How To Calculate My Coinsurance

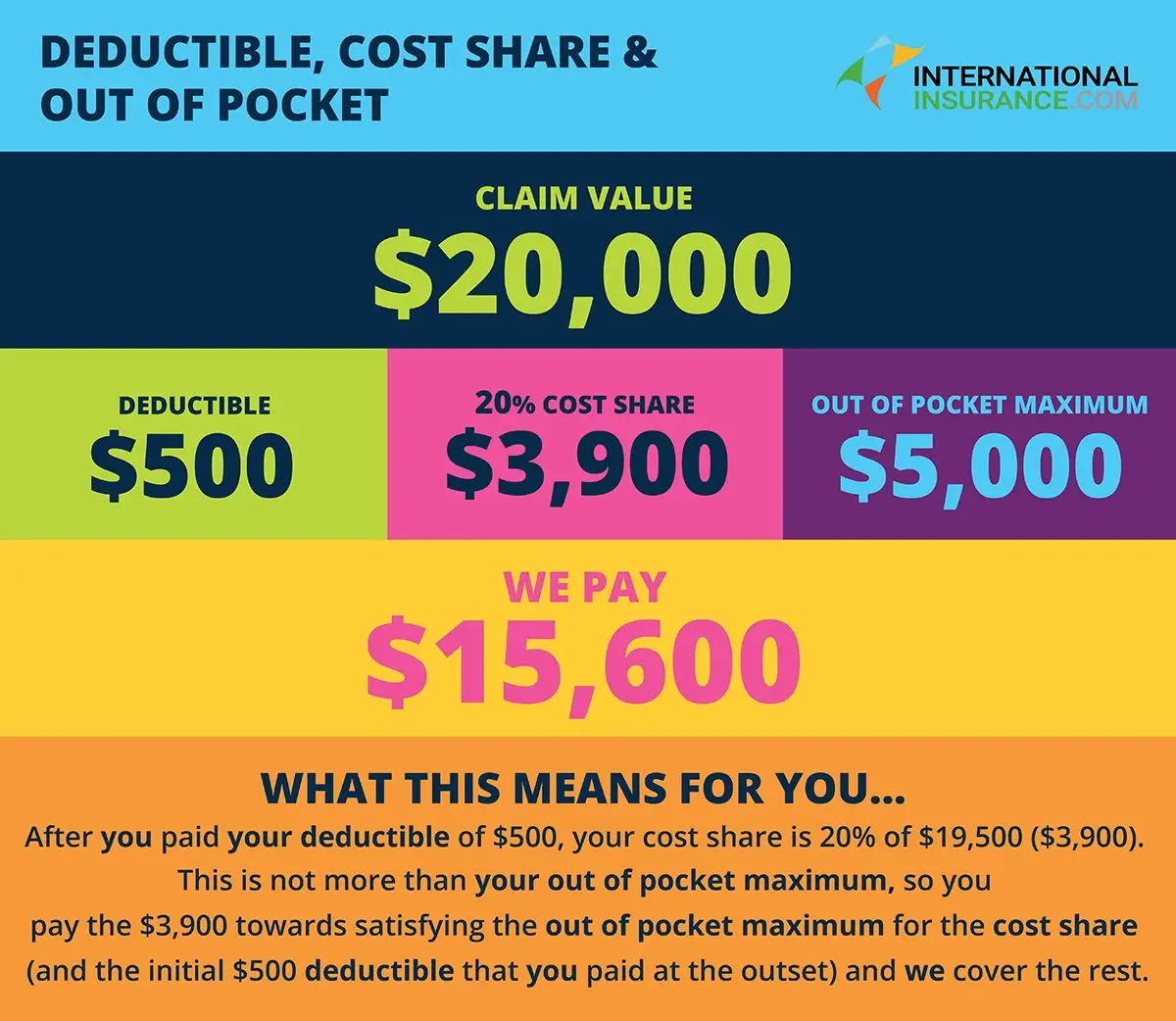

The calculation of your coinsurance will be based on the bill for services rendered. If you have a $7,000 bill, then you will pay $2,800 based on a Bronze Plan where you pay 40% and the insurance company will pay the other 60%. It is important to remember that not every service you want is necessarily covered. Always check with your insurer before having any treatment.

Find The Right Plan For Your Needs

Whatever the case, talking to a licensed insurance agent can help answer many of your questions, at no cost to you. Contact HealthMarkets to learn more about deductibles, out-of-pocket limits, and whether you may qualify for savings on your health plan. Our service is free to you and theres no obligation. Call to get started, or begin comparing plans online today.

