Adult & Child Dental Insurance In The Marketplace

Under the health care law, dental insurance is treated differently for adults and children 18 and under.

- Dental coverage is an essential health benefit for children. This means if youre getting health coverage for someone 18 or younger, dental coverage must be available for your child either as part of a health plan or as a stand-alone plan. Note: While dental coverage for children must be available to you, you dont have to buy it.

- Dental coverage isnt an essential health benefit for adults. Insurers dont have to offer adult dental coverage.

See The Benefits And Plans Cigna Offers In Your Area:

Loading…

Disclaimer Individual and family medical and dental insurance plans are insured by Cigna Health and Life Insurance Company , Cigna HealthCare of Arizona, Inc., Cigna HealthCare of Illinois, Inc., and Cigna HealthCare of North Carolina, Inc. Group health insurance and health benefit plans are insured or administered by CHLIC, Connecticut General Life Insurance Company , or their affiliates . Group Universal Life insurance plans are insured by CGLIC. Life , accident, critical illness, hospital indemnity, and disability plans are insured or administered by Life Insurance Company of North America, except in NY, where insured plans are offered by Cigna Life Insurance Company of New York . All insurance policies and group benefit plans contain exclusions and limitations. For availability, costs and complete details of coverage, contact a licensed agent or Cigna sales representative. This website is not intended for residents of New Mexico.

Selecting these links will take you away from Cigna.com to another website, which may be a non-Cigna website. Cigna may not control the content or links of non-Cigna websites. Details

What Are The Rates Of The Policies Offered

The rates for these policies will differ based on your unique situation. For example, smokers and others considered high-risk will have higher premiums than those that are healthy and in-shape. Pre-existing conditions also affect the rates of these policies, as do location, age, gender, and a host of other considerations.

You May Like: How To Get Cheap Health Insurance In Texas

Aetna Vs Cigna: Policyholder Experience

When comparing Aetna and Cigna, we looked at online customer reviews across several different sites to gauge the overall policyholder experience. Ultimately, both companies had a number of negative reviews, with many policyholders complaining about poor claim handling, misleading prices, and discrepancies around covered services.

If youre thinking about buying a Medicare plan from Aetna, also consider that the company was rated below average in the J.D. Power 2020 U.S. Medicare Advantage Study, which ranks insurance companies that offer Medicare Advantage plans based on cost, coverage, customer service, and other factors.

Is Cigna Ppo Good Insurance

Well-established company: Cigna is one of the best-known health insurance companies in the United States. Large network of physicians: Cigna has more than 500,000 physicians and more than 8,000 hospitals in its network. Low-cost coverage: Consumers can choose among a variety of plans, including low-cost offerings.

You May Like: Different Types Of Insurance Licenses

Don’t Miss: Is It Legal To Marry For Health Insurance

Its All About You We Want To Help You Make The Right Legal Decisions

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesnt influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

- »

- CIGNA® HEALTH INSURANCE REVIEW

Cigna is one of the largest providers of healthcare not only in America, but the world over. The company was founded in 1982 in the merger of the Connecticut General Life Insurance Company and the INA Corporation. The INA Corporation, otherwise known as the Insurance Company of North America, was first founded in 1792. The CG was founded in 1865. Both companies have a long and storied history in fact, the INA Corporation was one of only 51 insurance companies to pay claims in full from losses caused by the Great Chicago Fire of 1871.

Ensure You Meet The Credentialing Requirements

To join the Cigna behavioral network, you’ll need to have the following:

If you’re a clinic, you’ll need to meet the following criteria:

Also Check: How Do I Find My Health Insurance

Aetna Vs Cigna: Policy Management

Overall, Aetna and Cigna have good policy management tools in place. Both companies have a robust online customer portal, as well as a free mobile app for Android and iOS devices.

Cigna customers can use the myCigna mobile app to find in-network doctors, view and track claims, manage spending account balances, get cost estimates for procedures, and download ID cards. The Aetna Health app has most of the same features, but you can also make payments, which Cigna doesnt offer.

If you need to get in touch with either company, you can call the main number during business hours or send a message via the online form. Cigna also has a live chat feature if you create an account.

Do You Need A Qualifying Event To Cancel Dental Insurance

Why do I have to have a qualifying life event to cancel my coverage? Section 125 requires a valid qualifying life event in order to make any changes to insurance mid-year. Failure to abide by this means that the employer is subject to IRS enforcement actions. Both employer and employee are subject to tax penalties.

