Determining How Many Full

The regulations allow various calculation methods for determining full-time equivalent status. Because these calculations can be complex, employers should consult with their legal counsel.

- Full-timeemployees work an average of 30 hours per week or 130 hours per calendar month, including vacation and paid leaves of absence.

- Part-timeemployees’ hours are used to determine the number of full-time equivalent employees for purposes of determining whether the employer mandate applies.

- FTEemployees are determined by taking the number of hours worked in a month by part-time employees, or those working fewer than 30 hours per week, and dividing by 120.

If My Employer Voluntarily Provides Health Insurance Benefits Is It Obligated To Provide Benefits To All Employees

Maybe, depending on the employer. Employers covered by Obamacare must provide health insurance to at least 95% of their full-time employees and dependents up to age 26. Otherwise, an employer is free to cover some, as opposed to all, of its employees. For example, salespersons can be excluded from an insurance plan while administrators are covered.

Exception: If an employee is entitled to participate in an employer-provided health benefits plan under ERISA, an employer may not wrongfully deny participation. To qualify, an individual must be classified as an employee, not a temporary worker or independent contractor and must be eligible to receive benefits according to the terms of the plan.

Mandated Health Insurance Laws For Employers

You may have heard of the ACAs employer mandate, the play or pay requirement, or the employer shared responsibility provisions. All of these terms refer to the same legal requirement that dictates whether an organization is obligated to offer affordable minimum essential coverage to at least 95% of its full-time equivalent employees.

