How Much Does Supplemental Insurance Cost In 2022

Original Medicare at its best still suffers coverage gaps or deductibles the average recipient may struggle to afford. Some common services, such as dental care, glasses and hearing aids, arent covered at all.

Some people opt to purchase a supplemental plan called Medigap. This supplemental insurance is private insurance that bridges Medicare coverage gaps. It can help cover copays, coinsurance, deductibles and extended hospital visits. Some plans also cover health care costs outside the U.S.

Several factors can influence the cost of a Medigap policy. Each insurance company sets premiums based on the type of plan, your geographic area and different pricing models. For example, some plans are priced differently depending on your age, while others are not.

The cost of Medigap plans in 2022 ranges from $58 a month for a plan with fewer benefits to $411 a month for a more comprehensive plan.

How Much Does Health Insurance For Retirees Cost

When it comes to health insurance as a retiree, your costs depend on what insurance options you choose and your age.

Original Medicare: There are two parts to Original Medicare:

- Part A: You wont pay a premium for Medicare Part A as long as you or your spouse paid Medicare taxes for a certain amount of time. If you arent eligible for premium-free Part A, you can purchase Part A coverage. It costs $259 to $471 per month as of 2021.

- Part B: All beneficiaries have to pay a premium for Part B coverage. The standard Part B monthly premium is $148.50 per month, but it can increase based on your income.

Medicare Advantage Plans: If you opt for a Medicare Advantage Plan, you may have to pay a monthly premium in addition to your Part B premium. The average monthly premium for a Medicare Advantage Plan is $25.

Health Insurance Marketplace Plans: If you purchase insurance through healthcare.gov, your monthly premium cost is dependent on what tier you choose, the provider network, your selected deductible, and whether you are eligible for a subsidy. The average marketplace benchmark premium is $452 per month.

COBRA: With COBRA, you can continue your employer-offered insurance policy, but youre responsible for paying the entire premium yourself. The average premium for single coverage is $466 per month, or $5,588 per year.

Short-term coverage: Short-term coverage tends to be inexpensive, costing just $116 per month, on average.

Combining Life Insurance And Long

If you dont use it, you lose it. This is often the biggest complaint about traditional long-term care insurance. Paying into a policy you may never use doesnt sit well with some potential policy buyers.

A popular option addresses this concern by combining life and long-term care insurance. These products, known as hybrid or combination policies, pay long-term care costs when you are alive but become life insurance money for your heirs after you pass away.

The long-term care benefit amount is usually expressed as a percentage of the life insurance benefit. Hybrids usually cost more than traditional standalone products but often include additional benefits, such as protection against future premium increases.

Some hybrid polices also ensure that original death benefits are paid to your loved ones even if long-term care proceeds are fully tapped.

Hybrid and combination policies are now more popular than traditional long-term care insurance plans. In 2018, the number of combination policies sold totaled 404,000 significantly higher than the 15,000 combination policies sold in 2007, according to Limra, an industry research and consulting firm.

The COVID-19 pandemic led to steep declines in combination policies, but the market seemed to be stabilizing by late 2022, according to the firm.

Don’t Miss: How To Enroll In Cigna Health Insurance

How Much Does Retirement Health Care Cost

Retirement Health care in retirement How much does retirement health care cost? Planning for long-term care Retirement health care costs Understanding Medicare Parts A to D

It doesn’t have to be that way! Health care is a line item in your annual retirement budget, just like food, clothing, and shelter. And like those other expenses, you can plan for it.

Our research has revealed 6 factors that can nudge your personal annual health care spending higher or lower.

Providing Retiree Health Insurance Encourages Early Retirement

Employees under the age of 65 have substantially higher turnover rates at firms that offer subsidized retiree health coverage than at firms that do not.

The strong link between health insurance and employment in the United States may cause workers to delay retirement until they become eligible for Medicare at age 65. However, some employers extend health insurance benefits to their retirees, and individuals who are eligible for such benefits need not wait until age 65 to retire with group health coverage.

