When Are Premiums Paid

In most cases, premiums are paid on a monthly basis. Those purchasing insurance through the Marketplace are expected to pay their premiums each month.

If you purchase insurance independently through an insurance company, you may be able to work out a different payment plan. Some people may prefer to pay their premiums each year, every six months, each quarter, or every other month.

If you have insurance through an employer, its likely that the cost of your premium will be automatically deducted from your paycheck. If youre paid every other week, the correct amount will be calculated accordingly.

Some employers pay 100 percent of their workers premiums, but most do not. The majority of full-time employees have to pay for a portion of their health care premiums. A companys payroll department will take care of the accounting so that your premium payments will be sent to the insurance company directly.

Change In Average Health Insurance Cost For 2021

From 2020 to 2021 health insurance rates decreased across the nation by over 2%. Additionally, year over year, Indiana saw the largest jump in health insurance costs across all metal tiers increasing nearly 10%. Including Indiana, 21 states had their rates increase on average from 2020 to 2021.

Both Pennsylvania and New Jersey switched their health insurance exchanges from being government-based to state-based. Interestingly, New Jersey had an increase in rates of close to 9% due to the change, while Pennsylvania’s rates went down decreasing by 8%.

On the other hand, rates in Iowa and Maryland decreased the most year over year, falling 20% and 17%, respectively. Overall, 27 states experienced a decrease in health insurance premiums.

| State |

|---|

Policy premiums are for a 40-year-old applicant.

How Much Should I Pay For Healthcare Introducing The Health Affordability Ratio

Updated: by Financial Samurai

Healthcare affordability continues to be a concern for millions of Americans. When the Affordable Care Act was enacted in 2010 I was happy. A universal healthcare system would insure the ~47 million Americans who were previously not insured.

After all, disease doesnt discriminate between rich and poor. Also, being rejected for healthcare coverage due to a pre-existing condition is discriminatory. Healthcare affordability shouldnt be a national crisis. However, things have changed.

Don’t Miss: Starbucks Insurance Part Time

How To Estimate Your Yearly Total Costs Of Care

In order to pick a plan based on your total costs of care, youll need to estimate the medical services youll use for the year ahead. Of course its impossible to predict the exact amount. So think about how much care you usually use, or are likely to use.

- Before you compare plans when youre logged in to HealthCare.gov or preview plans and prices before you log in, you can choose each family members expected medical use as low, medium, or high.

- When you view plans, youll see an estimate of your total costs including monthly premiums and all out-of-pocket costs based on your households expected use of care.

- Your actual expenses will vary, but the estimate is useful for comparing plans total impact on your household budget.

Which Life Insurance Companies Offer Discounts For Annual Life Insurance Premium Payments

Most of the top life insurance companies offer some discount for paying annually, ranging from 0% to 5% for term life insurance policies. Our life insurance reviews can give you a full picture of the top-rated life insurance companies, but these are the approximate annual discounts currently offered by Policygeniusâ partner insurance companies.

| COMPANY |

|---|

| 3% |

Also Check: Starbucks Insurance Plan

Financial Tools Simplified Flexible Spending Accounts

A Flexible Spending Account can help you pay for:

- qualified medical, dental and vision expenses and supplies

- health insurance premiums for premium-only accounts

- dependent care expenses

How It Works: You set up the FSA and decide how much to put in. The money comes out of your paycheck before you pay taxes. You lower your taxable income and pay for health care with tax-free dollars.

Hot Tips!

- Except for dependent care, you can use the whole thing on the first day of the plan year.

- If you don’t use all the money by the end of the year, you lose what’s left. It does not “roll over” to the following year, so it’s important to carefully estimate the amount you’ll need.

- Use your FSA for things like eye glasses, sunglasses with readers, contact lenses and solution, sunscreen, certain medical equipment, qualifying prescriptions and copays.

- See IRS Publication 502 for a general list of what you can and cannot buy with your FSA. You can also search for more than 4000 items online at the FSA Store or the website of your favorite drug store.

Catastrophic Health Insurance Plans

For qualifying Americans under the age of 30, catastrophic plans are available to provide what can be considered last-resort health insurance. Catastrophic plan premiums are lower than even Bronze tier plans. However, you pay more for visits and prescriptions due to high deductibles, which are $8,550 for the year in 2021.

Read Also: Starbucks Health Insurance Eligibility

How To Get Car Insurance Lowered

One of the ways to lower car insurance is through a discount bulk rate for insuring several vehicles and drivers at once. Lower car insurance rates may also be available if you have other insurance policies with the same company. Maintaining a safe driving record is key to getting lower carinsurance rates.

