What’s The Difference Between A Deductible And An Out

Your insurance deductible is relevant at the beginning of your health insurance policy, and your out-of-pocket maximum is relevant after you’ve had significant health care during a policy year.

- Deductible: You pay 100% of your health care costs until your spending totals your deductible amount.

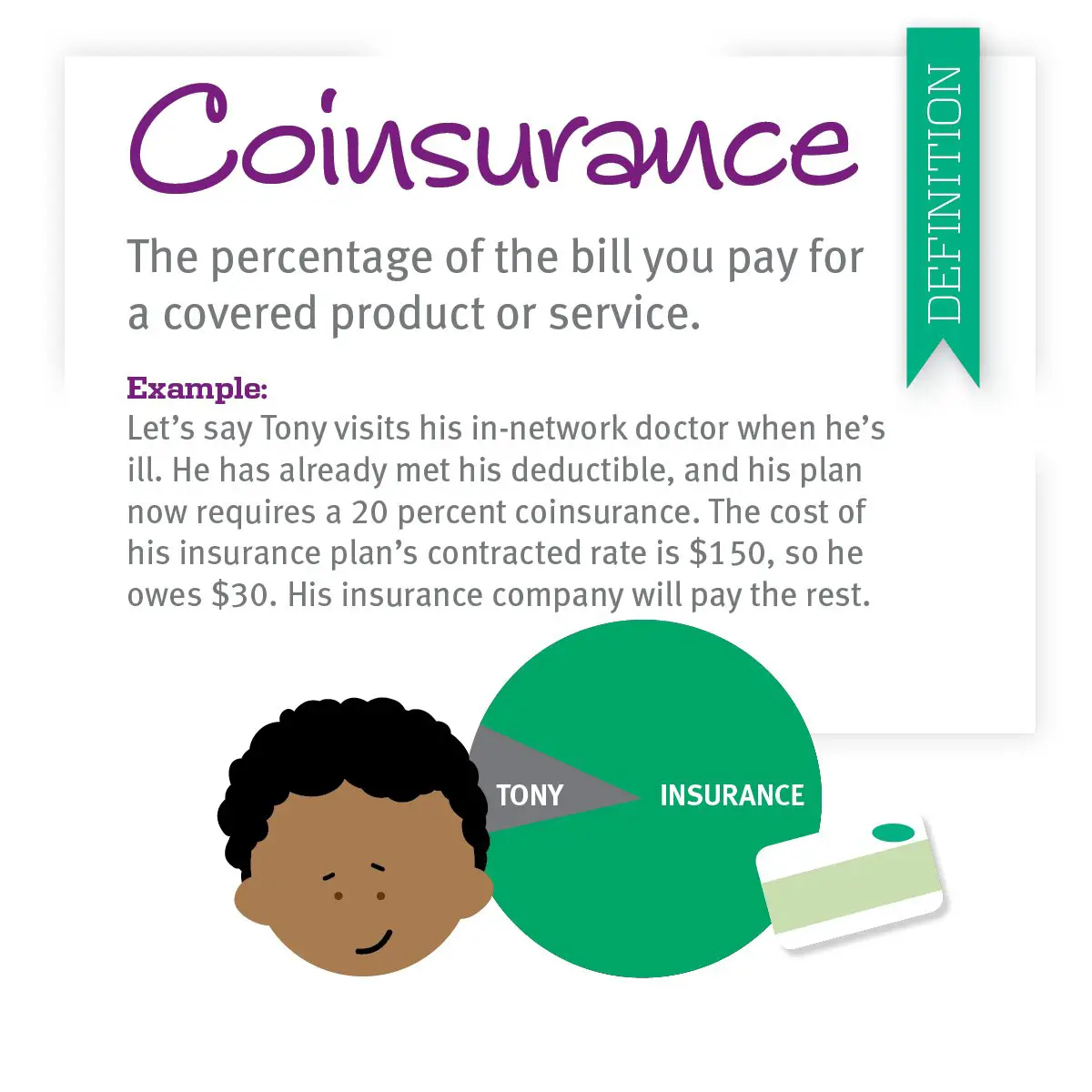

- Coinsurance/copay: You’ll pay a portion of your health care costs until your total spending reaches your out-of-pocket limit.

