Can I Start A Plan At Any Time During The Year

If you decide to begin offering health insurance to your employees, you can implement a plan at any time of year. Since health Insurance plans renew annually, many employers like to align their plans with the calendar or fiscal year, but its not required. In fact, it can be advantageous to have the plan start on an off-peak month to avoid the rush of renewals at peak times of the year and can make the process easier.

No matter when you start a plan, employees may have a waiting period between when they enroll in the plan and when coverage actually starts. For example, workers coverage may begin the first day of the next month.

When You Want To Boost Your Employee Wellness And Productivity

Healthy and comfortable employees are more productive than those with wellness-issues. Therefore, its essential to keep your employees as happy and healthy as possible by providing coverage so that they can get care whenever its necessary. So, if your employees are not performing well on the job because of healthcare-related issues, its time you consider giving them health insurance coverage.

It Saves You Money At Tax Time

Employer health-care premiums are tax exempt, which can greatly reduce or even erase your tax obligations. Your contributions are also tax deductible, meaning you can write off the cost of employer-sponsored contributions during tax season. By offering employee health insurance, you may also qualify for the Small Business Health Care Tax Credit.

Read Also: Kroger Health Insurance Benefits

If Your Workforce Is Growing Fast

If your small business is doing well and expanding its workforce quickly, then its a definite sign that soon you will need to offer your employees health insurance coverage. According to the Affordable Care Act,1 you will be required to provide coverage to your workers when your company grows to 50 or more employees or else you are likely to face a penalty. This employer mandate came into effect in 2016 and requires that employers with this number of employees need to offer health insurance to at least 95 percent of their full-time workforce .

Recommended Reading: Starbucks Health Insurance Eligibility

Summary Of Benefits And Coverage Disclosure Rules

Employers must provide employees with a standard “Summary of Benefits and Coverage” form explaining what their health plan covers and what it costs. The purpose of the SBC is to help employees understand their health insurance options. You could face a penalty for non-compliance. Learn more about SBCs and see a sample completed form.

You May Like: Starbucks Health Insurance Part Time

The Benefits Of Additional Employee Benefits

-

Attract and keep employees Today, most employees expect, and value, benefits. In fact, according to Sanofi CanadaOpens a new website in a new window – Opens in a new window, 86% of plan members agree their health benefits plan is an important factor when deciding on a job offer.

-

Healthier employees Benefits help keep your employees healthier by making health care costs easier to afford, which can lead to fewer sick days.

-

Morale boost Knowing you care about their well-being builds loyalty and appreciation.

-

Tax advantages The cost of many employee benefits can mean a tax deduction for the employer.

-

A foundation for success Offering employee benefits sets the stage for you to succeed and grow by attracting, hiring and keeping good employees. According to Sanofi CanadaOpens a new website in a new window – Opens in a new window, 71% said their health benefits plan is a strong incentive for them to stay with their employer.

