Are Immigrants Without Social Security Numbers Eligible For Medical Insurance Through The Exchange

If you do not have a social security number, you may be able to use your tax identifying number or another type of document to prove you are a legal resident. Illegal immigrants without the proper identifying paperwork are not eligible for health insurance through the Marketplace.

If you are a lawfully present immigrant, you are eligible to get health insurance through the Healthcare Exchange Marketplace. Those with a green card, an eligible visa, certain refugees, or another type of temporary protected status qualify to enroll in a Marketplace plan. They will need to provide documents validating their immigrant status.

The necessary documents might include a permanent resident card, refugee travel documents, a foreign passport, or a certificate of eligibility for student status or visitor status.

Some immigrant families have members with mixed status, meaning that some are able to purchase medical insurance on the Health Care Exchange Marketplace with the proper documentation, while others are not. Illegal immigrants are able to apply for insurance for their dependent family members with lawfully present status.

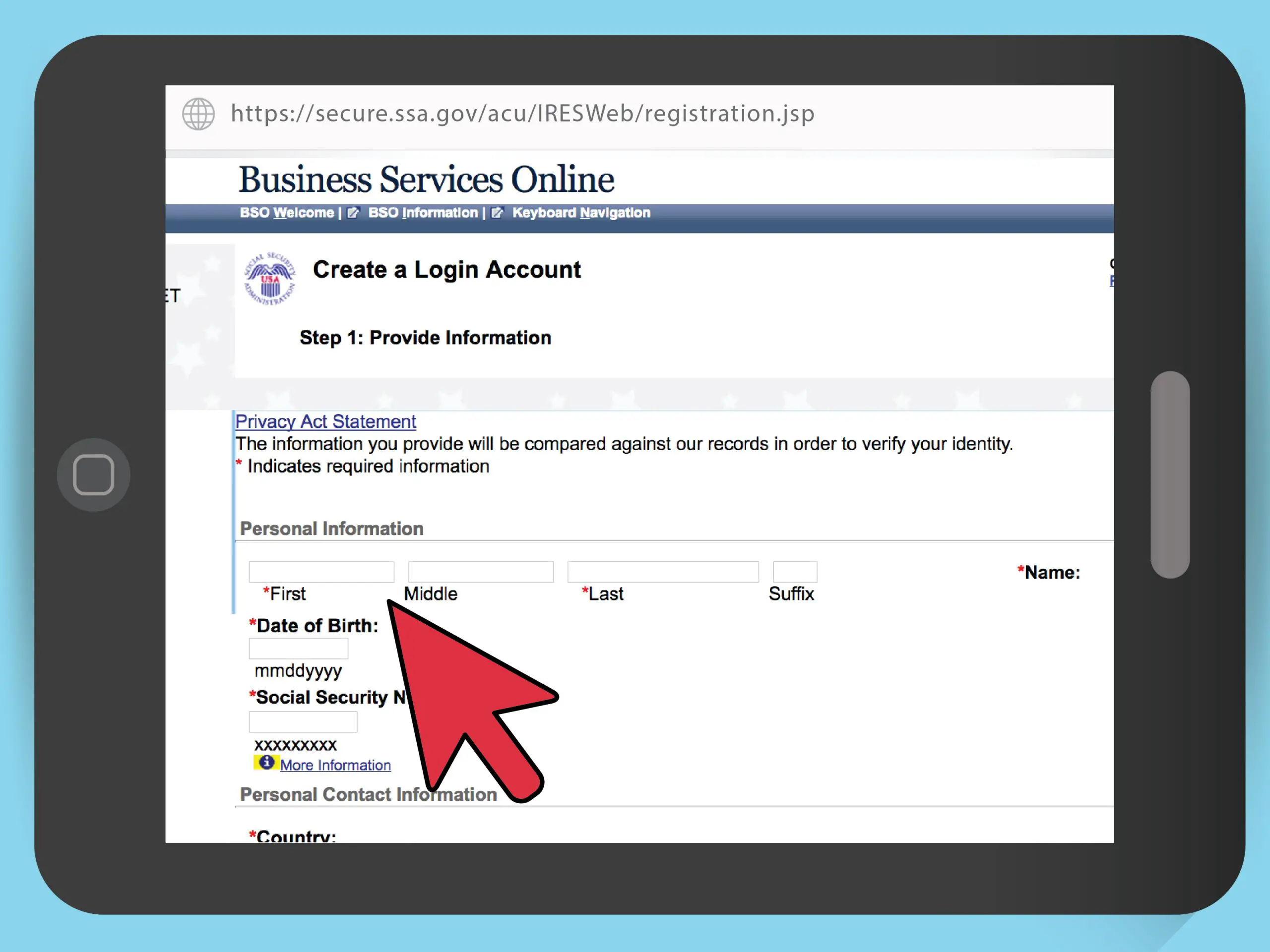

Finding Your Social Security Number

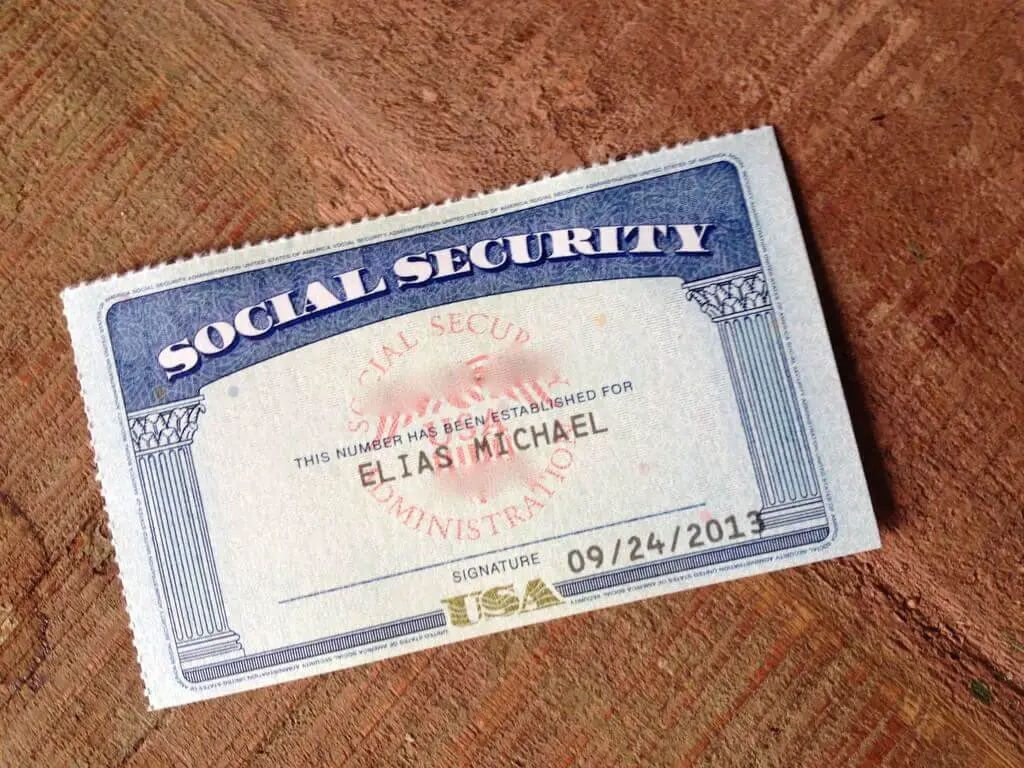

If you find yourself thinking, What is my SSN, then one of the easiest ways to find it is by looking on existing documentation that you may already have. Believe it or not, your Social Security number is listed on many documents that you might already have in your possession. It is a nine-digit number that will usually contain two hyphens. First, try and locate your Social Security card. Your number will be plainly displayed there. If you cannot find your card, there is still hope.