48298-HM-0222

What Doesnt Count Toward The Deductible

Healthcare expenses that arent a covered benefit of your health plan dont count toward your deductible even though youve paid for them. For example, if your health insurance doesnt cover orthotic shoe inserts, then the $400 you paid for a pair of orthotics prescribed by your podiatrist doesnt count toward your deductible.

Similarly, if your health plan doesn’t cover out-of-network care, any amount that you pay for out-of-network care will not be counted towards your deductible.

If your health insurance requires a per-episode deductible, or a deductible each time you get a particular type of service, as well as an annual deductible, money you pay toward the per-episode deductible might not count toward your annual deductible.

If you have separate deductibles for in-network and out-of-network care, the amount youve already paid toward your in-network deductible doesnt count toward your out-of-network deductible. Depending on your health plans rules, the amount youve paid toward your out-of-network deductible likely won’t count toward your in-network deductible, either.

In most health plans, copayments don’t count toward your annual deductible, although they do count toward your total out-of-pocket costs for the year.

Read Also: 8448679890

What 100% Coinsurance After Deductible Means

Having 100% coinsurance is anyone dream. After you have met your yearly deductible certain services are covered at 100%% and this means that you do not pay one penny towards the treatment. Your insurance company covers the entire bill so long as it is an agreed upon service that is considered essential by the insurer. There may be some charges on coinsurance after deductible, but your plan brochure will outline any and all possible charges.

What To Do If My Zero

If your favorite zero-deductible health plan increases its premium, you do have a few options if you cant, or dont want to, pay the new rate.

Switching to a low-deductible health plan or a high-deductible health plan is likely your best bet. Simply speaking, high-deductible plans generally charge a lower premium than low-deductible plans. But it can be tough to determine which one suits your organizations needs.

A good place for employers to start determining the best health plan is considering how much you can afford to pay for the monthly premium by assessing your budget. You should also consider the age and health of your workforce, as these are important factors when deciding coverage options.

To help you decide, lets dive a little deeper into how the two plans work so you can understand precisely how LDHPs and HDHPs compare.

Recommended Reading: Starbucks Open Enrollment 2020

Why Choose A High

Most people who choose a high-deductible plan do so because it will lower their monthly premium. Also, customers with a high-deductible plan are eligible for a Health Savings Account . An HSA allows you and your employer to deposit a limited amount of pre-tax dollars for medical expenses.

High-deductible health insurance policies make sense for individuals who are generally healthy and who do not anticipate getting hurt. Hint: a high-deductible plan may not be the best choice for a racecar driver or professional wrestler.

How Should I Choose A Health Insurance Deductible

Every persons situation is different, and what works for your needs will depend on your health needs, budget, and more. As youre considering your options, its important to take the time to shop around and compare costs. As mentioned, deductibles and other out-of-pocket costs may vary quite a bit from plan to plan. Comparing costs is easy and could save you money.

If youre interested, an eHealth licensed insurance agent would be happy to walk you through your options to find a health plan that might fit your needs. You can also start shopping on eHealth at your own convenience and compare all health insurance options in your state!

Related Articles

Read Also: How Long Do I Have Insurance After I Quit

How Do I Know If I Have A High

If you have access to a health savings account , then you have a high-deductible health plan. This type of insurance has a lower premium and a higher deductible than a traditional health plan. Having an HDHP is one of the requirements for a health savings account . If your current health insurance plan for 2021 has a minimum deductible of $1,400 with a maximum deductible of $7,000 , then it qualifies as an HDHP.

What Is The Main Benefit Of A High

If you are generally healthy and want to save for future health care expenses, the high-deductible plan gives you access to a triple-tax-advantaged savings vehicle, the health savings account. The HSA can make sense for many people, especially those nearing retirement, because the money can be used for medical care in retirement.

Don’t Miss: Health Insurance Starbucks

Questions To Ask About Your Out

Since health Insurance deductibles vary between plans and often within a single plan, it’s essential to understand the deductibles in your plan and how they can affect your out-of-pocket health care costs.

To understand how much money you will end up paying out of pocket, ask your plan provider these questions:

- What coverages are subject to a deductible?

- Are there any coverages that do not have a deductible?

- What coverages require a copay instead of a deductible?

- What coverages have coinsurance without a deductible?

- What are my maximum out-of-pocket expenses?

Armed with these answers, you can better determine which plans make sense for you and if a low-premium plan is ultimately worth it for your specific health care needs.