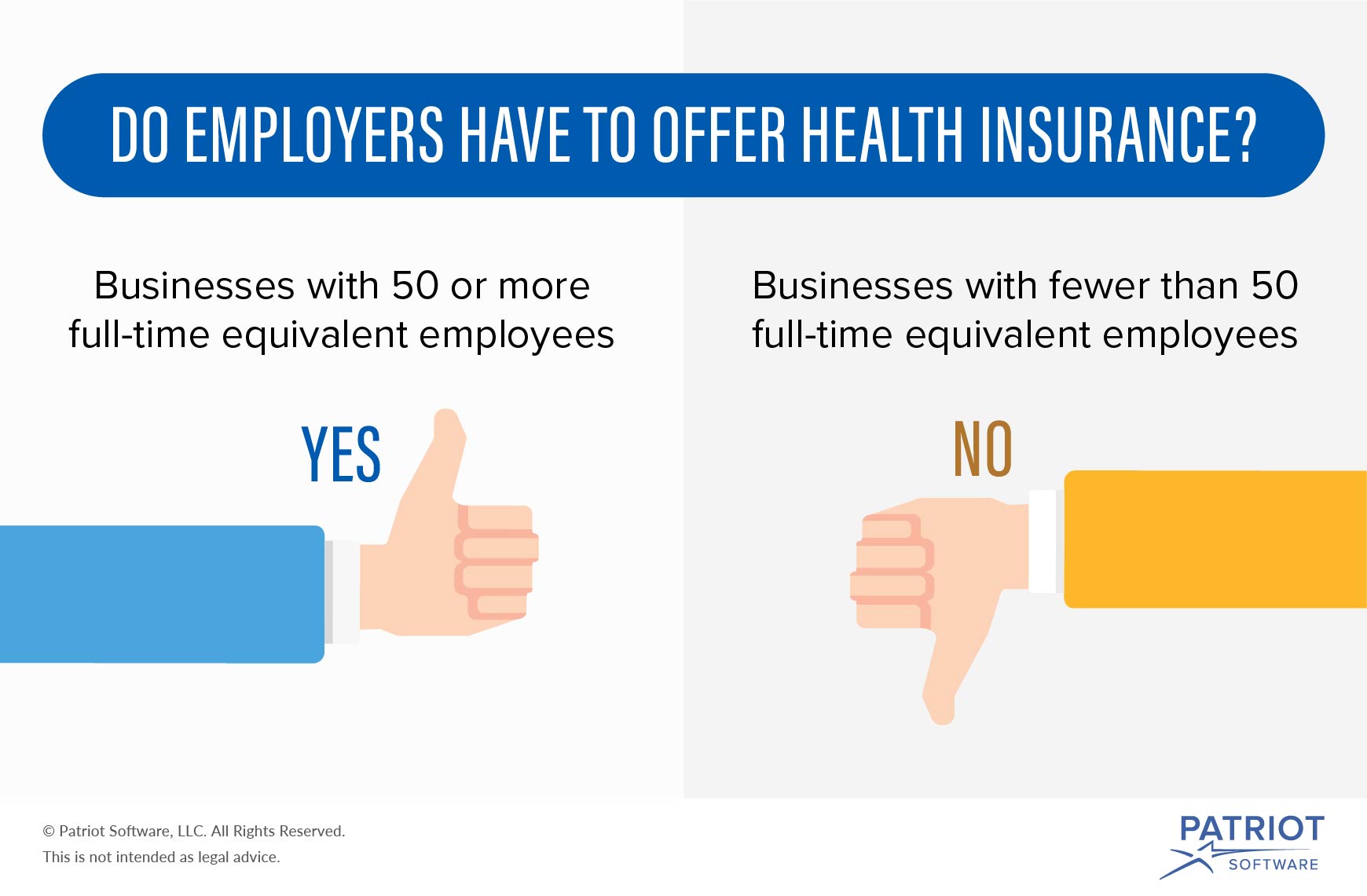

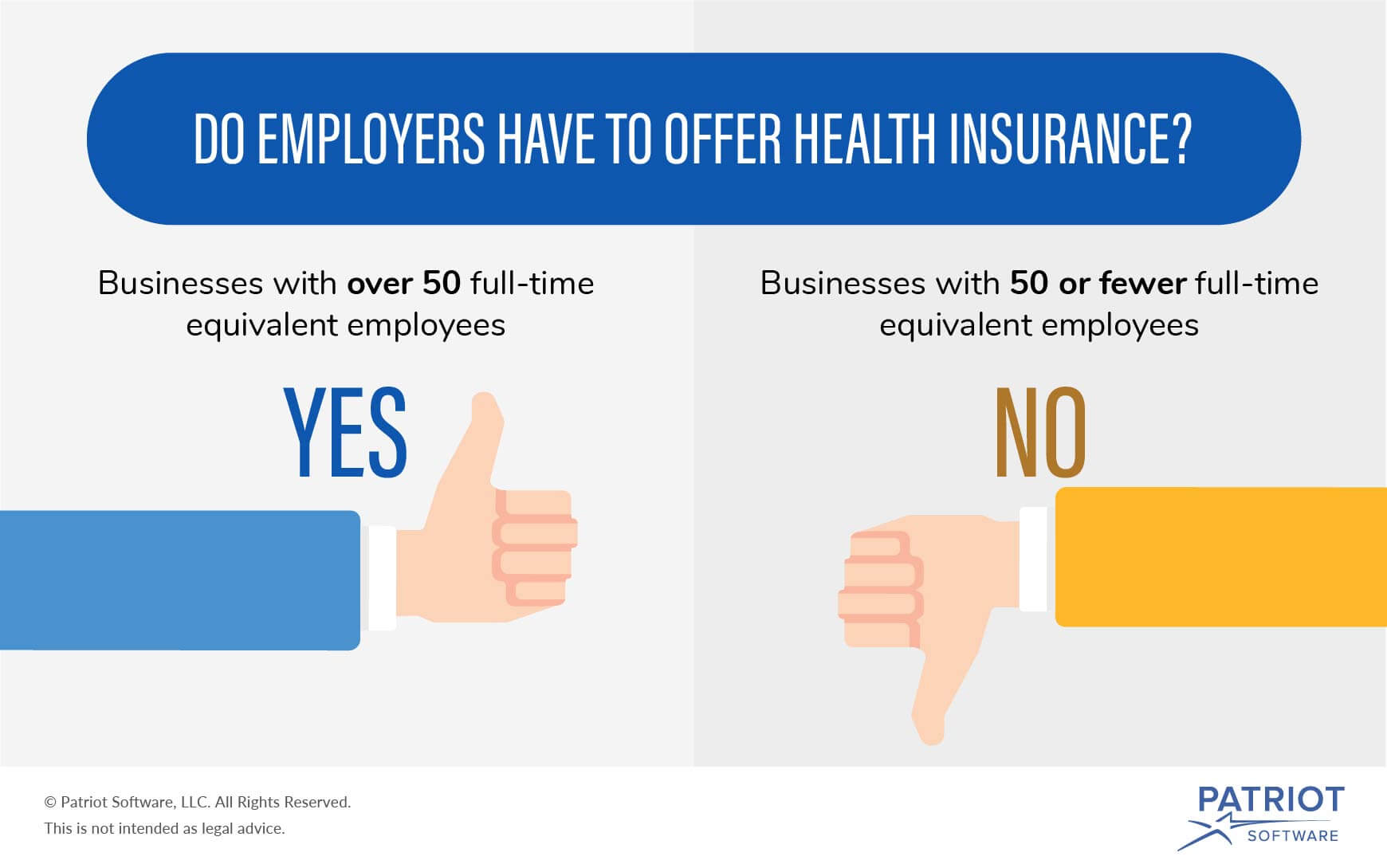

According to the ACA, only applicable large employers or employers with at least 50 full-time employeesare subject to the employer mandate. So if you have less than 50 employees, youre not legally required to offer health benefits to your employees.

However, offering health benefits is important for organizations of all sizes. Find out how much not offering health benefits can cost you.

Recommended Reading: Does Health Insurance Cover Giving Birth

How To Compensate Employees Who Opt

Due to the employer mandate under the Affordable Care Act , large employers with more than 50 full-time employees or full-time equivalent employees are required to offer medical coverage. However, its not necessarily a requirement for employees to purchase what the employer offers. In fact, employers are even allowed to provide incentives to employees with the goal of enticing them to purchase their health insurance plan elsewhere and forgo the group health coverage policy entirely. This type of special compensation is referred to as an opt-out arrangement or cash in lieu of benefits waiver.

With opt-out arrangements, the goal is to reduce insurance costs for the employer while simultaneously offering more options to the employee. When done correctly, its a win/win for both parties. This page provides an overview of how opt-out arrangements work along with important things for employers to keep in mind.

- Group Health Plan Opt-Out Arrangements

- Determining ACA Affordability

- Action Steps

Additional Details On The Employer Mandate

Employers with 50 or more full-time and/or FTE employees must offer affordable/minimum value medical coverage to their full-time employees and their dependents up to the end of the month in which they turn age 26, or they may be subject to penalties. The amount of the penalty depends on whether or not the employer offers coverage to at least 95% of its full-time employees and their dependents.

Employers must treat all employees who average 30 hours a week as full-time employees.

Dependents include children up to age 26, excluding stepchildren and foster children. At least one medical plan option must offer coverage for children through the end of the month in which they reach age 26. Spouses are not considered dependents in the legislation, so employers are not required to offer coverage to spouses.

