How Do I Enroll In Indiana’s Health Insurance Marketplace

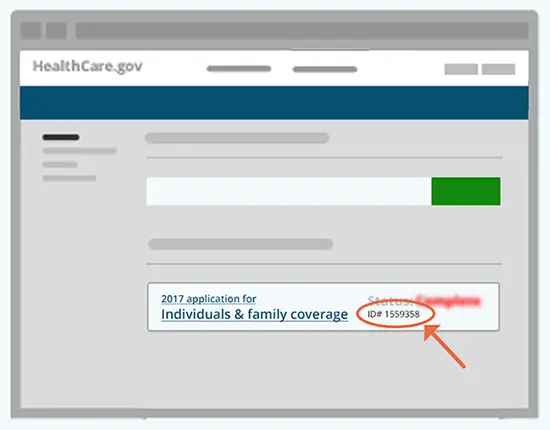

Indiana uses the federal Health Insurance Marketplace. You can create an account at HealthCare.gov to enroll in a health insurance plan. The process is relatively easy provide your contact information, choose several security questions, and select a password.

You should gather all of the information you need to provide ahead of time. This includes the full names, birth dates, and Social Security numbers for everyone you intend to include on your plan. After youve set up your account and provided all the information, HealthCare.gov automatically determines whether youre eligible for the Advanced Premium Tax Credit, Medicaid, or other financial assistance.

The application includes several questions regarding your income and household status, such as:

- How many people did you claim as dependents on your last tax return?

- What is your total household income?

- Would you like to apply for financial aid?

- What is your marital status?

Once youve provided all of the required information, you can compare health insurance plans to determine which one best suits your needs. HealthCare.gov provides a tool that helps you compare up to three plans side by side so you can see what each plan provides, as well as the premium, deductible, and coinsurance requirements. When you decide on a plan, you can complete the enrollment right on the website.

The following companies offer health insurance coverage in Indiana through the Health Insurance Marketplace:

- Anthem

- Celtic

Allows You To Retire In Thailand

As previously stated, people planning to retire in Thailand on a Non-Immigrant O-A or O-X visa must have adequate health insurance coverage. Health insurance policy must have coverage not less than 400,000 Thai Baht per policy year for Inpatient, and not less than 40,000 Thai Baht per policy year for outpatient.

Our plans will assist you in meeting the Thai governments criteria, as we can give an insurance certificate that can be submitted to the Department of Immigration, allowing you to spend your retirement years in the Land of Smiles.

Our plans also include a COE certificate, which meets the legal need of coverage of at least $100,000 USD for the duration of your stay.

Purchasing Health Care Coverage Through The Marketplace And Reporting Changes

Each year the Health Insurance Marketplace has an open enrollment period and special enrollment periods for eligible taxpayers. For information about enrollment periods, visit HealthCare.gov or contact your state-based Marketplace.

If you enrolled in insurance coverage through the Marketplace, you should report any changes in your circumstances like changes to your household income or family size to the Marketplace when they happen. Changes in circumstances may affect your advance payments of the premium tax credit. When you report a change in circumstances, you may become eligible for a special enrollment period, which allows you to purchase health care insurance through the Marketplace outside of the open enrollment period. Visit the Marketplace at HealthCare.gov for more information about reporting changes in circumstances and special enrollment.

To estimate the effect that changes in circumstances may have upon the amount of premium tax credit that you can claim – see the Premium Tax Credit Change Estimator on our Affordable Care Act Estimator Tools page.

Find out more about the Premium Tax Credit and other tax provisions of the Affordable Care Act at IRS.gov

Also Check: Is Eye Surgery Covered By Health Insurance

A Guide To Navigating Birth Control

Copayment and Coinsurance After you hit your deductible, you’ll likely still have some costs when you go to the doctor, in the form of a copayment or coinsurance .

Out-of-pocket maximum All this cost-sharing does have a limit. If you end up using a lot of health insurance in a single year, you might hit your out-of-pocket maximum, which is the most you’ll ever have to pay on covered health services in a given year. It’s the threshold above the deductible if you hit it, you’ll have no copays or coinsurance your insurance will pay 100% of the cost of all covered health services for the rest of that calendar year.