Do Small Businesses Have To Offer Health Insurance

Written by: Elizabeth WalkerDecember 17, 2021 at 8:53 AM

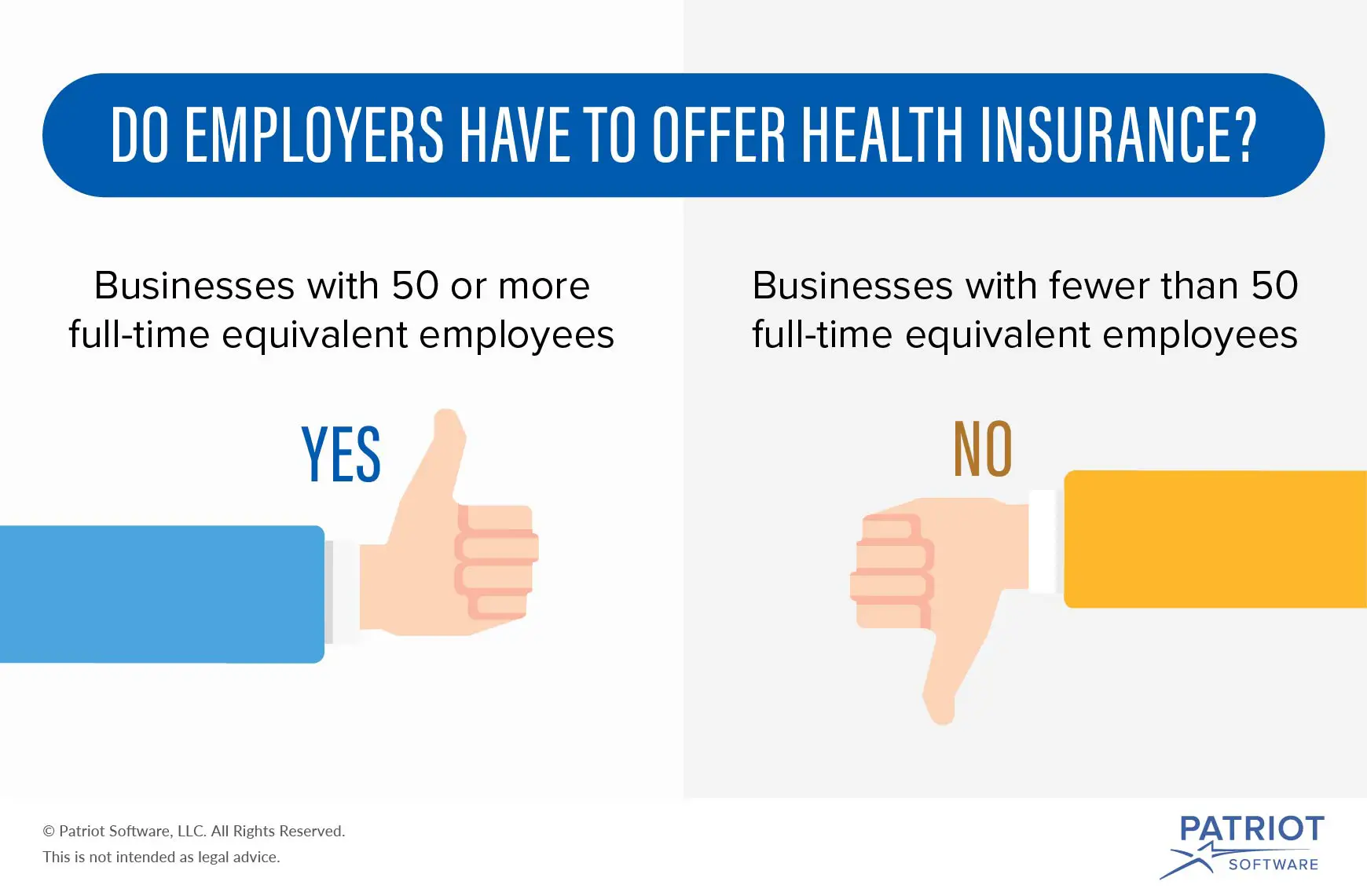

As a small business owner, you may be wondering, “Do I have to provide health insurance to my employees?” Under the Affordable Care Act , applicable large employers with 50 or more full-time equivalent employees are required to offer affordable health benefits that meet minimum essential coverage or be subject to a penalty. But smaller businesses arent under such obligations.

In this article, well discuss employer health insurance requirements like how to determine if youre an ALE, calculating FTEs, and what the ACA requirements are for employers with less than 50 employees.

Don’t Miss: Part Time Starbucks Benefits

What You Should Know

- The Employer Is the Policyholder

The employer is the master policyholder and the employees are certificate holders in an employer group health plan. The master policyholder:

- Negotiates the terms of the group policy with the health insurer.

- May reduce or change the plans benefits.

- May increase the employees premium contribution.

- Is permitted to switch health insurers.

- May allow the employees to choose from more than one plan.

- Can stop providing coverage entirely.

Coverage and rates may change annually. The employee contribution – what you pay – is determined by your employer.

Employees should be aware of the employers group health coverage enrollment policies and deadlines. Employers can require up to a 90-day waiting period before new employees are eligible to enroll in coverage.

Employers have an annual open enrollment period for employees to apply, change, or disenroll in coverage. Any benefit changes or premium adjustments in the group plan are communicated to employees during the annual open enrollment period.

Special enrollment periods are allowed when certain life events occur . Check with the employer’s human resources department for more information about SEPs.

Employer group health plans typically offer:

Employer Mandate Penalty Amounts And Processes

Examples of employer penalties

| Employer |

|---|

|

1,200 full-time employees Employer offers coverage, but coverage is not affordable and/or doesn’t provide minimum value |

The penalty is triggered if one employee purchases coverage on the Marketplace and receives a federal premium subsidy 250 employees purchase coverage on the Marketplace and are eligible for a subsidy |

Lesser of $2,570 per full-time employee, minus the first 30 employees, or $3,860 per full-time employee receiving a federal premium subsidy 1,170 x $2,570 = $3,006,900 penalty 250 x $3,860 = $965,000 penalty |

Here is a snapshot of the penalty assessment process:

|

Employer offers health coverage compliant with the employer mandate

|

|

Employer reports coverage offer and respective data during the applicable tax season |

|

IRS sends Letter 226J, with an Employer Shared Responsibility Payment assessment based on the data they have processed

|

|

IRS sends Notice 220J, confirming the final penalty amounts owed, which could state no amount is owed after final audit review. |

Read more about employers’ options on the IRS web page, Employer Shared Responsibility Payment Q& As, questions 55-58.

- I want to…

Recommended Reading: Insurance Lapse Between Jobs

If An Employer Voluntarily Provides Health Insurance Benefits Are There Any Laws That Cover Those Benefits

The Employee Retirement Income Security Act of 1974 governs employer-provided health benefits if an employer voluntarily provides insurance to employees. Under ERISA, employers must provide a Summary Plan Description to employees who participate in the plan. The SPD is usually a small pamphlet or other document that explains what the plan provides and how it operates. It provides information on when an employee can begin to participate in the plan, how service and benefits are calculated, when benefits become vested , when and in what form benefits are paid, and how to file a claim for benefits. The employer must provide the SPD to the employee free of charge within 90 days after an employee becomes a plan participant or within 120 days after the plan is established. If the plan changes, the employer must inform the employee through a revised SPD or in a separate document called a Summary of Material Modifications that must be provided to the employee free of charge.

Health and welfare benefits provided by employers are exempt from ERISAs minimum participation, vesting, benefit-accrual and minimum funding requirements that apply to employer-provided pension benefits.

Are You Legally Required To Provide Health Insurance For Employees

If you have more than 50 full-time and part-time employees, you are legally required to provide group health insurance to your employees. If you fall into that bucket, you’ll need to make sure you offer coverage to at least 95% of your full-time employees. Full-time employees are those who work more than 30 hours per week.

If you have less than 50 employees, you aren’t obligated to provide such benefits, but we’d highly encourage you to at least consider it. A strong benefits package can go a long way in terms of attracting and retaining talent, and the government also provides various incentives to help make this easier. If interested, we recommend SHOP, which we go into more detail on below.

You May Like: How Long After Quitting Job Health Insurance

When Do Employers Have To Offer Health Insurance

So, when does a company have to offer health insurance, and what happens if they fail to do so?

The ACA is the law responsible for imposing penalties upon large employers that fail to offer health insurance benefits to their employees. Under the ACA, businesses of a certain size are required to offer a company health plan.

Do You Offer Health Insurance To Employees

Do you offer health insurance to your employees? This quick read will help you navigate the ins and outs of offering health insurance and explore when to offer it.

No account yet? Register

Every growing business should consider offering health insurance to its staff members, but determining the right timing for the change can be tricky.

Offering health insurance too early or with the wrong health partner could mean skyrocketing costs that could cripple a young venture. But releasing it too late could seriously kill morale and motivate previously-dedicated employees to jump ship prematurely.

How should a new business owner navigate these murky waters?

Also Check: Evolve Health Products

Find Cheap Health Insurance Quotes In Your Area

If your business has over 50 employees, you are legally required to provide health insurance to employees due to the Affordable Care Act . If you have fewer than 50 employees, you’ll need to make the decision whether to offer your employees health care benefits. We examined every major decision point to help you make the right decision for your business.

Does A Company Have To Offerhealth Insurance In California

It’s a good question and there’s plenty of confusion.

10,000 pages of the new ACA law requirements doesn’t help the matter.

So what are the requirements for California companies when it comes tooffering health insurance to employees?

We’ll look at what is required.

What makes sense.

And what you should absolutely avoid doing .

Of course you can always quote all major carriers side by side here at nocost to you!

Read Also: Starbucks Benefits Part Time

Where Can Employers Get Health Insurance For Employees

Finding out how to access this program and offering a health insurance plan to your workers requires work. However, these online resources can help you on your journey:

Key takeaway: Smaller businesses that offer health insurance via SHOP may be eligible for tax credits of up to 50% of their portion of employee premium costs. To qualify, your company must have less than 25 full-time-equivalent employees who have an average salary of $50,000 or less. Qualifying businesses must also pay at least half of their employees’ premium costs.

If I File A Claim For Health Benefits Under A Plan Provided By My Employer And It Is Denied What Can I Do

If you believe that there has been a violation of the plan , you may bring an ERISA claim against your employer through an internal administrative claims process that is described in the SPD.