Assume each employer has 1,000 full-time employees who work at least 30 hours per week.

The regulations allow various calculation methods for determining full-time equivalent status. Because these calculations can be complex, employers should consult with their legal counsel.

Here are some considerations to help determine how part-time and seasonal employees equate to full-time and FTE employees.

U.S.-issued expatriate plans meet the employer mandate.

Effective July 16, 2014, the employer mandate no longer applies to insured plans issued in the U.S. territories . A territory may enact a comparable provision under its own law.

You May Like: When Does A Company Have To Offer Health Insurance

Employer Shared Responsibility Payment

Certain businesses with 50 or more full-time and full-time equivalent employees that don’t offer insurance that meets certain minimum standards may be subject to the payment. Learn more about the Employer Shared Responsibility Payment from the IRS.

IMPORTANT: No small employer, generally those with fewer than 50 full-time and full-time equivalent employees, is subject to the Employer Shared Responsibility Payment, regardless of whether they offer health insurance to their employees.

What You Should Know

- The Employer Is the Policyholder

The employer is the master policyholder and the employees are certificate holders in an employer group health plan. The master policyholder:

- Negotiates the terms of the group policy with the health insurer.

- May reduce or change the plans benefits.

- May increase the employees premium contribution.

- Is permitted to switch health insurers.

- May allow the employees to choose from more than one plan.

- Can stop providing coverage entirely.

Coverage and rates may change annually. The employee contribution – what you pay – is determined by your employer.

Employees should be aware of the employers group health coverage enrollment policies and deadlines. Employers can require up to a 90-day waiting period before new employees are eligible to enroll in coverage.

Employers have an annual open enrollment period for employees to apply, change, or disenroll in coverage. Any benefit changes or premium adjustments in the group plan are communicated to employees during the annual open enrollment period.

Special enrollment periods are allowed when certain life events occur . Check with the employer’s human resources department for more information about SEPs.