Dont Miss: Trustage Auto And Home Insurance Reviews

Don’t Miss: How Do I Get A Health Insurance Card

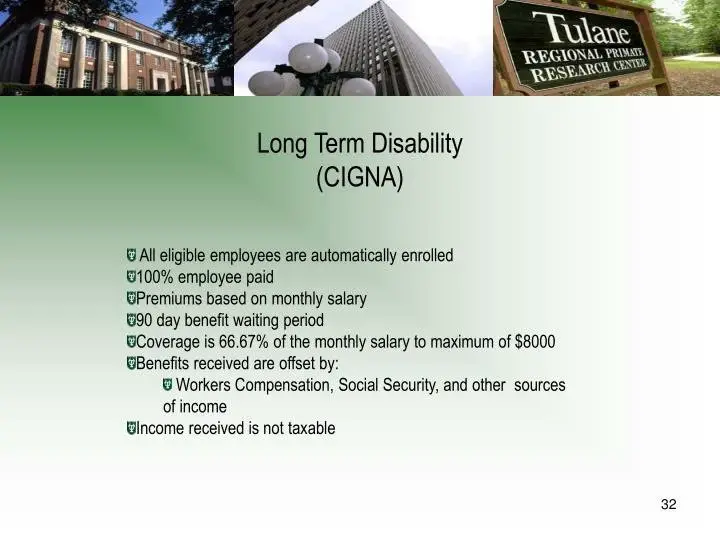

Basic Info About Cigna Life Insurance

The first marine insurance company in the USA was the Insurance Company of North America in the late 1700s. It is the oldest stockholder-owned insurer in the United States.

Back then the company issued marine policies for cargo transported from Philadelphia to Northern Ireland.

In 1865, INA and Connecticut General Life Insurance Company provided insurance for individuals and merchandise in the U.S. and across the globe. By 1926, both institutions started issuing accident insurance policies to airline passengers.

In 1982, INA and Connecticut General Corporation merged to form Cigna Health and Life Insurance Company.

Over 1.5 million users among health care providers, patients, clinics, and facilities

Above 67,000 contracted pharmacies represent more than 99% of all US pharmacies.

Over 175,000 mental and behavioral health care providers, a network that has grown 70% since 2016. 17 million global medical and dental customers and 22 million US customers covered by group disability and life Medicare Advantage plan are implemented in over 15 states including Washington, D.C.

Medicare prescription drug plans are available in all 50 US states

Ranked #13 on the 2020 Fortune 500 List.

Read: How Much Life Insurance Do I Need? | Full Guide

Questions To Ask Before You Choose A Health Plan

- How often do you or your family need medical care?

- Many medical costs are covered by you until you reach your deductible. If you anticipate a lot of medical care, you may want a lower deductible. But, plans with lower deductibles generally have a higher monthly premium.

Read Also: Is Eye Surgery Covered By Health Insurance

Who Shops On The Marketplace

If you and your family don’t have health insurance coverage through your job, you can choose a health plan from the Marketplace and pay for it on your own. If you are self-employed or unemployed, the Marketplace is a place to go for health coverage. If your employer offers health insurance coverage, you can still shop the Marketplace, but you will pay full price for your plan. Everyone who shops the health insurance Marketplace must be a U.S. citizen and live in the United States. If you qualify for Medicare, you are not eligible to shop the Marketplace. People who are incarcerated are also not eligible.

