Why Chooseinsuranceonlinecomcom

You can easily find the latest and accurate insurance information from ChooseinSuranceOnlinecom.com.

Most of the time, you need it to save your time and avoid being deceived!

How? When you are looking for what causes insurance premiums to increase.There are too many fake insurances that have not been verified on the Internet. How long does it take to find a truly reliable official insurance?

But with us, you just type what causes insurance premiums to increase and we have listed all the verified insurance pages with one click button to Access the Page.

Not just for this one, but we have created database of 1,00,000+ insurances and adding 50 more every day!

How Premiums Are Set

Under the health care law, insurance companies can account for only 5 things when setting premiums.

-

Age: Premiums can be up to 3 times higher for older people than for younger ones.

-

Location: Where you live has a big effect on your premiums. Differences in competition, state and local rules, and cost of living account for this.

-

Tobacco use: Insurers can charge tobacco users up to 50% more than those who dont use tobacco.

-

Individual vs. family enrollment: Insurers can charge more for a plan that also covers a spouse and/or dependents.

-

Plan category:There are five plan categories Bronze, Silver, Gold, Platinum, and Catastrophic. The categories are based on how you and the plan share costs. Bronze plans usually have lower monthly premiums and higher out-of-pocket costs when you get care. Platinum plans usually have the highest premiums and lowest out-of-pocket costs.

States can limit how much these factors affect premiums.

All Marketplace health plans cover the same essential health benefits. Insurance companies may offer more benefits, which could also affect costs.

Medical Providers Are Rewarded For Doing More

Most insurers — including Medicare — pay doctors, hospitals, and other medical providers under a fee-for-service system that reimburses for each test, procedure, or visit. This can incentivize the medical industry to order more services than are strictly needed. On top of this, our medical system is not integrated, which leads to repetitive tests and over-treatment.

Don’t Miss: Are Abortions Covered By Health Insurance

Other Things To Consider When Choosing A Health Insurance Plan

Premium costs matter, but they arent the only thing to keep in mind when choosing your insurance plan. Its also important to make sure your plan meets your coverage and health care needs. Otherwise, you can end up with high out-of-pocket costs.

Other things to think about as you evaluate your health insurance coverage options include:

What Causes Your Insurance Premium To Go Up

If you have any type of insurance whether its for your home, car or health chances are youve received a renewal bill in the mail and asked yourself, Why did my insurance premium go up? While some premium increases can be attributed to across-the-board rate hikes, which happen when an insurer and state department of insurance agree on a new rate plan for that year, others have more to do with you specifically caused by factors such as your driving record, medical history and credit score.

Don’t Miss: What’s The Penalty For Not Having Health Insurance In California

Heres What Should Happen

Someinsurers are already providing discounts for families in financial hardship, such as people receiving JobSeeker or JobKeeper. Others offer discounts or waive price rises to people who pre-pay their policies for up to 12 months. More insurers should do this.

Providing financial relief and delaying the October premium increase will not only help customers but also help private insurers in the long run.

Increasing premiums twice in six months during an unprecedentedly difficult time can backfire, especially if the reasons to support the increase do not stack up.

When premiums increase, young people are more likely to drop private health insurance. This will drive up premiums further for everyone. This in turn will lead to more young and healthy people dropping their cover.

Consequently, it may cause a death spiral, driving private health insurance out of business.

What Causes Health Insurance Premiums To Increase

The three most common reasons for premium raises include:

- A growing senior population

- Young individuals who cancel their private health insurance

- The ever-growing costs of life insurance

When insurers have a more significant percentage of seniors, people aged 60 and over, premiums generally rise because the people with private coverage tend to require more frequent and expensive medical assistance and thus claim more. These annual price hikes are necessary so companies can continue to cover the costs of benefits, including the salary increases of medical practitioners and the latest expensive innovative technologies.