- Out-of-pocket limit: You’ll pay 0% for covered health services after your out-of-pocket limit.

Things To Know About Deductibles In The Health Insurance Marketplace

IMPORTANT: This page is out-of-dateGet the latest information here.

Deductibles, premiums, copayments, and coinsurance, are important for you to consider when choosing a health insurance plan. You can compare health plans and see if you qualify for lower costs before you apply. Most people who apply will be eligible for help paying for health coverage.

Here are 6 important things to know about deductibles:

What Percent Of Health Insurance Is Paid By Employers

Written by: Elizabeth WalkerSeptember 24, 2021 at 9:37 AM

When youre considering a new health insurance program, your organizations contribution strategy is an important decision. In simple terms, how much will employees pitch in for coverage, and what percentage will be paid by the employer?

With traditional group health insurance plans, the organization must contribute a minimum percentage, leaving the employees to pay the remaining amount, usually through a payroll deduction. So just what percent do employers typically pay in the United States?

Across the country, a Kaiser Family Foundation survey found that the average percent of health insurance paid by employers is 83% for single coverage and 73% for family coverage. Lets dive into these stats a little deeper.

You May Like: Starbucks Employee Health Insurance

How Do Different Factors Work With Your Deductible

Your deductible is one part of your cost-sharing duty. After you fulfill this duty, you still have various out-of-pocket expenses related to your deductible. There are three main types of expenses, which we will discuss below.

Insurance premiums

As mentioned above, higher deductibles are linked to lower premiums. Similarly, lower deductibles typically lead to higher monthly premiums.

Copays and coinsurance

These cost-sharing charges start after you meet your deductible. Copays are flat fees for covered health services, such as $30 for a doctors visit. Coinsurance is the percentage of the medical bill youre responsible for paying. For example, with 20% coinsurance, youd owe $20 for a $100 doctors office visit. Your plan documents will have specific information on when these charges apply.

Out-of-pocket maximum

This figure represents the annual limit you owe for covered healthcare treatments and services. Beyond that amount, the insurer pays for 100% of the covered services. Deductibles count toward your out-of-pocket maximum, as do all payments you make for covered health services. With your deductible, your progress toward your out-of-pocket maximum resets to $0 when the new plan year starts.

How Premium Costs Have Changed In Recent Years

In recent years, healthcare costs have kept rising for both individuals and families in the U.S. This is also true for monthly and annual insurance premiums. The average yearly premium for a family has increased by 22% since 2015 its increased by 55% since 2010.

Healthcare spending in the U.S. grows each year. Projections estimate yearly annual spending of nearly $6 trillion by 2027, compared to $3.8 trillion in 2019.

You May Like: When Does Health Insurance Stop After Quitting Job

What Is A Typical Deductible

Deductibles can vary significantly from plan to plan. According to the Kaiser Family Foundation , the 2020 average deductible for individual, employer-provided coverage was $1,644 . KFF reported the average 2021 deductible for marketplace plans sold via HealthCare.gov, by metal rating: $6,921 for Bronze plans, $4,816 for Silver plans, $1,641 for Gold plans, and $0 for Platinum plans.

High-deductible health plans have become common. Typically, a healthcare plan with a higher deductible will have a lower premium, while a plan with a lower deductible will have a higher premium. For 2021, the IRS defines an HDHP as one with a minimum deductible of $1,400 for individual coverage or $2,800 for family coverage. HDHPs can have higher deductibles, although theyre more limited than other plans in terms of total out-of-pocket caps: In 2021, an HDHPs maximum out-of-pocket cant exceed $7,000 for an individual or $14,000 for a family .