Employer group health plans typically offer:

Don’t Miss: Can I Change My Health Insurance Outside Of Open Enrollment

Should Our Small Business Offer Benefits To Our Employees

What your company provides its employees in exchange for their hard work and dedication amounts to so much more than a set amount of money for a set amount of time. The benefits your firm offers contribute to the exceptional culture of your company. Benefits objectively attract and retain staff and are often almost as important to your team as their salary expectations. In fact, a 2018 survey revealed that 78% of employees reported being more likely to stay with an employer because of their benefits. For this reason alone, your company should consider offering benefits as your budget allows as part of your human resources strategies.

The benefits you offer can go beyond health coverage of any type. They can include things such as savings toward retirement, like 401K matches paid leave, such as sick leave or parental leave and vacation and holiday time. You can also incorporate perks such as flexible remote-working options. If your company is a budding start-up, giving stock options and/or company equity to your employees could be an attractive benefit, as well.

If You Dont Have A Qualifying Event Youll Need To Buy An Aca Health Plan During Open Enrollment

If your employer doesnt offer coverage and you dont have a recent or imminent qualifying life event, youll likely need to wait until open enrollment to sign up for your own health coverage. It runs from November 1 to January 15 in most states. If youve been uninsured or relying on a plan thats not ACA-compliant, open enrollment is your opportunity to upgrade your coverage and it might be much more affordable than you thought it would be.

However, Native Americans can enroll in coverage year-round through the marketplace/exchange. Medicaid/CHIP enrollment is also available year-round for people who are eligible. There is also a special enrollment opportunity in 2022 for people who are eligible for premium subsidies and whose household income doesnt exceed 150% of the poverty level.

Most of the American Rescue Plans subsidy enhancements are still in effect for 2022, so plans selected during a special enrollment period in 2022 continue to be more affordable than the coverage that was available in previous years.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health marketplace updates are regularly cited by media who cover health reform and by other health insurance experts.

Don’t Miss: How Much Is Health Insurance For One Person

What Is Business Health Insurance

Business health insurance is much like an individual health insurance policy. It pays for a large portion of the cost of various private medical treatments and care, but its taken out by employers to cover employees. When an employee is diagnosed with an illness, they can pay a small excess while the insurer pays for the cost of treatment.

Your business will have one policy to cover everyone and you can choose who you offer it to, as long as this decision isnt made on discriminatory grounds. By spreading the risk across a group, the cost of premiums is generally lower than that of individual polices.

Recommended Reading: Health Insurance Starbucks

Do Employers Have To Offer Health Insurance

Eden Health Team

Lets face it: Employer-provided health insurance is the gold standard of workplace benefits. However, its not always clear whether an employer provides healthcare and employees might ask: Do employers have to offer health insurance?

From a legal standpoint, there is no federal law that says companies must offer health insurance to their employees. However, employers health insurance requirements do apply for some businesses depending on their size. The Affordable Care Act , passed under President Barack Obama, stipulates that certain companies must provide health insurance or pay a fine.

Also Check: Is Dental Insurance Health Insurance

Employer Health Insurance Costs Explained

As a general rule of thumb, the cost of a policy might cost in the region of £10 to £100 per employee, per month.

The cost of employer health insurance will vary depending on a number of factors, such as the type of policy you choose and the number of employees you have. It is important to get quotes from a few different providers so that you can compare costs.

Healthcare You Can Afford

Group Insurance Explained

Generally, there are three types of health plans your employer may offer: HMO , EPO , POS , and PPO .Depending on the level of cost-sharing, most employers pay anywhere between 50-70% of your health plan.

Many group insurance plans can cover immediate family members, or dependents, such as a spouse and children. Additionally, the premium rates for all employees are determined by the insurer, and part of the employeesâ premiums are paid for by the employer.

The Cost of Group Insurance

The average costs of a health plan are $500 per individual and $1,000 per family. This means you can expect to pay $150 $300 a month out of your salary. In some cases, your employers can opt to pay for 100% of your health plan, but if there is a deductible , you still have to pay a certain amount out-of-pocket.

While it may be convenient to accept the health insurance plan your employer is offering, its important to evaluate if its actually worth accepting based on your healthcare needs.

Dr. Tulenko explains how to determine if the plan is right for you:

You should start by comparing the health insurance plan that your employer is offering with ones that you can purchase in your state health insurance market or the national health insurance market. Some factors to consider include:

Recommended Reading: Is There Still A Penalty For Not Having Health Insurance

Find Cheap Health Insurance Quotes In Your Area

If your business has over 50 employees, you are legally required to provide health insurance to employees due to the Affordable Care Act . If you have fewer than 50 employees, youâll need to make the decision whether to offer your employees health care benefits. We examined every major decision point to help you make the right decision for your business.