In Does Retiree Health Insurance Encourage Early Retirement , authors Steven Nyce, Sylvester Schieber, John Shoven, Sita Slavov, and David Wise use employee-level data from 64 diverse firms that are clients of TowersWatson, a leading benefits consulting firm, to investigate the impact of retiree health insurance on early retirement. After controlling for individual characteristics and pension incentives, they find that employees under the age of 65 have substantially higher turnover rates at firms that offer subsidized retiree health coverage than at firms that do not. Subsidized retiree health coverage has its strongest effects at ages 62 and 63, resulting in a 21 percent increase in the probability of turnover at age 62 and a 32 percent increase in the probability of turnover at age 63.

Claire Brunel

You May Like: Does Your Employer Have To Offer Health Insurance

Don’t Forget About Health Care Costs

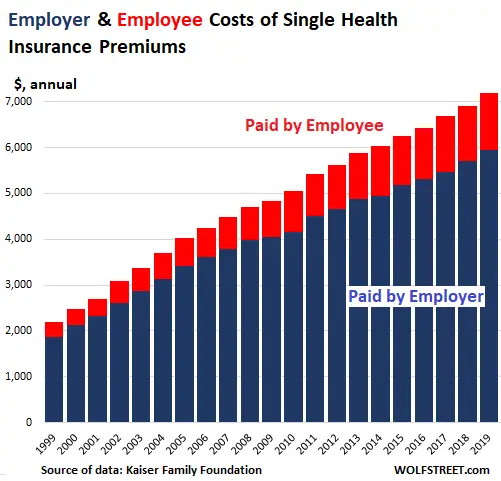

Many retirees and people getting ready to transition out of the workforce forget to budget for healthcare when they estimate their expenses in retirement. Why? Their employer is often picking up the majority of the tab and the remaining cost comes out of their paycheck. They think they need the same amount of take-home pay that they currently have, but they forget that they will now be responsible for paying their health care premiums in addition to the out-of-pocket costs.

If your modified adjusted gross income as reported on your IRS tax return from two years ago is above a certain amount, you’ll pay the standard premium amount and an Income Related Monthly Adjustment Amount . IRMAA is an extra charge added to your premium.

Medicare Covers A Lot Of Costs But Its Not Free

As you prepare to call it a career and say goodbye to your employer-provided health insurance coverage, youll want to know how much health insurance costs when you retire. And that involves understanding what Medicare is and how it works.

Medicare is how the overwhelming majority of retired Americans get their health insurance. But many Coloradans are unpleasantly surprised to learn that Medicare isnt free. Just as you have to pay premiums, copays, deductibles, and other expenses with your private health insurance coverage, youll need to pay similar health insurance costs when you retire. Additionally, while Medicare covers a significant amount of medical expenses, it does not cover everything. This means that you could be on the hook for enormous medical costs if you get seriously ill or require extensive care.

That is why so many retired Americans also get Supplemental Medicare Insurance, or Medigap policies, in addition to Medicare. These private plans also involve paying out-of-pocket expenses, but those pale in comparison to the amounts you would need to pay without such coverage. Additionally, many seniors also enroll in Medicare Advantage plans to expand the scope of coverage, requiring paying monthly premiums.

You Might Like:

Here are what those health insurance costs would be in 2022 if you enroll in Original Medicare:

You May Like: How To Apply For State Health Insurance

Fehb And Medicare Parts C & D

Federal employees should definitely enroll in Medicare Parts A & B according to Brian.

However, when it comes to Medicare Advantage, Brian recommends declining that coverage and sticking with your FEHB instead. Typically the FEHB has more benefits and greater coverage than Medicare part C. Finally, most FEHB plans also cover prescription drugs, so you should not need to enroll in Medicare Part D.

However, you may want to double check that your FEHB plan does cover the prescription drugs you need before declining Medicare Part D. If you decide you want Medicare Part D, you can add Medicare Part D during a future open enrollment period but may face a penalty in the form of an increased premium. Furthermore, you can only add Part D during the open season.

So, in summary, most federal employees should:

- Keep FEHB coverage

- Enroll in Medicare Parts A & B when they are eligible

If you want to go deep into the weeds on this topic, OPM published a 20 page book that walks you through the decision making process. Be warned that it is extremely dry reading.