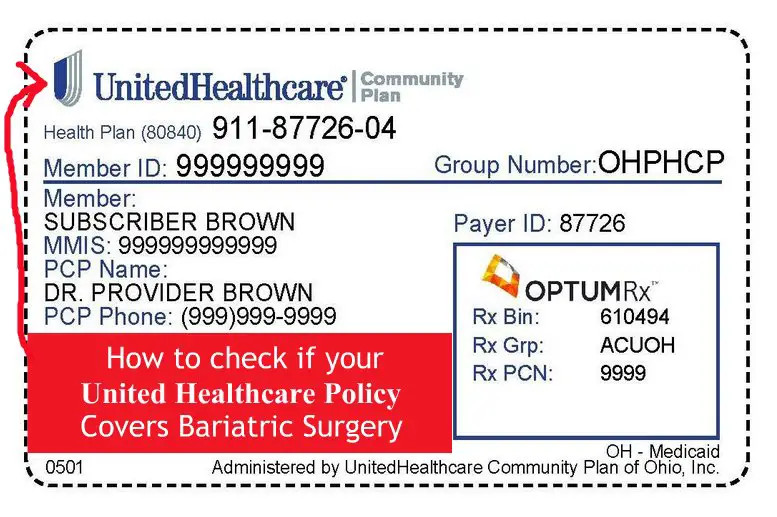

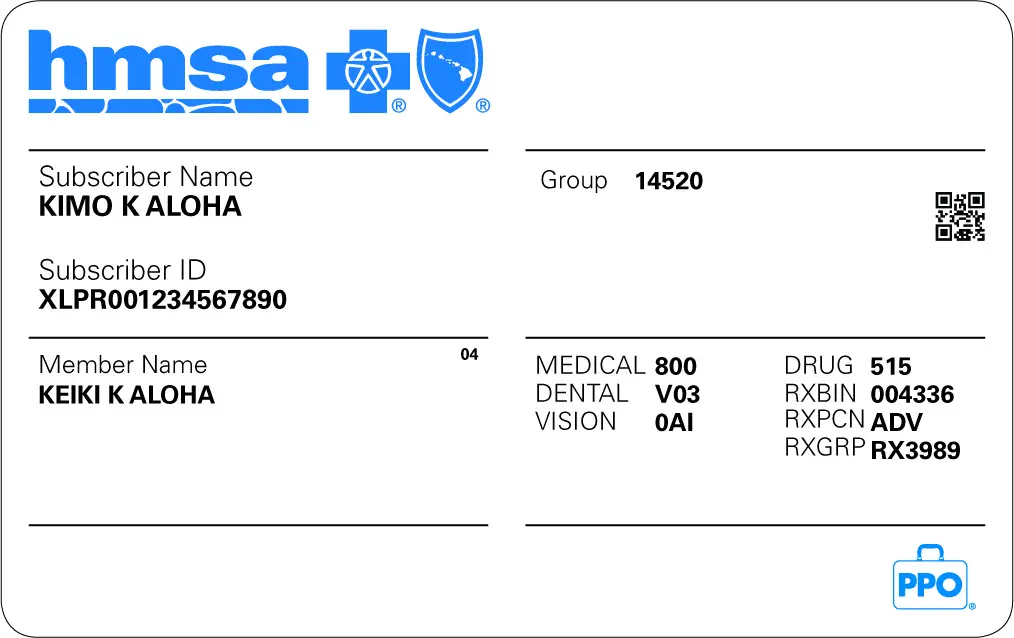

Questions Call Your Insurance Company

If your health insurance card has a symbol or information you do not understand, call the customer service number on the card. Your insurance company can answer any questions you have. Patients may also talk to their St. Jude social worker for help with getting insurance or for directions on how to access insurance.

Read Also: Who Pays First Auto Insurance Or Health Insurance

Keep Track Of Your Coverage

Manage your health the easy way. Through the member portal, you can access the following tips and tools to make things easy on yourself.

- Check coverage information. Have a glance at the benefits offered to you and your family. Or, download full coverage documents.

- Find a doctor. Provider Search easily lets you search by health plan or location. And you’re not limited to searching for a doctor. You can look for dental, vision, alternative, and other providers plus hospitals and care centers near you.

- Find a pharmacy. Use the Pharmacy Locator to find a retail pharmacy close to your home.

- Make a premium payment. Access three easy ways to pay online, by mail or by phone.

- Print and order ID cards. Need a new ID card? Print a replacement card quickly online or order a new card by mail.

- View claims, approvals and download forms. See a record of the services you’ve had. Find out if your approval has gone through, or download forms you need for your plan.

Keeps You Financially Protected

Your health risks rise as you become older and more prone to health issues, and medical expenses can rapidly mount up. That is why having comprehensive health insurance coverage is essential. If you have health insurance, you wont have to worry about the financial consequences of being sick or injured you can rest easy knowing that youll be covered if you have an unforeseen accident or sickness.

Under Hospital Miscellaneous Expenses and Surgeons Fee, Major Medical pays an additional 90% of expenses that exceed the benefit limit.