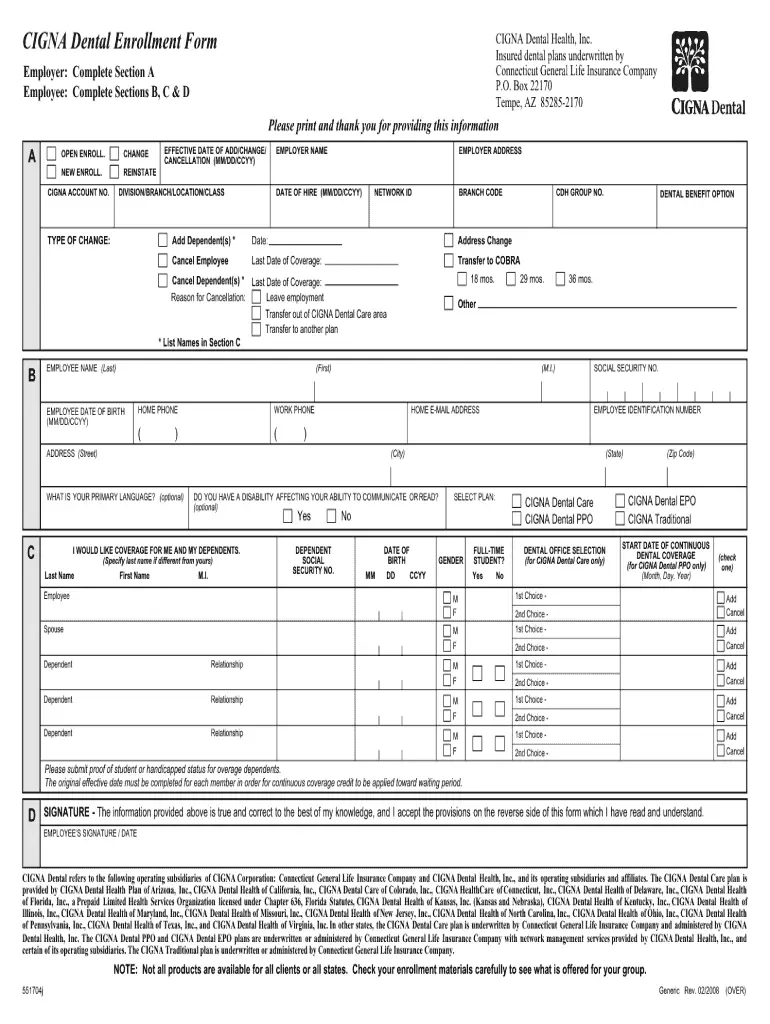

Cigna Dental Coverage Options

One way to obtain Cigna dental coverage is with a Cigna Medicare Advantage plan that offers dental benefits.

Medicare Advantage plans provide all of the same coverage as Original Medicare while also typically covering things not included in Original Medicare. Dental coverage is among the most common extra benefits available in Medicare Advantage plans, along with coverage of vision care and prescription drugs.

Some Cigna Medicare Advantage plans include a dental allowance that may be used toward the cost of dental care at any dentist who accepts Medicare. The allowance is not restricted to dentists within the Cigna network.

Some Cigna Medicare Advantage plans may provide dental benefits through Dentaquest, which is a partner of Cignas.

Some people may choose to get Cigna dental coverage through a standalone dental insurance plan. Cigna dental plans can provide 100% coverage of preventive dental care such as exams, cleanings and routine X-rays. Restorative care such as fillings, root canals, extractions, crowns, bridges and dentures along with orthodontic care like braces may also be covered defending on plan level.

You do not have to be enrolled in a Cigna health insurance plan to enroll in a standalone Cigna dental plan.

You May Like: How To Get Your Parents On Your Health Insurance

Why Choose Cigna For Your Medicare Coverage

Popular Coverage Options

Shop Medicare Advantage, Part D, and Medicare Supplement Insurance optionstheres a wide range to meet all lifestyle needs.

Guidance from Start to Finish

We make it easy to understand how Medicare works, and help you choose a coverage option thats right for you.

No-Cost Programs and Services1

Medicare Advantage Policy Disclaimers

All Cigna products and services are provided exclusively by or through operating subsidiaries of Cigna Corporation. The Cigna name, logos, and other Cigna marks are owned by Cigna Intellectual Property, Inc. All clinical products and services of the LivingWell Health Centers are either provided by or through clinicians contracted with HealthSpring Life & Health Insurance Company, Inc., HealthSpring of Florida, Inc., Bravo Health Mid-Atlantic, Inc., and Bravo Health Pennsylvania, Inc. or employees leased by HS Clinical Services, PC, Bravo Advanced Care Center, PC , Bravo Advanced Care Center, PC and not by Cigna Corporation. The Cigna name, logos, and other Cigna marks are owned by Cigna Intellectual Property, Inc. All pictures are used for illustrative purposes only.

Cigna contracts with Medicare to offer Medicare Advantage HMO and PPO plans and Part D Prescription Drug Plans in select states, and with select State Medicaid programs. Enrollment in Cigna depends on contract renewal.

Medicare Supplement Policy Disclaimers

Medicare Supplement website content not approved for use in: North Dakota and Oregon.

How Do I Know Which Policy Is The Best Fit For Me

Take an evaluation of your current health needs, the medical history of your family, and any other considerations. Find a policy that will provide you with the coverage you need for example, if you require expensive medicine each month, a plan with pharmaceutical coverage is a must.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

You May Like: How Much Do Health Insurance Agents Make

Cigna Silver Plan Coverage

| out-of-pocket maximum | $3,150 individual/$6,300 family3 |

For more plan details, review the Summary of Benefits and Coverage. If you have questions about the new plan before enrolling, call Cignas Silver plan pre-enrollment line at 806-5042.