People ask , what are the best ways to bring your car insurance down?

Also, what are 5 tips for lowering auto insurance rates?

, how do I ask for a lower insurance rate?

Contents

Choose A Plan With A High Deductible

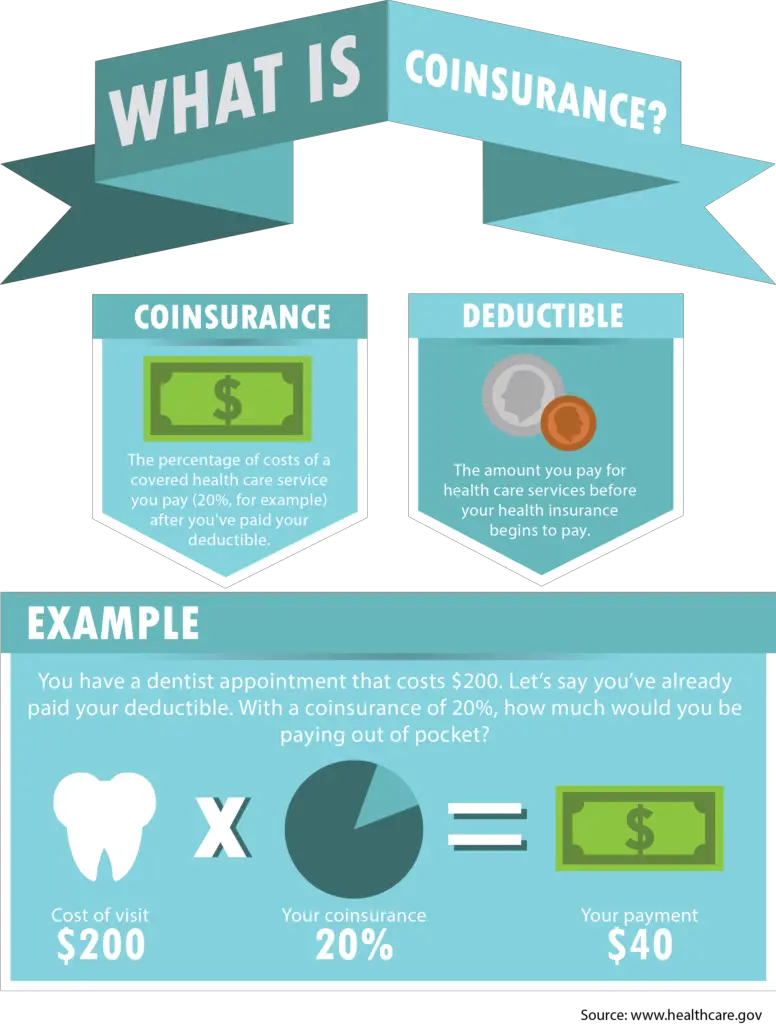

A deductible is the amount you pay for health care services before your health insurance begins to pay. A plan with a high deductible, like our bronze plans, will have a lower monthly premium.

If you dont go to the doctor often or take regular prescriptions, you won’t pay much toward your deductible. But that could change at any time. That’s the risk you take. If youre injured or get seriously ill, can you afford your plan’s deductible? Will you end up paying more than you save?

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

How Do Copayments And Coinsurance Work

After youve met your deductible depending on the type of plan you have you may pay a coinsurance for some services. Your coinsurance is a percentage you pay after meeting your deductible. Some of the most common percentage breakdowns are 80/20 and 90/10.

Your copayment, or copay, is different. Its a fixed amount you pay for a covered service. Its common to have separate copay rates for different types of care. For example, a visit to your primary care doctor may have a different copay than a visit to a specialist, like a dermatologist. You may also pay a copay for prescriptions. Youll often pay your copay during the time of service.

Two Things Determine Howmuch You Will Pay For A Year Of Healthcare

Premium

Think of this as your monthly bill the amount you must pay your insurance company on-time each month. It keeps your insurance active and helps cover the cost of services included in your plan like the preventive services.

Out-of-Pocket Costs

Health insurance is designed to share costs with you when you get healthcare or prescriptions. These shared costs come in two formscopayments and coinsurance. When these costs apply depends on the deductible and out-of-pocket maximum.

These shared costs come in two forms:

Copayments : A fixed amount $10 for example you owe for a medical visit or prescription that is covered by your health plan. It is usually due when you receive the service.

Coinsurance: A percentage of the costs 30% for example you owe for a medical visit or prescription that is covered by your health plan. You will receive a bill for this after you receive the service.

When these costs apply depends on two key details of your plan:

Deductible: The amount you have to spend on covered healthcare services and prescriptions before your health insurance company begins to pay a percentage of your bills.