Don’t Miss: How To Enroll In Health Insurance

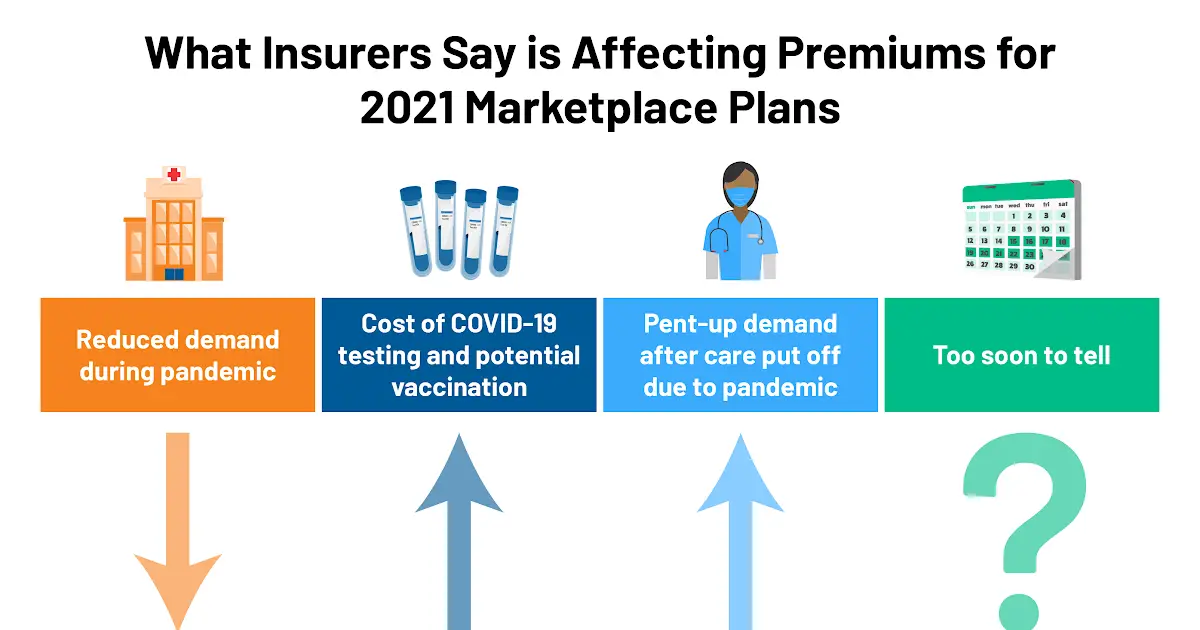

How Does The American Rescue Plan Affect Premiums For 2021

For many people who buy their own health insurance, the American Rescue Plan will make coverage more affordable in 2021 than it would otherwise have been. Most people who are receiving unemployment compensation in 2021 are eligible for $0 premium benchmark plans with robust cost-sharing reductions. And for 2021 and 2022, the subsidy cliff has been eliminated and the percentage of income that people have to pay for the benchmark plan has been reduced.

This comparison chart shows some examples of how the new rules result in increased premium subsidies for many enrollees, and lower after-subsidy premiums. The specifics will vary from one enrollee to another, since premiums depend on age and location. But in general, premiums for many enrollees are more affordable now that the American Rescue Plan has been enacted. The ARPs additional subsidies are retroactive to January 2021 for people who have been enrolled in marketplace plans all year. They can be claimed on 2021 tax returns, or enrollees can log back into their marketplace accounts in the coming months and follow the instructions for a subsidy redetermination so that the additional subsidies can be applied to their accounts in realtime.

Ny Health Insurance Premiums Increase 2021 Individual Health Plan

According to the NY Department of Financial Services, as of June 5th, 13 insurance carriers had filed a proposed rate change for 2021. The department has the discretion to accept, modify, or deny the adjustment based on the justification for a rate change.

| Individual health plan |

|---|

SOURCE: Department of Finance Services

Read Also: Is Eye Surgery Covered By Health Insurance

Rise Of Chronic Illness And Obesity

Did you know 6 in 10 adults in the U.S. population have a chronic condition, such as asthma, heart disease or diabetes? 4 in 6 have two or more chronic conditions. Chronic illnesses combined with an aging population drives up costs. Additionally, 42% of adults are obese, which leads to additional health conditions with estimated costs of $147-billion annually.