Health Insurance Deductibles And Marketplace Plans

The plans offered directly by insurers are similar to those that are available in the health insurance marketplaces that the federal government and many states have made available under the Affordable Care Act. The marketplaces offer four tiers of insurance plans:

- The Bronze plan, with the lowest monthly premium, covers an average of 60% of health costs.

- The Silver plan has a higher monthly premium and covers an average of 70% of health costs.

- The Gold plan has a higher monthly premium than the Silver plan but covers 80% of health costs.

- The Platinum plan has the highest monthly premium and the highest level of coverage at 90%.

Notably, there’s also a catastrophic plan that has a very high deductibleâ$8,150 in 2020âfor people under age 30, or those who have a hardship or affordability exemption.

Don’t Miss: Insurance Lapse Between Jobs

Drawbacks Of High Deductible Plans

One drawback of a high deductible health plan? In a worst-case scenario or emergency situation, meeting the deductible or out-of- pocket maximum could pose a financial burden. Another drawback? Some people might skip making doctors appointments or filling prescriptions to avoid spending money risking their health in the process.

Choosing The Best Health Insurance Policy

The deductible and out-of-pocket max are two very important factors when deciding which health insurance plan is right for your needs.

In general, you’ll pay more each month to get better cost-sharing benefits, such as lower deductibles, lower out-of-pocket maximums, and lower copayments or coinsurance. These higher monthly costs may be worth it if you’re expecting to need significant medical care in the upcoming year.

Choosing a plan with lower monthly payments can be good for those who are young and healthy, but it means higher deductibles, higher out-of-pocket maximums, and paying higher copayments or coinsurance for health services.

Comparing health insurance quotes can help you optimize how much you pay each month versus the policy’s yearly deductible amount, cost-sharing benefits and out-of-pocket maximum.

Deductible vs. out-of-pocket max vs. coinsurance

You May Like: Is Umr Good Insurance

Group Coverage Health Reimbursement Arrangement

Your first option is a GCHRA, also known as an integrated HRA. A GCHRA is a health reimbursement arrangement between employer and employee designed to reimburse employees for eligible out-of-pocket costs that arent fully covered in their group health plan.

If youre deciding to go with an LDHP or HDHP, the higher deductible can be difficult for your employees to manage. In these cases, a GCHRA can help bridge the gap between the group plan and the deductible, all while lowering premium costs for you.

Employers can use a GCHRA with either an LDHP or an HDHP, and their GCHRA can remain in place if they change insurance providers. The GCHRA is also customizable for employers since they can set an allowance cap. Once the allowances are set, employees cant exceed them, making it a budget-friendly and flexible benefit option.

Benefits Of Low Deductible Plans

The potential to save on out-of-pocket costs is a major draw of a low deductible health plan. Another benefit may be predictability: being able to budget for and manage your health care expenses. If you have a large family and anticipate regular trips to the doctor or have a busy medical history due to a chronic or pre-existing condition, a low deductible health plan may work best for you.

Don’t Miss: Starbucks Part Time Insurance

Types Of Individual Health Plans

There are several types of insurance plans a healthcare consumer can choose from. This is why its smart to shop around and review all of your options. Basic plans include:

- Preferred Provider Organization A PPO offers healthcare consumers a network of healthcare providers to use for their medical care. The providers within the network agree to provide care to plan members at an agreed-upon rate. With this type of plan, you pay less for providers within the network and more for providers outside of the network.

- Health Maintenance Organizations A HMO limits the healthcare coverage to care from doctors who work for or contract with an HMO. These often are more limited and regionally focused but provide cheaper rates. Additionally, they focus on providing prevention and wellness care to its members.

- Point of Service Plan A point of service plan combines elements of a PPO and an HMO. It uses a managed care foundation that offers lower medical costs in exchange for less choice. Like an HMO, policyholders have to select a primary care doctor from within the plans network. Like a PPO, out-of-network services are covered but at a higher rate.

- Catastrophic coverage One of the lowest cost options available, these are the most basic type of health insurance. They provide coverage against major injuries and illnesses but are limited to 3 basic visits per year up to the deductible. These types of plans are ideal for those with enough savings to cover most of their medical costs.

Are There Any Exceptions Or Exclusions In Zero

If you have a zero-deductible plan or are planning to buy one then find out beforehand about exclusions. Some companies exclude coverage for pregnancy or rehab treatments for nicotine addiction and such.Some policies offer partial zero-deductible coverage even if you have a deductible plan. These can be for dental work, vision-related care, or certain prescriptions. To check if such plans make sense to you, notice the difference in premium amounts for different policies that offer partial or full zero-deductible plans.Calculate all expenses you will need to bear against the benefits before buying a zero-deductible plan.

