Dropped By Your Existing Insurer

Although the Affordable Care Act prevents insurers from canceling your coverageor denying you coverage due to a preexisting condition or because you made a mistake on your applicationthere are other circumstances when your coverage may be canceled. It’s also possible that your insurance may become so expensive you cant afford it.

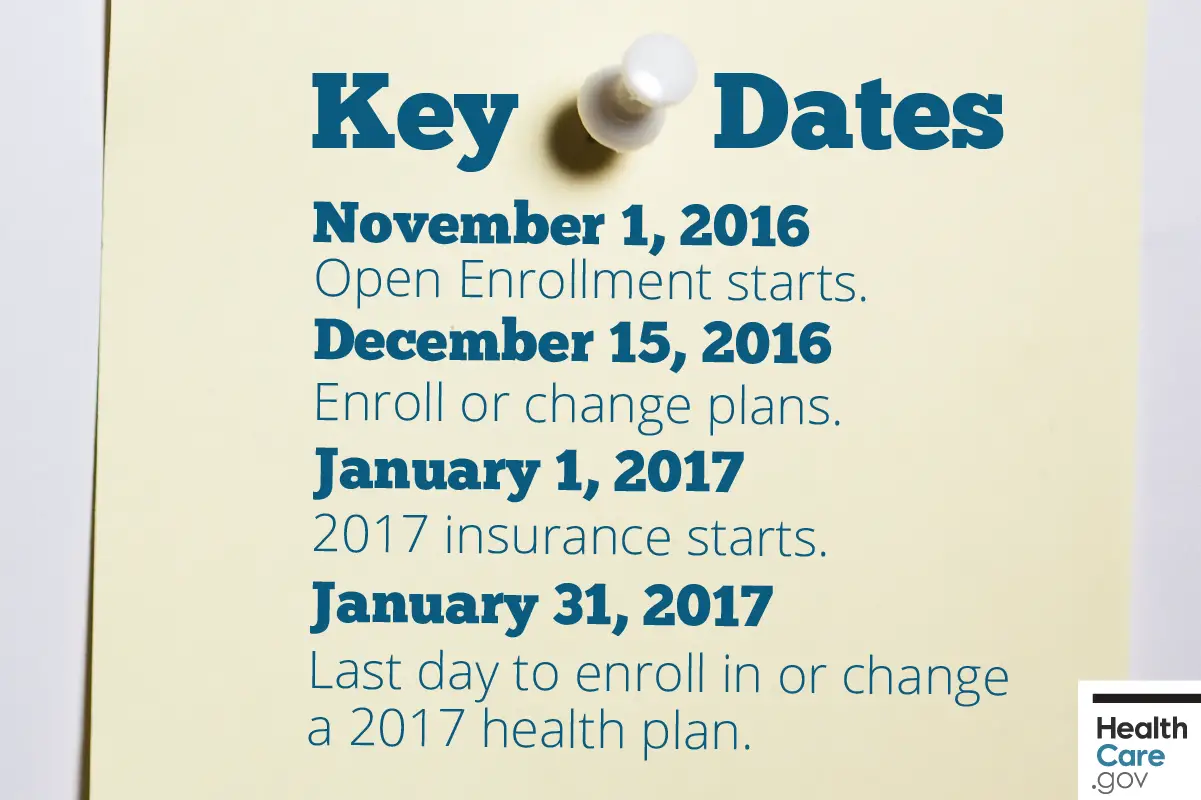

When Does The Openenrollment Period End

The open enrollment period ends on December 15th,unless youre living in a state with an extended open enrollment period.

Californias open enrollment date ends on January 31st. The last day to apply for coverage starting on January 1st is December 15th. Insurance purchased after December 15th will start no later than February 15th.

Colorados open enrollment ends on January 15th.The last day to apply for coverage starting on January 1st isDecember 15th. Insurance purchased after December 15thwill start no later than February 15th.

Washington DCs open enrollment date ends on January 31st.

Additionally, if you live in a state with a state-runmarketplace, your state may choose to extend open enrollment. States withstate-run marketplaces include Massachusetts, Minnesota, New York, and Vermont.

States with state-run marketplaces that have extended open enrollment in the past include Connecticut, Idaho, Maryland, Nevada, Rhode Island, and Washington.

In Pennsylvanias new state-run marketplace, enrollment will continue through January 15, 2021. New Jersey also has a new state-run marketplace, with enrollment continuing through January 31, 2021.