Reason #2 Insurance Companies Are Bailing Out

Leading the way in the Things That Arent Surprising category is that many insurance companies are discontinuing plans that lose money.

Additionally, some companies such as United Healthcare and Aetna are completely exiting some markets, leaving very little competition.

In some states, there is a single insurance provider, allowing them to raise their rates without consequence.

In 2017, its expected that the number of healthcare providers will drop by 3.9 percent in each state. As we all learning in introductory economics, less competition equals higher prices.

Also Check: How Much Does Health Insurance Cost In Ct

Free Life Insurance Comparison

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

Now could be the time to begin experimenting with those homeopathic cures weve been hearing about all these years, like rubbing cucumbers on our feet or bathing in olive oil.

Purchasing hundreds of gallons of olive oil is probably cheaper than premiums will be.

Having A Claims History

As far as insurers are concerned, a history of claims increases the odds that youll make another one. Home insurers, for example, share information about claims from the last seven years through the Comprehensive Loss Underwriting Exchange , which can boost your premiums even if you werent the homeowner who made the claims. Car insurance claims are also registered by CLUE, and your rates may increase if youve made a lot of claims even if you werent at fault because you pose a higher risk, statistically speaking.

You May Like: How Much Is Health Insurance Usually

Why Does Group Health Premium Go Up Every Year

Home » Why Does Group Health Premium Go Up Every Year?

In 2020, small and large businesses can expect the average increase in group health insurance premiums to be between 5% and 7%. And for some, the increase will even be higher climbing by as much as 20% and 30%.

Has your business consistently seen premium increases in your group health?

Why is this the case? Why do your group health insurance premiums always go up? Do you wonder if businesses ever see decreases?

Having worked in the group health insurance industry for the past 20 years, I know this is not a new problem. Year after year, employers like you come to me despairing over their latest group health renewal.

Are you desperately wanting to know if there is something you can do to manage your group health insurance costs?

To help you gain an understanding of why your group health insurance costs almost always see annual increases, lets look at some specifics regarding rate increases in group health insurance.

In this article, we will examine:

- Differences in rate increases between small group health plans and large group health plans

- Differences in increased costs between fully-funded group health plans and self-funded group health plans

- Increases due to rising health care costs

- The impact of ongoing health care innovations on premium costs

What Should You Do When Your Insurance Premiums Go Up

When your insurance premiums increase, it can be surprising, confusing, and discouraging. We understand those frustrations, and we think your insurance company should be able to explain to you what factors are influencing your insurance costs.

Some companies want to give you the very cheapest insurance quote, without considering what coverage you actually need.

Thrive Insurance is going to do everything we can to make sure that when lifes unexpected events happen, you have the coverage you need to protect you.

Our outstanding customer service is what sets us apart from our competitors, and part of that customer service is helping all of our clients/customers to understand their existing policies and any changes that need to be made.

If you are already a client of ours, thank you! Please contact us if you have any questions about your premiums or coverage. And if you are shopping for new insurance, perhaps because youre under- or over-insured, check us out. Let our team show you what real customer service can look like in the world of personal insurance.

Also Check: Does Short Term Health Insurance Cover Pre Existing Conditions

Effects Of Rising Health Insurance Premiums

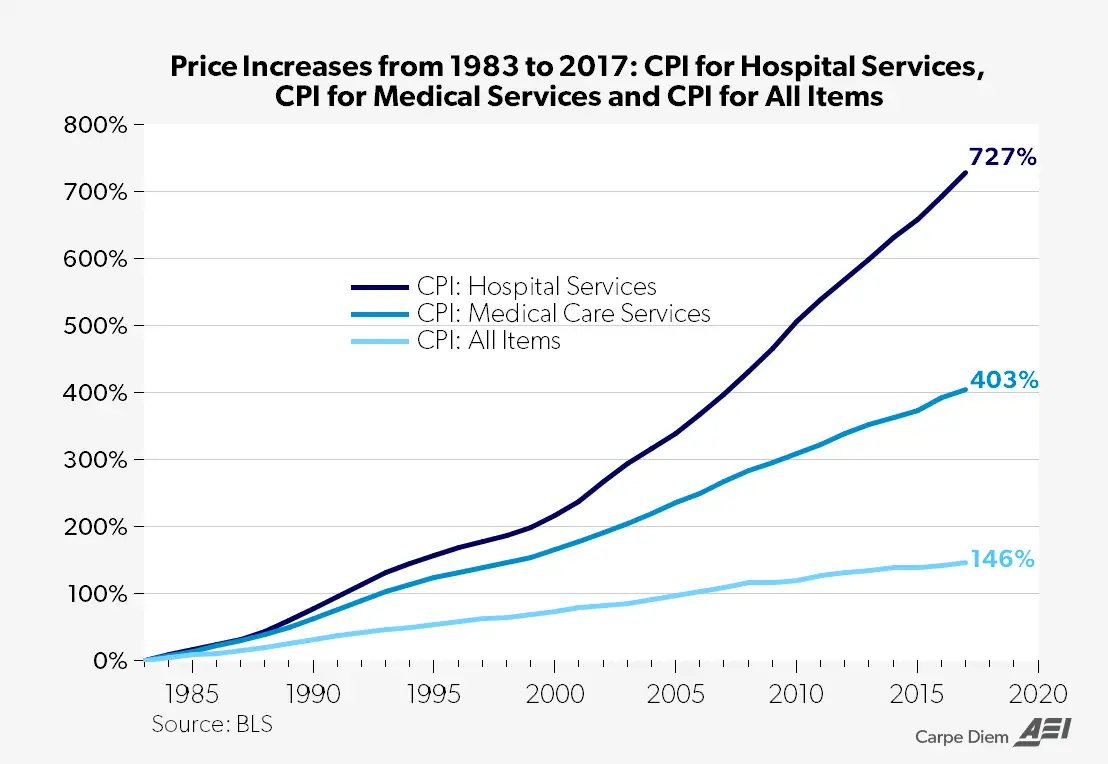

Every 10 percent increase in health insurance costs reduces the chances of being employed by 1.6 percent. It also reduces hours worked by 1 percent.Two-thirds of a premium increase is paid for with wages and the remaining third from a reduction in benefits.

In an indication of why the cause of health care reform is attracting a broader constituency, two new NBER studies offer evidence that soaring health insurance premiums do more than swell the ranks of the uninsured. They boost unemployment, push more workers into part-time jobs, and force employees to sacrifice wages and other benefits just to retain some measure of coverage.

In The Labor Market Effects of Rising Health Insurance Premiums , NBER associates Katherine Baicker and Amitabh Chandra note that premiums for employer-provided health insurance have risen 59 percent since 2000, far outstripping wage gains. For example, between 2003 and 2004 alone, premiums went up by 11.2 percent while wages increased only 2.3 percent.

Baicker and Chandra also note that married, healthy women are more likely to lose their employer-provided insurance when premiums go up, but for different reasons. Because they either can get coverage through their husband’s plan or because they don’t use health services frequently, the women may decide the higher premiums aren’t worth it.

— Matthew Davis

Factors That Affect Your Health Insurance Premiums

When you purchase an individual or family health insurance policy through the HealthCare.gov marketplace, directly from an insurance company, or through your employer, the premium is the amount you pay each month for the policy.

Even if you never go to the doctor or use any health care services, you have to pay your premium to keep your coverage. In the past, insurance companies could use a lot of information about you including your weight or body mass index, your family history, and your profession to determine what to charge you.

Now, thanks to the ACA, insurers can use only five factors when deciding how much your premiums will be.

You May Like: Can I Buy Dental Insurance Without Health Insurance

Headlines About Rate Increases

If you have an individual/family major medical health insurance plan, purchased on-exchange or off-exchange, that became effective January 2014 or later, its compliant with the ACA. The annual rate changes for these plans have been making headlines for the last several years, but the actual rate changes that apply to each enrollees premiums differ significantly because there are so many factors involved.