You May Like: If I Retire At 62 How Much Would I Get

How Long Does The Average Person Live After They Retire

According to a report by the aircraft manufacturer Boeing, workers who retire at age 55 often live to be 83 years old. However, those who retire at 65 only live an additional 18 months on average. Newspapers, journals, and commentators have all cited the âBoeing research.â It has been going around on the internet for years.

You May Like: How To See If You Have Health Insurance

Spousal Benefits Can Enable Insurance For An Early Retirement

An option that you may have if you are married is to use your spouses health insurance plan, Purkat explains.

I see in many cases, one spouse may be retiring early, but the other is still working full-time, Says Purkat. This is a great situation because if you can cover the years before you turn 62 with your spouses insurance, it can save you a lot of money.

How Much Money Should I Budget For Health Insurance In My Retirement

Summary:

If youâre about to retire, making sure you have adequate health insurance for retirees may be one of your top priorities. According to the National Library of Medicine, health care costs increase exponentially after age 50.

Hereâs some information about Medicare costs that you might find useful as you plan a budget for your retirement.

You May Like: How Do I Find My Health Insurance

How Will Age Affect Your Health

As we get older, our vision and hearing declines. Our bones often become more brittle, leading to mobility issues. Disease frequency tends to increase too.10 Medicine and health care havent figured out how to prevent us from aging, Reddy says.

Tip: Got lots of travel outside the United States planned for retirement? Medicare doesnt provide coverage outside the U.S., so plan for other care in case you have an unexpected illness or accident.

Create a health care retirement budget that addresses declining health due to aging. For example, teeth simply wear out over time: Over half of retired Americans wear dentures.11 While you can take good care of your dental health as you age, you may also plan for expenses related to the possibility of dentures, too.

And there are tangential considerations related to retirement health care costs. Mobility and driving issues often make it difficult for older people to get behind the wheel. How will you get to and from appointments? Medicare generally doesnt cover long-term care facility stays, says Reddy, so how you budget for it matters. The type of care and the state youre in, and what they provide, matters. The expensive things are all the things you need but dont think about.

Your health care costs in retirement: Consider your daily routine in your health care cost planning. If family doesnt live nearby, can you access mass transportation for doctor visits, or will you need to pay for rides, for example?

How To Plan For Health Care Costs In Retirement

Gordon Scott has been an active investor and technical analyst of securities, futures, forex, and penny stocks for 20+ years. He is a member of the Investopedia Financial Review Board and the co-author of Investing to Win. Gordon is a Chartered Market Technician . He is also a member of CMT Association.

David J. Rubin is a fact checker for The Balance with more than 30 years in editing and publishing. The majority of his experience lies within the legal and financial spaces. At legal publisher Matthew Bender & Co./LexisNexis, he was a manager of R& D, programmer analyst, and senior copy editor.

How do you account for health care costs in your retirement planning? If you’re like most people, you’re underestimating these expenses.

Although Medicare Part A, which covers some level of hospitalization, is free , the bulk of Medicare coverage is not free. You’ll pay premiums for Medicare Part B, and for supplemental insurance or prescription plans. In addition, you’ll have out-of-pocket costs.

When you factor all of this in, it is estimated Medicare will cover only about 50-60% of your healthcare needs. And, over time, premiums and out-of-pocket costs will go up.

Recommended Reading: How Much Does Short Term Health Insurance Cost

Taking Advantage Of Obamacare

Retirees younger than 65 who no longer have employer-sponsored health insurance can also use the federal governments health insurance marketplace to buy a plan at a subsidized rate. And, because losing health coverage qualifies individuals for a special enrollment period, retirees can enroll in a health plan even if it is outside the annual open enrollment period. They may also qualify for a private plan with premium tax credits, as well as extra savings known as cost-sharing reductions.