Recommended Reading: Where Do You Go If You Have No Health Insurance

Q How Do I Change My Name On My Health Card Upon Dissolution Of My Marriage

To change your name on your photo health card to reflect your birth name or a previous married name, you must visit a ServiceOntario centre, complete a Change of Information and present the original of one of the following:

- A divorce certificate which includes your previous name and the requested name

- A marriage certificate which includes your previous name and the requested name

- Birth certificate

- Change of name certificate

If you do not already have a photo health card, you must also provide three original documents to prove citizenship, Ontario residence and identity.

If you have any questions regarding your own specific situation, call the ServiceOntario, INFOline at 1-866-532-3161.

How Long Does Kaiser Take To Approve Insurance

Once youve enrolled and made your first payment it can take about 3 weeks, for your application to be processed. If you applied for major medical health insurance and your enrollment was received in the first fifteen days of the month, your coverage will typically begin on the first day of the following month.1 oct. 2018

Also, how do I know if my Kaiser insurance is active? To view your eligibility and the status of your coverage, you must be signed on to kp.org. Once youre signed on: Select Coverage & Costs from the dashboard.

People ask , how long does it take to get a referral from kaiser? Non-urgent requests: Decisions will be made within two working days after we receive of all needed information. The decision will be communicated to the requesting provider within one working day. If the referral is not approved, a letter will be sent to you within five working days of the decision.

, does kaiser deny coverage? Kaiser Permanente and other health management organizations often deny health insurance claims for the following reasons: A service or procedure is not covered under the claimants policy. A procedure is considered experimental, cosmetic, or is intended for investigation.

, can I buy health insurance and use it immediately? You can get temporary medical insurance coverage as soon as the next day with some short-term plans. Plans can be issued in less than 24 hours and usually kick in the next day.17 juil. 2020

Contents

You May Like: Do You Have Health Insurance

Compare Ppos Epos And Hmos

Why would I choose a PPO?

You have a doctor you like and want to keep your doctor. You want the freedom to see providers out of your network even if you have to pay more. You want to see specialists and other providers without having to get referrals or pre-approvals.

Why would I choose an EPO?

You do not want to use a primary care physician and do not want to get referrals to see specialists. You also don’t mind staying within the policy’s network of physicians.

Why would I choose a HMO?

You want to have a primary care doctor who can help you decide what care you need and how to get it. Often HMOs have fixed co-pays for certain services, so you don’t have to worry about getting a bill for a percentage of the cost of care.

When Can I Purchase Coverage

Usually, you can only purchase a new individual/family policy or make changes to your existing policy during California’s open enrollment period. That period usually begins during November and ends in January. Contact your insurer, licensed agent or the Department of Insurance for exact open enrollment dates.

You can purchase or change coverage outside of open enrollment if you have a Qualifying Life Event including, but not limited to:

- Lost or will soon lose your health insurance

- Permanently moved to California Had a baby or adopted a child

- Got married or entered into a domestic partnership

- Returned from active military service

- Gained citizenship/lawful presence

- Federally recognized American Indian or Alaska Native

For other qualifying life events, ask your insurer, licensed agent, or contact the Department of Insurance’s Consumer Hotline at 927-4357 .

You have sixty days from your qualifying life event to enroll or make changes to your policy. For example, if you adopt a child on June 1st, you will have until July 31st to enroll your child. If you miss this window, you will have to wait until the next open enrollment period.

When does my coverage start?

It is important to pay attention to enrollment deadlines to avoid gaps in your coverage.

Premiums

Can I be denied coverage?

Health insurers cannot refuse to sell you a policy even if you have a pre-existing condition or are currently sick.

Can a policy limit services to people with pre-existing conditions? No

Read Also: Does Short Term Health Insurance Cover Pre Existing Conditions

Take Stock Of What Your Employees Needs Are Find Out What Benefits Your Employees Prefer Remember That As Their Lives Change They May Also Need Different Types Of Coverage

Modern insurance companies provide a wide range of benefits in addition to medical, vision, and dental coverage. They may include maternity care, virtual doctors visits, wellness programs, and more.

If the insurance company charges for out-of-network coverage, you may want to find an alternative insurance provider. Most people want to choose their own doctors without finding one from a narrow, carrier-selected network list.

Understanding Health Insurance Costs

Having insurance doesnt mean your health care will be free. Youll still pay a monthly rate, or premium. Members may also pay copayments or other out-of-pocket fees or have to meet deductibles every year before insurance coverage kicks in.

Different factors can affect your health insurance costs. Its important to understand what these costs are before selecting a plan.

How To Check Form 1095

- Carefully read the instructions on the back.

- Make sure its accurate. If anything about your coverage or household is wrong, contact the Marketplace Call Center. Think the “monthly enrollment premium” may be wrong? Read this before contacting the Call Center.