Here are some things to keep in mind:

Can You Avoid Health Premium Increases

No matter what, you need to carefully compare your options when you enroll. If youre eligible for a premium subsidy, you need to shop in the exchange in your state.

And if you currently have a plan you purchased outside the exchange, be sure to double-check your on-exchange options for next year before deciding whether to renew your off-exchange plan. People with off-exchange plans should carefully consider the on-exchange options during the COVID-related enrollment window in 2021, as they may find that theyre newly eligible for premium subsidies as a result of the American Rescue Plan.

Even after 2022, when the ARPs subsidy enhancements are slated to end , its important to check on-exchange options each year before deciding to renew an off-exchange plan. As the poverty level numbers increase each year, the limits for subsidy eligibility go up as well. In 2014, a family of four had to have a household income of no more than $94,200 in order to get a subsidy. For 2020, that had grown to $103,000. There is no income limit for subsidy eligibility in 2021 and 2022, thanks to the ARP. But if and when an income limit is reinstated in 2023, it will have increased from the level that applied in 2020.

Don’t Miss: How To Apply For Low Cost Health Insurance

Lack Of Informed Decision Making

Health care consumers dont shop around for the best price.

Most of the time consumers shop around for the best price. If they are shopping for a car, they check out several dealerships and look at multiple cars. When shopping for a new phone, a consumer will look for deals online or call several cell phone carriers to see what options and prices they can lock-in.

This is not the case with health care!

In health care, employees often dont know the differing costs of health care procedures, facilities, doctors, and prescription drugs.

For example, most employees dont know that an advanced scan, such as an MRI, can be thousands of dollars less if performed at a free-standing clinic rather than in the hospital setting. Having the MRI performed at one of these clinics does not lessen the quality of the scan but can save thousands of dollars.

Whos Covered By The Plan

The more people your health insurance plan covers, the higher your premiums are. Dont let a higher monthly premium keep you from getting the coverage your family needs, though.

You also dont necessarily want to have each person purchase their own plan. You and your spouse will probably pay less overall if you purchase a family plan instead of individual plans.

You May Like: What Is The Health Insurance For Low Income

Why Do Health Plan Costs Increase Every Year

If you own a business that offers a group health insurance plan, you may notice that the group rates go up every year. Your employees definitely notice Its not always easy to explain premium increases, so weve provided a guide to help your employees understand why they must pay more for health insurance every year.

Recommended:

Premium Creation

Before you can explain why rates go up, first you need to understand how premiums are set. This is a fairly complex calculation, but there are basic principles thatll explain the process.

In the simplest terms, health insurance companies base their premiums on the amount of money they paid out in claims in a previous year, according to finance website ThisMatter.com. Then, they set premiums for subsequent years based on a series of complex statistical analyses of past claims by their insured members. The object of these analyses is to predict losses, or claims, in subsequent years. Simply put, insurance companies make educated guesses.

Why Premiums Go up Every Year

If health insurance companies base group rates in part on claims from previous years, why is it that those payouts increase every year?

Premium increases are also driven by expensive diseases. An unintended consequence of our success in treating cancer and other chronic diseases is that increasingly large numbers of Americans are surviving, only to incur more medical costs owing to their survival.

What Can You Do To Keep Your Premiums Affordable

- Request quotes and compare policies: Review which health fund meets your requirements with a premium you can afford. Also, be sure to check if they offer discounts.

- Choose a bigger hospital excess: If you have a Hospital policy, you might want to increase your Excess, usually youll have an option between $250, $500 and $750 for a single adult. Generally, the higher your upfront fee for hospital treatments, the lower your premium.

- Only pay for what you need: Review your policy at least annually to make sure youre still using the benefits provided. For example, if you still have a pregnancy benefit but dont plan on having any more children, you might want to downgrade your level of cover.

- Pay premiums annually: If you pay your premiums annually, before the April increase, youll generally pay the previous years rates on your premiums for the current year.

- Switch to a different health insurance provider that offers premiums that suit your budget and requirements.

Also Check: Does Health Insurance Pay For Abortions