What Is Health Insurance

Health insurance is a contract between an insurance provider and an insured party that requires the provider to cover medical expenses related to illnesses, injuries or other conditions. These expenses may include doctor visits and consultations, hospitalization, emergency services, surgery, laboratory tests, prescription medication, maternity and newborn care, mental health, ambulance rides and rehabilitation services. Health insurance may also cover some dental expenses, though separate dental insurance is common.

Health insurance generally doesnt cover cosmetic procedures like plastic surgery, laser hair removal or body contouring, nor does it cover fertility treatments, off-label prescription use or new and experimental technologies. Exactly what health insurance does cover varies by plan, provider and state.

I Am Enrolled In A Va Health Care Program Would I Be Eligible For Assistance To Pay Health Insurance Premiums On The Marketplace If I Choose To Purchase Health Care Outside Of Va

Since VA care meets the standard for health care coverage, you wouldnt be eligible for assistance to lower your cost of health insurance premiums if you chose to purchase additional health care coverage outside of VA. However, you may still purchase private health insurance on or off the Marketplace to complement your VA health care coverage.

What Is A Non

Non-ACA Plan is a very generalized term that people use to describe anything that is not compliant with the ACA. The problem is that a lot of plans that arent actual insurance get lumped in like faith-based cost-sharing plans which are not insurance. There are also a lot of new plans from carriers that no one has ever heard of pushing plans that sound like the greatest thing since sliced bread. None of these have passed our sniff test and as a result, the only non-ACA plan that we recommend is Short Term Medical Insurance . Due to recent changes in the law, these plans are now able to be purchased for 12-36 months at a time.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

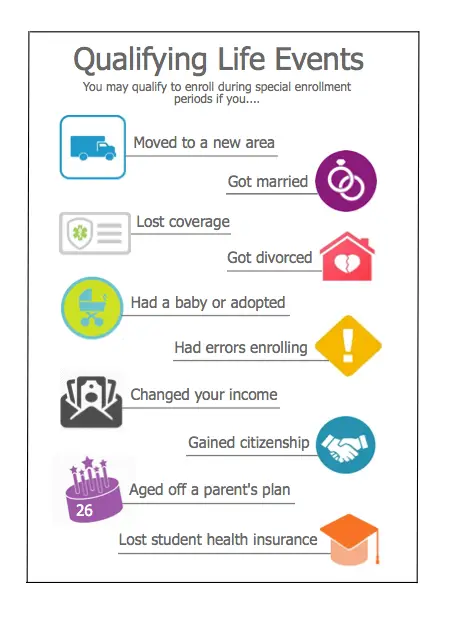

Can I Still Enroll Through The Health Insurance Marketplace Even When Were Not In An Open Enrollment Period

Individuals with a qualifying life event can enroll in health coverage or change their coverage outside of the open enrollment period and have it be effective for that coverage year. This is called the Special Enrollment period. Qualifying life events include having a baby or getting married. Visit www.healthcare.gov/coverage-outside-open-enrollment to learn more about these qualifying life events and other circumstances for special enrollment.

A Plans Premiums And Out

Most employers cover 60 to 80% of the costs of their health insurance, but theyre only required to cover at least 50% by law.

Kaiser Family Foundation estimates that the average annual premiums for employer sponsored health insurance in 2019 were $7,470 for single coverage and $21,342 for family coverage. Employers picked up well more than half of those costs.

The average single coverage premium that workers pay was $1,243 and family coverage was $5,588.

By contrast, Affordable Care Act insurance plans in 2020 that were unsubsidized had annual average premiums of $5,472 for individual health insurance coverage and $13,824 for family coverage.

Depending on your employers contribution, a significant amount of the expense may be deducted from payroll to cover the employees remaining portion of the premium, explains Jacquelynn Neat, president/founder of Indigo Care Partners in Overland Park, Kansas. Also, if you need to enroll a spouse and/or dependent child, it may be less expensive to seek alternative plans, such as those available at Healthcare.gov.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

Failing To File Tax Returns Will Prevent Advance Payments In The Next Year

The IRS reminds taxpayers who received advance payments of the premium tax credit that they should file their tax return timely to ensure they can receive advance payments next year from their Marketplace.

