Regulatory Changes Have Opened Up New Possibilities

Weve already seen the need for more flexibility in health benefits with the introduction of the Individual Coverage Health Reimbursement Arrangement . ICHRAs are designed to allow employers of all sizes to give employees pre-tax dollars to use to buy the insurance coverage that best fits their needs on an individual basis, instead of offering group coverage under the Affordable Care Act . By making a defined contribution toward coverage, employers can control rising healthcare costs and get out from under the administrative burden of administering health benefit programs while still giving employees greater flexibility, by allowing them to choose their coverage from a much wider array of options. This is very similar to the shift we saw in retirement benefits, from pension funds to 401ks.

The factors above have all led to increased discussion around the shift away from employer-sponsored health insurance. And consumers are showing theyre ready for the change, with data revealing that 41% of consumers say they think health insurance should be decoupled from employment. As business leaders look ahead to the next couple of years, with their employees as their guide, we have an opportunity to meet the moment and reimagine what health insurance looks like.

Health Insurance For Employees: What Are Your Options

If youre responsible for a team of employees, you know all too well how much pressure you can feel to protect people and give them the best working life possible. You dont want people looking back on the years theyve spent at your company with bitterness or rage but with fondness.

One major element that can cause a lot of headaches for employers is health insurance. You know you need your staff to have access to the best healthcare possible their well-being, job satisfaction, and work performance rely heavily on the state of their health.

Despite knowing this, dealing with insurance companies is always tricky and troublesome. The following aims to outline your options when it comes to providing health insurance for your employees so as to minimize the stress on your end and maximize the benefits on their end.

Small Employers Contribute Significantly Less To Family Coverage

While large employers contribute a significant amount to employees healthcare, small employers tell a different side of the story. 27% of covered workers in small firms are in a plan where the employer pays the entire premium for single coverage, compared to only 4% of covered workers in large firms. Similarly, 28% of covered workers are in a plan where they must contribute more than half of the premium for family coverage, compared to 4% of covered workers in large firms.

A likely reason for this is that small businesses simply cant afford to make the kind of contributions larger employers can. After all, even a 50% contribution may be more than whats available in a small employers benefits budget.

Considering that only 48% of firms with three to nine workers offer coverage compared to virtually all firms with 1,000 or more workers that offer coverage, small employers may also feel that they dont have enough employees to make investing in health benefits worth it at all. in order to offer a health benefit at all.

You May Like: Starbucks Dental Coverage

Find Cheap Health Insurance Quotes In Your Area

If your business has over 50 employees, you are legally required to provide health insurance to employees due to the Affordable Care Act . If you have fewer than 50 employees, you’ll need to make the decision whether to offer your employees health care benefits. We examined every major decision point to help you make the right decision for your business.

How Much Does An Employer Pay For Health Insurance

Employer health insurance is often more affordable than individual health insurance, thanks to the group discounts that accompany multiple policies.

KFF reports that employers paid an average of 83% of single premiums in 2020. The average employee spends an average insurance premium of $1,243 per year for single coverage with employers picking up an average of more than $6,200 annually.

Job-based plans are hugely affordable, compared to paying more than $5,000 annually for the average individual premium. Family plans could cost more than double or more.

Here are the average costs for employer group health insurance, according to Kaiser Family Foundation.

| Plan type |

|---|

| $21,342 |

Still, premiums continue to rise each year, with an average of 3% increases for single plans and around 5% for family coverage. Deductibles and out-of-pocket costs continue to increase, as well.

In addition to standard health insurance coverage, employers may also offer other benefits and perks that can increase the value of your healthcare.

You May Like: Shoprite Employee Benefits

Group Benefit Plans Are An Option

Group benefits services make it a little easier for employers to get quotes on plans from insurance providers. You can take a look at this article for more information on how to compare plans using a group benefits service. It can be really helpful when narrowing your choices down to have point-by-point comparison information.

What To Do After Quitting Your Job

When you quit your job, you can temporarily continue your employer-sponsored insurance plan thanks to a federal law known as COBRA. Some adjustments take place, however. You end up paying the cost of your health insurance coverage, as well as a maximum of 2% for added administrative costs. This can be quite the shocker if you have been used to your employer paying your coverage’s premium.

Also Check: How Long After Quitting Job Health Insurance

What Is A Group Health Insurance Plan

Group Insurance health plans provide coverage to a group of members, usually comprised of company employees or members of an organization. Group health members usually receive insurance at a reduced cost because the insurers risk is spread across a group of policyholders. There are plans such as these in both the US and Canada.