Health Insurance Deductibles And Marketplace Plans

The plans offered directly by insurers are similar to those that are available in the health insurance marketplaces that the federal government and many states have made available under the Affordable Care Act. The marketplaces offer four tiers of insurance plans:

- The Bronze plan, with the lowest monthly premium, covers an average of 60% of health costs.

- The Silver plan has a higher monthly premium and covers an average of 70% of health costs.

- The Gold plan has a higher monthly premium than the Silver plan but covers 80% of health costs.

- The Platinum plan has the highest monthly premium and the highest level of coverage at 90%.

Notably, there’s also a catastrophic plan that has a very high deductibleâ$8,150 in 2020âfor people under age 30, or those who have a hardship or affordability exemption.

Recommended Reading: Starbucks Dental Insurance

Cases Where You Don’t Pay The Deductible

The Affordable Care Act stipulates that you do not have to pay a deductible for some preventive care services for your in-network services, as long as your health plan wasn’t introduced before the enactment of the ACA. Such plans which were introduced before the passage of ACA are termed grandfathered plans.

A grandfathered plan is free from the obligations of the ACA and does not need to follow all its regulations. You may be responsible for some preventive care costs if your employer has a grandfathered plan.

Health Insurance Deductible Example

Example #1

Say you have a health insurance plan with a deductible of $1,000. During the course of the year, a medical event arises with a bill of $4,500 that is covered by your health insurance plan. Your health insurance policy will pay for this bill since it is covered, but you would first need to pay off the deductible. Here’s how that would play out:

Example #2

Now let’s say you have a health insurance plan with a deductible of $1,000 and coinsurance of 20% after the deductible has been reached. During the course of the year, you receive a medical bill for $4,500 that is covered under your health insurance policy. Here’s how that would play out:

Editorial Note: The content of this article is based on the authorâs opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Health Insurance Basics

You May Like: Burger King Health Insurance

The Date Your Deductible Rolls Over

Health insurance deductibles usually roll over every January, but some plans may use a different datefor example, health plans through schools or universities may use the academic year.

- Why do you need to know the deductible rollover date?

This date is important because you may want to plan your appointments and procedures to occur after your deductible is met and before the year rolls over. Or, you may need to budget more money for the early part of the year.

Lets say you have a $1,000 deductible and you meet it in June. Any other services you get for the rest of the year will only cost you copays or coinsurance. But if you wait until January, you will have to pay $1,000 all over again. You might consider scheduling bigger procedures before January to save you some cash if you are not planning other expensive services for the next year.

How Much Are Hdhp Deductibles

The average deductible for a employer-based plans single coverage is $1,644 in 2020 nearly identical to 2019. The average deductible for HDHPs is $2,303 for a single plan, a slight decrease from 2019, according to Kaiser Family Foundation.

Insure.com found that respondents single plan deductibles are usually between $1,701 and $4,000. Thats well above the $1,400 threshold for a plan to be considered high deductible.

Here are what the survey respondents said single coverage deductibles are:

- Between $1,701 and $2,499 33%

- $2,500-$4,000 26%

- More than $4,000 16%

- Less than $1,700 11%

Kaiser Family Foundation said the average HDHP annual deductible for family coverage is $4,552 for high-deductible employer-based plans in 2020. Our respondents said their family plan deductibles are:

- $3,001-$4,449 29%

- Less than $3,000 25%

- More than $6,000 18%

These deductibles are significantly higher than PPO and health maintenance organization plans. However, those higher costs are offset by lower premiums.