Group Health Plan Opt

Group health plan opt-out arrangements are allowed under the law, but if employers want to offer them, they should offer them to all employees. Selectively offering opt-out arrangements can put an employer at risk of discrimination in a variety of ways, such as violating the Health Insurance Portability and Accountability Act nondiscrimination rules.

Read Also: Is Health Insurance Required In Maryland

What Is Employer Health Insurance

Employer health insurance refers to a group health insurance plan chosen and maintained by a company for its employees.

Although optional for smaller companies, the Affordable Care Act mandates that larger companies must offer health insurance to employees or they may face penalties. This applies to employers with a minimum of 50 full-time equivalent employees. Employers are responsible for paying at least 50% of their employees annual premiums.

There are incentives for small companies, too. When there are fewer than 25 full-time equivalent employees, companies could receive a tax credit when they offer employee health insurance.

Key Takeaways

- Larger companies must offer health insurance to employees or face penalties.

- Smaller companies also often provide health coverage for employees and are eligible for tax credits when they offer job-based insurance

- If youre eligible, you can enroll in health coverage when youre first hired and can make changes to health insurance during the open enrollment period.

- Businesses also allow you to make changes to your job-based plan if you have qualifying life events that lead to a special enrollment period.

- If you decline an employer-sponsored plan, you may not be eligible for tax credits if you buy a health insurance marketplace plan.

Types Of Health Insurance Plans

There are several different types of health insurance plans available today. Some are more common than others, with Kaiser Family Foundation reporting the prevalence of each in todays group life insurance plans.

| Plan Name | |

|---|---|

| You want the option of both a PPO or HMO | 8% |

Your employer may choose from any of these, although its most likely that PPOs will be at least one choice. A 2020 Insure survey of 1,000 people found that 48% of respondents said their company only offers one health insurance plan. Forty-six percent said their job provides two or three options and only 7% provide different types.

Also Check: Does Burger King Offer Health Insurance

Health Insurance Requirements For Small Businesses

As a small business owner, it can be challenging to keep up with changing rules and regulations, especially those related to health insurance.

What are the essential insurance requirements you need to know for this year? And what are the advantages of offering small business health insurance? Keep reading to learn what your employer obligations are for group health insurance requirements in 2021.

How To Ask An Employer For Health Insurance

Many employers offer details and paperwork regarding health insurance when you first start a job.

However, Carey recommends broaching the subject even earlier.

During the interview process, ask if the employer offers health insurance and find the details of what the benefits and cost are, he encourages. If an employee works at a company that does not offer it, speak to HR indicating how important those benefits are.

OnPay, a payroll and HR software, conducted an extensive 2020 study regarding employee benefits preferences. Elliott Brown, OnPays Director of Marketing, explains, According to the employees we surveyed, health insurance is the most important benefit by a long shot . However, only about half of small businesses offer health insurance. Given this disparity, its not hard to see why employees with health benefits are more engaged and less likely to look for a new job.

A 2020 Insure survey also found that health coverage plays a major influence in employee recruitment and retention. Seventy percent rated a companys health insurance as important when deciding on a job or staying with a company.

Necole Gibbs, licensed broker and insurance professional for TNG Insurance Agency, says employees of small companies may not have success in getting their employer to add health insurance.

If your employer doesnt offer health insurance, some effective ways to initiate that conversation and discuss other alternatives include:

You May Like: How Much Does Health Insurance Cost An Employer

Know Your Hra Options

QSEHRA: a Qualified Small Employer HRA allows small employers to set aside a fixed amount of money each month that employees can use to purchase individual health insurance or use on medical expenses, tax-free. This means employers get to offer benefits in a tax-efficient manner without the hassle or headache of administering a traditional group plan and employees can choose the plan they want. The key thing to remember here is that all employees must be reimbursed at the same level. The QSEHRA is designed for employers with less than 50 employees to reimburse for premiums and medical expenses if the plan allows.

ICHRA: an Individual Coverage HRA allows employers of any size to reimburse any amount per month for healthcare expenses incurred by employees on a tax-free basis, starting at any time of the year. The distinguishing element of this HRA is that employees can be divided into an unlimited number of classes, like hourly vs. salary or even based on location, and be reimbursed at different levels. The ICHRA is for companies of any size. There are no limits to how much an employer can offer for reimbursement.