You can still try some of these other documents that are likely to have your number on them. Look for some of your old tax returns. Your number will be listed typically on the first page of your tax return. You can also check your W-2 from your employer and maybe even your bank statements. Both of these documents are common places to find your SSN listed. If you still have no luck, check your drivers license. While most states no longer display your SSN on your license, it is worth a look. If you have an immigrant visa, then your USCIS Forms are the next place you should look. SSNs are common on your visa paperwork, so you can often find your number there. If you are unable to find your number anywhere you look, then youll need to contact the SSA to start the process of getting a replacement Social Security card.

Can People Who Aren’t Us Citizens Apply For Health Coverage Through The Marketplace

Lawfully present immigrants can apply for health coverage. Applying or enrolling doesnt make someone a public charge. This means it wont affect their chances of becoming a Lawful Permanent Resident or U.S. citizen. .

Immigration information entered into the Marketplace will be used for administration of the Marketplace and insurance affordability programs only. People who arent applying for health coverage dont need to provide their citizenship or immigration status.

Read Also: Does Health Insurance Cover Birth Control Pills

You Have To Find The Right Company

For life insurance without SSN, the company would have to use some other form of identification such as a green card, visa, or an ITIN#. To make sure you are the person you say you are. You see, most life insurance companies use SSN to ensure no insurance fraud is being committed. Plus an SSN is the way the life insurance company will underwrite the policy.

Typically an SSN is needed to see about your health history and doctor records. Life insurance companies are trying to make a profit and provide everyone with affordable coverage so in order to do so they must do their due diligence and the proper underwriting for every individual.

Who Can My Marketplace Information Be Shared With And Why

CMS will only share your information as needed and allowed by the System of Records Notice or as authorized or required by law. Examples of when CMS may disclose your information to agencies or people who need the information for specific reasons are provided below. For more information, review the System of Records Notice.

Not all applicants will need to provide all of this information. For example, youll be asked about your employment, income, and enrollment in health coverage only if you want help paying for health coverage.

You may decide to give permission to organizations or people who can communicate with the Marketplace about your application for such needs as resolving inconsistencies, or ensuring complete and accurate applications. Depending on your permission, they may include:

Each application filer confirms that he or she is authorized to share information for everyone on the application. That way, the Marketplace has permission to share your information with your application filer.

Once you select coverage, CMS will use your information for purposes such as:

To maintain Marketplace operation, CMS works with the following groups and may therefore share your information with:

You May Like: What Is The Best Health Insurance In Alabama

Inform Service Canada If You Suspect That A Social Insurance Number Is Being Used Fraudulently

- If you have any reason to suspect that a SIN is being used fraudulently, immediately contact Service Canada at 1-866-274-6627. Provide your business number issued by Canada Revenue Agency along with appropriate identification.

- In Canada, the Personal Information Protection and Electronic Documents Act sets out rules about how private-sector organizations may collect, use or disclose personal information. For more information, visit the Office of the Privacy Commissioner of Canada.

Learn More About How Your Individual Marketplace Information Is Used

This fact sheet provides more information about how your information is being used in the Health Insurance Marketplace® run by CMS, your rights to access records that are maintained about you, your right to file an appeal, and other helpful information. Review it carefully.

Read the official Privacy Act Statement required by the Privacy Act of 1974.

Read the Privacy Policy for how this web site operates.

Read Also: How Much Do You Pay For Health Insurance

Why Are Social Security Numbers Requested In Health Insurance

Medical Fraud

Back in 2007, a law was established called the Red Flags Rule, which was developed by the Federal Trade Commission. In an attempt to diminish identity theft, including the sector of medical identity theft, Social Security numbers were made a requirement by creditors of all sorts. In order to abide by this rule and prevent medical identity theft, health insurers were considered creditors. Though a health care provider cannot legally ask you for your Social Security number, your insurance company is permitted to do so in order to verify that you, the patient, are in fact the policy-holder.