Read Also: Starbucks Partner Health Insurance

Its All About You We Want To Help You Make The Right Coverage Choices

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.Our insurance industry partnerships dont influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines:

Selecting the right type of healthcare plan can be a stressful process. Between the industry jargon and the sheer number of available options, you may have trouble determining which type of insurance is which, let alone deciding what overall healthcare plan is best for your health and financial situation.

For instance, did you know its possible to have a no-deductible health insurance plan? While most healthcare consumers dont opt for this option, it could be the ideal plan for you.

But what does a zero-deductible plan entail? What are the benefits? Heres what you need to know.

Before you dig in, if you want to see the best health insurance options for you, enter your ZIP code into our free health insurance comparison tool to view your options.

More About Higher Deductibles

Unlike a traditional health plan, a high deductible health plan has a lower premium. The primary aim of this health plan is to incentivise consumer-oriented health care. Besides, some of them also provide additional wellness benefits before the deductible amount is paid. The acceptance rate of higher deductibles has been on the rise since its introduction, as it increases options for employers, both government and private, offering healthcare benefits.

Don’t Miss: What Benefits Does Starbucks Offer

More About Lower Deductibles

Unlike a high deductible medical insurance plan, a low deductible plan comes with a higher premium. If your claim exceeds the pre-decided limit, insurers pay for the excess amount. Although the premium is higher, it saves individuals from substantial expenses during medical emergencies. In addition, in this type of deductible health plan, the benefits and financial coverage start earlier.Therefore, if individuals cannot pay a premium and require health cover for minor health emergencies, they can choose a high deductible health plan. However, suppose one does not want to lose out on their financial coverage and foresee any medical expenses in the near future in that case, they can go ahead with lower deductibles plans. To be able to choose and purchase the best-suited plan online, individuals can log in to the Bajaj Finance Limited platform and choose from a range of healthcare plans designed for different requirements.

Available Option Of Deductibles In Health Insurance

Insurance premiums and deductibles are essential health insurance terms that allow individuals to understand various policies to make an informed decision. As already stated, deductibles denote a percentage of the insured sum that policyholders need to pay before the insurer covers the rest.With in-depth online research, one can understand the terms and conditions of medical insurance policies. If you are mindful of the different aspects that can significantly impact your policy coverage, you can understand the difference in the premium cost and purchase the most suitable one. Lets take a look at the two types of deductible options and choose the ideal one:

Low deductible health insurance plan

- A low deductible health insurance plan is an effective option for individuals requiring regular and hassle-free health care benefits

- Individuals need to pay a higher premium amount

- Since the insurance premium is on the higher side, policyholders are not required to pay a substantial amount on their own in contrast to some other health insurance plans

- Policyholders can start their treatment without any financial burden

High deductible health insurance plan

- For a high deductible health plan, the insurance premium is comparatively lower.

- A policyholder needs to pay a percentage of the total cost before obtaining the benefits of an insurance policy

- Usually, most senior citizens and critical illness plans come with a higher deductible option

Also Check: Substitute Teacher Health Insurance

How Deductibles Differ

Your plan might have several different deductibles for various services. If you have individual coverage, you may pay one deductible for most of your healthcare expenses and another toward the cost of prescription drugs. If you have family coverage, you may pay individual deductibles for each person covered and a family deductible for the policy.

Many insurance plans pay for certain preventive care services without requiring you to pay any deductible or copay. For example, routine mammograms for women age 40 and over are covered in full with no deductible or copay. This is a federal requirement for new plans.

Insurance companies charge deductibles in part as a cost-saving measure. The logic is that anyone who is insured and has to pay out of pocket will think twice before using an emergency room or medical services if they don’t really need them.

Americans who have health insurance must pay between 10% and 40% of their own annual healthcare costs, depending on whether they go for a higher-premium or a lower-premium plan.

Where You Live

Where you live is important when it comes to no deductible insurance. Some states have particular stipulations regarding insurance requirements, with others outright banning it altogether.

Some states like Florida require specific types of insurance that can affect your health insurance, such as personal injury protection coverage or uninsured motorist property damage coverage. This can interfere with your health insurance options and potentially prevent you from obtaining no deductible health insurance.

Don’t Miss: Minnesotacare Premium Estimator