If advance payments of the premium tax credit were paid on behalf of you or an individual in your family, and you do not file a tax return reconciling those payments, you will not be eligible for advance payments of the premium tax credit or cost-sharing reductions to help pay for your Marketplace health insurance coverage in the next year. This means you will be responsible for the full cost of your monthly premiums and all covered services. In addition, we may contact you to pay back some or all of the advance payments of the premium tax credit.

If you have a question about the information shown on your Form 1095-A, or about receiving Form 1095-A, or about a letter you received, contact your Marketplace as shown in the table below or visit HealthCare.gov/taxes.

The Bottom Line On Off

In summary shopping around for quotes on health plans is a smart move every open enrollment. The more you understand what the private insurance market offers, the better your chances of finding the best plan for you. That being said, if you qualify for cost assistance your best choice will almost always be a subsidized marketplace plan.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Are Your Providers In Network

Check the health plan’s network to make sure it has a good selection of hospitals, doctors and specialists. Look for your providers in the plans network.

This is especially true if you get an HMO. HMOs have a restricted network and wont pay for the care you receive outside of the network.

If you get a PPO, youll likely be able to get out-of-network care, but it can come at a higher price tag.

Plan Design Pricing May Differ Between On

If an insurance carrier sells individual-market plans both on- and off-exchange, all of those plans are combined into one risk pool for rate-setting and risk adjustment purposes. So although the off-exchange population tends to be wealthier and that correlates with healthier, the insurer still has to combine the total individual market experience into one pool to set rates.

The on- and off-exchange plan rates can be different, however, if the plan designs and/or provider networks are different. And as described above, insurers in many states are adding the cost of CSR only to on-exchange Silver plans, making their off-exchange Silver plans less expensive than their on-exchange Silver plans. If youre not eligible for premium subsidies and you want a Silver plan, an off-exchange version might be a better option.

Some insurers only sell off-exchange plans, which allows them to better target wealthier and thus generally healthier enrollees. If youre in a state where there are different carriers offering plans in the on- and off-exchange markets, youll need to compare both if youre not eligible for a premium subsidy. If you are eligible for a premium subsidy, be aware that selecting an off-exchange plan means youre forfeiting your subsidy, and you wont have an option to claim it on your tax return after the year is over.

Also Check: Does Medical Insurance Cover Chiropractic

Health Insurance Options After Cancellation

As mentioned, your insurer must provide notice and give clear reasons for canceling your policy. The notice period is at least 30 days and should help you appeal or seek alternative coverage. If an insurer rejects your appeal, you have the right to purchase any other health plan you qualify for. Here are your health insurance options if your current coverage is canceled.

Pros And Cons Of Short

These plans, sometimes called short-term health insurance, typically do not meet the standards for health insurance as outlined in the Affordable Care Act and will not be available or shown to you when you shop the Marketplace during Open Enrollment , whether you shop through HealthCare.gov orHealthSherpa.

Though these plans may be cheaper than some plans on the Marketplace, they arent as comprehensive. Among other things, these plans typically do not cover maternity care or mental health care. They also typically dont cover preventive care, prescription drugs, or any pre-existing conditions. Experts do not advise using these short-term plans to replace regular health insurance because the health coverage they provide is not adequate.

Read Also: How To Keep Insurance Between Jobs

When To Buy An Individual Health Plan

You can purchase or make changes to individual health insurance during the open enrollment period. Open enrollment for most states is from . States with their own exchanges usually offer expanded open enrollment.

States with slightly different open enrollment periods include California, the District of Columbia, Idaho, Maryland, New Jersey and New York, and Rhode Island.