The amount of the premium tax credit depends on the estimated adjusted gross income a retiree has earned. This is where some creative planning techniques can be used to lower taxable income, says Dan Johnson, an assistant professor at the College for Financial Planning and a part-time instructor at UCLA, Boston University and Kaplan. Johnson advises clients to lower their adjusted gross income through tax-advantaged planning, such as taking income out of a brokerage account rather than an IRA, to benefit from the lower tax rate.

Rather than using money from an IRA, one takes money out of a brokerage account, which is taxed at capital gains rates, Johnson explains. A common strategy is to liquidate stocks that have a higher cost basis, and that way there is not a lot of capital gains tax.

If you have a client who is 63 right now, and in a couple of years they will qualify for Medicare, you can do some tax planning to potentially lower their adjusted gross income, Johnson says.

Getting Additional Health Insurance For Retirees

Unlike some other types of health insurance plans, Original Medicare has no out of pocket maximum. Medicare Part A generally doesnât pay for your inpatient hospital days after your lifetime reserve days are used up or skilled nursing facility care costs beyond your 100th day. For both inpatient hospital care and skilled nursing facility care, you may have a coinsurance payment that can add up to thousands of dollars. Having a serious illness is concerning enough without worrying that your health insurance for retirees wonât cover your care.

Some people get peace of mind about their health care costs by getting a Medicare Supplement Insurance plan. Medicare Supplement Insurance plans pay certain out-of-pocket costs including coinsurance, copayments and deductibles. Some Medicare Supplement Insurance plans even have out-of-pocket maximums.

There are up to 10 Medicare Supplement insurance plans labeled with letters A, B, C*, D, F,* G, K, L, M and N. Different plans may cover Medicare out-of-pocket costs to different extents, but they all cover 100% of the Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up. If you face an extensive hospitalization, this coverage may save you thousands of dollars in out-of-pocket costs.

*Plans C and F are being phased out, and are no longer available to people who qualified for Medicare after 2019.

Don’t Miss: Can You Switch Health Insurance Plans Mid Year

Healthcare Is One Of The Biggest Expenses You’ll Face In Retirement So It Pays To Pick The Right Insurance

When you’re preparing for retirement, healthcare expenses are probably one of the last things on your mind. But retirees can end up spending tens of thousands of dollars on healthcare alone during their golden years, making it one of the most crucial costs to prepare for.

The average retiree spends around $4,300 per year on out-of-pocket healthcare costs, according to a study from the Center for Retirement Research at Boston College, and that doesn’t include long-term care. Medicare will help cover some costs, but coverage is far from free, and you’ll still face some out-of-pocket expenses.

Image source: Getty Images

Health insurance in retirement is widely misunderstood, which can be an expensive problem. Seventy-two percent of adults over the age of 50 admit they don’t fully understand how Medicare works, a survey from the Nationwide Retirement Institute found, and more than half believe that coverage is free. In order to avoid any pricey surprises, it’s important to understand which costs you’re responsible for, what your insurance will cover, and how much coverage will cost.

Sign Up For Kiplingers Free E

Profit and prosper with the best of Kiplingers expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of Kiplingers expert advice – straight to your e-mail.

Those contemplating early retirement should consider those costs before taking the leap. If youre planning to keep your insurance under COBRA after you leave your job, the costs wont be much different, says Sunit Patel, senior vice-president of Fidelity Benefits Consulting. The $17,000 estimate helps people gain insight on the costs of retiring before Medicare kicks in. Fidelity also estimates that a couple could save $10,000 for each year they delay retirement until age 67.

Here are some strategies you can employ to ease the pain of health care costs in retirement.

Create a budget. Once of the most important moves for pre-retirees is to make sure that their financial plan explicitly accounts for health costs in retirement, Patel says. When preparing a budget, include a line item for health care. Some costs are relatively fixed, such as Medicare premiums. Remember inflation, which tends to rise faster for health care than the general inflation rate.

Also be prepared for unexpected spikes in costs, such as a $10,000 dental bill. Medicare does not cover dental or vision care. Nor does it cover long-term care. Be sure to set aside a large emergency reserve that you will not include when you calculate your monthly retirement expenses.

Also Check: What Causes Health Insurance Premiums To Increase