Mandatory Insurer Reporting Law

Section 111 of Public Law 110-173 requires group health insurance companies provide SSNs so that Medicare can coordinate payments with other health benefits. As a member of an employer-sponsored health plan, whether the policy holder or a dependent, your SSN is typically needed to fulfill this laws requirements. Likewise, anyone who is a recipient of reimbursement for health care services or a settlement through workers compensation, no-fault insurance, or liability insurance must present their SSN in order to receive benefits.

Residency Laws

Immigrants who do not have documentation or proof of residency could be identified as undocumented. In this way, obtaining health insurance coverage can be a great obstacle for many individuals relocating to the United States.

Public Programs

Death

Can You Buy Life Insurance If Youre Illegal Residents Or Alien

When it comes to people wanting to buy life insurance without SSN because they are actually illegal residents, this is a whole other situation entirely.

We do know of one company who will offer life insurance without being a US Citizen, but you need an ITIN and they will only write up to $250,000 in death benefit. You cannot be older than 60 to get the policy. See above for policy options.

Recommended Reading: What Is My Health Insurance Plan

The Beneficiary Of A Life Insurance Policy If He/she Does Not Have A Social Security Number

Can someone be a beneficiary of a life insurance policy if he/she does not have a social security number? You do not need to list beneficiaries SS# on the life application so it is possible to leave the money to who you choose. Typically you want to check with the life insurance companies before you would even apply, that way you are certain this is possible before you go through the whole underwriting process.

Listing the address, date of birth and ss# of a beneficiary makes it easier for a life insurance company to locate a beneficiary in the event of a claim.

Is A Social Security Number Required For Medical Insurance

To sum it up

- In most cases, a social security number is required in order to get medical insurance

- This is because the IRS requires you to fill out form 1095-B to ensure you have current health insurance

- If you do not fill out the form with your social security number or you do not have insurance, you may be responsible for paying the individual mandate penalty fine

- If you do not have a social security number, you may be able to use another tax identifying number

- Illegal immigrants without a social security number or other types of tax identifying numbers are not able to buy an insurance plan on the Health Care Exchange Marketplace

Since the Affordable Care Act was implemented, most insurance companies will ask for a social security number before allowing you to enroll in a plan. For the most part, they require this information so they can report it to the Internal Revenue Service. The IRS uses the information to determine who meets the minimum essential coverage requirements under the Affordable Care Act and who has to pay the individual mandate penalty fine.

The IRS uses the information to determine who meets the minimum essential coverage requirements under the Affordable Care Act and who has to pay the individual mandate penalty fine.

You will use all of the information on the form to help you file your federal taxes. It is not necessary to attach form 1095-B to your own federal tax returns.

You May Like: Which Is The Best Health Insurance Company In Texas

Protect Your Employees’ Personal Information And Sin

- Store all personal information in a secure area or on an encrypted computer system and ensure that only authorized individuals have access.

- If you become aware that an employee’s SIN has been stolen or inappropriately used, take immediately the following steps:

- assess the damage

- contact Service Canada at 1-866-274-6627

- contact the Office of the Privacy Commissioner, and

- if any criminal activity occurred, contact the police.

- More information is available in Annex 4 of the SIN Code of Practice, on the Canadian Anti-Fraud Centre site and on the Consumer Measures Committee site.

How Does The Marketplace Use My Information

As a federal agency operating the Marketplace and associated programs, CMS is required to protect the information it collects and maintains. CMS respects your right to privacy and will protect the information it maintains about you in the ongoing operation of the Marketplace in accordance with all required laws, regulations and standards. You refers to any person whose information is entered on your application, or those acting on such a persons behalf.