Out-of-pocket maximum: The most youd ever have to pay for covered services and prescriptions in a plan year.

You May Like: What Health Insurance Does Starbucks Offer

How Can I Lower My Monthly Health Insurance Cost

Who is this for?

If you’re wondering how you can save money on your premium for individual and family health insurance, this explains some strategies.

You can’t control when you get sick or injured. But you do have options when it comes to what you pay for your health insurance premium. That’s the monthly payment you make to your health insurance company to maintain your health care coverage. Here’s how you may be able to lower your bill.

Other Ways To Lower Your Tax Bill

If youre not eligible to deduct your health insurance premiumseither because you dont meet the cost threshold or because you opt to take the standard deduction when you’re filing taxesthere are other ways to reduce your overall medical expenses.

You might consider electing a high-deductible health plan as a type of insurance coverage. HDHPs typically offer lower premiums than other plans. They also offer the unique feature of enabling plan subscribers to open up a Health Savings Account , a tax-advantaged savings account. Money that is contributed to an HSA account can be used to pay for out-of-pocket healthcare expenses. Your contributions to an HSA are tax-deductible and, when used for eligible expenses, your withdrawals are tax-free, too.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

How To Pay Your Monthly Premium At Healthcaregov

Employer And Employee Contributions To Monthly Premiums

As a small business with less than 50 full-time equivalent employees, you are not required to offer group health insurance. If your company does decide to offer health coverage to your employees, then you are typically required to pay for at least 50 percent of employee premiums as a small employer. Keep in mind that your business can also decide to contribute a larger amount to your workers premiums.

If you are a small business with less than 50 full-time equivalent employees, youre not required to offer group health insurance. If you do choose to offer health coverage to your employees, then youre typically required to pay for at least 50 percent of employee premiums as a small employer. Keep in mind that your business can also decide to contribute a larger amount to your workers premiums.

The Employer Health Benefits 2019 Summary of Findings noted that the level of employer contributions to worker premiums tends to vary:

- 31 percent of covered small firm employees had their employer pay the entire premium for their single coverage.

- 35 percent of covered small firm employees were enrolled in a plan where they contribute more than one-half of the premium for family coverage.

- In 2019, the average amount covered employees contributed was $1,242 for single coverage and $6,015 for family coverage.

Source: Kaiser Family Foundation 2019 Employer Health Benefits Survey

Read Also: Starbucks Partner Health Insurance

How Much Is Family Health Insurance Per Month

The average premium for a family of 4 in 2020 is was $1,437, according to customer data gathered by one health insurance agency. This does not include families who received government subsides. Like individual insurance, your family cost will depend on ages, location, plan category, tobacco use, and number of plan members.

Your Gender And Marital Status

Under the Affordable Care Act, insurance companies are no longer able to charge consumers more based on their gender.8 But other factors do make a difference. For instance, if youre married and have kids, you can expect to pay more to cover your familys needs. Note that if your familys income falls below a certain level, a tax credit could save you money.9

But marital status arent the only things that determine how much you could be shelling out. Here are some other things insurance companies look for.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

How To Choose Your Premium And Deductible

Premiums and deductibles work together. Plans with higher deductibles usually have lower premiums, while plans with lower deductibles often have higher premiums. One thing to consider when choosing a plan is how much you think you will use your insurance.

- I will use my insurance often: Do you have small children? Or do you or a family member get sick often or have an ongoing illness or disability? If you think you’ll need to see doctors regularly, you may want to consider a plan with a higher premium and lower deductible. You’ll pay more each month, but you’ll also meet your deductible faster which means lower total out-of-pocket costs.

- I will not use my insurance often: If you’re healthy and don’t go to the doctor often, you may want to consider a plan with a lower monthly premium and higher deductible. If you don’t think you will meet your deductible with the amount of health care services you may use, a lower premium may be the best way to keep your overall annual costs down.

Find The Right Insurance For Your Needs

Health insurance is a very personal type of insurance protection for you and your family. Its important to know that the coverage you have are working in your best interests!

Thats why you need a top-notch independent insurance agent on your side to guide you through finding the best health insurance for you. We have the folks for the job, and you can find them through our Endorsed Local Providers program.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

What Impacts The Amount You Pay For Health Insurance

When it comes to health insurance, there are a few factors that can affect your costs. Your age, family size and where you live can all play into the amount you pay for your health insurance coverage.

Your age: premiums can be up to 3 times higher depending on your age. Typically, older people pay more than younger ones.