Additionally, a person also may appeal to the Secretary of Labor of the Department of labor for certain ERISA claims. The Department of Labor however, only assists claimants informally for non-ERISA based claims.

If you are unsure if your claim is non-ERISA based and whether you should bring a claim through the internal process or through the Department of Labor, you can refer to your SPD, which explains the administrative resources available to participants in the plan.

Recommended Reading: Starbucks Healthcare Benefits

What Is The Role Of The Employer

You might be wondering what the role of an employer is within employee insurance plans. Often, a plan is sponsored by the employer. A group insurance provider is typically hired to provide insurance for the members of the plan and manage the program, including paying any claims that are made. Benefit plan consultants can also be hired to offer support to the plan sponsor regarding the selection process.

It is also possible to select an administrative services-only plan. This approach involves the employer paying claims submitted by employees themselves. It also involves paying a group insurance provider or another organization to settle claims and report to management.

When Are My Employers Required To Provide Health Insurance

Heres what you need to know style=default]

- The Affordable Care Act requires companies with fifty or more employees in 2015 to offer qualified health insurance coverage to their employees in 2016

- Employers that fail to offer insurance when required must pay an employer shared responsibility payment

- Obamacare provides incentives and credits for small businesses that offer health coverage

- The Affordable Care Act encourages all employers to offer qualified health insurance to their employees

The Affordable Care Act contains a provision called the employer mandate. This provision requires employers with fifty or more full-time equivalent employees in the calendar year 2015 to offer qualified health insurance to at least 95 percent of their employees in 2016. Those employers that fail or refuse to do so may have to pay an employer shared responsibility penalty. Comparison shopping is the best way for employers to select health insurance options. It is the best way for employees to select health insurance plans for individual or family needs. Start comparing health insurance rates now by using our FREE tool above!

You May Like: Shoprite Employee Benefits

Small Businesses: Employer Healthcare And The Affordable Care Act

Do employers have to offer health insurance for small businesses? As discussed earlier, small businesses with fewer employees arent obligated to provide health insurance.

Ninety-nine percent of U.S. companies are considered small businesses, which means that a vast majority of employers dont have to offer health coverage.

However, even larger employers with over 50 full-time employees have concluded that even with the penalties levied, its still cheaper to either not to offer full healthcare coverage or to invest in alternative health coverage options, such as a Health Reimbursement Arrangement .

While offering employer-provided health insurance is considered best practice, the fact is the majority of businesses arent required to offer this benefit.

Should You Offer Health Benefits Anyway

Fifty-six percent of employees consider health insurance to be a key factor in determining whether they will stay at their job, according to the Society for Human Resource Management. Aflacs 2016 Workforces Report also showed that 60% of employees would take a job with lower pay but better benefits.

Offering health insurance can help maintain a productive, healthy, and happy workforce. The Centers for Disease Control and Prevention reports the loss of productivity related to personal and family health problems cost US employers a total of $225.8 billion annually. The CDC also notes that the hidden costs of an unhealthy workforce things like absenteeism and reduced work output can ultimately be several times higher than medical costs.

Another hidden cost to employers can come from presenteeism employees who come to work sick or injured. Beyond the fact that just one sick employee spending only a few hours at work can infect up to 60 percent of office or store common areas, according to one global study, presenteeism also results in the average worker losing almost 54 days worth of productivity every year.

Recommended Reading: Substitute Teacher Health Insurance

How Can Employers Qualify For The Small Business Health Insurance Tax Credit

A small business owner can usually qualify for the two-year tax credit if the following ACA requirements are met:

Smaller businesses can generally be eligible for a higher health care tax credit. For instance, a business with fewer than 10 employees and an average salary lower than $26,000 would qualify for the highest tax credit. Overall, the health care tax credit may help make the purchase of group health insurance more affordable for small businesses while ensuring that their coverage meets ACA insurance requirements. If you decide to offer a group health plan to your employees, you can calculate and claim the credit using IRS Form 8941.

Small Businesses And The Employer Mandate

The ACA offers the SHOP marketplace to help small businesses that wish to offer health insurance to their employees. When small businesses decide to offer health insurance coverage, they must offer it to all of their full-time equivalent employees and they can choose to offer it to part-time employees. The minimum participation rate is 70 percent unless states set a higher percentage.

- If fifty or more employees, then must offer health insurance to 96 percent of employees

- If 49 or fewer employees, then the mandate does not apply to these employers

- If 24 or fewer employees, businesses qualify for small business tax credits

- Maximum small business tax credits to businesses with ten or fewer employees.

Don’t Miss: Eligibility For Aarp