The only other time you can get individual health insurance coverage is if you have a qualifying event that launches a special enrollment period. These events may have caused you to lose your health insurance coverage. The special enrollment sign up period lasts 60 days.

Special enrollment qualifying events include:

- Getting married

- Having a baby, adopting a child or placing a child for adoption or foster care

- Moving

- Becoming a U.S. citizen

- Leaving incarceration

- Losing other health coverage due to job loss, divorce, COBRA expiration or aging off a parents plan

- Losing eligibility for Medicaid or the Childrens Health Insurance Program

- Change in income or household status that affects eligibility for premium tax credits or cost-sharing subsidies

- Gaining status as a member of an Indian tribe

Youre About To Lose Your Job Or Youve Lost Your Job And Are Offered Cobra

COBRA law gives you the right to continue the plan you had through your work after leaving a job, but your employer doesnt subsidize your premiums.

Besides, if you lose coverage through a job loss, its considered a qualifying life event and youre entitled to a special enrollment period for a health plan. So, if you lose your job after the regular open enrollment period has ended, you qualify for a special open enrollment of 60 days.

Recommended Reading: Asares Advanced Fingerprint Solutions

Find Affordable Healthcare That’s Right For You

Answer a few questions to get multiple personalized quotes in minutes.

Affordable Care Act Open Enrollment Period Snapshot Survey Key Findings 44% of…

Updated: February 2nd, 2022ByDan Grunebaum×

We do not sell insurance products, but there may be forms that will connect you with partners of healthcare.com who do sell insurance products. You may submit your information through this form, or call 855-617-1871 to speak directly with licensed enrollers who will provide advice specific to your situation. Read about your data and privacy.

Our mission is to provide information that will help everyday people make better decisions about buying and keeping their health coverage. Our editorial staff is comprised of industry professionals and experts on the ACA, private health insurance markets, and government policy. Learn more about our content.

Which Option Is Cheaper: Individual Health Insurance Or Group Health Insurance

Cost is a deciding factor for many when it comes to health insurance. The cost for both an employer-sponsored health insurance plan and an individual health insurance plan can vary greatly depending on several factors.

If you are an individual with access to employer-sponsored group health, the primary factors that may influence the monthly cost of your health insurance are income, location, size of family, and the percentage of your premium your employer pays, if any portion of it. According to the Kaiser Family Foundation , employers in the U.S. paid on average 72% of their employees family health insurance premiums in 2019. Proportionately, employees paid a relatively small amount of the family coverage premium, or, on average, $5,726 annually.

In a 2020 eHealth study, unsubsidized individuals paid onaverage $1,152 in monthly premiums for families , afigure essentially unchanged from 2019.

Depending on the percentage of the Federal Poverty Line you earn, you may be eligible for Affordable Care Act also known as Obamacare subsidies to help pay your monthly premium for an individual health insurance plan. Generally, if your household income is above 400% of the FPL you will not qualify for a tax credit subsidy. According to the KFF, the average monthly advanced premium tax credit received by marketplace enrollees in 2019 was $512.

Don’t Miss: Evolve Health Insurance Company

What Are The Advantages Of Employer

There are advantages to getting insurances through your employer. Typically, your employer will choose a coverage option for you and you can decide to accept the benefits if you are an eligible employee.

Several advantages of purchasing employer-sponsored healthinsurance include:

- Your employer selects your plan options and may engage benefits consultants or insurance brokers to identify the most suitable plan.

- Your employer will typically split the cost of your premiums with you, thereby reducing your out-of-pocket costs

- The premium contributions your employer makes are not taxed and your contributions can be made on a pre-tax basis. This will lower your taxable income.

If you are the owner of a small business with more than 1 unrelated employee, you may want to look at small business health insurance options before making a decision. eHealth can help you explore your options and select the right plan for your business and personal needs. eHealth works with highly rated insurance companies that specialize in individual and small group health plans. By using eHealths online tools, you can evaluate small group plans with ease.