CMS needs your information to determine eligibility for:

- Enrollment in a Marketplace plan, also known as a Qualified Health Plan

- Insurance affordability programs

- Certifications of exemption from the individual responsibility requirement

When you apply for health coverage or an exemption, your information may be used to:

- Help you with the application process

- Verify information like your identity and any income history you provide

- Give you accurate information about as many different cost-saving programs as possible

- Help you resolve questions about the results of your application, including an appeal if you decide to file one

- Communicate with you during the eligibility process

When you enroll in health coverage, your information may be used to:

- Help you enroll

- Report and manage the advance payments of premium tax credit and cost-sharing reductions to the issuer of your Marketplace plan, if youre eligible

- Communicate with you throughout the enrollment process

Also Check: How To Get Health Insurance For My Family

Can I Get A Replacement If Ive Lost My Sin

- To replace your lost SIN, youll need to visit your local Service Canada branch. If you visit with all the appropriate documents, Service Canada will give you your SIN number on the spot.

- If you live more than 100 km from a Services Canada branch or cannot visit a Service Canada branch because of a special situation, you can make a SIN request by mail. But, before mailing your SIN request, you must first get permission from Service Canada by calling 1-800-206-7218 .

- Its important to note that you will only be issued a brand new SIN if you were the victim of identity theft or fraud. Check out Service Canadas Protecting your Social Insurance Number web page for details.

What Is The Individual Mandate Penalty Fine

If you do not report your health insurance information to the IRS or you do not have health insurance, you may be responsible for paying the individual mandate penalty fine. You will have to pay the fee when you file your tax returns for the previous year.

The fee is calculated in one of two ways and you will have to pay whichever is higher you will either have to pay 2.5 percent of your household income or $695 per adult and $347.50 per child under 18 in the household with a maximum set to $2,085.

If you are paying the set fee, you only have to pay for each person in the household who does not have health insurance, not for everyone who lives there.

You only have to pay 1/12 of the annual fee for every month that you went without health insurance coverage. If you went without health insurance for less than three full months, you might qualify for the short coverage gap exemption and not have to pay the fine for that year. There are other exemptions you may qualify for as well depending on certain life circumstances.

If you do not pay the fee, the Internal Revenue Service will withhold it from your tax return for the following year. They will not use any typical means of collection or pursue any criminal penalties to collect the fine. So, if you were worrying, Will I go to jail if I dont have health insurance?, the answer is no.

Also Check: Can You Opt Out Of Health Insurance At Any Time

What Happens If I Still Can’t Afford To Buy Health Insurance

If you cannot purchase insurance, it will be extremely difficult to find Healthcare options in your area. Many doctors don’t accept patients without insurance and hospitals have the tendency to charge higher rates to customers without insurance. In emergency situations, you will be treated, but you will have little protection from the bills that the hospital charges you.

Do I Have To Provide Social Security Numbers For People Listed On My Application

People who apply for health coverage need to provide an SSN if they have one. An application filer must also provide the SSN of any tax filer who isnt applying for health coverage if the tax filers tax information will be used to verify the households eligibility for help with paying for health coverage. Other people not applying for health coverage are encouraged to provide their SSNs to speed up the application process, but arent required to provide one. We use SSNs to check income and other information to see whos eligible for help with health coverage costs. If someone wants help getting an SSN, they can visit socialsecurity.gov, or call 1-800-772-1213. TTY users should call 1-800-325-0778.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

Health Insurance For Children Without A Social Security Number

One cant underestimate the importance of health insurance here in the United States. If you and your family have a social security number, you can usually obtain a policy that complies with the Affordable Care Act. Some people here in the United States, including children, dont have a social security number. We know your children are very important. You want the best for them. You can still purchase health insurance for them, even if they do not have a social security number. In this article, we discuss health insurance for children without a social security number.

All Programs Except Ta 31 Tp 32 Tp 33 Tp 34 Tp 35 Tp 36 And Tp 45

All applicants must provide a Social Security number or apply for one through the Social Security Administration before certification, unless they meet one of the criteria in this section.

Exception: Undocumented aliens are not required to apply for an SSN.

Non-applicants are not required to provide an SSN or proof of an application for an SSN. When non-applicants provide an SSN, advisors may attempt to verify the SSN using the procedures explained in A-440, Verification Requirements. If verification is not available through electronic data sources, verification of the non-applicants SSN must not be requested from the applicant.

Also Check: Is It Legal To Marry For Health Insurance