide. Sometimes your provider gives you the paperwork to file the claim yourself. The insurance company must decide if they are going to pay for the service, medication, or device within a certain number days. The time depends on whether you have had the care yet, and if the care is urgent.

- If you have already received care, the insurance company must notify you of the claim decision within 30 days.

- If you have not received care and the medical situation is urgent, you must be notified within 72 hours.

- If you have not received care and the medical situation is not urgent, you will be notified of their coverage decision within 15 days.

In all situations, if your health insurance company refuses to provide coverage, you have a right to appeal the decision.

Recommended Reading: Is Platinum Health Insurance Worth It