Where To Find Health Insurance Plans

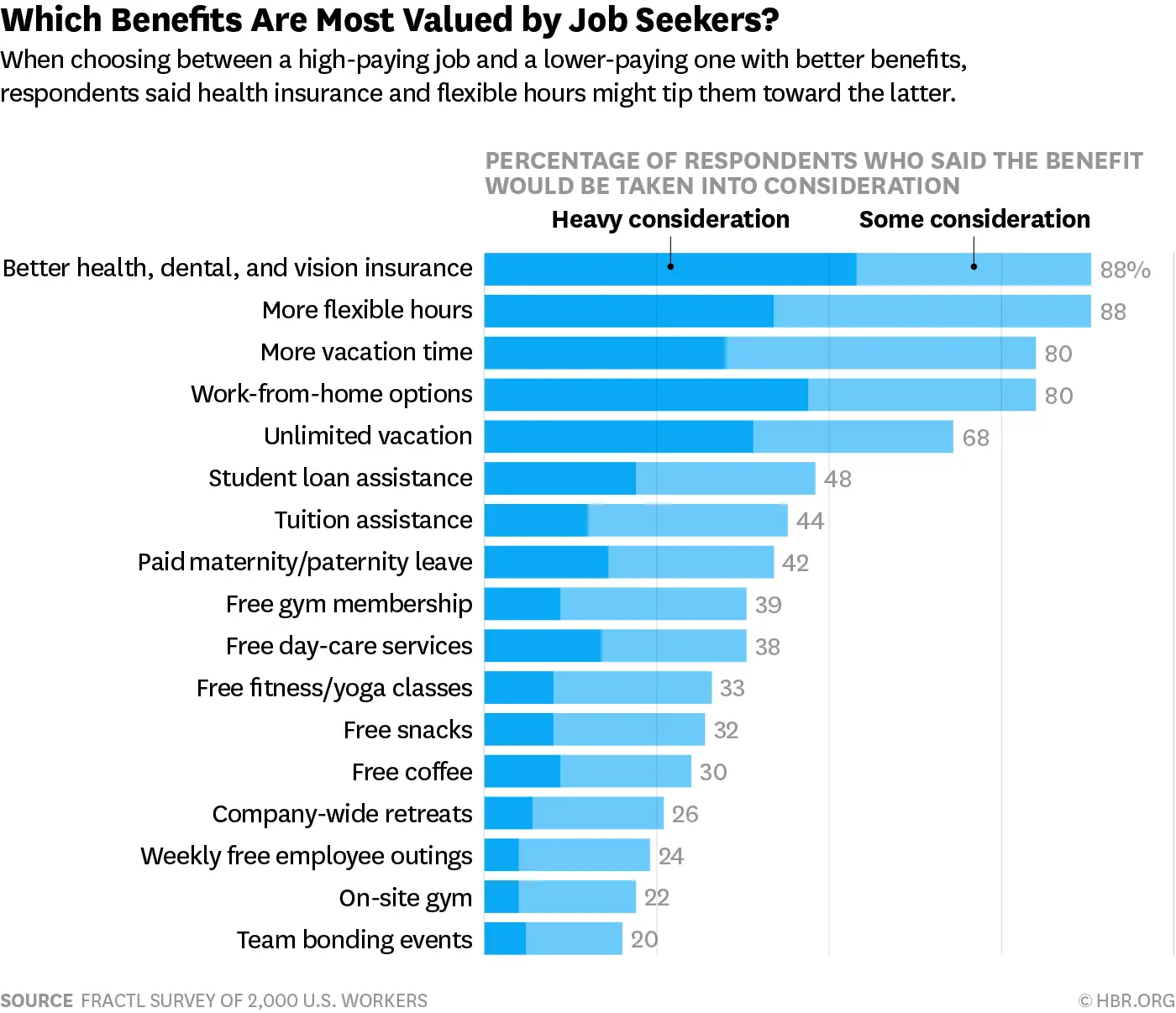

First, we highly recommend assessing what benefits your employees are looking for. If a high percentage of your employees, for example, are looking for strong dental benefits, you’ll want a plan that emphasizes that. If your employees want cheap, minimal insurance that they’d only use for emergencies, that’s helpful to know as well.