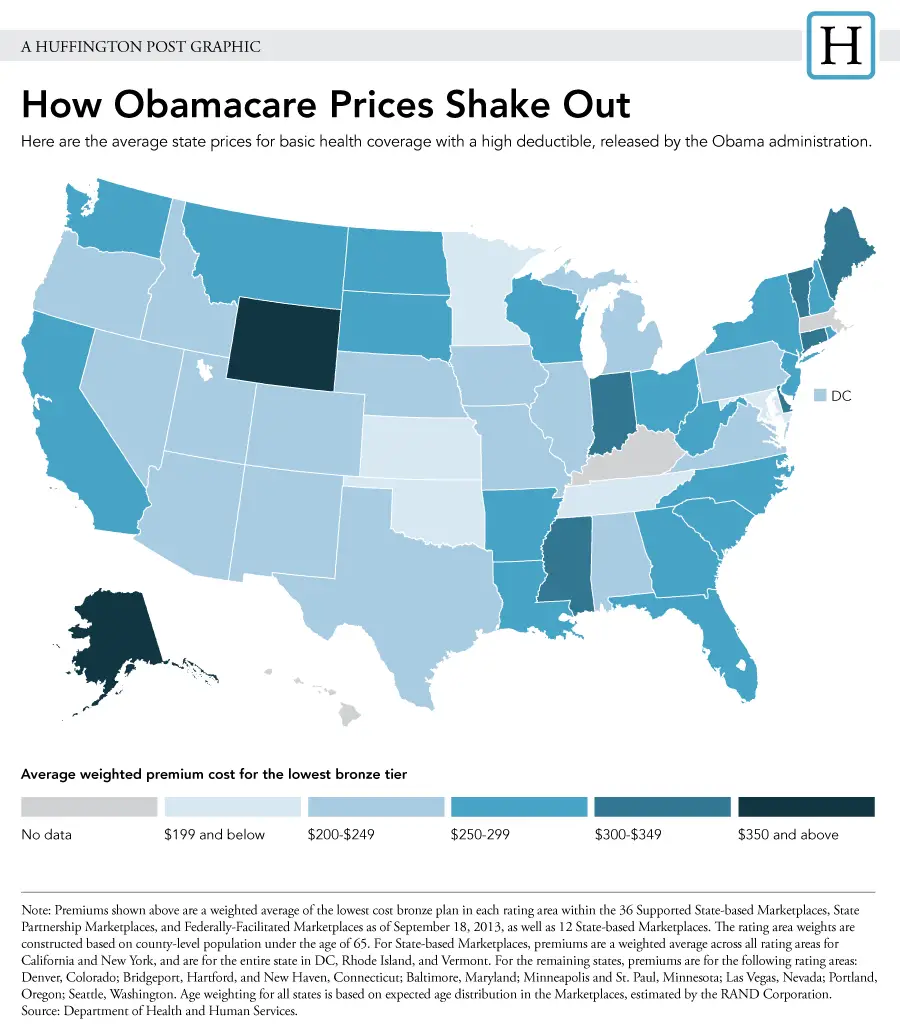

Location: where you live can have an impact on your health insurance costs because of local competition, state rules and cost of living.

Smoking: if you smoke tobacco, insurers may charge you up to 50% more than others who do not use tobacco.

Family size: if your plan covers your spouse and/or children, you may pay more for coverage.

How Can You Pay For Insurance Premiums

When you request health insurance quotes through First Quote Health, you will notice that premium amounts vary substantially. Depending on your health, age and other factors, you could find a monthly premium amount for under $300 to $400 per month to more than $900 per month. You can see that the cost of different health plans varies considerably. In many cases, those who use insurance coverage less frequently may benefit from a policy with a higher monthly premium and more expensive usage costs, such as a higher deductible and copayment amount.

On the other hand, if you frequently visit the doctor, it may make sense to pay a higher premium amount and lower out-of-pocket costs when you seek medical treatment. Many people who are reviewing health insurance quotes today may be inclined to initially buy coverage at the most affordable premium. However, you can see that a better strategy to consider when you are shopping for new coverage is to determine which policy may be most affordable based on how you intend to use the coverage over the course of the next year. Remember that most quotes for health insurance are shown on a monthly basis. More than that, you typically are required to make a monthly premium payment to your insurance provider.

Popular Articles

You May Like: Starbucks Healthcare Benefits

Different Types Of Plans

Shopping for a health insurance plan can sometimes feel like being in a grocery store and staring at rows of the same product for what seems like hoursonly its less exciting and way more expensive! But comparing plans could save you money. This is because the type of plan you choose also affects your health insurance costs.

Here are the plans and networks you can shop for in the health insurance marketplace: