How Fault Is Determined

After you report an accident, your insurance company will determine fault by following the Insurance Act and Fault Determination Rules. These rules:

- Use diagrams to cover more than 40 accident situations that can be applied to almost every possible road collision scenario

- Are applied regardless of road or weather conditions, visibility, point of impact on the vehicles, or the actions of pedestrians

Note that in some cases, fault may be shared between multiple parties involved in an accident.

Who Pays For Medical Bills After A Car Accident

First, lets make one thing clear: generally, the person at fault for the car accident will pay the medical bills of anyone injured in the accident.

If you have car insurance, and you caused the accident, then your car insurance company will cover the medical bills of anyone involved in the accident up to the limits of your policy.

All drivers are required to have bodily injury liability coverage in order to legally drive in most states. This coverage specifically covers the medical bills of other people involved in the collision assuming you were at fault.

Some states require additional coverage called personal injury protection . PIP covers your own medical bills regardless of who is at fault.

In other words, all car insurance policies have specific coverage limits for medical expenses. Now, lets look at how this coverage works.

How Much Is An Insurance Premium

An insurance premium will vary depending on the type of coverage you are looking for, as well as the risk.

This is why it is always a good idea to shop for insurance or work with an insurance professional who can shop premiums with several insurance companies for you.

When people shop around for insurance, they may find different premiums charged for the cost of their insurance with different insurance companies and save a lot of money on insurance premiums, just by finding a company that is more interested in “writing the risk.”

You May Like: Where Do You Go If You Have No Health Insurance

Check Out A New Quote

You are about to leave geico.com

GEICO Insurance Agency, Inc. has partnered with to provide insurance products. When you click “Continue” you will be taken to their website, which is not owned or operated by GEICO. GEICO has no control over their privacy practices and assumes no responsibility in connection with your use of their website. Any information that you directly provide is subject to the privacy posted on their website.

How Can Injured Drivers Pay For Needed Health Care

What happens if you have a car accident with no health insurance? You have options other than auto insurance and health insurance. Auto accident insurance proceeds are taxable, so injured drivers may take advantage of a pre-tax medical spending account to pay for health care until the auto insurance payment for health care and medical bills gets sorted out.

If you have no medical or flexible health care spending account, contact a local community health care center to obtain medical attention as soon as possible.

Watch this video on how you can pay for medical expenses after an accident.

If no other financial resources exist, you can get medical attention from an emergency room under the Emergency Medical Treatment and Active Labor Act passed in 1986.

Recommended Reading: Does Short Term Health Insurance Cover Pre Existing Conditions

What It Means To Pay Primary/secondary

- The insurance that pays first pays up to the limits of its coverage.

- The one that pays second only pays if there are costs the primary insurer didn’t cover.

- The secondary payer may not pay all the uncovered costs.

- If your group health plan or retiree health coverage is the secondary payer, you may need to enroll in Medicare Part B before your insurance will pay.

If the insurance company doesn’t pay the

promptly , your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should’ve made.

What Does Medical Payments Cover

Medical payments coverage applies to you and your relatives that live in your home. It may also apply to your passengers. This coverage helps pay for medical bills, including funeral expenses as a result of an accident. Some examples of these medical bills could include:

- Doctor visits

Medical payments can also provide coverage if you’re injured:

- In an accident while in someone else’s vehicle

- While being struck as a pedestrian

Recommended Reading: Is Eye Surgery Covered By Health Insurance

Do I Use Health Insurance Or Pip In A Car Accident

If you require medical care after a car accident, you should use up any PIP and MedPay auto insurance coverage you have before you file a claim to your health insurance.

There are two reasons for this: The first is that PIP and MedPay coverage usually do not have a deductible a dollar amount you must pay before insurance “kicks in” unless you’ve specifically opted for one. But most health insurance plans do have an out-of-pocket deductible. This means if you get medical treatment for a car accident and the cost for treatment doesn’t exceed your PIP/MedPay coverage limits, you might not have to pay anything at all. But if you send the bill to your health insurance company, you’ll likely have to pay a deductible, among other possible fees.

The second reason is that most health insurance plans have a “subrogation clause.” This clause states that if you are legally owed any money relating to reimbursement of health care costs, your health insurance company is entitled to that money to recoup its expenses. And PIP coverage, as well as money from a liability claim, both fall into this category. So using your PIP/MedPay allotment first saves a step.

How Much Is Car Insurance Nsw

The average car insurance cost per month in Australia is $82 thats for a comprehensive policy. But you dont need to pay that much. In fact, at $32, you might be able to buy comprehensive car insurance for the same price as the average third party insurance policy.6 jan. 2021

People ask , how much is insurance for a car normally? The national average cost of car insurance is $1,592 per year, according to NerdWallets 2021 rate analysis. That works out to an average car insurance rate of about $133 per month. But thats just for a good driver with good credit rates vary widely depending on your history.27 jan. 2021

Also, what insurance do I need for my car nsw? Compulsory Third Party

, how much is car insurance for a beginner? First-time drivers pose a higher risk to insurance companies and will pay more for coverage. On average, our sample data shows first-time drivers are paying about $4,529 per year for carinsurance, whereas experienced drivers are only paying $1,427 per year.9 juil. 2021

, how much should car insurance cost Australia? Key points. In 2019 Aussies were paying an average of $1,131 a year for their car insurance. The difference between the most expensive and the cheapest insurance plan across Australia was $1,047 on average. Things like age, gender and where you live factor very heavily in how much you pay.15 avr. 2021

Contents

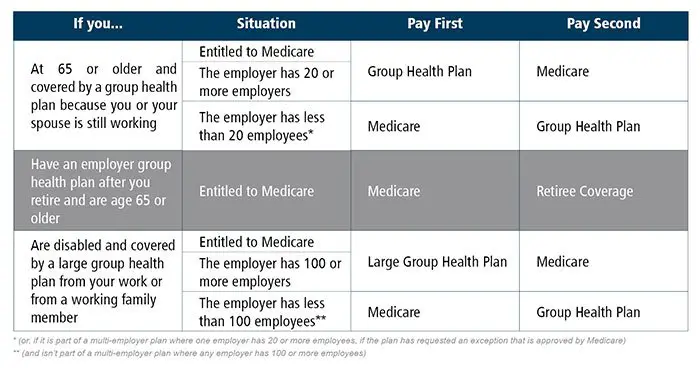

If Your Or Your Spouse’s Employer Has 20 Or More Employees Then The Group Health Plan Pays First And Medicare Pays Second

If the

didn’t pay all of your bill, the doctor or

should send the bill to Medicare for secondary payment. Medicare will pay based on what the group health plan paid, what the group health plan allowed, and what the doctor or health care provider charged on the claim. You’ll have to pay any costs Medicare or the group health plan doesn’t cover.

Employers with 20 or more employees must offer current employees 65 and older the same health benefits, under the same conditions, that they offer employees under 65. If the employer offers coverage to spouses, they must offer the same coverage to spouses 65 and older that they offer to spouses under 65.

What Is The Difference Between Medical Payments And Personal Injury Protection

These coverages may vary by state. Some states offer PIP coverage which is similar to med pay. For more information about your state, you can check out our state information pages.

Please note:

The above is meant as general information and as general policy descriptions to help you understand the different types of coverages. These descriptions do not refer to any specific contract of insurance and they do not modify any definitions, exclusions or any other provision expressly stated in any contracts of insurance. We encourage you to speak to your insurance representative and to read your policy contract to fully understand your coverages.

Michigan Drivers Will Have A Choice Of:

- The unlimited medical benefits that have been offered previously.

- A new managed care option for medical benefits. Managed care does not apply to emergency care, meaning you dont have to get pre-authorization to go to the emergency room after a car accident. This option is intended to save money, but consider the unlimited option if you dont like managed care.

Auto insurance companies in Michigan can apply a deductible to PIP claims, meaning youll have to pay the deductible amount before insurance pays.

When can you sue a driver in Michigan who caused the accident? A driver can be sued if they caused serious impairment of body function, permanent serious disfigurement or death.

How To Pay Your Medical Bills During An Auto Accident Claim

Private Health Insurance

Medicaid or Medicare

But what if your health insurance coverage doesnt cover all of your medical bills? For example, what about co-pays or remaining balances after insurance has paid their portion? Or, what if you dont have health insurance in the first place?

Your Auto Insurance Company

optionalWhat happens if you dont have private health insurance, dont qualify for Medicaid or Medicare, and didnt have Med Pay coverage on your auto insurance policy at the time of the accident? Does that mean you cant receive the medical treatment that you need?

Medical Lien or Payment Plan

lien

Who Pays My Medical Bills After An Accident

Many people dont have health insurance. Does this mean that people without health insurance will have to pay for medical treatment themselves? Not necessarily. Kentucky is a no-fault state. No-fault means that no matter whose fault the accident is, your own personal car insurance will pay for your medical treatment and for your injuries.

PIP benefitsThis is short for Personal Injury Protection. PIP is also referred to as No-Fault Benefits or Basic Reparations Benefits. Its something you pay for under your automobile insurance policy. The first $10,000 of your medical treatment will be paid for by your insurance company. How this works is you fill out a PIP application that is sent by your insurance company. This triggers the payments to your doctor automatically and will continue until the $10,000 of benefits is exhausted.