Benenson Strategy Group reported that out of the 1,000 employees surveyed, most said that they’d opt for better health insurance rather than a 10% pay raise. In other words, it’s a big deal to employees.

After assessing their wants and needs, you can now enter the insurance market with a comprehensive list of the services you’d like covered and your budget, two of the most helpful initial filters.

Small Business Health Options Program

SHOP is a federal marketplace for small-business owners seeking health care plans. Each state maintains its own SHOP marketplace, but they’re all similar. In order to qualify to use SHOP, businesses must generally meet the following requirements:

- Have one to 50 employees

- Offer health care benefits to all employees who work over 30 hours a week

- 70% of your employees must enroll

- Have an office or employee in the state whose SHOP you’d like to use

Employers have the opportunity to select from three tiers of health insurance based on price and coverage. Once a tier is selected, employees can then go into SHOP on their own and can select their own individual plan based on the tier the employer selected.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

How To Prepare To Leave A Job

Before quitting your job, review all of your options for health insurance. Remember that everyones medical and financial situations are different. You might benefit from continuing coverage via COBRA, or it may make more sense to join an individual plan through the marketplace.

Use these tips to make sure youre covered when your employer-sponsored insurance expires:

- Talk with your HR representative before you resign to learn how your employers insurance plan works and when youll lose coverage.

- Consider quitting earlier in the month if your company lets you keep coverage until the last day of the month. This could give you the time you need to get new coveragesuch as from a new employerwithout having to pay for COBRA.

- Gather any documents youll need to enroll in your new health insurance plan. For example, the marketplace offers a convenient checklist to help you apply for a plan.

Consumer Expectations Have Evolved

We no longer accept one-size-fits-all solutions in other areas of our lives, so why should healthcare be any different? Consumer needs and perspectives on health insurance coverage vary widely across many dimensions, including generational differences.

As a father of four, including a son who has newly entered the workforce, I have seen first-hand how differently younger generations think about their insurance plan options and experiences.

Younger generations have only lived a digital age and therefore have high expectations for flexibility, convenience, and personalization. They are generally in good health, so they are far less likely to be dealing with chronic conditions, specialized physicians and treatments, or high-cost prescriptions. Many are single and have not yet started families, which simplifies their considerations when choosing coverage. Younger generations are great adopters and proficient users of technology, and are therefore likely to be more receptive to change, and are at the forefront of adopting new technologies and experiences.

Its inevitable that demands for more personalization in healthcare will reach a tipping point and employer plans will either have to evolve to deliver these experiences, or consumers may take matters into their own hands, re-evaluating where they get their healthcare coverage.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

Join Your Spouses Plan

If youre married, you may be able to enroll in your spouses employer-sponsored health insurance. To be eligible, you typically must have been covered by a different plan when you initially declined coverage from your spouses plan. Or, you’ll need to wait until your spouse’s open enrollment period at work.

For instance, say you already had your current job when you and your spouse got married. You both had health insurance through work and declined to join each others plans. Now that youre leaving your job and losing your health insurance, you should be able to enroll in your spouses plan under a special enrollment period.

What Does An Employer Contribution Look Like

Imagine that Jillian is one of your employees at your toy store. She has a gold HMO, and her premium costs $250 a month. This is how one situation could play out:

- Monthly health premium for Jillian: $250

- Your toy store pays: $220

- Jillian pays: $30

That means that for each pay period, Jillian will have $30 subtracted pre-tax for her health premium.

Lets say you have four employees on your team. Your company pays a chunk of the insurance bill for the entire team each month:

- Monthly premium for Jillian, Jack, Joe, and Jerrold: $1,000

- Your toy store pays: $880 collectively

- Jillian, Jack, Joe, and Jerrold each pay: $30

Keep in mind, if Jack has a higher premium than Joefor example, if hes older or a smoker and your insurer prices policies individuallythe exact costs would adjust slightly based on the percentage you chose to contribute.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

Understanding Health Insurance Costs

Having insurance doesnt mean your health care will be free. Youll still pay a monthly rate, or premium. Members may also pay copayments or other out-of-pocket fees or have to meet deductibles every year before insurance coverage kicks in.

Different factors can affect your health insurance costs. Its important to understand what these costs are before selecting a plan.