Kaiser Family Foundation said the average premiums for plans in 2020 are:

| Type of plan |

|---|

Recommended Reading: Kroger Associate Discounts

What Is A Deductible

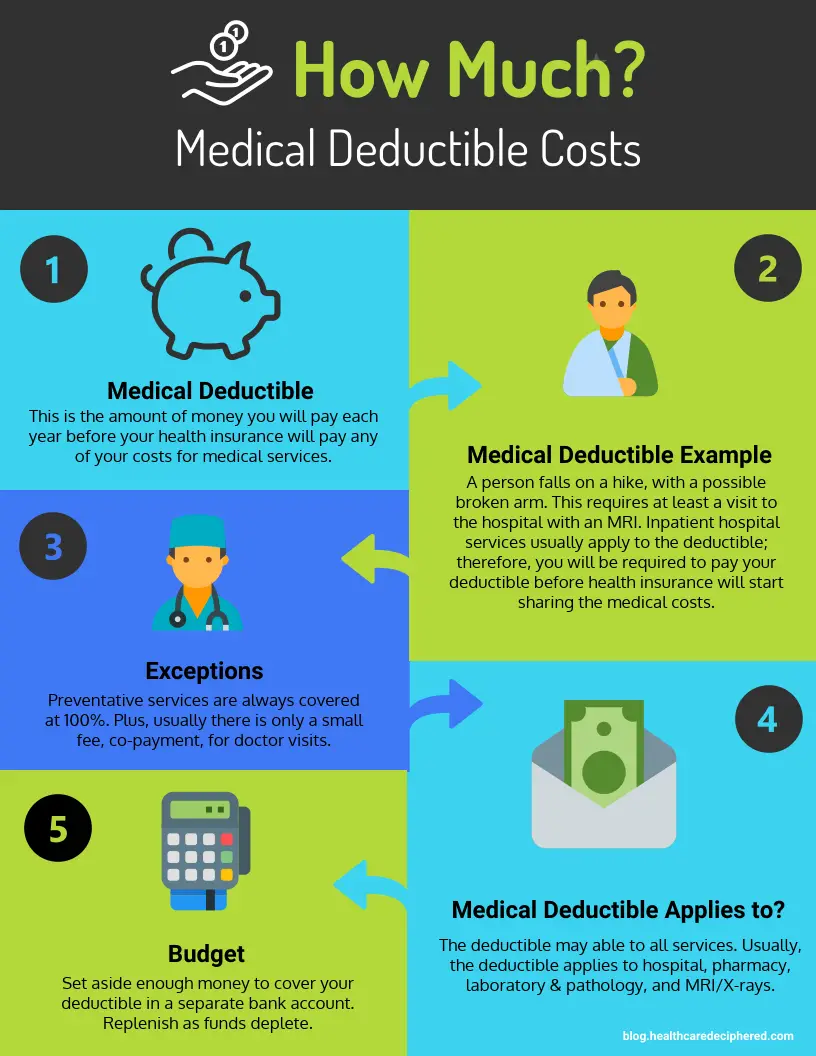

A deductible is the amount you pay for health care services before your health insurance begins to pay.

How it works: If your plans deductible is $1,500, youll pay 100 percent of eligible health care expenses until the bills total $1,500. After that, you share the cost with your plan by paying coinsurance.