How Buying Private Health Insurance Works

Some Americans get insurance by enrolling in a group health insurance plan through their employers.

Medicare provides health care coverage to seniors and the disabled, and Medicaid has coverage for low-income Americans.

Medicare is a federal health insurance program for people who are 65 or older. Certain young people with disabilities and people with end-stage renal disease may also qualify for Medicare. Medicaid is a public assistance healthcare program for low-income Americans regardless of their age.

If your company does not offer an employer-sponsored plan, and if you are not eligible for Medicare or Medicaid, individuals and families have the option of purchasing insurance policies directly from private insurance companies or through the Health Insurance Marketplace.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

What Is A Hardship Exemption

*A hardship exemption is an exceptional circumstance, and it triggers a 60-day Special Enrollment Period. Examples of exceptional circumstances are unexpected hospitalizations, natural disasters, or temporary cognitive disability. Other hardships may include enrollment errors created by HealthCare.gov, your broker or by your insurance carrier. For more information, please visit HealthCare.gov.

Can I Still Get Health Insurance After Open Enrollment

Outside of open enrollment, there are various ways that you can still secure a health insurance plan. You can still get public insurance or a subsidy if you qualify for special enrollment otherwise, the private market is in fact open all year round.

You can get insurance after open Enrollment through Medicaid or CHIP. They are available throughout the year, and if you qualify for one or both of these programs, Enrollment can begin immediately. For more information, feel free to visit the following website: www.healthcare.gov

You May Like: Starbucks Health Insurance Cost

Changing Policies When Pregnant

Switching policies while pregnant may be the best way to adjust an individual or family insurance to a change in status. It is worthwhile to note that before the Affordable Care Act, insurers could deny coverage because of past or present pregnancy. They could also charge more for pregnancies.

Today, adding a child to the family by birth or adoption is simply a change in status.

It is a substantial change that requires a fresh assessment of health insurance. Pregnancy changes coverage needs and medical care priorities. Prevention and wellness services are important for the expectant woman as are prenatal health services and medical care. Obamacare provides maternity benefits and prenatal care as part of the essential health benefits. Comparison shopping is a great way to determine the policies that offer the best value and the lower costs.

Enter your zip below to compare multiple health insurance quotes and ensure your familys coverage.

Does Covered California Verify Income

Covered California will check the income you reported on your application and compare it to what the IRS has on file for you. They will just tell Covered California if the income you reported does or does not match what they have on file for you. The IRS information comes from your latest income tax return.

Also Check: Starbucks Part Time Insurance

What Is A Special Enrollment Period

Now lets tackle the big question: Can I enroll in health insurance outside of Open Enrollment?

To enroll in health insurance outside of an Open Enrollment Period, youll need to experience a qualifying life event which triggers a Special Enrollment Period . In most cases, if you experience a qualifying life event, youre able to enroll up to 60 days after the event.

When Is Open Enrollment 2022

Open enrollment for 2022 insurance plans begins Monday, Nov. 1, 2021, and continues through Dec. 15 for individual and family insurance plans purchased through the Health Insurance Marketplace. By signing up for an insurance plan in late 2021, youll usually have health insurance coverage effective on Jan. 1, 2022.

In some states, the open enrollment period may be longer due to state extensions or COVID-19-related initiatives. Usually, signing up after Dec. 31 may mean your policy won’t begin until Feb. 1.

| State | Extended open enrollment dates for 2022 health insurance |

|---|---|

| California | |

| Colorado | |

| District of Columbia | |

| Massachusetts | |

| Minnesota | |

| Nevada | |

| New Jersey | |

| New York | |

| Pennsylvania |

If you miss the open enrollment deadline, youll only be able to sign up or change your health insurance if you have a qualifying life event such as moving, a change in your household size or losing health insurance coverage.

Other open enrollment schedules:

- Medicare: Medicare open enrollment runs from Oct. 15 through Dec. 7, 2021.

- Employer health insurance: If you receive health insurance through your job, open enrollment dates are set by your employer.

Changes to open enrollment dates in 2022

Recommended Reading: Starbucks Health Insurance Eligibility

How To Change Your Obamacare Health Plan

Your search for affordable Health, Medicare and Life insurance starts here.

Call us 24/7 at or Find an Agent near you.

Need to know how to change your Obamacare health plan? Many Americans who signed up for an Affordable Care Act plan have their plans set to automatically renew during the annual Open Enrollment Period .1,2

In addition to having your enrollment in your current health insurance plan automatically renewed, you may also have tax credits or subsidies automatically renewed.3 This can be a huge convenience to many Americans, as it means that they won’t have to go through the headache of trying to navigate the health insurance marketplace again.