Is My Employer Required To Provide Medical Benefits To My Spouse Domestic Partner Or Dependent Children

Much like employers are not required by law to provide health and welfare benefits to employees, they are equally not required to provide those benefits to spouses, domestic partners or dependent children. If, however, an employer voluntarily provides spousal benefits through an insurance provider or health maintenance organizations , the employer must also provide those same benefits to registered domestic partners of the covered employees. Thats because AB 2208 requires equal treatment of spouses and registered domestic partners in all aspects of insurance coverage.

Note: AB 2208 applies to insurance providers and HMOs who supply insurance to an employers employees, but does not apply to employers who self-insure, who are not required to provide equal domestic partner coverage to their employees.

You May Like: Uber Driver Health Insurance

What Contribution Level Or Premium Cost

Group health insurance plans are a form of employer-sponsored coverage. This means that a business is required to share the cost of group health insurance with employees. Typically, this cost-sharing element of health insurance requirements refers to a small business splitting monthly premium costs with workers. If you opt for a group health insurance plan, in most states, employers are required to contribute or pay at least 50% of each employees health insurance premium, although this may vary, depending upon the state in which your business is located.

Failure To Provide Coverage

Employers that have enough workers to trigger the coverage requirement are referred to as applicable large employers or ALEs. The law calls for penalties on applicable large employers that fail to sponsor coverage as required, just as it fines individuals who fail to have basic health coverage.

Like many other elements of the Affordable Care Act, these penalties take effect over time. From 2016 and beyond, penalties will apply to those with 50 to 99 employees.

Also Check: What Health Insurance Is Available In Nc

Also Check: Starbucks Dental Insurance

Your Parents Or Spouses Health Insurance Plan

Many employers allow a person to add spouses and children to their health insurance plans.

This is a great option for stay at home parents, children that havent found jobs yet or even a spouse between jobs.

An employer does not have to subsidize coverage for family members even if they subsidize coverage for their employees.

That means:

The additional cost to add a spouse or child to a policy could be much different than the premium for the employee only.

A spouse or child can be added during the plans annual open enrollment period.

If you lose coverage due to a qualifying event, you may be able to get health insurance from your spouse or your parents during the year, too.

Your spouse or parent can inquire with their companys HR department to see what options they have. If youre trying to qualify for insurance through a qualifying event, act fast.

Qualifying events may only allow you to make changes for 30 days. This can be different from marketplace health insurance.

How Do I Purchase Group Health Insurance For My Small Business

There are various means by which a small business employer can shop for group health coverage. Some of those include:

- Agent/Broker: There are two types of agents/brokers – those that can only sell for one carrier and those that can sell for multiple carriers . A captive agent can only provide quotes for plans sold by the carrier they represent. Independent agents can provide multiple quotes from multiple carriers. Various factors can determine which agent would be best for your group.

- SHOP: The Small Business Health Options Program was created in conjunction with the Affordable Care Act and provides an online medium for small business owners to search for and purchase group health insurance. You can visit for further information on the SHOP and/or to search for and purchase group health coverage.

- Carrier: Insurance carriers maintain websites through which, typically, you can search for and purchase their health insurance products. Some carriers will allow you to conduct the quoting and enrollment process online however, some may require you to call the carrier directly. An enrollment/eligibility specialist will then assist you through the process of purchasing a health insurance product.

Before purchasing, interview several licensed insurance agents who specialize in serving the health insurance needs of small businesses.

Don’t Miss: Does Starbucks Provide Health Insurance

Common Health Insurance Terms

Deductibles, premiums, network, claims, benefits what do all these words actually mean? Health insurance practically seems to have a language of its own. To make it easier, you can check out our list of common terms and get quick definitions that help explain what they mean in everyday language.

If I File A Claim For Health Benefits Under A Plan Provided By My Employer And It Is Denied What Can I Do

If you believe that there has been a violation of the plan , you may bring an ERISA claim against your employer through an internal administrative claims process that is described in the SPD.

Additionally, a person also may appeal to the Secretary of Labor of the Department of labor for certain ERISA claims. The Department of Labor however, only assists claimants informally for non-ERISA based claims.

If you are unsure if your claim is non-ERISA based and whether you should bring a claim through the internal process or through the Department of Labor, you can refer to your SPD, which explains the administrative resources available to participants in the plan.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

How Do Group Health Insurance Plans Work

If youre considering a group health insurance plan for your company, there are some things about it that youll need to know. After all, its important to have all the information before you choose a plan. In some cases you may not qualify for the kind of group health insurance you want, so you need to know if there are other options. Here are some of the most significant issues to consider, so you can learn more about how group health plans work.