What Is Health Insurance Deductible

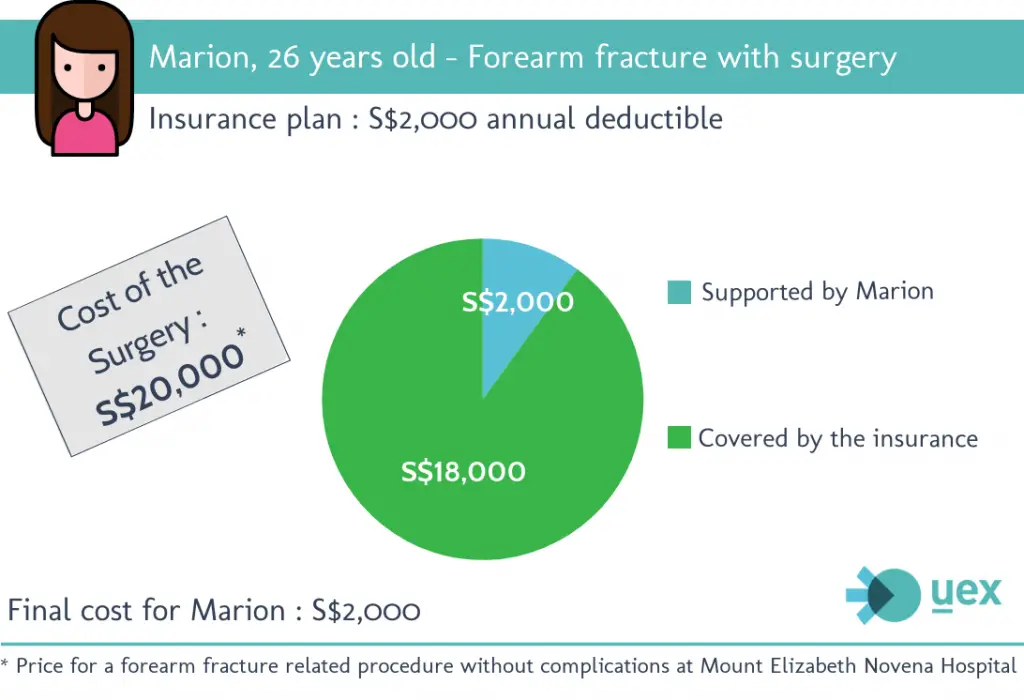

A health insurance deductible is a pre-defined amount you have to pay from your pocket for your medical expenses before getting the claim under medical insurance from the company. It is the part of the claim that you have to pay each year every time you make a claim. The health insurance company will bear the rest up to the policy limits.

Generally, the higher the premium amount, the lower the amount of deductible the person must pay. In the case of a lower monthly premium, there is a likelihood that the insured person may have to pay a higher health insurance deductible.

Read Also: Starbucks Health Insurance Eligibility

Insurance Plan With No Deductible

There is of course no obligation to subscribe a health insurance plan with deductible. But, not taking advantage of it will likely have a direct impact on the premium amount.

It can also happen that people forget they have deductibles in their insurance plan. They will usually realise that when claiming as they will end up with a lower, or no, reimbursement. This will be caused by the fact that amount of the deductibles is either not reached or partly reached.

A Simple Guide To Health Insurance Deductibles And How They Work

A health insurance deductible is the amount the insured individual pays for the received healthcare before the insurance comes into play. Deductibles are an integral part of the cost sharing model of health insurance.

It is essential we understand the various components attached to it. While most companies offer health insurances with the cost sharing option, you must learn what the process entails.

The deductible being a critical aspect of the cost sharing will be the main focus of this article.

In this post, we shall grasp the concepts as mentioned here:

- What is Cost sharing?

- What is Health Insurance Deductible?

- Types of Deductibles

- Difference between Individual and Family deductibles

- Health insurance and Deductibles: How are they related?

- How do Deductibles work?

- Average and High Deductible Plans

- Eligibility

- Cases where you don’t pay the Deductible

- Deductibles that do not apply

- Know about Preventive Care

You May Like: Does Starbucks Provide Health Insurance

How Often You Actually Meet Your Deductible

Odds are, if you purchased health insurance, you hope that it will pay for the health care you use. So if you find that every year you come close to meeting your deductible but never do, you may be tempted to get a plan with a lower deductible so that you end up paying less out of pocket.

Be aware, though: premiums for lower-deductible plans might be higher than you would end up saving.

When you weigh this decision, make sure you consider the full cost spectrum of:

- Premiums

- How much health care you expect to receive that year

What Counts Toward Your Health Insurance Deductible

Lisa Sullivan, MS, is a nutritionist and health and wellness educator with nearly 20 years of experience in the healthcare industry.

Your health insurancedeductible and your monthly premiums are probably your two largest healthcare expenses. Even though your deductible counts for the lions share of your healthcare spending budget, understanding what counts toward your health insurance deductible, and what doesnt, isnt always easy.

This article will help you understand what you need to know about health insurance deductibles and how your medical expenses are counted.