Once the PIP benefits are exhausted, you will send your medical bills to your health insurance company. Any additional treatment will be paid by your health insurance carrier. Your health insurance company will then forward your bills to the at-fault insurance company for reimbursement.

Some States Have Exceptions

There are a few no-fault states in which you can choose to limit your PIP coverage and rely on your health insurance after a car accident, in order to reduce the cost of car insurance. In New Jersey, drivers have the option of selecting their health insurance to be their primary provider for medical expenses. This means that your health insurance will cover medical bills first, and PIP medical coverage will only kick in if your care costs exceed your health plan limits.

In Michigan, where unlimited PIP coverage contributes to very high auto insurance premiums, you can coordinate your health and car insurance policies to reduce your premiums. If you choose this option, your MI health insurer would take care of your hospital and doctor bills, while PIP would cover lost wages and rehabilitation costs. Note that recipients of Medicaid and Medicare may not coordinate health and automobile insurance.

The Insurer Is Entitled To Reimbursement

If a health insurer, Medicare, or the state agency administering Medicaid benefits pays your medical bills related to your accident, they are entitled to be reimbursed for what they paid your health care providers, if you eventually receive a personal injury settlement or a favorable court verdict against the defendant. Learn more about health care liens in personal injury cases.

Find Cheap Health Insurance Quotes In Your Area

If you have PIP or MedPay as part of your auto insurance coverage, you’ll typically use those first before going to your health insurance company. Drivers without PIP coverage can still use health insurance to pay for injuries after a car accident, but there are some advantages to adding PIP or MedPay to your car insurance policy.

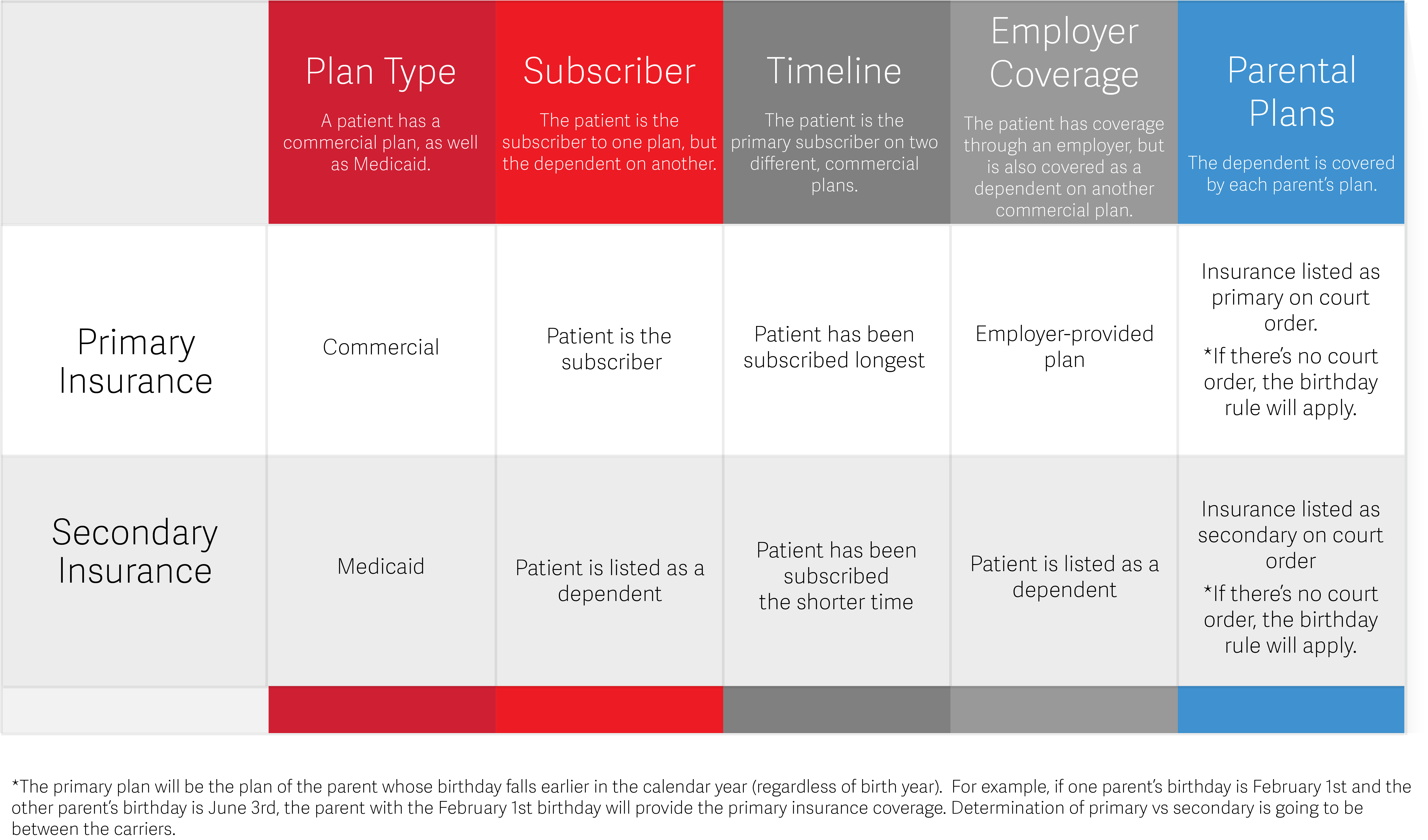

Situations When Coordination Of Benefits Is Needed

There are various situations when two health insurers need to coordinate on medical claims. You and your spouse may be eligible for two different policies from your jobs. Your spouse might be on Medicare and you have your own health plan. You might be under 26 and have your employer’s coverage and a parent’s insurance.

Here is a list of situations and which plan would likely serve as primary insurer and which ones would probably be secondary:

| Situation |

|---|

| Medicaid |

Here’s more information about the above scenarios:

A child has dual coverage by married parents – In this case, the so-called “birthday rule” will apply. The birthday rule means whichever parent has the first birthday in a calendar year is the one whose insurance plan is considered primary.

Remember — it’s not who is oldest. It’s where the birthday falls in the calendar year. If parents have the same birthday, the primary coverage will go to the plan that has covered a parent longer.

A child has divorced parents – The child is usually covered by the parent who has custody. If the childâs custodial parent remarried, the step-parentâs plan may provide secondary coverage for the child. The plan of the parent who doesn’t have custody usually pays last. If it’s joint custody, the birthday rule usually applies.

If the decree states that both parents are responsible, their plans would be given the same priority, thus reverting back to the birthday rule for who would pay first.

If You Have Or Can Get Both Medicare And Veterans’ Benefits You Can Get Treatment Under Either Program

If you have or can get both Medicare and Veterans benefits, you can get treatment under either program. Generally, Medicare and VA cant pay for the same service or items. Medicare pays for Medicare-covered services or items. Veterans Affairs pays for VA-authorized services or items.

When you get health care, you must choose which benefits to use each time you see a doctor or get health care.

| Note |

|---|

|

To get the U.S. Department of Veterans Affairs to pay for services, you must go to a VA facility or have the VA authorize services in a non-VA facility. |

If the VA authorizes services in a non-VA hospital, but didnt authorize all of the services you get during your hospital stay, then Medicare may pay for the Medicare-covered services the VA didnt authorize.

For active-duty military enrolled in Medicare, TRICARE pays for Medicare-covered services or items, and Medicare pays second

For inactive-duty military, Medicare pays first for Medicare-covered services and TRICARE may pay second.

TRICARE pays first for services or items from a military hospital or any other federal provider

Get more information on TRICARE.

Should You Get Pip Or Medpay If You Have Health Insurance

While health insurance, PIP and MedPay all help you pay for medical expenses after a car accident, they each serve a different purpose. You may want to consider adding PIP or MedPay to your car insurance coverages, even if you’re not required by state law to do so.

For one, PIP and MedPay can also help pay for the deductible on your health insurance. If you anticipate having to use your health insurance, like if your PIP or MedPay allowances run low, you can use the last of your MedPay allotment to pay your health insurance deductible. PIP and MedPay will also cover expenses associated with a funeral, which health insurance does not. While it may be unpleasant to consider, funerals are expensive something that can add more financial stress to an already upsetting situation for your family. PIP and MedPay will cover those costs.

Additionally, PIP and MedPay provide coverage for passengers injured in your vehicle. If you find yourself in the car often with nonimmediate family, it may be a benefit to have PIP or MedPay cover their injuries in the event of an accident.

Lastly, there is simply a degree of peace of mind in knowing you have a second source of coverage to pay for a potentially expensive injury. Medical bills can pile up after a car accident, and having an extra $50,000 worth of PIP or MedPay coverage can make a difference. You’ll also have a backup in the event your health insurance company denies your claim.

Medical Payment Insurance Coverage

Many drivers in states that do not have no fault insurance have what is called medical payment insurance coverage. “Med pay” coverage will pay the medical bills of drivers or passengers who are involved in a car accident with the insured person, up to the insured’s “med pay” policy limits, which are generally less than $10,000. After your bills exceed the “med pay” policy limits, you will be responsible for paying them. “Med pay” coverage is not always required, so if neither you nor the person at fault have “med pay” coverage, you are responsible for paying the bills. While drivers in no fault states can purchase “med pay” coverage, there is not much need for it, given the existence of no fault coverage.