Does the Cigna Silver plan include the same network of doctors and hospitals as the Equity-League Health Fund plan?

Yes, both plans feature the same Cigna provider network.

About 2021 Cigna Health Insurance

If you live in the Virginia counties* shown in dark orange on the map to the left, you can enroll in a Cigna health plan. .

You must choose providers who participate in the Cigna Connect network. Be sure to designate a primary care provider who accepts Cigna Connect. Starting in 2021, you will no longer be required to have a referral from your PCP to visit a specialist.

Out-of-network care is not covered, except in the event of a true emergency. Always verify that a doctor, pharmacy, hospital or other medical provider is in-network with Cigna Connect before you seek care.

All plans in 2021 offer 24/7 virtual care at no cost . You can also choose a plan that covers acupuncture or one that is good for diabetes.

If you are eligible for a subsidy to help pay for health insurance, you must buy a Cigna plan through the exchange. to find out if you may qualify for a subsidy in 2021.

Read Also: How To Add Dependent To Health Insurance

How To Cancel Cigna Health Insurance

Disenrollment means ending your membership in a Cigna health insurance plan. Canceling health insurance can be voluntary or involuntary .

Some examples:

- You can disenroll from Cigna Medicare from October 15 until December 7. You may be able to disenroll at other times of the year if you meet certain exceptions like moving out of the Cigna service area or eligible for Extra Help with prescription drugs.

- There are also a few instances where you would be required to leave the plan, as well as if you move out of a Cigna service area, or if Cigna leaves the Medicare program.

Whether leaving the Cigna health insurance plan is your choice or not, this section explains your Medicare prescription drug coverage options after you leave and the rules that apply. Till your membership officially ends, you must retain your Medicare prescription drug services through your Cigna health insurance plan, or you will have to pay for them yourself.

Financial Strength And Customer Reviews

Cigna receives below-average reviews when compared to its competitors. Overall, customers say the provider network is insufficient and the customer service is poor when it comes to managing claims. The company’s Complaint Index, measured by the National Association of Insurance Commissioners , is 1.04. That means the company has received slightly more complaints than expected for a company of its size.

Some good news: Cigna is financially stable, which is reflected in its A.M. Best Financial Strength Rating and Standard & Poor’s rating. Cigna receives a rating of A from both companies.

Editorial Note: The content of this article is based on the authorâs opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Recommended Reading: Does Cigna Health Insurance Cover International Travel

Cons/setbacks With Cigna Life Insurance

Read: Read: Safeco Insurance Reviews 2021: Pros & Cons | Legit & Scam | How it Works

Using A Cigna Dental Provider

Your use of dental providers may depend on the type of Cigna dental plan you have.

- An HMO plan generally restricts members to visiting dental providers within the Cigna network. In most cases, care administered by a non-Cigna dental provider will not be covered by an HMO plan. In addition, you may be required to see a primary dentist first for all your dental needs and may only visit with a dental specialist if issued a referral.

- A PPO plan grants policyholders some more freedom to seek care outside of the Cigna network and still receive at least partial care in most cases. PPO plan members are not bound by a primary dentist and are free to make specialist appointments without a referral.

You May Like: How To Get Health Insurance For My Small Business

Healthy Discounts For A Healthy Smile With

Cignas dental plans already offer cover for members dental treatment costs. However, as an added benefit, CIGNA members have the benefit of what they have introduced as their Healthy Discounts.

Healthy Discounts offers an additional value giving all dental plan customers the chance to pay 20% less for dental *treatments.

Thats a 20% saving on covered and non-covered private treatment costs. As a Healthy Discounts approved and fully private digital dental and implant clinic, you can save more on the costs of dental care. Only approved clinics like ourselves offer these savings. So, if your own registered dentist doesnt offer Healthy Discounts, you can of course continue to use them and your dental plan but you wont be entitled to these savings. However, to benefit from these savings, all you need do is register with us and you can then start benefitting from these member savings straight away. To find out more about how to register with us as a CIGNA member, scroll down for further information.

What sort of treatments do you offer to patients?

- Oral Surgery

All registered patients are privileged to contact us 7 days a week

So I understand you are a multi award winning digital dental & implant clinic undertaking all types of dental treatment including specialist treatments where other dental clinics are unable to provide?

This sounds amazing. Have you received many awards to reflect your leading status?

To find out more about our clinic, please visit .