The design of each health plan determines what counts toward the health insurance deductible, and health plan designs can be notoriously complicated. Health plans sold by the same health insurer will differ from each other in what counts toward the deductible. Even the same plan may change from one year to the next.

You need to read the fine print and be savvy to understand what, exactly, you’ll be expected to pay, and when, exactly, you’ll have to pay it.

Read Also: Starbucks Healthcare Benefits

Do All Healthcare Insurance Policies Have Deductibles

Every health insurance plan generally has deductibles. However, there might be some plans that have zero deductibles. The question that arises in most consumers minds is which health insurance plans always have deductibles. So, you can expect deductibles on these plans.

- Medicare and Medicare Advantage

- Qualified health plans , whether from employers or the health insurance marketplace

- Short-term, limited-duration health insurance

Is It Better To Have A High Or Low Deductible For Health Insurance

The best health insurance policy for you depends on your budget and health history. During the purchase of an insurance policy, a buyer can choose the deductible amount. Many people only look at insurance premiums when comparing health plans. However, they are oblivious that this monthly price only represents one of the expenses that contribute to how much a consumer will spend on health care in a given month.

Nevertheless, deciding to opt for a high or low deductible while buying a health insurance plan decides several aspects of your coverage. Whether you are an employer looking for group plan options or an individual looking for yourself and your family, the question that is likely on your mind during the open enrollment is: Is it better to have a high deductible health plan or a low deductible health plan ? and what is a good deductible for health insurance?

Also Check: Starbucks Open Enrollment 2020

Better Go Out And Get That Health Care Now Folks Because Come January 1 Youre Going To Start Paying For It Again

A few weeks back, I had the opportunity toteach a course on pathways to universal health care in the United States. To beclear, I have a very particular viewpoint on thisI literally co-wrote the book on Medicarefor All. But I do my best toexplain precisely why Medicare for All is head and shoulders a more efficient,effective, and yes, even politically plausible approach to solving ourhealth care crisis.

Yet as someone who spends a lot of my timethinking about our health care system, I sometimes forget just how inured Ivebecome to how broken it really is. And I was reminded anew by the disgustedreaction my students had to some of the most galling aspects of Americanhealth care we tend to take for granted. There were a lot of things they didntlike, but none elicited quite the same reaction as the concept of adeductible.

Many of you are probably shuttering justthinking about your deductible. Thats because, if you think about it, adeductible is the paywall to get the insurance you already paid for. Its likesigning up for a streaming service and then having to pay extra to watch the movieyou wanted, except that its thousands of dollars instead of $14.99. Healthinsurance companies use deductibles to kick costs back onto theirbeneficiaries, who may choose to pay less up front in premiums .

For families around the country, that meansracing the clock to get all the health care they need before the new year. BlackFriday, indeed.

How Does Your Annual Deductible Work

A health insurance deductible is a particular amount that a policyholder has to pay before their plan starts paying for their healthcare expenses. You should note that not every insurance policy comes with a deductible.

And the ones that do have one usually have varying prices. Your deductible is only active for a year, meaning that it rolls over, and you will have to meet your deductible for the new year before you can benefit from your health insurance plan.

You should remember that only expenses on covered medical costs count towards your deductible. An annual deductible refers to your health insurance benefits and coverage payment, valid for a year.

In other words, the sum you get as your health insurance policy deductible is valid for that year only and rolls over the next year. Even if you meet your deductible within the year, the moment the new year begins, you start all over again.

Your annual deductible can be an excellent way for your health insurance provider to share the policy’s expenses with you. Your health insurance provider will issue higher premiums to cover the shortfall in the absence of a deductible.

The price you pay as your annual deductible depends on the health insurance policy. Policies on the higher metal tiers such as platinum or gold policies generally have higher premiums but lower deductibles.

The inverse is valid for the lower metal tiers as they have higher annual deductibles but lower premiums.

Read Also: Is Umr Good Insurance