Pay close attention to the letter you receive from your insurance company, as insurance premiums are rising.4 In this case, you may want to opt for a new plan to balance the rising costs of your insurance.

Don’t want to be automatically re-enrolled in your current plan? Perhaps your monthly premiums are expecting to go up, or it doesn’t provide you with the coverage you need for your personal health needs. Don’t worry. You can change your Obamacare health plan if you want, and you don’t have to stick with the same plan indefinitely.

What Insurance Plans And Benefits Are Available

Under the Affordable Care Act , insurers in all states are required to provide 10 essential health benefits. Also, you cant be denied coverage because of a preexisting condition.

What’s covered:

- Substance abuse services

- Pediatric care

In 2022, marketplace health insurance plans will have a maximum out-of-pocket capped at $8,700 for individuals or $17,400 for families. Even if you have significant health care needs, your spending for covered in-network services will not be higher than your out-of-pocket maximum.

This is an important protection offered by health insurance plans compatible with the Affordable Care Act that isnt offered with short-term health insurance or through indemnity-style insurance companies like Sidecar Health.

On the marketplace, plans will be organized into metal tiers:

Bronze plans

Cheapest monthly costs but generally have high deductibles or fewer cost-sharing benefits.

Best for: Those who are young and healthy or who dont expect to need significant medical care.

Silver plans

Most expensive but have strong cost-sharing benefits and low deductibles.

Best for: Those who expect to need significant medical care.

In addition to comparing plans based on health coverage, we also recommend you choose one of the best-rated health insurance companies to help you have fewer frustrations, wider access to doctors and useful add-on benefits.

We recommend UnitedHealthcare, Anthem, Oscar and Kaiser Permanente as some of the best overall insurance companies.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

What If I Want To Change Something About My Health Coverage Or Renew My Plan Through Covered California

Renewal usually starts in the fall, right before the open-enrollment period. At that point, you’ll be able to switch your plan and make any changes. You can always report changes when things like your household size and income have changed. Sometimes these changes make you eligible for special enrollment, at which point you can change your plan.

If you take no action to actively renew or change plans, you will automatically be enrolled, 30 days after the date on the renewal notice you received in the mail, into the same plan you had the previous year and using the most recent household size and income information you gave us.

When you renew your health insurance plan, you will be able to:

For questions or additional help renewing your health plan, contact an expert in your area for free assistance or call Covered California at 300-1506 .

arrow_back

Covered California Plans: Metallic Plan Benefits

Find Bronze, Silver, Gold and Platinum Obama Care Plans and Prices

When the Affordable Care Act became law, health insurance plans were repackaged, and categorized into 4 metal tiers: Bronze, Silver, Gold and Platinum. Covered California took this a step further and streamlined all the plans they offered on-exchange, so they became a real apples to apples comparison.

The silver tier is the most popular, so using it as an example, if you were looking at all the Silver 70 plans on the Covered California marketplace, there would be no plans benefit differences. You would only have to decide which carrier you want, and whether you want an HMO, EPO, PPO or HSP. These acronyms represent the type of network you would have access to and essentially which doctors, and hospitals accept your insurance.

Price: $

Bronze 60 Plan

Best For: A healthy individual/family that does not have medical conditions, but wants insurance just in case something major happens

Features:

- First 3 office visits are a fixed copay before deductible is reached

- High deductible

- Out-of-pocket maximum limit which is the most you would pay in a calendar year if the worst happened.

Bronze HDHP 60 Plan:

Best For:A healthy individual/family that wants to take advantage of tax savings, and plans on putting money into a special bank account called a Health Savings Account. This money can be used for medical expenses and the money roles over from year to year.

Features:

Minimum Coverage Plan

Features:

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Exceptional Cases For Cancelling Health Insurance

- Child Support or Divorce: You might be legally obligated to maintain your health insurance policy as part of court-ordered child support or divorce proceedings. Also, if a Medicare recipient decides to get private insurance or HMO coverage, that person must apply to the Health Care Financing Administration before changing insurers or plans.

- When You Cancel Medicare and Want to Switch to Private Coverage: When someone covered by Medicare decides to switch to better private insurance, say, through coverage offered by a new job, that person must apply to the Healthcare Financing Administration before changing insurers or plans.