Private Versus Public Health Insurance

Private health insurance, offered through the ACA federal marketplace or directly from private health insurance companies, is different from public health insurance — meaning Medicare or Medicaid.

“Medicare is generally more cost-effective for Americans over age 65, the vast majority of whom qualify for Medicare,” says Martucci. “Medicaid, on the other hand, is a free or very low-premium health insurance option for low-income Americans and is a very good deal for those who qualify. But eligibility requirements vary significantly by state and in many places are restrictive to the point of excluding all but the most vulnerable people.”

You May Like: Kroger Health Insurance Part-time

Can Employees Decline Employer Sponsored Health Coverage

You arent required to accept an employer health insurance plan. You can decline or waive this benefit.

But you may have to sign a waiver that you will be obtaining another insurance plan or accepting someone elses insurance coverage so that your employer has proof that you are insured for legal purposes, Schrader says.

If you decline or waive your employer sponsored coverage, you are allowed to enroll later during the employers open enrollment period unless you qualify for a special enrollment because of a qualifying event.

Certain qualifying life events, such as you losing coverage not provided by your employer, getting married or having children may trigger a special open enrollment period during which you can sign up for group coverage at work, too, says Kronk.

Also, be aware that, once you sign up for employer sponsored health coverage and agree to have your premiums deducted from your paychecks, you cant drop coverage during the year unless you experience a qualifying life event. Under new IRS rules established as a result of the Covid-19 pandemic, you can drop your coverage but only if you replace it with another form of comprehensive coverage, says Colburn.

How Long Must An Employer Provide Health Insurance After Termination

There is no particular time frame when an employer must keep your health insurance coverage after a job termination. This decision is up to the company.

Some employers cancel health insurance on the day of termination. Others wait until the end of the month or a few months so that you can have extra time to seek new employment.

That being said, most employers are required to provide you access to its employer health insurance plan for at least 18 months after termination through COBRA . COBRA requires that private employers with at least 20 employees offer COBRA benefits to former employees, except those fired for gross misconduct. Many states also have mini-COBRA laws for small businesses.

Note that youll pay the full price of health insurance during this COBRA period, with no subsidies provided from your employer, so expect to pay costly premiums, adds Kronk.

Find out more about COBRA costs.

Don’t Miss: Shoprite Employee Benefits

Is It Better To Get Employer Sponsored Health Insurance Or On Your Own

Employer based health insurance is often more affordable than an individual plan, but not always and you may find an ACA plan with a better provider network.

Brian Colburn, senior vice president of corporate development & strategy at Waltham, Massachusetts-headquartered Alegeus, says that, despite the advantages of employer group insurance plans, many still choose to purchase individual health insurance.

Oftentimes, this happens when the employees needs dont match up with what the employer sponsored coverage offers. If you have unique health care needs, desire doctors and specialists out of network or want a more bare-bones plan, the individual marketplace can be a good alternative, says Colburn.

Neat explains that it may be best to shop for coverage at Healthcare.gov if you qualify for an income-based subsidy. The ACA marketplace provides subsidies and tax credits to help people pay for ACA plans. The subsidies can save members hundreds of dollars each month, but they arent available for plans outside of the ACA marketplace.

If you are self-employed or you do not have affordable options at work, an individual ACA or private marketplace plan may be the only option in your area. The good news is that ACA plans have no penalties for pre-existing conditions, so if you are struggling with a health condition, this may be your best choice, she says.

Why Does Open Enrollment Exist

Before the Affordable Care Act, insurance companies could raise insurance premiums or refuse coverage to an individual based on their medical history. The Affordable Care Act made it illegal for insurance companies to deny coverage due to someones medical history or any type of pre-existing condition. To avoid a situation where people only get health insurance the month they know they need medical care, the Affordable Care Act established an Open Enrollment Period so that everyone can get health insurance once a year.

So now when someone pays their monthly insurance premium, it essentially goes into a large pot . And this gives insurance companies the ability to put that money towards medical care whenever a consumer needs it.

Also Check: Kroger Employee Discount Card