- Make sure the information about the second lowest cost Silver Plan is correct.

Big Savings Now At More Income Levels Find A Health Plan Now

New Jersey and the federal government are offering even more help to lower the cost of health insurance. You can enroll through the COVID-19 Special Enrollment Period now. If you are an existing customer, review your account to see if you qualify for extra savings.

Big savings â now at more income levels. Find a health plan now.

New Jersey and the federal government are offering even more help to lower the cost of health insurance. You can enroll through the COVID-19 Special Enrollment Period now. If you are an existing customer, review your account to see if you qualify for extra savings.

New Savings Due to COVID-19 Relief

Learn more about additional financial help available now through Get Covered New Jersey as a result of Federal and State COVID-19 Relief.

New Customers

Learn how you can shop for a health plan through Get Covered New Jersey.

More people now qualify for financial help. If you did not qualify for financial help before based on income, you may qualify now with new state and federal savings.

Compare plans and prices

Before you shop for health coverage, find if you qualify for financial help to lower your costs. Find which plans have your doctors, and compare plans and prices. You can browse health plans now.

Existing Marketplace Customers

Where can I get help?

Get free local help applying for health coverage from a certified assister or agent.

When can I buy insurance?

How To Get Health Coverage

You can get health care coverage through:

- A group coverage plan at your job or your spouse or partner’s job

- Your parents’ insurance plan, if you are under age 26

- A plan you purchase on your own directly from a health insurance company or through the Health Insurance Marketplace

- Government programs such as

What If I Have A Peo

A professional employees organization handles human resource functions, such as workplace insurance policies for many small to medium-sized businesses.

Businesses that are less healthy overall can lower their health insurance costs by getting volume discounts from PEOs, which aggregate several groups under one umbrella. The major downside here is that if youre a relatively healthy company, your rates may be higher than needed by being lumped in with less-healthy companies.

Choose Your Health Plan Marketplace

Most people with health insurance get it through an employer. If youre one of those people, you wont need to use the government insurance exchanges or marketplaces. Essentially, your company is your marketplace.

If your employer offers health insurance and you wish to search for an alternative plan in the exchanges, you can. But plans in the marketplace are likely to cost a lot more. This is because most employers pay a portion of workers insurance premiums and because the plans have lower total premiums, on average.

If your job doesnt provide health insurance, shop on your states public marketplace, if available, or the federal marketplace to find the lowest premiums. Start by going to HealthCare.gov and entering your ZIP code during open enrollment. Youll be sent to your states exchange if there is one. Otherwise, youll use the federal marketplace.

You can also purchase health insurance through a private exchange or directly from an insurer. If you choose these options, you wont be eligible for premium tax credits, which are income-based discounts on your monthly premiums.

Failing To File Tax Returns Will Prevent Advance Payments In The Next Year

The IRS reminds taxpayers who received advance payments of the premium tax credit that they should file their tax return timely to ensure they can receive advance payments next year from their Marketplace.

If advance payments of the premium tax credit were paid on behalf of you or an individual in your family, and you do not file a tax return reconciling those payments, you will not be eligible for advance payments of the premium tax credit or cost-sharing reductions to help pay for your Marketplace health insurance coverage in the next year. This means you will be responsible for the full cost of your monthly premiums and all covered services. In addition, we may contact you to pay back some or all of the advance payments of the premium tax credit.

If you have a question about the information shown on your Form 1095-A, or about receiving Form 1095-A, or about a letter you received, contact your Marketplace as shown in the table below or visit HealthCare.gov/taxes.

Does Blue Cross Blue Shield Cover Therapy

The vast majority of Blue Cross Blue Shield insurance plans cover therapy.

If, however, your plan started before 2014 your plan may not cover therapy.

Blue Cross Blue Shield only covers evidence-based therapeutic services, such as psychoanalysis.

It doesnt cover therapeutic services provided by a life coach or career coach.

It also doesnt cover therapeutic services provided outside of a therapeutic setting, such as therapist-led systematic desensitization for phobias. These types of sessions may take place in a variety of locations, such as in a car if you have a phobia of driving, or on a plane if you have a phobia of flying.

Q Do I Need To Notify The Ministry If My Baby And I Are Leaving The Province

You should contact the Ministry of Health and Long-Term Care with any change of address for both you and your baby. If you move to a location outside Ontario, you should inform the ministry of your new address and the date of the move as soon as possible. To inform the ministry of your move, you can either :

- Obtain a for you and your baby. Complete and sign the form and return it by mail. Forms are available from your local ServiceOntario Centre or from .

- Send a letter to your local ServiceOntario centre. You must include your names, health numbers, telephone number, current address, new address including postal code, and the effective date of the move for yourself and child.