A Business Owner Who Has Employees

If you start a business and you have employees, you might be required to offer them health insurance. Even if it’s not required, you might decide to offer health insurance in order to be a competitive employer that can attract qualified job candidates. In this situation, you will be required to purchase a business health insurance plan, also known as a group plan.

Don’t Miss: Does Starbucks Have Health Insurance

Why Is There An Open Enrollment Period

Well there isnt a clear definitive answer for why the government has certain systems in place as there is no system without a flaw. However the main idea behind an open enrollment period is to insure that people are paying towards their health insurance to be able to use it.

Health care needs funding in order to be able to cover the cost of incidents in treatment. Similar to how you cant get auto insurance after a car accident to file a claim, you cant apply for health insurance to cover a bill after the incident.

This is simply to ensure that the healthcare system itself is consistently behind funded by its citizens or people using the plan.

In the other hand, Open Enrollment it is an opportunity to change your Medical, Dental, and Life coverage. Its also an opportunity for your organization to modify your plan configuration and start with new benefits.

Finally, the purpose of Open Enrollment is to ensure that all employees receive a comprehensive overview of the benefit offerings to make informed decisions on the best benefits for themselves and their families.

Which The Other States Can Still Extend Their Health Insurance Open Enrollment Period

Health insurance open enrollment extensions for Obamacare could be seen as a partisan issue, with Democrats in favor of longer enrollment periods and Republicans against them. However, open enrollment benefits are popular enough for very fine folks on all sides to have embraced them in the past.

Not every state can change the dates for the upcoming open enrollment for health insurance. These four states run their own exchange and can push back open enrollment:

States can extend open enrollment at any time, even once its already underway. For instance, Maryland waited until the last day it could to extend its open enrollment.

You May Like: Starbucks Employee Insurance

When You Can Sign Up

Sign up now for 2022 health coverage. Open Enrollment goes through Jan. 15, 2022. Otherwise, Coloradans who experience a Qualifying Life Change Event, during or outside of the Open Enrollment Period have a 60-day window to buy or change plans. This is known as a Special Enrollment Period. Certain events, including moving, getting married, and having a baby all make you eligible for a Special Enrollment Period.

If you miss your Special Enrollment Period window, you may have to wait until the next Open Enrollment Period to apply. You can enroll in Medicaid or the Child Health Plan Plus program any time of year, whether you qualify for a Special Enrollment Period or not.

Special Enrollment Periods For Health Insurance

Special enrollment periods are so named because thats exactly what they are: special. During a special enrollment period, only you and your family have the chance to decide on new coverage options.

Special enrollment periods are triggered by specific events, including:

- Getting married, divorced or legally separated

- Giving birth or adopting

- Starting, ending or losing a job

- Losing other health insurance coverage

- A death in the family

- Moving to a new ZIP code or county

- Certain other qualifying events

If one of these events applies to you, youll usually have 60 days to switch to a new plan or make changes to your existing one.

Just like with open enrollment, you can shop around and compare plans by talking to your existing health insurance provider, your broker or visiting your states health insurance marketplace. In some cases, youll need to provide evidence of your qualifying life event before enrollment is complete.

Read Also: Do Starbucks Employees Get Health Insurance

How To Switch From Obamacare To Medicare

- Happy 65th Birthday: If you have a Marketplace plan, you can keep it until you decide to get Medicare. Most people enroll as soon as they are eligible through the Initial Enrollment Period, which begins three months before their 65th birthday and ends three months after their 65th birthday.

- If you like, you can keep your Marketplace plan, too. But once your Medicare Part A coverage starts, youll no longer be eligible for premium tax credits or other cost savings you may be getting. So youd have to pay full price for the Marketplace plan.

- There is another option after turning 65. You could continue getting your health insurance at work until you retire or lose your job.

What Is Individual And Family Health Insurance

Unlike traditional insurance through your employer, with Individual insurance, you can shop for a plan that suits your familyâs own needs, purchase the plan and make monthly premium payments directly with the carrier of your choice.

Any of the individual health plans you choose will cover the same 10 essential health benefits, but the copays, deductibles, provider networks, benefits, and rates will vary.

There are a number of scenarios where someone would purchase an individual policy including self-employed individuals, and those who are in-between jobs for more than 3 months, not offered affordable coverage through their employer, or no longer being covered by their parentâs health plan.

Health insurance coverage is now required for almost everyone by the Affordable Care Act . You might have to pay a penalty if you go without coverage.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees